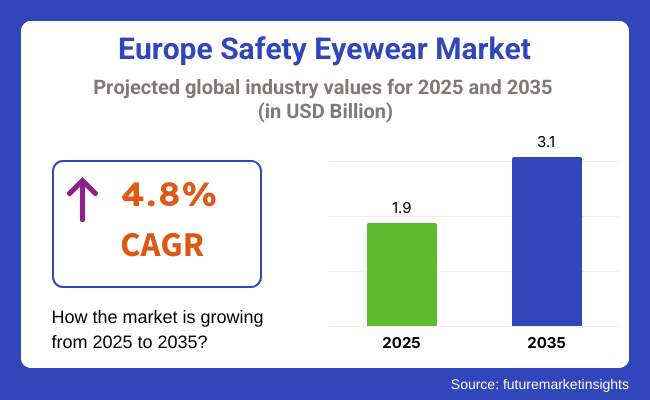

The Europe safety eyewear market size was valued at USD 1.9 billion in 2025 and is expected to grow at a 4.8% CAGR from 2025 to 2035. The market is projected to reach USD 3.1 billion by 2035. A major key driver of this growth is the increasing enforcement of occupational safety regulations across industrial sectors and the growing emphasis on worker health and vision protection.

Safety eyewear has become an indispensable component of personal protective equipment (PPE) across Europe’s construction, manufacturing, chemical, and healthcare industries. As regulatory bodies across the EU tighten compliance mandates for on-site safety, employers are prioritizing investment in certified eye protection solutions that meet EN166 standards and offer impact, chemical, and UV resistance.

Technological advancements in lens coatings, anti-fog solutions, and ergonomic frame designs are redefining user experience and effectiveness. Companies are increasingly offering eyewear with integrated prescription lenses, enhanced visual clarity, and lightweight materials to promote continuous wear without discomfort. Additionally, innovations in smart eyewear that incorporate AR-assisted maintenance guidance and real-time hazard detection are emerging in industrial applications.

The COVID-19 pandemic has permanently altered attitudes toward protective gear, resulting in spillover demand in healthcare, laboratories, and public-facing roles. Moreover, the integration of fashion aesthetics into safety eyewear has opened new opportunities in consumer adoption, especially in sectors like hospitality and logistics, where eye protection and presentation co-exist.

Germany, France and the UK lead in both production and consumption due to mature industrial ecosystems and strict safety norms. Eastern European countries are witnessing growing demand due to increased foreign investment in manufacturing and infrastructure projects. As workplaces evolve and technology enhances PPE efficiency, the Industry is poised for consistent growth through 2035.

In consumer electronics manufacturing industries, safety spectacles must protect workers from exposure to blue light, dust and micro-particulate without fogging to maintain clarity for detailed tasks. The integration of looks and lightness are also critical considerations, allowing for high frequency of use and multi-function demands.

Industrial use environments demand maximum ruggedness, optical precision, and compliance with very high regulatory standards. Anti-fog lenses, scratch resistance and prompt danger warnings by embedded sensors are valued in these environments. Buying in bulk stresses certification, buying in bulk, and compatibility with other PPE systems.

In healthcare and disinfection usage, safety eyewear is required to shield it from biological contaminants as well as chemical splashes. Clear vision, comfort and anti-fog qualities are crucial for high-stress, high-hazard environments. Likewise, for environmental monitoring, sun protection against chemicals and debris is weighed for outdoor and field operators. Compliance certification and comfort over extended periods of wear are high priorities during nighttime shifts.

Despite its projected growth, the European safety eyewear market is not free of challenges. Volatility in raw material supply, particularly for polycarbonate lenses and specialty coatings, is one of the prominent risks. Cost or availability changes can impact manufacturing schedules and profitability, particularly for small manufacturers that rely on third-party sourcing.

Regulatory heterogeneity among EU member states also presents compliance risks. Although there are harmonized standards such as EN166, local implementation differences can lead to certification and industry entry delays. Manufacturers need to navigate this terrain with caution to prevent reputational risks or legal consequences from non-compliant distribution.

An additional issue is the proliferation of low-cost imports that were unable to be verified for quality. These can overwhelm the industry, pushing compliant manufacturers out of business and compromising user safety. Building industry confidence will depend on consistent product performance, sound testing regimes, and good distributor relations founded on tested quality and worker trust.

Between 2020 and 2024, the European market for safety eyewear experienced gradual growth as a result of strict implementation of occupational safety standards and increased awareness of protecting eyes in risky working environments. Manufacturing, construction, healthcare, and chemical industries adopted protective eyewear more rigorously based on compliance demands as well as awareness regarding workers' safety.

The COVID-19 pandemic also further boosted the increasing significance of personal protective equipment, driving the demand for safety eyewear across different industries. Comfort, anti-fog coating, UV protection, and light weight were the most significant factors that manufacturers reported to improve the user experience. E-commerce greatly contributed to the accessibility of the product, as it was simple for small enterprises and end-users to access quality protective eyewear.

Forward to 2025 to 2035, the industry will likely move with greater focus on innovation and sustainability. Smart safety glasses with augmented reality and data visualization features will gain more acceptance, particularly in technical and high-hazard sectors. Shoppers will be searching for adjustable, ergonomic frames that ensure longer-term comfort.

The game will be sustainability, and companies will be under pressure to utilize cleaner production and biodegradable materials. Even regulatory systems will need to undergo a transformation with a focus on technology integration and environmental conservation. As a result, safety glasses will evolve from mere protection gear to a techno-integrated, multi-functional, and eco-friendly safety solution.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Occupational safety legislation and pandemic-related PPE awareness | Technology and sustainability integration as business strategies |

| Lightweight frames, anti-fog lenses, UV protection | Smart glasses featuring AR, biometric feedback, and adjustable ergonomic designs |

| Pressure for comfort, clarity, and regulatory-approved products | Transition toward smart, sustainable, and multipurpose safety glasses |

| Emergence of digital channels and PPE-centric online retail | Blending of omnichannel approaches and D2C technology-enabled product choice |

| Initial moves toward recyclable materials and packaging | Focus on biodegradable materials, lower carbon footprint, and circular design patterns |

| Conformity with current EU PPE directives | Increased attention to environmental regulation and tech-related safety certifications |

By the year 2025, safety glasses will be the major drivers of the European safety eyewear industry, having an estimated share of 40.2% of the total industry. Followed by safety goggles, with an industry share of about 28.6%.

Safety glasses are a major industry unit because they are used in a wide variety of applications such as construction, manufacturing, and laboratory environments. Leading companies like 3M and Honeywell industry their safety glasses for comfort, durability, and effective protection against flying debris and chemical splashes.

Safety glasses, since they can be used without much involvement and light, are usually much less heavyweight, promoting their popularity. Safety glasses are, therefore, ideal for workers in those sectors where mobility is a primary requirement.

Safety goggles are part of the smaller share but are critically important in applications where there is a higher propensity for direct contact with hazardous chemicals, dust, or splashes. Their primary use by industries such as chemical manufacturing, pharmaceuticals, and medical laboratories is because of the snug fit they offer and the superior protection available.

Companies, including Uvex and Bolle Safety, are well-known manufacturers of high-quality goggles designed to ensure an optimal fit, not allowing contaminants to enter and, thus, cause harm. The demand for safety goggles is increasing as industries are placing more emphasis on employee health and safety, especially in areas where high risks are involved.

Both product types will never be cut off from the European Ehead industry, as safety glasses will be favored by public use, and goggles will be necessary in environments that are particularly high risk.

The industry forecasts suggest that plastic frames will be the mainstay of the industry in 2025, comprising around 48.2% of the total share, followed by metal frames, accounting for 27.4% of the share.

Plastic frames are, therefore, light, flexible, and durable, and they find applications in numerous industries. For example, 3M and Bolle Safety manufacture plastic-frame safety eyewear, offering the requisite comfort to wear for long hours.

Plastic frames are more likely to cause less discomfort or fatigue during prolonged wear; hence, they are best fitted for workers within the manufacturing, construction, and general industrial environments where safety eyewear is put on for long hours. Their ability to withstand impact and corrosion adds to their popularity, especially in very harsh chemical or temperature environments.

Metal frames, although they hold a relatively smaller share, are still crucial for some segments of the industry because of their strength and sleekness. Metal frames are most popular because they are considered more robust and less likely to break with the addition of prescriptions.

This makes them somewhat attractive to employees who work in conditions where safety eyewear doubles as vision correction. Companies such as Honeywell and Uvex manufacture safety glasses with metal frames that are aesthetically appealing but also top performing for the discerning consumer who is safety conscious. Metal frames are also increasing in attractiveness in the healthcare and laboratory industry, were accuracy and durability matter in protective eyewear.

Both frame materials will have demand as their needs differ for different areas. Plastic frames, however, will dominate everyday industrial use, while metal frames will get some share of the industry for their higher durability and specialized application.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

| Germany | 5% |

| France | 4.7% |

| Italy | 4.5% |

The UKindustry is expected to grow at 5.2% CAGR during the study period. Expansion is supported by robust policies for workplace health and safety, particularly in the construction, manufacturing, and chemical sectors. The increasing importance of safeguarding employees and following regulatory guidelines such as COSHH (Control of Substances Hazardous to Health) and PPE at Work Regulations is propelling consistent demand for protective eye gear.

In addition, there is more demand for style, ergonomic protective eyewear merging comfort and utility, particularly by younger workers and those in the more hazardous industries. Technological innovations such as anti-fog treatments, resistance to impact, and prescription-convenient designs also influence adoption.

UK companies are investing in the diversification of products and eco-materials, as well as reusable and recyclable protection gear, with a view to the overall environment. E-commerce distribution of safety products is expanding as purchasing processes become computerized, which increases industry reach and growth further.

The German industry will experience a growth rate of 5% CAGR during the study period. As a manufacturing and engineering hub, Germany has a stringent on-the-job safety culture, and safety eyewear is a mandatory component of industrial applications of PPE. Employers' high culture of risk management and strict enforcement of EU workplace safety legislations are the key drivers of product uptake in industries like automotive, metalworking, pharmaceuticals, and building construction.

German consumers and businesses consider quality, reliability, and conformity with certification important when buying safety glasses. The manufacturers are meeting this by incorporating new materials, ventilation technologies, and modular designs into their products.

In addition, the introduction of smart safety solutions, such as sensor-based spectacles for factory and laboratory environments, is long on the horizon. With regular training sessions and PPE usage audits, technologically advanced and certified glasses are likely to increase gradually over the next decade.

The French industry is predicted to grow at 4.7% CAGR during the period of study. Demand for safety eyewear in France is increasing with increased emphasis on occupational health requirements and safeguarding workers in chemical processing, energy, construction, and manufacturing sectors. Government initiatives to curb workplace accidents have fueled the widespread use of personal protective gear, including approved eyewear.

French design preferences are for light, anti-scratch, and anti-fog models, particularly for long wear in industrial settings. Regional and local manufacturers are also producing comfortable and sustainable designs for different working conditions.

Health authority and trade union-sponsored education outreach and safety training programs have raised awareness and compliance, especially among SMEs. As automation and precision industries continue to grow, demand is rising for high-clarity protective goggles that can be equipped with prescription lenses and technical specifications.

The Italian industry is projected to grow at 4.5% CAGR through the analysis period. Increased investment in construction, light manufacturing, and food processing industries predominantly drive the growth of the Italian industry. Although compliance levels are on an upward trend, the Italian industry still has some hindrances in embracing standardized PPE, especially among small enterprises. However, the rising use of EU directives and occupational protection standards is driving slow modernization of the industry.

Italian companies are increasingly adopting high-end protective eyewear products that strike a balance between style and functionality, in line with a cultural preference for design-oriented products. Principal applications include dust protection, impact resistance, and chemical splash protection.

Internet purchasing and increased demand from sole professionals, contractors, and health professionals are supporting increased product demand. With the digitization of the industry and workplace rules tending to get more strictly controlled, the demand for Italian security eyewear will increase upwards in 2035.

The industry is highly competitive due to innovations and the continuous concern for workers' safety in hazardous environments. 3M, Bolle Safety, and PIP Global are the major industry players that provide the widest variety of safety eyewear solutions that combine comfort, durability and high-level protection.

All these companies have heavily invested in research and development (R&D) of lens technologies like anti-fog coatings and UV protection. The industry is highly competitive due to innovations and the continuous concern for workers' safety in hazardous environments. 3M, Bolle Safety, and PIP Global are the major industry players that provide the widest variety of safety eyewear solutions that combine comfort, durability and high-level protection.

All these companies have heavily invested in research and development (R&D) of lens technologies like anti-fog coatings, UV protection, and optical clarity, ensuring that their eyewear conforms to strict European safety standards.

Bolle Safety emphasizes an ergonomically designed impact-resistant product that is comfortable while retaining protective capabilities and, therefore, is an important actor on the European Scene. PIP Global has solidified its reputation for securing eyewear solutions that are customizable and durable in various industrial applications to protect workers in multiple sectors better.

Other players like Honeywell Safety Products and Radians, Inc. are also extending their portfolios to provide customizable and stylish eyewear to serve additional industries, including construction and healthcare.

Gentex Corporation is also leading the field by enhancing functionality by integrating smart technology into eyewear, such as built-in communication systems. Delta Plus Group and Moldex/Metric AG & Co. KG are ensuring that their eyewear products meet European safety standards, which is why they are in a good position to contend well in the industry.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| 3M | 18-22% |

| Bolle Safety | 14-18% |

| PIP Global | 12-16% |

| SureWerx | 10-14% |

| Stanley Black & Decker | 8-12% |

| Other Players | 24-28% |

| Company Name | Offerings & Activities |

|---|---|

| 3M | Advanced safety eyewear with features like anti-fog coatings, UV protection, and optical clarity. |

| Bolle Safety | A range of protective eyewear products focusing on ergonomic design and impact-resistant lenses. |

| PIP Global | Customizable and durable safety eyewear for diverse industrial applications. |

| SureWerx | It focuses on durable, comfortable, and safe eyewear designed for industrial use, with a focus on reliability and value. |

| Stanley Black & Decker | Safety eyewear integrates advanced safety features with innovative design as well as comfort. |

Key Company Insights

3M (18-22%)

A safety eyewear leader that combines comfort, clarity, and innovative protection in multiple industrial segments.

Bolle Safety (14-18%)

Experts in ergonomic, impact-resistant eyewear with a strong European industry presence, emphasizing comfort and protection.

PIP Global (12-16%)

Offers customizable safety eyewear solutions that cater to the requirements of various industries, providing high-quality protection.

SureWerx (10-14%)

Famous for comfortable and long-lasting glasses, providing reliability and value for industrial personnel, particularly for heavy-duty usage.

Stanley Black & Decker (8-12%)

It is one of the most serious competitors for safety eyewear, with its reputation for high-performance protection paired with comfort for the wearer.

Other Key Players

The industry is segmented into safety glasses, safety goggles, welding helmets, face shields, laser safety glasses, and prescription safety eyewear.

The industry is categorized based on frame material into plastic, metal, nylon, rubber, and others.

The industry includespolycarbonate lenses, trivex lenses, clear lenses, polarized lenses, photochromic lenses, mirrored lenses, and other lens types.

The industry comprisesconstruction, manufacturing, oil and gas, chemical, healthcare, mining, military and defense and residential/households.

The industry is segmented into online retail, offline retail (specialty stores, department stores, safety equipment suppliers), and institutional sales (B2B).

The industry is analyzed across Germany, United Kingdom, Spain, France, Italy, Nordics, Benelux, GCC, Russia, Poland, and the rest of Europe.

The industry is expected to be valued at USD 1.9 billion in 2025.

The industry is projected to reach USD 3.1 billion by 2035.

The UK is forecast to grow at a 5.2% CAGR.

Safety glasses remain the dominant product type due to their extensive usage across diverse industrial sectors and availability in impact-resistant designs.

Leading companies include 3M, Bolle Safety, PIP Global, SureWerx, Stanley Black & Decker, Gentex Corporation, Encon Safety Products, Inc., Klein Tools, Delta Plus Group, Moldex/Metric AG & Co. KG, Lakeland Industries, Inc., JSP Limited, Bunzl plc, Radians, Inc., Honeywell Safety Products, UNIVET Group, Ansell Ltd., and Infield Safety.

Table 1: Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 2: Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 3: Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 4: Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 5: Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 6: Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 7: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 8: Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 9: Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 10: Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 11: Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 12: Market Volume (Million Units) Analysis By Country, 2018 to 2033

Table 13: Germany Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 14: Germany Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 15: Germany Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 16: Germany Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 17: Germany Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 18: Germany Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 19: Germany Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 20: Germany Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 21: Germany Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 22: Germany Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 23: United Kingdom Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 24: United Kingdom Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 25: United Kingdom Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 26: United Kingdom Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 27: United Kingdom Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 28: United Kingdom Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 29: United Kingdom Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 30: United Kingdom Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 31: United Kingdom Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 32: United Kingdom Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 33: Spain Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 34: Spain Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 35: Spain Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 36: Spain Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 37: Spain Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 38: Spain Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 39: Spain Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 40: Spain Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 41: Spain Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 42: Spain Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 43: France Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 44: France Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 45: France Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 46: France Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 47: France Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 48: France Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 49: France Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 50: France Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 51: France Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 52: France Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 53: Italy Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 54: Italy Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 55: Italy Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 56: Italy Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 57: Italy Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 58: Italy Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 59: Italy Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 60: Italy Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 61: Italy Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 62: Italy Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 63: Nordics Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 64: Nordics Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 65: Nordics Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 66: Nordics Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 67: Nordics Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 68: Nordics Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 69: Nordics Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 70: Nordics Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 71: Nordics Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 72: Nordics Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 73: Benelux Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 74: Benelux Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 75: Benelux Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 76: Benelux Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 77: Benelux Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 78: Benelux Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 79: Benelux Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 80: Benelux Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 81: Benelux Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 82: Benelux Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 83: Russia Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 84: Russia Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 85: Russia Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 86: Russia Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 87: Russia Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 88: Russia Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 89: Russia Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 90: Russia Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 91: Russia Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 92: Russia Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 93: Poland Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 94: Poland Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 95: Poland Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 96: Poland Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 97: Poland Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 98: Poland Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 99: Poland Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 100: Poland Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 101: Poland Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 102: Poland Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Table 103: Rest of Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 104: Rest of Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Table 105: Rest of Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 106: Rest of Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Table 107: Rest of Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 108: Rest of Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Table 109: Rest of Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 110: Rest of Market Volume (Million Units) Analysis By End User, 2018 to 2033

Table 111: Rest of Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 112: Rest of Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 01: Market Value (US$ Million) and Volume (Million Units) Analysis, 2018 to 2022

Figure 02: Market Value (US$ Million) and Volume (Million Units) Forecast, 2023 to 2033

Figure 03: Market Value (US$ Million) Analysis, 2018 to 2022

Figure 04: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Market Absolute $ Opportunity Value (US$ Million), 2023 to 2033

Figure 06: Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 07: Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 08: Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 11: Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 13: Market Attractiveness By Frame Material, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 15: Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 17: Market Attractiveness By Lens Type, 2023 to 2033

Figure 18: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 19: Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 20: Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 21: Market Attractiveness By End User, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 23: Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 24: Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 25: Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 27: Market Volume (Million Units) Analysis By Country, 2018 to 2033

Figure 28: Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 29: Market Attractiveness By Country, 2023 to 2033

Figure 30: Germany Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 31: Germany Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 32: Germany Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 33: Germany Market Attractiveness By Product Type, 2023 to 2033

Figure 34: Germany Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 35: Germany Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 36: Germany Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 37: Germany Market Attractiveness By Frame Material, 2023 to 2033

Figure 38: Germany Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 39: Germany Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 40: Germany Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 41: Germany Market Attractiveness By Lens Type, 2023 to 2033

Figure 42: Germany Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 43: Germany Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 44: Germany Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 45: Germany Market Attractiveness By End User, 2023 to 2033

Figure 46: Germany Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 47: Germany Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 48: Germany Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 49: Germany Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 50: United Kingdom Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 51: United Kingdom Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 52: United Kingdom Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 53: United Kingdom Market Attractiveness By Product Type, 2023 to 2033

Figure 54: United Kingdom Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 55: United Kingdom Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 56: United Kingdom Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 57: United Kingdom Market Attractiveness By Frame Material, 2023 to 2033

Figure 58: United Kingdom Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 59: United Kingdom Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 60: United Kingdom Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 61: United Kingdom Market Attractiveness By Lens Type, 2023 to 2033

Figure 62: United Kingdom Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 63: United Kingdom Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 64: United Kingdom Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 65: United Kingdom Market Attractiveness By End User, 2023 to 2033

Figure 66: United Kingdom Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 67: United Kingdom Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 68: United Kingdom Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 69: United Kingdom Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 70: Spain Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 71: Spain Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 72: Spain Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 73: Spain Market Attractiveness By Product Type, 2023 to 2033

Figure 74: Spain Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 75: Spain Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 76: Spain Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 77: Spain Market Attractiveness By Frame Material, 2023 to 2033

Figure 78: Spain Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 79: Spain Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 80: Spain Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 81: Spain Market Attractiveness By Lens Type, 2023 to 2033

Figure 82: Spain Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 83: Spain Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 84: Spain Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 85: Spain Market Attractiveness By End User, 2023 to 2033

Figure 86: Spain Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 87: Spain Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 88: Spain Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 89: Spain Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 90: France Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 91: France Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 92: France Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 93: France Market Attractiveness By Product Type, 2023 to 2033

Figure 94: France Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 95: France Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 96: France Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 97: France Market Attractiveness By Frame Material, 2023 to 2033

Figure 98: France Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 99: France Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 100: France Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 101: France Market Attractiveness By Lens Type, 2023 to 2033

Figure 102: France Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 103: France Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 104: France Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 105: France Market Attractiveness By End User, 2023 to 2033

Figure 106: France Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 107: France Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 108: France Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 109: France Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 110: Italy Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 111: Italy Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 112: Italy Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 113: Italy Market Attractiveness By Product Type, 2023 to 2033

Figure 114: Italy Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 115: Italy Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 116: Italy Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 117: Italy Market Attractiveness By Frame Material, 2023 to 2033

Figure 118: Italy Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 119: Italy Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 120: Italy Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 121: Italy Market Attractiveness By Lens Type, 2023 to 2033

Figure 122: Italy Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 123: Italy Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 124: Italy Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 125: Italy Market Attractiveness By End User, 2023 to 2033

Figure 126: Italy Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 127: Italy Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 128: Italy Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 129: Italy Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 130: Nordics Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 131: Nordics Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 132: Nordics Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 133: Nordics Market Attractiveness By Product Type, 2023 to 2033

Figure 134: Nordics Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 135: Nordics Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 136: Nordics Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 137: Nordics Market Attractiveness By Frame Material, 2023 to 2033

Figure 138: Nordics Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 139: Nordics Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 140: Nordics Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 141: Nordics Market Attractiveness By Lens Type, 2023 to 2033

Figure 142: Nordics Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 143: Nordics Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 144: Nordics Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 145: Nordics Market Attractiveness By End User, 2023 to 2033

Figure 146: Nordics Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 147: Nordics Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 148: Nordics Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 149: Nordics Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 150: Benelux Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 151: Benelux Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 152: Benelux Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 153: Benelux Market Attractiveness By Product Type, 2023 to 2033

Figure 154: Benelux Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 155: Benelux Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 156: Benelux Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 157: Benelux Market Attractiveness By Frame Material, 2023 to 2033

Figure 158: Benelux Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 159: Benelux Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 160: Benelux Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 161: Benelux Market Attractiveness By Lens Type, 2023 to 2033

Figure 162: Benelux Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 163: Benelux Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 164: Benelux Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 165: Benelux Market Attractiveness By End User, 2023 to 2033

Figure 166: Benelux Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 167: Benelux Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 168: Benelux Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 169: Benelux Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 170: Russia Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 171: Russia Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 172: Russia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 173: Russia Market Attractiveness By Product Type, 2023 to 2033

Figure 174: Russia Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 175: Russia Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 176: Russia Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 177: Russia Market Attractiveness By Frame Material, 2023 to 2033

Figure 178: Russia Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 179: Russia Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 180: Russia Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 181: Russia Market Attractiveness By Lens Type, 2023 to 2033

Figure 182: Russia Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 183: Russia Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 184: Russia Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 185: Russia Market Attractiveness By End User, 2023 to 2033

Figure 186: Russia Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 187: Russia Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 188: Russia Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 189: Russia Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 190: Poland Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 191: Poland Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 192: Poland Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 193: Poland Market Attractiveness By Product Type, 2023 to 2033

Figure 194: Poland Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 195: Poland Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 196: Poland Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 197: Poland Market Attractiveness By Frame Material, 2023 to 2033

Figure 198: Poland Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 199: Poland Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 200: Poland Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 201: Poland Market Attractiveness By Lens Type, 2023 to 2033

Figure 202: Poland Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 203: Poland Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 204: Poland Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 205: Poland Market Attractiveness By End User, 2023 to 2033

Figure 206: Poland Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 207: Poland Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 208: Poland Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 209: Poland Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 210: Rest of Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 211: Rest of Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 212: Rest of Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 213: Rest of Market Attractiveness By Product Type, 2023 to 2033

Figure 214: Rest of Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 215: Rest of Market Volume (Million Units) Analysis By Frame Material, 2018 to 2033

Figure 216: Rest of Market Y-o-Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 217: Rest of Market Attractiveness By Frame Material, 2023 to 2033

Figure 218: Rest of Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 219: Rest of Market Volume (Million Units) Analysis By Lens Type, 2018 to 2033

Figure 220: Rest of Market Y-o-Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 221: Rest of Market Attractiveness By Lens Type, 2023 to 2033

Figure 222: Rest of Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 223: Rest of Market Volume (Million Units) Analysis By End User, 2018 to 2033

Figure 224: Rest of Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 225: Rest of Market Attractiveness By End User, 2023 to 2033

Figure 226: Rest of Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 227: Rest of Market Volume (Million Units) Analysis By Distribution Channel, 2018 to 2033

Figure 228: Rest of Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 229: Rest of Market Attractiveness By Distribution Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA