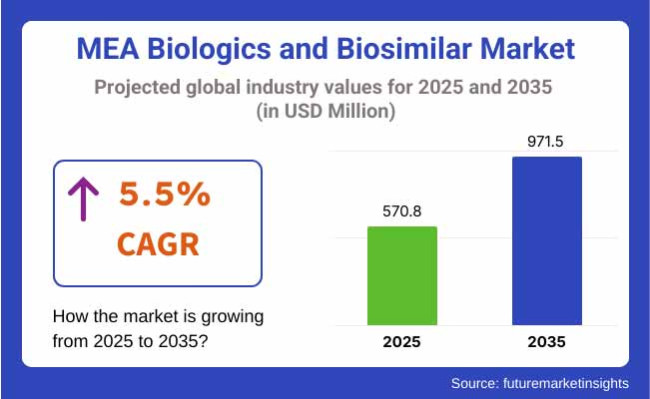

The Middle East & Africa (MEA) biologics and biosimilar industry is valued at USD 570.8 million in 2025. It is expected to grow at a CAGR of 5.5% and reach USD 971.5 million by 2035. The MEA biosimilars and biologics industry is on a stable growth path due to rising demand for cost-effective and innovative drugs. Fueling this growth is rising healthcare investment, a growing population of chronic disease patients, and supporting biosimilar policy.

In 2024, the MEA biologics and biosimilars sector in the Middle East and Africa grew steadily. This growth happened because more approvals came from regulatory bodies, and the use of biosimilars increased in important sectors like Saudi Arabia, the UAE, and South Africa.

Governments in these regions worked to speed up the adoption of biosimilars to lessen the reliance on costly biologics. Adalimumab was the top-selling biosimilar in which wider insurance coverage and competitive pricing from manufacturers.

The rising incidence of chronic conditions such as rheumatoid arthritis, cancer, and diabetes further drives the demand for biosimilars & biologics throughout the region.

The other driver includes technological advancements in evolving healthcare infrastructure and growing usage preference for biosimilars over branded counterparts that rely on price sensitivity. The industry is also seeing greater cooperation between drug makers and regulators to speed up approvals and improve access.

The MEA biologics and biosimilars industry is growing steadily with increasing demand for affordable alternatives to expensive biologics, regulatory encouragement, and growing healthcare infrastructure.

Primary beneficiaries are pharmaceutical companies investing in biosimilar manufacturing, healthcare providers looking for cheaper treatment, and patients with greater access to life-saving therapies. But the established biologic players can also lose revenues as biosimilar uptake gains momentum, changing the competitive dynamics.

Expand Local Manufacturing & Regulatory Alignment

Executives must invest in local production plants and work with regulatory agencies to speed up biosimilar approvals, making them affordable and supply chain resilient.

Diversify Product Portfolios in High-Growth Therapeutic Areas

Firms have to go with the sector trend by giving top priority to oncology, autoimmune, and diabetes biosimilars while utilizing digital health technologies to get more patients engaged and compliant.

Strengthen Distribution Networks & Strategic Partnerships

Strategic expansion of partnerships with pharmacies, hospitals, and payers will improve segment penetration, and partnerships with multinational biotech companies can foster innovation and competitive advantage.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays & Compliance Hurdles | Medium Probability - High Impact |

| Industry Penetration Challenges Due to Physician & Patient Hesitancy | High Probability - Medium Impact |

| Price Pressures & Competitive Pricing from Innovator Biologics | High Probability - High Impact |

| Priority | Immediate Action |

|---|---|

| Regulatory Streamlining & Compliance | Engage with regional regulators to fast-track biosimilar approvals and ensure compliance alignment. |

| Industry Expansion & Physician Education | Launch targeted awareness campaigns and training programs to drive biosimilar adoption among healthcare providers. |

| Strategic Partnerships & Distribution Growth | Establish alliances with key hospitals, pharmacies, and payers to strengthen sector access and distribution channels. |

With the dynamic MEA biologics and biosimilars landscape, the companies should target greater regulatory engagement, increased local manufacturing, bolstered physician and patient adoption plans.

Now that biosimilars are beginning to take hold, the next 12 months should be dedicated to getting fast-track approvals, partnership building with hospitals and payers, and driving educational campaigns to mitigate hesitancy.

Pricing pressure from innovator biologics will increase competition, and cost optimization and strategic partnerships will become essential. Future differentiation will come from investments in oncology and diabetes biosimilars, alongside digital health integration.

Regional Variance:

High Variance:

ROI Perspectives:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

Healthcare Providers:

Alignment:

Divergence:

High Consensus:

Regulatory efficiency, affordability, and healthcare provider education are critical for biosimilar adoption.

Key Variances:

Strategic Insight:

A regionally adapted approach is essential-premium pricing models in the Gulf, local production incentives in South Africa, and education-driven adoption in North Africa will drive long-term growth.

| Country | Regulatory Impact on MEA Biologics and Biosimilars |

|---|---|

| Saudi Arabia | SFDA has streamlined biosimilar approvals, aligning with EMA/FDA standards. Price controls and reimbursement policies support affordability but create pricing pressures for manufacturers. Strong government incentives promote local manufacturing. |

| UAE | Follows fast-track approval pathways for biosimilars. Government-backed pricing and reimbursement schemes enhance access. Investments in biotech hubs encourage domestic production. |

| South Africa | SAHPRA follows WHO biosimilar guidelines but faces approval delays due to resource constraints. Limited reimbursement restricts access, but policies are evolving. Government promotes local biosimilar manufacturing to reduce import reliance. |

| Egypt | Biosimilar regulations are still developing, leading to complex and slow approval processes. Pricing negotiations are inconsistent, limiting affordability. Minimal local manufacturing incentives create dependency on imports. |

| Morocco | Approval pathways for biosimilars are less structured, slowing industry entry. Fragmented pricing policies and weak enforcement reduce cost control effectiveness. Limited government incentives for domestic production. |

The segment for MEA biologics and biosimilars in the UAE is anticipated to grow at a CAGR of 6.8% by 2025 to 2035 owing to the bolstering or supporting factors of the UAE government towards the healthcare policies, uplifts in the foreign investment in the realm of biotech, and favorable regulatory environment.

Healthcare implicitly promotes higher-quality patient care that minimizes costs while enhancing outcomes, which is why national bodies, including the Emirates Health Services (EHS) and the UAE Ministry of Health and Prevention (MOHAP), have promoted biosimilar adoption.

Demand is accelerating for other reasons, including the UAE’s sophisticated healthcare ecosystem, robust reimbursement policies, and growing collaborations with international biopharma companies.

Underlying this growth is supportive biopharma regulation that allows these drugs to reach the sector more quickly, an increase in medical tourism, and growing investment in home quality production, thereby decreasing dependence on imports.

Nonetheless, challenges such as high pricing pressures, lack of national manufacturing, and physician reluctance to switch to biosimilars remain. Despite these challenges, the UAE is considered a regional leader in biosimilars adoption, aided by government incentives, strong healthcare infrastructure, and growing partnerships with international pharmaceutical companies.

From 2025 to 2035, the Kuwait industry is anticipated to undergo a CAGR of 6.2% on account of government-supported universal healthcare, a growing need for affordable biologics, and a well-established hospital network.

In Kuwait, the Ministry of Health (MOH) has issued stringent pharmaceutical regulations that allow for expedited approvals for biosimilars, enticing overseas biopharma companies. High per capita healthcare spending with a burgeoning private sector drives growth in biosimilar penetration in oncology, rheumatology, and endocrinology.

Kuwait boasts a robust public healthcare system that fully reimburses biosimilars and has a favorable prevalence of chronic diseases, particularly diabetes and autoimmune diseases. Kuwait has greater collaboration with international biosimilar manufacturers to increase segment access.

Despite this positive reimbursement climate, there are significant obstacles to overcome with respect to price negotiation, sluggish regulatory evolution, and physician reluctance to switch from originator biologics. The biosimilar industry is likely to grow at a controlled pace with an increased government focus on cost-saving healthcare solutions.

The MEA biologics and biosimilar segment in Qatar is expected to grow between 2025 and 2035 at a rate of 6.5%, backed by high-value healthcare investments, well-funded insurance systems, and collaborations with leading global biotechnology companies.

The Health Ministry (MOPH) and Hamad Medical Corporation (HMC) have focused on biosimilar uptake to make treatment accessible and reduce pharmaceutical costs. With increased investment in cutting-edge medical research and partnerships with biotech firms, Qatar's healthcare sector is emerging as a promising one for biosimilar expansion. Adding more fuel to the segment growth are the country's efforts to build domestic biopharmacy capabilities and push biosimilar adoption programs.

Some factors Government-sponsored initiatives for biosimilars, growth in the private healthcare sector, and increasing demand for biosimilars in oncology and autoimmune diseases are some of the key trends in the sector, with details provided below. Nonetheless, Qatar’s favorable regulatory backdrop and growing attention to biosimilar affordability is expected to allow it to emerge as a regional leader in terms of biosimilar utilization.

With government initiatives for cost-effective health care and increasing prevalence of chronic diseases, the Bahrain MEA biologics and biosimilars sector is anticipated to grow at a CAGR of 5.9% between 2025 and 2035.

The NHRA strives to streamline biosimilar approval pathways, making Bahrain a desired segment for international manufacturers. Biosimilar penetration is nevertheless still lower than in the UAE and Qatar, driven primarily by slower physician uptake and limited domestic pharmaceutical manufacturing.

Key factors aiding the segment include the growth of the private sector of healthcare, driving the demand of biosimilars, and government-assisted cost-control initiatives, along with enhanced training of physicians regarding the efficacy and safety of biosimilars. However, challenges remain, including limited local production capacity and pricing competition, as well as gradual regulatory adaptation.

Bahrain will convert this exceptional transfer of advice and assistance into a new era of prosperity by increasing growth in the biosimilar sector, notwithstanding these obstacles that pose a challenge to achieving this potential at any given point; and the strategic reforms Bahrain is making in its healthcare and growing public-private partnerships would play an essential role in the move toward wider biosimilar use in the following years.

The sector for MEA biologics and biosimilars in Oman is estimated to grow with a CAGR of 5.7% from 2025 to 2035, owing to improved healthcare expenditure, a highly effective public health system, and developing alliances with global biosimilar producers. The Omani Ministry of Health (MOH) is taking steps to increase the availability and affordability of the treatment through the use of biosimilars.

Demand for biosimilar alternatives in oncology and immunology is growing, with a rising burden of chronic diseases including cancer and diabetes. Similarly, private healthcare providers in Oman are slowly expanding their treatment protocols, with biosimilars being introduced as part of them.

Thus, constrained domestic production, lengthy regulatory approval pathways, and physician hesitance regarding biosimilar substitution limit rapid growth at the local level. Oman is addressing these challenges by simplifying biosimilar regulations, improving physician awareness, and increasing public-private partnerships.

Saudi Arabia’s industry is expected to expand with a CAGR of 7.2% from 2025 to 2035, emerging as one of the most lucrative segments in the region. Aligned with Vision healthcare reforms, increased investment in local biopharma manufacturing, and strong regulatory frameworks, the Kingdom leads biosimilar adoption in the Middle East.

The Saudi Food and Drug Authority (SFDA) has submitted data for biosimilars to enable faster approvals and broader access. By focusing on local production, the Saudi government is lessening dependence on imports and opening new avenues for both international and local biosimilar developers.

In addition, the increasing prevalence of chronic diseases such as cancer and autoimmune disorders has driven high demand for biosimilar treatments. The presence of well-established healthcare infrastructure and favorable reimbursement policies in the country also contributes to segment growth.

The challenges include high competition from global and local players with pricing pressures as well as increased physician and patient awareness about biosimilar safety. Nonetheless, Saudi Arabia's efforts to ensure biosimilar affordability and grow domestic production capacity will ensure it remains a leader in the MEA biologics and biosimilars prescribers' sector.

The Iran MEA biologics and biosimilar industry is estimated to expand at a compound annual growth rate (CAGR) of 5.4% throughout the forecast period 2025 to 2035, as the country enjoys a fully established domestic pharmaceutical industry with healthcare subsidies extended by the government and a demand for affordable rate biologic treatments.

The current country is a regional leader in the field of biosimilar production, and several domestic companies are already producing biosimilars for local and foreign sectors. Economic sanctions, restricted access to international supply chains, and regulatory complications present significant obstacles.

The MEA biologics and biosimilar industry in Iran relies heavily on government funding, and price pressures are a concern for both manufacturers and patients. Nevertheless, Iran’s strong pharmaceutical capabilities and government-led biosimilar adoption schemes are likely to maintain steady growth for the overall segment.

The CAGR for the MEA biologics and biosimilars segment by drug is projected to be 5.5% in 2025 to 2035. The MEA biologics and biosimilars industry is fueled by the growing incidence of autoimmune disorders, cancer, and orphan diseases and is characterized by significant growth in key drugs.

Adalimumab remains the segment leader because of widespread application in rheumatoid arthritis and inflammatory bowel conditions, while oncology drugs Bevacizumab and Trastuzumab are showing robust uptake in light of escalating cancer cases. The availability of biosimilars for expensive biologics like rituximab and eculizumab is enhancing access to therapy, although affordability and regulatory issues are still major barriers.

The CAGR for the MEA biologics and biosimilars segment by drug class is projected to be 5.6% in 2025 to 2035. The sector is divided into different drug classes, with TNF alpha inhibitors and VEGF inhibitors dominating because of their extensive use in autoimmune disorders and oncology. Antirheumatics continue to account for a major share of prescriptions, while HER2 inhibitors are gaining traction in breast cancer treatment.

Selective immunosuppressants and interleukin inhibitors are expanding their industry presence as more patients seek targeted therapies for chronic inflammatory diseases. The shift toward biosimilars is expected to reshape the competitive landscape, particularly in cost-sensitive sectors.

The CAGR for the MEA biologics and biosimilars segment by dosage form is projected to be 5.7% in 2025 to 2035. The industry is segmented into intravenous and subcutaneous formulations, and subcutaneous biologics are increasingly becoming popular because of patient convenience and ease of administration.

Intravenous formulations are still prevalent in oncology and hospital-based treatments that need specialized administration. The move toward self-administrable biologics is expected to push innovation in autoinjector technologies and prefilled syringes.

The CAGR for the MEA biologics and biosimilars segment by indication is projected to be 5.6% in 2025 to 2035. The key indications fueling sector growth are cancer, autoimmune diseases, and rare diseases. Cancer is the largest therapeutic area, led by the increasing incidence of breast, colorectal, and lung cancers.

Arthritis and inflammatory bowel diseases also play a significant role, with biologics being the treatment of choice. Dermatological diseases like psoriasis and hidradenitis suppurativa are seeing higher use of biologics, whereas rare diseases are seeing challenges in the segment due to high prices and small patient populations.

The CAGR for the MEA biologics and biosimilars segment by distribution channel is projected to be 5.5% in 2025 to 2035. Specialty clinics and hospitals control the segment due to the complexity of biologic drug administration. Retail pharmacies and internet sales are increasingly becoming popular as the availability of biosimilars enhances affordability.

Cancer research institutions are crucial in clinical trials and early adoption of biologics. The emergence of mail-order pharmacies and digital health platforms will likely increase access to biologics, especially in rural communities where specialty care is scarce.

Key players in the MEA biologics and biosimilars sector are adopting a mix of pricing strategies, innovation, strategic alliances, and regional development. As biosimilars become more widely used to combat the rising costs of biologic drugs, companies are using competitive pricing models to expand industry share while maintaining healthy profits.

To spur growth, key players are increasing their production capabilities and reinforcing distribution networks, especially in underserved regions where access to biologics is insufficient.

Companies are also working with governments and healthcare agencies to encourage biosimilar uptake through subsidized programs and public health campaigns. M&As is a key driver, with top biologics companies buying up small biosimilar firms to broaden product offerings and expedite regulatory approvals.

Mergers & Acquisitions

Product Launches & Approvals

Regulatory & Partnerships

Adalimumab, Bevacizumab, Trastuzumab, Ustekinumab, Golimumab, Eculizumab, and Rituximab

Antirheumatics, TNF Alfa Inhibitors, VEGF/VEGFR Inhibitors, HER2 Inhibitors, Selective Immunosuppressant’s, Interleukin Inhibitors

Subcutaneous and Intravenous

Cancer, Arthritis, Skin Disorders, Inflammatory Bowel Disease (IBD), Rare Disease, and Others

Hospitals(Specialty Clinics and Cancer Research Centers), Retail Sales ( Retail Pharmacies, Mail Order Pharmacies /Online Sales)

UAE, Bahrain, Iraq, Jordan, Kuwait, Lebanon, Oman, Qatar, KSA, Iran, and Palestine

The rise in healthcare investments, increasing prevalence of chronic diseases, and regulatory support for biosimilars are responsible for the market growth.

Biologics are mainly adopted in oncology, autoimmune (e.g., rheumatoid arthritis, inflammatory bowel disease), and rare diseases.

Cost-containment strategies, collaborations with domestic manufacturers, and government-led health initiatives are contributing to better affordability.

The pathway towards approval for biosimilars is being expedited by agencies like the Saudi FDA (SFDA), UAE’s MOHAP, and Egypt’s EDA to improve accessibility.

Hospitals and specialty clinics are the dominant sources, with retail pharmacies, online sales, and mail-order services growing to improve patient access.

Table 01: Market Demand Volume Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 02: Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 03: Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 04: Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 05: Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 06: Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 07: Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 08: UAE Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 09: UAE Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 10: UAE Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 11: UAE Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 12: UAE Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 13: Kuwait Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 14: Kuwait Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 15: Kuwait Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 16: Kuwait Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 17: Kuwait Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 18: Qatar Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 19: Qatar Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 20: Qatar Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 21: Qatar Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 22: Qatar Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 23: Bahrain Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 24: Bahrain Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 25: Bahrain Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 26: Bahrain Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 27: Bahrain Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 28: Oman Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 29: Oman Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 30: Oman Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 31: Oman Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 32: Oman Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 33: Lebanon Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 34: Lebanon Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 35: Lebanon Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 36: Lebanon Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 37: Lebanon Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 38: Jordan Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 39: Jordan Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 40: Jordan Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 41: Jordan Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 42: Jordan Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 43: Palestine Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 44: Palestine Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 45: Palestine Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 46: Palestine Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 47: Palestine Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 48: Iraq Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 49: Iraq Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 50: Iraq Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 51: Iraq Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 52: Iraq Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 53: KSA Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 54: KSA Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 55: KSA Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 56: KSA Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 57: KSA Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 58: Iran Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug

Table 59: Iran Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 60: Iran Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Dosage Form

Table 61: Iran Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 62: Iran Market Demand Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Figure 01: Market Volume Analysis, 2017 to 2022

Figure 02: MEA Average Drug Pricing Analysis Benchmark (US$), 2021

Figure 03: Market Value Analysis (US$ Million), 2017 to 2022

Figure 04: Market Share Analysis (%), By Drug, 2022A & 2023E

Figure 05: Market Share Analysis (%), By Drug Class, 2022A & 2023E

Figure 06: Market Share Analysis (%), By Dosage Form, 2022A & 2023E

Figure 07: Market Share Analysis (%), By Indication, 2022A & 2023E

Figure 08: Market Share Analysis (%), By Distribution Channel, 2022A & 2023E

Figure 09: Market Share Analysis (%), By Country, 2022A & 2023E

Figure 10: UAE Market Split By Drug 2022 (A)

Figure 11: UAE Market Split By Drug Class 2022 (A)

Figure 12: UAE Market Split By Dosage Form 2022 (A)

Figure 13: UAE Market Split By Indication 2022 (A)

Figure 14: UAE Market Split By Distribution Channel 2022 (A)

Figure 15: UAE Market Value Analysis (US$ Million), 2017 to 2022

Figure 16: Kuwait Market Split By Drug 2022 (A)

Figure 17: Kuwait Market Split By Drug Class 2022 (A)

Figure 18: Kuwait Market Split By Dosage Form 2022 (A)

Figure 19: Kuwait Market Split By Indication 2022 (A)

Figure 20: Kuwait Market Split By Distribution Channel 2022 (A)

Figure 21: Kuwait Market Value Analysis (US$ Million), 2017 to 2022

Figure 22: Qatar Market Split By Drug 2022 (A)

Figure 23: Qatar Market Split By Drug Class 2022 (A)

Figure 24: Qatar Market Split By Dosage Form 2022 (A)

Figure 25: Qatar Market Split By Indication 2022 (A)

Figure 26: Qatar Market Split By Distribution Channel 2022 (A)

Figure 27: Qatar Market Value Analysis (US$ Million), 2017 to 2022

Figure 28: Bahrain Market Split By Drug 2022 (A)

Figure 29: Bahrain Market Split By Drug Class 2022 (A)

Figure 30: Bahrain Market Split By Dosage Form 2022 (A)

Figure 31: Bahrain Market Split By Indication 2022 (A)

Figure 32: Bahrain Market Split By Distribution Channel 2022 (A)

Figure 33: Bahrain Market Value Analysis (US$ Million), 2017 to 2022

Figure 34: Oman Market Split By Drug 2022 (A)

Figure 35: Oman Market Split By Drug Class 2022 (A)

Figure 36: Oman Market Split By Dosage Form 2022 (A)

Figure 37: Oman Market Split By Indication 2022 (A)

Figure 38: Oman Market Split By Distribution Channel 2022 (A)

Figure 39: Oman Market Value Analysis (US$ Million), 2017 to 2022

Figure 40: Lebanon Market Split By Drug 2022 (A)

Figure 41: Lebanon Market Split By Drug Class 2022 (A)

Figure 42: Lebanon Market Split By Dosage Form 2022 (A)

Figure 43: Lebanon Market Split By Indication 2022 (A)

Figure 44: Lebanon Market Split By Distribution Channel 2022 (A)

Figure 45: Lebanon Market Value Analysis (US$ Million), 2017 to 2022

Figure 46: Jordan Market Split By Drug 2022 (A)

Figure 47: Jordan Market Split By Drug Class 2022 (A)

Figure 48: Jordan Market Split By Dosage Form 2022 (A)

Figure 49: Jordan Market Split By Indication 2022 (A)

Figure 50: Jordan Market Split By Distribution Channel 2022 (A)

Figure 51: Jordan Market Value Analysis (US$ Million), 2017 to 2022

Figure 52: Palestine Market Split By Drug 2022 (A)

Figure 53: Palestine Market Split By Drug Class 2022 (A)

Figure 54: Palestine Market Split By Dosage Form 2022 (A)

Figure 55: Palestine Market Split By Indication 2022 (A)

Figure 56: Palestine Market Split By Distribution Channel 2022 (A)

Figure 57: Palestine Market Value Analysis (US$ Million), 2017 to 2022

Figure 58: Iraq Market Split By Drug 2022 (A)

Figure 59: Iraq Market Split By Drug Class 2022 (A)

Figure 60: Iraq Market Split By Dosage Form 2022 (A)

Figure 61: Iraq Market Split By Indication 2022 (A)

Figure 62: Iraq Market Split By Distribution Channel 2022 (A)

Figure 63: Iraq Market Value Analysis (US$ Million), 2017 to 2022

Figure 64: KSA Market Split By Drug 2022 (A)

Figure 65: KSA Market Split By Drug Class 2022 (A)

Figure 66: KSA Market Split By Dosage Form 2022 (A)

Figure 67: KSA Market Split By Indication 2022 (A)

Figure 68: KSA Market Split By Distribution Channel 2022 (A)

Figure 69: KSA Market Value Analysis (US$ Million), 2017 to 2022

Figure 70: Iran Market Split By Drug 2022 (A)

Figure 71: Iran Market Split By Drug Class 2022 (A)

Figure 72: Iran Market Split By Dosage Form 2022 (A)

Figure 73: Iran Market Split By Indication 2022 (A)

Figure 74: Iran Market Split By Distribution Channel 2022 (A)

Figure 75: Iran Market Value Analysis (US$ Million), 2017 to 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Measurement Technology in Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Mead Beverages Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA