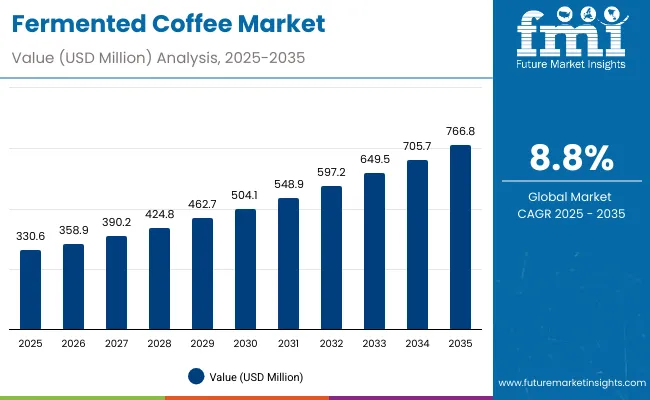

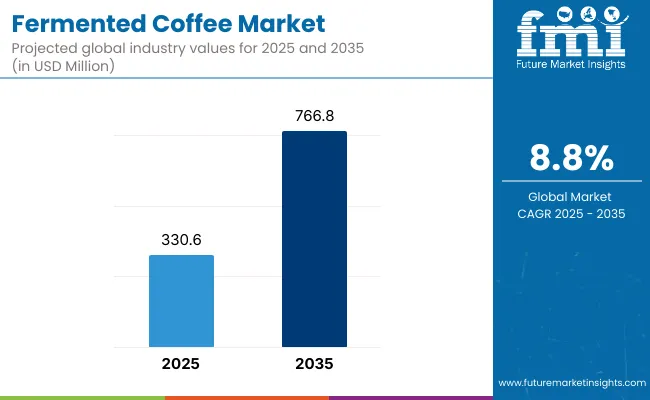

The global fermented coffee market is expected to be valued at USD 330.6 million in 2025 and reach USD 766.8 million by 2035, reflecting an absolute growth of USD 436.2 million over the forecast period. This expansion represents a compound annual growth rate (CAGR) of 8.8%, signaling a more than 2.3X increase in market size over the decade.

Fermented Coffee Market Key Takeaways

| Metric | Value |

|---|---|

| Fermented Coffee Estimated Value in (2025E) | USD 330.6 million |

| Fermented Coffee Forecast Value in (2035F) | USD 766.8 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

During the first half of the forecast window, from 2025 to 2030, the market is projected to grow from USD 330.6 million to USD 504.1 million, contributing approximately USD 173.5 million, which equates to 39.7% of the decade’s total value addition. This period is expected to be defined by early-stage adoption across health-focused beverage portfolios, with growing clinical validation around gut health and antioxidant benefits driving manufacturer interest. Yeast-based and bacterial fermentation techniques are anticipated to lead during this phase, supported by sensory differentiation and process consistency.

The second half, spanning 2030 to 2035, is projected to generate USD 262.7 million, accounting for the remaining 60.3% of the total decade gain. During this phase, fermented coffee is expected to transition from niche to mainstream within functional and specialty beverage categories, particularly as integration into sports nutrition and cognitive wellness products becomes more prevalent. Premiumization, clean-label positioning, and hybrid fermentation methods are forecasted to drive accelerated value creation, especially in East Asia, North America, and parts of Europe.

From 2020 to 2024, the fermented coffee market evolved from artisanal micro-lots to early-stage commercial scalability. Growth during this period was driven by specialty cafés, direct-to-consumer wellness brands, and functional beverage startups. Leading players such as Nestlé and Starbucks introduced early RTD fermented variants, while niche players like Blue Bottle and Bulletproof pioneered co-fermented and probiotic-enhanced formats.

By 2025, demand for fermented coffee is projected to reach USD 330.6 million, supported by growing consumer interest in gut health, low-acidity brews, and clean-label innovation. Between 2025 and 2035, the competitive landscape is expected to shift from flavor innovation alone to health claims, ingredient transparency, and multi-format convenience. Ecosystem differentiation will be driven by sourcing traceability, microbial processing technology, and wellness-driven brand positioning. Players integrating fermentation science with consumer lifestyle branding are expected to outperform those offering commodity coffee products.

The fermented coffee market has been propelled by a growing convergence of health-conscious consumption, ingredient innovation, and demand for differentiated beverage experiences. Consumer preferences have shifted toward functional drinks offering digestive benefits, enhanced antioxidant potential, and smoother taste profiles-all of which have been increasingly associated with fermented coffee.

Scientific advancements in microbial and enzymatic fermentation have enabled controlled flavor modulation, acid reduction, and nutritional enhancement-allowing manufacturers to meet rising demand for low-acidity, gut-friendly options. These innovations have been supported by investments in proprietary fermentation methods and biotechnological process optimization.

Rising interest in probiotic-infused beverages and clean-label formulations has further accelerated the inclusion of fermented coffee in wellness-focused portfolios. The category is being increasingly positioned within functional beverage sets, particularly among younger consumers seeking alternatives to conventional energy drinks and nootropics.

Sustainable sourcing of Arabica and Robusta beans, coupled with regenerative agricultural practices, has also contributed to the market's credibility and growth. In parallel, market expansion has been enabled by online retail channels, artisanal coffee shops, and direct-to-consumer models that allow small-batch, story-driven offerings to reach global audiences.

As fermentation becomes more integrated into premium coffee production, its role in enhancing sensorial and functional value is expected to deepen-establishing fermented coffee as a long-term growth category in the global beverage industry.

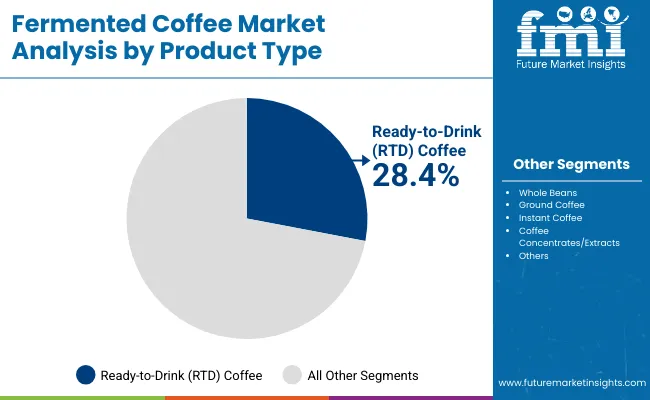

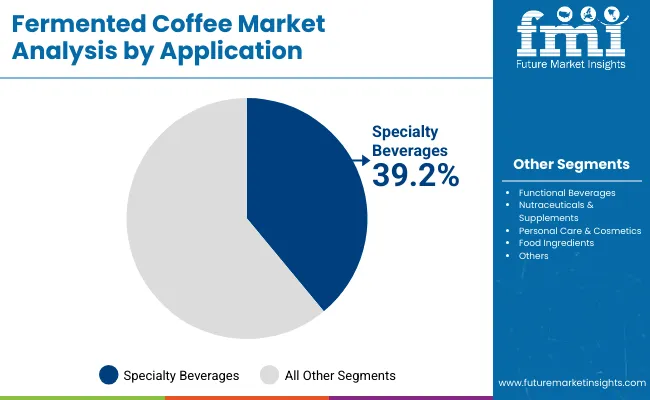

The fermented coffee market has been segmented across Product Type, Application, and Source, each representing critical dimensions of market evolution. Product categories such as RTD coffee, ground coffee, and instant formats have been adopted in response to shifting consumer lifestyles and preferences for convenience. Application segmentation spans specialty beverages, functional health drinks, and nutraceuticals, indicating cross-category penetration. Sourcing strategies, meanwhile, are differentiated by bean variety arabica, robusta, liberica, and excelsa each contributing distinct flavor profiles and microbial compatibility in fermentation processes. These segments have been shaped by consumer demand for functional health benefits, premium sensory experiences, and sustainability-linked product positioning. As fermented coffee moves from artisanal experimentation to commercial scale, value capture across segments is expected to deepen. A focus on diversified product forms, health-enhancing applications, and bean traceability is likely to define competitive positioning across the forecast horizon.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Ready-to-Drink (RTD) Coffee | 28.4% |

| Ground Coffee | 22.6% |

The Ready-to-Drink (RTD) coffee segment is projected to hold the largest market share of 28.4% in 2025. This leadership has been supported by consumer demand for convenience, on-the-go formats, and functional refreshment. RTD fermented coffee has been positioned as a bridge between health-conscious beverages and specialty brews, offering enhanced bioavailability and reduced acidity without preparation complexity.

Growth in this segment has been reinforced by rising placements in retail chillers, vending machines, and online wellness platforms. Innovations in probiotic-infused and adaptogen-enhanced RTD coffees have been adopted by functional beverage brands targeting the mental clarity, gut health, and energy niches. As cold-brew fermentation techniques become mainstream, flavor retention and stability have been optimized further boosting RTD appeal. Continued investment in shelf-stable formulations and recyclable packaging is expected to consolidate this segment's lead.

| Application | 2025 Share% |

|---|---|

| Specialty Beverages (cafés, artisanal brewing) | 39.2% |

| Functional Beverages (probiotic/enhanced coffee drinks) | 21.7% |

| Food Ingredients (flavoring agents, chocolate & confectionery infusions) | 15.6% |

The Specialty Beverages segment is expected to account for 39.2% of market share in 2025, maintaining its role as the foundational application for fermented coffee. This segment has been driven by the premiumization of coffee culture and the expansion of third-wave cafés that prioritize small-batch, single-origin, and process-differentiated offerings. Fermentation has been leveraged by artisanal roasters and boutique coffee houses to achieve unique flavor expressions and microbial terroir. Customer experiences have been elevated through educational tastings, fermentation storytelling, and transparent sourcing enhancing brand affinity. This segment has also served as an innovation sandbox for functional crossover applications. As global café chains expand their specialty menus and urban consumers seek craft-level beverage experiences, fermented coffee is expected to remain a pillar within this segment's evolution.

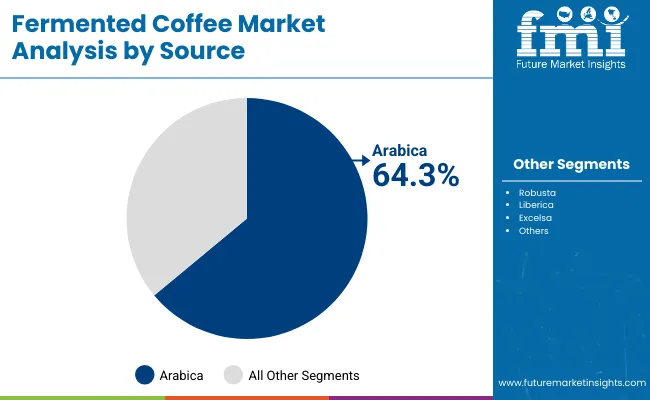

| Source | 2025 Share% |

|---|---|

| Arabica | 64.3% |

| Robusta | 20.9% |

| Liberica | 9.7% |

Arabica beans are forecasted to represent 64.3% of the fermented coffee market by 2025, establishing them as the dominant source material. This preference has been attributed to Arabica’s superior cupping profile, lower bitterness, and higher compatibility with fermentation cultures. Processing with Arabica has allowed producers to emphasize clarity, fruit-forward notes, and floral complexity characteristics highly valued in specialty and RTD segments. Organic and regenerative farming methods have increasingly been applied to Arabica cultivation, aligning with ethical and clean-label market demands. However, emerging experimentation with Liberica and Excelsa is expected to expand microbial diversity and flavor novelty. While Arabica will likely retain its lead in terms of volume and consumer preference, broader source diversification is anticipated as fermentation methods mature.

While growing health awareness continues to drive fermented coffee consumption, challenges such as sensory acceptance and microbial process variability remain under scrutiny. The market is being reshaped by innovation in probiotic formulation, cross-category beverage integration, and consumer demand for functional wellness-all underpinned by traceable sourcing and sustainability commitments across global supply chains.

Demand for Gut-Health & Functional Beverages

The fermented coffee market has been propelled by its alignment with gut-health and functional beverage trends. As digestive wellness becomes a top health priority, demand for naturally probiotic-rich drinks has been amplified. Fermented coffee has been positioned as a low-acidity, antioxidant-enhanced alternative to conventional brews-making it highly attractive to wellness-conscious consumers. The inclusion of prebiotic fibers and bioactive compounds has enabled further value differentiation. This shift has been reinforced by clinical studies and clean-label marketing, allowing the category to gain momentum in both retail and foodservice channels.

Integration into Nootropic & Adaptogen Drink Categories

A trend toward multi-functional beverage positioning has been observed, with fermented coffee increasingly integrated into nootropic and adaptogen-infused formulations. Mental clarity, energy balance, and stress management have been identified as emerging consumer needs, and fermented coffee is being adapted to support these functions. Product formats combining fermented coffee with L-theanine, lion’s mane, or ashwagandha are being introduced, particularly through direct-to-consumer brands. This convergence with cognitive wellness is expected to reshape product innovation pipelines, especially in North America and East Asia.

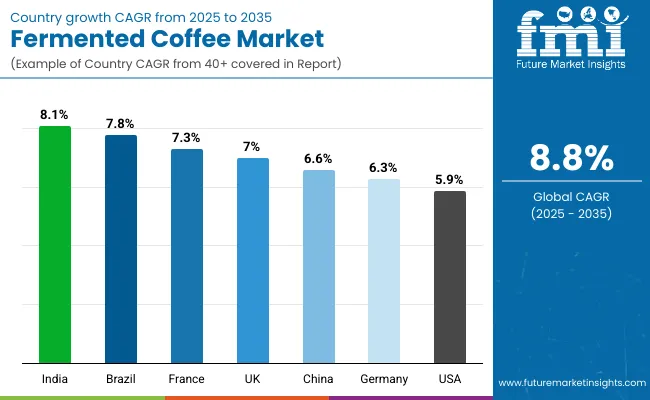

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.6% |

| India | 8.1% |

| Germany | 6.3% |

| France | 7.3% |

| UK | 7.0% |

| USA | 5.9% |

| Brazil | 7.8% |

The global fermented coffee market has demonstrated regionally uneven growth, shaped by health awareness, café culture maturity, and functional beverage adoption. Asia-Pacific has been positioned as the fastest-growing regional cluster, led by India at 8.1% CAGR and China at 6.6% CAGR. In India, market expansion has been fueled by rising urban health consciousness, growing penetration of probiotic-enhanced drinks, and rapid digitalization of specialty retail. In China, demand has been driven by innovations in functional RTD coffees and the integration of traditional wellness cues with contemporary beverage formats.

Europe has continued to maintain strong growth momentum, anchored by France (7.3%), the UK (7.0%), and Germany (6.3%). These markets have benefited from sophisticated specialty coffee consumption, increasing preference for low-acidity variants, and sustainability-linked product sourcing. Government-backed support for organic and circular food systems has further accelerated fermented coffee inclusion in both retail and foodservice menus.

In North America, the United States has exhibited a moderate CAGR of 5.9%, with growth being driven primarily through premiumization, direct-to-consumer channels, and cognitive health product crossovers. Meanwhile, Brazil, at a robust 7.8% CAGR, has emerged as a dual-market-serving both origin-based specialty exports and domestic adoption of wellness-oriented coffee innovations. Country-level innovation and localized taste adaptation are expected to remain key to regional leadership.

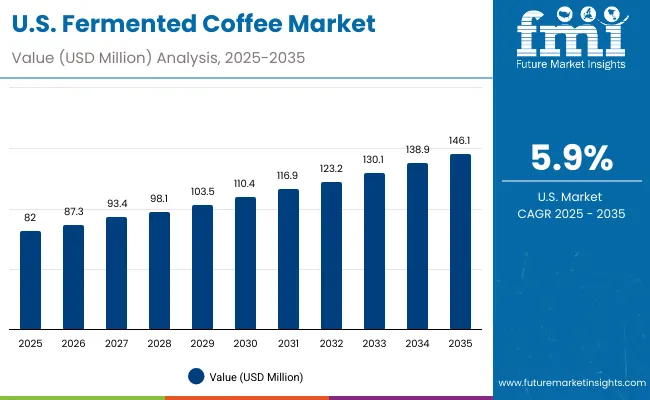

| Year | USA Fermented Coffee Market (USD Million) |

|---|---|

| 2025 | 82.0 |

| 2026 | 87.3 |

| 2027 | 93.4 |

| 2028 | 98.1 |

| 2029 | 103.5 |

| 2030 | 110.4 |

| 2031 | 116.9 |

| 2032 | 123.2 |

| 2033 | 130.1 |

| 2034 | 138.9 |

| 2035 | 146.1 |

The fermented coffee market in the United States is projected to expand from USD 82.0 million in 2025 to USD 146.1 million in 2035, reflecting a compound annual growth rate (CAGR) of 5.9% over the forecast period. Growth is expected to be led by premiumization trends, rising demand for gut-health beverages, and increasing RTD coffee penetration across urban and suburban markets.

Adoption has been supported by direct-to-consumer (DTC) wellness brands, café chains incorporating functional beverages, and the emergence of probiotic coffee blends targeting digestive and mental clarity benefits. Consumer preferences have increasingly shifted toward low-acidity, clean-label formats driving experimentation in fermentation processes and hybrid blends.

Further acceleration is expected to be driven by cold-chain infrastructure improvements, retail diversification, and partnerships with functional ingredient suppliers, especially within the health-focused food and beverage segments.

The fermented coffee market in the United Kingdom is expected to grow at a CAGR of 7.0% between 2025 and 2035, supported by a growing appetite for premium, health-enhancing beverages. As consumers move away from high-sugar energy drinks, fermented coffee has been positioned as a clean-label alternative offering gut-health and cognitive wellness benefits. The RTD segment has shown strong traction, with chilled probiotic coffee blends increasingly offered through premium retailers, health stores, and foodservice outlets.

Fermentation has been adopted by local roasters to enhance product storytelling, leveraging flavor complexity and sustainability claims. Innovation has been promoted through partnerships between specialty coffee producers and biotech startups exploring nootropic and adaptogenic infusions. Regulatory alignment around sugar reduction and wellness product labeling has further boosted fermented coffee's retail acceptance.

In China, the fermented coffee market is projected to register a CAGR of 6.6%, driven by rising consumer sophistication in the functional beverage space and an accelerated transition to wellness-based coffee offerings. While the coffee market remains dominated by instant and milk-based drinks, the demand for low-acidity, gut-friendly formulations has been rising among younger, urban populations.

RTD fermented coffee infused with probiotics, collagen, and adaptogenic herbs has gained shelf presence in high-end supermarkets and online wellness platforms. The influence of traditional Chinese medicine (TCM) has encouraged acceptance of fermentation as a health-enhancing process. Café chains in Tier 1 cities such as Shanghai, Beijing, and Shenzhen have begun experimenting with small-batch fermented brews, often marketed as energy-balancing or digestion-friendly drinks.

India’s fermented coffee market is forecasted to grow at an impressive CAGR of 8.1% during 2025-2035, placing it among the most dynamic emerging markets. Urbanization, rising middle-class health awareness, and a digitally engaged youth demographic have accelerated the shift toward functional and wellness-based beverages. Fermented coffee is being introduced as both a ready-to-drink (RTD) format and as part of premium café menus in metro cities like Bengaluru, Mumbai, and Delhi.

Consumer curiosity has been amplified by India’s long-standing cultural association with fermented foods and gut health via Ayurveda. This cultural alignment has been leveraged by DTC brands offering localized blends with Ayurvedic herbs and natural probiotics. E-commerce platforms have enabled smaller startups to enter the market efficiently, offering clean-label, fermented coffee formats with adaptogenic positioning.

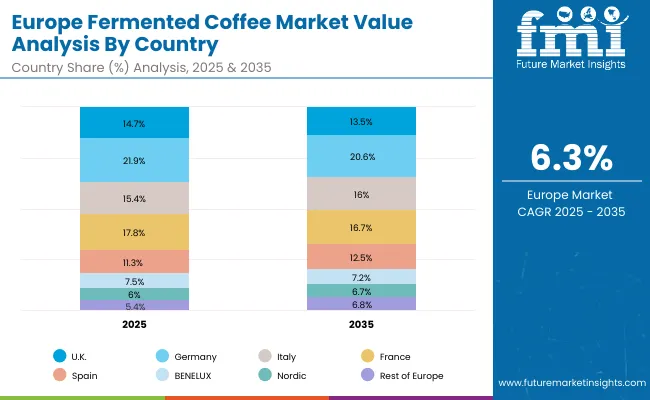

| Countries | 2025 |

|---|---|

| UK | 14.7% |

| Germany | 21.9% |

| Italy | 15.4% |

| France | 17.8% |

| Spain | 11.3% |

| BENELUX | 7.5% |

| Nordic | 6.0% |

| Rest of Europe | 5.4% |

| Countries | 2035 |

|---|---|

| UK | 13.5% |

| Germany | 20.6% |

| Italy | 16.0% |

| France | 16.7% |

| Spain | 12.5% |

| BENELUX | 7.2% |

| Nordic | 6.7% |

| Rest of Europe | 6.8% |

The fermented coffee market in Germany is anticipated to expand at a CAGR of 6.3%, driven by a sophisticated consumer base that values product integrity, functional health claims, and sustainability. Germany has long been a pioneer in organic food and beverage innovation, making it an ideal launchpad for fermented coffee products that align with microbiome health and clean-label preferences.

Specialty cafés in Berlin, Hamburg, and Munich have incorporated fermented brews into seasonal menus, often emphasizing flavor terroir and bean fermentation techniques. Retail chains and bio-supermarkets have embraced RTD fermented coffees that are shelf-stable, plant-based, and enhanced with prebiotics or adaptogens. Ingredient transparency, recyclable packaging, and certifications such as Fairtrade and EU Organic have further driven consumer trust and loyalty.

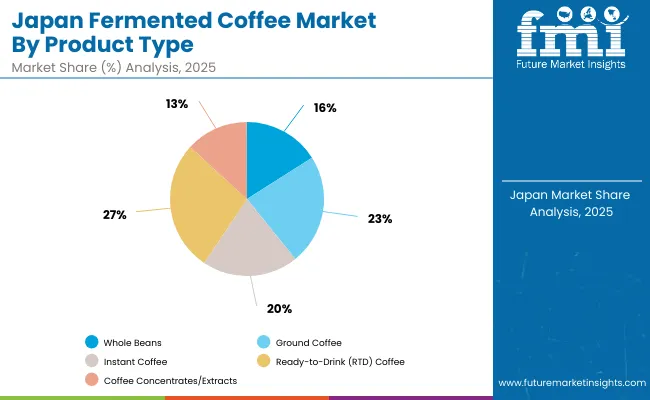

| Product Type | Market Value Share, 2025 |

|---|---|

| Whole Beans | 16.0% |

| Ground Coffee | 23.2% |

| Instant Coffee | 20.2% |

| Ready-to-Drink (RTD) Coffee | 27.4% |

| Coffee Concentrates/Extracts | 13.2% |

The fermented coffee market in Japan is projected to hold a significant position in the global landscape by 2025, led by an advanced food innovation ecosystem and strong consumer openness to health-focused beverages. The RTD segment, accounting for 27.4%, is expected to lead due to Japan’s mature convenience culture and high demand for on-the-go, functional refreshment. Ground coffee and instant coffee collectively capture over 43% of the market, reflecting continued preference for at-home and workplace consumption.

Market expansion is being supported by the integration of probiotic and prebiotic claims, a growing focus on digestive health, and a consumer base already familiar with fermented foods such as natto, miso, and kombucha. Fermented coffee aligns naturally with this landscape, offering both functional and flavor benefits.

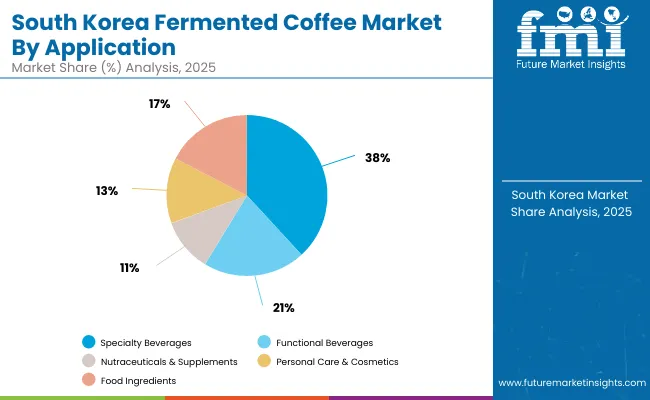

| End-Use Application | Market Value Share, 2025 |

|---|---|

| Specialty Beverages (cafés, artisanal brewing) | 38.2% |

| Functional Beverages (probiotic/enhanced coffee drinks) | 20.6% |

| Nutraceuticals & Supplements | 10.7% |

| Personal Care & Cosmetics (antioxidant-rich formulations) | 13.2% |

| Food Ingredients (flavoring agents, chocolate & confectionery infusions) | 17.4% |

The fermented coffee market in South Korea is projected to expand robustly through 2035, driven by consumer affinity for functional, aesthetic, and health-enhancing products. In 2025, the specialty beverages segment is expected to contribute 38.2% of the market value, led by a flourishing café culture where innovation in fermentation is being embraced for flavor complexity, health benefits, and visual appeal.

Rising consumer interest in K-beauty and wellness has positioned fermented coffee extracts as attractive bioactive ingredients in cosmetics and nutraceuticals, with 13.2% and 10.7% share respectively. The use of fermented coffee in food ingredients, contributing 17.4%, is also gaining momentum across confectionery and bakery applications, supported by its antioxidant properties and natural bitterness reduction.

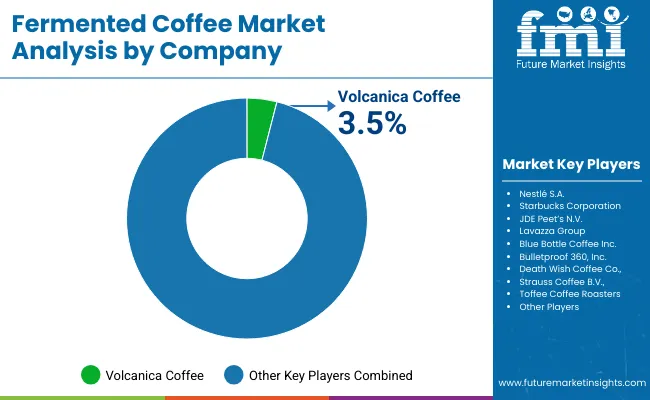

| Company | Global Value Share 2025 |

|---|---|

| Volcanica Coffee | 3. 5% |

| Others | 96 .5% |

The fermented coffee market has been characterized as moderately fragmented, with participation from multinational beverage giants, mid-sized specialty brands, and niche innovators competing across product formats and functional positioning. Global leaders such as Nestlé S.A., JDE Peet’s N.V., and Starbucks Corporation have maintained dominant positions, supported by vast distribution networks, diversified product portfolios, and early-stage investments in RTD and functional coffee innovations. Emphasis has been placed on incorporating probiotics, plant-based ingredients, and fermentation storytelling into mainstream offerings.

Mid-sized players such as Lavazza Group, Volcanica Coffee, and Blue Bottle Coffee Inc. have focused on artisanal fermentation techniques, café-led consumer education, and limited-edition specialty launches. These brands have gained traction through flavor differentiation, transparency in sourcing, and cross-collaborations with health and wellness startups.

Niche brands like Bulletproof 360, Death Wish Coffee Co., and Strauss Coffee B.V. have cultivated loyal followings by integrating fermented coffee into cognitive health, energy, and sports nutrition segments. Meanwhile, green coffee exporters such as Toffee Coffee Roasters are exploring fermentation at the origin level to enhance bean quality and value.

As consumer demand evolves, competitive advantage is expected to shift from single-product innovation to ecosystem-driven models that integrate health claims, sustainability narratives, and multi-format versatility.

Key Developments in Fermented Coffee Market

| Item | Value |

|---|---|

| Quantitative Units | USD 330.6 million |

| Product Type | Whole Beans, Ground Coffee, Instant Coffee, Ready-to-Drink (RTD) Coffee, Coffee Concentrates/Extracts |

| Source | Arabica, Robusta, Liberica, Excelsa |

| Fermentation Method | Yeast-Based Fermentation, Bacterial Fermentation, Fungal Fermentation, Combined/Hybrid Fermentation |

| Application | Specialty Beverages (cafés, artisanal brewing), Functional Beverages, Nutraceuticals & Supplements, Personal Care & Cosmetics, Food Ingredients |

| Distribution Channel | Online Retail, Specialty Coffee Shops, Supermarkets/Hypermarkets, Convenience Stores, Foodservice (cafés, restaurants, QSRs) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé S.A., Starbucks Corporation, JDE Peet’s N.V., Lavazza Group, Blue Bottle Coffee Inc., Bulletproof 360, Inc., Volacanica Coffee, Death Wish Coffee Co., Strauss Coffee B.V., and Toffee Coffee Roasters |

| Additional Attributes | Market share by fermentation method and product format, adoption of co-fermentation and fruit-inoculated processing, growth in gut-health and functional beverages, rise of convenience formats (RTD, sachets), integration with beauty and personal care markets, sustainability-linked origin sourcing, regional trends in café culture and D2C health brands, and innovation in microbial processing and cold brew fermentation techniques. |

The global Fermented Coffee is estimated to be valued at USD 330.6 million in 2025.

The market size for the Fermented Coffee is projected to reach USD 766.8 million by 2035.

The Fermented Coffee is expected to grow at an 8.8% CAGR between 2025 and 2035.

The key product types in the Fermented Coffee Market are Ready-to-Drink (RTD) Coffee, ground coffee, instant coffee, whole beans, and coffee concentrates/extracts.

In terms of product type, the Ready-to-Drink (RTD) Coffee segment is expected to command the highest share at 28.4% of the Fermented Coffee Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA