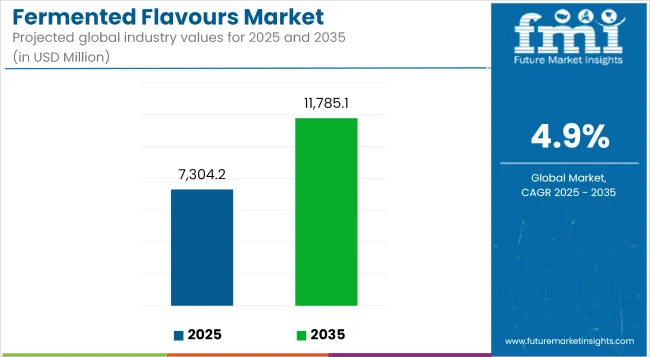

In 2025, the global fermented flavours market size is assessed at USD 7,304.2 million and is forecasted to witness robust growth, reaching USD 11,785.1 million by 2035, reflecting a CAGR of 4.9%. This steady expansion has been attributed to rising consumer affinity for complex and authentic taste experiences across culinary formats.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7,304.2 million |

| Industry Value (2035F) | USD 11,785.1 million |

| CAGR (2025 to 2035) | 4.9% |

Growing awareness around gut health, functional foods, and traditional preservation techniques has reinforced the use of fermented ingredients in both premium and mainstream product categories. The industry's shift toward fermentation has been actively pursued by flavor formulators as a response to evolving clean label and natural positioning trends.

Demand for fermented flavours has been stimulated by shifting consumer expectations around taste sophistication and digestive benefits. Fermented dairy derivatives, such as yogurt-based and cheese-inspired profiles, have become prominent across sauces, snacks, and frozen meals. However, constraints have emerged in the form of regulatory complexities associated with natural origin claims and stability challenges in processed applications.

Meanwhile, botanical and vegetable-based ferments have gained momentum in plant-based and vegan product lines, underpinned by functional claims and sour-forward profiles. Innovation has primarily been focused on cross-cultural blends, yeast-based umami enhancers, and high-temperature-stable formats tailored for foodservice. Strategic investments have also been directed toward scalable fermentation processes, microbial strain enhancement, and long-shelf-life flavor concentrates.

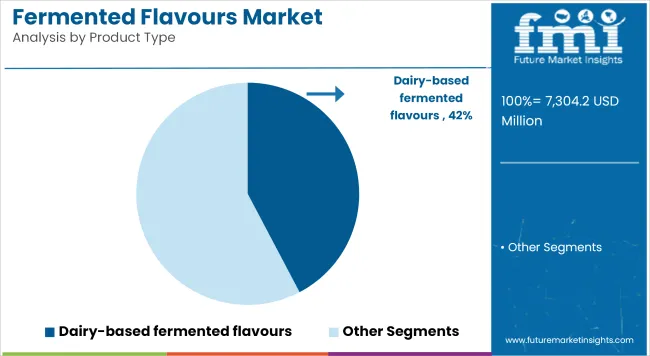

By 2035, the market is anticipated to experience notable diversification, with natural fermentation methods sustaining their edge due to perceived healthfulness and ingredient familiarity. In 2025, dairy-based fermented flavours are expected to command a 42.3% share, a trend likely to continue through 2035 owing to strong usage in both Western and Asian cuisines.

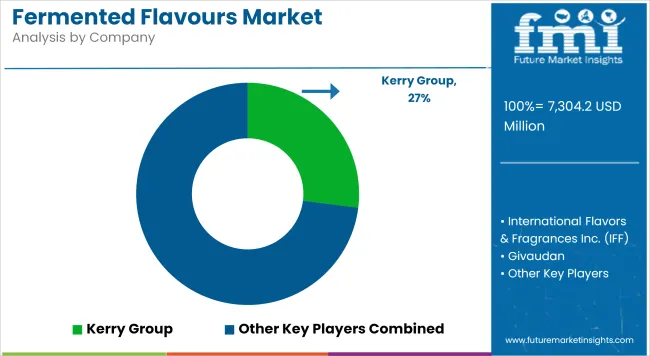

Additionally, the natural fermentation processing segment, already holding a 59.7% share in 2025, is projected to expand further, reinforcing consumer trust through minimal processing claims. Growth is expected to remain high across North America, Europe, and East Asia, with tailored regional innovations becoming central to competitive strategies. Global flavor houses and specialty fermentation firms are expected to deepen collaboration to address technical and sensory barriers in emerging formulations.

Fermented beverage flavours are estimated to capture 18.6% of the global fermented flavours market in 2025. Their growth is being catalyzed by increasing adoption in functional drinks, kombuchas, and ethnic fermented beverages such as kvass, kefir, and tepache. As consumer preference shifts toward low-alcohol, probiotic-rich, and sensory-complex options, these beverages have become a fertile domain for flavour formulators and beverage startups alike.

Regulatory allowances for live cultures and fermented ingredients vary, but in key markets like the EU, kombucha and kefir producers are guided by EFSA-compliant labelling and health claim directives. Recent innovations include high-pressure pasteurized fermented drinks from brands like Health-Ade and functional RTD options in East Asia that retain sour-acidic profiles while maintaining stability across cold-chain logistics.

With crossover appeal to wellness, alternative dairy, and botanical drink segments, this category remains strategically poised for growth in both natural and hybrid flavour systems. Major ingredient players such as Givaudan and IFF have invested in fermentation platforms that offer customizable postbiotic and prebiotic notes to satisfy evolving consumer expectations. As traditional boundaries between health drinks and indulgent flavour experiences blur, fermented beverages will continue to play a pivotal role in global flavour innovation pipelines.

Microbial-derived fermented flavour bases are projected to account for 12.4% of the fermented flavours market by 2025. Their relevance stems from their scalable, consistent, and controlled output compared to traditional batch fermentation. These bases, often produced via precision fermentation using GRAS-certified microbial strains, have gained traction among large-scale food manufacturers aiming to replicate artisanal flavour depth while ensuring cost-effectiveness.

Companies such as DSM-Firmenich and Ajinomoto have developed microbial solutions mimicking miso, soy, and vinegar-like notes with high thermal and pH stability. These attributes are essential in processed foods and snacks where clean-label positioning must be balanced with long shelf-life and ingredient performance.

Regulatory clarity around microbial fermentation for flavour production is progressing, with Codex Alimentarius and FDA guidelines promoting traceability and safety for food additives and flavour precursors. The scalability of microbial fermentation also aligns with sustainability goals, reducing dependency on agricultural substrates and minimizing waste. With increasing investments in synthetic biology and bioreactor efficiency, microbial flavour bases are poised to become central to next-gen flavour manufacturing strategies.

Regulatory Compliance and Product Stability

One of the biggest hurdles in the fermented flavours space centers on getting around the regulatory framework set in different parts of the world around naturally derived ingredients. On the manufacturing side, the technical challenge lies in maintaining the stability of the product and consistency of fermented flavour profiles. Solving these problems will involve investments in standardized fermentation processes, better storage solutions, and clear labels so that consumers know what they are paying for.

Expansion of Functional and Sustainable Fermented Flavour Solutions

The growth of the functional food ingredients and sustainable flavour production in market opens immense prospects. The emergence of probiotic-enhanced and bio-fermented flavour solutions corresponds with increasingly health-aware consumers.

On top of that, advancements in precision fermentation and microbial-based flavour production are broadening the possibilities for clean-label and plant-based alternatives. With natural, sustainable flavouring options leading the food development agenda, the market is likely to see a boom over the next 10 years in the fermented flavours sector.

The United States continues to be a key market for fermented flavours driven by growing consumer interest in natural and clean-label food ingredients, the popularity of probiotic-rich diets and the rising demand for functional foods.

Increasing use of fermented flavours and sauces, condiments, beverages, and plant-based alternatives are propelling it market growth Industry trends are also being shaped by innovations in fermentation technology including precision fermentation for flavour-enhancing and longer shelf-life products.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The fermented flavours market in the UK is expanding steadily on the back of strong demand for natural flavour enhancers, a longer growing interest in gut-friendly and fermented foods and the rising use of fermentation-derived ingredients in plant-based and alternative protein products.

The growth of organic and artisanal food sectors is also fuelling fermented flavours in snacks, dressings and non-alcoholic drinks. To add to it, rising importance being placed on sustainable and eco-friendly fermentation processes are also driving innovation in this space.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

Germany, France and Italy are the primary fermented flavours market in the European Union due to their rich culinary fermentation legacy, escalating demand for functional food ingredients, and growing consumer inclination towards natural and non-GMO flavour enhancers.

European Union stringent regulations on artificial additives are driving demand for fermentation derived natural, flavouring solutions. Market growth is also being driven by the rising use of fermented flavours in the dairy, bakery, and alternative protein sectors. Consumer purchasing behaviour is also being influenced by the rise of clean-label and organic food certifications.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The growth of Japan’s fermented flavours market can be attributed to the rising demand for traditional fermented ingredients, such as miso, soy sauce, and koji-based seasonings, growing adoption of functional and probiotic-rich foods, and strong government support for food innovation.

Umami enhancement and the clean-label food products have resulted in the development of new fermented flavour applications in the country. Other factors driving growth of the market are the spread of fusion cuisine trends and incorporation of fermented flavours in convenience foods. The emergence of fermentation-driven taste enhancers for plant-based food products is also driving industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

South Korea is becoming a central market for fermented flavours, with consumer interest in probiotic and umami-rich foods, growing export of traditional fermented condiments like kimchi and gochujang clashing to meet increasing demand for traditional and non-conventional fermentation-based ingredients.

Strong domestic culture of fermentation in food processing is driving the demand for naturally developed flavours in snacks, beverages and meat alternatives in the country. Experts are anticipating surge of demand due to enhanced fermentation biotechnology, with a wider pathway of flavour compounds being produced by microbial fermentation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Growth in agro-food processing industry is driving the demand for the fermented flavours market, as consumer shift towards natural and umami taste enhancers and increasing awareness towards gut health benefits also drives the demand for the fermented flavours market.

The market is witnessing steady growth as a consequence of the wide diversifications of each plant based and practical food segments. Some of the key trends impacting the market include organic and non-GMO fermented flavours, probiotic-infused seasoning solutions, and new innovations in fermentation techniques for advanced taste profiles.

The overall market size for the fermented flavours market was USD 7,304.2 million in 2025.

The fermented flavours market is expected to reach USD 11,785.1 million in 2035.

The demand for fermented flavours will be driven by increasing consumer preference for natural and clean-label ingredients, rising awareness of gut health benefits, growing demand for probiotic-rich foods and beverages, and advancements in fermentation technology for flavour enhancement.

The top 5 countries driving the development of the fermented flavours market are the USA, China, Germany, Japan, and India.

The Food Fermented Flavours segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA