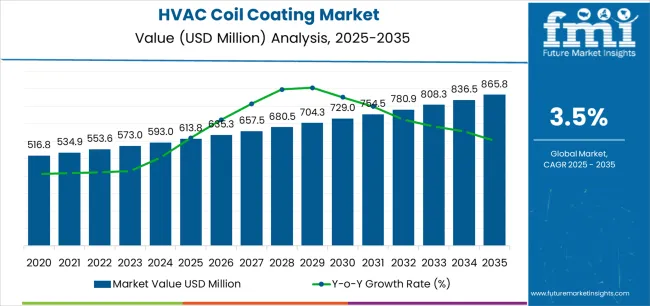

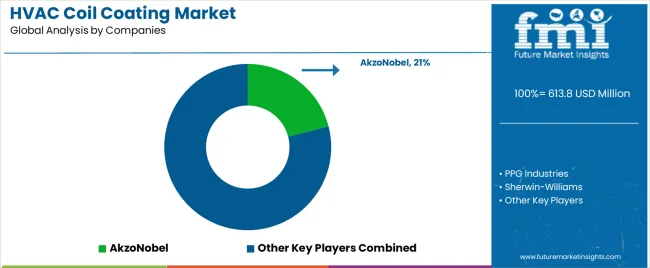

The global HVAC coil coating market is valued at USD 613.8 million in 2025. It is slated to reach USD 865.8 million by 2035, recording an absolute increase of USD 252.0 million over the forecast period. This translates into a total growth of 41.1%, with the market forecast to expand at a CAGR of 3.5% between 2025 and 2035. The overall market size is expected to grow by nearly 1.41X during the same period, supported by increasing emphasis on HVAC system longevity, growing awareness of corrosion protection requirements, and rising adoption of environmentally friendly coating formulations across diverse residential air conditioning, commercial HVAC, and industrial refrigeration applications.

Between 2025 and 2030, the HVAC coil coating market is projected to expand from USD 613.8 million to USD 704.3 million, resulting in a value increase of USD 90.5 million, which represents 35.9% of the total forecast growth for the decade. This phase of development will be shaped by increasing coastal and industrial environment installations requiring enhanced corrosion resistance, rising building energy efficiency standards driving premium HVAC equipment adoption, and growing awareness of maintenance cost reduction through protective coatings. HVAC manufacturers and coating applicators are expanding their coil coating capabilities to address the growing demand for durable protection solutions that extend equipment service life and maintain heat transfer efficiency.

From 2030 to 2035, the market is forecast to grow from USD 704.3 million to USD 865.8 million, adding another USD 161.5 million, which constitutes 64.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of smart building integration requiring long-life HVAC components, the development of advanced coating formulations with antimicrobial and self-cleaning properties, and the growth of retrofit coating applications addressing aging HVAC infrastructure. The growing adoption of sustainable building practices and green certification requirements will drive demand for HVAC coil coatings with enhanced environmental performance and extended warranty capabilities.

Between 2020 and 2025, the HVAC coil coating market experienced steady growth, driven by increasing recognition of corrosion as primary cause of premature HVAC system failure and growing acceptance of protective coatings as cost-effective maintenance strategy extending equipment lifespan in challenging environmental conditions. The market developed as facility managers and HVAC contractors recognized the potential for coil coating technology to prevent corrosion damage, maintain thermal efficiency, and reduce replacement costs while addressing warranty requirements. Technological advancement in coating chemistry and application methods began emphasizing the critical importance of maintaining heat transfer performance and ensuring long-term adhesion in demanding operating environments including coastal areas, industrial facilities, and high-humidity climates.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 613.8 million |

| Forecast Value in (2035F) | USD 865.8 million |

| Forecast CAGR (2025 to 2035) | 3.5% |

Market expansion is being supported by the increasing prevalence of corrosive operating environments driven by coastal installations and industrial facility locations, alongside the corresponding need for protective coating systems that can prevent premature coil failure, maintain heat transfer efficiency, and extend equipment service life across various air conditioning, refrigeration, and ventilation applications. Modern facility managers and HVAC contractors are increasingly focused on implementing coil coating solutions that can deliver long-term corrosion protection, resist chemical exposure, and maintain thermal performance throughout extended operating periods.

The growing emphasis on total cost of ownership reduction and maintenance optimization is driving demand for protective coatings that can eliminate premature equipment replacement, reduce cleaning frequency, and ensure consistent performance in challenging environmental conditions. Building owners' preference for coating solutions that combine corrosion protection with environmental compliance and minimal heat transfer impact is creating opportunities for innovative coil coating implementations. The rising influence of green building certifications and sustainable facility management is also contributing to increased adoption of water-based coatings that can provide effective protection without compromising indoor air quality or environmental performance.

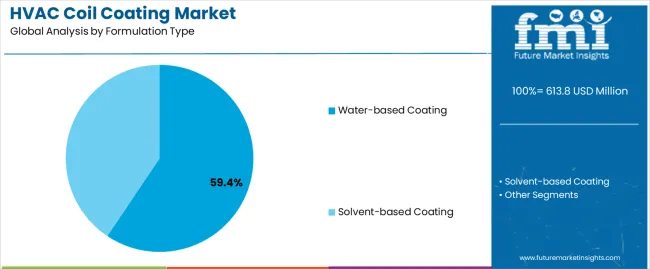

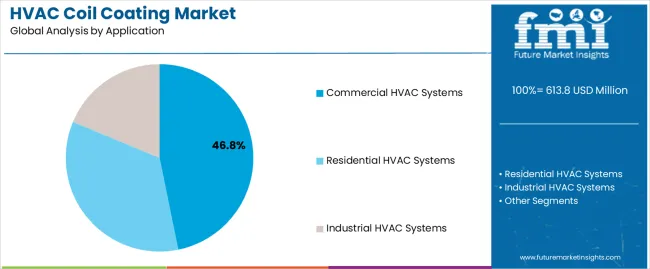

The market is segmented by formulation type, application, and region. By formulation type, the market is divided into water-based coating and solvent-based coating. Based on application, the market is categorized into residential HVAC systems, commercial HVAC systems, and industrial HVAC systems. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The water-based coating segment is projected to maintain its leading position in the HVAC coil coating market in 2025 with a 59.4% market share, reaffirming its role as the preferred formulation for environmentally conscious coating applications and indoor air quality sensitive installations. HVAC contractors and facility managers increasingly utilize water-based coil coatings for their low volatile organic compound emissions, reduced environmental impact, and proven effectiveness in delivering corrosion protection without compromising occupant health or regulatory compliance. Water-based coating technology's proven effectiveness and environmental acceptability directly address the industry requirements for sustainable maintenance practices and green building certification across diverse residential, commercial, and institutional applications.

This formulation segment forms the foundation of modern HVAC coating practice, as it represents the product type with the greatest contribution to environmental performance improvement and established safety record in occupied building applications. Building industry investments in sustainable facility management and indoor environmental quality continue to strengthen adoption among property owners and facility operators. With green building standards emphasizing low-emission materials and regulatory frameworks restricting volatile organic compound content, water-based coatings align with both environmental objectives and health protection requirements, making them the central component of comprehensive HVAC maintenance strategies.

The commercial HVAC systems application segment is projected to represent the largest share of HVAC coil coating demand in 2025 with a 46.8% market share, underscoring its critical role as the primary driver for coating adoption across office buildings, retail facilities, hotels, and institutional buildings requiring reliable climate control equipment. Commercial building owners prefer HVAC coil coatings for their ability to extend equipment service life, reduce maintenance costs, and ensure consistent cooling performance while supporting asset management objectives and tenant comfort requirements. Positioned as essential maintenance solutions for commercial property management, coil coatings offer both equipment protection and operational cost reduction benefits.

The segment is supported by continuous growth in commercial building stock and the expanding awareness of preventive maintenance value in reducing total cost of ownership for HVAC assets. Commercial property managers are investing in comprehensive equipment protection programs addressing corrosion risks from coastal environments, industrial emissions, and high-humidity conditions. As commercial real estate investment continues globally and property management standards advance, the commercial HVAC systems application will continue to dominate the market while supporting asset preservation and facility performance optimization strategies.

The HVAC coil coating market is advancing steadily due to increasing HVAC equipment investment requiring protection in corrosive environments driven by coastal construction and industrial facility development, and growing awareness of maintenance cost optimization through preventive coating applications addressing premature failure and expensive equipment replacement across diverse climate control, refrigeration, and ventilation applications. The market faces challenges, including application complexity requiring skilled technicians and proper surface preparation, performance variability based on coating quality and application methods, and competition from factory-applied coatings integrated during equipment manufacturing. Innovation in application technologies and performance enhancement continues to influence product development and market adoption patterns.

The accelerating construction activity in coastal regions and corrosive industrial environments is driving substantial demand for HVAC coil coatings as essential protection against salt spray, industrial emissions, and high-humidity conditions that rapidly degrade unprotected aluminum and copper coil materials. Property developers and facility owners are increasingly recognizing that standard HVAC equipment specifications provide inadequate corrosion resistance for challenging installation environments, creating requirements for supplemental protective coatings extending equipment service life from typical five-year unprotected lifespan to fifteen years or longer with proper coating protection. HVAC contractors are successfully demonstrating return on investment for coating applications through documented equipment longevity improvements, reduced maintenance intervention frequency, and elimination of premature coil replacement costs. Coastal population growth and industrial facility expansion continue to create sustained market demand as HVAC installations in corrosive environments require enhanced protection beyond manufacturer specifications.

Modern HVAC coil coating manufacturers are incorporating advanced functional additives including antimicrobial agents, photocatalytic materials, and hydrophobic surface treatments that provide additional performance benefits beyond corrosion protection including microbial growth prevention, automatic dirt removal, and indoor air quality enhancement. Leading coating suppliers are developing multifunctional formulations with silver ion technology, titanium dioxide photocatalysts, and specialty surface modifiers that address expanding customer requirements for hygienic climate control systems, reduced maintenance cleaning, and enhanced indoor environmental quality. These advanced coating technologies create opportunities for premium product positioning emphasizing health benefits, operational cost savings through self-cleaning performance, and differentiated value propositions justifying higher pricing compared to conventional corrosion protection coatings. Healthcare facility adoption and food processing installation requirements continue to drive antimicrobial coating demand as facility hygiene standards increasingly address HVAC system cleanliness.

The substantial installed base of aging HVAC equipment and growing awareness of coating applications for existing systems is driving market expansion beyond new equipment installation into comprehensive retrofit coating services addressing corrosion damage on operating HVAC units. Specialized coating contractors are developing systematic retrofit methodologies including coil cleaning procedures, surface preparation techniques, and field application methods that enable effective coating of installed equipment without complete system replacement or extensive downtime. These retrofit services create significant market opportunities addressing millions of existing HVAC units experiencing early-stage corrosion where coating intervention prevents progression to complete coil failure requiring expensive equipment replacement. Building retrofit and preventive maintenance emphasis continues to position field-applied coatings as cost-effective life extension strategy for aging HVAC infrastructure throughout commercial and industrial facilities.

| Country | CAGR (2025-2035) |

|---|---|

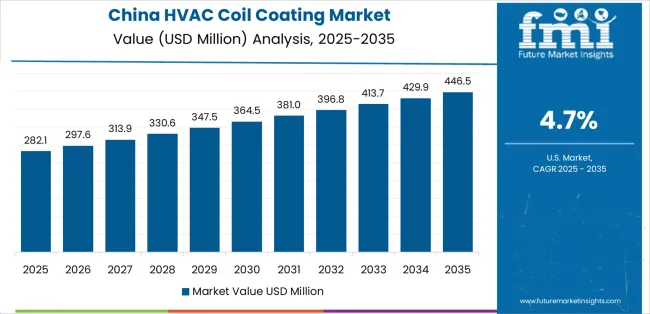

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| United States | 3.3% |

| United Kingdom | 3.0% |

| Japan | 2.6% |

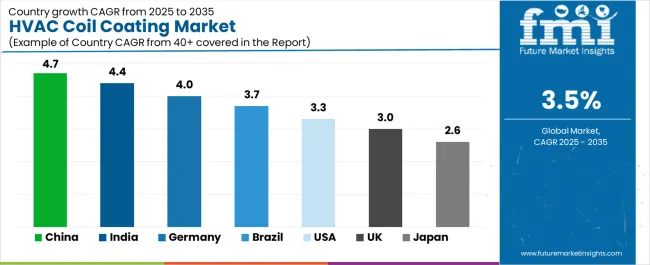

The HVAC coil coating market is experiencing solid growth globally, with China leading at a 4.7% CAGR through 2035, driven by massive air conditioning market expansion, growing awareness of equipment maintenance, and increasing coastal construction requiring corrosion protection. India follows at 4.4%, supported by expanding HVAC market, growing commercial construction, and increasing adoption of preventive maintenance practices. Germany shows growth at 4.0%, emphasizing quality maintenance standards, comprehensive building management, and environmental compliance.

Brazil demonstrates 3.7% growth, supported by tropical climate conditions, coastal development, and growing commercial HVAC installations. The United States records 3.3%, focusing on aging HVAC infrastructure, coastal property protection, and maintenance cost optimization. The United Kingdom exhibits 3.0% growth, emphasizing building maintenance standards and equipment longevity priorities. Japan shows 2.6% growth, supported by comprehensive maintenance culture and quality-focused facility management.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from HVAC coil coatings in China is projected to exhibit exceptional growth with a CAGR of 4.7% through 2035, driven by massive air conditioning market expansion, growing awareness of equipment maintenance and corrosion protection, and extensive coastal construction requiring enhanced HVAC equipment durability. The country's enormous HVAC installation volume and increasing maintenance sophistication are creating substantial demand for coil coating solutions. Coating manufacturers and application service providers are establishing comprehensive capabilities to serve growing market requirements.

Revenue from HVAC coil coatings in India is expanding at a CAGR of 4.4%, supported by rapidly growing air conditioning market, expanding commercial construction, and challenging tropical climate conditions creating corrosion and biological fouling risks requiring protective coating solutions. The country's developing HVAC maintenance awareness and coastal development are driving coating demand throughout metropolitan and industrial regions. Coating suppliers and application contractors are establishing market presence through distribution networks and technical education programs.

Revenue from HVAC coil coatings in Germany is expanding at a CAGR of 4.0%, supported by comprehensive building maintenance culture, stringent quality standards, and established facility management practices emphasizing preventive maintenance and equipment longevity. The nation's emphasis on quality and sustainability are driving sophisticated coating utilization throughout commercial and industrial facilities. Coating manufacturers and applicators maintain strong market presence through quality-focused offerings and technical expertise.

Revenue from HVAC coil coatings in Brazil is expanding at a CAGR of 3.7%, supported by challenging tropical climate conditions creating accelerated corrosion, extensive coastal construction requiring enhanced equipment protection, and growing commercial HVAC installations. The nation's environmental challenges and expanding commercial sector are driving demand for protective coating solutions. Coating suppliers and contractors are investing in market development addressing diverse climate zones and facility types.

Revenue from HVAC coil coatings in the United States is expanding at a CAGR of 3.3%, supported by substantial aging HVAC infrastructure requiring life extension solutions, extensive coastal property requiring corrosion protection, and established maintenance industry offering comprehensive coating services. The nation's mature HVAC market and maintenance sophistication are driving consistent coating demand. Coating manufacturers and applicators maintain extensive market presence through established distribution networks and service capabilities.

Revenue from HVAC coil coatings in the United Kingdom is expanding at a CAGR of 3.0%, supported by comprehensive building maintenance standards, coastal climate conditions requiring corrosion protection, and established facility management practices emphasizing equipment longevity. The UK's maintenance culture and coastal environment are driving stable coating demand. Coating suppliers and applicators maintain market presence through established customer relationships and technical support capabilities.

Revenue from HVAC coil coatings in Japan is growing at a CAGR of 2.6%, driven by comprehensive maintenance culture, quality-focused facility management, and emphasis on equipment longevity through preventive protection measures. Japan's sophisticated maintenance standards and quality consciousness are supporting demand for premium coating products. Coating manufacturers and applicators maintain market presence through quality-focused offerings and technical expertise.

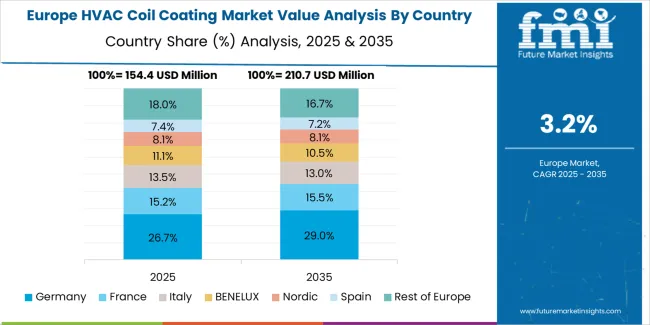

The HVAC coil coating market in Europe is projected to grow from USD 168.4 million in 2025 to USD 227.3 million by 2035, registering a CAGR of 3.1% over the forecast period. Germany is expected to maintain leadership with a 26.8% market share in 2025, moderating to 26.2% by 2035, supported by comprehensive facility management, quality maintenance standards, and environmental compliance emphasis.

France follows with 18.4% in 2025, projected at 18.9% by 2035, driven by building maintenance standards, coastal installations, and facility management practices. The United Kingdom holds 15.6% in 2025, expected to reach 16.1% by 2035 supported by maintenance culture and coastal environment requirements. Italy commands 13.2% in 2025, rising slightly to 13.6% by 2035, while Spain accounts for 11.8% in 2025, reaching 12.3% by 2035 aided by coastal construction and Mediterranean climate conditions.

The Netherlands maintains 5.4% in 2025, up to 5.7% by 2035 due to marine environment exposure and comprehensive facility management. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 8.8% in 2025 and 7.2% by 2035, reflecting varied facility management maturity and environmental conditions across diverse national markets.

The HVAC coil coating market is characterized by competition among established industrial coating manufacturers, specialized HVAC coating suppliers, and regional application service providers. Companies are investing in formulation development, application technology improvement, environmental compliance, and technical service capabilities to deliver effective, durable, and environmentally compliant HVAC coil coating solutions. Innovation in water-based formulations, antimicrobial additives, and field application methods is central to strengthening market position and competitive advantage.

AkzoNobel leads as a major industrial coatings manufacturer offering comprehensive HVAC coil coating solutions with emphasis on environmental performance, technical support, and global supply capabilities. PPG Industries provides advanced coating technologies with focus on corrosion protection and environmental compliance. Sherwin-Williams delivers comprehensive coating solutions including specialized HVAC formulations. Axalta offers industrial coatings with emphasis on performance and durability. Titan Coating specializes in HVAC-specific coating products and application expertise. Unichem focuses on specialized coatings for HVAC and refrigeration applications.

Heresite provides corrosion-resistant coatings for heat transfer equipment. GMG specializes in HVAC coil coating products and application services. Blygold offers comprehensive coil coating systems and global application network. Nyalic provides protective coating solutions for HVAC equipment. Rahn Industries focuses on specialty coating formulations. Modine Coatings specializes in heat exchanger protective coatings. Rectorseal offers HVAC maintenance products including coil coatings. Protexion provides specialized protective coatings for HVAC applications. Ozkem focuses on coil coating products serving regional markets.

HVAC coil coatings represent a specialized protective coating segment within building maintenance and HVAC service industries, projected to grow from USD 613.8 million in 2025 to USD 865.8 million by 2035 at a 3.5% CAGR. These protective coating products, primarily water-based and solvent-based formulations for corrosion prevention, serve as essential maintenance solutions in climate control systems where protection of aluminum and copper heat exchanger coils from corrosion, biological growth, and chemical attack is critical for equipment longevity and thermal efficiency. Market expansion is driven by increasing coastal construction requiring enhanced corrosion protection, growing emphasis on equipment life extension and maintenance cost reduction, rising environmental regulations favoring low-emission formulations, and expanding awareness of preventive maintenance value in commercial and industrial facility management.

How Building Code Authorities Could Strengthen Standards and Performance Requirements?

How Industry Associations Could Advance Technical Knowledge and Market Development?

How Coating Manufacturers Could Drive Innovation and Market Leadership?

How Facility Managers and Building Owners Could Optimize Equipment Protection and Cost Management?

How Research Institutions Could Enable Technology Advancement?

How Distributors and Service Providers Could Support Market Growth?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 613.8 million |

| Formulation Type | Water-based Coating, Solvent-based Coating |

| Application | Residential HVAC Systems, Commercial HVAC Systems, Industrial HVAC Systems |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | AkzoNobel, PPG Industries, Sherwin-Williams, Axalta, Titan Coating, Unichem |

| Additional Attributes | Dollar sales by formulation type and application category, regional demand trends, competitive landscape, technological advancements in coating chemistry, environmental compliance, antimicrobial additives, and field application methodologies |

The global HVAC coil coating market is estimated to be valued at USD 613.8 million in 2025.

The market size for the HVAC coil coating market is projected to reach USD 865.8 million by 2035.

The HVAC coil coating market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in HVAC coil coating market are water-based coating and solvent-based coating.

In terms of application, commercial HVAC systems segment to command 46.8% share in the HVAC coil coating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

Smart HVAC Controls Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Global HVAC Filter Market

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive HVAC Ducts Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Coiled Tubing Market Analysis by Service, Operation, Application and Region Through 2035

Coil Assisted Flow Diverters Market – Growth, Demand & Forecast 2025 to 2035

Coil Winding Machine Market Growth – Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA