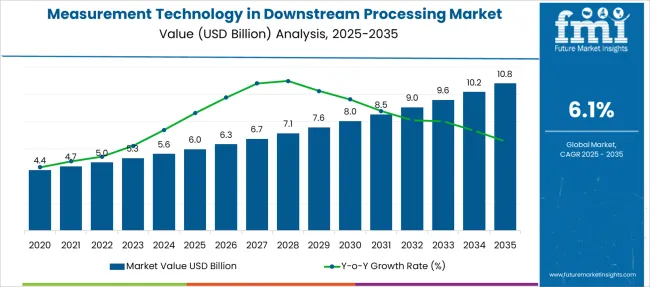

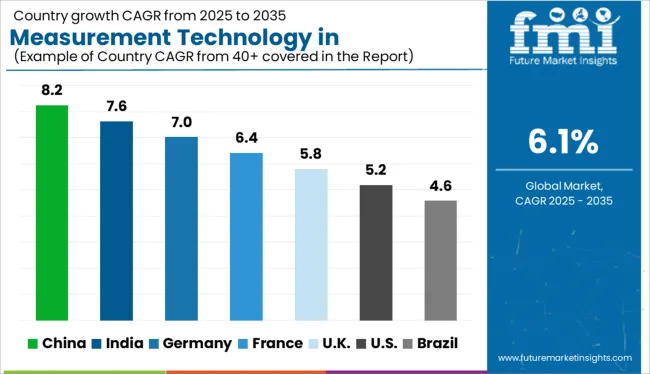

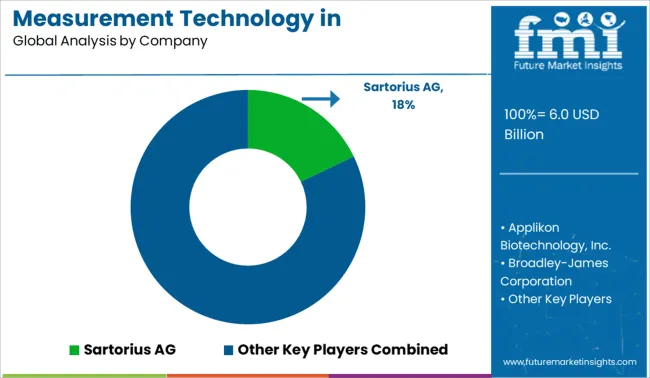

The Measurement Technology in Downstream Processing Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 10.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Measurement Technology in Downstream Processing Market Estimated Value in (2025 E) | USD 6.0 billion |

| Measurement Technology in Downstream Processing Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The measurement technology in downstream processing market is undergoing strong expansion due to increased pressure on biomanufacturers to improve yield, ensure product consistency, and comply with evolving regulatory requirements. As biologics and cell therapies scale from lab to commercial production, demand for real-time monitoring and precision analytics is rising.

Innovations in PAT (Process Analytical Technology), integration of sensor networks, and compatibility with single-use bioprocessing systems have transformed how critical process parameters are measured and controlled. Industry focus has shifted from end-point testing to continuous quality assurance, necessitating robust, inline measurement tools.

Regulatory encouragement of QbD (Quality by Design) principles and increasing biopharmaceutical investments in continuous manufacturing are accelerating adoption of advanced measurement technologies. Moving forward, miniaturization, automation, and integration with cloud-based analytics platforms are expected to further enhance process efficiency and scalability.

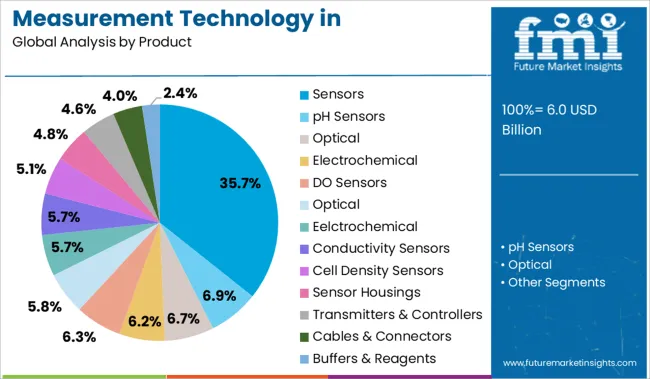

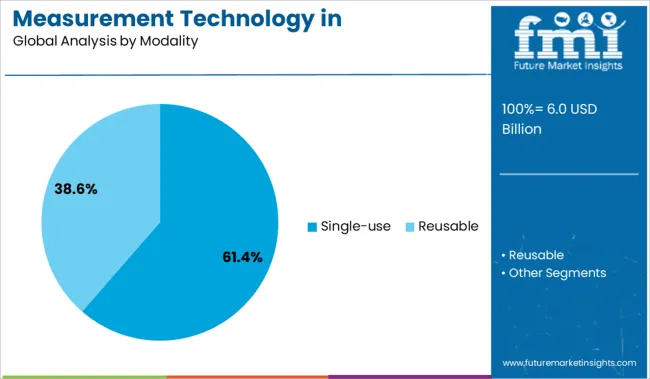

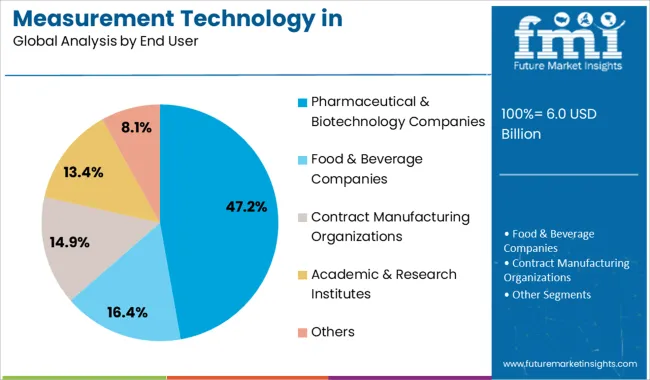

The market is segmented by Product, Modality, and End User and region. By Product, the market is divided into Sensors, pH Sensors, Optical, Electrochemical, DO Sensors, Optical, Eelctrochemical, Conductivity Sensors, Cell Density Sensors, Sensor Housings, Transmitters & Controllers, Cables & Connectors, and Buffers & Reagents. In terms of Modality, the market is classified into Single-use and Reusable. Based on End User, the market is segmented into Pharmaceutical & Biotechnology Companies, Food & Beverage Companies, Contract Manufacturing Organizations, Academic & Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Sensors are projected to account for 35.70% of the market share in 2025, making them the leading product segment. Their widespread adoption is being driven by the increasing need for real-time, non-invasive monitoring of pH, dissolved oxygen, conductivity, and other critical variables during downstream processing.

The ability to deliver immediate feedback on process deviations allows for greater control, reducing batch failures and improving throughput. Advancements in optical and electrochemical sensing technologies have improved precision and durability, making sensors suitable for both stainless-steel and single-use systems.

Furthermore, compliance with data integrity and GMP guidelines has positioned sensors as indispensable tools in modern bioprocessing workflows where traceability and reproducibility are essential.

Single-use systems are anticipated to capture 61.40% of the total market share by 2025, emerging as the dominant modality in downstream processing. This growth is being supported by the need for flexible manufacturing, reduced risk of cross-contamination, and faster changeovers in multiproduct facilities.

Single-use-compatible measurement technologies have advanced significantly, enabling reliable process monitoring without compromising sterility. These systems offer scalability from pilot to commercial batches and eliminate the need for cleaning validation, reducing downtime and operating costs.

As biologics manufacturers face rising demand for agility and cost control, single-use modalities have become essential for aligning with lean manufacturing goals, especially in contract development and manufacturing organizations (CDMOs).

Pharmaceutical and biotechnology companies are forecast to represent 47.20% of total market revenue in 2025, positioning them as the top end-user segment. This lead is attributed to their extensive investment in high-throughput biologics development and commercial-scale manufacturing infrastructure.

With increasing regulatory scrutiny and market competition, these companies are prioritizing advanced measurement systems to ensure compliance, reduce variability, and accelerate product release timelines. Strategic adoption of real-time analytics and integration with automation platforms is enhancing process control across production stages.

Additionally, rising demand for monoclonal antibodies, gene therapies, and vaccines is compelling these firms to adopt robust downstream measurement tools that support scalability and reproducibility, further solidifying their leadership in this segment.

| Particulars | Details |

|---|---|

| H1, 2024 | 6.09% |

| H1, 2025 Projected | 6.15% |

| H1, 2025 Outlook | 6.05% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 4 ↓ |

A comparative analysis about the market growth rates and development prospects in the global measurement technology in downstream processing market has been presented by FMI. The market is subject to be influenced by regulatory approvals for biologics and innovation factors in accordance with impact of macro and industry factors.

Online digital holographic microscopy when monitoring a bioreactor culture, and nano-plasmonic sensing are major progresses in this market.

As per the analysis by Future Market Insights, the market will decrease by 4 Basis Point Share (BPS) between H1-2024 and H1-2025(O). Major reasons for this decrease in BPS is attributed to the presence of flocculants during downstream processing of pharmaceutical proteins, impacting quality by design aspects of process development.

The market witnessed a decline in growth rate by 10 BPS between the periods of H1-2025 outlook over H1-2025 projected.

Other market segments are set to perform fairly and attain promising growth prospects in the next half of projection period. There are some relevant deterrent points that affect the industry growth, including the market entry of biosimilars and increasing costs in research and development of new drugs.

In addition, rising costs per approved drug and reduced sales of off-patent blockbuster drugs due to price competition from a variety of biosimilar competitors might affect the growth of the measurement technology in downstream processing market.

| Data Points | Market Insights |

|---|---|

| Market Value 2024 | USD 4.7 billion |

| Global Market Value (2025) | USD 5.0 billion |

| Forecasted Global Market Value (2035) | USD 7.2 billion |

| Market Growth Rate 2025 to 2035 | 6.1% |

| Top 5 Countries % Share | 58.3% |

| Key Players | Companies are like Applikon Biotechnology Inc.; Sartorius AG; Broadley-James Corporation; Thermo Fisher Scientific Inc.; Hamilton Company give 8% market share. |

Sales of measurement technology in downstream processing market grew at a CAGR of 5.6% between 2012 and 2024.

There is a high demand for high precision, continuous feedback sensors in bioprocessing to get precise results. Several standard operating procedures (SOPs) call for continuous feedback and process control for measuring key parameters such as pH, DO, temperature etc. This create demand for sensors in measurement technology in downstream processing market.

New and innovative sensor technologies and smart bioprocess control equipment can enhance process development at the bench or lab scale and lead to a better route to scale up operations. In larger scale operations, especially in commercial manufacturing, GMP regulations apply due to which process deviations can result in significant losses to revenue and production thus creating the need for precise measuring devices.

Therefore, the use of improved sensor technology is crucial in optimizing processing parameters and thus is likely to drive the growth of measurement technology in downstream processing market.

Considering this, it is expected for the global measurement technology in downstream processing market to grow at a CAGR of 6.1% through 2035.

High failure rates in conventional sensors limiting use in large-scale applications is expected to hamper the growth of market over the forecast period. Conventional sensors such as electrochemical DO probes have exhibited high failure rates due to deposition at the membrane where process liquid contact occurs.

Continuous biopharmaceutical manufacturing may be consistent with FDA’s Quality by Design (QbD) efforts, but there is still untapped potential for manufacturers of bioprocessing equipment to improve product quality assurance.

Sensors contributes in providing product quality, lowering the manufacturing cycle time, and reducing capital costs & time by stabilizing bioprocessing operations. So, failure of this sensors may result in declining the market growth to some extent for the Measurement technology in downstream processing market.

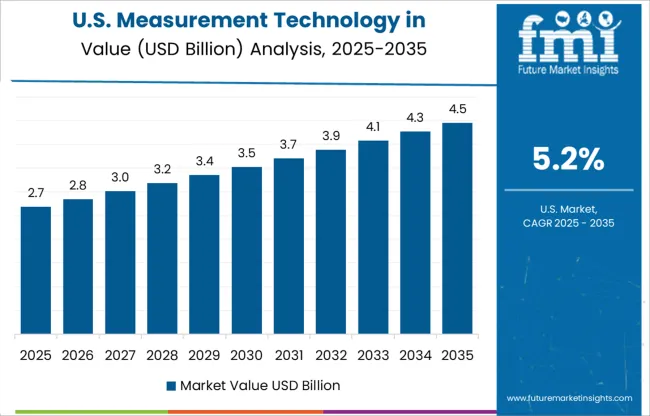

The USA is estimated to account for over 95.3% of the North America measurement technology in downstream processing market demand in 2025. High adoption rate of automated in bioprocessing system.

Many bioprocessing vendors in USA are adopting developed technologies that typically address automation challenges, extending from software development and integration, to continuous process. Accessibility of technical resources and an enhanced knowledge to improve the quality of research and success rates, thereby bringing more novel therapeutics to the market.

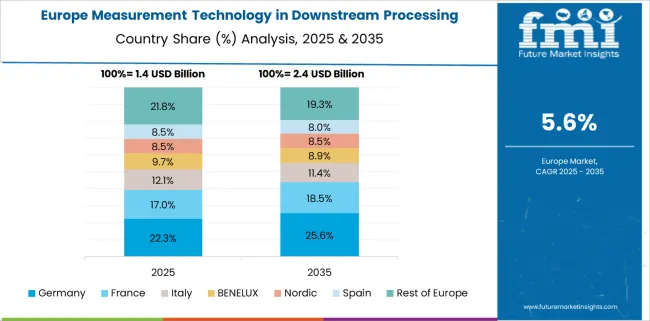

Germany is estimated to account for 34.5% market share in Europe in 2025. Factors such as increase in presence of research and development program, adequate research infrastructure with satisfactory results for biologics is boosting the demand for measurement technology in downstream processing market in Germany.

To enable collaboration and cross-functional research and development, several different for-profit and not-for-profit agencies have come forth to bringing innovative therapeutic biological options for chronic disease. This bring positive growth for market in Germany.

China is estimated to account for 49.8% of the East Asia market by 2025 owing to shift of investment in R&D and technology, especially in the life sciences, from North America and Europe to Asia Pacific.

China government have started taking initiatives to support growth of the local biotechnology industry by offering tax exclusions for R&D, increased budgets and funding’s. So more focus is generated to develop effective measuring tool for biological products for measurement technology in downstream processing market.

Demand for measurement technology in downstream processing market in India is expected to rise at an impressive growth opportunities with 9.6% CAGR over the forecast period.

Developing countries like India have ample qualified manpower and skilled labor at reasonable costs thereby raising the scope for attracting outsourcing of biotechnology projects this is responsible for the growth of the market in India.

By Product, the sensors segment is anticipated to hold the maximum share of 49.8% in 2025. Sensors play important role in biological production and technological advancement in sensor which will give boost to market.

Life science and downstream processing technology have moved to a great extent of sensing and automated process control as new technologies including wireless sensors such as VisiPro DO sensor, Contactless optical DO sensors etc. are introduced in the market. This provides huge opportunity for product business to existing players in the market

This advanced sensors are highly adopted by researcher and biopharmaceutical companies, due to which there is a significant demand for sensors over the forecast period.

Demand for single-use by modality are expected to rise at an impressive 6.9% CAGR over the forecast period. Due to its numerous advantage of single-use unit measurement technology in downstream processing for step by steps detection in various analytical system as well as optimization, and elimination of standardization steps, the market is witness growth during the forecast period.

Moreover, single-use measuring products are rapidly becoming commonplace at not just the lab or bench scale, but also at commercial scale due to ease of use and limited potential for cross-contamination which give global traction to measurement technology in downstream processing market.

By end user, pharmaceutical & biotechnology company segment lead the market with market share of 42.8% in 2025. Most of the pharma and biopharma players focus in collaboration with research institutes to increase their product portfolio.

Moreover, most of companies’ revenue is spend towardss research and development department where measuring tool is highly used. So, large biopharmaceutical companies hold large share in measurement technology in downstream processing market.

Companies operating in the measurement technology in downstream processing market devices are actively seeking to strengthen their position through expansion, and merger & acquisition, with established as well as emerging market players.

Some of the recent instances include:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | USD Billion for Value and Volume in Unit |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, UK, France, Italy, Spain, BENELUX, Russia, Poland, Nordic, China, Japan, South Korea, India, Australia, New Zealand, GCC Countries, South Africa |

| Key Segments Covered | Product, Modality, End User and Region |

| Key Companies Profiled | Applikon Biotechnology Inc.; Sartorius AG; Broadley-James Corporation; Thermo Fisher Scientific Inc.; Hamilton Company; Waters Corporation; PreSens Precision Sensing GmbH; PendoTECH LLC; Endress+Hauser AG; Mettler-Toledo International Inc.; Metroglas AG; Madison; YSI; Evoqua; Sensorex; Forbes |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global measurement technology in downstream processing market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the measurement technology in downstream processing market is projected to reach USD 10.8 billion by 2035.

The measurement technology in downstream processing market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in measurement technology in downstream processing market are sensors, ph sensors, optical, electrochemical, do sensors, optical, eelctrochemical, conductivity sensors, cell density sensors, sensor housings, transmitters & controllers, cables & connectors and buffers & reagents.

In terms of modality, single-use segment to command 61.4% share in the measurement technology in downstream processing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wound Measurement Devices Market

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Height Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Phasor Measurement Unit Market Size and Share Forecast Outlook 2025 to 2035

Surface Measurement Equipment And Tools Market

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Distance Measurement Image Sensor Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Sensors Market Size and Share Forecast Outlook 2025 to 2035

Distance Measurement Sensor Market Size and Share Forecast Outlook 2025 to 2035

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Sound Level Measurement Meter Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

Track Geometry Measurement System Market Size and Share Forecast Outlook 2025 to 2035

Coating Thickness Measurement Instruments Market

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Impedance-based TEER Measurement System Market Size and Share Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Intra-Abdominal Pressure Measurement Devices Market Analysis - Size, Trends & Forecast 2025 to 2035

General Purpose Electronic Test and Measurement Instruments Market Analysis and Forecast by Product, End Use, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA