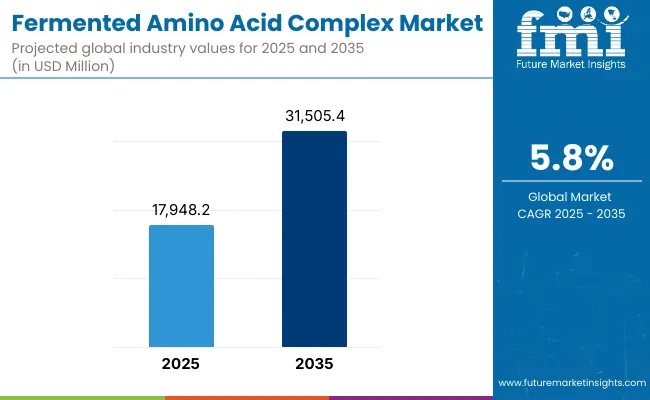

The Fermented Amino Acid Complex Market is expected to record a valuation of USD 17,948.2 million in 2025, rising to USD 31,505.4 million by 2035, reflecting a CAGR of 5.8% across the decade. Expansion during the first half of the forecast period (2025 to 2030) is expected to add approximately USD 5,502.7 million in market value, supported by the rising use of fermented amino acids in fortified foods, animal nutrition, and dietary supplements.

Fermented Amino Acid Complex Market Key Takeaways

| Metric | Value |

|---|---|

| Fermented Amino Acid Complex Market Estimated Value In (2025 E ) | USD 17,948.2 Million |

| Fermented Amino Acid Complex Market Forecast Value In (2035f) | USD 31,505.4 Million |

| Forecast CAGR (2025 to 2035) | 5.8% |

This phase of growth will be driven by consistent demand from poultry, aquaculture, and swine feed industries, as well as expanding applications in sports nutrition and pharmaceuticals.Between 2030 and 2035, incremental gains of nearly USD 8,054.5 million are forecast, reflecting accelerating adoption of specialty fermented blends and conditionally essential amino acids in high-value nutraceutical and cosmetic applications.

This growth will also be influenced by technological improvements in microbial and algal fermentation, which enhance yield efficiency and reduce production costs, making amino acids more accessible for wider industrial applications.

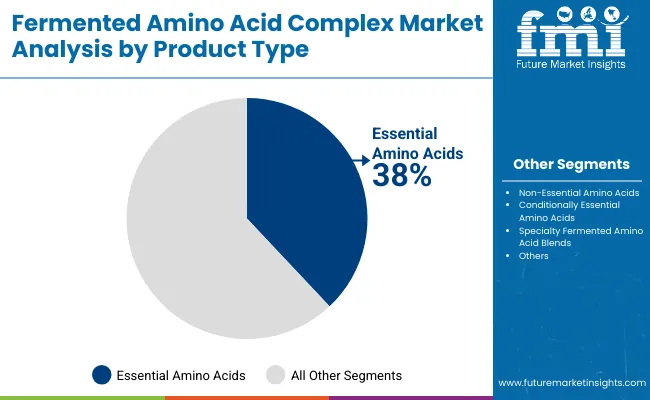

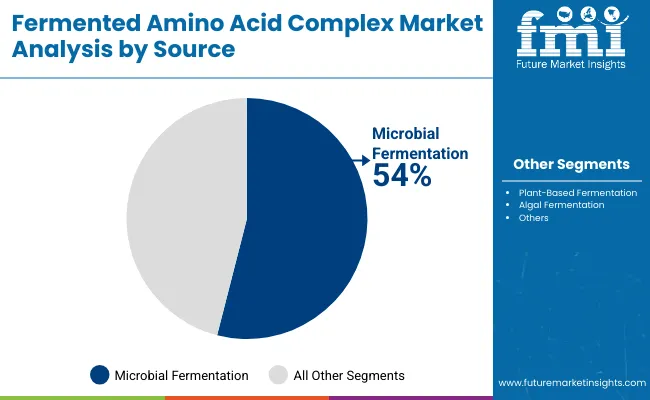

In terms of product type, essential amino acids dominate with 38% share in 2025, supported by their indispensable role in food and feed formulations. Microbial fermentation remains the leading source with 54% share, while algal fermentation, though smaller in base, expands fastest at 8.5% CAGR.

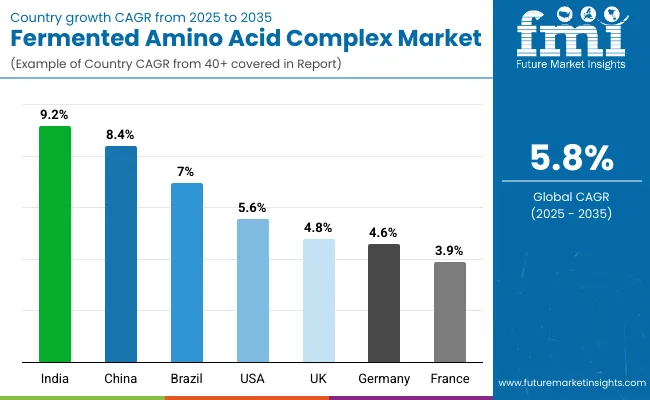

Regional growth hotspots include India (9.2% CAGR) and China (8.4% CAGR), driven by robust nutraceutical demand and feed industry expansion. By 2035, the market is expected to be characterized by greater diversification, with functional blends gaining traction in dietary supplements and personal care formulations.

From 2020 to 2024, the Fermented Amino Acid Complex Market expanded steadily, supported by increasing use in animal nutrition and functional foods. In 2025, the market is projected at USD 17,948.2 Million, with essential amino acids anchoring demand.

By 2035, the market will reach USD 31,505.4 Million, driven by specialty fermented blends, the surge of sports nutrition, and personal care applications. Competitive advantage is shifting from bulk amino acid supply toward integrated fermentation capabilities, innovation in conditionally essential amino acids, and partnerships in nutraceutical and cosmetic formulations.

Growth of the Fermented Amino Acid Complex Market is being driven by rising demand for nutritional fortification, sustainable sourcing, and functional health solutions. Advances in microbial and algal fermentation are enabling higher yields, reduced production costs, and diversification of amino acid profiles for food, pharmaceutical, and cosmetic applications.

Essential and conditionally essential amino acids are being increasingly utilized in fortified foods, intravenous therapeutics, and sports nutrition, supported by clinical evidence highlighting their benefits in muscle recovery, immunity, and metabolic health. The surge in animal feed requirements, particularly for poultry, aquaculture, and swine, has further reinforced adoption, as fermented amino acids ensure digestibility and feed efficiency.

In parallel, cosmetics and personal care industries are integrating amino acid complexes into anti-aging and skin health formulations. This combination of technological scalability, cross-sector utility, and consumer preference for clean-label and natural solutions ensures consistent expansion of the market across the forecast horizon.

The Fermented Amino Acid Complex Market is segmented across product type, source, and application, each reflecting distinct adoption pathways and growth potential. Product type analysis highlights the dominant role of essential amino acids, which remain the cornerstone for food, feed, and healthcare formulations, while specialty fermented blends expand fastest.

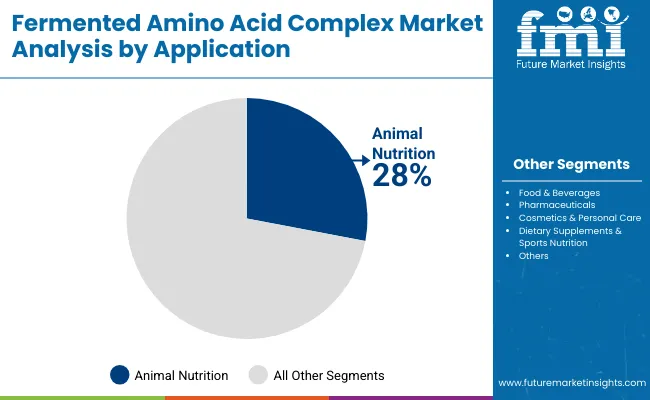

Source segmentation emphasizes microbial fermentation as the largest category, supported by technological maturity, while algal fermentation is gaining traction for its sustainability and innovation-led applications. Application segmentation underscores the prominence of animal nutrition and dietary supplements, both of which are forecast to drive substantial incremental growth. Together, these segments reveal how advancements in fermentation technology, rising consumer awareness, and industrial scalability are shaping a market that is both broad-based and innovation-intensive.

Essential amino acids dominate with 38% share in 2025, expanding at 6.1% CAGR, reflecting their indispensable role in food, feed, and supplement formulations. Their importance in poultry, swine, and aquaculture feed ensures consistent demand, while lysine, methionine, and threonine lead consumption within this category.

Non-essential amino acids contribute 22% share but grow more modestly, while conditionally essential amino acids gain relevance in medical nutrition and sports applications. Specialty fermented blends, although smaller at 16% share, expand fastest at 8.2% CAGR, highlighting their potential in premium nutraceuticals and cosmetics. Overall, essential amino acids anchor volume while specialty blends drive innovation.

| Product Type | Market Value Share, 2025 |

|---|---|

| Essential Amino Acids | 38% |

| Others | 62% |

Microbial fermentation dominates with 54% share in 2025, reflecting its technological maturity and scalability in industrial amino acid production. This method supports cost-efficient output of lysine, glutamic acid, and threonine, ensuring widespread adoption across food, feed, and pharma industries. Growth is steady at 5.6% CAGR, underpinned by established infrastructure in Asia-Pacific and Europe.

Plant-based fermentation, with 28% share, is gaining traction as sustainable sourcing becomes more critical. Algal fermentation, though holding only 12% share in 2025, is forecast to grow fastest at 8.5% CAGR, supported by rising adoption in cosmetics, dietary supplements, and specialty food products. This shift highlights how sustainability and innovation are reshaping sourcing preferences beyond microbial dominance.

| Source | Market Value Share, 2025 |

|---|---|

| Microbial Fermentation | 54% |

| Others | 46% |

Insights into the Application Segment with Animal Nutrition Leading Market Share

Animal nutrition dominates with 28% share in 2025, growing at 5.1% CAGR, reflecting its central role in poultry, aquaculture, and swine feed formulations. Fermented amino acids are valued for their digestibility, efficiency, and ability to reduce reliance on antibiotics, making them critical in modern feed solutions.

Dietary supplements and sports nutrition, with 26% share, represent the fastest-growing segment at 8.4% CAGR, supported by consumer focus on muscle recovery, metabolic health, and performance. Pharmaceuticals contribute 14% share and expand steadily at 6.3% CAGR, supported by demand for IV nutrition and therapeutic formulations. Cosmetics and personal care applications, while smaller at 8% share, are growing at 7.1% CAGR, reflecting integration into skin health and anti-aging products.

| Application | Market Value Share, 2025 |

|---|---|

| Animal Nutrition | 28% |

| Others | 72% |

The Fermented Amino Acid Complex Market is influenced by growth drivers, regulatory and cost restraints, and evolving innovation trends. Together, these dynamics shape adoption pathways, competitive positioning, and the market’s transition from commodity supply to high-value, application-driven, and sustainability-aligned solutions.

Driver: Rising Demand from Dietary Supplements and Sports Nutrition

One of the strongest drivers for the Fermented Amino Acid Complex Market is the surging demand from the dietary supplements and sports nutrition sector, which is forecast to expand at a8.4% CAGR from 2025 to 2035. Consumers are increasingly prioritizing functional health, with amino acids recognized for their role in muscle recovery, energy metabolism, and immunity.

Conditioned by fitness trends, aging populations, and post-pandemic wellness awareness, demand for branched-chain amino acids (BCAAs) such as leucine, isoleucine, and valine has intensified. Fermentation technologies provide sustainable and consistent production of these amino acids, ensuring supply reliability compared to extraction from animal sources.

Specialty fermented blends are also gaining visibility, offering synergistic benefits in sports recovery, weight management, and cognitive health. The integration of fermented amino acids into ready-to-drink beverages, capsules, and functional foods is broadening accessibility across global retail channels.

As consumer preference for clean-label and plant-based supplements grows, fermentation-derived amino acids are positioned as superior alternatives, balancing efficacy with sustainability. This driver is expected to solidify the role of fermented amino acids as cornerstone ingredients within the broader nutraceutical ecosystem, enabling strong, long-term growth in high-value supplement categories.

Restraint: High Production Costs and Scalability Challenges

Despite strong growth potential, high production costs and scalability limitations remain significant restraints in the Fermented Amino Acid Complex Market. Fermentation processes, while sustainable and flexible, require intensive infrastructure investments, including bioreactors, microbial cultures, and downstream purification systems.

Operational expenses linked to sterilization, energy usage, and nutrient feedstock inputs further elevate costs. Although microbial fermentation is well established, production efficiency for certain amino acids, such as tryptophan and specialty blends, remains comparatively low, limiting large-scale adoption.

Algal fermentation, though promising as the fastest-growing source at 8.5% CAGR, also faces scalability challenges due to limited biorefinery infrastructure and higher cultivation costs. These cost constraints make price competitiveness difficult against chemically synthesized amino acids, particularly in feed and food applications where margins are thin.

Smaller producers and startups struggle with financial sustainability, while larger players manage to offset expenses through economies of scale. Without continuous innovation in strain engineering, process optimization, and renewable feedstock utilization, the cost gap may persist as a barrier to broader adoption.

While premium applications such as nutraceuticals and cosmetics absorb higher costs, mainstream food and feed industries may continue to face adoption hurdles, tempering the overall market expansion pace despite favorable demand dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.4% |

| India | 9.2% |

| Germany | 4.6% |

| France | 3.9% |

| UK | 4.8% |

| USA | 5.6% |

| Brazil | 7.0% |

Adoption of fermented amino acid complexes is advancing at varying speeds globally, shaped by nutritional priorities, industrial modernization, and regulatory frameworks. In Asia-Pacific, rapid expansion is forecast, with India (9.2% CAGR) and China (8.4% CAGR) emerging as the most dynamic markets.

This growth reflects strong demand for animal feed, dietary supplements, and functional foods, supported by government policies encouraging sustainable protein sourcing and investment in fermentation infrastructure. By 2035, China’s share is projected to rise from 15% in 2025 to 19%, overtaking Europe in certain applications.

In North America, the United States leads with 22% share in 2025, though this is forecast to decline slightly to 20% by 2035 as Asia-Pacific accelerates adoption. Growth in the USA, at 5.6% CAGR, remains supported by high demand from sports nutrition and dietary supplement brands, alongside pharmaceutical integration of conditionally essential amino acids in therapeutics.

Europe reflects more modest growth, with Germany (4.6% CAGR) and France (3.9% CAGR) emphasizing regulatory compliance, sustainability mandates, and innovation in specialty fermented blends for cosmetics and personal care. The UK, at 4.8% CAGR, highlights balanced demand across food, pharmaceuticals, and supplements.

Emerging opportunities are visible in Latin America and the Middle East, with Brazil (7.0% CAGR) showing strong potential in animal feed applications, supported by its expanding livestock industry.

| Year | USA Fermented Amino Acid Complex Market (USD Million) |

|---|---|

| 2025 | 3,948.6 |

| 2026 | 4,177.6 |

| 2027 | 4,409.1 |

| 2028 | 4,636.7 |

| 2029 | 4,868.0 |

| 2030 | 5,116.7 |

| 2031 | 5,395.6 |

| 2032 | 5,713.2 |

| 2033 | 6,061.9 |

| 2034 | 6,427.7 |

| 2035 | 6,809.0 |

A CAGR of 5.6% has been projected for the United States, reflecting consistent growth in a mature but innovation-driven market. Market share is expected to decline slightly from 22% in 2025 to 20% by 2035, as Asia-Pacific accelerates expansion. Adoption is being driven by dietary supplement brands and sports nutrition companies, where essential and conditionally essential amino acids are integrated into protein powders, capsules, and functional beverages.

Pharmaceutical applications in intravenous therapies and medical nutrition are also expanding steadily, supported by clinical validations of glutamine, arginine, and cysteine. High investments in microbial fermentation capacity ensure steady supply, while clean-label positioning and plant-based nutrition trends reinforce consumer preference for sustainable sourcing. Despite moderating global share, the USA will remain vital for premium innovation and commercialization of fermented amino acid complexes.

A CAGR of 4.8% has been projected for the United Kingdom, indicating moderate but steady growth. Market share is forecast to decline from 5% in 2025 to 4% by 2035, as faster-growing Asian markets increase their global weight. Adoption is being shaped by food and beverage manufacturers, nutraceutical companies, and pharmaceutical firms integrating fermented amino acids into functional formulations.

Demand from cosmetics and personal care is also strengthening, particularly in anti-aging and skin health applications. While microbial fermentation remains the leading source, algal fermentation is gaining interest due to its alignment with sustainability and clean-label standards. Cloud-based digital platforms for tracking fermentation efficiency are emerging, supporting production optimization. The UK market will remain important for premium segments, innovation-led adoption, and strong consumer preference for natural and evidence-backed nutritional products.

A CAGR of 4.6% has been projected for Germany, reflecting modest expansion in a mature, compliance-driven European market. Market share is forecast to decline slightly from 7% in 2025 to 6% by 2035, as Asia-Pacific adoption strengthens. Demand is being shaped by pharmaceutical and healthcare applications, particularly intravenous nutrition and therapeutic formulations where glutamine and arginine are widely used.

Cosmetics and personal care represent another growing avenue, with fermented amino acid complexes gaining traction in anti-aging and skin repair solutions. Regulatory emphasis under the EU Green Deal ensures preference for microbial and algal fermentation, reinforcing sustainability in production. Germany is also a hub for specialty fermented blends that cater to high-value niches, although large-scale expansion is constrained by production costs and regulatory compliance measures.

A CAGR of 8.4% has been projected for China, positioning it among the fastest-growing global markets. Market share is forecast to rise from 15% in 2025 to 19% by 2035, reflecting strong momentum across food, feed, and nutraceutical industries. Animal nutrition remains a key driver, supported by large-scale poultry and swine feed industries incorporating lysine, threonine, and methionine.

Rising consumer focus on wellness is expanding demand for dietary supplements, with BCAAs, glutamine, and specialty fermented blends becoming mainstream in sports and functional nutrition. Investment in microbial and plant-based fermentation facilities is scaling production, while algal fermentation is attracting interest for cosmetics and high-value nutraceuticals. Strong government support for sustainable protein alternatives is reinforcing adoption. By 2035, China is expected to be one of the largest producers and consumers of fermented amino acid complexes worldwide.

A CAGR of 9.2% has been projected for India, making it the fastest-growing market globally. Market share is expected to expand from 9% in 2025 to 12% by 2035, supported by surging demand across animal nutrition, dietary supplements, and functional foods. Poultry, aquaculture, and swine feed industries are anchoring large-scale adoption of lysine, methionine, and threonine.

Rising disposable incomes and health awareness are accelerating uptake in nutraceuticals and sports nutrition, where fermentation-derived amino acids are integrated into powders, capsules, and functional beverages. Pharmaceutical applications, particularly glutamine and arginine in therapeutics, are also expanding. Strong policy support for sustainable protein alternatives and rapid scaling of fermentation facilities are reinforcing growth. India is expected to emerge as a hub for both production and consumption, with competitive advantages in scalability and cost efficiency.

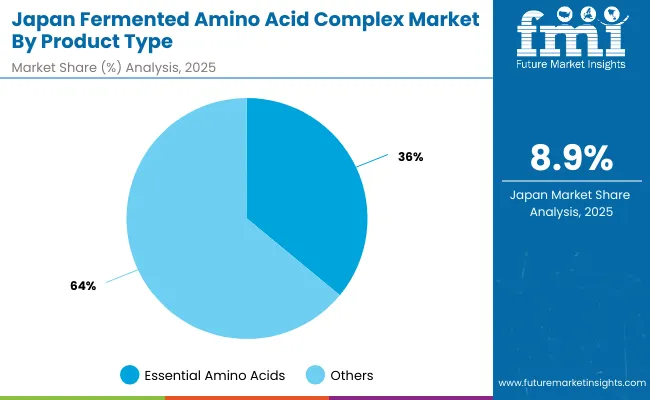

A CAGR of 8.9% has been projected for Japan, reflecting innovation-driven adoption in food, supplements, and cosmetics. Essential amino acids dominate with 36% share in 2025, while specialty fermented blends, at 23% share, are expanding fastest at 8.9% CAGR, supported by demand for premium nutraceutical and personal care products.

Pharmaceuticals and intravenous nutrition strengthen adoption of conditionally essential amino acids, while cosmetics integrate amino acid complexes into anti-aging and skin health formulations. Regulatory focus on sustainability ensures steady investment in microbial and algal fermentation. Japan is expected to retain its status as a premium market, shaped by innovation, consumer trust, and diversification into specialty applications.

| Product Type | Market Value Share, 2025 |

|---|---|

| Essential Amino Acids | 36% |

| Others | 64% |

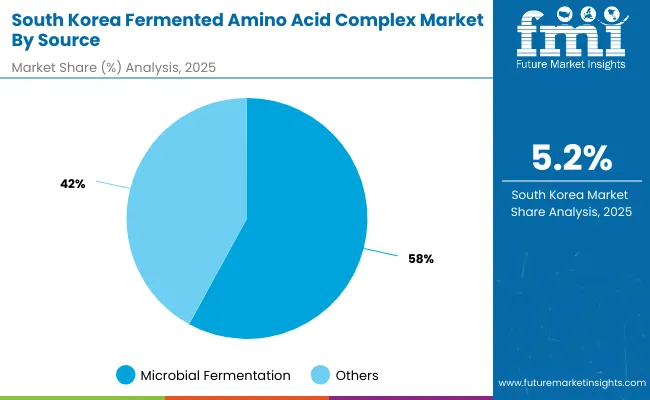

A CAGR of 5.2% has been projected for South Korea, reflecting balanced yet sustainability-focused growth. Microbial fermentation dominates with 58% share in 2025, supported by strong industrial capacity for lysine, glutamic acid, and threonine production.

However, plant-based fermentation, holding 25% share, is forecast to grow faster at 8.0% CAGR, driven by consumer preference for sustainable protein ingredients in food, nutraceuticals, and cosmetics. Algal fermentation, though smaller at 11% share, represents the fastest-growing category at 8.6% CAGR, highlighting its role in high-value dietary supplements and personal care formulations.

Adoption is also being reinforced by South Korea’s advanced cosmetic industry, where amino acid complexes are increasingly integrated into skin health and anti-aging formulations. Government policies supporting biomanufacturing and clean-label food standards further strengthen long-term adoption.

| Source | Market Value Share, 2025 |

|---|---|

| Microbial Fermentation | 58% |

| Others | 42% |

The Fermented Amino Acid Complex Market is characterized by a mix of global leaders, regional producers, and specialized innovators. Established companies such as Ajinomoto Co., Inc., Evonik Industries AG, CJ CheilJedang, Archer Daniels Midland (ADM), and Kyowa Hakko Bio Co., Ltd. dominate the industry through their extensive fermentation capacities, diversified amino acid portfolios, and global distribution networks. Collectively, these players account for a substantial portion of worldwide supply, ensuring consistency in essential amino acid production for food, feed, and pharmaceutical applications.

Regional producers, particularly in Asia-Pacific, such as Fufeng Group and Meihua Holdings, play an important role in supporting the feed industry with bulk fermentation-derived lysine and threonine. Meanwhile, European firms are strengthening competitiveness through innovation in specialty fermented blends targeted at nutraceutical and cosmetic formulations. Niche players and startups are increasingly focusing on algal fermentation, tapping into high-value opportunities in dietary supplements, sports nutrition, and personal care.

The competitive edge is shifting from bulk commodity supply toward high-value specialty solutions, sustainability, and innovation in conditionally essential amino acids. Companies that integrate advanced fermentation technologies, align with clean-label consumer preferences, and develop synergistic partnerships across nutraceutical and cosmetic sectors are expected to gain long-term strategic advantage.

Key Developments in Fermented Amino Acid Complex Market

| Item | Value |

|---|---|

| Market Size, 2025 | USD 17,948.2 Million |

| Market Size, 2035 | USD 31,505.4 Million |

| Absolute Growth (2025 to 2035) | USD 13,557.2 Million |

| CAGR (2025 to 2035) | 5.80% |

| Value Added 2025 to 2030 | USD 5,502.7 Million |

| Value Added 2030 to 2035 | USD 8,054.5 Million |

| Product Type (2025) | Essential Amino Acids: 38% (USD 6,820.3 Million); Others: 62% |

| Source (2025) | Microbial Fermentation: 54% (USD 9,696.0 Million); Others: 46% |

| Application (2025) | Animal Nutrition: 28% (USD 5,025.5 Million); Others: 72% |

| Form (2025) | Powder dominates with 52% share |

| Key Growth Applications (CAGR) | Dietary Supplements & Sports Nutrition 8.4%; Cosmetics & Personal Care 7.1% |

| Growth Hotspots (CAGR) | India 9.2%; China 8.4%; South Asia & Pacific 8.2%; East Asia 7.0% |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, China, India, Japan, South Korea, Brazil |

| Key Companies Profiled | Ajinomoto, Evonik Industries, CJ CheilJedang , ADM, Kyowa Hakko Bio, Novus International, Fufeng Group, Meihua Holdings |

| Additional Attributes | Sustainability in fermentation, algal fermentation scale-up, specialty blends for nutraceuticals, and cosmetic applications are shaping market expansion. |

The market is valued at USD 17,948.2 Million in 2025, with essential amino acids driving the largest share of demand.

The market is forecast to reach USD 31,505.4 Million by 2035, reflecting an absolute growth of USD 13,557.2 Million.

The market is expected to expand at a 5.8% CAGR between 2025 and 2035.

Essential amino acids dominate with 38% share, supported by their wide use in food, feed, and dietary supplements.

Dietary supplements and sports nutrition are forecast to grow at the fastest pace, recording an 8.4% CAGR during 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA