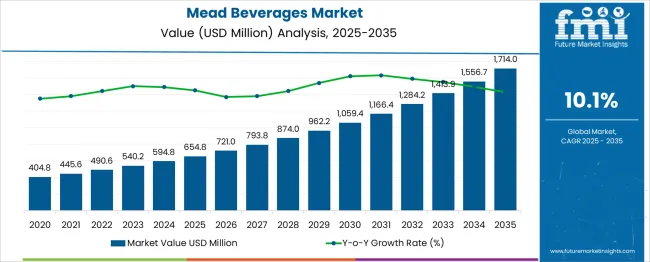

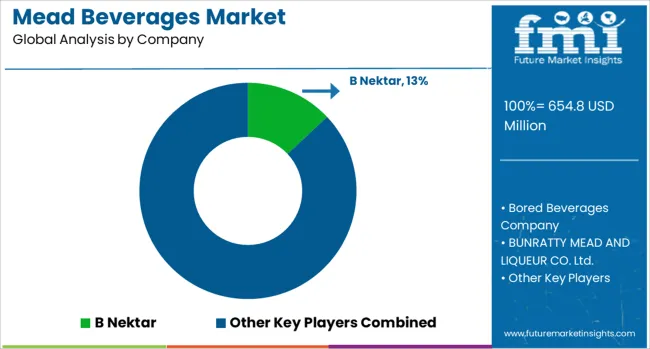

The Mead Beverages Market is estimated to be valued at USD 654.8 million in 2025 and is projected to reach USD 1714.0 million by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

A detailed examination of value troughs and peaks reveals a consistent climb without contraction phases, indicating low volatility and a stable upward trajectory. The initial five-year phase (2025–2030) shows growth from USD 654.8 million to USD 1,059.4 million, adding USD 404.6 million, equivalent to a 61.8% cumulative gain. This stage captures rising traction in North American and Western European craft alcoholic beverage markets, as consumer preference shifts toward low-ABV alternatives. From 2030 to 2035, the market adds another USD 654.6 million, reaching USD 1,714.0 million. This second stage delivers a larger absolute gain, showing a sharper climb as Asian markets expand mead import volumes and commercial meaderies scale up. No trough is observed within the 11-year timeline, but the steepest YoY gain appears between 2034 and 2035, where value rises from USD 1,556.7 million to USD 1,714.0 million, a USD 157.3 million jump. The absence of dips implies solidified demand and limited cyclicality, with peak acceleration occurring in the last three forecast years.

| Metric | Value |

|---|---|

| Mead Beverages Market Estimated Value in (2025 E) | USD 654.8 million |

| Mead Beverages Market Forecast Value in (2035 F) | USD 1714.0 million |

| Forecast CAGR (2025 to 2035) | 10.1% |

The mead beverages market makes up around 5–7 % of the global honey-based alcoholic drinks segment, reflecting its niche positioning among sweet and specialty fermented beverages. It accounts for roughly 2–3 % of the broader craft alcoholic beverages sector, due to its artisanal and small-batch production profile. In the ready to drink (RTD) cocktails and flavored beverages category, mead holds approximately 1–2 %, often positioned as premium or botanical-infused varieties.

Among alternative fermented beverages such as ciders, perries, and fruit wines, mead contributes about 8–10 %. Distribution via craft breweries and specialty retailers covers nearly 60 %, while direct-to-consumer and online channels make up about 20–25 %, with tasting rooms and festivals accounting for the remainder. Demand is rising for fruit and spice infused meads, especially botanical blends and organically certified variants that attract health aware consumers. Beverage producers are enhancing carbonation and flavor profiles to appeal as craft mixers or wine alternatives. Collaborations between meaderies and local beekeepers enable regional sourcing of diverse honey varietals, supporting flavor differentiation and sustainability narratives. Packaging innovations such as canned meads and small-format bottles improve accessibility and shelf presence in retail environments. Mead is gaining visibility at tasting festivals, pairing events, and hospitality experiences, reinforcing education around serving styles and food pairings. These trends reflect an evolution toward more versatile, locally inspired, and consumer-driven mead offerings.

The mead beverages market is experiencing steady expansion, fueled by the resurgence of traditional alcoholic drinks, increasing consumer interest in craft and artisanal products, and a shift toward natural, honey-based fermentation. Mead producers are leveraging local sourcing of honey and botanical infusions to differentiate product lines and cater to health-conscious consumers.

As mead gains popularity in both on-premise and off-premise channels, investments in product education, tasting events, and heritage branding are further driving awareness. Additionally, innovation in flavors and aging techniques has allowed mead to appeal to wine and cider drinkers seeking alternative alcoholic experiences.

Regulatory support for craft alcohol producers and the rising trend of premiumization across the beverage industry are expected to support long-term growth in this category.

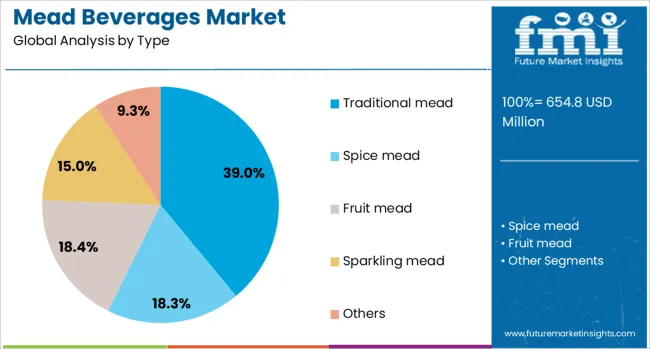

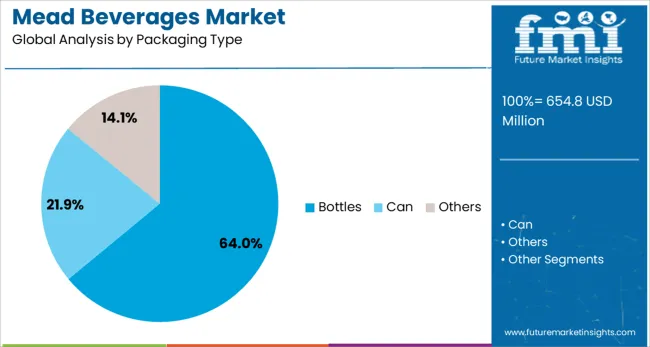

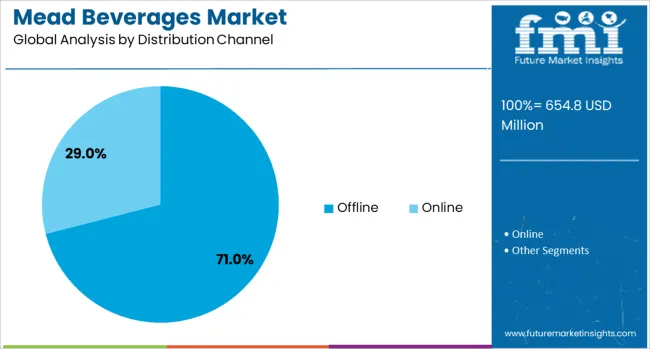

The mead beverages market is segmented by type, packaging type, distribution channel, and geographic regions. The mead beverages market is divided by type into Traditional mead, Spice mead, Fruit mead, Sparkling mead, and Others. In terms of packaging type, the mead beverage market is classified into Bottles, cans, and Others. The distribution channel of the mead beverage market is segmented into Offline and Online. Regionally, the mead beverages industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Traditional mead is projected to dominate the product type category with a 39.0% market share in 2025. Its leadership is attributed to rising consumer preference for historically rooted, naturally fermented drinks that offer both authenticity and minimal processing.

Traditional mead’s straightforward recipe—fermented honey, water, and yeast—aligns well with clean-label demands and appeals to those seeking gluten-free and low-sulfite alternatives. Producers are focusing on heritage storytelling and ancient recipe revival to strengthen emotional and cultural connections with buyers.

As awareness of mead’s versatility and pairing potential grows, traditional variants are likely to remain the foundation of product portfolios for both small-scale meaderies and expanding craft beverage brands.

By packaging type, bottles are expected to account for 64.0% of the total market share in 2025, making them the preferred format for mead distribution. Bottled packaging offers durability, visual appeal, and preservation advantages that are especially important for alcoholic beverages with varying alcohol content and aging profiles.

Glass bottles enable premium positioning and allow for intricate branding through labeling and embossing, which enhances shelf presence. Their compatibility with both sparkling and still meads, along with widespread acceptance across retail and hospitality sectors, supports continued growth.

With increasing interest in gifting and artisanal presentation, bottles remain the go-to choice for both casual consumers and connoisseurs.

Offline channels are projected to lead the distribution landscape with a commanding 71.0% market share in 2025. This dominance is fueled by the importance of in-person discovery, tasting, and education in influencing mead purchases.

Specialty liquor stores, farmer’s markets, and tasting rooms provide consumers the opportunity to sample and learn about mead varieties, which is essential for this relatively niche beverage. Furthermore, partnerships with restaurants, pubs, and breweries have boosted offline visibility and trial rates.

As experiential retail gains momentum and consumers seek curated beverage experiences, the offline segment is expected to remain crucial in driving volume and brand loyalty in the mead category.

Global demand for mead has grown as consumers seek craft and heritage beverages beyond traditional beer and wine. Interest in honey-based fermentation and botanical infusions has fueled new market entries. Craft meaderies are expanding across North America and Europe, while startup brands have emerged in Asia-Pacific. Mead is being positioned in casual dining and retail as a premium beverage, offering varietal differentiation via fruit, spice, and barrel-aging profiles. Its appeal to health-conscious consumers and those reducing alcohol intake has supported consistent market traction in niche and specialty channels.

Artisanal mead producers are applying innovative fermentation techniques to create diverse flavor profiles, including fruit-infused, spiced, sour, and barrel-aged meads. Seasonal honey varietals provide unique terroir-driven taste character. Fermentation processes are tailored with yeast selection and controlled temperature regimes to enhance nuance and consistency. Meads aged in oak barrels or wine casks attract consumers seeking depth and complexity. Novel styles such as sparkling, session-strength, and low-Alc made with honey blends are being introduced. These innovations have enabled meaderies to compete with craft beers and ciders on flavor variety, helping to expand presence in restaurants, taprooms, and specialty retail spaces.

Distribution has been broadened via online platforms, direct-to-consumer shipping, and specialty beverage stores. Craft beverage festivals, tasting events, and mead competitions have increased consumer exposure. Partnerships with local breweries and cideries as draught outlets have improved retail presence. Premium restaurant menus and tasting bars offer curated flights alongside wine programs. Subscription boxes and club memberships have elevated brand loyalty and recurring sales. Export initiatives have emerged as small producers seek access to cross-border markets. Educational outreach—for hospitality professionals and consumers—has accelerated mead’s inclusion in mixed beverage menus, helping to drive premium pricing and repeat purchase behavior.

Cost of honey and specialty botanicals affects production economics. Premium floral honey varieties used to produce single-origin meads can cost up to 40–50% more than bulk honey. Seasonal variations and supply variability can lead to price instability. Regulatory frameworks classifying mead across beer, wine, or cider categories vary by country, complicating labeling and tax obligations. Licensing for fermentation and alcohol distribution can be costly and time-intensive in emerging markets. Shelf stability over 12 months can be constrained without pasteurization or sulfite use, sometimes deterring export prospects. These factors limit scalability and consistency for small-scale producers operating in niche segments.

Gir trend toward craft, low-Alc, and gluten-free beverages has increased consumer trial of mead. Health-conscious drinkers appreciate honey’s floral sugars and antioxidant associations. Botanical flavorings like elderflower, hibiscus, and yuzu attract consumers seeking novelty. Mead’s pairing potential with cheese boards, charcuterie, and artisanal foods has boosted its presence in gastropubs and tasting rooms. Collaborations with chefs and mixologists have enabled cocktails featuring mead as a base or modifier. Emerging interest in mead tourism—through meadery visits, themed events, and mead trails—is driving storytelling around local provenance. These consumer-driven trends are broadening mead’s appeal beyond traditional enthusiasts and supporting market growth in niche premium beverage channels.

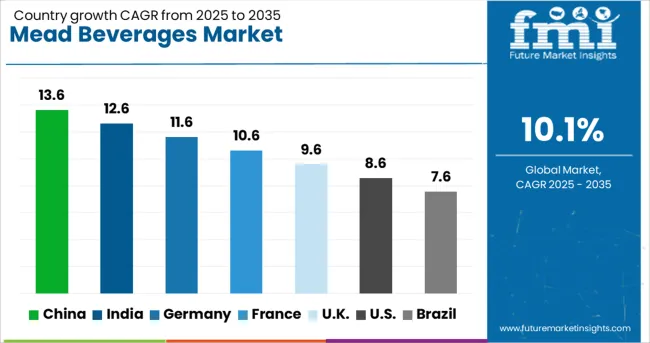

| Country | CAGR |

|---|---|

| China | 13.6% |

| India | 12.6% |

| Germany | 11.6% |

| France | 10.6% |

| UK | 9.6% |

| USA | 8.6% |

| Brazil | 7.6% |

The global mead beverages market is projected to expand at a CAGR of 10.1% from 2025 to 2035. China leads with a CAGR of 13.6%, exceeding the global trend by 35%, driven by diversification across specialty beverages. India is growing at 12.6%, 25% above the global rate, supported by health-oriented preferences and regulatory clarity. Germany at 11.6% continues above trend, influenced by food retail integration and low-intervention formats. The UK and US are growing below the global average at 9.6% and 8.6% respectively, hindered by regulatory barriers and slower consumer uptake. ASEAN-aligned growth is observed in India and China, while OECD markets including Germany benefit from traditional fermentation programs. The market’s performance reflects strong demand in emerging segments, while traditional alcohol economies experience slower acceleration.

China is projected to register a CAGR of 13.6% from 2025 to 2035, outpacing the global average by 35%. Rising demand for locally-produced alternatives to conventional spirits is accelerating domestic output. Mead is increasingly marketed as a premium yet accessible option within second and third-tier cities. Younger demographics are influencing purchase patterns, supported by tailored branding around health and purity. Product lines are expanding into functional and botanical blends to attract novelty-seeking consumers. Multi-channel distribution through e-commerce platforms has widened reach, reducing reliance on niche outlets. Regional players are consolidating supply chains through partnerships with apiaries, enhancing traceability. Channel diversification continues to reshape availability across urban and peri-urban markets.

India is forecast to grow at a CAGR of 12.6% between 2025 and 2035, exceeding the global benchmark by 25%. Mead consumption is rising as regulatory shifts across Indian states are including it under modern brewery frameworks. Emphasis on local ingredients, particularly tribal-sourced honey, is creating distinctive product positioning. Urban consumers are exploring mead as a low-alcohol, natural alternative to mainstream liquor. Strategic collaborations with food tech platforms and beverage aggregators are improving visibility in tier I and II cities. State-level policy adaptations are enabling increased microbrewery participation. Subscription-based direct sales are also gaining traction, offering curated variants to high-income consumers.

Germany is expected to grow at a CAGR of 11.6% from 2025 to 2035, outperforming the global average by 15%. Product development is focused on low-volume, high-margin offerings tailored to food retail and gastronomy sectors. Consumers are drawn to heritage and sustainability-linked branding narratives. Mead has been included in food innovation pilot programs, facilitating access to research support and retailer trials. Urban expansion is being supported by legal recognition of non-grain fermented beverages under evolving EU classifications. Interest in traditional fermentation techniques continues to attract producers leveraging Germany’s regulated craft alcohol ecosystem.

The United Kingdom is forecast to expand at a CAGR of 9.6% during 2025–2035, slightly below the global average of 10.1%. Independent producers are strengthening presence through local pub chains and seasonal events. Historical branding linked to folklore and artisanal production remains a key strategy. Constraints persist in labeling compliance and distribution economics. Rural meaderies are leveraging agri-tourism and farmgate sales to offset limited retail access. Urban penetration is slower due to high saturation of craft beer and gin alternatives. Subscription-based offerings and cultural festivals remain effective tools for market entry.

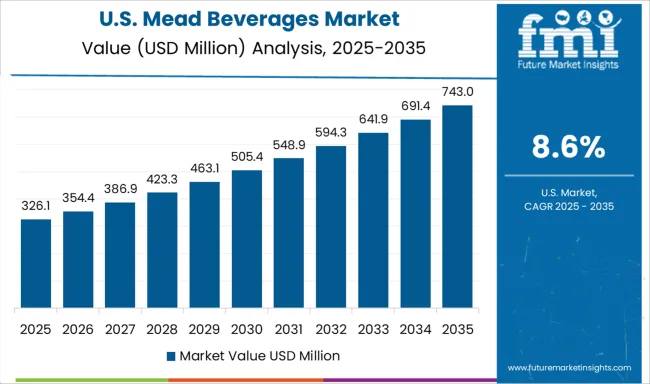

The United States is anticipated to grow at a CAGR of 8.6% from 2025 to 2035, which is 15% lower than the global average. The segment remains fragmented, dominated by regional producers facing distribution and compliance bottlenecks. Consumer attention has shifted toward hybrid variants such as melomels and session meads. Regulatory complexity at both federal and state levels continues to constrain rapid SKU turnover. Mead is mainly sold through specialty retailers, craft markets, and direct-to-consumer channels. Price sensitivity and lack of mainstream positioning remain challenges outside urban enclaves.

B Nektar continues to shape the mead beverages market by combining honey fermentation with fruit infusions and craft-inspired flavors. Its strategy involves frequent seasonal releases and distribution expansion through retail partnerships across the United States. Bored Beverages Company targets millennial consumers with canned meads, emphasizing portability and distinct taste profiles.

BUNRATTY MEAD AND LIQUEUR CO. Ltd. leverages its heritage positioning by supplying traditional Irish mead to tourism outlets and export markets, with efforts focused on regional bottling partnerships. Charm City Meadworks focuses on session-style sparkling meads available in cans, capitalizing on demand for low-ABV beverages. Heidrun Meadery differentiates through méthode champenoise production, offering varietal honey-based meads with premium branding.

Kuhnhenn Mead and Nectar Creek have built loyal followings by concentrating on small-batch, locally sourced production models. PASIEKA JAROS emphasizes monofloral honey meads and exports to European markets, with growing attention to mead-based cocktail mixers. Redstone Meadery offers both traditional and modern variants, including carbonated products in keg-ready formats.

Schramm's Mead specializes in fruit-forward meads using high-density fermentation techniques for rich flavor expression. Wild Blossom Meadery integrates mead tourism, bottling, and vineyard-scale honey production, combining direct-to-consumer sales with specialty retail presence.

Several meaderies introduced sparkling and flavored meads in cans, appealing to the ready-to-drink segment. Low-alcohol and probiotic-infused variants emerged, targeting health-conscious consumers.

Distribution widened through e-commerce, specialty stores, and festival sales. The craft meaderies in Asia-Pacific and Latin America began launching mead-based beverages incorporating local fruit and botanical flavors, expanding mead’s global reach into mainstream artisan beverage categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 654.8 Million |

| Type | Traditional mead, Spice mead, Fruit mead, Sparkling mead, and Others |

| Packaging Type | Bottles, Can, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | B Nektar, Bored Beverages Company, BUNRATTY MEAD AND LIQUEUR CO. Ltd., Charm City Meadworks, Heidrun Meadery, Kuhnhenn Mead, Nectar Creek, PASIEKA JAROS, Redstone Meadery, Schramm's Mead, and Wild Blossom Meadery |

| Additional Attributes | Dollar sales by product type and packaging format, demand dynamics across traditional and flavored meads, regional trends in North America and Europe, innovation in low sugar and sparkling variants, sustainability of honey sourcing, and emerging use cases in craft festivals and D2C e commerce. |

The global mead beverages market is estimated to be valued at USD 654.8 million in 2025.

The market size for the mead beverages market is projected to reach USD 1,714.0 million by 2035.

The mead beverages market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in mead beverages market are traditional mead, spice mead, fruit mead, sparkling mead and others.

In terms of packaging type, bottles segment to command 64.0% share in the mead beverages market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Mead Beverages Industry

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Fusion Beverages in Japan Market Analysis – Size, Share & Growth 2025-2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Beverages Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Spirulina Beverages Market Outlook – Size, Share & Innovations 2025-2035

Zero Sugar Beverages Market Analysis by Product Type and Sales Channel Through 2035

Adaptogenic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Demand for Malt Beverages in EU Size and Share Forecast Outlook 2025 to 2035

Instant Protein Beverages Market Analysis by Type, End-Use Packaging, Form, Source and Region Through 2035

Low-calorie RTD Beverages Market Analysis by Product Type, Flavor, Distribution Channel and Region through 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Demand for Fusion Beverages in EU Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA