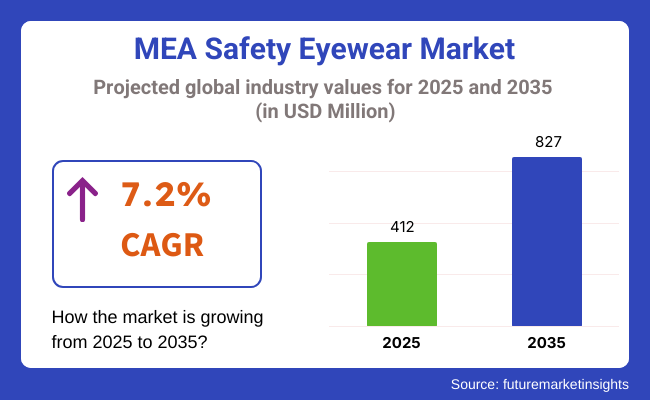

The MEA (Middle East and Africa) safety eyewear market size was valued at USD 412 million

in 2025 and is expected to grow at a 7.2% CAGR from 2025 to 2035. This industry in the MEA is expected to reach USD 827 million by 2035. A major key driver of this growth is the intensifying enforcement of workplace safety regulations in sectors such as oil & gas, mining, and construction, where eye protection is a mandated component of personal protective equipment (PPE).

The region’s expanding industrial base, especially in the Gulf Cooperation Council (GCC) countries and parts of Sub-Saharan Africa, has significantly increased the demand for occupational safety solutions. Employers are progressively adopting advanced eyewear that offers not only impact protection but also features such as UV resistance, anti-fog coatings, and prescription lens compatibility to cater to diverse working environments.

Technological integration is also elevating industrial standards. Smart safety eyewear equipped with heads-up displays, real-time hazard alerts, and wearable tracking is gaining traction among multinational firms seeking to enhance productivity without compromising worker safety. This shift toward connected PPE reflects the broader trend of digital transformation in MEA's industrial safety infrastructure.

Moreover, the rise of healthcare initiatives and laboratory expansions in the region, driven by both public investment and private medical infrastructure growth, has further reinforced the demand for specialized eyewear. This includes sterile, anti-contamination designs suited for controlled environments, highlighting the expanding use cases beyond traditional industrial domains.

In the forecast period, there will be compliance with international safety standards and demand for user-centric, comfort-enhancing features. Manufacturers that offer modular, durable, and customizable eyewear options will be better positioned to capture emerging demand across multiple sectors and climatic conditions, particularly in desert and humid environments typical of the MEA region.

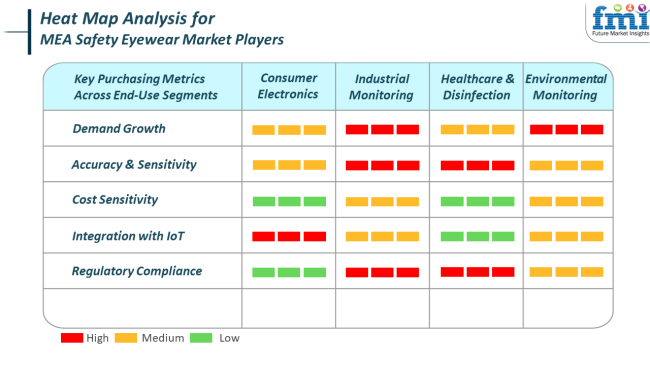

Industrial and regulatory impacts on protective eyewear sales in the MEA predominantly impact purchasing behavior among industries. Industrial operating environments in factory facilities and oil wells require reliable, compliant protective eyewear that is resistant to high intensities of precision and durability when subjected to abusive environments. Higher demand and regulation continue to lead procurement activity to be among the top driving forces in environments where this growth is occurring.

Medical and disinfection application puts the spotlight on sterile-grade glasses that are clean in specifications and provide comfort and clarity under long wear. Anti-fog and sealed frames are desirable among such users, with increasing emphasis on recyclability and biodegradability materials. Environmental monitoring uses-e.g., hazard site surveys-are calling for apparatus with high potential for integration and high protection features.

The integration of digital safety technology with conventional PPE is most robust in consumer electronics-related sectors where smart integration, comfort, and design are of the topmost concern. In all such applications, the future of buying behavior will gravitate more and more toward adaptive eyewear, balancing safety compliance with user-specific function and ergonomic precision.

One of the major risks is the political and economic uncertainty in certain regions. Erratic investment in industry and infrastructure initiatives because of shifting government agendas or internal strife will dampen growth momentum and procurements, largely in Sub-Saharan Africa and the North.

Another threat is industry fragmentation and the spread of low-quality, non-compliant products. Uncontrolled imports and counterfeit PPE still pose a threat to quality control initiatives, particularly in rural or informal industries. This negatively affects consumer trust and increases the burden on regulatory bodies and genuine vendors to guarantee authenticity and safety certification.

Lastly, the rapid rate of technological progress poses a double-edged sword. While materials and intelligent features innovation drive functionality, it also threatens to price out portions of the industry that cannot afford high front-end costs. In the absence of scalable product levels and training programs that encourage adoption, safety eyewear manufacturers stand to face resistance in low-income portions of the MEA, constraining the broad penetration of high-end product offerings.

During the period 2020 to 2024, the industry experienced substantial growth due to increased industrial activity, growing concern for workplace safety, and more stringent regulatory environments in several industries like construction, manufacturing, oil and gas, and healthcare. With the strict safety norms for sectors, the demand for protective eyewear increased in order to avoid the risks of eye injury in hazardous environments.

The development of industries within developing economies like South Africa was also responsible for driving the market at this time. Technological and other innovations in material, including UV resistance, anti-fog coatings, and comfort features, assisted in gaining more consumers.

Through 2035, smart technology and wearable technologies will be integrated into protective eyewear. This will allow real-time monitoring of environmental conditions and personal health, offering workers higher protection. There will be an increasing focus on sustainable, green materials and more customized, ergonomic designs geared toward industries. With safety becoming a concern for a rising number of industries, like laboratories, the military, and high-hazard industries, there will be a steady demand for protective eyewear over the next few years.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing industrial operations and tighter safety policies | Adoption of smart technology, emphasis on sustainability, and tailored solutions |

| Improved comfort, anti-fog, UV block, and superior designs | Intelligent safety goggles with real-time tracking, AI-enabled features, and sustainable materials |

| Growing demand for industrial safety goggles and compliance with regulations | Choice of customized, ergonomic, and advanced goggles solutions for varied uses |

| Expansion of e-commerce and digital platforms for convenient access to safety goggles | Omnichannel strategies with a dual online and offline retail focus for customized experiences |

| Early moves towards sustainable and green materials | Widespread use of biodegradable products, recyclability, and moral manufacturing practices |

| Adherence to workplace safety standards in industrial activities | Improved safety standards with an emphasis on technological advancement and environmental sustainability |

| Countries | CAGR (2025 to 2035) |

|---|---|

| Turkey | 5.1% |

| United Arab Emirates | 5.4% |

| South Africa | 5.2% |

| Qatar | 5.3% |

| Morocco | 4.9% |

Turkey will grow at a 5.1% CAGR over the study period. Turkey is an important industrial hub in the Middle East and Eastern Europe region with an emerging focus on manufacturing, automotive, and construction activities. Governmental measures to modernize workplace safety norms, particularly as part of EU alignment drives, have led to stronger enforcement of occupational safety norms. This directly supports the demand growth for protective equipment, including safety eyewear.

Heavy industries, as well as infrastructure megaprojects, have caused a greater potential for workplace danger and thus required the use of safety goggles and impact-resistant spectacles in regular business. Turkish consumers are also seeing the rewards of higher exportation and domestic production of personal protective equipment, leading to easier accessibility and lower prices locally.

In addition, public and private sector stakeholders' safety campaigns are propelling awareness of the need for eye protection. Advances in distribution infrastructure and industrial safety training programs' expansion will continue to place the industry on a growth trajectory through 2035. The incorporation of advanced materials and ergonomic design in safety eyewear is enabling manufacturers to address changing user expectations.

The United Arab Emirates is anticipated to expand at 5.4% CAGR throughout research. The UAE is marked by a robust construction-driven economy supported by ambitious national infrastructure schemes like smart cities and renewable energy centers. With such a high level of development activity, strict safety compliance is required, which creates demand for top-quality safety eyewear in public as well as private sectors.

The government's strict occupational safety regulations, especially in Dubai and Abu Dhabi, have set the stage for regular procurement of protective gear. The nation is also experiencing diversification in industrial operations, such as manufacturing, energy, logistics, and healthcare, all of which translate to an expanding demand for safety goggles, face shields, and anti-UV protective eyewear. Being a regional trade and logistics center, the UAE is also a hub for top PPE brands and distributors that further increase product exposure and availability.

Sustainability measures and new retail channels, such as online, are making the supply chain more efficient. Ongoing investments in employee well-being, as well as the implementation of labor protection laws in hot and dangerous conditions, will be able to maintain protective eyewear sales in the UAE.

South Africa is slated to grow at 5.2% CAGR throughout the study. South Africa is among the most industrialized nations on the African continent, with notable mining, building, and power sectors. They are industries where safety risks naturally are high, adding strength to the necessity of good protective devices, particularly protection for the eyes. Enforcement of workplace safety acts and audit regimes is driving demand in the marketplace for certified impact-resistant and ergonomic-designed eyewear.

South Africa's vast mining labor force especially gains from high-durability protective eyewear appropriate for dusty and high-hazard environments. Furthermore, growing concern with occupational health in urban construction and manufacturing sites has broadened the use range of safety eyewear.

The government's efforts to enhance labor conditions and private investment in PPE solutions are promoting a mature safety equipment industry. Also, the increased development of healthcare infrastructure has added to the demand for safety eyewear in laboratories and healthcare institutions. As public-private partnerships increase, South Africa stands to take the leading position in implementing safety standards, which drives demand for protective eyewear throughout the forecast period.

The Qatar market is likely to expand at 5.3% CAGR over the forecast period. Qatar is experiencing high economic growth driven by high-scale infrastructure and energy projects, particularly in readiness for continuous urban change and global business investments.

As one of the richest countries on a per capita basis, Qatar is significantly concerned with the protection of labor and adherence to international safety standards, especially in the construction and energy industries. The nation's sun-prone weather and stressful outdoor work environments have also required specialized eyewear solutions to protect workers from anti-fog, UV, and moisture-related hazards.

Increasing foreign labor participation in industrial careers has compelled employers to spend money on premium PPE, including dependable safety glasses and goggles. Advancements in healthcare and lab growth are also fueling diversified demand.

Domestic programs promoting the health and well-being of blue-collar workers and increased inspections have raised safety standards. Advanced products have been made available through digital procurement platforms and collaborations with global PPE producers. With Qatar's continued investment in industrial diversification, the market for safe and compliant eye protection will grow steadily across the forecast period.

The Morocco market will grow at 4.9% CAGR in the study period. Morocco is witnessing slow and steady industrial expansion, especially in automotive assembly, aerospace, textile, and agriculture. This diversification in the industry is fueling a mounting focus on occupational safety practices, thus supplementing the demand for protective eyewear. With the expansion in international trade relationships, particularly with Europe and China, there is increased compliance with global workplace safety standards, shaping market behavior.

National labor and health officials are focusing on reforms to strengthen the protection of workers, particularly in Casablanca and Tangier manufacturing enclaves. Promotional efforts combined with investments by private industry in workplace safety training are slowly increasing PPE use across sectors.

The nation is also blessed with a strategic logistics location, making it easy to access foreign safety eyewear brands and supply chains. Although the market is fairly new compared to leaders in the region, expansion in infrastructure projects and foreign direct investment will drive steady demand growth.

Adoption of technology within the PPE sector, such as anti-fog and anti-scratch safety glasses, is increasingly becoming key, bringing the Moroccan market into line with larger MEA-wide trends in compliance for safety and product innovation.

In 2025, the industryis expected to be governed mainly by safety glasses, slated for a 46.5% share of the total market share, followed by safety goggles with a share of 30%.

Safety glasses are primarily favored in the market due to their extensive use in the construction, oil and gas, and mining industries, which are most dominant across the MEA region. Rapid infrastructure and industrial development in countries like the United Arab Emirates and Saudi Arabia have given rise to the demand for personal protective equipment (PPE), including safety eyewear.

Pioneer brands such as 3M, Honeywell, and JSP Safety are producing lightweight, impact-resistant safety spectacles that provide maximum comfort and protection for workers using them for long hours, thus catering to the demand. The popularity of the 3M SecureFit™ series in the region, which integrates pressure diffusion temple technology for comfort during extended wear, adds to this demand.

Safety goggles occupy a slightly smaller market share but are nevertheless indispensable for applications that require higher protection, especially in such settings as handling chemicals, laboratories, and healthcare. The preferences for safety goggles go out to those, in particular, being used in pharmaceutical manufacturing and heavy chemical processing industries, taking their operations in South Africa and Nigeria.

High-performance goggles offering fog resistance, comfort, and compliance with international safety standards are provided by Uvex and Bollé Safety. Full eye protection and enclosure from splashes, dust, and airborne particles allow for extensive utilization of the Uvex Ultrasonic series.

Growing regulatory focus on occupational safety and rising awareness about eye protection across high-risk industrial sectors and healthcare environments are also expected to bring sustained growth for safety glasses and goggles across the MEA region. This trend showcases a commitment to worker safety and compliance with international safety norms.

By frame material, plastic frames account for a 59% share, while metal sundries are credited with 24%.

Plastic frame predominance arises from being lightweight, cheap, and adapted to high-temperature dusty industrial environments found all over the region. Countries such as Saudi Arabia, the UAE, and South Africa have highly developed construction, oil and gas, and mining industries, wherein great reliance is placed on plastic safety eyewear for high-impact resistance and wearing comfort.

Key industry players like Bollé Safety and 3M have introduced product lines that cater directly to these conditions. Made of lightweight polycarbonate, Bollé Rush + and 3M SecureFit have been designed for comfort with UV and scratch protection for extended use in highly heated environments. These models are popular among oil rig workers in the Gulf Region and site engineers across large-scale infrastructure projects in Egypt and Kenya.

Metal frame-based safety spectacles account for a 24% share. They perform significant functions in niche environments, such as laboratory testing, pharmaceuticals, and precision tasks. Uvex's i-5 metal series or ChemPro goggles from MSA Safety are some examples of high-end models that were constructed in the cleanroom and biomedical labs in South Africa and Morocco, where the applications of firm fit and chemical resistance are imperative.

Moreover, Delta Plus provides hybrid-frame goggles that comprise plastic frames with reinforced metallic elements meant for automotive manufacturing units in Algeria and Tunisia. To these, Dr. Ger Safety has custom-fit eyewear, which is gaining popularity in the health sector, especially in hospitals and diagnostic labs within urban centers in Nigeria, because of its famed excellence in protection and fog resistance.

It emphasizes the variety with which the selection of material has been made for use and demonstrates once again that safety eyewear adoption in the MEA area has primarily resulted from application-induced requirements and a diversified range of industry-specific hazards as companies have tailored their products to suit the legislation and environment.

The industry has prominent global companies, including 3M, Honeywell Safety Products, Bollé Safety, PIP Global, and Delta Plus Group, each of which is making strides across the MEA with local solutions through partnerships and distribution networks. The ongoing industrialization in the region, and especially regarding oil & gas, construction, and mining, created a demand for safety eyewear that is impact-resistant and prescription-compatible.

3M has continued to lead through its comprehensive PPE product portfolio, with a variety of offerings, including anti-fog, UV-protective, and ANSI-compliant eyewear designed for harsh climatic conditions. Honeywell Safety Products offers very advanced lens technology with comfortable designs that are adaptable to its environments, especially in the industrial zones of the UAE and Saudi Arabia.

Bollé Safety has distinguished what appears to be a superior premium offering in the fields of high-clarity vision and fashion for both environments, industrial and laboratory settings. PIP Global uses its distribution, which is also highly scalable, for ruggedized eyewear solutions directed at mining-intensive regions. Delta Plus Group has ramped up its North African visibility with value-for-money, EU-certified gear.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| 3M | 18-22% |

| Honeywell Safety Products | 14-18% |

| Bollé Safety | 10-14% |

| PIP Global | 9-12% |

| Delta Plus Group | 7-10% |

| Other Players | 27-32% |

| Company Name | Offerings & Activities |

|---|---|

| 3M | Offers ANSI-rated anti-scratch, UV-protected, and fog-resistant eyewear for heavy industries. |

| Honeywell Safety Products | Focuses on comfort-fit eyewear with multi-coating options and regional certifications. |

| Bollé Safety | Delivers high-performance, sleek industrial eyewear with advanced lens clarity. |

| PIP Global | Supplies durable, impact-rated eyewear for mining and construction through regional partners. |

| Delta Plus Group | Expanding low-cost safety glasses with CE-compliant designs into North Africa and the Gulf. |

Key Company Insights

3M (18-22%)

Commands the MEA with an extensive product line tailored to industrial demands, backed by robust distribution and training programs.

Honeywell Safety Products (14-18%)

Integrates advanced material science and design customization to deliver reliable, ergonomic eyewear across MEA’s industrial sectors.

Bollé Safety (10-14%)

Known for blending safety with aesthetics, Bollé continues to expand its high-clarity product lines for technical and lab environments.

PIP Global (9-12%)

Strengthens its footprint with value-driven offerings and dependable logistics in energy and resource extraction sectors.

Delta Plus Group (7-10%)

Focuses on affordability and compliance, offering wide availability of CE-certified eyewear to contractors and infrastructure projects.

The segmentation is into Safety Glasses, Safety Goggles, Welding Helmets, Face Shields, Laser Safety Glasses, and Prescription Safety Eyewear.

The segmentation is into plastic, metal, nylon, rubber, and other materials.

The segmentation is into Polycarbonate Lenses, Trivex Lenses, Clear Lenses, Polarized Lenses, Photochromic Lenses, Mirrored Lenses, and Other Lens Types.

The segmentation is into Construction, Manufacturing, Oil and Gas, Chemical, Healthcare, Mining, Military and Defense, and Residential/Household sectors.

The segmentation is into Online Retail, Offline Retail (Specialty Stores, Department Stores, Safety Equipment Suppliers), and Institutional Sales.

The report covers GCC, Turkey, Northern Africa, South Africa, and the Rest of MEA.

The MEA safety eyewear market is projected to be valued at USD 412 million in 2025, driven by increasing demand for protective eyewear in the industrial and commercial sectors.

The industry is expected to reach USD 827 million by 2035, with steady growth attributed to the expanding industrial activities and heightened awareness about worker safety.

United Arab Emirates is expected to witness significant growth with a 5.4% CAGR, supported by ongoing infrastructure development and the adoption of stringent safety regulations.

The demand for safety glasses is the key factor driving the industry, with industries prioritizing worker safety and comfort alongside regulatory requirements for personal protective equipment.

Key players in the MEA safety eyewear market include 3M, Bollé Safety, PIP Global, SureWerx, Stanley Black & Decker, Gentex Corporation, Encon Safety Products, Inc., Klein Tools, Delta Plus Group, Moldex/Metric AG & Co. KG, Lakeland Industries, Inc., JSP Limited, Bunzl plc, Radians, Inc., Honeywell Safety Products, UNIVET Group, Ansell Ltd., and Infield Safety.

Table 1: Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 2: Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 3: Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 4: Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Table 5: Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 6: Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Table 7: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 8: Market Volume (Units) Analysis By End User, 2018 to 2033

Table 9: Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 10: Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 11: Market Value (US$ Million) Analysis By Region, 2018 to 2033

Table 12: Market Volume (Units) Analysis By Region, 2018 to 2033

Table 13: Turkey Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 14: Turkey Market Volume (Units) Analysis By Country, 2018 to 2033

Table 15: Turkey Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 16: Turkey Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 17: Turkey Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 18: Turkey Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Table 19: Turkey Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 20: Turkey Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Table 21: Turkey Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 22: Turkey Market Volume (Units) Analysis By End User, 2018 to 2033

Table 23: Turkey Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 24: Turkey Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 25: Northern Africa Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 26: Northern Africa Market Volume (Units) Analysis By Country, 2018 to 2033

Table 27: Northern Africa Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 28: Northern Africa Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 29: Northern Africa Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 30: Northern Africa Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Table 31: Northern Africa Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 32: Northern Africa Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Table 33: Northern Africa Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 34: Northern Africa Market Volume (Units) Analysis By End User, 2018 to 2033

Table 35: Northern Africa Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 36: Northern Africa Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 37: South Africa Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 38: South Africa Market Volume (Units) Analysis By Country, 2018 to 2033

Table 39: South Africa Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 40: South Africa Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 41: South Africa Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 42: South Africa Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Table 43: South Africa Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 44: South Africa Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Table 45: South Africa Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 46: South Africa Market Volume (Units) Analysis By End User, 2018 to 2033

Table 47: South Africa Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 48: South Africa Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 49: South Asia Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 50: South Asia Market Volume (Units) Analysis By Country, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 52: South Asia Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 54: South Asia Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 56: South Asia Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 58: South Asia Market Volume (Units) Analysis By End User, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 60: South Asia Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 61: Rest of Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 62: Rest of Market Volume (Units) Analysis By Country, 2018 to 2033

Table 63: Rest of Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 64: Rest of Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 65: Rest of Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Table 66: Rest of Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Table 67: Rest of Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Table 68: Rest of Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Table 69: Rest of Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 70: Rest of Market Volume (Units) Analysis By End User, 2018 to 2033

Table 71: Rest of Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 72: Rest of Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 01: Market Value (US$ Million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: Market Value (US$ Million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: Market Value (US$ Million) Analysis, 2018 to 2022

Figure 04: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Market Absolute $ Opportunity Value (US$ Million), 2023 to 2033

Figure 06: Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 07: Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 08: Market Y to Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 11: Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Figure 12: Market Y to Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 13: Market Attractiveness By Frame Material, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 15: Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Figure 16: Market Y to Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 17: Market Attractiveness By Lens Type, 2023 to 2033

Figure 18: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 19: Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 20: Market Y to Y Growth (%) Projections, By End User, 2023 to 2033

Figure 21: Market Attractiveness By End User, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 23: Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 24: Market Y to Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 25: Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 27: Market Volume (Units) Analysis By Region, 2018 to 2033

Figure 28: Market Y to Y Growth (%) Projections, By Region, 2023 to 2033

Figure 29: Market Attractiveness By Region, 2023 to 2033

Figure 30: Market Absolute $ Opportunity, By GCC 2023 to 2033

Figure 31: Market Absolute $ Opportunity, By Turkey 2023 to 2033

Figure 32: Market Absolute $ Opportunity, By Northern Africa 2023 to 2033

Figure 33: Market Absolute $ Opportunity, By South Africa 2023 to 2033

Figure 34: Market Absolute $ Opportunity, By Rest of MEA 2023 to 2033

Figure 35: GCC Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 36: GCC Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 37: GCC Market Y to Y Growth (%) Projections, By Country, 2023 to 2033

Figure 38: GCC Market Attractiveness By Country, 2023 to 2033

Figure 39: GCC Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 40: GCC Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 41: GCC Market Y to Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 42: GCC Market Attractiveness By Product Type, 2023 to 2033

Figure 43: GCC Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 44: GCC Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Figure 45: GCC Market Y to Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 46: GCC Market Attractiveness By Frame Material, 2023 to 2033

Figure 47: GCC Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 48: GCC Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Figure 49: GCC Market Y to Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 50: GCC Market Attractiveness By Lens Type, 2023 to 2033

Figure 51: GCC Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 52: GCC Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 53: GCC Market Y to Y Growth (%) Projections, By End User, 2023 to 2033

Figure 54: GCC Market Attractiveness By End User, 2023 to 2033

Figure 55: GCC Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 56: GCC Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 57: GCC Market Y to Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 58: GCC Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 59: Turkey Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 60: Turkey Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 61: Turkey Market Y to Y Growth (%) Projections, By Country, 2023 to 2033

Figure 62: Turkey Market Attractiveness By Country, 2023 to 2033

Figure 63: Turkey Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 64: Turkey Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 65: Turkey Market Y to Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 66: Turkey Market Attractiveness By Product Type, 2023 to 2033

Figure 67: Turkey Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 68: Turkey Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Figure 69: Turkey Market Y to Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 70: Turkey Market Attractiveness By Frame Material, 2023 to 2033

Figure 71: Turkey Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 72: Turkey Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Figure 73: Turkey Market Y to Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 74: Turkey Market Attractiveness By Lens Type, 2023 to 2033

Figure 75: Turkey Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 76: Turkey Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 77: Turkey Market Y to Y Growth (%) Projections, By End User, 2023 to 2033

Figure 78: Turkey Market Attractiveness By End User, 2023 to 2033

Figure 79: Turkey Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 80: Turkey Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 81: Turkey Market Y to Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 82: Turkey Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 83: Northern Africa Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 84: Northern Africa Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 85: Northern Africa Market Y to Y Growth (%) Projections, By Country, 2023 to 2033

Figure 86: Northern Africa Market Attractiveness By Country, 2023 to 2033

Figure 87: Northern Africa Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 88: Northern Africa Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 89: Northern Africa Market Y to Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 90: Northern Africa Market Attractiveness By Product Type, 2023 to 2033

Figure 91: Northern Africa Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 92: Northern Africa Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Figure 93: Northern Africa Market Y to Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 94: Northern Africa Market Attractiveness By Frame Material, 2023 to 2033

Figure 95: Northern Africa Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 96: Northern Africa Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Figure 97: Northern Africa Market Y to Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 98: Northern Africa Market Attractiveness By Lens Type, 2023 to 2033

Figure 99: Northern Africa Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 100: Northern Africa Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 101: Northern Africa Market Y to Y Growth (%) Projections, By End User, 2023 to 2033

Figure 102: Northern Africa Market Attractiveness By End User, 2023 to 2033

Figure 103: Northern Africa Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 104: Northern Africa Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 105: Northern Africa Market Y to Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 106: Northern Africa Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 107: South Africa Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 108: South Africa Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 109: South Africa Market Y to Y Growth (%) Projections, By Country, 2023 to 2033

Figure 110: South Africa Market Attractiveness By Country, 2023 to 2033

Figure 111: South Africa Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 112: South Africa Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 113: South Africa Market Y to Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 114: South Africa Market Attractiveness By Product Type, 2023 to 2033

Figure 115: South Africa Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 116: South Africa Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Figure 117: South Africa Market Y to Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 118: South Africa Market Attractiveness By Frame Material, 2023 to 2033

Figure 119: South Africa Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 120: South Africa Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Figure 121: South Africa Market Y to Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 122: South Africa Market Attractiveness By Lens Type, 2023 to 2033

Figure 123: South Africa Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 124: South Africa Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 125: South Africa Market Y to Y Growth (%) Projections, By End User, 2023 to 2033

Figure 126: South Africa Market Attractiveness By End User, 2023 to 2033

Figure 127: South Africa Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 128: South Africa Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 129: South Africa Market Y to Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 130: South Africa Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 131: Rest of Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 132: Rest of Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 133: Rest of Market Y to Y Growth (%) Projections, By Country, 2023 to 2033

Figure 134: Rest of Market Attractiveness By Country, 2023 to 2033

Figure 135: Rest of Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 136: Rest of Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 137: Rest of Market Y to Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 138: Rest of Market Attractiveness By Product Type, 2023 to 2033

Figure 139: Rest of Market Value (US$ Million) Analysis By Frame Material, 2018 to 2033

Figure 140: Rest of Market Volume (Units) Analysis By Frame Material, 2018 to 2033

Figure 141: Rest of Market Y to Y Growth (%) Projections, By Frame Material, 2023 to 2033

Figure 142: Rest of Market Attractiveness By Frame Material, 2023 to 2033

Figure 143: Rest of Market Value (US$ Million) Analysis By Lens Type, 2018 to 2033

Figure 144: Rest of Market Volume (Units) Analysis By Lens Type, 2018 to 2033

Figure 145: Rest of Market Y to Y Growth (%) Projections, By Lens Type, 2023 to 2033

Figure 146: Rest of Market Attractiveness By Lens Type, 2023 to 2033

Figure 147: Rest of Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 148: Rest of Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 149: Rest of Market Y to Y Growth (%) Projections, By End User, 2023 to 2033

Figure 150: Rest of Market Attractiveness By End User, 2023 to 2033

Figure 151: Rest of Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 152: Rest of Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 153: Rest of Market Y to Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 154: Rest of Market Attractiveness By Distribution Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Measurement Technology in Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Mead Beverages Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA