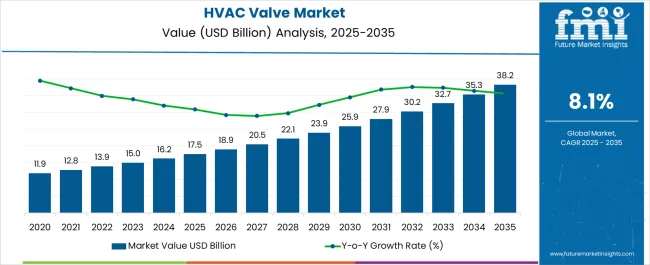

The HVAC valve market is valued at USD 17.5 billion in 2025 and is estimated to reach USD 38.2 billion by 2035, reflecting a CAGR of 8.1%. From 2021 to 2025, the market rises from USD 11.9 billion to USD 17.5 billion, marking the initial phase of steady growth. Annual increments show consistent gains with values reaching USD 12.8 billion in 2022, USD 13.9 billion in 2023, USD 15.0 billion in 2024, and USD 16.2 billion just before the 2025 milestone. This period is characterized by gradual adoption of advanced HVAC systems in commercial and residential buildings, increased focus on energy efficiency, and rising construction activities in emerging regions.

Between 2026 and 2030, the market experiences a pronounced inflection in growth trajectory, advancing from USD 17.5 billion to USD 25.9 billion. Intermediate values progress to USD 18.9 billion in 2026, USD 20.5 billion in 2027, USD 22.1 billion in 2028, USD 23.9 billion in 2029, and USD 25.9 billion in 2030. This stage reflects accelerated adoption of smart valves, integration of automated building management systems, and rising replacement cycles of conventional valves with high-performance alternatives. From 2031 to 2035, the market continues on an upward curve, reaching USD 38.2 billion. Values increase to USD 27.9 billion in 2031, USD 30.2 billion in 2032, USD 32.7 billion in 2033, USD 35.3 billion in 2034, culminating at USD 38.2 billion in 2035.

| Metric | Value |

|---|---|

| HVAC Valve Market Estimated Value in (2025 E) | USD 17.5 billion |

| HVAC Valve Market Forecast Value in (2035 F) | USD 38.2 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The HVAC valve market is shaped by several parent markets that collectively influence its expansion across equipment, construction, and energy applications. The HVAC equipment market is the most dominant, with valves contributing around 20-25% of the segment. These valves are vital for regulating fluid and gas flow in heating, ventilation, and air conditioning systems, ensuring system reliability, temperature balance, and energy efficiency.

The building automation and control market accounts for about 12-15%, as advanced smart valves are increasingly integrated into automated systems for intelligent buildings. They allow precise temperature control, optimize energy use, and improve occupant comfort, making automation one of the fastest-growing application areas. The construction and infrastructure market contributes nearly 10-12%, since valves are installed in HVAC systems across residential, commercial, and industrial projects.

The demand is particularly strong in urban developments and retrofitting initiatives, where energy-efficient HVAC systems are being adopted. The industrial equipment market represents about 8-10% of the share, with valves playing a critical role in HVAC systems for manufacturing plants, clean rooms, and warehouses, where precision in airflow and temperature is necessary to maintain operational standards. The energy and utilities market contributes approximately 6-8%. District cooling systems, large power plants, and energy distribution facilities rely on HVAC valves to manage chilled water and steam distribution for improved efficiency and long-term reliability.

The market is experiencing steady expansion, supported by the growing emphasis on energy efficiency, automation, and precise climate control in residential, commercial, and industrial environments. The integration of advanced control technologies has allowed HVAC systems to operate with greater accuracy, reducing energy consumption and enhancing occupant comfort.

Increasing investments in modernizing building infrastructure and the adoption of smart building concepts have further accelerated the demand for high-performance valve solutions. Regulatory mandates for energy conservation and sustainability are prompting the use of valves that can be seamlessly integrated into intelligent HVAC networks.

The market outlook remains positive as manufacturers focus on developing valves with enhanced durability, improved sealing capabilities, and compatibility with automated control systems. With urbanization and infrastructure development continuing worldwide, the requirement for reliable and efficient HVAC valves is expected to remain strong, positioning the sector for consistent growth in the coming years.

The HVAC valve market is segmented by valve type, operation type, application, end use, and geographic regions. By valve type, HVAC valve market is divided into Ball valves, Globe valves, Butterfly valves, Check valves, Gate valves, Pressure relief valves, Control valves, Solenoid valves, and Others. In terms of operation type, HVAC valve market is classified into Electric, Manual, Pneumatic, Hydraulic, and Smart/connected.

Based on application, HVAC valve market is segmented into Heating systems, Cooling systems, Ventilation systems, District cooling, and Refrigeration. By end use, HVAC valve market is segmented into Commercial. Regionally, the HVAC valve industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

.webp)

The ball valves segment is projected to hold 30% of the HVAC Valve market revenue share in 2025, making it the leading valve type. Growth in this segment has been driven by the valve’s robust construction, low maintenance requirements, and reliable shut-off capabilities, which are critical in HVAC applications. Ball valves have been favored for their ability to provide tight sealing and quick operation, ensuring efficient system performance.

Their adaptability to a wide range of pressures and temperatures has made them suitable for both heating and cooling systems. Additionally, the design of ball valves supports long service life, which reduces operational downtime and replacement costs.

The increasing preference for valves that can be easily automated has further enhanced their adoption. As HVAC systems become more complex and efficiency-driven, the role of ball valves as a dependable and cost-effective control solution is expected to remain strong.

The electric operation type segment is expected to account for 35% of the HVAC Valve market revenue share in 2025, positioning it as the leading operation type. The rising adoption of automation and smart control technologies in HVAC systems has supported this dominance. Electric valves enable precise modulation and remote control, allowing building managers to optimize system performance and energy consumption.

The ability to integrate with building management systems has made electric operation valves highly desirable for both new installations and retrofit projects. The reduced need for manual intervention and the capacity for predictive maintenance through data monitoring have further reinforced their value proposition.

The shift towards sustainable and energy-efficient building solutions has prompted greater investment in electric valve technologies. As demand for intelligent HVAC infrastructure grows, electric operation valves are expected to maintain their leadership position due to their performance advantages and compatibility with emerging smart building trends.

.webp)

The heating systems segment is anticipated to capture 34% of the HVAC Valve market revenue share in 2025, making it the dominant application segment. Growth in this area has been supported by rising demand for efficient heat distribution and control in both residential and commercial spaces. The integration of advanced valve technologies in heating systems has improved temperature regulation, energy efficiency, and system reliability.

Increasing awareness of energy conservation and government incentives for upgrading to modern heating infrastructure have further boosted adoption. Valves in heating systems play a critical role in optimizing fluid flow, maintaining consistent temperatures, and reducing heat loss, which directly impacts operating costs.

The trend towards district heating and the modernization of older heating networks has also contributed to market expansion. As consumers and enterprises continue to prioritize comfort and efficiency, the heating systems segment is expected to retain its leading position within the HVAC Valve market.

The HVAC valves are critical in regulating airflow, temperature, and humidity, with adoption supported by smart building development and rising infrastructure investments. High installation costs, skilled labor shortages, and maintenance requirements remain barriers in cost-sensitive regions. Expanding opportunities exist in commercial complexes, hospitals, and industrial facilities requiring precise climate control. With smart technology integration, predictive monitoring, and regional expansion, HVAC valves are becoming essential components in modern energy-efficient infrastructure worldwide.

Valves are essential in regulating the flow of heating, cooling, and ventilation systems, ensuring precision in energy use and comfort levels. Rapid urban development and rising investments in commercial real estate are fueling installations of advanced HVAC systems that rely heavily on reliable valve components. Industrial facilities also adopt these valves for process cooling, ventilation, and controlled environments, further increasing demand. The shift toward smart buildings has enhanced interest in automated and remotely controlled valves that improve system efficiency. As awareness of indoor air quality grows, HVAC valves are being integrated into systems designed to balance temperature, airflow, and humidity with greater accuracy. This rising dependence on efficient, high-performance climate control solutions continues to reinforce the importance of HVAC valves in modern infrastructure.

Advanced valve systems, particularly those integrated with automation and digital monitoring, are more expensive than conventional options. Smaller enterprises and budget-sensitive consumers often hesitate to adopt such systems due to the upfront investment required. Maintenance adds another layer of expense, as valves exposed to constant thermal and pressure variations require regular servicing to ensure reliability. Complex systems demand skilled technicians, which raises labor costs and creates additional challenges in regions with limited technical expertise. Supply chain disruptions and volatile raw material prices further complicate production and procurement, affecting affordability for end users. These financial and technical barriers slow adoption in certain regions, although larger organizations with higher operating requirements continue to invest in premium solutions to achieve long-term efficiency and reliability.

Shopping malls, hospitals, office complexes, and educational institutions are investing in advanced HVAC systems that require precision valves to maintain consistent comfort and safety levels. In industrial environments, HVAC valves are critical in cleanrooms, manufacturing plants, and data centers, where precise climate control directly affects productivity and equipment performance. Manufacturers are responding with product innovations such as pressure-independent valves, electronically actuated systems, and compact designs tailored for space-constrained environments. Growing preference for modular systems and retrofitting solutions is also creating opportunities for valve producers to tap into existing infrastructure upgrades. By offering customized products that meet sector-specific requirements, companies are positioning HVAC valves as indispensable components for facilities seeking greater control, efficiency, and operational stability.

Valves equipped with sensors and digital connectivity are enabling real-time monitoring, predictive maintenance, and integration with building management systems. This enhances system reliability while reducing unplanned downtime. In developed regions, adoption is strong in smart building projects and large-scale infrastructure upgrades. Emerging economies are showing increasing uptake as urban growth drives demand for modern HVAC systems in residential and commercial sectors.

Industry collaborations between valve manufacturers, automation companies, and HVAC contractors are fueling innovations in intelligent control systems. Manufacturers are focusing on regional production facilities to address supply chain challenges and meet local demand.

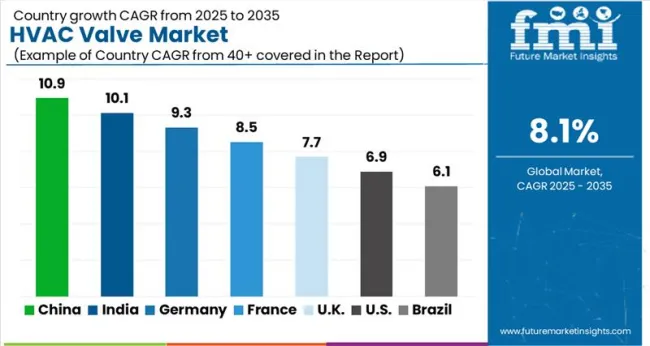

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The HVAC valve market is projected to expand at a global CAGR of 8.1% between 2025 and 2035. China leads growth at 10.9%, followed by India at 10.1% and Germany at 9.3%, while the United Kingdom records 7.7% and the United States posts 6.9%. China and India secure the highest growth premiums of +2.8% and +2.0% above the baseline, supported by infrastructure projects, rising urban housing, and smart building adoption. Germany maintains strength through industrial and healthcare projects, while the UK and USA reflect moderate but steady expansion, backed by office, retail, and data center developments. The analysis includes over 40 countries, with the leading markets shown below.

China is expected to lead the global HVAC valve market, growing at a CAGR of 10.9% between 2025 and 2035. Rapid urban development, large-scale infrastructure projects, and high demand for commercial and residential complexes are fueling expansion. HVAC valves are increasingly utilized in advanced heating, ventilation, and cooling systems to ensure precise temperature control and energy efficiency. Manufacturing strength in China also supports large-scale production of HVAC components, boosting domestic availability. Industrial facilities, hospitals, and office complexes are integrating high-performance HVAC systems, which rely heavily on valves for optimized operation. International players are collaborating with local firms to expand their footprint, introducing advanced control valves to meet modern requirements.

The HVAC valve market in India is forecasted to grow at a CAGR of 10.1% from 2025 to 2035. Rising demand for modern residential complexes, office spaces, and healthcare infrastructure is shaping higher adoption of HVAC systems across the country. The expansion of commercial real estate, coupled with government-driven industrial projects, has increased the need for advanced climate control solutions. HVAC valves are vital for maintaining system performance, enabling better airflow regulation and operational efficiency. The growth of shopping malls, airports, and urban housing projects has further added to the demand. Domestic manufacturers are increasingly entering the HVAC component space, while multinational suppliers are introducing high-performance solutions to meet market requirements. Rapid adoption of air-conditioning in middle-class households is also boosting demand.

Germany is projected to expand at a CAGR of 9.3% between 2025 and 2035 in the HVAC valve market. A strong focus on industrial automation, advanced engineering, and precision-based infrastructure projects is driving demand. HVAC systems in Germany’s commercial, residential, and industrial facilities rely on high-quality valves to achieve operational efficiency and regulatory compliance. The manufacturing sector, along with the growth of smart factories and research facilities, is creating additional demand for sophisticated HVAC systems. Hospitals, office complexes, and retail buildings are also adopting modern climate control technologies that depend heavily on control valves. The strong engineering base and emphasis on high-performance materials ensure reliability and innovation in HVAC components.

The United Kingdom is expected to record a CAGR of 7.7% from 2025 to 2035 in the HVAC valve market. Growth is being influenced by the modernization of urban infrastructure and steady demand for advanced HVAC systems in commercial and residential projects. Office buildings, educational institutions, and hospitals are adopting energy-efficient HVAC systems that rely on precision valves. The retail sector is also contributing significantly, with shopping centers and supermarkets requiring advanced temperature regulation systems. Domestic distributors are actively collaborating with European suppliers to strengthen availability of advanced components. Research activity from universities and private institutions is contributing to the development of innovative control systems, ensuring integration with smart building applications

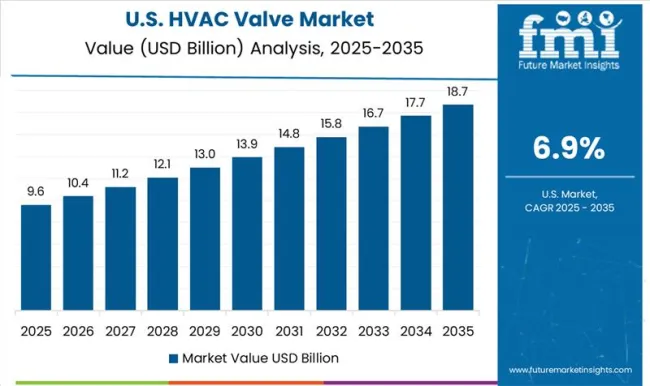

The United States is projected to grow at a CAGR of 6.9% from 2025 to 2035 in the HVAC valve market. Rising investments in commercial construction, industrial facilities, and healthcare infrastructure are supporting higher adoption of HVAC systems. Demand for advanced valves is increasing in office complexes, hospitals, and educational facilities where precision climate control is essential. The USA market benefits from strong R&D activity, with companies investing in innovative designs for smart HVAC valves that enhance system performance. Industrial users, including data centers and manufacturing facilities, are driving demand for high-performance valves that can handle large-scale operations. Domestic manufacturers maintain strong leadership, while imports from European and Asian suppliers provide competitive alternatives.

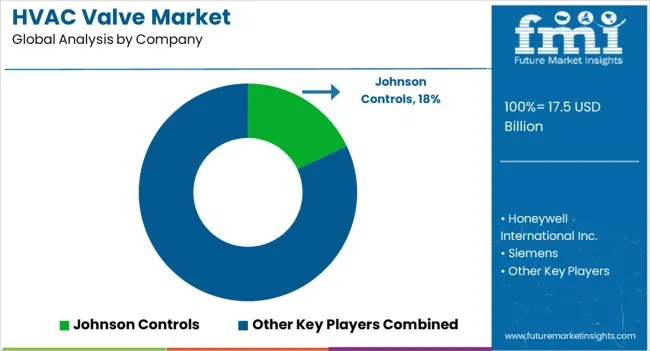

In the HVAC valve market, competition is shaped by control precision, energy efficiency, and integration with building management systems. Johnson Controls leverages its position as a full-scale building solutions provider, offering a wide portfolio of control valves designed for chilled water, hot water, and steam applications, ensuring seamless connectivity with its automation platforms.

Honeywell International Inc. competes with a broad range of balancing, butterfly, and pressure-independent control valves, emphasizing reliability and compatibility with advanced HVAC control systems. Siemens provides high-performance valves integrated with its building automation suite, focusing on precision flow regulation and durability in large-scale commercial facilities. Belimo differentiates with pressure-independent control valves and damper actuators engineered for energy efficiency, gaining significant traction in green building projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.5 Billion |

| Valve Type | Ball valves, Globe valves, Butterfly valves, Check valves, Gate valves, Pressure relief valves, Control valves, Solenoid valves, and Others |

| Operation Type | Electric, Manual, Pneumatic, Hydraulic, and Smart/connected |

| Application | Heating systems, Cooling systems, Ventilation systems, District cooling, and Refrigeration |

| End Use | Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Johnson Controls, Honeywell International Inc., Siemens, Belimo, Danfoss, Emerson, KSB, and Others |

| Additional Attributes | Dollar sales by valve type (ball, butterfly, globe, control), application (residential, commercial, industrial), and actuation method (manual, electric, pneumatic). Demand is driven by energy efficiency mandates, smart building adoption, and need for precise HVAC control. Regional trends highlight strong adoption in North America and Europe, with growing opportunities in Asia-Pacific due to infrastructure expansion and commercial building development. |

The global HVAC valve market is estimated to be valued at USD 17.5 billion in 2025.

The market size for the HVAC valve market is projected to reach USD 38.2 billion by 2035.

The HVAC valve market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in HVAC valve market are ball valves, globe valves, butterfly valves, check valves, gate valves, pressure relief valves, control valves, solenoid valves and others.

In terms of operation type, electric segment to command 35.0% share in the HVAC valve market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Smart HVAC Controls Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Global HVAC Filter Market

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive HVAC Ducts Market Growth - Trends & Forecast 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Valve Grinder Market Size and Share Forecast Outlook 2025 to 2035

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Valve Driver Market Size and Share Forecast Outlook 2025 to 2035

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Valve Positioner Market Growth – Trends & Forecast (2024-2034)

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA