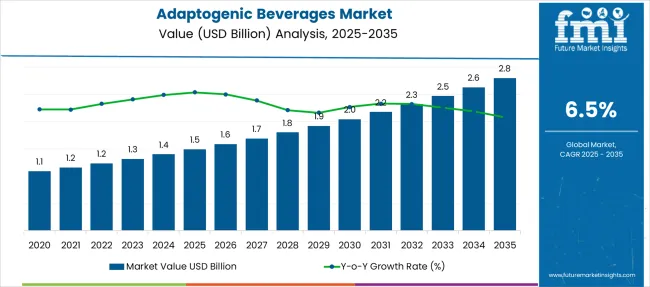

The Adaptogenic Beverages Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The market is projected to gain an absolute dollar increase of USD 1.3 billion. This reflects a 6.5% CAGR rate over ten years, resulting in a market expansion multiple of 1.87. The growth curve demonstrates a steady and predictable incline, lacking sharp fluctuations, suggesting a low-volatility growth environment. This shape indicates measured adoption driven by wellness-oriented consumer behavior rather than aggressive penetration dynamics.

By 2030, the market is expected to reach approximately USD 2.0 billion, accounting for nearly USD 500 million in new value in the first half of the forecast period. The remaining USD 800 million is projected between 2030 and 2035, reflecting a consistent slope rather than exponential acceleration. The Growth Rate Volatility Index for this segment can be interpreted as low, given the linear progression and absence of abrupt jumps or dips.

Brands such as Recess and Kin Euphorics have expanded their portfolios around botanicals like ashwagandha, schisandra, and reishi, reinforcing stable demand patterns in functional hydration. Shelf placement in natural food retail and increased DTC visibility have contributed to gradual market maturity. Structural growth is likely to continue under consistent health-forward consumption trends and ingredient diversification.

| Metric | Value |

|---|---|

| Adaptogenic Beverages Market Estimated Value in (2025 E) | USD 1.5 billion |

| Adaptogenic Beverages Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The adaptogenic beverages industry accounts for approximately 38% of the functional beverages market, supported by consumer demand for drinks that help manage fatigue, stress, and energy balance. It contributes nearly 32% to the health and wellness drinks market, where products containing herbs like ashwagandha, ginseng, and rhodiola are consumed as daily tonics. Within the nutraceuticals market, adaptogens account for approximately 22% of the market share, as they are positioned for cognitive, metabolic, and immune support. The non-alcoholic beverages market reflects an 18% share, driven by alternatives to energy drinks, soda, and coffee. Around 26% of the plant-based food and beverage market is attributed to adaptogenic drinks that use herbal infusions, botanical extracts, and functional mushrooms.

The market is evolving quickly as consumers increasingly turn to plant-based drinks that promote mental clarity, energy balance, and stress adaptation. Ingredients such as ashwagandha, reishi, and schisandra are being incorporated into functional beverages tailored for daily wellness routines. Brands are focusing on clean formulations with minimal additives and natural flavors to meet rising expectations around ingredient transparency. E-commerce platforms and personalized subscription models are accelerating product access and consumer engagement. North America holds the largest share, while demand across the Asia Pacific continues to rise due to cultural familiarity with herbal adaptogens. High production costs and scientific scrutiny still present key industry hurdles.

With rising awareness of natural health alternatives, adaptogens have emerged as popular functional ingredients in beverages that promote balance in physiological functions.

The market is witnessing strong demand among health-conscious millennials and urban professionals seeking convenient, natural, and non-pharmaceutical wellness options. Ready-to-drink formats are particularly favored for their portability and ease of consumption, aligning well with on-the-go lifestyles.

The growing popularity of herbal remedies and plant-based formulations, supported by social media influence and celebrity endorsements, is further accelerating market penetration. Innovation in flavor profiles, functional blends, and clean-label transparency is expected to drive long-term adoption. The shift toward preventive health and sustainable nutrition continues to position adaptogenic beverages as a promising category within the broader health and wellness industry.

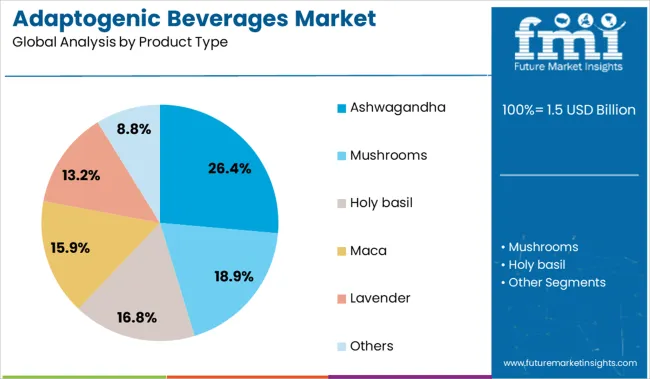

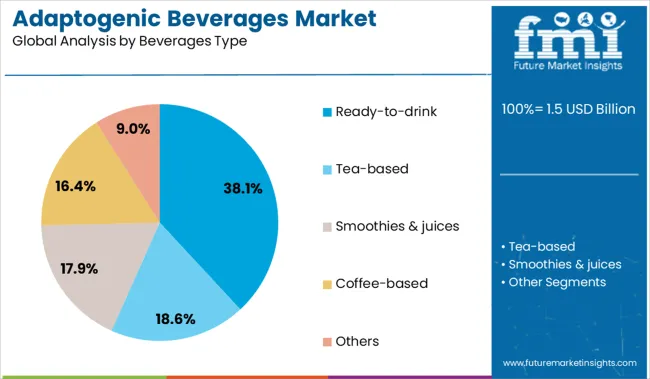

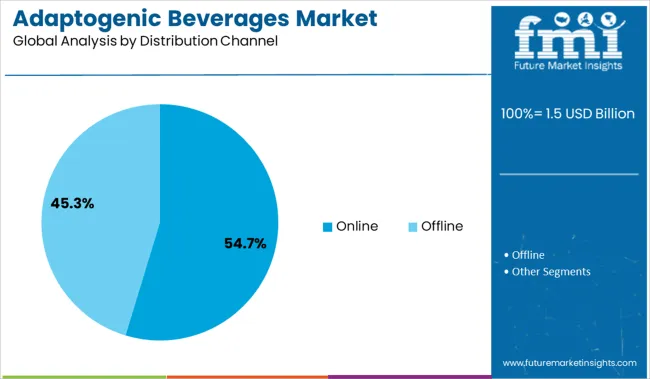

The adaptogenic beverages market is structured by product type, beverage format, distribution channel, and regional presence. Product type categories include ashwagandha, mushrooms, holy basil, maca, lavender, and other herbal ingredients known for stress-relief and wellness properties. Beverage formats are segmented into ready-to-drink products, tea-based beverages, smoothies and juices, coffee-based options, and additional formulations designed to boost functionality. Distribution channels are classified into online platforms and offline retail outlets, reflecting the mix of e-commerce and traditional sales approaches. Geographically, the market covers North America, Latin America, Western Europe, Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Ashwagandha leads the product type category with a 26.4% market share, owing to its well-documented adaptogenic properties and long-standing use in traditional medicine systems such as Ayurveda. Known for its potential to reduce stress, improve focus, and support overall vitality, Ashwagandha has become a preferred active ingredient in functional beverage formulations.

The segment benefits from increasing clinical validation of its benefits, which has helped elevate consumer trust and interest. Brands are incorporating Ashwagandha into a variety of product lines, including energy drinks, calming tonics, and wellness shots, catering to both daily routine use and specific health goals.

As demand for natural and plant-based ingredients grows, Ashwagandha’s versatility and proven efficacy position it as a cornerstone of the adaptogenic beverage segment. Its sustained popularity is expected to support continued formulation innovation and wider distribution across global markets.

The ready-to-drink segment captures a leading 38.1% share of the beverage type category, reflecting strong consumer preference for convenience and immediate functionality. Ready-to-drink adaptogenic beverages eliminate the need for preparation, making them an attractive option for busy consumers who prioritize wellness but seek low-effort solutions.

This segment has seen robust growth due to increased shelf presence in natural food stores, gyms, and wellness boutiques. Manufacturers are enhancing appeal by offering a diverse range of flavor combinations and targeted benefits, such as mood support, energy boost, and relaxation.

Packaging innovations, including sustainable and portable formats, are also helping boost product visibility and consumer trial. As consumer demand for clean-label and functional hydration products increases, the ready-to-drink segment is expected to maintain its growth trajectory and remain the preferred format for adaptogenic beverage consumption.

The online distribution channel dominates with a 54.7% market share, highlighting the shift in consumer purchasing behavior toward digital platforms for health and wellness products. E-commerce provides access to a wide variety of adaptogenic beverage brands, supported by detailed product information, consumer reviews, and personalized recommendations.

The convenience of doorstep delivery, subscription models, and exclusive online-only formulations further drives sales through this channel. Online platforms have also become critical for emerging brands to build visibility, educate consumers, and foster loyalty through social engagement and targeted marketing.

The segment's growth has been accelerated by pandemic-induced shifts in shopping habits and the growing popularity of wellness-focused digital marketplaces. Continued advancements in direct-to-consumer logistics and mobile commerce are expected to solidify the online channel's position as the dominant distribution route for adaptogenic beverages.

From 2025 to 2035, robotics and automated storage systems were introduced in cold warehouses, improving throughput, reducing labor exposure, and enhancing accuracy. These developments position automation-ready solutions as critical differentiators for providers aiming to serve high-volume food and pharmaceutical distribution networks efficiently.

An increase in parasitic outbreaks among commercial and small-scale livestock has been recognized as the primary catalyst for growth in the animal parasiticides market. In 2023, a surge in tick and mite infestations was documented within cattle herds, prompting widespread adoption of synthetic parasiticide treatments to mitigate economic losses.

By 2024, demand was elevated as veterinary services recommended integrated parasitic control regimens to address rebound infestations in swine and poultry. In 2025, shifts in grazing patterns and climate variability were tied to elevated worm burdens, necessitating broader administration of macrocyclic lactones and combination therapies.

These developments demonstrate that disease pressure rather than commodity price or production volume is forcing farmers to prioritize parasitic management solutions.

Robotics and automated storage systems had been deployed within cold-storage facilities to streamline handling and improve throughput under controlled temperature conditions. Autonomous forklifts and collaborative robots were being used to transfer perishable goods between temperature zones, reducing manual labor and minimizing exposure to freezing environments.

These implementations demonstrate that when cold chain logistics adopt robotics and AS/RS systems, operational accuracy and labor efficiency are significantly enhanced. Providers that offer robotics-compatible cold storage equipment and warehouse control software are being positioned to capture growing demand from large-scale food distributors and pharmaceutical logistics operators.

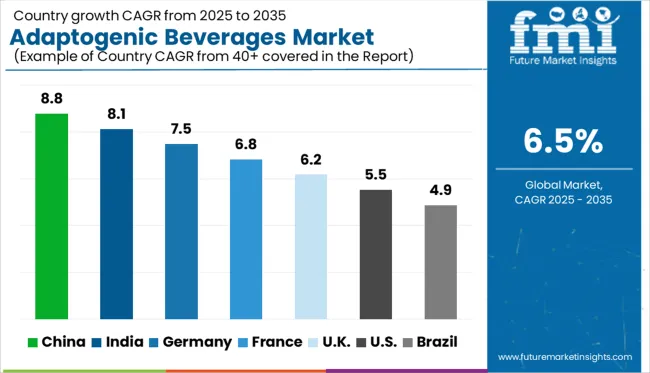

| Countries | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

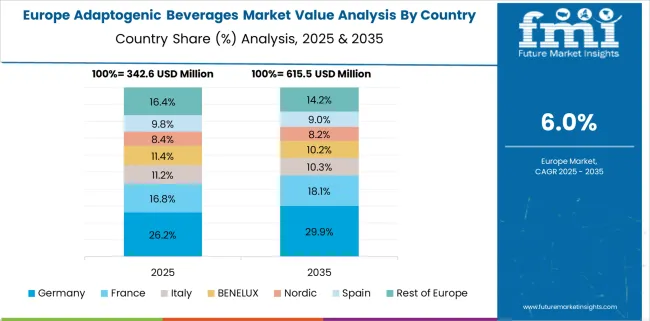

The global adaptogenic beverages market is forecast to grow at a 6.5% CAGR from 2025 to 2035. BRICS nations such as China and India lead with 8.8% and 8.1%, supported by functional beverage innovations and infusion of botanicals into ready-to-drink products. OECD economies show consistent growth with Germany at 7.5%, driven by clean-label adaptogenic teas and nootropic blends, while France at 6.8% and the UK at 6.2% focus on premium natural energy drinks and stress-relief formulations. ASEAN markets, including Thailand, Indonesia, and Vietnam, experience increasing adoption due to wellness-centric preferences and café culture expansion, though at an early stage compared to BRICS.

China is expected to lead the adaptogenic beverages market with a CAGR of 8.8%, fueled by consumer demand for functional wellness drinks and energy-enhancing formulations. Domestic brands are launching adaptogen-infused teas, plant-based lattes, and herbal RTD blends targeting stress relief and cognitive support. Retail penetration in e-commerce platforms is accelerating uptake, supported by influencer-driven campaigns and functional claims compliance.

India is forecast to grow at 8.1% CAGR, driven by traditional Ayurvedic herbs entering modern beverage formats. Adaptogenic drinks are gaining traction in urban centers, particularly among health-conscious millennials. Domestic players integrate ashwagandha, tulsi, and ginseng into energy beverages and immunity-boosting drinks. Organized retail and direct-to-consumer channels boost product availability in metro and tier-2 cities.

Germany is projected to grow at a 7.5% CAGR, supported by strong demand for clean-label drinks and plant-based energy beverages. Functional tea blends with adaptogens like rhodiola and ginseng dominate premium retail shelves. Manufacturers focus on organic certification and low-sugar formulations to meet regulatory and consumer expectations. Distribution partnerships with specialty retailers and online wellness platforms accelerate market penetration.

France is expected to grow at 6.8%, driven by demand for premium health beverages in cafes, supermarkets, and specialty stores. Adaptogen-based formulations are increasingly positioned as natural energy boosters and stress-relief products. Beverage companies are experimenting with botanical extracts blended into sparkling water and juice-based drinks. Marketing campaigns emphasize purity, origin traceability, and sensory appeal for upscale consumers.

The UK is projected to grow at 6.2%, supported by rising interest in functional wellness beverages and mental well-being products. Adaptogen-infused teas, smoothies, and sparkling drinks are gaining momentum in urban retail and online health platforms. Local brands leverage partnerships with gyms and lifestyle influencers to expand awareness. Sustainability-focused packaging is influencing purchasing decisions in the premium beverage segment.

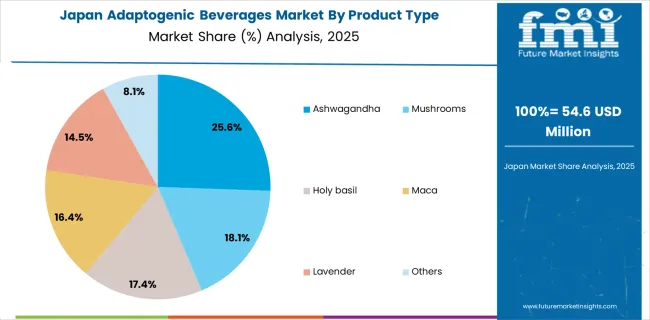

Japan contributes USD 54.6 million to the global market in 2025, accounting for approximately 3.6% of the global adaptogenic beverages market valued at USD 1.5 billion. Maca-based drinks hold the largest share at 25.6%, equal to nearly USD 14 million, showing strong demand for endurance-focused formulations. Lavender and Holy Basil together account for 35.5%, reflecting rising interest in stress-relief beverages. Mushroom-based beverages form 16.4% of the market, while Ashwagandha stands at 14.5%, driven by energy and wellness trends.

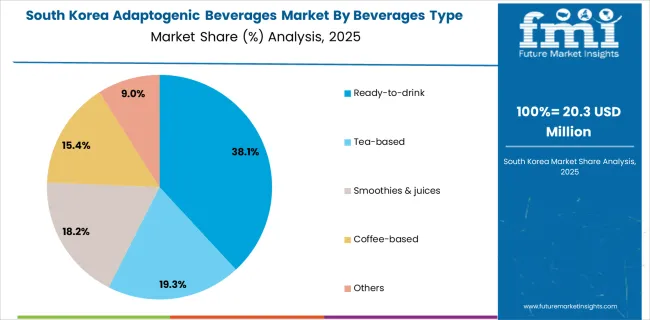

The adaptogenic beverages market in South Korea is valued at USD 20.3 million in 2025, contributing approximately 1.4% of the global market worth USD 1.5 billion. Coffee-based formats lead with a 38.1% share, equal to USD 7.7 million, supported by the nation’s established café culture and preference for functional energy beverages. Smoothies and juices hold 19.3%, while tea-based options account for 18.2%, tied to wellness traditions. Ready-to-drink (RTD) products make up 15.4% in 2025.

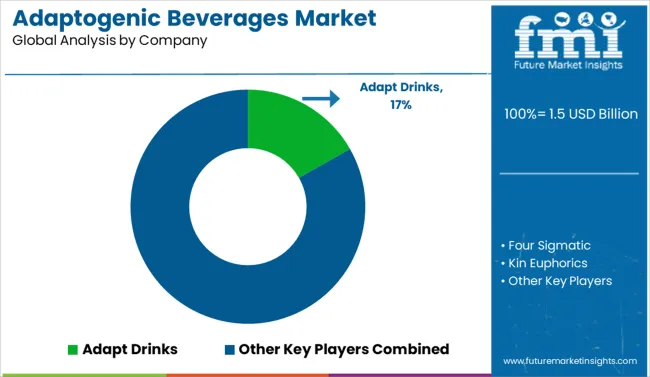

The adaptogenic beverages market is moderately consolidated, led by Adapt Drinks with a 16.8% market share. The company holds a dominant position through its focus on functional formulations, strong consumer loyalty in the wellness category, and wide retail and e-commerce distribution networks.

Dominant player status is held exclusively by Adapt Drinks. Key players include Four Sigmatic, Kin Euphorics, Om Mushroom, Peak And Valley, Rasa, Rebbl, and Sunwink, each offering adaptogen-infused beverages featuring botanicals, mushrooms, and herbal extracts designed for stress management, energy support, and cognitive health, supported by clean-label claims and influencer-driven marketing strategies.

Emerging players are limited in this category due to brand-driven consumer trust and high product development costs in functional beverage innovation. Market demand is driven by growing consumer interest in holistic wellness, rising awareness of herbal adaptogens, and increased preference for plant-based, ready-to-drink functional products.

Recent Industry Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Product Type | Ashwagandha, Mushrooms, Holy basil, Maca, Lavender, and Others |

| Beverages Type | Ready-to-drink, Tea-based, Smoothies & juices, Coffee-based, and Others |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adapt Drinks, Four Sigmatic, Kin Euphorics, Om Mushroom, Peak And Valley, Rasa, Rebbl, and Sunwink |

| Additional Attributes | Dollar sales by beverage type (RTD drinks, shots, powders), regional demand trends, competitive landscape, consumer preference for natural adaptogen blends, integration with functional wellness apps, innovations in nootropics, adaptogen micro-dosing, and clean-label formulations. |

The global adaptogenic beverages market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the adaptogenic beverages market is projected to reach USD 2.8 billion by 2035.

The adaptogenic beverages market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in adaptogenic beverages market are ashwagandha, mushrooms, holy basil, maca, lavender and others.

In terms of beverages type, ready-to-drink segment to command 38.1% share in the adaptogenic beverages market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mead Beverages Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Mead Beverages Industry

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Fusion Beverages in Japan Market Analysis – Size, Share & Growth 2025-2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Beverages Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Spirulina Beverages Market Outlook – Size, Share & Innovations 2025-2035

Zero Sugar Beverages Market Analysis by Product Type and Sales Channel Through 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Demand for Malt Beverages in EU Size and Share Forecast Outlook 2025 to 2035

Instant Protein Beverages Market Analysis by Type, End-Use Packaging, Form, Source and Region Through 2035

Low-calorie RTD Beverages Market Analysis by Product Type, Flavor, Distribution Channel and Region through 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Demand for Fusion Beverages in EU Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA