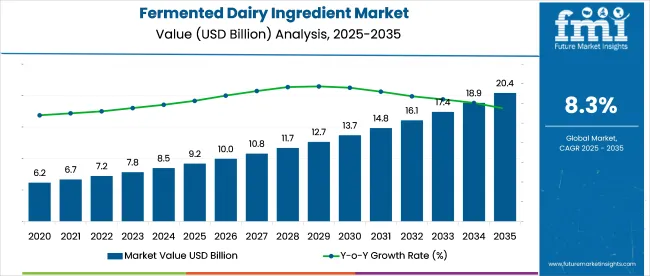

The global fermented dairy ingredient market is projected to rise significantly from USD 9.2 billion in 2025 to USD 20.4 billion by 2035, expanding at a robust CAGR of 8.3%. This upward momentum reflects a growing global preference for natural, health-promoting food components that offer both nutritional and functional benefits.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 9.2 billion |

| Projected Industry Value (2035F) | USD 20.4 billion |

| CAGR (2025 to 2035) | 8.3% |

Fermented dairy ingredients are increasingly integrated into diverse food and beverage applications, from conventional dairy products to modern fortified formulations such as probiotic drinks, snackable dairy formats, and nutritional powders. The expanding role of these ingredients in health-centric diets-particularly those focused on gut health, immune support, and clean-label claims-is creating strong commercial traction across developed and emerging economies alike.

The industry registers an estimated 11-14% share of the global dairy and dairy products industry, driven by its application in yogurts, kefir, and cheese. Within the functional food ingredients industry, fermented dairy ingredients account for roughly 8-10%, supported by rising consumer demand for gut-health-promoting and probiotic-rich components.

In the food and beverage additives industry, their share is modest at 4-6%, as they represent a niche compared to synthetic preservatives and flavoring agents. However, their role is expanding in the probiotics industry, where they contribute 18-22%, owing to their naturally cultured bacterial strains.

In the nutraceutical ingredients industry, it contributes about 6-8%, largely through its integration into clinical and digestive health formulations. In 2020 and 2024, the surge in consumption of fermented dairy ingredients was primarily influenced by the global COVID-19 pandemic, which heightened public consciousness around immunity and digestive health.

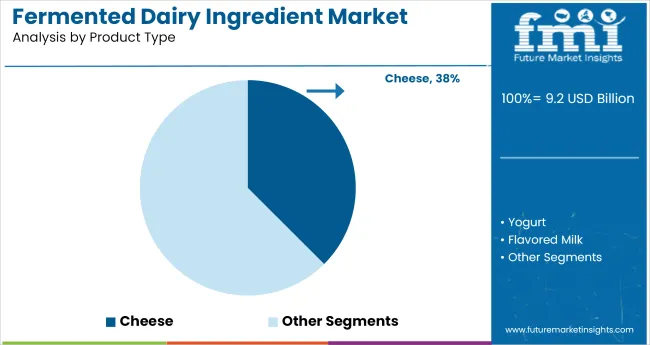

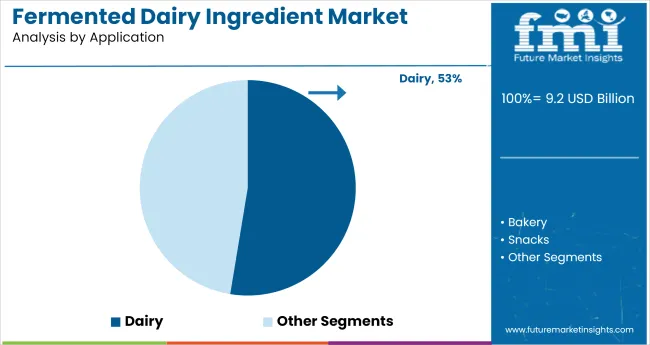

Cheese leads the market by product type with a 38% share in 2025, driven by its global culinary use in probiotic variants and extended shelf life. The dairy segment dominates applications with a 52.6% share, owing to widespread use in yogurt, kefir, and cheese, supported by consumer demand for natural, functional, and clean-label products.

Cheese is projected to capture a leading 38% share of the fermented dairy ingredients market in 2025 due to its unmatched versatility and culinary value. The growing use of microbial starters in both industrial and artisanal cheese-making elevates demand for high-performing fermentation agents. Trends in plant-based and functional cheese alternatives also promote specialized ingredient use.

Additionally, global fusion cuisine, which frequently includes cheese components, has widened industry exposure. Longer shelf life, enhanced umami profiles, and probiotic enrichment further add to its commercial potential, positioning cheese fermentation as a long-term, scalable growth driver across both developed and emerging food markets.

Dairy applications dominate the fermented dairy ingredients market with 52.6% share in 2025, underpinned by high consumption of cultured dairy staples like yogurt, kefir, and buttermilk. Fermentation is crucial to improving not only taste and shelf stability but also functional attributes such as probiotic density and digestibility.

The rising prevalence of lactose sensitivity has sparked demand for fermented dairy that offers enzymatic breakdown of lactose. Innovations in cold fermentation and high-pressure processing are helping retain microbial efficacy. These applications allow dairy manufacturers to meet evolving consumer health priorities, particularly in immunity, gut health, and naturally preserved product development.

The market is driven by growing demand for gut-health, clean-label, and functional nutrition products, especially in urban and health-conscious segments. Innovation in cultures and supportive regulations are further expanding market reach and product quality.

Health Focus and Functional Demand

The fermented dairy ingredient market is experiencing strong growth due to increasing consumer focus on digestive health, immunity, and functional nutrition. The surge in demand for probiotic-rich, clean-label, and naturally fermented products has positioned these ingredients as essential in both traditional and modern food formulations.

Consumers are seeking minimally processed options that support gut health, and this shift is reshaping the food industry’s formulation strategies.

R&D and Regulatory Frameworks Driving Quality and Market Access

Evolving product regulations are also key drivers are also key drivers shaping the market. Companies are investing in R&D to develop novel cultures, extend shelf life, and improve the sensory profile of fermented dairy products. At the same time, supportive regulations that promote functional and probiotic-enriched food consumption, especially in Europe, North America, and parts of Asia, are expanding market accessibility.

Labeling transparency and safety standards are pushing manufacturers to adopt high-quality, naturally derived fermentation inputs.

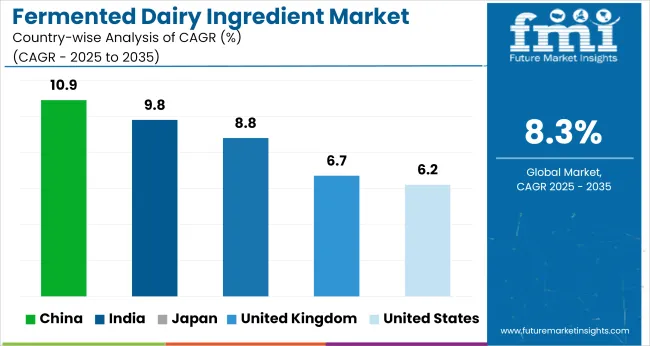

China and India are the fastest-growing markets for fermented dairy ingredients, with CAGRs of 10.9% and 9.8% from 2025 to 2035. Both BRICS nations benefit from urbanization, rising disposable incomes, and increasing interest in functional nutrition. In China, fortified and probiotic dairy products thrive via e-commerce and cold-chain upgrades.

In India, curd and lassi are being modernized to meet urban health trends. The United States, United Kingdom, and Japan-OECD members-register stable growth between 6.2% and 8.8%, driven by clean-label demand and gut-health focus. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

| United Kingdom | 6.7% |

| Japan | 8.8% |

| China | 10.9% |

| India | 9.8% |

The United State fermented dairy ingredients market is projected to register a CAGR of 6.2% from 2025 to 2035. This growth reflects a maturing yet increasingly health-aware population, where fermented dairy products are favored for their gut-friendly attributes and clean-label status. The industry benefits from a rise in consumer interest in foods that support immune health, a trend amplified during and after the COVID-19 pandemic.

Leading food manufacturers are reformulating products with bioactive ingredients like probiotic yogurt concentrates and fermented milk powders to meet evolving wellness trends. Dairy processing and fermentation techniques are also enabling the expansion of ingredient versatility across food applications, including protein bars, smoothies, and meal replacements.

The fermented dairy ingredients market in China is set to grow at a robust CAGR of 10.9% through 2035. This steep growth is primarily driven by rising disposable incomes, increasing health awareness, and the cultural acceptance of dairy in modern diets, particularly in urban centers.

The Chinese population is increasingly leaning toward probiotic-rich foods to counteract gut-related health issues stemming from sedentary lifestyles and high-stress environments. Domestic and multinational players are rapidly expanding their portfolios with locally tailored flavors and ingredients, making fermented dairy more appealing to a broad consumer base.

Fermented dairy ingredients market in Japan is forecasted to grow at a CAGR of 8.8% between 2020 and 2035. The market is influenced by a deep-rooted culture of consuming fermented products, complemented by modern scientific validation of probiotic benefits.

The aging population is a crucial driver, with older adults seeking functional foods to support digestion, bone strength, and immunity. Japanese consumers are also highly brand-conscious and quality-sensitive, prompting companies to emphasize ingredient transparency, fermentation authenticity, and clean labeling. Functional dairy beverages and probiotic supplements featuring traditional fermented dairy extracts are increasingly integrated into daily diets.

The fermented dairy ingredients market in the United Kingdom is anticipated to expand at a CAGR of 6.7% over the 2020 to 2035 period. The UK industry is evolving amid growing consumer preference for sustainable, low-sugar, and plant-blended dairy alternatives, where fermented ingredients are being explored for both functional and flavor-enhancing roles.

Post-Brexit nutritional labeling and local sourcing emphasis are compelling brands to differentiate through traceable, health-forward offerings. Consumers, particularly Gen Z and millennials, are driving the surge in probiotic yogurt, kefir drinks, and fortified cheese spreads. The rise of flexitarian and health-centric lifestyles has positioned fermented dairy as a premium functional ingredient across both dairy and non-dairy matrices.

Fermented dairy ingredients market in India is projected to grow at an estimated CAGR of 9.8% from 2025 to 2035. Rapidly growing industry in India is powered by a strong dairy culture, an expanding middle class, and increasing awareness of functional nutrition. Traditional fermented dairy products like curd, buttermilk, and lassi are being modernized into convenient formats enriched with probiotics and functional strains.

At the same time, government initiatives promoting nutritional awareness and school meal programs are integrating fermented dairy as a key component of daily diets. Domestic producers and startups are also investing in regional ingredients to combine tradition with science, fostering wider industry penetration.

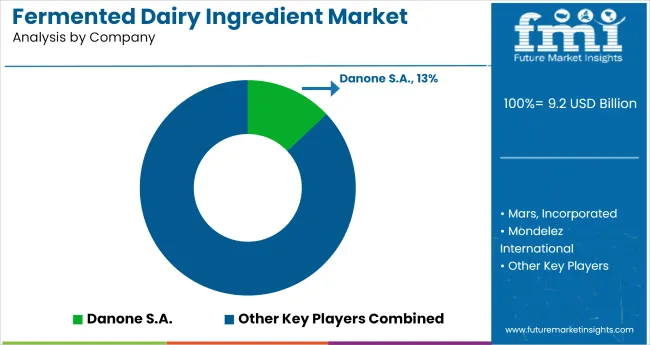

Leading Company - Danone S.A.

Market Share - 12%

The fermented dairy ingredients market is dominated by global giants such as Danone S.A., Nestlé S.A., and The Kraft Heinz Company, leveraging strong dairy portfolios, proprietary cultures, and extensive global distribution in yogurt, cheese, and probiotic beverages. Key players including General Mills, Inc., Unilever PLC, and Mondelez International focus on innovation in flavor, texture, and functional health benefits, catering to evolving consumer preferences.

Emerging players like Hain Celestial Group, Inc., Mars, Incorporated, PepsiCo, Inc., and Kellogg Company are entering the space via strategic acquisitions and fermented product extensions. Industry growth is driven by rising demand for gut-health solutions, protein-rich snacking, and clean-label dairy formulations.

Recent Fermented Dairy Ingredients Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 9.2 billion |

| Projected Industry Size (2035) | USD 20.4 billion |

| CAGR (2025 to 2035) | 8.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Cheese (Natural Cheese and Processed Cheese), Yogurt (Spoonable Yogurt, Drinkable Yogurt, Cultures, And Enzymes), Flavored Milk (Cultures And Enzymes), and Starch (Native and Modified). |

| Application Analyzed (Segment 2) | Bakery, Dairy, Snacks, and Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Mars, Incorporated, Mondelez International, Nestlé S.A., The Kraft Heinz Company, General Mills, Inc., PepsiCo, Inc., Kellogg Company, Danone S.A., Hain Celestial Group, Inc., and Unilever PLC |

| Additional Attributes | Dollar sales, share, fastest-growing applications, regional demand hotspots, product trends, clean-label shifts, and competitor strategies for growth. |

The industry is segmented into cheese (natural cheese and processed cheese), yogurt (spoonable yogurt, drinkable yogurt, cultures, and enzymes), flavored milk (cultures and enzymes), and Starch (native and modified).

The industry finds applications in bakery, dairy, snacks, and other products.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 9.2 billion in 2025.

It is forecasted to reach USD 20.4 billion by 2035.

The industry is anticipated to grow at a CAGR of 8.3% during this period.

Dairy is projected to lead the market with a 52.6% share in 2025.

Asia Pacific, particularly China, is expected to be the key growth region with a projected growth rate of 10.9%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Fermented Sweeteners Market

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Market Share Breakdown of Fermented Ingredients

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA