The Safety Towing System Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 6.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

Quick Stats for Safety Towing System Market

| Metric | Value |

|---|---|

| Safety Towing System Market Estimated Value in (2025 E) | USD 4.4 billion |

| Safety Towing System Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

Market expansion is being supported by the continuous growth of global automotive production across established and emerging markets and the corresponding need for efficient towing equipment that ensures optimal vehicle performance and operational safety. Modern automotive operations require sophisticated towing systems that can deliver precise weight control, reduced operational stress, and enhanced safety characteristics while operating under diverse vehicle configurations and load requirements. The superior towing capacity and safety characteristics of high-quality safety towing systems make them essential equipment in automotive operations where towing performance directly impacts vehicle safety and operational reliability.

The growing emphasis on automotive safety standards and operational efficiency enhancement is driving demand for advanced towing equipment from certified manufacturers with proven track records of quality and reliability in automotive applications. Vehicle manufacturers and fleet operators are increasingly investing in premium safety towing systems that offer extended service life while maintaining consistent towing performance and system reliability. Regulatory requirements and automotive standards are establishing performance benchmarks that favor high-quality towing equipment with superior engineering properties and resistance to operational stresses.

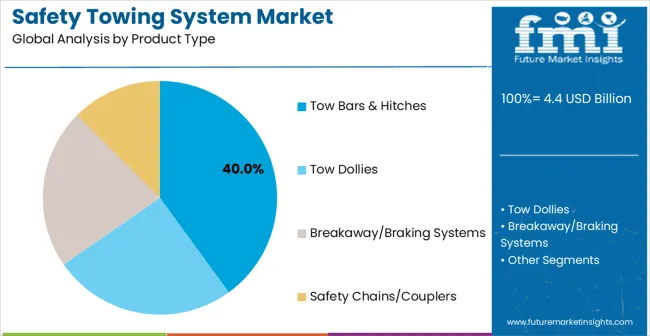

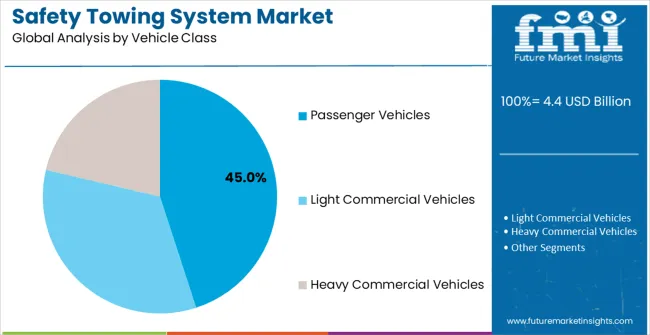

The safety towing system market is segmented by product type, capacity (gvwr), vehicle class, and geographic regions. By product type, safety towing system market is divided into Tow Bars & Hitches, Tow Dollies, Breakaway/Braking Systems, and Safety Chains/Couplers. In terms of capacity (gvwr), safety towing system market is classified into ≤3.5t, 3.6–7.5t, and >7.5t. Based on vehicle class, safety towing system market is segmented into Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles. Regionally, the safety towing system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by product type, capacity, vehicle class, and region. By product type, the market is divided into tow bars & hitches, tow dollies, breakaway/braking systems, and safety chains/couplers configurations. Based on capacity, the market is categorized into ≤3.5t, 3.6-7.5t, and >7.5t segments. By vehicle class, the market includes passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

Tow Bars & Hitches product configurations are projected to account for 40% of the safety towing system market in 2025. This leading share is supported by the proven reliability and versatility of tow bar and hitch systems in vehicle towing operations and the widespread preference for mechanical towing solutions in both commercial and recreational applications. Tow bars & hitches offer excellent load distribution and operational durability, making them ideal for diverse towing applications and challenging operational environments where strength and operational flexibility are essential. The segment benefits from technological advancements that have improved material strength, corrosion resistance, and installation requirements.

Modern tow bars & hitches incorporate advanced steel alloy technologies, precision-engineered connection components, and specialized safety mechanisms that deliver exceptional towing performance while maintaining operational simplicity and reliability under demanding towing conditions. These innovations have significantly improved towing capacity while maintaining compatibility with various vehicle configurations and reducing maintenance costs through enhanced durability and reduced wear requirements. The commercial vehicle sector particularly drives demand for tow bars and hitch solutions, as fleet operations require reliable towing equipment that can meet stringent performance standards and operational requirements.

.webp)

Light capacity (≤3.5t) applications are expected to represent 45% of safety towing system demand in 2025. This significant share reflects the substantial volume of passenger vehicle and light commercial vehicle towing activities globally and the need for specialized towing equipment that meets light-duty operational requirements and safety standards. Light capacity operations require consistent supplies of safety towing systems for recreational towing, urban delivery services, and personal transportation applications across diverse operational environments and vehicle configurations. The segment benefits from ongoing automotive industry growth and increasing emphasis on towing accessibility and safety in light-duty applications.

Light capacity applications demand exceptional equipment reliability to ensure consistent towing performance throughout operational periods while meeting stringent automotive safety standards and regulatory compliance requirements. These applications require safety towing systems that can withstand regular use, load variations, and long-term service under demanding conditions and operational schedules. The growing emphasis on recreational vehicle use and urban mobility solutions, particularly in passenger vehicle applications requiring versatile towing systems for trailers and recreational equipment, drives consistent demand for high-quality light capacity towing equipment.

Passenger Vehicles are projected to account for 45% of the safety towing system market in 2025. This substantial share is supported by the growing emphasis on recreational vehicle use and the increasing need for personal towing solutions that meet consumer convenience and safety requirements. Passenger vehicle applications require versatile and user-friendly towing equipment that can perform across varying recreational towing needs while maintaining operational ease and safety compliance. The segment benefits from the increasing popularity of recreational activities and growing investments in personal vehicle capabilities.

Modern passenger vehicle applications demand safety towing systems that offer superior operational simplicity, reduced installation complexity, and enhanced safety features to support diverse consumer towing requirements and recreational specifications. These applications operate under consumer use patterns and safety expectations, requiring equipment that can adapt to different towing conditions while maintaining consistent performance and user-friendly operation. The growing emphasis on outdoor recreation and personal mobility drives demand for consumers who can provide comprehensive towing solutions with proven track records of safety and operational reliability.

The safety towing system market is advancing steadily due to continuing global automotive industry growth and increasing recognition of towing equipment reliability's importance in operational safety and vehicle performance. However, the market faces challenges, including raw material price volatility affecting equipment costs, increasing adoption of electric vehicles requiring specialized towing solutions, and varying automotive regulations across different regional markets affecting equipment specifications. Environmental rules and vehicle electrification continue to influence equipment design and market development patterns.

The growing deployment of electronic brake controllers, digital monitoring technologies, and smart towing solutions is enabling superior operational safety and enhanced performance characteristics in safety towing system applications. Advanced safety systems and digital integration provide enhanced load monitoring, real-time performance feedback, and predictive maintenance capabilities compared to traditional mechanical towing systems. These innovations are particularly valuable for commercial vehicle operations that require reliable equipment capable of meeting automated fleet management and demanding operational conditions.

Modern towing equipment manufacturers are incorporating electric vehicle compatibility and hybrid towing technologies that provide enhanced integration with electric powertrains and reduced environmental impact compared to traditional towing systems. Integration of electronic controls, regenerative braking systems, and intelligent power management creates opportunities for advanced towing equipment that supports both high-performance vehicle operation and environmental sustainability requirements. Advanced control technologies and energy management systems also support the development of more sophisticated towing solutions for modern electric and hybrid vehicle applications.

| Country | CAGR |

|---|---|

| Brazil | 5.3% |

| India | 4.7% |

| France | 3.5% |

| USA | 3.4% |

| UK | 3.2% |

The safety towing system market is growing steadily, with Brazil leading at a 5.3% CAGR through 2035, driven by expanding automotive production, increasing commercial vehicle fleet development, and comprehensive transportation infrastructure programs supporting both domestic consumption and export markets. India follows at 4.7%, supported by extensive automotive manufacturing growth, expanding commercial transportation activities, and increasing focus on vehicle safety and operational compliance, serving domestic and regional markets. France records strong growth at 3.5%, emphasizing automotive industry leadership, advanced vehicle technologies, and operational excellence in commercial and recreational vehicle operations. The United States shows steady growth at 3.4%, focusing on automotive equipment replacement, recreational vehicle market expansion, and advanced towing technologies. The United Kingdom maintains consistent expansion at 3.2%, supported by engineering excellence and precision manufacturing capabilities.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from safety towing systems in Brazil is projected to exhibit the highest growth rate with a CAGR of 5.3% through 2035, driven by expanding automotive production and comprehensive transportation infrastructure development, creating substantial opportunities for towing equipment suppliers across commercial vehicle manufacturing, fleet operations, and recreational vehicle sectors. The country's growing automotive manufacturing capacity and expanding transportation infrastructure are creating significant demand for both traditional mechanical and advanced electronic towing equipment. Major automotive companies and fleet operators are establishing comprehensive local equipment procurement to support large-scale operations and meet growing demand for reliable towing solutions.

Revenue from safety towing systems in India is expanding at a CAGR of 4.7%, supported by extensive automotive manufacturing development and comprehensive commercial vehicle industry growth, creating sustained demand for reliable towing equipment across diverse vehicle categories and transportation segments. The country's rapid automotive sector expansion and growing transportation capabilities are driving demand for towing equipment that provides consistent performance while supporting cost-effective operational requirements. Towing equipment manufacturers are investing in local production facilities to support growing automotive operations and commercial transportation demand.

Demand for safety towing systems in France is projected to grow at a CAGR of 3.5%, supported by the country's leadership in automotive technology and advanced vehicle manufacturing, requiring sophisticated towing equipment for commercial and recreational vehicle operations. French automotive companies are implementing high-quality towing systems that support advanced vehicle technologies, operational efficiency, and comprehensive safety protocols. The market is characterized by a focus on operational excellence, equipment reliability, and compliance with stringent automotive performance and safety standards.

Revenue from safety towing systems in the United States is growing at a CAGR of 3.4%, driven by automotive equipment replacement programs and increasing recreational vehicle market development, creating sustained opportunities for towing equipment suppliers serving both commercial fleets and consumer applications. The country's mature automotive sector and expanding recreational vehicle industry are creating demand for towing equipment that supports diverse operational requirements while maintaining performance standards. Vehicle manufacturers and fleet operators are developing equipment procurement strategies to support operational efficiency and safety compliance.

Demand for safety towing systems in the United Kingdom is expanding at a CAGR of 3.2%, driven by engineering excellence and precision manufacturing capabilities supporting advanced towing equipment development and comprehensive automotive applications. The country's established automotive expertise and premium vehicle market segments are creating demand for high-quality towing equipment that supports operational performance and regulatory standards. Equipment manufacturers and automotive suppliers are maintaining comprehensive development capabilities to support diverse vehicle requirements.

The safety towing system market in Europe is projected to grow from USD 1.1 billion in 2025 to USD 1.5 billion by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 35.2% market share in 2025, remaining stable at 35.0% by 2035, supported by its advanced automotive equipment manufacturing sector, precision engineering capabilities, and comprehensive innovation expertise serving European and international automotive markets.

The United Kingdom follows with a 22.8% share in 2025, projected to reach 23.1% by 2035, driven by automotive equipment modernization programs, advanced towing technology development capabilities, and growing focus on operational efficiency solutions for premium automotive operations. France holds an 18.4% share in 2025, expected to maintain 18.2% by 2035, supported by automotive industry demand and advanced towing technology applications, but facing challenges from market competition and economic considerations.

Italy commands a 12.6% share in 2025, projected to reach 12.8% by 2035, while Spain accounts for 7.3% in 2025, expected to reach 7.5% by 2035. The Netherlands maintains a 3.7% share in 2025, growing to 3.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 18.6% in 2025, declining slightly to 18.4% by 2035, attributed to mixed growth patterns with strong expansion in some Nordic automotive markets balanced by moderate growth in smaller countries implementing automotive equipment modernization programs.

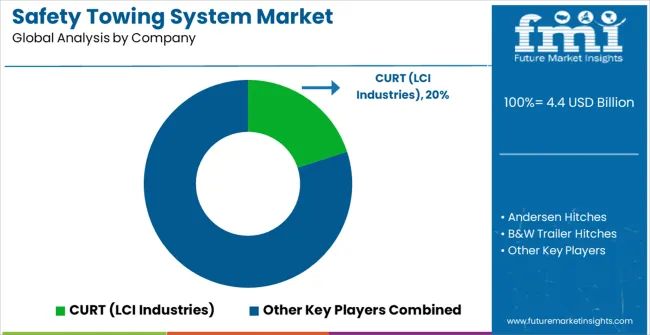

The safety towing system market is defined by competition among established automotive equipment manufacturers, specialized towing system providers, and emerging vehicle technology firms. Companies are investing in advanced towing technology, manufacturing process optimization, quality management systems, and global distribution capabilities to deliver reliable, efficient, and cost-effective towing equipment. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

CURT (LCI Industries), operating globally, offers comprehensive automotive towing solutions with a focus on advanced technology, operational excellence, and automotive industry partnerships, holding a 20% market share. Andersen Hitches provides specialized towing equipment with emphasis on manufacturing efficiency and operational reliability. B&W Trailer Hitches, an American towing equipment specialist, delivers advanced towing technologies with a focus on precision engineering and commercial vehicle applications. These leading companies demonstrate strong market presence through technological innovation and comprehensive service capabilities.

Established towing equipment providers include Blue Ox, offering specialized towing solutions with a focus on operational performance and customer service excellence. Demco delivers comprehensive towing systems with emphasis on recreational vehicle technology and technical support. Draw-Tite provides towing equipment with a focus on passenger vehicle applications and global distribution networks. Gen-Y Hitch offers specialized towing solutions with emphasis on heavy-duty manufacturing and regional market development.

Emerging market participants include Reese, Roadmaster Inc., and Weigh Safe, offering specialized towing expertise, innovative technologies, and technical support across global and regional automotive markets, with a focus on advanced towing capabilities and operational safety solutions.

The safety towing system market underpins automotive safety enhancement, operational efficiency optimization, recreational mobility improvement, and transportation reliability. With automotive industry growth, advancing towing technologies, and increasing safety regulations, the sector must balance equipment quality, operational efficiency, and cost competitiveness. Coordinated contributions from governments, automotive associations, equipment manufacturers, vehicle manufacturers, and investors will accelerate the transition toward advanced, reliable, and highly efficient towing systems.

| Items | Values |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Product Type | Tow Bars & Hitches, Tow Dollies, Breakaway/Braking Systems, Safety Chains/Couplers |

| Capacity | ≤3.5t, 3.6-7.5t, >7.5t |

| Vehicle Class | Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, United Kingdom, Brazil, India, France, and over 40+ other countries |

| Key Companies Profiled | CURT (LCI Industries), Andersen Hitches, B&W Trailer Hitches, Blue Ox, Demco, Draw-Tite, Gen-Y Hitch, Reese, Roadmaster Inc., Weigh Safe |

| Additional Attributes | Dollar sales by product type/capacity, regional demand (NA, EU, APAC), competitive landscape, mechanical vs. electronic system adoption, safety/digital integration, and smart towing innovations driving vehicle safety, operational efficiency, and towing reliability |

The global safety towing system market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the safety towing system market is projected to reach USD 6.2 billion by 2035.

The safety towing system market is expected to grow at a 360.0% CAGR between 2025 and 2035.

The key product types in safety towing system market are tow bars & hitches, tow dollies, breakaway/braking systems and safety chains/couplers.

In terms of capacity (gvwr), ≤3.5t segment to command 45.0% share in the safety towing system market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA