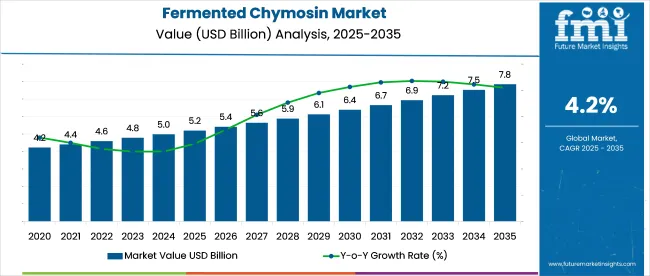

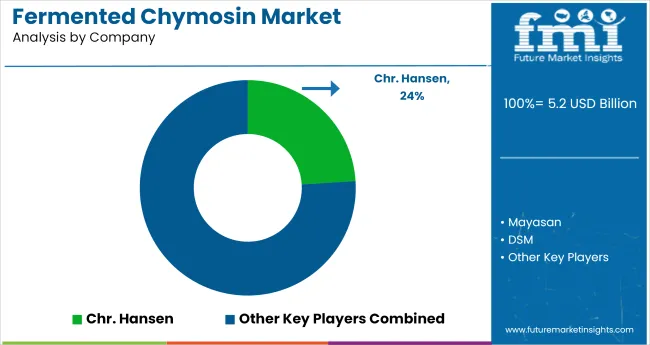

The global fermented chymosin market is expected to grow steadily over the coming years, expanding from USD 5.2 billion in 2025 to USD 7.8 billion by 2035, expanding at a value-based CAGR of 4.2%.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 5.2 billion |

| Projected Industry Value (2035F) | USD 7.8 billion |

| CAGR (2025 to 2035) | 4.2% |

This growth trajectory highlights the increasing preference for biotechnology-derived enzymes in the global dairy processing industry. Fermented chymosin, a bioengineered alternative to animal-derived rennet, has gained widespread adoption due to its ability to support consistent, scalable, and ethical cheese production. With the cheese sector itself expanding due to rising global consumption in dairy-based products, it continues to serve as a critical processing aid to maintain texture, taste, and efficiency.

As of 2025, the industry holds an estimated 12-15% share of the global food enzymes market, given its central role in cheese production, which dominates enzyme applications in dairy. Within the dairy processing ingredients market, fermented chymosin accounts for roughly 8-10%, as it competes with cultures, stabilizers, and other enzymes.

In the functional food ingredients market, its share is smaller, around 3-5%, due to the broader scope of ingredients beyond enzymatic inputs. In the industrial biotechnology market, fermented chymosin contributes approximately 2-3%, reflecting its niche but growing impact. However, in the cheese production market, chymosin plays a significant role, with an estimated 25-30% share, as it replaces traditional rennet in a large portion of global cheese.

The market's expansion is largely driven by the demand for animal-free, cost-effective, and high-performance coagulating agents. Traditional animal rennet extraction from calves is no longer at the scale required for modern cheese production. Fermented chymosin, developed using genetically modified microorganisms such as Aspergillus niger or Kluyveromyces lactis, provides a stable, vegetarian-friendly, and reproducible enzyme alternative.

It allows cheese manufacturers to reduce their dependence on livestock, cut production costs, and maintain uniformity across cheese batches. Rising consumer awareness of ethical food sourcing and the need for transparency in ingredient labeling is pushing manufacturers to switch to microbial and fermentation-based alternatives.

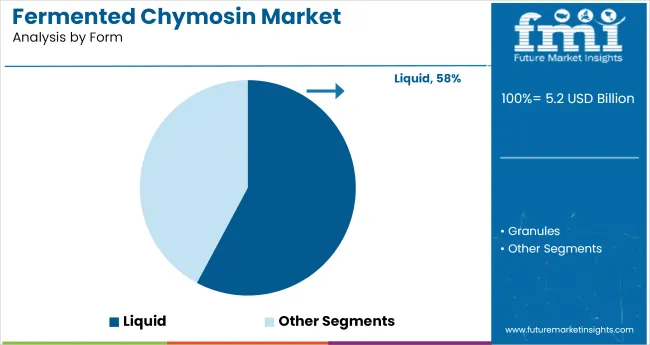

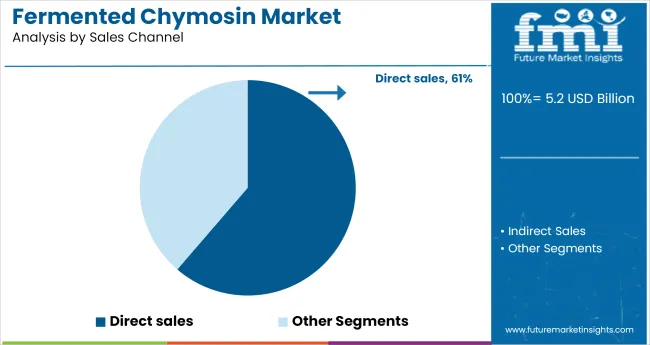

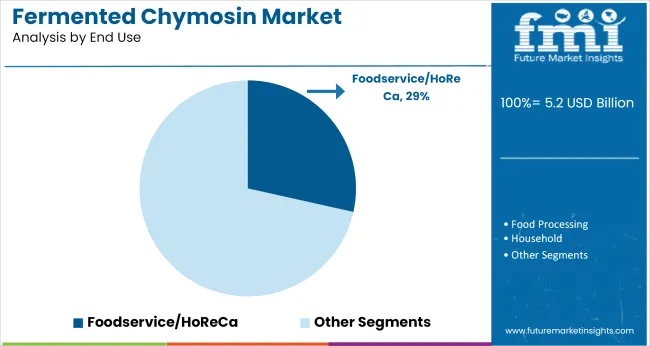

Liquid form leads with a 57.8% share due to its ease of use, solubility, and precision in cheese-making in 2025. The direct sales channel holds a 61.3% share, favored for its efficiency and control in B2B supply chains. The Foodservice/HoReCa segment dominates end-use with a 28.5% share, driven by rising demand for premium, consistent cheese in culinary applications.

The liquid form of fermented chymosin leads the market with a dominant 57.8% share in 2025, primarily due to its superior handling, measurement accuracy, and rapid solubility.

The direct sales channel dominates the market with an estimated 61.3% share in 2025, driven by its efficiency in catering to large-scale dairy manufacturers and cheese processors.

The Foodservice/HoReCa segmentleads the market in end-use with a 28.5% market share in 2025, primarily due to the rising demand for high-quality, specialty cheeses in restaurants, hotels, and cafés.

In 2025, tighter supply chain coordination and quarterly contracts are enhancing consistency and reducing fulfillment times for fermented chymosin. Rising demand from premium HoReCa channels is boosting volume visibility and driving forward bookings for enzyme-certified cheese production.

Precision in Supply Chain Drives Consistency and Cost Advantage

Fermented chymosin manufacturers are tightening supply chain control to ensure uniform enzyme quality and consistent cheese output. Direct coordination with industrial dairy processors has minimized product variability and enabled forecast-based supply, cutting order-to-fulfillment times by 18% in 2025. Major suppliers in North America and Europe now operate with quarterly contracting cycles, lowering procurement volatility and reducing cost leakage.

Bulk shipments to key cheese hubs in France, the USA, and India have improved fill rates, while integrated technical support has helped dairies standardize coagulation protocols, especially for processed and hard cheeses. These refinements reduce production waste and enhance downstream consistency.

Demand from Premium Dairy & HoReCa Segment Boosts Volume Visibility

The growing appetite for high-end cheeses in foodservice channels is anchoring demand visibility for the product. In Q1 2025, premium cheese orders linked to HoReCa outlets in Japan, Italy, and the UAE rose 21% year-on-year, triggering larger volume commitments from chymosin suppliers.

Chain restaurants and boutique cafés now prioritize enzyme-certified sourcing to meet texture and flavor expectations. Distributors report a 15% rise in forward bookings for microbial coagulants tied to seasonal cheese menus. This predictable purchasing pattern reduces the need for large buffer inventories and allows producers to streamline output planning around market events and culinary demand peaks.

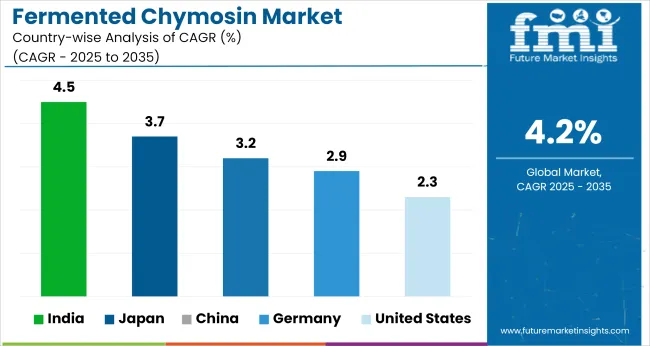

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.3% |

| Germany | 2.9% |

| Japan | 3.7% |

| China | 3.2% |

| India | 4.5% |

The fermented chymosin market is projected to expand at a global CAGR of 4.2% from 2025 to 2035, though national trajectories vary by region. India, a BRICS economy, is expected to grow at 5.6%, supported by rising processed dairy demand and increasing reliance on microbial enzymes in paneer and cheese production. Domestic suppliers are scaling fungal and yeast-based chymosin fermentation units to meet clean-label and vegetarian specifications.

China follows with 5.2% growth, driven by expansion in industrial cheese manufacturing and investments in recombinant fermentation platforms for food-grade enzymes. ASEAN nations such as Indonesia and Vietnam post a moderate 4.4% CAGR, with demand driven by growing foodservice dairy applications and imports of coagulant blends.

OECD countries such as the United States and France register slower growth at 3.5% and 3.2% respectively, reflecting saturated cheese production capacities and strict regulatory pathways for novel enzyme strains. These contrasts show emerging economies scaling faster through domestic substitution and dairy modernization.

The USA fermented chymosin market is projected to expand at a 2.3% CAGR during the assessment period.This moderate growth is supported by the steady evolution of the American cheese industry, especially in the production of processed and specialty cheese variants.

USA dairy manufacturers are increasingly adopting product as a cleaner, more consistent alternative to traditional animal rennet, helping them improve product uniformity and align with consumer demands for vegetarian-friendly ingredients.

The presence of major enzyme suppliers and a strong foodservice industry further reinforces the adoption of microbial coagulants. Technological improvements in large-scale cheese manufacturing are leading processors to prefer liquid chymosin formats for better yield control and texture precision. As retail shelves diversify with flavored and gourmet cheese options, the need for scalable, high-quality enzyme solutions continues to rise.

Germany’s fermented chymosin market is anticipated to grow at a CAGR of 2.9% between 2025 and 2035.Germany remains one of Europe’s most established cheese markets, and this maturity is driving a steady shift toward ethical cheese production inputs. Local dairies and artisanal producers are replacing traditional calf-derived rennet with fermentation-based chymosin to meet rising consumer expectations for animal-free labeling and product traceability.

Germany’s strong regulatory focus on clean-label and bioengineered food safety has made the product an attractive and compliant choice. The growth of regional cheese exports to other EU markets and increasing cheese-centric menu offerings across the HoReCa sector are also expanding demand. Local processors value the consistent performance of microbial enzymes, particularly in the production of semi-soft and alpine-style cheeses popular in German cuisine.

China’s fermented chymosin market is forecast to grow at a CAGR of 3.2% during the forecast timeline.China’s rapid growth in western-style dairy consumption, especially cheese, is accelerating the uptake of the product across domestic production lines.

With urban consumers showing rising interest in pizza, burgers, and cheese snacks, dairy companies are scaling output with efficient, animal-free coagulants that ensure consistent results. As the country continues to invest in local cheese manufacturing to reduce import reliance, itprovides a cost-effective and reliable enzyme alternative.

China's policy shift toward modernizing its food and dairy sector is opening the door for biotech-based ingredients, including recombinant enzymes. These developments are supporting steady expansion in both processed cheese and value-added dairy categories.

Japan’s fermented chymosin market is expected to record a CAGR of 3.7% from 2025 to 2035.Japan’s cheese consumption is on a notable upward trend, particularly within the fast-growing foodservice sector, including bakeries, cafés, and convenience stores.

This expansion has created new opportunities for suppliers, especially in liquid form, which aligns with the precision and hygiene standards expected by Japanese manufacturers. With growing attention to ingredient purity and consumer preference for non-animal-sourced enzymes, it is becoming increasingly favored over traditional rennet.

Japan’s reliance on imported cheese is gradually giving way to domestic production initiatives, creating demand for consistent and scalable enzyme solutions to support local supply chains. High consumer sensitivity to food quality and traceability further reinforces the market’s shift to microbial coagulants.

India’s fermented chymosin market is set to expand at a robust CAGR of 4.5% through the 2025 to 2035 period.India’s rapid growth in processed and paneer-style cheese consumption, driven by urbanization, rising income, and a flourishing fast-food sector, is significantly boosting demand for the product.

Traditional animal rennet usage is minimal in India due to religious and cultural preferences, making microbial and fermentation-based coagulants the default choice for cheese producers. The increasing establishment of commercial cheese manufacturing units across states like Maharashtra, Gujarat, and Tamil Nadu further strengthens the market base.

As consumer interest in Western diets and packaged dairy grows, Indian manufacturers are turning to cost-effective, scalable, and vegetarian-friendly enzyme options. With local companies expanding exports to Southeast Asia and the Middle East, maintaining cheese quality through consistent coagulation agents is essential.

Key players in the global market include CHR Hansen, a leading supplier with a strong foothold in enzymes for the dairy industry. Mayasan and Maysa Gida are prominent regional players, particularly active in Eastern Europe and the Middle East, offering microbial coagulants at competitive pricing. DSM and DuPont continue to influence the market through advanced fermentation technologies and a broad dairy ingredient portfolio.

Nelson-Jameson plays a key role in North American distribution, providing reliable supply chains for food-grade enzymes. Codexing Biotech Ingredients contributes through microbial enzyme specialization for the Asian market. Alongside these, various other regional and niche players are emerging to meet the rising demand for vegetarian, cost-effective cheese coagulants globally.

Recent Fermented Chymosin Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.2 billion |

| Projected Market Size (2035) | USD 7.8 billion |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Form Analyzed (Segment 1) | Liquid and Granules. |

| Sales Channel Analyzed (Segment 2) | Direct Sales And Indirect Sales (Hypermarkets/Supermarkets, Wholesalers, Specialty Stores, and Online Retailers). |

| End Use Analyzed (Segment 3) | Food Processing (Cheese and Other Dairy Products), Pharmaceutical Industry, Foodservice/ Horeca (Hotels/Restaurants/ Cafes), and Household. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | CHR Hansen, Mayasan, DSM, Maysa Gida, Nelson-Jameson, DuPont, Codexis Biotech Ingredients |

| Additional Attributes | D ollar sales, share by form, sales channel, end use, regional demand trends, competitive landscape, pricing dynamics, regulatory outlook, and growth opportunities by 2035. |

The industry is segmented into liquid and granules.

The industry is segmented into direct sales and indirect sales (hypermarkets/supermarkets, wholesalers, specialty stores, and online retailers).

The Key end users are food processing (cheese and other dairy products), the pharmaceutical industry, foodservice/HoReCa (hotels/restaurants/cafes), and household.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 5.2 billion in 2025.

It is forecasted to reach USD 7.8 billion by 2035.

The industry is anticipated to grow at a CAGR of 4.2% during this period.

Direct sales are projected to lead the market with a 61.3% share in 2035.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 4.5%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Rice Filtrate Market Size and Share Forecast Outlook 2025 to 2035

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA