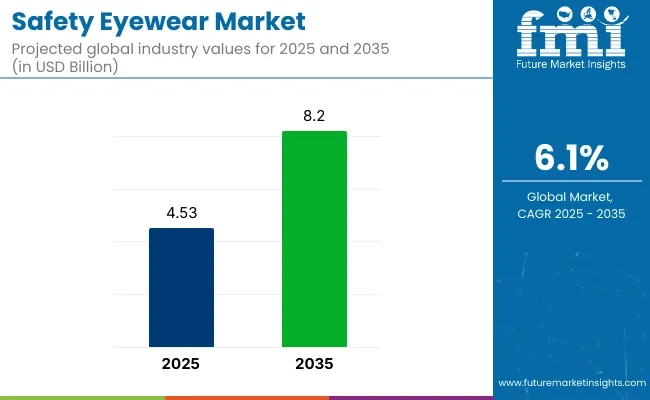

The global safety eyewear market is poised for significant growth, projected to expand from an estimated USD 4.53 billion in 2025 to approximately USD 8.20 billion by 2035 at a CAGR of 6.1%. This upward trajectory is driven by several factors, including increasing industrial activities, stringent workplace safety regulations, and heightened awareness of eye protection.

Industries such as construction, manufacturing, and healthcare are witnessing a rise in workplace eye injuries, underscoring the need for effective protective eyewear. In response, governments and organizations worldwide are enforcing stricter safety standards, compelling businesses to adopt comprehensive personal protective equipment (PPE) solutions.

Technological advancements are playing a pivotal role in shaping the future of safety eyewear. Innovations such as anti-fog coatings, UV protection, and customizable frame designs are enhancing the functionality and comfort of protective eyewear. Polycarbonate lenses, known for their impact resistance and lightweight properties, are increasingly preferred in industrial settings.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 4.53 billion |

| Market Size in 2035 | USD 8.20 billion |

| CAGR (2025 to 2035) | 6.1% |

Ergonomics and style are also gaining prominence as manufacturers recognize the importance of user compliance. Comfortable, adjustable frames with customizable fittings are being designed to cater to diverse facial structures and preferences, encouraging consistent use among workers.

Curt Holtz, President and CEO of Protective Industrial Products (PIP), commented on the evolving landscape of workplace safety " We are delighted to welcome these brands, capabilities, and new employees into PIP with the acquisition of Honeywell’s PPE Business, which is highly complementary to our business. The combination of our expanded portfolio of brands and enhanced geographic reach will enable us to offer more growth opportunities for our valued customers around the world."

This acquisition underscores the industry's commitment to providing comprehensive safety solutions and reflects the growing demand for advanced protective eyewear. The safety eyewear market's growth over the next decade will be propelled by regulatory enforcement, industrial expansion, material innovations, and ergonomic design enhancements. These factors collectively contribute to improving workplace safety standards globally, reducing eye injury rates, and boosting demand for effective and comfortable protective eyewear solutions.

The below table presents the expected CAGR for the safety eyewear industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 6.7% |

| H2(2024 to 2034) | 5.7% |

| H1(2025 to 2035) | 6.9% |

| H2(2025 to 2035) | 5.2% |

The CAGR exhibits a fluctuating trend, initially increasing by 67 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. Further, a slight increase of 69 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external growth.

Growth declines in H2 (2025 to 2035) with a 52 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

The safety eyewear market is projected to experience strong growth, driven by key segments such as safety glasses and polycarbonate lenses. Safety glasses are expected to dominate the market, while polycarbonate lenses will continue to lead in terms of lens type. These segments are essential in providing protective eyewear solutions across industries, ensuring eye safety in various hazardous environments.

Safety glasses are expected to capture 70% of the safety eyewear market share by 2025. These glasses are widely used across industries such as construction, manufacturing, and laboratories, where there is a high risk of eye injuries due to flying debris, chemicals, or intense light. Safety glasses are designed to provide a secure, comfortable fit while offering high levels of protection against physical impacts and hazardous substances.

Leading companies like 3M, Honeywell, and Uvex are major suppliers of safety glasses, offering products with enhanced features such as anti-fog coatings, adjustable straps, and UV protection. The growing focus on worker safety and increasing regulations across various industries are driving the demand for safety glasses.

Additionally, the rise in construction and industrial activities, along with the increasing awareness of occupational hazards, is expected to further boost the market for safety glasses, solidifying their dominant role in the safety eyewear market.

Polycarbonate lenses are projected to capture 80% of the safety eyewear market share by 2025. Known for their superior impact resistance, polycarbonate lenses are significantly stronger than regular lenses, making them an ideal choice for safety eyewear applications where high durability is required.

These lenses are also lightweight, scratch-resistant, and provide excellent UV protection, making them especially popular in industries such as construction, manufacturing, and military applications. Major eyewear brands such as Oakley, Bolle, and Pyramex are incorporating polycarbonate lenses into their safety eyewear products to enhance performance and user comfort.

The high impact resistance of polycarbonate lenses makes them suitable for environments where workers face exposure to high-velocity objects or chemicals. Furthermore, the increasing demand for durable, lightweight, and high-performance safety eyewear solutions is expected to support the continued dominance of polycarbonate lenses in the market, driving substantial growth in the safety eyewear sector.

Multifunctional Safety Eyewear is in High Demand

Multifunctional safety eyewear epitomizes the blend of technology and practicality, addressing the diverse requirements of modern workplaces. These glasses surpass conventional eye protection by integrating features. Like, built-in LED lighting provides enhanced visibility in low-light conditions, thus bolstering safety in industries like mining.

Moreover, embedded cameras facilitate photo and video capture. They are very useful in documentation, training and refer-a-friend programs, to promote special communication and information dissemination.

Moreover, Bluetooth connectivity facilitates integration into any device and promotes hands-free operation and improved productivity in areas like construction, and logistics. This convergence of advanced functionalities enhances safety and streamlines workflow processes, leading to more demand.

E-commerce and DIY Culture Rise are Leading to More Revenues

More people are getting involved in recreational activities. As such, manufacturers are providing products that satisfy safety concerns in Do-it-Yourself (DIY) projects. They are launching protective eyewear that is stylish and functional.

The e-commerce boom has made it simpler to buy these products online. With more products to compare and purchase, safety eyewear sales are rising. Review and comparisons help make informed purchasing decisions. Penetration in this industry has thus become easier for players. The ongoing digitalization wave is beneficial for safety eyewear manufacturers in the long run.

Offering Value-added Services and Solutions can be Opportunistic

Beyond merely selling safety eyewear, businesses can capitalize on opportunities by offering value-added services and solutions. These can range from conducting thorough safety assessments and providing training programs to offering maintenance and repair services.

Implementing subscription-based models for recurring purchases further enhances revenue streams. By providing comprehensive eyewear safety solutions tailored to individual customer needs, businesses can cultivate enduring relationships and ensure sustained revenue growth. This approach can expand reach and also enhance customer loyalty through ongoing support and value delivery.

Tier 1: The leading players in the global safety eyewear market request cutting-edge technology, premium quality products, and strict adherence to safety regulations. They maintain their significant international presence through wide distribution networks, strategic partnerships, and collaborations with key industries such as construction, manufacturing, healthcare, and sports.

R&D is an area where Tier 1 companies daily invest significantly to put into functional protective eyewear advanced properties like anti-fog coatings, blue light filtration, impact resistance, and UV protection into work. Its standing also rests on having adequate adherence to the proposed standards, endorsements from industry insiders, and agency certifications. Tier 1 consists of 3M, Honeywell, Uvex, Bollé Safety, and Pyramex Safety.

Tier 2: Tier 2 players are established in safety eyewear, offering a full suite of reliable and economical eyewear products. Though Tier 1 manufacturers may dominate in global reach, Tier 2 has an appreciable following among varied customers: industrial workers, medical professionals, and outdoor sportspersons.

These companies are focused on cheaper alternatives, comfort, and durability by targeting prescription safety eyewear, tactical goggles, and lightweight protective glasses. They capitalize on online and regional distribution channels that help gain a foothold in the market. Prominent Tier 2 companies include Gateway Safety, Radians, Edge Eyewear, MCR Safety, and Kimberly-Clark Professional.

Tier 3: Tier 3 companies are new entrants who specialize in innovative approaches to customization and niche markets. Some of their specialities include fashion-style safety glasses, eco-compatible materials, and industry-unique safety equipment.

Although they must contend with bigger brands, they win customer loyalty over product quality, targeted marketing campaigns, and direct customer engagement. Many Tier 3 companies are also working with industrial safety specialists, sports teams, and small enterprises to strengthen their position in the market. These include companies like HexArmor, Jackson Safety, Encon Safety, Crossfire Safety Eyewear, and SafeVision.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 4.5 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 3.2 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 3.8 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 3 |

| Country | Australia |

|---|---|

| Population (millions) | 26.3 |

| Estimated Per Capita Spending (USD) | 3.5 |

In the USA, the per capita spending on safety eyewear was USD 4.50 per year, which is due to a tightly knit workplace safety regulation and the strong awareness concerning eye protection. In addition, construction, manufacturing, and healthcare are essential sectors where demand for specialized eyewear is becoming a trend.

At USD 3.20 per capita spending, the UK safety eyewear market benefits from occupational safety standards and demand from industries like construction, healthcare, and sports. Increasing urbanization and technological advancements in lens protection boost market growth.

Germany's spending per capita at USD 3.80 is induced by firm support from the industrial sector, where there exists serious interest in workplace safety. Fueling this demand is also a robust durability feature further strengthened by toughened safety standards and innovations in the anti-fog and anti-scratch coatings.

In Japan, per capita spending equals USD 3.00,the items here are mostly qualitative and technologically designed protective eyewear. Rising UV protection, blue light filtering, and industrial safety needs are contributing to the growth of demand for safety eyewear products in these markets.

In Australia, per capita spending is at USD 3.50, largely benefiting from heightened safety awareness across industries such as the construction, mining, and healthcare sectors. Outfitters are responsible for the durable and stylish demand for safety eyewear with outdoor working environments and extreme weather as promoting factors.

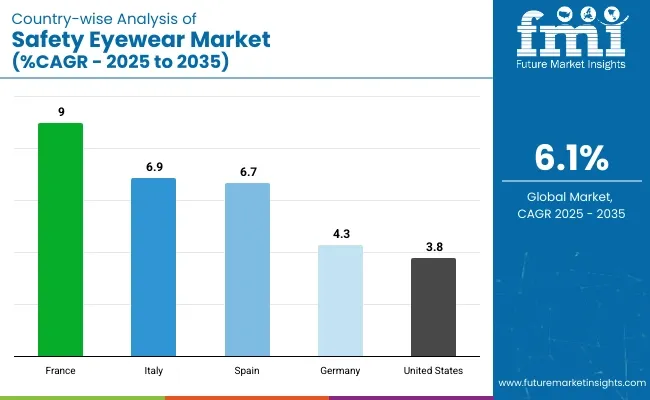

| Countries | CAGR (2025 to 2035) |

|---|---|

| France | 9% |

| Italy | 6.9% |

| Spain | 6.7% |

| Germany | 4.3% |

| United States | 3.8% |

The demand for safety eyewear in France will rise at a 9% CAGR until 2034. Urban development projects offer opportunities for safety eyewear manufacturers, particularly wherein the construction and infrastructure sectors are involved.

French fashion culture drives the application of safety eyewear to be stylish, leading designers to work together to collect protection into aesthetics. Besides, demands fostered by the health care and biomedical research growing sectors facilitate development. This boosts market growth enhanced by a sustained rise in demand for specialized safety eyewear for certain professional groups.

Bollé Safety and Uvex Safety Group are prominent in France. These companies focus on advanced materials and designs to improve safety and comfort. They expand their presence in industrial sectors using targeted marketing and distribution.

In Italy, the growth of safety eyewear is forecasted to grow with a 6.9% CAGR until 2035. The evolution of Italian manufacturing towards becoming high-tech boosts the muscle behind the advanced safety glasses. The stylish designs meet fashion status for potential customers, complementing Italy's reputation regarding design excellence.

The focus on sustainability within the nation has propelled the use of eco-friendly materials, now tuned to take on environmentally conscious buyers. The implementation of digitization provides a substantial boost in production efficiency, with Italy positioned at the forefront of innovation in this field.

Luxottica is an old brand in Italy that sells safety eyewear under the paronym of Oakley. The company is very much focused on its quality and innovations to expand its network across the globe.

The sales of safety eyewear in Spain are set to amplify at a 6.7% CAGR till 2034. The focus on sustainability in Spain has increased the demand for eco-friendly safety eyewear. This also pushes manufacturers to go circular economy and join smart manufacturing technologies to increase efficiency and customization.

The growth of the healthcare and biomedical research sectors further fuels the need for specialized safety eyewear capable of protecting against specific hazards.

Remote work, which grew immensely due to the pandemic, also demands protective eyewear solutions. Spain's dream for innovation, sustainability, and adopting a new work setup makes Spain a key player in the market.

The safety eyewear segment is competitive with major established players like Honeywell, 3M, and UVEX Safety making use of their brand recognition and considerable problems concerning R&D. However, certain niche firms like Pyramex Safety Products and Gateway Safety started to take a certain vertical with a specific emphasis on customization and flexibility.

Competition is centred on pricing, differentiation, and regulatory compliance, with disruptive factors such as technology improvements and digitalization influencing the industry.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 4.53 billion |

| Projected Market Size (2035) | USD 8.20 billion |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Safety Glasses, Others |

| Lens Types Analyzed (Segment 2) | Polycarbonate Lenses, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Safety Eyewear Market | Honeywell, 3M, UVEX Safety, Bolle Safety, MSA Safety, Kimberly-Clark Corporation, DEWALT, Pyramex Safety Products, MCR Safety, Encon Safety Products, Gateway Safety, Jackson Safety, Ergodyne, Sellstrom |

| Additional Attributes | Growth driven by industrial safety regulations, Market adoption of polycarbonate lenses for durability, Product innovations in comfort and style, Trends in impact resistance and lightweight materials, Regional occupational safety initiatives influencing demand |

| Customization and Pricing | Customization and Pricing Available on Request |

Safety Glasses and Others are the key segments driving market growth.

The lens type segment is segregated into Polycarbonate Lenses and Others.

The market spans across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

The market is expected to grow at 6.1% CAGR between 2025 and 2035.

The industry stood at USD 4.53 billion in 2025.

The market is projected to reach USD 8.20 billion by 2035.

South Asia is expected to grow at an 8.5% CAGR during the forecast period.

Major players Honeywell, 3M, UVEX Safety, Bolle Safety, MSA Safety, and Kimberly-Clark Corporation among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Safety Eyewear Sector

MEA Safety Eyewear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Europe Safety Eyewear Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Safety Actuators Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Safety Limit Switches Market Size and Share Forecast Outlook 2025 to 2035

Safety Reporting Systems Market Size and Share Forecast Outlook 2025 to 2035

Safety Box for Syringe Market Size, Share & Forecast 2025 to 2035

Safety Valve Market Size, Growth, and Forecast 2025 to 2035

Safety Relays Market Size, Share, and Forecast 2025 to 2035

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Safety Interlock Switches Market Analysis by Actuation Method, Application and End-use Industry and Region 2025 to 2035

Safety Light Curtains Market Growth - Trends & Forecast 2025 to 2035

Industry Share Analysis for Safety Box for Syringe Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA