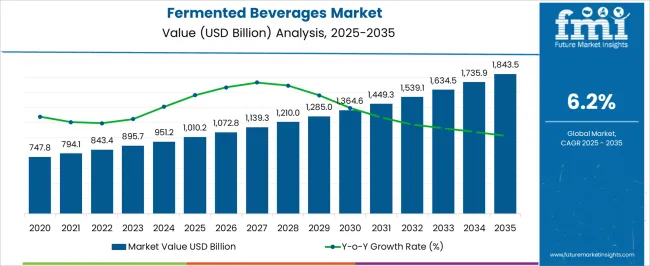

The fermented beverages market is projected to increase from USD 1,010.2 billion in 2025 to USD 1,843.5 billion by 2035, reflecting a steady CAGR of 6.2%. Regulatory frameworks exert a significant influence on the market, affecting production processes, labeling, distribution, and quality compliance. Governments across major regions impose strict standards on alcohol content, hygiene, and safety, which directly shape operational strategies for manufacturers.

Compliance with food safety regulations and beverage-specific legislation increases operational costs but ensures product integrity and consumer trust, which are critical for long-term market growth.

Emerging regulations around labeling, nutritional information, and allergen disclosure require producers to adapt packaging and documentation practices, thereby influencing the cost structure. Taxation policies and import-export duties further affect market dynamics, particularly in regions with high regulatory oversight, creating barriers for smaller players while favoring established companies with the capacity to absorb compliance costs. Additionally, environmental regulations targeting sustainable production and waste management indirectly affect fermentation processes, energy consumption, and water usage, prompting innovation in process optimization and resource efficiency.

The overall impact of regulations is multifaceted. While compliance introduces operational and financial challenges, it simultaneously elevates product quality standards, boosts consumer confidence, and drives the adoption of advanced manufacturing and monitoring technologies. The market’s projected growth underscores that regulatory alignment will remain a critical determinant for sustainable expansion across global regions.

The fermented beverages market represents a specialized segment within the global beverage industry, emphasizing its role in health, taste, and cultural consumption. Within the overall beverages market, it accounts for about 5.8%, reflecting growing consumer interest in probiotic and functional drinks. In the functional foods and nutraceuticals segment, it holds nearly 4.3%, driven by health oriented formulations and gut wellness benefits.

Across the alcoholic beverages market, fermented beverages secure 6.1%, supported by beer, cider, and traditional fermented alcohol consumption. Within the dairy and non-dairy probiotic drinks category, it represents 3.9%, reflecting the popularity of yogurt drinks and kombucha. In the natural and organic beverages segment, the market captures 3.2%, emphasizing demand for minimally processed, fermented products.

Recent developments in this market highlight innovation in fermentation processes, ingredient diversity, and product positioning. Advances in controlled microbial fermentation and strain selection are enhancing flavor profiles and functional benefits. Key players are exploring novel fruit, botanical, and plant-based bases to diversify offerings, while reducing sugar content and increasing natural probiotics.

Packaging innovations, including small single-serve bottles and environmentally friendly formats, have gained traction. Strategic collaborations between fermentation technology providers and beverage companies are increasing production efficiency and consistency. The expansion of e-commerce and direct-to-consumer channels has improved accessibility, while educational campaigns on gut health are driving consumer adoption. These trends demonstrate how taste, wellness, and innovation are shaping the fermented beverages market.

| Metric | Value |

|---|---|

| Fermented Beverages Market Estimated Value in (2025 E) | USD 1010.2 billion |

| Fermented Beverages Market Forecast Value in (2035 F) | USD 1843.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The fermented beverages market is witnessing sustained momentum, underpinned by increasing consumer interest in products offering unique flavor profiles, perceived health benefits, and artisanal craftsmanship. Demand is being bolstered by the expanding variety of both alcoholic and non-alcoholic options, alongside the integration of functional ingredients to cater to wellness-focused consumers.

Producers are optimizing product formulations, leveraging advanced fermentation techniques, and enhancing quality control to ensure consistency and safety, while premiumization trends are driving value growth in mature markets. In emerging economies, rising disposable incomes, urban lifestyle shifts, and greater exposure to global beverage trends are contributing to increased consumption.

The market’s growth trajectory is further reinforced by strategic investments in marketing, packaging innovation, and expanded distribution networks Over the forecast horizon, continued diversification of product portfolios, combined with responsive supply chains and compliance with evolving regulatory frameworks, is expected to secure steady expansion and strengthen the market’s global footprint.

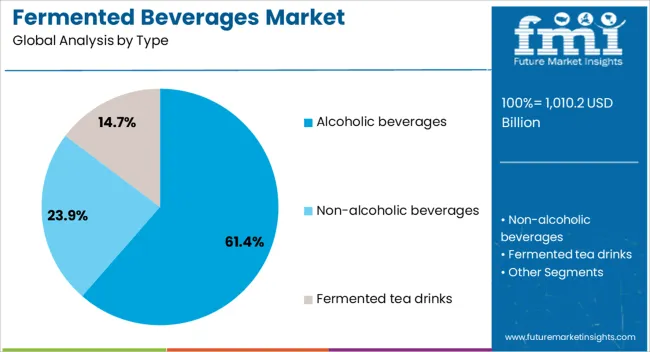

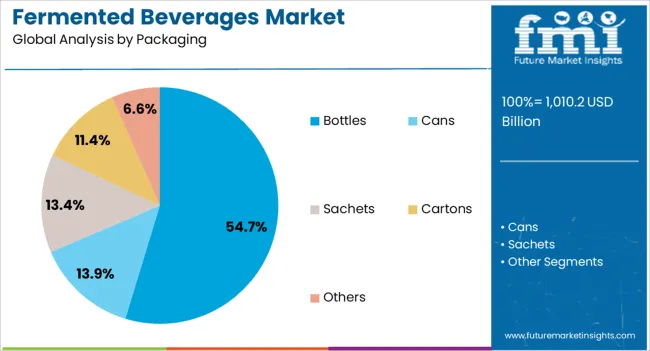

The fermented beverages market is segmented by type, packaging, distribution channel, and geographic regions. By type, fermented beverages market is divided into Alcoholic beverages, Non-alcoholic beverages, and Fermented tea drinks. In terms of packaging, fermented beverages market is classified into Bottles, Cans, Sachets, Cartons, and Others.

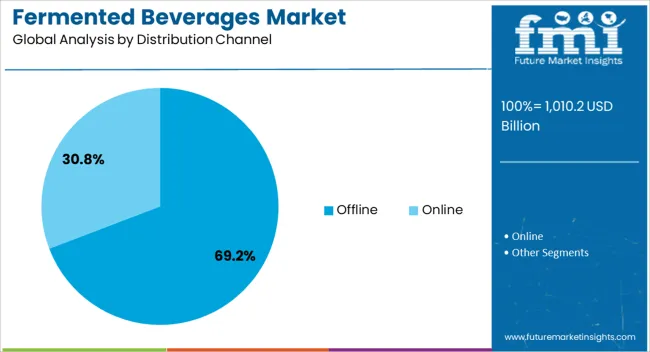

Based on distribution channel, fermented beverages market is segmented into Offline and Online. Regionally, the fermented beverages industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The alcoholic beverages segment, representing 61.40% of the type category, remains the dominant force due to entrenched cultural acceptance, established consumption habits, and broad product diversity across global markets. Its sustained leadership is supported by the strong performance of beer, wine, and spirits, which collectively drive high-volume sales through both retail and hospitality channels.

Technological advancements in fermentation and aging processes have enhanced product quality, flavor complexity, and shelf stability, ensuring competitiveness in both premium and mass-market tiers. Marketing strategies emphasizing authenticity, heritage, and artisanal production have further reinforced brand loyalty.

The segment also benefits from well-developed global trade channels, enabling producers to capture demand spikes in emerging markets while maintaining strong positions in mature regions Continuous product innovation, including limited editions and cross-category blends, is expected to sustain consumer engagement and safeguard its market share in the face of growing non-alcoholic alternatives.

The bottles segment, accounting for 54.70% of the packaging category, leads the market owing to its versatility, product preservation qualities, and consumer preference for traditional presentation formats. Glass bottles, in particular, are valued for their ability to maintain flavor integrity, while also supporting premium brand positioning.

The segment’s share is bolstered by its widespread acceptance across both alcoholic and non-alcoholic fermented beverages, with manufacturers leveraging customizable designs and sustainable production methods to align with evolving consumer expectations. Enhanced bottling technologies have improved production efficiency, sealing performance, and recyclability, contributing to stronger environmental credentials.

The ability to cater to both small-batch artisanal producers and large-scale beverage companies has allowed bottles to maintain relevance across diverse market segments Growth prospects are reinforced by rising demand for eco-friendly materials and packaging innovations that balance functionality with aesthetic appeal, ensuring continued preference in the competitive packaging landscape.

The offline distribution channel, holding 69.20% of the category, dominates due to its extensive reach, established retail infrastructure, and consumer purchasing habits favoring in-person selection. Supermarkets, specialty stores, and on-premise establishments such as bars and restaurants form the backbone of this channel, enabling widespread accessibility to a broad product range.

The segment benefits from opportunities for direct consumer engagement, product sampling, and promotional activities that enhance brand visibility and influence purchasing decisions. Reliable cold-chain logistics and efficient stock management practices have ensured consistent product quality across varied retail environments.

While e-commerce is gaining traction, particularly in urban centers, offline channels continue to command trust through personalized service and immediate product availability Strategic partnerships between producers and retailers, coupled with in-store marketing campaigns, are expected to sustain the offline segment’s market share, even as hybrid distribution models evolve to integrate both physical and digital sales channels.

The market has experienced significant growth due to rising consumer interest in health-oriented, functional, and probiotic-rich drinks. Products such as kombucha, kefir, kvass, and traditional fermented teas are being increasingly consumed for their digestive benefits and perceived contribution to gut health. The market has been influenced by changing lifestyles, growing awareness of natural and organic products, and the proliferation of innovative flavors and formulations. Beverage manufacturers are investing in R&D to enhance shelf life, taste, and nutrient profiles, while distribution networks are expanding in both retail and online channels.

Consumer demand for functional beverages has significantly driven fermented beverage adoption. These drinks are often associated with improved digestive health, immunity support, and nutrient enrichment. Probiotic content, antioxidants, and natural fermentation processes appeal to health-conscious consumers seeking alternatives to carbonated or sugar-laden beverages. The increasing focus on wellness in both developed and emerging markets has encouraged manufacturers to highlight the health benefits of fermented beverages through labeling and marketing campaigns. Retailers have responded with dedicated sections and online visibility, further increasing accessibility. This health-driven trend ensures sustained demand, positioning fermented beverages as both a lifestyle and functional product category.

Manufacturers are increasingly exploring innovative flavors, blends, and fermentation techniques to attract diverse consumer segments. Kombucha, fruit-fermented drinks, and dairy-based kefir variants are combined with natural flavors, herbs, and functional ingredients such as vitamins or plant extracts. Packaging innovations, including single-serve bottles and sustainable formats, have improved convenience and environmental appeal. Experimentation with fermentation durations, strains, and sweetening agents allows for product differentiation, targeting both traditional consumers and younger demographics seeking unique taste experiences. Continuous innovation has become critical in expanding the consumer base and maintaining engagement in an increasingly competitive beverage landscape.

The global distribution of fermented beverages has been strengthened by growth in modern retail chains, health stores, and online marketplaces. E-commerce platforms enable direct-to-consumer delivery and subscription models, expanding access beyond traditional urban centers. Supermarkets and convenience stores have allocated dedicated sections for functional and fermented drinks, increasing visibility and consumer trial. Cold chain logistics improvements have facilitated the transport of perishable fermented products while maintaining quality and safety standards. The combination of offline retail penetration and online availability has broadened market reach, allowing smaller artisanal brands to compete alongside established players, thus accelerating overall market growth.

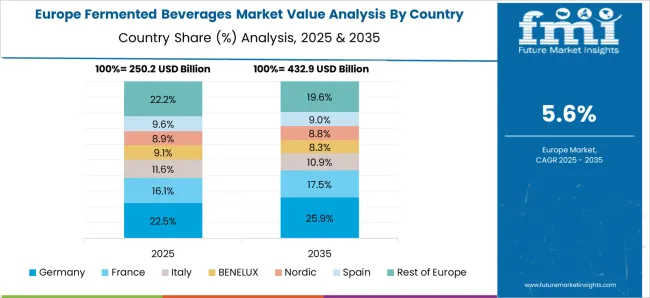

Regional consumption patterns strongly influence fermented beverage demand. Asia-Pacific countries, particularly Japan, Korea, and China, have deep-rooted traditions of fermented teas and rice-based drinks, driving both domestic consumption and export opportunities. North America and Europe have seen rapid adoption of kombucha and dairy-based fermented beverages, fueled by wellness trends and increasing awareness of probiotics. Latin America and the Middle East are emerging markets, where urbanization and lifestyle shifts have created new consumer segments. Cultural familiarity, dietary habits, and regional health trends continue to shape product portfolios, marketing strategies, and adoption rates, reinforcing the global expansion of fermented beverages.

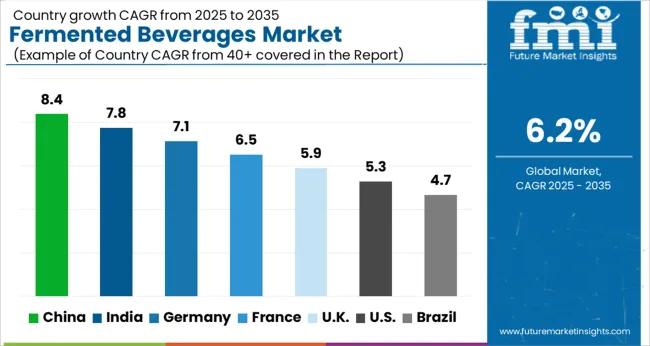

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The market is anticipated to grow steadily due to rising consumer interest in functional and probiotic drinks. China leads with 8.4%, driven by strong domestic production and increasing health-conscious consumption. India follows at 7.8%, supported by growing adoption of traditional and modern fermented beverages. Germany achieves 7.1%, benefiting from advanced brewing technologies and export-oriented production.

The United Kingdom records 5.9%, where innovation in craft and specialty beverages fuels market activity. The United States attains 5.3%, with steady demand from health-focused and premium beverage segments. Collectively, these countries represent a diversified landscape of production, adoption, and technological development shaping the global fermented beverages industry. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to register a CAGR of 8.4%, fueled by rising consumer preference for functional and traditional fermented beverages. Expanding retail and e-commerce channels, coupled with increasing awareness of health benefits, are driving market adoption. Domestic players are innovating with fruit, herbal, and probiotic-infused beverages to capture urban consumer demand. The shift towards natural and low-sugar options is further enhancing market potential, while regulatory support for food safety and quality standards strengthens confidence among consumers.

India is projected to grow at a CAGR of 7.8%, supported by increasing awareness of digestive health and traditional fermented drink consumption. Rising disposable incomes and growing modern retail presence are creating opportunities for packaged and premium beverage segments. Companies are introducing innovative formats, including ready-to-drink probiotic drinks and kombucha, to appeal to young urban populations. Government initiatives promoting food safety and nutritional labeling also encourage consumer confidence, helping domestic and international brands gain traction.

Germany is anticipated to grow at a CAGR of 7.1%, driven by high consumer preference for natural, organic, and functional drinks. Fermented beverages are increasingly adopted in health-conscious urban populations. Retail expansion, particularly in supermarkets and specialized organic stores, is supporting market penetration. Producers are innovating with low-sugar, herbal, and probiotic blends to meet evolving consumer preferences. Regulatory emphasis on quality and health claims continues to shape product offerings and marketing strategies.

The United Kingdom is forecasted to grow at a CAGR of 5.9%, driven by the demand for health-oriented beverages and functional drinks. Kombucha and probiotic drinks are increasingly popular among urban consumers, while supermarkets and convenience stores are expanding shelf space for such products. Product innovations focusing on natural ingredients, sugar reduction, and flavor variety continue to attract health-conscious consumers. Marketing campaigns emphasizing wellness benefits further boost market growth and brand recognition.

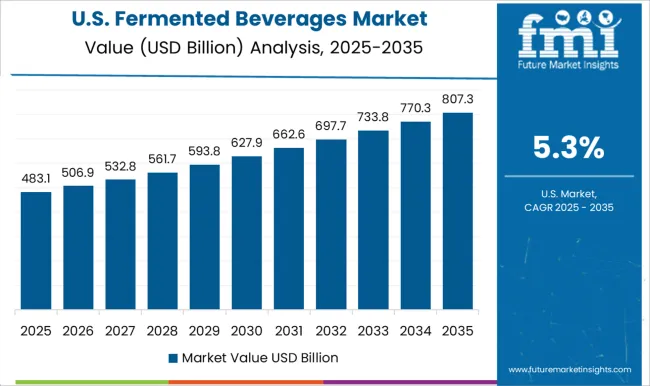

The United States is projected to grow at a CAGR of 5.3%, supported by rising health awareness and consumer shift toward functional beverages. The market is witnessing innovation in probiotic-infused and low-calorie fermented drinks. Supermarkets, e-commerce platforms, and health stores are key distribution channels expanding product availability. Consumer interest in organic, non-GMO, and clean-label options continues to shape product development strategies. International brands are leveraging the trend toward wellness beverages to strengthen their presence.

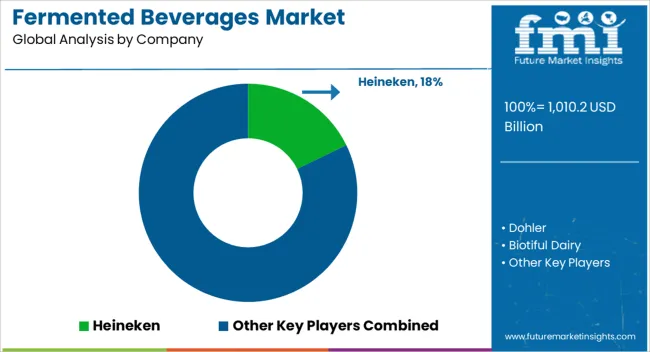

The market is driven by a mix of multinational corporations and specialized regional players offering a wide range of alcoholic and non-alcoholic products. Heineken and Diageo are prominent global players, providing an extensive portfolio of beers, ciders, and fermented spirits that cater to diverse consumer preferences. Suntory Holdings Limited and Kirin Holdings strengthen the market with innovative beverage solutions and regional brand dominance, particularly in Asia-Pacific markets.

Chr. Hansen and Dohler contribute to the sector by supplying fermentation cultures, enzymes, and natural ingredients essential for beverage production, supporting both quality and consistency. Danone, Biotiful Dairy, and Lifeway Foods focus on probiotic-rich fermented drinks, such as yogurts and kefir, responding to growing consumer awareness of gut health.

PepsiCo and The Coca-Cola Company have expanded their portfolios to include functional fermented beverages, leveraging their distribution networks and brand recognition to reach wider markets. Sula Vineyards provides artisanal and premium fermented beverages, emphasizing wine and boutique spirits, while Yakult Honsha has carved a niche in probiotic drink segments with strong consumer loyalty.

| Item | Value |

|---|---|

| Quantitative Units | USD 1010.2 Billion |

| Type | Alcoholic beverages, Non-alcoholic beverages, and Fermented tea drinks |

| Packaging | Bottles, Cans, Sachets, Cartons, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Heineken, Dohler, Biotiful Dairy, Chr. Hansen, Danone, Diageo, Kirin Holdings, Lifeway Foods, PepsiCo, Sula Vineyards, Suntory Holdings Limited, The Coca-Cola Company, and Yakult Honsha |

| Additional Attributes | Dollar sales by beverage type and distribution channel, demand dynamics across retail, foodservice, and health-focused segments, regional trends in fermented beverage adoption, innovation in flavor profiles, probiotic formulations, and packaging, environmental impact of production and waste management, and emerging use cases in functional drinks and wellness-focused products. |

The global fermented beverages market is estimated to be valued at USD 1,010.2 billion in 2025.

The market size for the fermented beverages market is projected to reach USD 1,843.5 billion by 2035.

The fermented beverages market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in fermented beverages market are alcoholic beverages, beer, wine, cider, wine coolers, alcopops, others, non-alcoholic beverages, fermented tea drinks, fermented dairy-based drinks, fermented fruit-based drinks, fermented cereal-based drinks and others.

In terms of packaging, bottles segment to command 54.7% share in the fermented beverages market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA