The safety valve market is projected to grow from USD 5.2 billion in 2025 to USD 11.87 billion by 2035, registering an impressive CAGR of 8.6% during the forecast period. China stands out as the most lucrative market, driven by large-scale industrialization, LNG infrastructure, and domestic manufacturing policy initiatives. India is projected to grow the fastest between 2025 and 2035 at a CAGR of 8.2%, propelled by power generation expansion, refinery development, and strong regulatory reforms.

The market is being driven by surging demand across oil & gas, nuclear, chemical, and energy sectors. Increasing global investments in LNG terminals, hydrogen production, and advanced power plants are reinforcing the need for high-performance safety valves. Stainless steel dominates material usage for its strength and adaptability across critical applications.

Meanwhile, cryogenic valves are gaining momentum in hydrogen and aerospace sectors. Regulatory frameworks such as OSHA, PED, and SELO are compelling manufacturers to innovate, while IoT-enabled valves with predictive maintenance capabilities are becoming standard across automated facilities.

From 2025 to 2035, the market will shift toward smart, high-spec safety valve systems that align with digital operations and climate-conscious manufacturing. Customized, compact, and sustainable valve solutions will see rising demand across both mature and emerging markets. Suppliers will focus on material innovation, compliance upgrades, and strategic collaborations to capture market share in fast-evolving end-use sectors.

As industries pursue predictive maintenance and asset health monitoring, demand for valves embedded with sensors, real-time alert systems, and digital twin compatibility will rise sharply. Furthermore, advancements in metallurgy and additive manufacturing will enable production of lighter, high-performance valves tailored for extreme conditions, including cryogenic and high-corrosive environments. With decarbonization and hydrogen strategies gaining ground globally, safety valves designed for new energy carriers will become a major focus for R&D and global standardization efforts.

Stainless steel remains the most dominant material in the safety valve market, accounting for the largest share in 2025. It is favored for its corrosion resistance, strength under high pressure, and versatility across sectors including oil & gas, chemicals, and power generation. Cast iron and alloy variants are commonly used in less extreme operating environments such as HVAC and water treatment systems.

However, the cryogenic segment is poised to witness the fastest CAGR between 2025 and 2035. This surge is driven by rising investments in LNG terminals, hydrogen fuel systems, and space/aerospace infrastructure-sectors requiring valves that operate efficiently at extremely low temperatures. Asia Pacific, in particular, is emerging as a hotbed for cryogenic valve installations, with governments investing heavily in liquefaction and storage facilities.

| Material Segment | CAGR (2025 to 2035) |

|---|---|

| Cryogenic | 9.1% |

The oil & gas industry holds the largest market share in 2025, due to widespread use of safety valves across drilling, refining, and LNG shipping operations. Regulatory mandates and safety-critical nature of operations ensure sustained demand.

The power generation segment, however, is projected to be the fastest-growing end-use between 2025 and 2035, registering strong growth from nuclear, thermal, and green hydrogen applications. Safety valves are increasingly deployed in steam generation, hydrogen storage, and turbine systems. Other end-use industries like chemicals, metal & mining, and food & beverages will also witness stable growth, particularly in developed markets adopting smart and compliant valve systems.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Power Generation | 9.3% |

Regional Difference

Regional Investment Trends

ROI Perspectives

Consensus

The most commonly used material was stainless steel (69% overall) due to its corrosion resistance and strength in high-pressure applications.

Regional Variance

Shared Concerns

Regional Differences

Manufacturers

Distributors

End-Users

Worldwide Trends

Regional Focus Areas

Important Variances

Strategic Observations

| Countries | Key Regulations & Mandatory Certifications |

|---|---|

| United States | Safety valves are regulated by OSHA, API 526, ASME Section VIII, and ANSI standards. The oil & gas industry must comply with the EPA and DOT safety norms, respectively. |

| United Kingdom | Ensure pressure equipment directive (PED) compliance and UKCA marking post-Brexit. Any valve in a hazardous area has to be compliant with ATEX. |

| France | Compliance with the EU's Pressure Equipment Directive (PED) is required. Other national safety certifications may also be required in nuclear and chemical industries. |

| Germany | The industrial valves undergo testing in accordance with PED and DIN EN 12266-1. This TÜV certification is often required by law, particularly in the case of high-risk operations. |

| Italy | Pressure relief devices must comply with PED and ISO 4126. These processes often require specific certifications from the chemical and food industries. |

| South Korea | Regulatory bodies like KOSHA oversee safety standards. In the case of pressure relief valves, KSB ISO 4126 certification is compulsory. |

| Japan | The High Pressure Gas Safety Act and JIS (Japanese Industrial Standards) govern safety valve performance and certification for industrial and gas use. |

| China | Adheres to the conditions of GB/T, API. Pressure relief valves are widely used in industries; thus, SELO certification for pressure relief valves is mandatory. |

| Australia-NZ | Meets AS/NZS 3788; WHS requirements: EU exports require compliance with the PED. |

| India | BIS (Bureau of Indian Standards) regulated safety valve standards. The safety valve standards are in compliance with ISO 4126 and IBR. |

The industry in USA is expected to expand steadily at a rate of 7.8% during the forecast period between 2025 and 2035, owing to strong industrial safety regulation and high end-user demand in the oil & gas, chemical, and power industries. OSHA (Occupational Safety and Health Administration) and ASME (American Society of Mechanical Engineers) both have strict safety standards that manufacturers must comply with.

The growing adoption of IoT-driven predictive maintenance among smart safety valves is revolutionizing this industry, especially at plants within refineries and chemical facilities. Demand for high-performance safety valves is also driven by shale gas development and expanded LNG infrastructure. However, supply chain disruptions and pricing volatility for raw materials may present a headwind in the near term.

In the UK, the valve industry will grow at a CAGR of 7.2% through 2025 to 2035, prompted by strict governing environments for applications such as the Pressure Equipment Directive (PED) and the UKCA marking required after Brexit.

The oil & gas industry remains a primary end-user, with continued investment in offshore drilling and hydrogen energy projects driving demand. As industries push forward on sustainable manufacturing and decarbonization strategies, momentum is quickly building to incorporate the best and worst of advanced safety valve technology.

Additionally, the expanding nuclear energy industry in the country, under the auspices of government-sponsored programs, is creating new prospects for development. Trade uncertainties and compliance costs stemming from Brexit, however, are testing the patience of industry operators, which is forcing manufacturers to focus on localized production and strategic partnerships.

France's safety valve industry catalyses with a CAGR of 7.0% through the years 2025-2035, owing to augmenting industrial automation combined with the country's superiority in the nuclear energy industry. As one of the major producers of nuclear energy, the high demand for safety valves is driven by the stringent PED Pressure Equipment Directive, along with domestic nuclear safety regulations. The chemical and pharmaceutical industries add demand, with both being major contributors to the growth of the industry due to the requirement of safety valves to facilitate critical process control.

Moreover, France's allocation to renewable energy resources, such as hydrogen and wind power, is prompting manufacturers to create valves customized to novel applications. High labour costs and stringent environmental regulations could drive a rise in production costs, posing challenges for several companies to earn incomes and indicating innovation in terms of material efficiency and digital integration.

Germany is expected to have the highest CAGR of 7.5% between 2025 and 2035 in the safety valves industry due to strong industrialization and advanced manufacturing excellence. Stringent safety standards in effect in the country, including PED and DIN EN 12266-1, ensure higher demand for safety valve-certified products. The increasing integration of key industries, such as chemical and automotive, along with growing automation and Industry 4.0 adoption, also drives the industry.

New opportunities for safety valves are also evolving from Germany's energy transition drive, such as hydrogen fuel and offshore wind farms. In addition, TÜV certification requirements for industrial products also drive product standardization and conformity. But supply disruptions and higher raw material prices present difficulties, and producers must adopt cost-efficient production techniques.

The chemical industry is also bound to revive the growth of the safety valve industry as its application is heavily demanded in various sectors across the globe. Many countries adopt both PED (Pressure Equipment Directive) guidance and ISO 4126 regulations to ensure manufacturers achieve tight safety standards. The rising demand by the pharmaceutical industry, particularly in sterile and high-purity applications, boosts demand for this industry.

In addition, the strengthening of renewable energy projects in Italy, including solar and biogas plants, is resulting in the emergence of new industry opportunities. Economic uncertainties and divergent industrial production may, however, impact demand stability. To remain competitive, companies are currently investing in intelligent valve technologies and enhancing their export capabilities to international and European industries.

The South Korean industry in this sector is growing robustly at a CAGR of 7.7% in the forecast years of 2025-2035, supported by its high-tech manufacturing sector and bolstering energy sector. As KOSHA (Korea Occupational Safety & Health Agency) imposes strict standards for ensuring safety, it is critical for safety valves to be of the highest quality in these applications. The country's growing LNG and hydrogen energy infrastructure is driving demand.

With the industry moving toward industrial automation, IoT-enabled safety valves are gaining immense popularity. Dependency on imported raw materials and global industry fluctuations continue to be the main issues, regardless. All the companies have taken to R&D and localized manufacturing to reduce risks in a vulnerable and competitive landscape to ensure sustainable growth.

The valve industry sector in Japan is forecast to have a high growth rate of 7.4% during 2025-2035, backed by its highly regulated industrialized economy and strong industry penetration in the energy and automotive sectors. The strictest compliance with the valve industry is mandated by the High Pressure Gas Safety Act and JIS and is reflected in the high quality and reliability of products.

The text introduces new growth opportunities, such as Investment in hydrogen fuel technology and carbon-neutral projects offers new growth opportunities Smart safety valves with predictive maintenance capabilities can thus be easily adopted in India, given the nation's sophisticated manufacturing base.

For example, the nuclear industry represents a key end-user industry requiring high-performance safety valves with the ability to achieve high levels of compliance with strict regulatory demands. An aging labour force and high production costs are long-term problems, so investment in broad employee training is necessary to reduce costs.

The China industry is expected to grow with the highest rate of 8.9% CAGR during the forecast period (2025 to 2035) as China's industrialization and growth in the oil & gas, chemicals, and power generation industries accelerate. The government's "Made in China 2025" policies" are accelerating the promotion of new manufacturing technologies, which will further promote the demand for intelligent safety valves.

Tight safety valve certification is required by the Special Equipment Licensing Office (SELO) to ensure product quality in high-risk industries. Chinese investments in LNG terminals, coal-to-gas conversion, and renewable energy facilities further contribute to the industry expansion.

Foreign producers can still face uncertainties from trade tensions and regulatory changes. Companies are locating production closer to their industries, designing cost-efficient products, and tailoring themselves to the shifting Chinese standards to maintain their edge.

India's safety valve industry is to see an impressive growth of 8.2% CAGR during the forecast period of 2025-2035, owing to rapid industrialization and increasing investments in the oil & gas, power generation, and chemicals sectors. The Bureau of Indian Standards (BIS) and Indian Boiler Regulations (IBR) mandate adherence to industry-wide quality standards with strict valve industry compliance.

Government initiatives such as “Make in India” and highway construction schemes are adding to the demand. The nation's pharmaceutical and food processing industries also serve as significant growth drivers. But there are still problems, from uneven regulation enforcement to price-volatile industry conditions. To capitalize on industry opportunities, suppliers are focusing on cost-effective production, local sourcing, and the development of innovative smart safety valves.

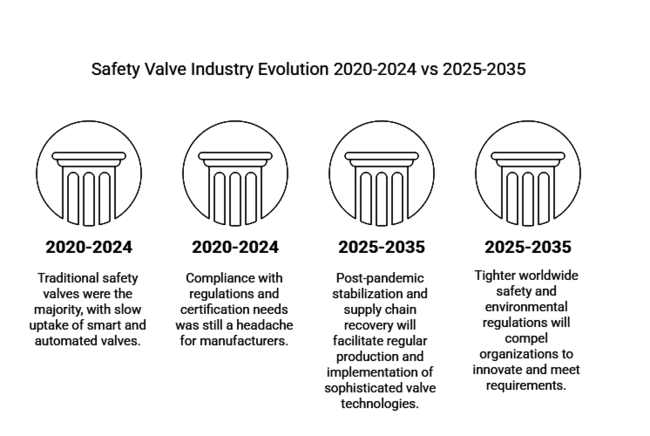

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced steady growth due to rising industrialization, especially in the oil & gas and chemicals industries. | Industry growth will be fuelled by increasing investment in renewable energy, hydrogen initiatives, and Industry 4.0 implementations. |

| The COVID-19 pandemic first disrupted supply chains, causing manufacturing and installation delays. | Post-pandemic stabilization and supply chain recovery will facilitate regular production and implementation of sophisticated valve technologies. |

| Traditional safety valves were the majority, with slow uptake of smart and automated valves. | Predictive maintenance Smart safety valves enabled through IoT will find wide industrial acceptance. |

| Compliance with regulations and certification needs was still a headache for manufacturers. | Tighter worldwide safety and environmental regulations will compel organizations to innovate and meet requirements. |

| Oil & gas industry demand was the key driver of industry growth. | Although oil & gas remains a key driver, power generation, hydrogen energy, and pharmaceuticals will propel the next growth phase. |

The manufacturing, energy, and infrastructure sectors closely link with the valve industry, which is part of the industrial equipment and process safety segment. Industry performance is reliant on industrial growth, regulatory plans, and technical renovations because of its significant role in preventing overpressure anomalies in oil & gas, power generation, chemical processing, and food & beverage industries. Power: Global economic trends such as industrial automation, expansion of renewable energy, and increasing investment in infrastructure are solid demand drivers.

Producers of some safety valves are also benefiting from the switch to green energy sources around the world, including hydrogen, nuclear, and LNG. However, supply chain issues, volatile raw material prices, and geopolitical clashes still dominate challenges in terms of production and distribution.

The leading players in the safety valve industry develop pricing models, products, suppliers, and distribution channels to help them compete globally. Differentiation is rooted in innovation; companies are investing in Internet of Things-enabled smart valves and high-performance materials to drive efficiency and regulatory compliance.

Recently, pricing has remained aggressive, with affordable options accelerating adoption, especially in developing economies. Mergers, acquisitions, and partnerships with energy and industrial companies strengthen supply chains and industry access.

In high-performing enterprise systems, preventative activities are mostly focused on aggressive growth in high-growth industries like India, China, and Southeast Asia, as well as research and development investments in hydrogen-compatible and cryogenic valves that put companies in a position to meet future demand for renewable energy and advanced manufacturing industries.

One such product is Emerson Electric Co.'s new range of intelligent safety valves, which integrate IoT control for real-time monitoring and predictive maintenance. The move is in line with the growing demand for the digitization of industry processes.

SLB (formerly Schlumberger) partnered with a major energy company to create next-generation safety valves for carbon capture and storage (CCS) applications. SLB introduced new high-pressure safety valves for offshore drilling operations, enhancing safety and reliability in extreme environments.

Baker Hughes made headlines by purchasing a manufacturer specializing in safety valves with hydrogen experience. With this acquisition, Baker Hughes positions itself at the forefront of the emerging hydrogen economy, providing safety solutions for hydrogen production, storage, and transportation. Baker Hughes also devoted resources to developing valves that are compatible with renewable energy systems.

The new series of safety valves for nuclear power plants from Curtiss-Wright Corporation meet today's regulatory requirements for both performance and safety. The company also expanded its afterindustry support and servicing, offering full-service maintenance and repair solutions to extend the lifespan of its valves.

In Q4 of the year, which ended on 31st December 2023, IMI plc announced the reintroduction of a series of green safety valves that would combat emissions and improve energy efficiency. The company also partnered with a leading pharmaceutical company to develop specialty valves used in biopharmaceutical production.

Weir Group PLC announced the development of smart safety valves for geothermal energy, which, according to the company, would support the transition to renewable energy sources. The company also improved its supply chain resiliency by diversifying its manufacturing base and sourcing key materials locally.

The industry for safety valves offers tremendous growth prospects in renewable energy, hydrogen infrastructure, and digitalization. The shift toward green hydrogen and LNG is creating demand for specialized safety valves with the ability to withstand extreme temperatures and pressures.

Stakeholders need to focus on cryogenic and corrosion-resistant valve technologies to meet this transition. Besides, as nuclear power becomes a favoured source of power, suppliers will need to target high-reliability safety valves that live up to the tight safety measures required in nuclear uses. In addition, all parties should prioritize geographic expansion within rapidly growing countries such as India and Southeast Asia, where the industrialization rate is on the increase.

Financing valve monitoring technology through AI may bring a competitive advantage in forward failure analysis to decrease end-user cost. Mergers and acquisitions of IoT solution providers and specialty material suppliers will further enhance industry positioning and build differentiated product offerings for next-generation safety valve solutions.

The Industry is segmented into stainless steel, cryogenic, cast iron, alloy and other materials

It segmented among oil & gas, chemical, building & construction, agriculture, metal & mining, food & beverages and other end uses

It is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, Middle East and Africa

Main drivers for increasing adoption are growing industrial automation, stringent safety regulations, and growing hydrogen and LNG projects.

Rapid incorporation of emerging needs has begun in areas as diverse as renewable energy, pharmaceuticals, and advanced manufacturing.

Smart valves with cloud connectivity and predictive maintenance capabilities are reducing downtime and improving operational efficiency.

Meeting changing global regulatory safety standards and price volatility of raw materials are significant challenges.

Yes, ASME, API, and CE marking are essential certifications for regulatory compliance in different regions.

Table 1: Global Sales Revenue (US$ Million/Billion) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 6: Global Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Sales Revenue (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 8: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 10: North America Volume (Units) Forecast by Material, 2018 to 2033

Table 11: North America Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 12: North America Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Sales Revenue (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 14: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 16: Latin America Volume (Units) Forecast by Material, 2018 to 2033

Table 17: Latin America Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 18: Latin America Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Western Europe Sales Revenue (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 20: Western Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 22: Western Europe Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Western Europe Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 24: Western Europe Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Eastern Europe Sales Revenue (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 28: Eastern Europe Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Eastern Europe Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 30: Eastern Europe Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Asia and Pacific Sales Revenue (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 34: South Asia and Pacific Volume (Units) Forecast by Material, 2018 to 2033

Table 35: South Asia and Pacific Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 36: South Asia and Pacific Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: East Asia Sales Revenue (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 38: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 40: East Asia Volume (Units) Forecast by Material, 2018 to 2033

Table 41: East Asia Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 42: East Asia Volume (Units) Forecast by End Use, 2018 to 2033

Table 43: Middle East and Africa Sales Revenue (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Sales Revenue (US$ Million/Billion) Forecast by Material, 2018 to 2033

Table 46: Middle East and Africa Volume (Units) Forecast by Material, 2018 to 2033

Table 47: Middle East and Africa Sales Revenue (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 48: Middle East and Africa Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 2: Global Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 3: Global Sales Revenue (US$ Million/Billion) by Region, 2023 to 2033

Figure 4: Global Sales Revenue (US$ Million/Billion) Analysis by Region, 2018 to 2033

Figure 5: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Sales Revenue Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Sales Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 9: Global Volume (Units) Analysis by Material, 2018 to 2033

Figure 10: Global Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 11: Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 12: Global Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 13: Global Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Attractiveness by Material, 2023 to 2033

Figure 17: Global Attractiveness by End Use, 2023 to 2033

Figure 18: Global Attractiveness by Region, 2023 to 2033

Figure 19: North America Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 20: North America Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 21: North America Sales Revenue (US$ Million/Billion) by Country, 2023 to 2033

Figure 22: North America Sales Revenue (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 23: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Sales Revenue Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Global Sales Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 27: North America Volume (Units) Analysis by Material, 2018 to 2033

Figure 28: North America Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 29: North America Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 30: North America Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 31: North America Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Attractiveness by Material, 2023 to 2033

Figure 35: North America Attractiveness by End Use, 2023 to 2033

Figure 36: North America Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 38: Latin America Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 39: Latin America Sales Revenue (US$ Million/Billion) by Country, 2023 to 2033

Figure 40: Latin America Sales Revenue (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 41: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Sales Revenue Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Global Sales Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 45: Latin America Volume (Units) Analysis by Material, 2018 to 2033

Figure 46: Latin America Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 47: Latin America Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 48: Latin America Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Attractiveness by Material, 2023 to 2033

Figure 53: Latin America Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 56: Western Europe Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 57: Western Europe Sales Revenue (US$ Million/Billion) by Country, 2023 to 2033

Figure 58: Western Europe Sales Revenue (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Sales Revenue Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Global Sales Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 63: Western Europe Volume (Units) Analysis by Material, 2018 to 2033

Figure 64: Western Europe Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 65: Western Europe Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 66: Western Europe Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 67: Western Europe Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Western Europe Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Attractiveness by Material, 2023 to 2033

Figure 71: Western Europe Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 74: Eastern Europe Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 75: Eastern Europe Sales Revenue (US$ Million/Billion) by Country, 2023 to 2033

Figure 76: Eastern Europe Sales Revenue (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Sales Revenue Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Global Sales Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 81: Eastern Europe Volume (Units) Analysis by Material, 2018 to 2033

Figure 82: Eastern Europe Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 83: Eastern Europe Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 84: Eastern Europe Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 85: Eastern Europe Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Eastern Europe Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Attractiveness by Material, 2023 to 2033

Figure 89: Eastern Europe Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 92: South Asia and Pacific Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 93: South Asia and Pacific Sales Revenue (US$ Million/Billion) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Sales Revenue (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Sales Revenue Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Global Sales Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 99: South Asia and Pacific Volume (Units) Analysis by Material, 2018 to 2033

Figure 100: South Asia and Pacific Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 101: South Asia and Pacific Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 102: South Asia and Pacific Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 103: South Asia and Pacific Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: South Asia and Pacific Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia and Pacific Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia and Pacific Attractiveness by Material, 2023 to 2033

Figure 107: South Asia and Pacific Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 110: East Asia Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 111: East Asia Sales Revenue (US$ Million/Billion) by Country, 2023 to 2033

Figure 112: East Asia Sales Revenue (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 113: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Sales Revenue Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Global Sales Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 117: East Asia Volume (Units) Analysis by Material, 2018 to 2033

Figure 118: East Asia Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 119: East Asia Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 120: East Asia Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 121: East Asia Volume (Units) Analysis by End Use, 2018 to 2033

Figure 122: East Asia Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: East Asia Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: East Asia Attractiveness by Material, 2023 to 2033

Figure 125: East Asia Attractiveness by End Use, 2023 to 2033

Figure 126: East Asia Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Sales Revenue (US$ Million/Billion) by Material, 2023 to 2033

Figure 128: Middle East and Africa Sales Revenue (US$ Million/Billion) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Sales Revenue (US$ Million/Billion) by Country, 2023 to 2033

Figure 130: Middle East and Africa Sales Revenue (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Sales Revenue Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Global Sales Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Sales Revenue (US$ Million/Billion) Analysis by Material, 2018 to 2033

Figure 135: Middle East and Africa Volume (Units) Analysis by Material, 2018 to 2033

Figure 136: Middle East and Africa Sales Revenue Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 137: Middle East and Africa Global Sales Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 138: Middle East and Africa Sales Revenue (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 139: Middle East and Africa Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Middle East and Africa Sales Revenue Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Global Sales Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Attractiveness by Material, 2023 to 2033

Figure 143: Middle East and Africa Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Safety Actuators Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Safety Limit Switches Market Size and Share Forecast Outlook 2025 to 2035

Safety Reporting Systems Market Size and Share Forecast Outlook 2025 to 2035

Safety Eyewear Market Analysis - Size, Share, and Forecast 2025 to 2035

Safety Box for Syringe Market Size, Share & Forecast 2025 to 2035

Safety Relays Market Size, Share, and Forecast 2025 to 2035

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Safety Interlock Switches Market Analysis by Actuation Method, Application and End-use Industry and Region 2025 to 2035

Safety Light Curtains Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Safety Eyewear Sector

Industry Share Analysis for Safety Box for Syringe Companies

Safety Label Market Growth & Industry Demand 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA