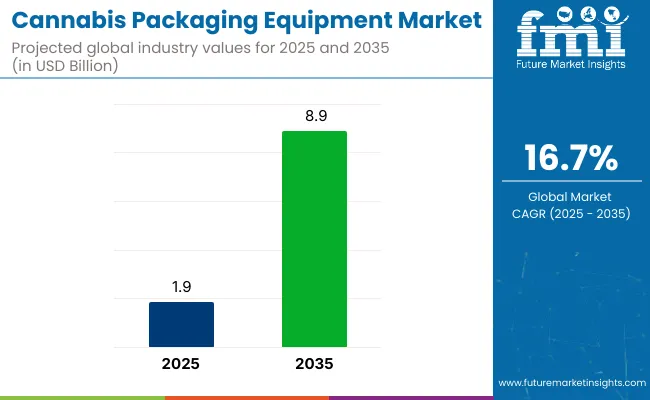

The cannabis packaging equipment market is projected to grow from USD 1.9 billion in 2025 to USD 8.9 billion by 2035, registering a CAGR of 16.7% during the forecast period. Sales in 2024 reached USD 1.6 billion, reflecting steady growth driven by increasing demand for efficient and compliant packaging solutions in the cannabis industry.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 1.9 billion |

| Market Size in 2035 | USD 8.9 billion |

| CAGR (2025 to 2035) | 16.7% |

This growth is attributed to the rising legalization of cannabis for medical and recreational use across various regions, necessitating advanced packaging systems that ensure product integrity, safety, and regulatory compliance. The market's expansion is further supported by innovations in packaging technologies, automation, and sustainability initiatives.

Green Vault Systems (GVS), a leading manufacturer of cannabis weighing and packaging equipment asn Phat Panda announced partnership. Phat Panda, a premier cannabis grower and processor based in Washington State. Tyler Miller, Phat Panda Director of Facilities, explains the challenges the company faced with a competitor’s equipment before switching to Green Vault Systems’ equipment. “Making the change to Green Vault Systems increased our overall efficiency and output,” Tyler says, adding that the repairs for the competitor’s equipment were also difficult, resulting in considerable downtime for Phat Panda.

Environmental responsibility is increasingly shaping the cannabis packaging equipment market, as manufacturers concentrate on developing machines capable of processing biodegradable and recyclable packaging materials. Innovations include the development of energy-efficient machines, integration of smart technologies for real-time monitoring, and the use of advanced materials to enhance the environmental friendliness of packaging.

Additionally, advancements in automation and modular designs are improving the efficiency and flexibility of packaging lines, enabling manufacturers to meet the evolving needs of the cannabis industry. These innovations align with global sustainability goals and regulatory requirements, making cannabis packaging equipment an attractive option for environmentally conscious producers.

The cannabis packaging equipment market is expected to expand rapidly, propelled by the rising need for automated, regulatory-compliant, and eco-friendly packaging solutions within the cannabis sector. Companies investing in innovative technologies, such as smart packaging systems and modular machinery, are expected to gain a competitive edge.

The market's expansion is further supported by the growing legalization of cannabis across various regions and the rising consumer preference for packaged cannabis products. With continuous advancements in materials and manufacturing processes, the cannabis packaging equipment market is set to offer lucrative opportunities for stakeholders over the forecast period.

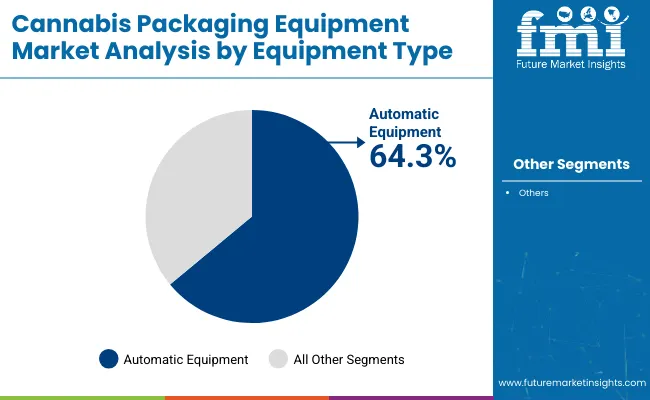

The market has been segmented based on equipment type, application, and region. By equipment type, automatic equipment and semi-automatic equipment have been adopted to support scalability, precision, and operational flexibility in cannabis packaging processes.

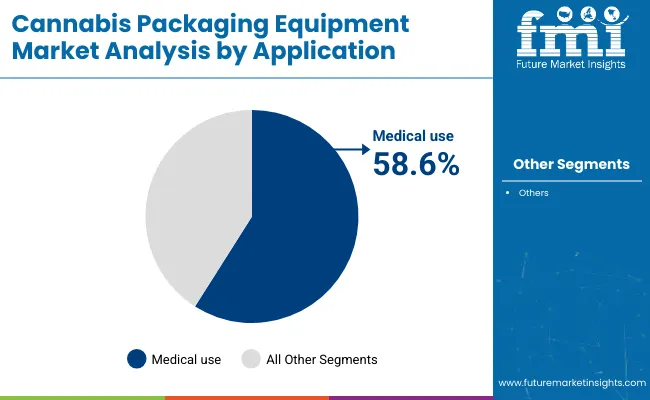

Applications have been categorized into medical use, recreational use, and others, where packaging machinery has been utilized to meet dosage accuracy, compliance, and branding requirements. Regional segmentation has been structured to include North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa to reflect varying regulatory landscapes and cannabis legalization trends.

The automatic equipment segment is expected to hold the largest share of 64.3% in the cannabis packaging equipment market by 2025, as its use has been driven by high-volume processing demands and labor optimization. Fully integrated systems for weighing, filling, sealing, and labeling have been deployed across licensed facilities seeking GMP compliance.

Equipment reliability, throughput consistency, and tamper-proof output have been prioritized for premium and regulated product formats. Packaging speed and accuracy have been enhanced to meet the growing scale of cannabis operations in legal markets.

Downtime and human error have been minimized through programmable logic controllers and smart sensor integration. Strain-specific packaging runs have been executed efficiently using automated SKU switching capabilities. Capital investments have been justified by long-term cost savings and quality assurance needs. The dominance of automatic systems has been reinforced by rapid legalization trends and brand competition in standardized cannabis formats.

The medical use segment is projected to account for a 58.6% share of the cannabis packaging equipment market in 2025, driven by strict compliance, patient safety, and dosage traceability. Tamper-evident closures, child-resistant formats, and batch-level labeling have been mandated across medical cannabis packaging lines.

Packaging machines compatible with opaque bottles, blister packs, and pre-measured sachets have been adopted to meet prescription-grade standards. Real-time serialization and barcode tracking have been implemented for pharmacovigilance and recall readiness.

Sterile barrier packaging and contamination controls have been enhanced to maintain clinical-grade handling protocols. Patient-specific product delivery and extended shelf life have been supported through nitrogen-flush and vacuum sealing technologies. Integration with EMR systems and pharmacy management software has improved distribution traceability. Market dominance has been maintained as global health authorities expand access to therapeutic cannabis treatments.

Regulatory Uncertainty and Compliance Costs

Another key challenge in the cannabis packaging equipment market is the dynamic regulatory environment. Laws around cannabis vary from place to place, with some countries and states legalizing its medical and recreational use, while others have strict restrictions. These inconsistencies in things like child-resistant packaging requirements, label mandates, and sustainability guidelines make things complex for equipment manufacturers as well as cannabis businesses.

Adhering to a constantly evolving regulatory framework adds to the operational costs of cannabis packaging firms. Businesses are regularly required to replace equipment and infrastructure to meet new standards that come into play, which drives up capital expenditure. Also, failing to comply with regulations can lead to costly fines or product recalls, both of which affect profitability.

To meet this challenge, cannabis packaging equipment manufacturers need to remain on top of regulatory updates and create flexible, modular solutions. Investing in research and development to develop packaging systems complying with several regional requirements will keep businesses on the right side of compliance without continuous expensive upgrades. The best practices include working closely with industry associations and regulatory bodies to future-proof their model and processes.

Growing Demand for Sustainable and Automated Packaging Solutions

As cannabis is increasingly legalized across the globe, the need for efficient cannabis packaging that is automatic and sustainable is on the rise. As a fast-growing industry, the cannabis companies are investing in the packaging capital for better productivity, lesser labour costs, and promoting standardization of products. Cannabis packaging equipment filling, labelling and sealing systems, for example are automated, so they speed up production, increase accuracy and reduce human error.

Cannabis packaging sustainability too has been identified as a significant concern. Consumers and regulators alike are increasingly demanding the use of eco-friendly solutions like biodegradable packaging, recyclable products, and reduced plastic usage. But, for the sake of sustainability, cannabis companies are spending on packaging equipment that is more conducive to sustainable initiatives such as automated machinery made to support compostable materials or packaging lines designed to prevent waste.

Businesses that utilize clean, green, customizable packaging solutions and save money on energy costs for consumers will have a leg up. Smart packaging and tamper-evident packaging, biodegradable materials, and other solutions will help propel the transformation of cannabis packaging equipment.

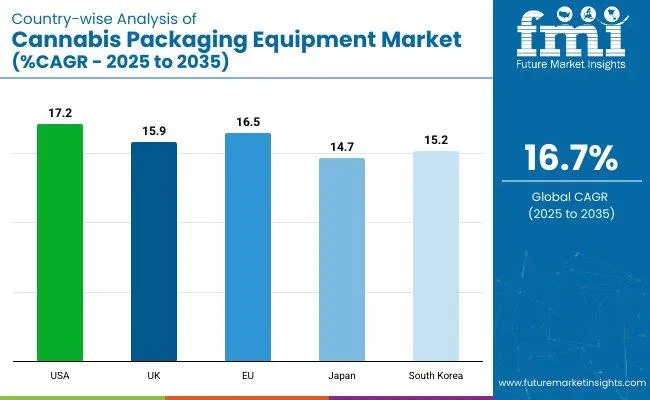

As the legal cannabis movement continues to grow, alongside increasingly stringent packaging regulations, we've come to the conclusion that our data will help drive the development of the USA cannabis packaging equipment market. As more states legalize both medical and recreational cannabis, the need for sophisticated, compliant and efficient packaging solutions is climbing. Innovations in child-resistant, tamper-proof, and sustainable packaging are forcing manufacturers to spend on automated packaging machinery.

Additionally, the rise of cannabis-infused drinks, edibles, and vapes, is driving this need for specialized packaging equipment. Development of the market is coupled with the presence of large cannabis companies and packaging technology companies in the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 17.2% |

While cannabis is largely illegal within the UK, the medical cannabis sector is increasingly dominating the market, increasing the demand for compliant packaging equipment. As more patients gain access to cannabis-based medicines, pharmaceutical-grade packaging solutions are starting to become more prevalent.

The regulatory framework in the UK government imposes strict labelling, child-proofing, and tamper-evident packaging requirements, thus posing an opportunity for cannabis packaging equipment. Moreover, increasing consumption

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.9% |

Cannabis packaging equipment has recorded healthy growth over the past decade and this translucency is pushed by the growing leisure and medical cannabis market in countries like Germany, France, and The Netherlands, thus country is evolving as a key market for revenue generation for cannabis packaging equipment.

Demand for automated, compliant packaging solutions is being driven by strict EU regulations on pharmaceutical packaging standards. Companies are investing in new filling, sealing and labelling machinery to support the explosion in cannabis-derived wellness and pharmaceutical products. Additionally, the increase in cannabis related research and development in Europe is driving innovation in packaging technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 16.5% |

Stringent cannabis regulations make the Japanese cannabis packaging equipment market relatively small. But this nation has a rising appetite for CBD-linked health and wellness products and specific packaging needs. With Japan slowly gaining traction towards medical cannabis applications, pharmaceutical grade packaging equipment is expected to have gradual yet steady growth. Japanese Market: Niche opportunities for high precision, tamper proof packaging solutions for cannabis-derived products

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.7% |

Cannabis-based medicines have limited acceptance in South Korea, where a much regulated cannabis market exists. The growing sale of institutions for CBD-infused products is fuelling the demand for high-quality packaging solutions. Tempering with this demand, however, is strict government regulations with respect to product safety, labelling and compliance, which are providing a lucrative opportunity for automated packaging equipment manufacturers. Further, the country’s advanced technology in packaging machinery has contributed to the emergence of precision cannabis packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 15.2% |

As of today, data-based analysts drive on the cannabis packaging equipment market at large due to the growing legalization of cannabis for medical and recreational use and the demand for regulatory compliance, automated, tamper-proof, and child-proof packaging; the key driving factors for the cannabis packaging market.

An instance of a machine with multiple packaging forms is the all-purpose filler and sealing machines while prominent transformation areas comprise precision filling & sealing machines, sustainable packaging, and high-speed automated labelling or wrapping systems. Businesses are focusing on compliant-driven solutions that also drive improvements in efficiency while adhering to changing industry standards.

The Cannabis Packaging Equipment Market was valued at approximately USD 1.9 billion in 2025.

The market is projected to reach USD 8.9 billion by 2035, growing at a compound annual growth rate (CAGR) of 16.7% from 2025 to 2035.

The demand for Cannabis Packaging Equipment Market is expected to be driven by the rapid legalization of cannabis products, increasing demand for child-resistant and tamper-evident packaging, the shift towards automation for efficiency and compliance, and the rising adoption of sustainable and biodegradable packaging solutions.

The top 5 countries contributing to the Cannabis Packaging Equipment Market are the United States, Canada, Germany, the Netherlands, and Australia.

The Automation and Sustainability segment is expected to lead the Cannabis Packaging Equipment market, driven by increasing regulatory requirements, growing investment in automated packaging solutions, and the push for eco-friendly materials in cannabis product packaging.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cannabis Beverages Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Concentrate Market Analysis - Size, Share, and Forecast 2025 to 2035

Cannabis Use Disorder Treatment Market – Trends & Innovations 2025 to 2035

Cannabis Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Portable Cannabis Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA