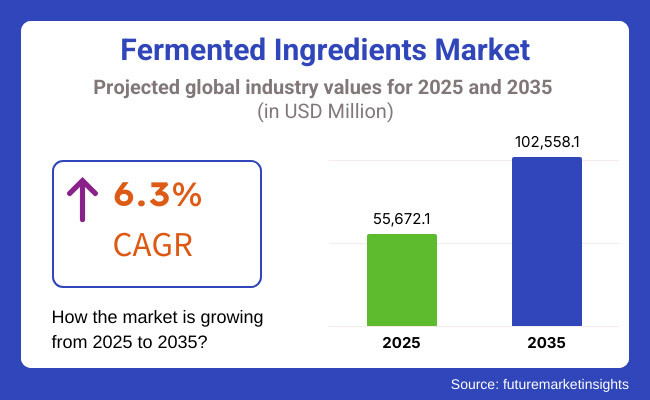

The fermented ingredient market is projected to be worth USD 55,672.1 million in 2025 and is anticipated to surge to USD 102,558.1 million by 2035, expanding at a CAGR of 6.3%.

Globally, the United States represents the most lucrative market in terms of revenue, owing to robust food processing and biopharmaceutical manufacturing. Meanwhile, China is projected to be the fastest-growing market during the forecast period, reflecting its strategic investment in biotech-driven ingredient innovation and expanded capacity in food-grade fermentation.

Strong upward momentum in this sector stems from rising consumer and industry demand for natural, clean-label, and health-forward products. Fermented ingredient are being actively deployed across diverse sectors including food and beverages, pharmaceuticals, and personal care, driven by their ability to improve product stability, shelf life, flavor, and health benefits. Increased prevalence of lactose intolerance and preference for plant-based, digestible alternatives has boosted demand for fermentation-enabled products.

However, production cost volatility, complex downstream processing, and strain development challenges pose notable restraints. Market participants are responding with precision fermentation, bio-based strain optimization, and investment in localized fermentation hubs to enhance yield efficiency and cost competitiveness.

Looking forward to 2035, the fermented ingredient market is expected to transition toward even more customized, strain-specific, and precision-engineered formulations. Advanced microbial solutions will become central to value-added product innovation, particularly in functional beverages, alternative proteins, and medical nutrition.

Partnerships between bioengineering firms and food & pharma giants are likely to deepen, supporting innovation pipelines and regional market expansions. Fermentation is anticipated to play a pivotal role in delivering sustainable solutions aligned with circular economy goals, further enhancing its strategic importance in future ingredient development.

The enzyme segment is projected to grow at a CAGR of approximately 6.7% through 2035, supported by expanding cross-industry applications and growing reliance on bio-catalytic processes. While not the largest in terms of current market share, enzymes represent one of the most strategically vital components within the fermented ingredient ecosystem due to their role in enabling sustainable manufacturing, process efficiency, and clean-label reformulation.

This segment’s momentum has been reinforced by growing regulatory and consumer pressure to replace synthetic additives with natural, eco-friendly alternatives. Enzymes produced via microbial fermentation offer superior specificity and functionality, reducing the need for chemical processing in food, textiles, pharmaceuticals, and biofuels.

Their use in optimizing dough rheology, dairy digestibility, and brewing efficiency highlights their versatility across traditional and novel formulations alike. Moreover, the segment benefits from a high level of customization potential-enzymes can be engineered to function under specific pH, temperature, or substrate conditions, aligning with diverse industrial requirements.

Looking ahead, enzymes are expected to play a pivotal role in unlocking value in circular and regenerative manufacturing systems. Emerging trends such as enzyme immobilization, directed evolution, and AI-guided strain selection are anticipated to further lower production costs and extend enzyme application scope, cementing their role as essential bio-tools for future-ready industries.

Holding the largest product segment share in 2025, the amino acids category leads the fermented ingredient market and is forecast to grow in line with the overall CAGR of 6.3% through 2035. This sustained trajectory underscores its strategic role across clinical, nutritional, and performance-based applications.

The segment’s enduring strength stems from its multifunctionality, serving both structural and metabolic roles in human health. Widespread utilization in pharmaceuticals, dietary supplements, and medical nutrition has positioned amino acids at the intersection of therapeutic efficacy and preventive wellness. Demand is being further amplified by global aging demographics, fitness-forward consumer segments, and rising incidences of chronic disease.

On the supply side, advances in microbial fermentation, including strain optimization and genome editing, have enabled cost-efficient and scalable production, especially of rare or conditionally essential amino acids. Additionally, amino acid fermentation now aligns more closely with sustainability goals due to improved feedstock conversion and reduced energy intensity.

By 2035, the segment is expected to move beyond basic macronutrient supplementation toward condition-targeted formulations. Growth will likely center around innovations in personalized nutrition, sports recovery, and neurocognitive support. As functional food and pharma converge, amino acids will remain indispensable to the evolution of science-backed, fermentation-enabled health solutions.

Challenge

High Production Costs and Quality Control Issues

The market for fermented ingredient is impeded by the high cost associated with its production as well as strict regulations surrounding quality control. Fermentation entails the use of specific bioreactors, an environment that needs to be stringently controlled, and specific microbial strains, all of which adds up to higher operational costs. Moreover, fluctuations in the availability of raw materials and microbial performance makes production consistency a challenge for large-scale commercialization.

Keenly, we note that regulation compliance also increases prices for food safety, pharmaceuticals, and other cosmetics, as manufacturers have to comply with rigorous testing, labelling, and certification regimes to guarantee the safety and effectiveness of their products.

Opportunity

Growing Demand for Natural and Functional Ingredient

There is a growing demand for clean-label, natural, and functional ingredient which represents a high opportunity for the fermented ingredient market. Innovation in fermentation-based solutions is being driven by consumers already seeking probiotic-rich, plant-based and bioactive ingredient in their food, beverages, pharmaceuticals, and personal care products.

Historically fermentation was used in the production of thousands of products from foods to pharmaceuticals, and with advances in precision fermentation, synthetic biology, and enzyme engineering, we can make products more efficiently and at scale, thus providing a sustainable replacement for synthetic additives. Moreover, growing health awareness and supportive regulations for gut health and immune-boosting ingredient contribute to market growth.

The United States fermented ingredient market is witnessing a strong growth trajectory in recent years, driven by the increasing demand for natural, clean-label, probiotics, and functional food products in the country. The increasing focus on gut health and foods that boost immune systems has driven demand for fermented dairy, plant-based alternatives and probiotic supplements.

Market growth is further propelled by the increasing shift to plant-based and fermented protein sources such as tempeh/fermented soy products. Fermented ingredient are also increasingly used in pharmaceuticals, cosmetics and animal feed. The USA is emerging as a major hub for the development of next-generation fermentation technology, drawing growing investments in biotechnology and food innovation via fermentation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

Growth of the UK fermented ingredient market increasing demand for plant-based cultured, fermented, and functional food products is likely to inspect demand for fermented ingredient in the UK market. Health and sustainability trends are driving demand for fermented dairy alternatives, kombucha and fermented protein sources.

The increasing inclination of the food & beverage industry towards clean-labels has propelled the demand for natural fermentation-based preservatives, enzymes, and probiotics. Finally, the expanding cosmetics and personal care industry is discovering the inclusion of fermented ingredient in beauty products, taking advantage of their antioxidant and skin-healthy qualities. In addition, the continued support of the UK for sustainable fermentation technologies is also boosting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

The European Union is a consistently growing market for fermented ingredient, largely due to rising interest in probiotic foods, dairy alternatives and fermented functional ingredient. Germany, France, and Italy among others are well-positioned as key players in the market owing to significant consumer preference towards natural and health-benefited fermented dietary products.

The EU’s antibiotic-free food additive and food preservative regulations have pushed food manufacturers to adopt natural fermentation-based solutions for process replacement of synthetic ingredient in processed foods. Demand for plant-based proteins and dairy substitutes is also being driven by the growth of vegan and flexitarian diets. The market growth is embraced by advancements in fermented feed additives for livestock and the increasing utilization of microbial fermentation in pharmaceuticals.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

Japan’s use of fermented ingredient has a long history, with staples like miso, natto and sake, and this has proven active for fermented food products. Some of the driving forces for market growth are increasing demand for traditional and functional food products containing probiotics and probiotic-rich ingredient.

According to a report published by Future Market Insights, the growing application of fermented enzymes and amino acids in pharmaceuticals and dietary supplements is a significant contributor to market demand.

And Japan’s cosmetic sector is combining fermented extracts into skincare and anti-aging products to take advantage of their skin-renewing and microbiome-stabilizing capabilities. Japan remains at the forefront of ideas around fermented foods, with a growing interest in biotechnology-based approaches to fermentation as a solution.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

Rapid growth in South Korean fermented ingredient market is driven by rising consumption of fermented functional foods, probiotics supplements, and fermented beverages. The nation’s strong tradition of fermented foods like kimchi, doenjang and makgeolli is fueling innovation in fermentation-based food technologies.

Similarly, the cosmetics and personal care industry is harnessing the power of fermented botanical extracts and probiotic skincare formulations, with an attention to anti-aging and microbiome-friendly beauty trends.

The growing adoption of fermented enzymes & bioactive compounds in pharmaceuticals further contributes to the market growth. With increased governmental support for applications of biotechnology-driven fermentation, South Korea is becoming a major player in the global fermented ingredient market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

DuPont de Nemours, Inc. (18-22%)

While DuPont is top of the class in fermentation-based probiotics, enzymes and natural preservatives that aid food safety and gut health applications.

Chr. Hansen Holding A/S (15-19%)

Chr. Hansen makes lactic acid bacteria and probiotics for dairy and plant-based foods and dietary supplements, all based on microbial fermentation.

Kerry Group plc (12-16%)

Kerry Group Kerry Group offers fermented, natural flavours, and food protection solutions (clean-label and functional).

Cargill, Incorporated (8-12%)

Cargill, which specializes in foods, feeds and biopharmaceuticals, develops fermentation-based amino acids, organic acids and bio-sweeteners.

Lallemand Inc. (5-9%)

Lallemand specializing in yeast fermentation, probiotics, and bio-ingredient, serving the food, animal feed and industrial fermentation markets.

Other important players (30-40% combined)

Other companies have a presence in the fermented ingredient market with advanced fermentation technologies, along with a wide range of food products:

The overall market size for the fermented ingredients market was USD 55,672.1 million in 2025.

The fermented ingredients market is expected to reach USD 102,558.1 million in 2035.

The increasing demand for natural food preservatives, rising consumer preference for probiotics, and growing adoption in the food and beverage industry fuel the fermented ingredients market during the forecast period.

The top 5 countries driving the development of the fermented ingredients market are the USA, UK, European Union, Japan, and South Korea.

Food & beverages lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Metric Tons) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 4: Global Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 6: Global Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 8: Global Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 10: Global Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 14: North America Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 16: North America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 18: North America Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 20: North America Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 24: Latin America Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 26: Latin America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 28: Latin America Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 30: Latin America Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 34: Europe Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 36: Europe Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 38: Europe Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 40: Europe Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: East Asia Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 44: East Asia Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 46: East Asia Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 48: East Asia Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 50: East Asia Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: South Asia Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 54: South Asia Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 56: South Asia Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 58: South Asia Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 60: South Asia Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: Oceania Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 64: Oceania Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 66: Oceania Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 68: Oceania Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 70: Oceania Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 72: MEA Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 74: MEA Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 76: MEA Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 78: MEA Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Process, 2017 to 2033

Table 80: MEA Market Volume (Metric Tons) Forecast by Process, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Process, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Metric Tons) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 11: Global Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 15: Global Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 19: Global Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 23: Global Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 26: Global Market Attractiveness by Form, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Process, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Process, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 41: North America Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 45: North America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 49: North America Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 53: North America Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 56: North America Market Attractiveness by Form, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Process, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Process, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 71: Latin America Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 75: Latin America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 79: Latin America Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 83: Latin America Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Process, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Process, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 101: Europe Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 105: Europe Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 109: Europe Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 113: Europe Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 116: Europe Market Attractiveness by Form, 2023 to 2033

Figure 117: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Europe Market Attractiveness by Process, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Process, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: East Asia Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 131: East Asia Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 135: East Asia Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 139: East Asia Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 143: East Asia Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Process, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Process, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: South Asia Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 161: South Asia Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 165: South Asia Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 169: South Asia Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 173: South Asia Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Process, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Process, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: Oceania Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 191: Oceania Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 195: Oceania Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 199: Oceania Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 203: Oceania Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Process, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Process, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 217: MEA Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 221: MEA Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 225: MEA Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 229: MEA Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Process, 2017 to 2033

Figure 233: MEA Market Volume (Metric Tons) Analysis by Process, 2017 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 236: MEA Market Attractiveness by Form, 2023 to 2033

Figure 237: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Application, 2023 to 2033

Figure 239: MEA Market Attractiveness by Process, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Fermented Ingredients

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

UK Fermented Ingredients Market Report – Growth, Demand & Industry Forecast 2025–2035

USA Fermented Ingredients Market Growth – Trends, Demand & Forecast 2025–2035

ASEAN Fermented Ingredients Market Growth – Innovations, Trends & Forecast 2025–2035

Europe Fermented Ingredients Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Fermented Ingredients Market Analysis – Demand, Growth & Forecast 2025–2035

Latin America Fermented Ingredients Market Trends – Size, Demand & Forecast 2025–2035

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA