The Valve Driver Market is estimated to be valued at USD 581.0 million in 2025 and is projected to reach USD 1011.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. Despite this steady growth, regional expansion is expected to be uneven due to differences in industrial demand, infrastructure development, and technological adoption across Asia-Pacific, Europe, and North America. Asia-Pacific is likely to dominate market expansion, driven by rapid industrialization, large-scale deployment of automated systems, and increasing investments in energy, manufacturing, and process industries.

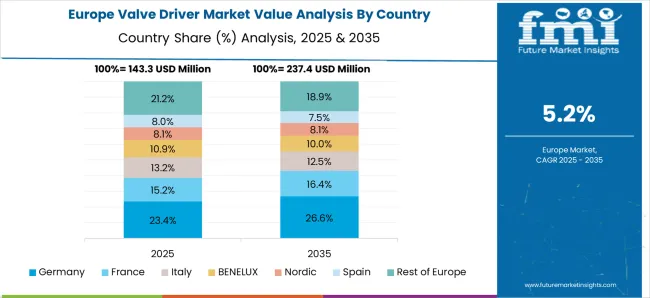

Strong demand for advanced valve automation solutions in countries such as China, India, and Japan is expected to create higher regional revenue contributions relative to other regions. Europe is anticipated to experience moderate growth, as regulatory frameworks, stringent environmental compliance, and high automation standards encourage the adoption of high-performance, energy-efficient valve drivers, albeit with slower deployment due to established infrastructure and slower industrial expansion. North America is projected to see steady growth driven by the modernization of industrial facilities, the integration of smart control systems, and the adoption of advanced oil and gas, chemical, and water treatment applications, though mature industrial bases and higher operational costs constrain market expansion.

Asia-Pacific is expected to capture the largest share, followed by Europe and North America, resulting in a pronounced regional growth imbalance. Manufacturers focusing on localized production, region-specific features, and strategic partnerships are likely to leverage the growth potential, while regions with slower adoption may require targeted incentives and tailored technological offerings to accelerate market penetration. This regional disparity will shape global competition and supply chain priorities throughout the forecast period.

| Metric | Value |

|---|---|

| Valve Driver Market Estimated Value in (2025 E) | USD 581.0 million |

| Valve Driver Market Forecast Value in (2035 F) | USD 1011.4 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The valve driver market is experiencing robust development due to increased automation in industrial operations, rising demand for energy efficiency, and the integration of smart flow control systems across critical infrastructure. As industries modernize fluid control frameworks, valve drivers are being widely adopted for their precision, responsiveness, and compatibility with various actuation mechanisms.

The expansion of smart manufacturing and building automation systems has also elevated the demand for electronically controlled valve interfaces. Ongoing technological innovations in compact driver design, real time control feedback, and enhanced thermal stability are further accelerating market adoption.

Regulatory standards focusing on safety, environmental performance, and process optimization are reinforcing the role of advanced valve drivers across sectors. Looking ahead, the market is expected to benefit from sustained investments in intelligent fluid control technologies, particularly in HVAC, water treatment, and energy systems.

The valve driver market is segmented by function, valve type, end-use industry, and geographic regions. By function, the valve driver market is divided into Solenoid and Proportional. In terms of valve type, the valve driver market is classified into Conventional Control Valve and Expansion Valve. Based on end-use industry, the valve driver market is segmented into Commercial, Residential, and Industrial. Regionally, the valve driver industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solenoid segment is projected to account for 54.20% of total market revenue by 2025 within the function category, marking it as the dominant technology. This leadership is attributed to the simplicity, fast switching capability, and reliability of solenoid based valve drivers across high frequency and cyclic operations.

Their ability to provide consistent actuation without mechanical wear makes them particularly valuable in applications requiring rapid and repeated valve movements. Additionally, solenoid valve drivers are cost effective and easy to integrate into both existing and new automation systems.

Their compact structure and compatibility with low voltage systems have enhanced their utility in space constrained and portable devices. As demand rises for responsive and efficient control systems, the solenoid function continues to lead due to its operational stability and widespread applicability.

The conventional control valve segment is anticipated to contribute 48.70% of the total revenue in the valve type category by 2025, maintaining its position as the preferred configuration. This is driven by the extensive use of conventional valve architectures in industrial process control systems where flow regulation and system reliability are critical.

These valves offer a high degree of compatibility with standardized driver interfaces and require minimal system redesign, making them ideal for brownfield upgrades. Furthermore, their proven mechanical performance and ease of maintenance have sustained adoption across industries such as oil and gas, water treatment, and power generation.

The continued demand for durable and adaptable flow control mechanisms reinforces the dominance of conventional control valves in this market.

The commercial segment is forecasted to represent 46.90% of the overall revenue in the end use industry category by 2025, establishing it as the leading contributor. This segment's growth is driven by the increasing use of automated fluid systems in commercial buildings, hospitality infrastructure, and retail environments.

Applications such as climate control, fire suppression, and water management are benefiting from intelligent valve driver systems that enable energy savings, real time monitoring, and compliance with building safety codes. The push for green building certifications and smart facility management solutions has accelerated the adoption of responsive and digitally integrated valve drivers.

As commercial infrastructure modernizes globally, this end use sector continues to lead due to its emphasis on operational efficiency, occupant comfort, and environmental responsibility.

The market has been expanding due to rising adoption of automation and precise flow control in industrial, oil and gas, water treatment, and energy sectors. Valve drivers, which convert electrical, pneumatic, or hydraulic signals into valve actuation, have been deployed to ensure accurate flow regulation, pressure control, and system efficiency. Market growth has been influenced by the increasing demand for automated systems, energy-efficient operations, and predictive maintenance. Integration with IoT, smart sensors, and control platforms has made valve drivers essential components in modern industrial and process control networks globally.

The market has been significantly driven by industrial automation and the need for efficient process control. Valve drivers have been extensively deployed in chemical, oil and gas, water treatment, and power generation facilities to regulate flow, pressure, and temperature. Automation of valve operation has enabled precise control over industrial processes, reducing manual intervention and operational errors. Real-time monitoring and feedback mechanisms integrated with control systems have allowed predictive maintenance, ensuring minimal downtime and consistent system performance. Additionally, the use of valve drivers has optimized energy consumption by reducing overuse of pumps and compressors. The demand for enhanced reliability, safety, and system efficiency has encouraged the deployment of advanced valve drivers, establishing them as critical elements in modern industrial automation and process management systems.

Technological innovation has played a key role in expanding the valve driver market by improving functionality, reliability, and integration capabilities. Modern valve drivers have incorporated features such as digital interfaces, programmable control, and precise torque adjustment, ensuring optimal valve operation under diverse conditions. IoT-enabLED drivers have allowed remote monitoring, data analytics, and predictive maintenance scheduling, reducing operational disruptions. Low-power designs, compact form factors, and enhanced thermal management have facilitated deployment in confined and high-temperature environments. Integration with SCADA systems, PLCs, and distributed control systems has enhanced system-level automation and control precision. Continuous improvements in materials, electronics, and communication protocols have strengthened durability and interoperability. These technological advancements have enabled valve drivers to support complex industrial processes, ensuring reliability, energy efficiency, and seamless integration across automated systems.

The market has been influenced by regulatory standards and safety compliance requirements, particularly in critical applications. Compliance with international standards, such as ISO, IEC, and ATEX certifications, has ensured that valve drivers perform safely under high-pressure, hazardous, or explosive environments. Safety guidelines have mandated features including fail-safe operation, emergency shutdown compatibility, and electrical isolation. Environmental regulations regarding energy efficiency and emission control have encouraged the use of low-power, high-precision drivers. Industry-specific standards in oil and gas, power generation, and water treatment have further driven adoption of certified, reliable products. Adherence to these regulatory frameworks has enhanced market credibility, reduced operational risk, and motivated manufacturers to invest in compliant, robust, and high-performance valve driver solutions for a wide range of industrial applications.

The market has been strengthened by the availability of customized solutions and comprehensive aftermarket services. Drivers have been designed to accommodate different valve types, sizes, and operational conditions, including pneumatic, hydraulic, and electric actuation. Programmable torque, adjustable stroke, and modular design have allowed tailored deployment across diverse industries. Aftermarket services, including calibration, firmware updates, maintenance, and technical support, have ensured sustained performance and reliability. Integration with smart sensors and cloud-based monitoring platforms has enabled predictive analytics and operational optimization. Custom solutions for extreme temperature, high-pressure, and corrosive environments have expanded market adoption in niche applications. These customization capabilities, combined with value-added services, have reinforced the role of valve drivers as essential components in automated, efficient, and reliable industrial process control systems globally.

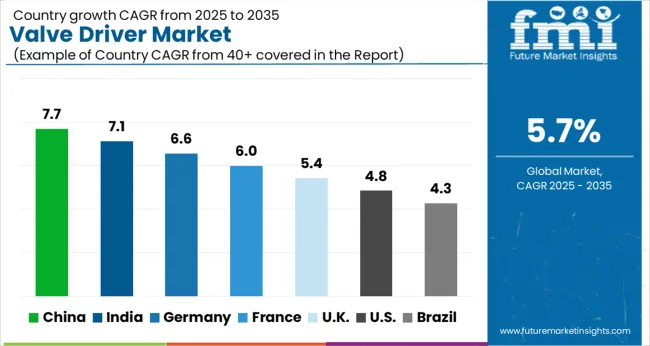

The market is anticipated to expand at a CAGR of 5.7% between 2025 and 2035, driven by increasing automation in industrial processes, adoption of smart valve technologies, and rising demand in oil and gas, chemical, and power sectors. China leads with a 7.7% CAGR, propelled by industrial modernization and investments in automated process control. India follows at 7.1%, supported by expanding manufacturing infrastructure and adoption of advanced valve systems. Germany, at 6.6%, benefits from precision engineering and high-tech industrial applications. The UK, growing at 5.4%, focuses on energy and water infrastructure upgrades, while the USA, at 4.8%, experiences steady demand from industrial automation and process optimization initiatives. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s market is projected to grow at a CAGR of 7.7%, driven by increasing automation in industrial machinery and process control applications. Rising adoption of smart manufacturing, energy management, and HVAC systems is supporting market growth. Companies are integrating IoT-enabled and high-precision valve drivers to enhance operational efficiency and reduce energy consumption. Research and development efforts are focused on improving durability, response time, and compatibility with diverse industrial protocols. Government incentives promoting industrial digitalization and energy-efficient solutions are further accelerating adoption. Strategic partnerships between manufacturers and system integrators are enhancing market reach and expanding deployment across sectors.

India is forecasted to expand at a CAGR of 7.1% due to rising industrial automation and growing adoption of advanced process control systems. Demand for high-precision, reliable valve drivers is increasing across manufacturing, power, and oil and gas sectors. Government initiatives promoting smart factories and digitalization are supporting market growth. Manufacturers are developing compact and energy-efficient drivers compatible with IoT platforms to meet industry requirements. Strategic collaborations with industrial players and technology providers are enhancing distribution and adoption.

Germany’s market is anticipated to grow at a CAGR of 6.6%, supported by strong industrial, automotive, and energy sectors. Adoption of valve drivers in smart manufacturing, process automation, and energy optimization is increasing. Manufacturers are focusing on high-precision, durable, and compact drivers to enhance operational efficiency. Integration with IoT and predictive maintenance systems is driving adoption across industries. Research and development efforts targeting miniaturization, advanced control algorithms, and enhanced reliability are further strengthening market potential.

The United Kingdom market is projected to expand at a CAGR of 5.4%, driven by adoption in industrial automation, HVAC, and process control systems. Demand for reliable, high-performance valve drivers is increasing due to energy efficiency initiatives and automation upgrades. Manufacturers are providing compact, IoT-enabled solutions to meet industrial requirements. Collaborations between suppliers and industrial operators are facilitating broader deployment. Focus on operational efficiency, predictive maintenance, and regulatory compliance is further enhancing market prospects.

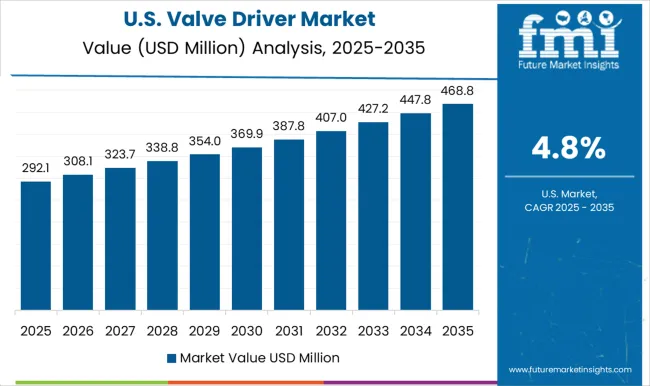

The United States market is expected to grow at a CAGR of 4.8%, supported by manufacturing, energy, and industrial sectors. Increasing demand for IoT-compatible valve drivers for process automation and predictive maintenance is driving market growth. Manufacturers are focusing on improving reliability, response time, and energy efficiency. Strategic partnerships with industrial operators and technology providers are enhancing deployment and market reach. Investments in smart manufacturing and energy optimization solutions are further fueling adoption. Continuous innovation in high-performance, compact valve drivers is strengthening competitiveness and industry integration.

The market is driven by companies providing precision control solutions for industrial automation, HVAC systems, fluid handling, and process control applications. Carel Industries delivers advanced electronic valve drivers that enhance energy efficiency and system performance in refrigeration and air-conditioning systems. Danfoss offers versatile and reliable drivers supporting a range of solenoid and proportional valves, ensuring accurate flow control and operational stability. Eliwell Controls specializes in compact and programmable drivers for both residential and industrial applications, optimizing system responsiveness and reliability. Emerson Electric Co. and Flowserve Corporation provide robust solutions for process industries, combining valve actuation with intelligent control features to enhance operational efficiency. Fujikoki Corporation and Honeywell International Inc. deliver drivers with high precision and durability, suitable for critical industrial applications. Hussmann Corporation, Hydraforce Inc., and MKS Instruments focus on hydraulic and electronic valve drivers for fluid management systems.

Parker Hannifin Corporation and Sanhua offer modular and scalable driver solutions compatible with a wide variety of valves. Schneider Electric SE, Siemens AG, and Spirax-Sarco Engineering plc provide advanced valve driver systems integrated with automation platforms, enabling optimized process control, enhanced safety, and precise fluid regulation across diverse industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 581.0 Million |

| Function | Solenoid and Proportional |

| Valve Type | Conventional Control Valve and Expansion Valve |

| End-use Industry | Commercial, Residential, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carel Industries, Danfoss, Eliwell Controls, Emerson Electric Co., Flowserve Corporation, Fujikoki Corporation, Honeywell International Inc., Hussmann Corporation, Hydraforce Inc., MKS Instruments, Parker Hannifin Corporation, Sanhua, Schneider Electric SE, Siemens AG, and Spirax-Sarco Engineering plc |

| Additional Attributes | Dollar sales by driver type and application, demand dynamics across oil and gas, chemical, and manufacturing sectors, regional trends in industrial automation adoption, innovation in precision control and energy efficiency, environmental impact of production and disposal, and emerging use cases in smart process management and automated systems. |

The global valve driver market is estimated to be valued at USD 581.0 million in 2025.

The market size for the valve driver market is projected to reach USD 1,011.4 million by 2035.

The valve driver market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in valve driver market are solenoid and proportional.

In terms of valve type, conventional control valve segment to command 48.7% share in the valve driver market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Valve Grinder Market Size and Share Forecast Outlook 2025 to 2035

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Valve Positioner Market Growth – Trends & Forecast (2024-2034)

Valve Cover Gasket Market

Valve Sack Market

ESD Valve Market Size and Share Forecast Outlook 2025 to 2035

EGR Valve Market

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

Flat Valve Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Gate Valve Market Growth – Trends & Forecast 2023-2033

Korea Valve Seat Insert Market Trend Analysis Based on Sales, Material, Engine, End-Use, and Provinces 2025 to 2035

Japan Valve Seat Inserts Market Trend Analysis Based on Sales Channel, Material, Engine, End-Use and Provinces 2025 to 2035

Lined Valve Market Growth – Trends & Forecast 2024-2034

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Engine Valve Market Size and Share Forecast Outlook 2025 to 2035

Pasted Valve Bags Market Size and Share Forecast Outlook 2025 to 2035

Slurry Valves Market Analysis - Size, Share, and Forecast 2025 to 2035

Safety Valve Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA