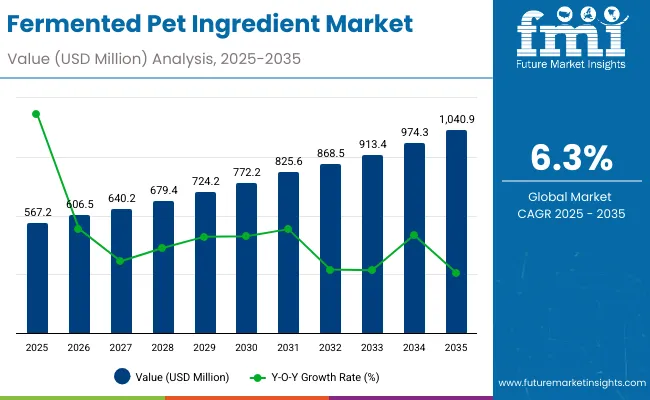

The Fermented Pet Ingredient Market has been valued at USD 567.2 million in 2025 and is projected to expand to USD 1,040.9 million by 2035, representing an absolute increase of USD 473.7 million across the decade. The expansion reflects a CAGR of 6.3%, pointing to robust and sustained momentum as fermentation-enabled nutrition transitions into mainstream pet health solutions.

| Metric | Value |

|---|---|

| Fermented Pet Ingredient Market Estimated Value in (2025E) | USD 567.2 Million |

| Fermented Pet Ingredient Market Forecast Value in (2035F) | USD 1,040.9 Million |

| Forecast CAGR (2025 to 2035) | 6.3% |

Between 2025 and 2030, the market is forecast to climb from USD 567.2 million to USD 763.2 million, generating USD 196.0 million in additional value, or nearly 41% of the total decade growth. Early adoption during this phase is expected to be supported by probiotics, proteins, and yeast derivatives, as digestive and immune health solutions become central to pet wellness positioning.

The second half of the period, from 2030 to 2035, is anticipated to add USD 277.7 million, as the market advances from USD 763.2 million to USD 1,040.9 million, contributing nearly 59% of the incremental gains. Expansion in this phase is likely to be driven by diversification into postbiotics, algae-based ferments, and functional beverage applications, supported by regulatory clarity and wider integration into veterinary channels.

Annual growth rates are expected to range between 5.5% and 8.6%, indicating resilience even under varying adoption cycles. The outlook highlights a steady transition of fermented inputs from niche inclusion toward becoming a cornerstone of functional pet nutrition by 2035.

From 2025 to 2030, expansion from USD 567.2 million to USD 763.2 million is projected, supported by rising inclusion of probiotics and proteins in dry food and supplement formats. Between 2030 and 2035, further acceleration to USD 1,040.9 million is anticipated, as postbiotics, algae-based ferments, and functional beverages gain wider traction.

Regional demand is expected to strengthen in Asia-Pacific, while established markets in North America and Europe maintain leadership through premium and regulatory-driven adoption. Competitive advantage is forecast to shift toward evidence-backed claims, stability data, and veterinary endorsements, positioning fermented ingredients as a mainstream element of pet nutrition.

Advances in fermentation technology have improved nutrient stability and bioavailability, enabling more efficient delivery of functional health benefits in companion animal diets. Probiotics have gained prominence due to their role in digestive and immune support, while postbiotics are emerging as a credible alternative supported by regulatory clarity and clinical validation. Functional claims linked to gut health, stress management, and nutrient absorption are driving product differentiation in the market.

Expansion of premium pet food categories and veterinary-endorsed supplements has fueled market growth. Innovations in microencapsulation and precision fermentation are expected to accelerate adoption, supporting sustainability narratives and widening inclusion in diverse product formats. Segment growth is expected to be led by probiotics, plant-based fermentation substrates, and supplement applications due to their adaptability, efficacy, and consumer preference for natural solutions.

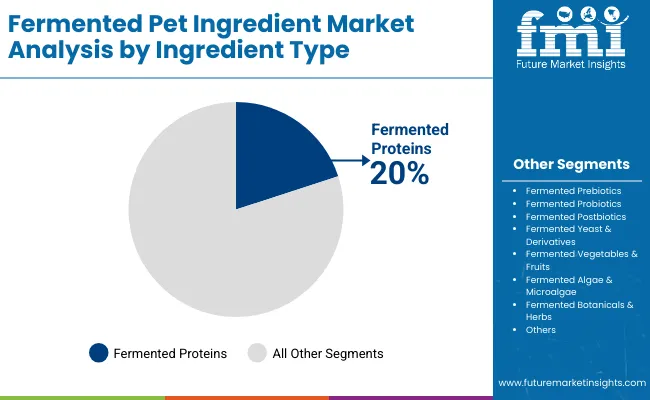

The Fermented Pet Ingredient Market is segmented by ingredient type, source material, application, pet type, health functionality, fermentation type, distribution channel, and region. These classifications capture the breadth of product innovation, raw material diversity, and end-use integration that are shaping growth. Ingredient type segmentation covers proteins, probiotics, prebiotics, postbiotics, yeast derivatives, algae, botanicals, and fruit- or vegetable-based ferments.

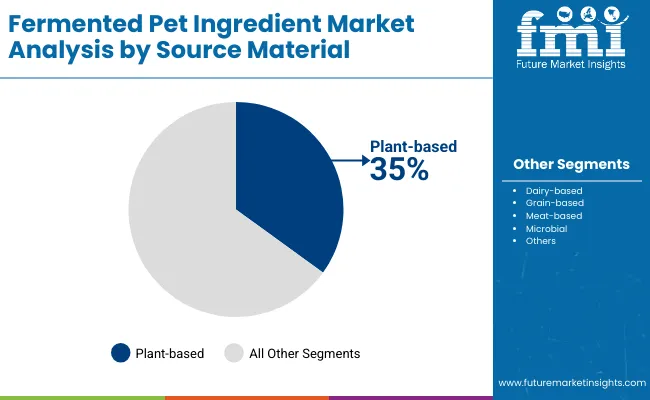

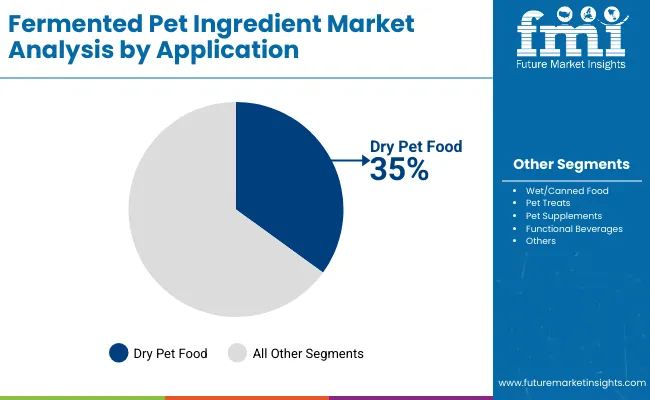

Source material includes plant-based, dairy-based, grain-based, meat-based, and microbial inputs, each offering different cost, sustainability, and functionality profiles. Applications span dry food, wet food, treats, supplements, and functional beverages, where adoption trends vary by pet type and health positioning. Regionally, the market is evaluated across North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Ingredient Type | 2025 Share |

|---|---|

| Fermented Proteins | 20% |

| Fermented Prebiotics | 15% |

| Fermented Probiotics | 20% |

| Fermented Postbiotics | 10% |

| Fermented Yeast & Derivatives | 12% |

| Fermented Vegetables & Fruits | 8% |

| Fermented Algae & Microalgae | 7% |

| Fermented Botanicals & Herbs | 8% |

The ingredient type segment is expected to be dominated by probiotics at 20% share in 2025, reflecting their widespread association with digestive and immune health. Demand is projected to strengthen as regulatory clarity around strain-specific claims encourages veterinary endorsement and consumer trust. Fermented proteins, also at 20% share, are anticipated to benefit from sustainability credentials and suitability for hypoallergenic diets. Prebiotics, at 15%, are forecast to expand steadily, supported by their synergy with probiotics in synbiotic blends. Fastest growth is projected from algae and botanicals, where novel compounds align with clean-label preferences. Postbiotics are expected to gain traction in dry food applications, supported by improved stability and storage benefits.

| Source Material | 2025 Share |

|---|---|

| Plant-based | 35% |

| Dairy-based | 15% |

| Grain-based | 15% |

| Meat-based | 20% |

| Microbial | 15% |

The source material segment is anticipated to be dominated by plant-based substrates at 35% share in 2025, as soy, pea, chickpea, and rice provide scalable, cost-efficient, and sustainable options. This segment is expected to expand as pet owners align their pets’ diets with eco-friendly preferences and flexitarian lifestyles. Meat-based ferments, projected at 20% share, are likely to sustain relevance in protein-dense diets, though their growth may be tempered by environmental concerns. Dairy-based inputs, at 15%, are expected to maintain niche adoption in premium formulations. Microbial fermentation, while smaller in base share, is projected to record the fastest CAGR due to rising use of precision fermentation for customized, high-efficacy pet ingredients.

| Application | 2025 Share |

|---|---|

| Dry Pet Food | 35% |

| Wet/Canned Food | 20% |

| Pet Treats | 20% |

| Pet Supplements | 20% |

| Functional Beverages | 5% |

The application segment is forecast to be anchored by dry pet food at 35% share in 2025, reflecting its global dominance as the most widely consumed format. Encapsulation and fermentation advances are expected to make probiotics and proteins more compatible with kibble production, driving inclusion at scale. Pet supplements, at 20% share, are anticipated to post faster growth, as pet owners initially explore functional claims through add-on products before transitioning into daily diets. Treats, also 20%, are expected to gain traction as convenient functional delivery vehicles. Functional beverages, though only 5% in 2025, are projected to record the highest CAGR, reflecting premium humanization spillovers. Wet food is forecast to grow steadily, albeit at a more moderate pace.

Growing complexity in regulatory alignment and shifting nutritional expectations is shaping the Fermented Pet Ingredient Market, even as broader adoption is anticipated across functional pet food, supplements, and veterinary-prescribed diets.

Scientific Validation of Postbiotics and Precision Fermentation

Expansion is being reinforced by the increasing body of pet-specific clinical validation that highlights the stability, efficacy, and immune-modulating properties of postbiotics. Unlike probiotics, postbiotics do not require viability, allowing consistent inclusion in dry food formulations without loss of activity. This advantage is expected to reduce formulation risk for manufacturers while enabling clearer health claims supported by scientific consensus. In parallel, advances in precision fermentation are providing highly controlled production pathways for bioactive compounds, ensuring reproducibility, scalability, and improved sustainability outcomes. Together, these scientific developments are projected to accelerate mainstream adoption and to differentiate premium brands that can substantiate efficacy through peer-reviewed outcomes and clinical collaborations.

Limited Clinical Depth Across Diverse Pet Species

While validation is advancing, a critical restraint remains in the limited depth and diversity of trials across multiple pet species. Most available studies are concentrated on canines, leaving significant gaps in cats, rabbits, and other companion animals. This limitation constrains broad-spectrum marketing claims and compels regulatory caution in product positioning. Investment in cross-species research is anticipated to be required for category credibility to fully mature, as evidence gaps may hinder adoption in certain premium or veterinary-led channels. The lack of uniform trial data is expected to slow the pace of claim liberalization, particularly in markets with stricter compliance regimes.

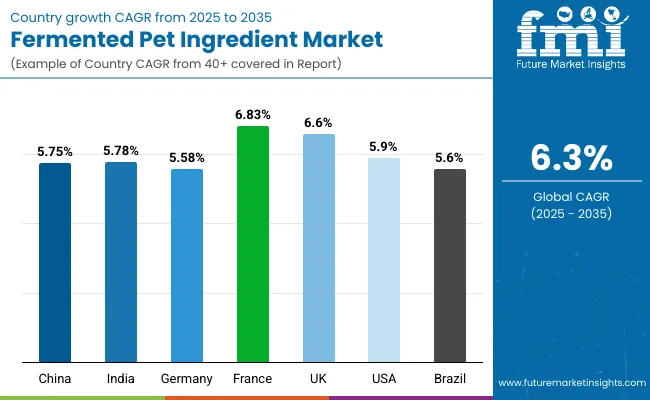

| Country | CAGR |

|---|---|

| China | 5.14% |

| India | 5.89% |

| Germany | 5.81% |

| France | 6.36% |

| UK | 5.79% |

| USA | 6.18% |

| Brazil | 6.03% |

The global Fermented Pet Ingredient Market demonstrates a varied country-level growth profile, shaped by differences in dietary habits, pet ownership dynamics, and regulatory maturity. Asia-Pacific remains central to long-term momentum, anchored by China at 5.14% CAGR and India at 5.89% CAGR. Growth in China is expected to be supported by a rising premiumization of pet diets, although the relatively lower CAGR suggests a more gradual integration of functional ferments into staple categories. India’s slightly higher growth rate reflects expanding urban pet ownership and growing reliance on supplements, even as affordability remains a constraint.

Europe continues to show resilience, led by France at 6.36% CAGR, Germany at 5.81% CAGR, and the UK at 5.79% CAGR. France’s faster pace signals a strong consumer preference for natural, functional, and sustainability-driven formulations, which aligns with cultural acceptance of fermented nutrition. Germany and the UK, while expanding steadily, are expected to focus more on regulatory compliance and product innovation through veterinary endorsement.

North America, represented by the United States at 6.18% CAGR, is projected to maintain consistent adoption through supplements and dry food integration. In Latin America, Brazil at 6.03% CAGR is forecast to play a pivotal role, with functional formulations expected to align with expanding middle-class pet ownership trends.

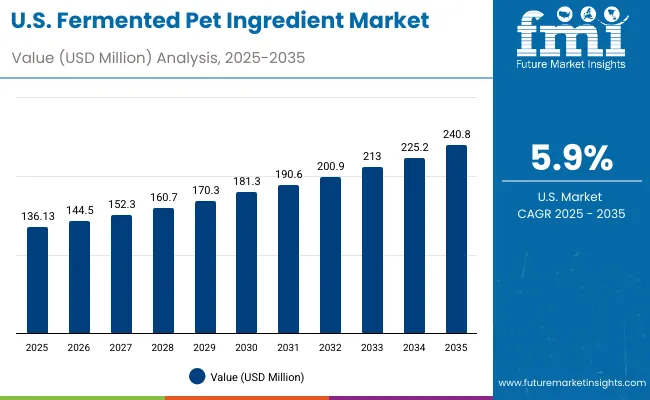

| Year | Fermented Pet Ingredient Market (USD Million) |

|---|---|

| 2025 | 136.13 |

| 2026 | 143.4 |

| 2027 | 152.9 |

| 2028 | 163.1 |

| 2029 | 172.7 |

| 2030 | 184.6 |

| 2031 | 196.9 |

| 2032 | 207.8 |

| 2033 | 219.5 |

| 2034 | 234.3 |

| 2035 | 246.9 |

The Fermented Pet Ingredient Market in the United States is projected to expand from USD 136.13 million in 2025 to USD 246.9 million by 2035, reflecting steady growth at a CAGR of around 6.1%. Expansion is expected to be enabled by a combination of functional nutrition trends, veterinary-led adoption, and sustained demand for natural formulations. The USA market is positioned as a hub for innovation, where probiotics and postbiotics are anticipated to dominate early inclusion in dry food, supplement, and treat applications. The role of microencapsulation and precision fermentation is expected to reinforce stability, extend shelf life, and strengthen claims credibility.

The Fermented Pet Ingredient Market in the UK is projected to grow at a CAGR of 5.79% from 2025 to 2035, supported by the country’s strong preference for premium pet nutrition and natural health claims. The UK market is expected to be shaped by pet humanization trends, where functional attributes such as digestive health, immunity, and stress relief are increasingly valued. Regulatory oversight on ingredient transparency and sustainability credentials is anticipated to encourage innovation in plant-based and microbial ferments. Veterinary recommendations are forecast to further strengthen adoption of probiotics and postbiotics.

The Fermented Pet Ingredient Market in India is projected to expand at a CAGR of 5.89% between 2025 and 2035, reflecting steady growth supported by urbanization and expanding middle-class pet ownership. The market is expected to be driven by supplements and treats, which provide affordable entry points for functional nutrition. Cost sensitivity may limit early penetration in staple foods, but innovation in small-pack formats is anticipated to widen adoption. Plant-based and microbial ferments are likely to dominate, reflecting compatibility with local production capabilities and cultural familiarity with fermentation.

The Fermented Pet Ingredient Market in China is forecast to record a CAGR of 5.14% from 2025 to 2035, reflecting moderate but steady expansion. Premiumization of pet food is underway, though fermented ingredients are expected to remain concentrated in supplements and high-end dry food categories initially. Regulatory alignment and safety standards are likely to play a critical role in shaping adoption. Cultural familiarity with fermented foods is anticipated to aid acceptance, particularly in urban areas. Market expansion is expected to be anchored in probiotics and postbiotics, with future growth supported by algae-based and precision fermentation products.

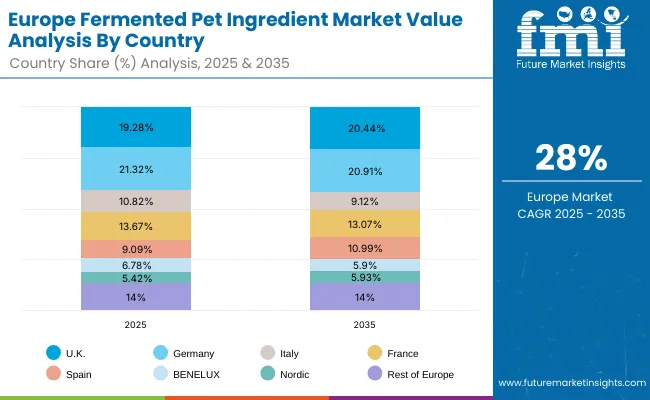

| Countries | 2025 |

|---|---|

| UK | 18.96% |

| Germany | 21.14% |

| Italy | 10.73% |

| France | 13.06% |

| Spain | 10.35% |

| BENELUX | 6.95% |

| Nordic | 5.19% |

| Rest of Europe | 14% |

| Countries | 2035 |

|---|---|

| UK | 20.23% |

| Germany | 20.58% |

| Italy | 9.89% |

| France | 14.22% |

| Spain | 9.15% |

| BENELUX | 5.08% |

| Nordic | 5.80% |

| Rest of Europe | 15% |

The Fermented Pet Ingredient Market in Germany is projected to grow at a CAGR of 5.81% between 2025 and 2035, underpinned by the country’s strong pet ownership culture and emphasis on functional health solutions. Demand is expected to be supported by high consumer awareness of probiotics and sustainable nutrition. Regulatory frameworks in the EU are anticipated to provide clarity on postbiotic claims, enhancing brand credibility. The German market is forecast to be a hub for innovation, where plant-based ferments and yeast derivatives are expected to gain share due to their alignment with sustainability and clean-label trends.

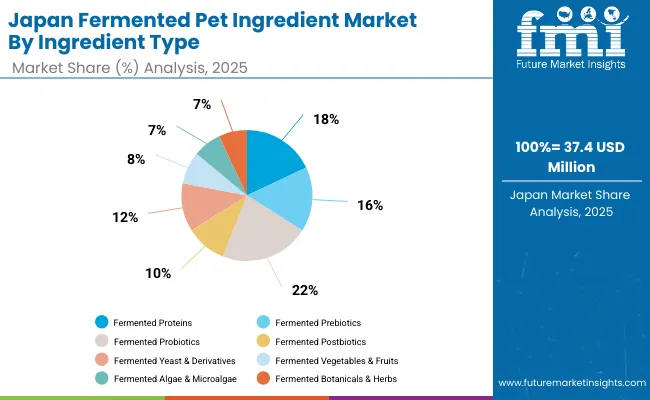

| Japan Ingredient Type | 2025 Share |

|---|---|

| Fermented Proteins | 18% |

| Fermented Prebiotics | 16% |

| Fermented Probiotics | 22% |

| Fermented Postbiotics | 10% |

| Fermented Yeast & Derivatives | 12% |

| Fermented Vegetables & Fruits | 8% |

| Fermented Algae & Microalgae | 7% |

| Fermented Botanicals & Herbs | 7% |

The Fermented Pet Ingredient Market in Japan is projected at USD 37.4 million in 2025, with the ingredient mix led by fermented probiotics at 22%. Proteins account for 18%, while prebiotics contribute 16%, signaling the early dominance of functional strains that align with digestive and immune health positioning. This leadership is reinforced by cultural familiarity with fermented foods, which improves consumer acceptance of similar concepts in companion animal diets.

Growth momentum is expected to be further shaped by increasing demand for postbiotics (10%), supported by their stability in dry formulations, and yeast derivatives (12%), valued for immune-modulating properties. Algae, botanicals, and fruit-based ferments, while smaller in share, are projected to gain ground as natural and clean-label narratives strengthen.

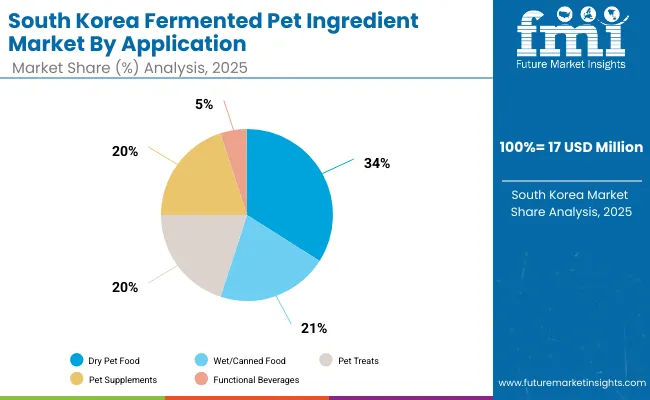

| South Korea Application | 2025 Share |

|---|---|

| Dry Pet Food | 34% |

| Wet/Canned Food | 21% |

| Pet Treats | 20% |

| Pet Supplements | 20% |

| Functional Beverages | 5% |

The Fermented Pet Ingredient Market in South Korea is projected at USD 17 million in 2025, with dry pet food holding 34% share as the dominant application. This leadership is expected due to the widespread preference for kibble formats, which allow easier incorporation of probiotics, proteins, and yeast derivatives. Wet and canned food follows with a 21% share, reflecting demand for premium and palatable formulations in urban households.

Pet treats and supplements, each with a 20% share, are forecast to grow rapidly as pet owners seek convenient ways to introduce functional ferments for digestive health, immunity, and stress relief. Functional beverages, while only 5% of the mix, are anticipated to post the fastest growth rate, supported by Korea’s strong culture of fermented health drinks, which is expected to spill over into pet nutrition.

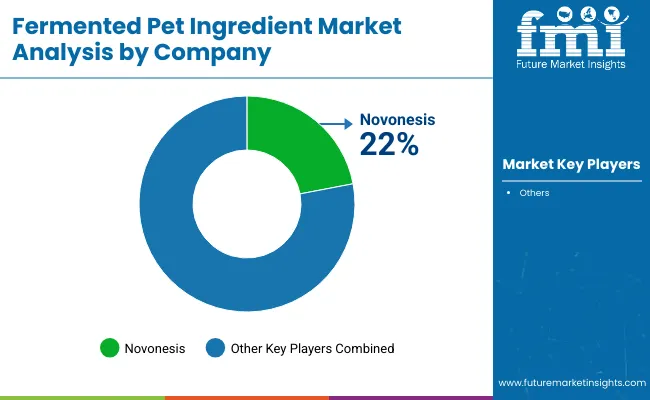

| Company | Global Value Share 2025 |

|---|---|

| Novonesis | 22% |

| Others | 78% |

The Fermented Pet Ingredient Market is moderately fragmented, with global leaders, established feed additive firms, and niche-focused innovators competing across ingredient categories and regional channels. Global leaders such as ADM, Cargill, Evonik Industries, Lallemand Animal Nutrition, and Novonesis are projected to hold significant shares, supported by extensive microbial fermentation platforms, established supply chains, and investment in encapsulation and stability technologies. Their strategies are expected to emphasize precision fermentation, clinical validation of probiotics and postbiotics, and partnerships with pet food OEMs to secure volume growth.

Mid-sized innovators, including regional players and specialized biotech firms, are anticipated to accelerate adoption through targeted portfolios of plant-based proteins, yeast derivatives, and algae-based ferments. Their relevance is being reinforced by sustainability positioning, cost optimization, and the ability to provide adaptable solutions for supplements, treats, and functional beverages.

Specialist providers focusing on botanicals, herbs, and niche microbial strains are expected to compete through customization and localized regulatory compliance, catering to premium brands that require differentiation.

Competitive differentiation is forecast to shift away from single-strain or formulation advantages toward integrated ecosystems combining ingredient science, regulatory credibility, and veterinary endorsement. Value creation is expected to increasingly rely on evidence-backed claims, transparent sourcing, and the alignment of sustainability with functional efficacy.

Key Developments in XYZ Market

| Item | Value |

|---|---|

| Quantitative Units | USD 567.2 Million |

| Ingredient Type | Fermented Proteins, Fermented Prebiotics, Fermented Probiotics, Fermented Postbiotics, Fermented Yeast & Derivatives, Fermented Vegetables & Fruits, Fermented Algae & Microalgae, Fermented Botanicals & Herbs |

| Source Material | Plant-based (soy, pea, rice, chickpea), Dairy-based (milk, whey), Grain-based (corn, barley, oats), Meat-based (chicken, fish), Microbial (yeast, bacteria) |

| Application | Dry Pet Food, Wet/Canned Food, Pet Treats, Pet Supplements, Functional Beverages |

| Pet Type | Dogs, Cats, Other Companion Animals (rabbits, birds, reptiles) |

| Health Functionality | Digestive Health, Immune Support, Skin & Coat Health, Stress & Anxiety Relief, Anti-inflammatory/Joint Health, Nutrient Absorption Enhancement |

| Fermentation Type | Solid-State Fermentation, Submerged Fermentation, Anaerobic Fermentation, Precision Fermentation |

| Distribution Channel | B2B Ingredient Supply, Pet Food Manufacturers (OEM/ODM), Direct-to-Consumer Supplement Brands, Veterinary Clinics & Specialty Stores |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | ADM, Cargill, Evonik Industries, Lallemand Animal Nutrition, Novonesis (formerly Chr. Hansen Holding A/S) |

| Additional Attributes | Dollar sales by ingredient type and application; adoption trends in probiotics and postbiotics ; growth in supplements and functional beverages; sustainability narratives in plant-based and microbial fermentation; veterinary endorsements driving credibility; regional adoption influenced by premiumization and regulatory harmonization. |

The global Fermented Pet Ingredient Market is estimated to be valued at USD 567.2 million in 2025.

The market size for the Fermented Pet Ingredient Market is projected to reach USD 1,040.9 million by 2035.

The Fermented Pet Ingredient Market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in the Fermented Pet Ingredient Market are fermented proteins, probiotics, prebiotics, postbiotics, yeast derivatives, algae & microalgae, botanicals & herbs, and fermented fruits & vegetables.

In terms of ingredient type, the fermented probiotics segment is expected to command the largest share at 22% of the Japanese market and 20% of the global market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Fermented Sweeteners Market

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Market Share Breakdown of Fermented Ingredients

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA