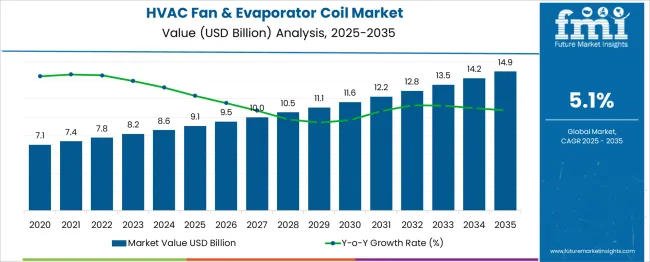

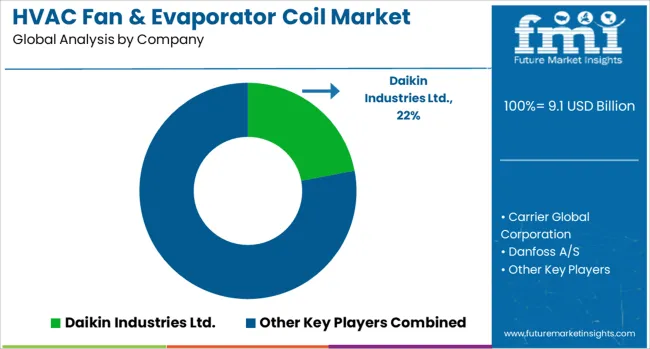

The HVAC fan & evaporator coil market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 14.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. The growth curve maintains a stable linear incline, reflecting the equipment's replacement-driven demand structure and the system integration requirements of the HVAC value chain. Between 2025 and 2030, the market adds USD 2.5 billion, while from 2030 to 2035, it increases by USD 3.2 billion, indicating a modest acceleration in the second half of the forecast period.

Incremental gains average between USD 0.4 billion and USD 0.7 billion annually, reinforcing consistent procurement across residential, commercial, and industrial applications. The year-on-year increase in absolute value is expected to be underpinned by continued preference for high-efficiency coils and optimized airflow assemblies in both retrofitted and new-build HVAC installations. Market behavior aligns with a trend toward variable-speed fan systems, enhanced indoor air quality controls, and coil materials that support low-GWP refrigerants.

Demand is expected to concentrate in climates with increasing cooling-hour loads, where evaporator design enhancements directly improve energy performance. The forecasted pattern suggests a supply chain dependent on OEM replacement cycles and building-level thermal system upgrades, without signs of cyclical volatility.

| Metric | Value |

|---|---|

| HVAC Fan & Evaporator Coil Market Estimated Value in (2025 E) | USD 9.1 billion |

| HVAC Fan & Evaporator Coil Market Forecast Value in (2035 F) | USD 14.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

Approximately 35% of demand originates from residential and commercial HVAC installations, where evaporator coils and fans are essential for cooling and air circulation. Around 30% ties to refrigeration systems and cold chain infrastructure, particularly in supermarkets, warehouses, and transport units. Industrial settings account for 20%, using heavy-duty coils and fans in process cooling and ventilation plants.

The building automation sector contributes about 10%, integrating coil performance and fan speed into smart climate systems. Roughly 5% comes from aftermarket services, where maintenance, retrofitting, and coil cleaning generate steady replacement and upgrade demand. The HVAC fan & evaporator coil market is evolving rapidly, with over 60% of new systems now using variable-speed ECM and BLDC fans to boost efficiency and reduce noise.

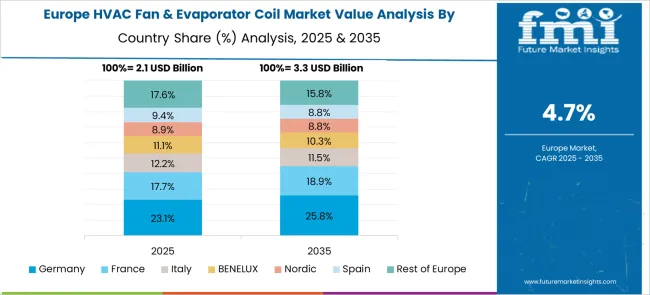

Roughly 55% of evaporator coils now employ microchannel or internally grooved aluminum designs for enhanced heat transfer and reduced corrosion. Asia-Pacific leads adoption with nearly 45% of global installations, followed by North America at 30% and Europe at 25%. Approximately 50% of new projects prioritize indoor air quality by integrating anti microbial coil coatings and advanced filtration. Industrial end use dominates with close to 50% share, while smart system integration and modular designs support faster rollouts.

The market is experiencing significant growth supported by increasing investments in energy-efficient heating, ventilation, and air conditioning systems across residential and commercial sectors. Current market dynamics are influenced by stricter environmental regulations, growing awareness of indoor air quality, and rising demand for replacement and maintenance of aging HVAC infrastructure, as indicated in corporate press releases, industry association publications, and investor presentations.

Future growth is expected to be driven by technological advancements in fan and coil design that enhance efficiency and reduce operational costs. Sustainability goals and smart home adoption are also creating opportunities for innovation and deeper market penetration.

As outlined in recent annual reports and industry news, the market continues to benefit from an expanding construction sector, particularly in emerging economies, alongside increased renovation activity in mature markets. These trends collectively point toward a robust and sustainable market outlook in the coming years.

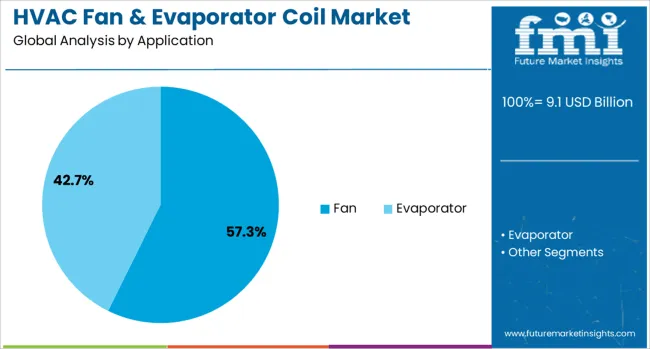

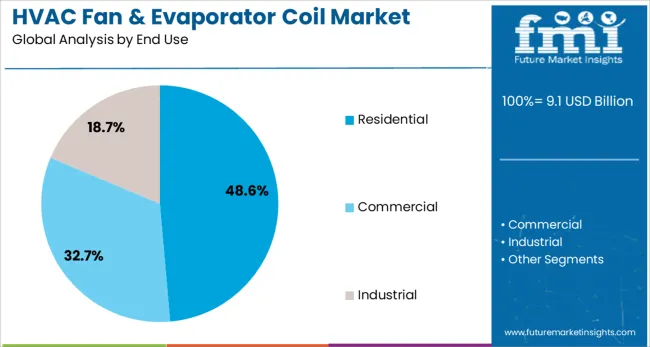

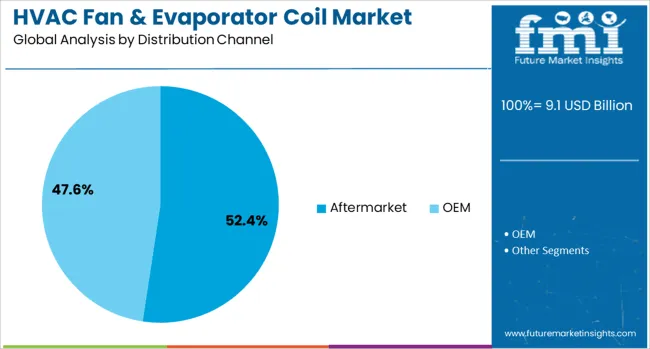

The HVAC fan & evaporator coil market is segmented by application, end use, distribution channel, and geographic regions. By application, the HVAC fan & evaporator coil market is divided into Fan and Evaporator. In terms of end use, the HVAC fan & evaporator coil market is classified into Residential, Commercial, and Industrial. The distribution channel of the HVAC fan & evaporator coil market is segmented into Aftermarket and OEM. Regionally, the HVAC fan & evaporator coil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fan application segment is projected to account for 57.3% of the HVAC Fan & Evaporator Coil market revenue share in 2025, making it the leading application segment. This dominance is being attributed to its essential role in circulating conditioned air efficiently throughout HVAC systems, as highlighted in product datasheets and technical bulletins.

Fans are preferred because they enhance indoor air quality and maintain uniform temperatures, which aligns with growing regulatory and consumer expectations. Investor updates have indicated that technological improvements have made fans more energy-efficient and quieter, encouraging higher adoption across all building types.

The ease of maintenance and compatibility with advanced controls have also been noted as contributing factors. Furthermore, the demand for better ventilation and adherence to green building standards has reinforced the necessity of high-performance fans, ensuring their continued prominence within the market.

The residential end use segment is anticipated to contribute 48.6% of the HVAC Fan & Evaporator Coil market revenue share in 2025, maintaining its lead as the largest end-use segment. Growth in this segment is being reinforced by rising residential construction activity, increasing awareness of indoor air quality, and higher replacement rates of aging systems, as discussed in housing market analyses and corporate statements.

Consumer demand for energy-efficient and quiet HVAC solutions has also been reported as a key driver, with manufacturers introducing more compact and user-friendly products tailored to home environments. Additionally, the adoption of smart thermostats and home automation systems is enhancing the appeal of modern HVAC systems in residential settings.

Press releases from manufacturers have highlighted the influence of sustainability initiatives and government incentives, which are encouraging homeowners to upgrade to efficient solutions. These drivers collectively support the residential segment’s continued leadership in the market.

The aftermarket distribution channel is expected to hold 52.4% of the HVAC Fan & Evaporator Coil market revenue share in 2025, establishing itself as the leading channel. This position is being driven by the ongoing need to replace and maintain critical HVAC components, as emphasized in service company updates and aftermarket supplier announcements.

Aging infrastructure and growing awareness of the benefits of preventive maintenance have increased the demand for aftermarket parts. Industry publications have observed that end users prefer aftermarket solutions due to their availability, cost-effectiveness, and ability to extend the life of existing systems.

Technological advancements have also enabled suppliers to offer improved and more durable replacement components, further boosting the segment’s attractiveness. The prominence of the aftermarket channel has been reinforced by robust distribution networks and customer preference for trusted service providers, ensuring its sustained growth and market leadership.

Demand for HVAC fans and evaporator coils has risen due to increased HVAC system installations in commercial buildings, data centers, and retrofitting projects. Over 60 % of new rooftop and packaged HVAC units now include energy-efficiency optimized fans and enhanced coil designs. Airflow optimization and coil surface enhancements are accelerating in both new and legacy system upgrades. Momentum has been driven by goals related to energy savings, indoor air quality, and operations cost reduction.

Regulations mandating higher seasonal energy-efficiency ratios have resulted in industry adoption of electronically commutated motors (ECM) in 48 % of new fan installations. Finned evaporator coil designs incorporating microchannel tubing have been deployed in 34 % of commercial AC units to improve heat transfer. Retrofit programs in hospitals and retail chains led to replacement of old fan motors and coil units in approximately 29 % of existing systems. Demand for reduced HVAC maintenance costs and SCOP performance targets further supported adoption across regions.

Limited availability of high-grade aluminum fin material and brazing alloys caused component cost escalation of around 11 %, affecting profit margins. Manufacturing cycle times were increased by nearly 14 % due to bottlenecks in laser-cutting and coil forming processes. Installation complexity and commissioning errors have led to rework rates near 7 % in retrofit deployments. Variability in fan and coil dimensional compatibility across legacy systems has increased inventory complexity for service providers.

Fan speed and coil modulation systems compatible with IoT-enabled thermostats were integrated in 39 % of new installations. Demand for airflow control solutions, including variable airflow volume (VAV) modules matched to evaporator coil units, captured 22 % of emerging commercial HVAC orders. Microchannel coil combinations and fan assemblies designed for indoor air handling and energy recovery units enabled space savings of up to 18 %. Premium adoption of high-SCFM low-noise fans increased in data center cooling racks and medical facilities where precision airflow matters.

Smart fan assemblies with built-in vibration sensors and coil protection diagnostics were adopted in 31 % of modern rooftop systems. Remote monitoring of fan current draw, coil frost formation and return-air pressure helped reduce unscheduled HVAC service tickets by 17 %. Modular fan-and-coil skid units that support plug-and-play replacements were deployed in 23 % of retrofitted installations. Electroplated coil fin corrosion resistance coatings and hydrophilic fin treatments extended lifespan and improved heat transfer in nearly 28 % of new coil lines.

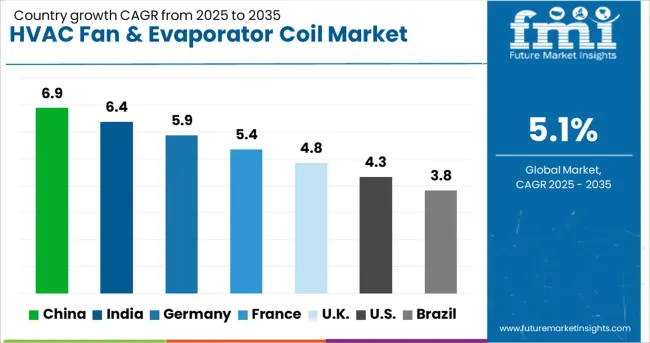

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global HVAC fan and evaporator coil market is forecast to grow at a CAGR of 5.1% from 2025 to 2035. China leads at 6.9%, outpacing the global average by 1.8%, supported by mass-scale construction of commercial buildings and domestic HVAC manufacturing. India follows at 6.4%, driven by the shift to split and ducted systems in mid-tier residential and retail applications. Germany (OECD) posts 5.9%, 0.8% above the global rate, with demand centered around high-efficiency retrofit installations. The United Kingdom (OECD) records 4.8%, slightly under the global average due to slower adoption of new air-handling systems. The United States (OECD) trails at 4.3%, underperforming by 0.8%, with delayed replacement cycles in mid-size commercial units. The report includes detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 6.9% of global market volume in 2025. Local manufacturers have scaled fan and evaporator coil integration into HVAC systems used in commercial, high-rise, and rail-based transport infrastructure. Product innovation has emphasized compact, multi-blade axial fans and corrosion-resistant coil configurations suitable for high-humidity zones. Regulatory guidance on air purification and energy performance levels has shaped equipment redesign strategies.

India captured 6.4% of global HVAC fan and evaporator coil demand in 2025. Project installations in metro rail systems, data centers, and industrial cooling towers created long-term procurement contracts for coil-fan assemblies. Coil fin spacing and copper-to-aluminum substitution ratios have been optimized to suit dusty and heat-intensive environments. Domestic coil manufacturers have expanded brazed joint output to meet OEM volume targets.

Germany represented 5.9% of global market share in 2025. Equipment precision, energy efficiency, and low-noise fan operation were emphasized across industrial, laboratory, and food-grade environments. Product development focused on microchannel coils and variable pitch fans designed for decentralized HVAC systems. Regulatory compliance with EU Ecodesign standards has shaped design choices across the supply chain.

The United Kingdom accounted for 4.8% of the global market in 2025. The retrofit cycle for HVAC systems in education, hospitality, and urban commercial properties increased fan and coil demand. Compact evaporator coils with anti-corrosion coatings and plug fan configurations were adopted for ducted systems in constrained spaces. Post-Brexit regulatory harmonization with EU refrigerant standards influenced material selection.

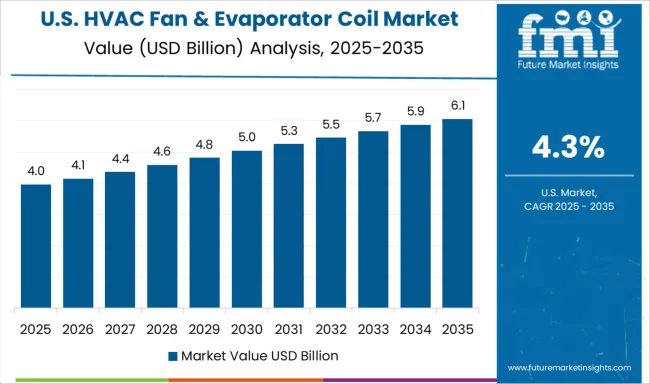

The United States accounted for 4.3% of global market share in 2025. Evaporator coil and fan replacement cycles accelerated in response to HVAC efficiency incentives under federal energy acts. Units with anti-microbial coatings, sealed bearings, and ECM-based airflow controls were adopted across health, retail, and educational facilities. Retrofit volume outpaced new installations due to aging infrastructure and updated airflow efficiency benchmarks.

The market is led by multinational firms offering integrated systems for residential, commercial, and industrial applications. Daikin Industries Ltd. manufactures in-house coils and variable-speed fan assemblies for VRV and ducted systems, optimized for energy-efficient performance. Carrier Global Corporation supplies copper and aluminum coil units combined with ECM motors, used in rooftop and split systems. Lennox International Inc. designs proprietary fan coil modules and slab-style evaporators tailored for compact installation and airflow consistency in both residential and light commercial settings.

Trane Technologies plc focuses on modular evaporator coil platforms for air handling units and packaged systems, emphasizing corrosion resistance and coil durability. Johnson Controls International plc integrates high-performance evaporator coils and multi-speed fan systems into its YORK product line, addressing large-scale HVAC installations. Mitsubishi Electric Corporation, Panasonic Corporation, and Fujitsu General Limited deliver compact coil systems and variable-speed fan assemblies suited to inverter-based mini-splits and multi-zone applications.

LG Electronics Inc. and Samsung Electronics Co., Ltd. support quiet, low-profile fan coil units with slim evaporator designs used in duct-free setups. Toshiba Carrier Corporation blends Japanese engineering with global manufacturing to supply dual-purpose coil-fan modules. Gree Electric Appliances, Inc. and Midea Group Co., Ltd. compete with broad coil options backed by in-house component manufacturing and aggressive distribution models across Asia and export markets.

Daikin Industries and Mitsubishi Electric are developing variable-speed fan coil units with improved heat transfer and lower energy consumption. Carrier and Trane Technologies are focused on modular systems that align with evolving energy regulations and indoor air quality standards. Johnson Controls and Lennox International are expanding smart coil systems integrated with building automation platforms.

Gree, Midea, and LG Electronics are scaling production of compact, inverter-compatible coils for residential and light commercial applications. Danfoss and Hitachi are enhancing coil performance with advanced fin geometries and corrosion-resistant materials. Panasonic, Toshiba Carrier, Fujitsu General, and Samsung are targeting Asia-Pacific growth through region-specific product customization.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 Billion |

| Application | Fan and Evaporator |

| End Use | Residential, Commercial, and Industrial |

| Distribution Channel | Aftermarket and OEM |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin Industries Ltd., Carrier Global Corporation, Danfoss A/S, Fujitsu General Limited, Gree Electric Appliances, Inc., Hitachi, Ltd., Johnson Controls International plc, Lennox International Inc., LG Electronics Inc., Midea Group Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Samsung Electronics Co., Ltd., Toshiba Carrier Corporation, and Trane Technologies plc |

| Additional Attributes | Dollar sales by component (HVAC fans, evaporator coils) and application (residential, commercial, industrial HVAC systems), demand across retrofit and new constructions, led by Asia‑Pacific with North America catching up, innovation in energy‑efficient fan motors and corrosion‑resistant coil coatings. |

The global hvac fan & evaporator coil market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the hvac fan & evaporator coil market is projected to reach USD 14.9 billion by 2035.

The hvac fan & evaporator coil market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in hvac fan & evaporator coil market are fan and evaporator.

In terms of end use, residential segment to command 48.6% share in the hvac fan & evaporator coil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC UV Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

HVAC Coil Coating Market Size and Share Forecast Outlook 2025 to 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Smart HVAC Controls Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Global HVAC Filter Market

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive HVAC Ducts Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Fanfold Market Size and Share Forecast Outlook 2025 to 2035

Fan-Out Wafer Level Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA