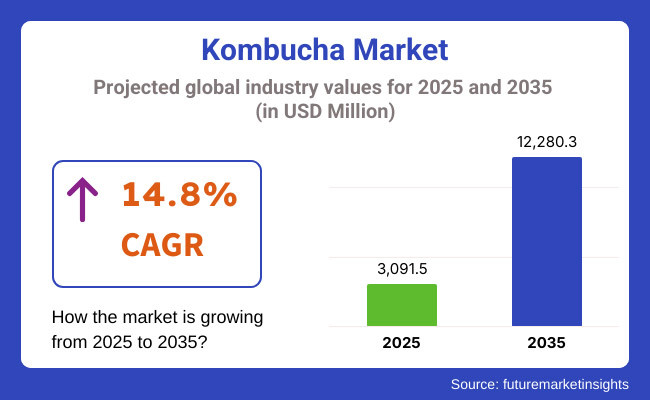

The global kombucha market is poised for remarkable expansion, forecasted to grow at a CAGR of 14.8% between 2025 and 2035 and reach a total valuation of USD 12,280.3 million by the end of the forecast period.

A confluence of health-conscious consumer behaviors, functional beverage trends, and a widespread cultural shift toward preventive wellness drives this upward trajectory. Kombucha- an ancient fermented tea beverage- is increasingly being recognized for its probiotic properties, which support digestive health, boost immunity, and aid in detoxification. These benefits have positioned kombucha as a standout performer in the broader functional beverage category.

Flavored kombucha dominates the market, accounting for an estimated 61.7% share in 2025. This dominance is fueled by innovation in flavor profiles, from classic fruity blends like mango and berry to botanical infusions such as hibiscus, lavender, and ginger turmeric.

As consumers seek out both health and sensory experience, brands are actively investing in R&D to deliver cleaner-label, low-sugar, and organic offerings with enhanced shelf stability. The rise in vegan, gluten-free, and non-GMO claims further reinforces kombucha’s alignment with clean-label expectations.

Regionally, North America leads the global kombucha market, thanks to an established health and wellness culture, the presence of leading brands, and widespread retail distribution. However, the Asia Pacific region is witnessing the fastest growth, with countries such as Japan, South Korea, and Australia experiencing increased demand. Europe is not far behind, with consumers favoring kombucha as a sophisticated alternative to sugary carbonated drinks and alcohol.

Distribution channels are diversifying rapidly. While supermarkets and health food stores remain key, online platforms are emerging as a significant driver of revenue, particularly among urban and health-conscious demographics. D2C models and e-commerce subscription services are helping new brands achieve direct market penetration without relying on traditional retail infrastructure.

Looking ahead, continued investments in advanced fermentation technologies, cold-chain logistics, and sustainable packaging are likely to reshape market dynamics. Additionally, brand collaborations with fitness influencers, nutritionists, and lifestyle platforms are expected to accelerate consumer engagement and product trials.

As regulatory clarity improves and consumer education deepens, kombucha is poised to transition from a niche wellness beverage to a mainstream functional staple across both developed and emerging markets, with significant white-space opportunities in hybrid beverages and nutraceutical applications.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global kombucha industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thereby providing stakeholders with a clearer understanding of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 13.9% (2024 to 2034) |

| H2 | 14.4% (2024 to 2034) |

| H1 | 14.4% (2025 to 2035) |

| H2 | 14.8% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is expected to surge at a compound annual growth rate (CAGR) of 13.9%, followed by a higher growth rate of 14.4% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 14.4% in the first half and remain high at 14.8% in the second half. In the first half (H1), the sector experienced a 50 basis point (bps) increase, while in the second half (H2), the business saw a 40 bps increase.

Flavored kombucha is expected to command a 61.7% market share in 2025, maintaining its lead through 2035 in alignment with the global market’s CAGR of 14.8%. This segment’s sustained growth reflects its alignment with evolving wellness trends and sensory-driven consumer preferences.

The strategic dominance of flavored kombucha lies in its convergence of health functionality with experiential appeal. As fermented tea garners attention for its gut-friendly probiotics and detoxification benefits, flavored variants broaden its accessibility by enhancing palatability and shelf appeal.

Consumers are increasingly favoring flavor-forward formulations that strike a balance between authenticity and refreshment, driving the proliferation of botanically infused, tropical, and spiced profiles. Product development efforts are heavily focused on clean-label attributes, with growing demand for organic, low-sugar, and functional flavor combinations, particularly those incorporating adaptogens, prebiotics, or herbal extracts.

Market leaders are leveraging small-batch craftsmanship and scalable fermentation techniques to achieve consistency while expanding SKU portfolios. In mature markets like the U.S., flavor innovation has become a primary lever to secure differentiation and consumer loyalty, while in high-growth Asia Pacific countries, flavor localization, such as yuzu or matcha, is fueling new adoption.

Over the next decade, flavored kombucha is expected to drive cross-category expansion into ready-to-mix powders, alcohol-inspired mocktails, and wellness boosters, further solidifying its role as a dynamic, multifunctional beverage platform.

Holding a projected 61.7% share of the global kombucha market in 2025, the flavored segment is set to remain the cornerstone of category growth through 2035, expanding in step with the market’s impressive 14.8% CAGR. This segment’s trajectory reflects a blend of functional demand and flavor-driven consumer exploration.

Flavored kombucha has evolved from a niche fermented product into a leading format for delivering probiotics with sensory appeal. Its widespread acceptance stems from its ability to satisfy three core purchase drivers: wellness functionality, low-sugar refreshment, and label transparency.

Global beverage manufacturers and startups alike are capitalizing on this trend by expanding their SKUs to include exotic fruit, floral, and herbal combinations that align with clean-label values, such as gluten-free, vegan, non-GMO, and low-calorie options. These attributes enable flavored kombucha to compete not only with sodas and juices but also with emerging alcohol alternatives and sports hydration products.

Retail diversification is accelerating the segment’s penetration. Once confined to health stores, flavored kombucha is now prominent in mainstream grocery stores, convenience stores, e-commerce platforms, and on-the-go channels. As brands invest in extended shelf-life packaging and cold-chain optimization, global availability is improving across climates and markets.

Looking forward, the flavored kombucha segment is likely to lead hybridization trends, spanning nutraceutical kombuchas, fiber-enriched blends, and even caffeine-functional fusions, solidifying its transition into a mainstream wellness beverage with scalable mass appeal.

Tier I is dedicated to established kombucha makers with significant market shares, extensive distribution networks, and comprehensive brand visibility. GT's Living Foods, the category pioneer and market leader, maintains its standing through its raw, unpasteurized formulas, which appeal to health-conscious purists. The company continues to expand its extensive product line across several flavors and functional improvements, and invests considerable marketing efforts to sustain its leadership in the category.

Similarly, KeVita has been acquired by PepsiCo and utilizes the distribution backbone mentioned above to penetrate exceptional markets through all conventional retail channels without compromising the credibility of the product among natural products consumers.

Tier 2 comprises established growth brands that hold strong regional strength and/or operate under a specialized market positioning. Brew Dr. Kombucha has established a significant market presence, combining sustainability with its brewing approach, while its tea-forward formulations emphasize flavor complexity over sweetness.

Humm Kombucha made a strong hold on the region through a majority of community outreach prior to launching a full-blown national rollout of easily drinkable flavor profiles, inviting mainstream consumers to try kombucha after they had tried mainstream beverages. These companies demonstrate robust growth trajectories, driven by clear differentiation strategies and loyal consumer bases in their core markets.

Tier 3 consists of highly-focused craft producers and emerging brands addressing niche market opportunities or regional situation cases. With higher alcohol and richer flavor profiles, Boochcraft holds the banner of hard kombucha. SCOBY Kombucha cultivates a loyal fan base through small-scale fermentation using traditional batch processing methods.

Kosmic Kombucha and Buchi Kombucha operate with a strong regional focus, creating local followings by engaging the community and offering taproom experiences that foster brand loyalty.

Mainstream Flavor Accessibility

Shift: Kombucha has evolved from a sour, vinegar-like drink into newer flavors made more palatable to suit average beverage drinkers. This shift is vital in attracting mainstream consumers who are drawn to unconventional options for soft drinks and juices, but are hesitant about intense fermentation flavors, in an arena far removed from core health enthusiasts.

Strategic Response: KeVita created its Master Brew line with fruity flavors familiar to mainstream drinkers and a more moderate level of acidity to ease the transition to fermented beverages. Health-Ade popped on the scene with flavors intended to resemble sodas like vanilla cream and cherry cola, taking on a familiar taste while also providing probiotic benefits. GT's Living Foods extended its reach with SYNERGY, offering fruitier flavors with controlled above-average sweetness in order to win over consumers who were not too keen about fermentation until now.

Functional Benefits Enhancement

Shift: While these drinks have been within the arena of "healthy" beverages, in recent times, consumers are demanding more than a general wellness claim and are interested in specific areas like immunity, energy, and mental clarity when going out to purchase the drinks. Specific active benefits have drained kombucha from a broad health beverage into a vehicle for delivering various functional ingredients, thus complementing the benefits of fermentation.

Strategic Response: Brew Dr. Kombucha put together a Clear Mind variety infused with rosemary, mint, & sage, specifically positioned for cognitive function support. Health-Ade's PLUS line includes functional supplements, such as immune-supporting mushroom extracts and metabolism-boosting heat ingredients. Remedy Kombucha has produced a prebiotic-enhanced variety that adds fibres to complement the beverage's probiotic content for total gut health support.

Low/No Sugar Formulations

Shift: Dietary views on sugar consumption have helped develop a solid case for kombuchas with lesser or no sugar per flavor, offering a non-glycaemic effect. This shift has shown itself through common consumer direction following sugar reduction but with an understanding of complex taste expectations.

Strategic Response: Remedy Kombucha, where the makers utilize long fermentation techniques, allowing for a fermentation time that completely converts sugar, resulting in a zero-sugar product with all the probiotic benefits and complex flavor intact. GT's Living Foods Enlightened line, with less sugar but lower sugar levels over time than through sugar substitutes, is now on the shelves. Humm Kombucha honoured another unique brewing method, taking into consideration the health of an SCOBY through the incorporation of alternative sweeteners, while keeping the desired end sugar content low in their Zero line.

Hard Kombucha Expansion

Shift: Hard kombucha growth is great, the health consciousness with drinking occasions has spawned, with consumers now seeking alcoholic options with perceived health benefits and natural ingredients. This shift represents a meeting of two worlds in this niche space: healthward beverages and alcoholic-user refreshment, mostly appealing to health-conscious millennials and Gen Z.

Strategic Response: Boochcraft became the leader in the category with high-alcohol, organic-based products featuring refined herbal fusion. Brew Dr. Kombucha markets its Clear Mind Hard Kombucha at 4.5% ABV and infused with botanicals as an alternative to mindful drinking. JuneShine (even if not among the top makers) also gained a large market share in premium hard kombucha made from sustainable ingredients paired with lifestyle marketing targeting outdoor enthusiasts.

Convenience and On-the-Go Formats

Shift: While at-home consuming occasions were the initial need, with the growing demand for convenience packaging that protects the product added to on-the-go lifestyles, kombucha consumption has expanded beyond home. Meaning to say, from a specialty health product, this drink is on its way to becoming an everyday refreshment choice.

Strategic Response: Health-Ade slim cans for their core flavors make a portable and recyclable statement for on-the-go consumers. Humm kombucha has developed shelf-stable versions through modified processing, allowing for distribution through convenience channels without refrigeration requirements. KeVita launched a single-serve PET bottle with resealable caps, designed for active users to prioritize portion control and convenience.

Premium Positioning for Craft

Shift: The production emotion has taken consumers to the height of expectations in terms of transparency regarding the making, quality of ingredients, and authenticity of the brand. The rising trend of craft beverages also has a place for kombucha, particularly in the premium category, where small batches are made, different techniques are used to create flavors, and artisanal stories are told through the brand's narrative to explain the higher price point.

Strategic Response: Kosmic Kombucha implemented an open-door brewery policy, allowing consumers to observe its small-batch production while providing them with information on the fermentation process. Buchi Kombucha had wild fermentation with culture collection from areas close to the brewery, and that accounts for its regionally unique flavor profiles, which are terroir specific. SCOBY Kombucha has created limited-availability ingredients in ever-changing seasonal varieties that collector programmers and premium positioning create perceived exclusivity through perceived exclusiveness.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 12.9% |

| Germany | 14.3% |

| China | 16.2% |

| Japan | 15.1% |

| India | 17.0% |

Product innovation has reached such a high level that manufacturers like GT's Living Foods have even created functional drink products designed to address specific wellness concerns, including immunity, energy, and cognitive performance. The novel functionalism of the new drinks appeals to those who would like to benefit from their drinking beyond simple refreshment. Distribution openings have experienced dramatic increases, with kombucha using the channels of modern supermarkets, club stores, convenience stores, and food services.

Health-Ade has successfully managed the expansion into this channel since messaging and consistency in products maintain brand integrity. The hard kombucha segment has made tremendous advancements, with Boochcraft establishing leadership in this category, which is considered an alternative to alcohol. This trading of hard kombucha options appeals to health-conscious people who prefer to drink less.

Briefly, the strong tradition of fermented foods has had its place in creating a cultural receptivity towards the taste profile and functional benefits of kombucha, thus bringing a favorable foreword for developing the market. Organic certification is becoming almost obligatory for success in this market, with citizens expecting very stringent norms regarding the quality of materials and processes.

Not ranked among the premier global producers, European manufacturers like Agua De Madre are, however, leveraging certified organic compositions with a transparent supply chain. Sugar-low varieties have also been performing remarkably, matching the low-sweet flavor profiles, especially those targeting health-conscious consumers in Germany. Sustainability is a success factor, with the recyclability of packaging and the environmental practices of companies heavily influencing consumer decision-making.

The small but robust growth potential of China lies in its culture of fermented drinks and its fast-increasing health consciousness. The traditional medicine heritage makes the public naturally receptive to understanding the functional advantages of kombucha, while the general attitude makes it easy to accept claims related to digestive health and immunity support.

This might explain why a solid foundation for market development exists, even if the product in question is quite new to the industry thus far. Successful brands develop well-developed products with traditional Chinese ingredients such as chrysanthemum, goji berries, and oolong tea, along with presenting familiar flavor connections that provide innovative refreshment experiences.

The global kombucha market is characterized by dynamic competition, with brands employing distinctive positioning strategies to vie for leadership in this rapidly expanding category. The primary competitive avenue remains product differentiation, with manufacturers working to create a distinct image from other brands in the marketplace through unique formulations, taste profiles, and functional enhancements.

Some brands, like GT's Living Foods, use traditional raw fermentation, whereas others, like KeVita, apply modern technologies such as filtration and pasteurization to create significant separation in sensory and shelf stability characteristics of the product.

The rate of acquisition significantly increased as major beverage players came to terms with the growth potential of kombucha, with KeVita by PepsiCo being the most prominent example, highlighting the entry of conventional beverage companies into the fermented beverage space.

Distribution strategies vary among competitors, with some focusing on natural products channels to maintain authenticity, while others pursue mainstream retail placement to maximize growth potential. Price positioning varies significantly, ranging from premium craft brands charging substantial premiums to mainstream options that compete with conventional functional products.

For instance

As per product variety, the industry has been categorized into Original/Traditional, Fruit-Flavored, Herb/Botanical, and Hard/Alcoholic.

This segment is further categorized into Short-Fermented, Long-Fermented, Continuous Brew, and Controlled SCOBY.

This segment is further categorized into Glass Bottles, Cans, Kegs/On-Tap, and Alternative Packaging.

This segment is further categorized into Mainstream, Premium Craft, Therapeutic/Wellness, and Alcohol Alternative.

Industry analysis has been conducted in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global industry is estimated at a value of USD 3,091.5 million in 2025.

The market is projected to grow at a CAGR of 14.8% between 2025 and 2035.

Leading manufacturers include GT's Living Foods, KeVita (PepsiCo), Health-Ade, Brew Dr. Kombucha, and Humm Kombucha, among others.

Manufacturers are developing extended fermentation processes that reduce or eliminate residual sugar, utilizing alternative sweeteners, and creating balanced formulations that require less sweetening.

Hard Kombucha growth is driven by consumer demand for alcoholic options with health halo benefits, natural ingredients, and more sophisticated flavor profiles than traditional ready-to-drink alcoholic beverages.

The competitive landscape is evolving through increased acquisition activity by major beverage corporations, product differentiation through functional enhancements, expansion of distribution channels, and development of specialized varieties targeting specific consumer segments.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Litres) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Flavour, 2017 to 2033

Table 4: Global Market Volume (Litres) Forecast by Flavour, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 6: Global Market Volume (Litres) Forecast by Sales Channel, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Packaging, 2017 to 2033

Table 8: Global Market Volume (Litres) Forecast by Packaging, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (Litres) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Flavour, 2017 to 2033

Table 12: North America Market Volume (Litres) Forecast by Flavour, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 14: North America Market Volume (Litres) Forecast by Sales Channel, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Packaging, 2017 to 2033

Table 16: North America Market Volume (Litres) Forecast by Packaging, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (Litres) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Flavour, 2017 to 2033

Table 20: Latin America Market Volume (Litres) Forecast by Flavour, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 22: Latin America Market Volume (Litres) Forecast by Sales Channel, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Packaging, 2017 to 2033

Table 24: Latin America Market Volume (Litres) Forecast by Packaging, 2017 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (Litres) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Flavour, 2017 to 2033

Table 28: Europe Market Volume (Litres) Forecast by Flavour, 2017 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 30: Europe Market Volume (Litres) Forecast by Sales Channel, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Packaging, 2017 to 2033

Table 32: Europe Market Volume (Litres) Forecast by Packaging, 2017 to 2033

Table 33: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: Asia Pacific Excluding Japan Market Volume (Litres) Forecast by Country, 2017 to 2033

Table 35: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Flavour, 2017 to 2033

Table 36: Asia Pacific Excluding Japan Market Volume (Litres) Forecast by Flavour, 2017 to 2033

Table 37: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 38: Asia Pacific Excluding Japan Market Volume (Litres) Forecast by Sales Channel, 2017 to 2033

Table 39: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Packaging, 2017 to 2033

Table 40: Asia Pacific Excluding Japan Market Volume (Litres) Forecast by Packaging, 2017 to 2033

Table 41: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Japan Market Volume (Litres) Forecast by Country, 2017 to 2033

Table 43: Japan Market Value (US$ Million) Forecast by Flavour, 2017 to 2033

Table 44: Japan Market Volume (Litres) Forecast by Flavour, 2017 to 2033

Table 45: Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 46: Japan Market Volume (Litres) Forecast by Sales Channel, 2017 to 2033

Table 47: Japan Market Value (US$ Million) Forecast by Packaging, 2017 to 2033

Table 48: Japan Market Volume (Litres) Forecast by Packaging, 2017 to 2033

Table 49: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Middle East and Africa Market Volume (Litres) Forecast by Country, 2017 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Flavour, 2017 to 2033

Table 52: Middle East and Africa Market Volume (Litres) Forecast by Flavour, 2017 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 54: Middle East and Africa Market Volume (Litres) Forecast by Sales Channel, 2017 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Packaging, 2017 to 2033

Table 56: Middle East and Africa Market Volume (Litres) Forecast by Packaging, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (Litres) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Flavour, 2017 to 2033

Figure 10: Global Market Volume (Litres) Analysis by Flavour, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 14: Global Market Volume (Litres) Analysis by Sales Channel, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Packaging, 2017 to 2033

Figure 18: Global Market Volume (Litres) Analysis by Packaging, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 21: Global Market Attractiveness by Flavour, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (Litres) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Flavour, 2017 to 2033

Figure 34: North America Market Volume (Litres) Analysis by Flavour, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 38: North America Market Volume (Litres) Analysis by Sales Channel, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Packaging, 2017 to 2033

Figure 42: North America Market Volume (Litres) Analysis by Packaging, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 45: North America Market Attractiveness by Flavour, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (Litres) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Flavour, 2017 to 2033

Figure 58: Latin America Market Volume (Litres) Analysis by Flavour, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 62: Latin America Market Volume (Litres) Analysis by Sales Channel, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Packaging, 2017 to 2033

Figure 66: Latin America Market Volume (Litres) Analysis by Packaging, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Flavour, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (Litres) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Flavour, 2017 to 2033

Figure 82: Europe Market Volume (Litres) Analysis by Flavour, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 86: Europe Market Volume (Litres) Analysis by Sales Channel, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Packaging, 2017 to 2033

Figure 90: Europe Market Volume (Litres) Analysis by Packaging, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 93: Europe Market Attractiveness by Flavour, 2023 to 2033

Figure 94: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Excluding Japan Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 98: Asia Pacific Excluding Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 99: Asia Pacific Excluding Japan Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 100: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: Asia Pacific Excluding Japan Market Volume (Litres) Analysis by Country, 2017 to 2033

Figure 103: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Flavour, 2017 to 2033

Figure 106: Asia Pacific Excluding Japan Market Volume (Litres) Analysis by Flavour, 2017 to 2033

Figure 107: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 108: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 109: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 110: Asia Pacific Excluding Japan Market Volume (Litres) Analysis by Sales Channel, 2017 to 2033

Figure 111: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Packaging, 2017 to 2033

Figure 114: Asia Pacific Excluding Japan Market Volume (Litres) Analysis by Packaging, 2017 to 2033

Figure 115: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 116: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 117: Asia Pacific Excluding Japan Market Attractiveness by Flavour, 2023 to 2033

Figure 118: Asia Pacific Excluding Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Asia Pacific Excluding Japan Market Attractiveness by Packaging, 2023 to 2033

Figure 120: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 121: Japan Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 122: Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: Japan Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 124: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: Japan Market Volume (Litres) Analysis by Country, 2017 to 2033

Figure 127: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Japan Market Value (US$ Million) Analysis by Flavour, 2017 to 2033

Figure 130: Japan Market Volume (Litres) Analysis by Flavour, 2017 to 2033

Figure 131: Japan Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 132: Japan Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 133: Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 134: Japan Market Volume (Litres) Analysis by Sales Channel, 2017 to 2033

Figure 135: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: Japan Market Value (US$ Million) Analysis by Packaging, 2017 to 2033

Figure 138: Japan Market Volume (Litres) Analysis by Packaging, 2017 to 2033

Figure 139: Japan Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 140: Japan Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 141: Japan Market Attractiveness by Flavour, 2023 to 2033

Figure 142: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: Japan Market Attractiveness by Packaging, 2023 to 2033

Figure 144: Japan Market Attractiveness by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 146: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 147: Middle East and Africa Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Middle East and Africa Market Volume (Litres) Analysis by Country, 2017 to 2033

Figure 151: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Middle East and Africa Market Value (US$ Million) Analysis by Flavour, 2017 to 2033

Figure 154: Middle East and Africa Market Volume (Litres) Analysis by Flavour, 2017 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 157: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 158: Middle East and Africa Market Volume (Litres) Analysis by Sales Channel, 2017 to 2033

Figure 159: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 160: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 161: Middle East and Africa Market Value (US$ Million) Analysis by Packaging, 2017 to 2033

Figure 162: Middle East and Africa Market Volume (Litres) Analysis by Packaging, 2017 to 2033

Figure 163: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 164: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 165: Middle East and Africa Market Attractiveness by Flavour, 2023 to 2033

Figure 166: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 167: Middle East and Africa Market Attractiveness by Packaging, 2023 to 2033

Figure 168: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kombucha Tea Market Growth – Functional Beverage Trends & Industry Expansion 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA