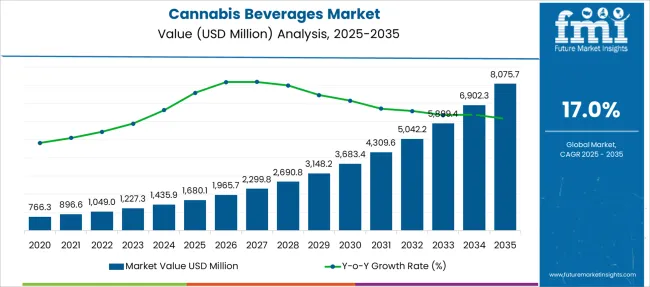

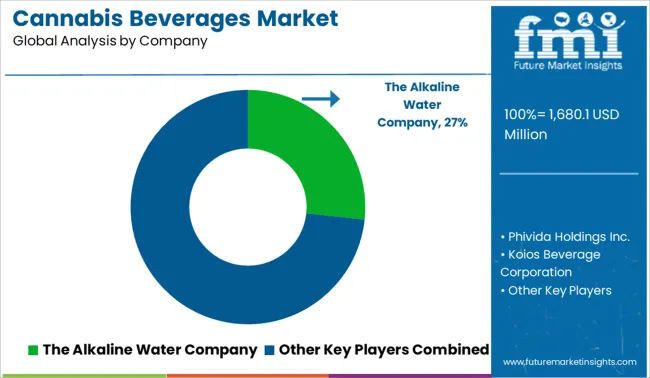

The Cannabis Beverages Market is estimated to be valued at USD 1680.1 million in 2025 and is projected to reach USD 8075.7 million by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| Cannabis Beverages Market Estimated Value in (2025 E) | USD 1680.1 million |

| Cannabis Beverages Market Forecast Value in (2035 F) | USD 8075.7 million |

| Forecast CAGR (2025 to 2035) | 17.0% |

The cannabis beverages market is witnessing robust growth driven by the rising acceptance of cannabis infused wellness products and the shift toward functional beverages with mood enhancing and therapeutic effects. Consumers are increasingly seeking alternatives to traditional alcohol and carbonated drinks, favoring beverages that promote relaxation, pain relief, and sleep enhancement.

The legalization of cannabis for recreational and medicinal use across various regions is accelerating product innovation and market entry by established beverage manufacturers and cannabis startups. Additionally, advancements in emulsion and infusion technologies are enhancing bioavailability, taste, and onset time, which is improving consumer experience and expanding appeal.

As regulatory frameworks evolve and consumer education increases, the market is positioned for continued expansion, with both alcoholic and non alcoholic formulations gaining traction in mainstream retail and hospitality sectors.

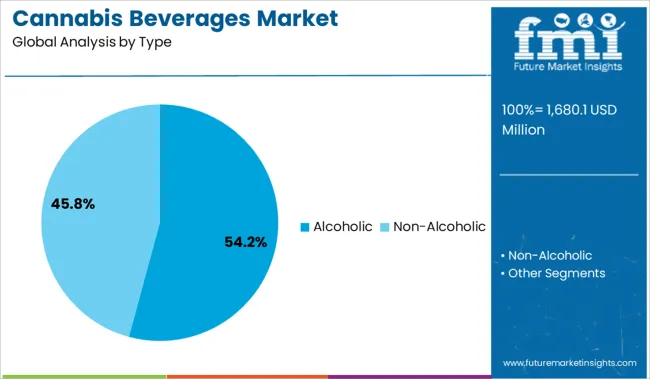

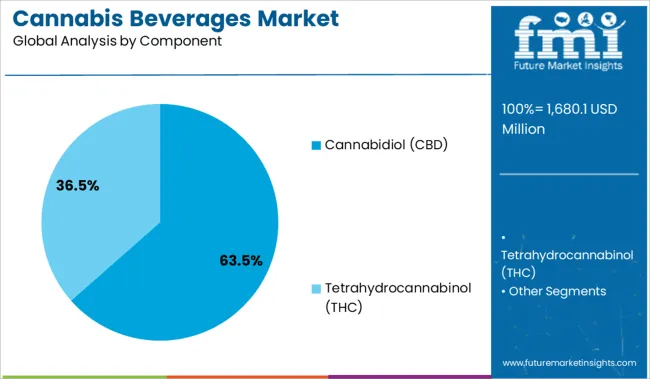

The market is segmented by Type and Component and region. By Type, the market is divided into Alcoholic and Non-Alcoholic. In terms of Component, the market is classified into Cannabidiol (CBD) and Tetrahydrocannabinol (THC). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The alcoholic segment is projected to account for 54.20% of the total cannabis beverages market revenue by 2025, positioning it as the dominant product type. This growth is being driven by the increasing popularity of low alcohol cannabis infused beers, wines, and spirits among consumers seeking a social drinking experience with added wellness benefits.

The segment is gaining momentum as traditional alcohol brands diversify into cannabis offerings to appeal to younger health conscious demographics. Moreover, favorable regulations in North America and select European regions have facilitated the launch of premium cannabis alcoholic products in licensed dispensaries and specialized bars.

The ability to merge recreational consumption with perceived functional benefits has elevated the alcoholic segment’s demand, establishing its leadership in the cannabis beverages landscape.

The cannabidiol CBD segment is expected to contribute 63.50% of the total market revenue by 2025, making it the leading component in the cannabis beverages category. This is attributed to the non psychoactive nature of CBD, which makes it widely acceptable for daily consumption without intoxicating effects.

Consumers are drawn to CBD beverages for their potential to relieve anxiety, improve sleep quality, and support overall wellness. Increased inclusion of CBD in sparkling waters, teas, and energy drinks is expanding product accessibility across retail and e commerce channels.

Regulatory clarity around hemp derived CBD in several markets has further supported product innovation and brand investment. As the wellness trend continues to influence beverage choices, CBD’s dominance is reinforced by its health aligned positioning and growing mainstream appeal.

Cannabis as a Wellness Option

Consumers concerned about their health are becoming increasingly Cali sober, a term that sounds antiquated but describes replacing alcohol intake with "less damaging" substitutes like cannabis. Alcohol makers should know that the cannabis-infused beverage sector primarily emphasizes wellness and health in their product promotion.

Industry leaders are taking advantage of cultural shifts that make many consumers reevaluate their consumption of alcohol, sugar, and other substances. Marketing teams promote cannabis-infused beverages as a "health option" that can aid in improved sleep and relaxation because they lack alcohol and frequently have few calories.

Expansion of eCommerce Channels Would Assist Market Growth

There is a significant increase in demand for cannabis-infused beverages via e-commerce platforms that offer a high degree of autonomy, privacy, and accessibility in product selection.

Cannabis sales have increased from regulated dispensaries, opening up many opportunities for specialized retailers to present delicious and creative drinks infused with some active principles from cannabis. Furthermore, these distribution channels intend to serve as the go-to place for cannabis-based edibles and aid their growth.

Cannabis users are no longer satisfied with smoking flowers with joints, bongs, or pipes; instead, they have a growing preference for new products, including concentrated and infused items. As a result, the beverage sector is going through a necessary shift.

Customers, especially those in the developed markets of North America and Europe, are consistently establishing the category of organic and chemical-free, as well as detectable and herbal formulation trends and advancements. This is expected to support the market for cannabis beverages in the coming years.

Cannabis beverages with CBD as an ingredient saw the most substantial rise of 17.8% in 2024. Due to CBD's non-psychoactive qualities, the demand is also anticipated to increase over the projected time.

Drinks containing CBD have fewer psychotropic side effects, increasing their potential for treatment in medical conditions. Like the probiotic kombucha, many customers are exploring CBD beverages as wellness and anti-inflammatory goods.

In 2025, it is anticipated that non-alcoholic cannabis beverages could represent the most significant and fastest-growing market as customers invest more in wellness drinks.

The demand for non-alcoholic cannabis beverages is also increasing as more people have opened to trying new flavors and edibles. Non-alcoholic cannabis-infused beverages such as teas, drops, elixirs, water, carbonated beverages, energy drinks, lemonade, and fruit drinks are more popular among customers looking for healthy beverages.

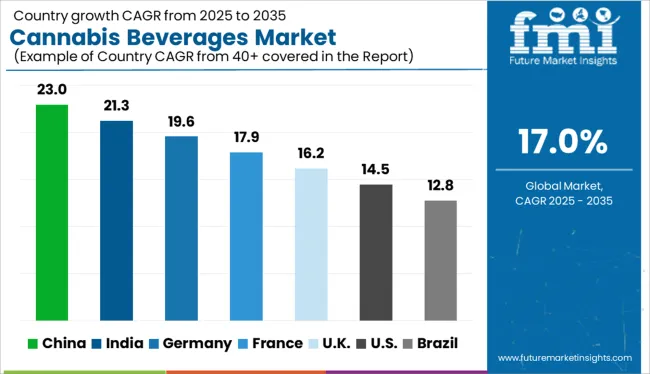

The largest market share for cannabis beverages is held by North America, which also commands the top spot in the industry. In 2024, this region was expected to generate USD 527.83 Million. The functional beverage market in the USA dominated the industry, where a sharp growth curve is exhibited.

The regional market's rapid growth can be attributed to rising consumer demand for these beverages. According to the Cannabis Trade Association, many regional businesses are working to develop new products to meet the growing demand for wellness beverages. Marijuana-friendly restaurants and cafes in the Netherlands are also expected to contribute to demand opportunities. A noticeable increase in cannabis tourism across the country is expected to boost demand for these products even more. The European market is expected to account for 41% of the global platform in the coming years.

Cann, a Cannabis-infused Beverage Company, Sells 150,000 Units and Raises USD 5 Million in Funding

Cann, a cannabis beverage firm that positions itself as a pleasant substitute for alcohol, is increasing funding as it introduces the product to Canada, its first venture into the foreign market. The company offers a wide range of products, some of which are only available in certain areas. These products include THC-infused syrups, which can be combined with tonic water or used as a component in cannabis cocktails.

Of course, Cann is constrained in what markets it can enter by more general cannabis regulation. Currently, the firm offers its goods in Illinois, Massachusetts, Nevada, California, and Massachusetts. Their debut in the Ontario market marks the beginning of their expansion into Canada.

The dominant competitors in the market employ various strategies to strengthen their position as the industry's top businesses. One such effective strategy is acquiring companies to increase brand value among consumers. Intermittently offering ground-breaking products after thoroughly analyzing the market and its target audience is another crucial tactic.

For instance, Molecule Holdings Inc. launched Molecule Crafted, a line of specialty beverages with cannabis infusions, in Canada in April 2024. These cannabis beverages have few calories and come in exotic and potent flavors.

Latest Developments in the Cannabis Beverages Market:

In August 2024, Cann, a California-based producer of THC beverages, announced the release of Passion Peach Mate, a unique and exclusive caffeinated cannabis beverage. The producer created this line of products to give consumers who are looking for alternatives to alcoholic beverages all-natural caffeine with a trace amount of THC.

Cannabidiol, or CBD as it is more commonly known, is a substance derived from cannabis that Coca-Cola Inc. (COKE) is considering incorporating into functional wellness beverages around the world.

According to a preliminary study, CBD provides considerable medical benefits for treating neurological illnesses. Additionally, it is non-psychoactive, which means that it has no adverse effects on one's awareness of their surroundings.

Constellation Brands (STZ), the company behind the best-selling Corona and Modelo beers, entered the cannabis market last year by purchasing a 10% interest in Canopy Growth Corp., the country's most prominent cannabis producer (CGC). The beer business reportedly intends to create cannabis-infused beverages.

Two further breweries have joined the cannabis movement. Heineken, a Dutch brewer, introduced Hi-Fi Hops through its Lagunitas American brand, which is sold at a few California medicinal marijuana clinics. The beverage, which has a beer-likEflavor, substitutes tetrahydrocannabinol (THC), a psychoactive component of cannabis, for alcohol.

The Molson Coors Brewing Company (TAP), based in Denver, has teamed with the Canadian brand Hydropothecary. Following legalization, both businesses intend to "pursue chances to manufacture non-alcoholic, cannabis-infused beverages for the Canadian market."

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 17.00% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Type, By Component, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Canopy Growth Corporation (Canada); The Cronos Group (Canada); Tilray. (USA); Hexo (Canada); CannTrust (Canada); Aurora Cannabis Inc. (Canada); GW Pharmaceuticals plc. (United Kingdom); VIVO Cannabis Inc. (Canada); Alkaline88, (USA); NewAge Inc. (USA); Cannara. (Canada); Dixie Brands (USA); KANNAWAY LLC. (USA) |

The global cannabis beverages market is estimated to be valued at USD 1,680.1 million in 2025.

The market size for the cannabis beverages market is projected to reach USD 8,075.7 million by 2035.

The cannabis beverages market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in cannabis beverages market are alcoholic and non-alcoholic.

In terms of component, cannabidiol (cbd) segment to command 63.5% share in the cannabis beverages market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cannabis Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Packaging Equipment Market Growth - Forecast 2025 to 2035

Cannabis Concentrate Market Analysis - Size, Share, and Forecast 2025 to 2035

Cannabis Use Disorder Treatment Market – Trends & Innovations 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Portable Cannabis Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

Mead Beverages Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Mead Beverages Industry

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Fusion Beverages in Japan Market Analysis – Size, Share & Growth 2025-2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Spirulina Beverages Market Outlook – Size, Share & Innovations 2025-2035

Zero Sugar Beverages Market Analysis by Product Type and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA