The HVAC Centrifugal Compressors Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.3 billion by 2035, registering a compound annual growth rate (CAGR) of 2.0% over the forecast period. The Growth Rate Volatility Index (GRVI) indicates a low-to-moderate level of volatility throughout the forecast period. In the early years, from 2025 to 2027, the market remains largely stable, with minimal fluctuations, with the value staying at USD 1.1 billion each year, reflecting a phase of market maturity and steady demand driven by replacement cycles.

The GRVI begins to show slight fluctuations between 2027 and 2030, when the market experiences a modest increase to USD 1.2 billion in 2028, driven by a CAGR of around 3.3%. The market value then holds steady at USD 1.2 billion from 2028 to 2030. From 2030 to 2035, the market sees gradual growth, reaching USD 1.3 billion, with a decelerated CAGR of 1.9%, indicating a period of market saturation where growth stabilizes.

The GRVI decreases during this phase, as the market enters a more predictable, low-growth stage with reduced volatility, influenced by incremental technological improvements and a more stable regulatory environment. The GRVI analysis suggests that the market will experience moderate fluctuations primarily driven by incremental advancements rather than disruptive changes.

| Metric | Value |

|---|---|

| HVAC Centrifugal Compressors Market Estimated Value in (2025 E) | USD 1.1 billion |

| HVAC Centrifugal Compressors Market Forecast Value in (2035 F) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 2.0% |

The HVAC centrifugal compressors market is experiencing steady growth, supported by increasing demand for energy-efficient, large-capacity cooling systems across commercial and industrial sectors. Emphasis on reducing carbon emissions and enhancing building energy performance has driven investments in high-performance HVAC infrastructure.

Regulatory bodies in major economies are enforcing stricter energy codes and promoting next-generation refrigeration systems, prompting OEMs to adopt oil-free and variable-speed centrifugal compressors. Technological advancements in aerodynamics, impeller design, and digital monitoring are improving system reliability, operational efficiency, and lifecycle performance.

Emerging smart city developments, retrofitting of aging commercial facilities, and the growth of district cooling networks are also contributing to long-term demand. Continued innovation in compressor design and control integration is expected to play a central role in shaping future adoption patterns.

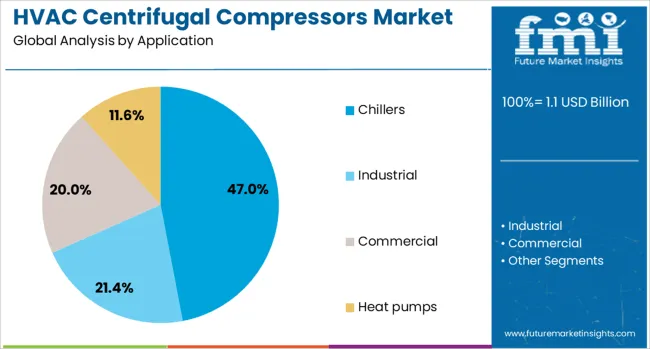

The HVAC centrifugal compressors market is segmented by application, and geographic regions. By application of the HVAC centrifugal compressors market is divided into Chillers, Industrial, CommercialHeat pumps. Regionally, the HVAC centrifugal compressors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Chillers are anticipated to account for 47.0% of the total revenue in the HVAC centrifugal compressors market by 2025, making them the dominant application segment. This leadership is being driven by rising demand for high-capacity cooling systems in commercial buildings, data centers, and process industries.

Centrifugal compressors are preferred in chillers for their high efficiency at full load, low maintenance requirements, and ability to handle large cooling loads with minimal energy consumption. Technological enhancements such as magnetic bearing systems, oil-free operation, and real-time performance analytics have further improved their adoption in mission-critical environments.

As urban infrastructure expands and building owners prioritize sustainability certifications and energy efficiency targets, centrifugal compressor-based chillers continue to be the system of choice for large-scale, reliable cooling solutions.

The demand for energy-efficient and high-performance heating, ventilation, and air conditioning (HVAC) systems is driving growth in the use of HVAC centrifugal compressors. These compressors are preferred for their efficiency, reliability, and low maintenance, particularly in large-scale applications. While challenges such as high initial costs and maintenance expenses persist, advancements like variable speed drives (VSD) and IoT-enabled predictive maintenance offer significant opportunities. The increasing construction of smart homes and green buildings, particularly in developing regions, is further fueling the adoption of HVAC centrifugal compressors.

The growing demand for energy-efficient and high-performance heating, ventilation, and air conditioning (HVAC) systems is driving the adoption of HVAC centrifugal compressors. As global energy consumption increases, both residential and commercial sectors are turning to energy-efficient solutions to lower operating costs and reduce environmental impact. HVAC centrifugal compressors are recognized for their efficiency, reliability, and low maintenance, making them ideal for this transition. Additionally, regulatory pressure to reduce carbon emissions is pushing industries to adopt more sustainable cooling systems, where HVAC centrifugal compressors are preferred for their ability to handle large capacities with lower energy consumption. The growing focus on green buildings and smart homes is further fueling the demand for advanced HVAC systems, accelerating the adoption of centrifugal compressors.

A significant challenge in adopting HVAC centrifugal compressors is the high initial cost associated with purchasing and installing these advanced systems. Compared to reciprocating compressors, HVAC centrifugal compressors tend to be more expensive, which can deter cost-sensitive customers from investing in them. Despite their energy efficiency, maintenance and repair costs can also be high, particularly for larger systems in commercial and industrial HVAC installations. The need for specialized technicians and quality spare parts further adds to operational expenses. Additionally, the time-consuming installation process for larger compressor systems can delay projects, creating obstacles for industries requiring faster, more cost-effective solutions.

Significant opportunities for HVAC centrifugal compressors driven by technological advancements aimed at improving energy efficiency and system performance. The development of advanced variable speed drive (VSD) systems allows these compressors to adjust according to demand, improving both efficiency and reliability. This innovation reduces energy consumption, particularly in systems with varying load conditions. The expansion of commercial and residential construction, especially in emerging markets, creates new opportunities for the adoption of HVAC systems incorporating centrifugal compressors. Additionally, the growing demand for eco-friendly solutions offers a promising avenue for market growth. The integration of IoT technologies for predictive maintenance and real-time monitoring is opening new doors for smarter, more efficient HVAC systems.

A key trend in the HVAC centrifugal compressors industry is the growing integration of IoT technology, which enables real-time monitoring and predictive maintenance of compressor systems. This trend ensures better performance, reduces downtime, and enhances operational efficiency by identifying potential issues before they escalate into costly repairs. Another trend is the increasing adoption of variable speed drives (VSD) that allow HVAC centrifugal compressors to adjust their speed based on real-time cooling demands, improving energy efficiency. These innovations are particularly beneficial for systems operating in environments with fluctuating load conditions, minimizing energy waste and operational costs. Additionally, the rise of smart homes and green buildings is driving demand for more advanced and energy-efficient HVAC solutions, which further boosts the adoption of HVAC centrifugal compressors.

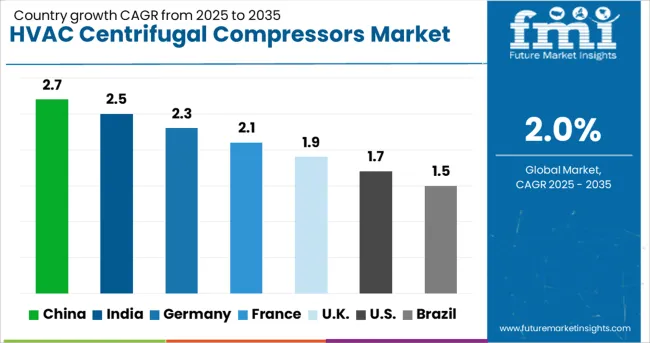

| Country | CAGR |

|---|---|

| China | 2.7% |

| India | 2.5% |

| Germany | 2.3% |

| France | 2.1% |

| UK | 1.9% |

| USA | 1.7% |

| Brazil | 1.5% |

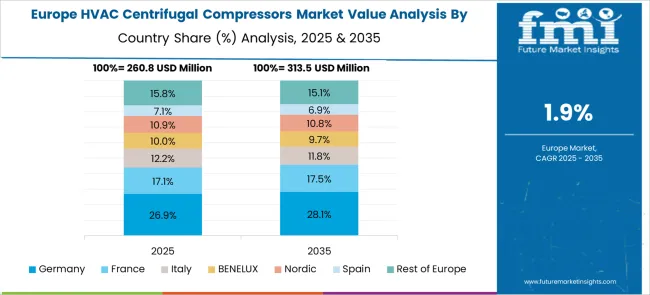

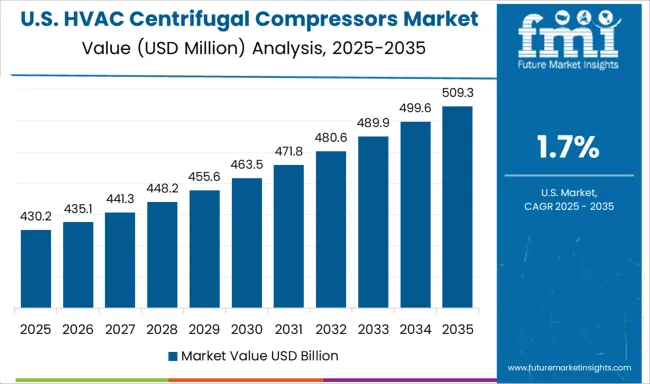

The HVAC centrifugal compressors market is projected to grow globally at a CAGR of 2.0% from 2025 to 2035. Among the top markets, China leads at 2.7%, followed by India at 2.5%, while Germany posts 2.3%, the United Kingdom records 1.9%, and the United States stands at 1.7%. These growth rates reflect stronger demand in emerging markets like China and India, driven by rapid urbanization, industrialization, and increased demand for HVAC systems in residential and commercial buildings. On the other hand, mature markets like the USA and the UK show steady growth, primarily fueled by the ongoing need for replacement and system upgrades. The analysis spans over 40 countries, with the leading markets detailed below.

China is expected to grow at a CAGR of 2.7% through 2035, supported by rapid urbanization and increasing industrialization. The country’s expanding manufacturing sector and growing commercial infrastructure are driving demand for advanced HVAC systems, including centrifugal compressors. As the demand for better cooling and air conditioning systems increases in cities, the HVAC sector continues to expand, particularly in commercial and industrial applications. Government policies promoting energy-efficient systems are encouraging the adoption of centrifugal compressors. The booming construction sector, along with the rise in the number of shopping malls, offices, and residential complexes, further fuels the demand for these compressors.

India is projected to grow at a CAGR of 2.5% through 2035, driven by expanding urban development, increased construction activities, and growing demand for residential and commercial HVAC systems. As the country experiences rapid urbanization and industrial growth, the need for HVAC systems, including centrifugal compressors, continues to rise. The growing demand for energy-efficient and cost-effective HVAC systems in residential, commercial, and industrial applications is contributing to market growth. Moreover, the increasing adoption of air conditioning systems in cities, coupled with government initiatives to improve infrastructure, is driving the demand for HVAC centrifugal compressors in India.

France is forecasted to grow at a CAGR of 4.9% through 2035, with adoption supported by advanced manufacturing ecosystems and stringent quality requirements in aerospace, pharmaceuticals, and specialty chemicals. Demand for ultra-high purity nitrogen gas is rising, creating opportunities for high-performance cryogenic ASUs. French equipment providers are integrating automation, digital monitoring, and energy recovery systems to meet industrial performance standards. Growth in healthcare infrastructure and packaged food industries further adds to demand for nitrogen-based preservation systems. Collaborations with research institutions are advancing membrane and hybrid separation technologies for niche applications.

Germany is projected to grow at a CAGR of 2.3% through 2035, with steady demand for HVAC centrifugal compressors driven by the country’s strong focus on energy efficiency and building modernization. As Germany continues to invest in upgrading its commercial and residential infrastructure, the demand for advanced HVAC systems is growing. In particular, centrifugal compressors are becoming increasingly popular in commercial buildings and industrial applications for their energy efficiency and cost-saving potential. Germany’s well-established manufacturing base and its focus on high-quality standards further boost the market for HVAC centrifugal compressors. The rise of smart building technologies is also increasing the adoption of these compressors.

The United States is expected to expand at a CAGR of 4.0% through 2035, led by applications in electronics manufacturing, chemical processing, and industrial gas distribution networks. Growing investments in semiconductor fabrication and data center cooling systems are amplifying demand for high-purity nitrogen. USA manufacturers are focusing on enhancing cryogenic system efficiency, implementing heat integration and advanced control systems for improved energy performance. Long-term supply agreements between industrial gas companies and manufacturing enterprises are shaping stable revenue streams. Strategic developments in digital twin technology for ASU operations are further improving predictive maintenance and process optimization.

The HVAC centrifugal compressors market is characterized by key players providing high-efficiency, durable, and energy-saving compressors used in air conditioning, refrigeration, and industrial applications. Atlas Copco leads the market with its wide range of centrifugal compressors designed for both small-scale and industrial HVAC applications, emphasizing low energy consumption and high reliability. Ingersoll Rand offers advanced centrifugal compressors known for their performance in large-scale HVAC systems, focusing on energy efficiency and integration with IoT for smart building solutions.

Hitachi and Mitsubishi Heavy Industries are major players in the Asia-Pacific region, offering compressors that cater to both residential and commercial sectors, with a focus on high-performance and environmentally friendly refrigerants. Danfoss specializes in centrifugal compressors with variable-speed drives, enabling precise control and reduced energy consumption for commercial HVAC systems.

SKF is a key player providing high-quality bearings and other components critical for centrifugal compressors, ensuring enhanced efficiency and operational lifespan. Celeroton focuses on developing high-speed centrifugal compressors for advanced HVAC applications in clean rooms, data centers, and medical environments.

Howden Group delivers a variety of compressor models designed for critical HVAC, industrial refrigeration, and energy applications, emphasizing customization and robust performance under high loads. GFA Compressors and Elliott Group serve niche markets with specialized centrifugal compressors for industrial and utility-scale applications, offering solutions for harsh environments and high-pressure systems. Barriers to entry include high capital investment in manufacturing, technological expertise in fluid dynamics, and strict regulatory compliance for refrigerant management.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Application | Chillers, Industrial, Commercial, and Heat pumps |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco, Hitachi, Danfoss, Mitsubishi Heavy Industries, SKF, Celeroton, Howden Group, Ingersoll Rand, GFA Compressors, and Elliott Group |

| Additional Attributes | Dollar sales by compressor type (oil-free, oil-injected) and end-use segments (residential HVAC, commercial HVAC, industrial refrigeration, district cooling). Demand dynamics across energy efficiency demands, environmental regulations, and adoption of eco-friendly refrigerants in commercial and industrial cooling systems. Regional trends in North America and Europe show strong growth driven by regulatory requirements for energy-efficient systems, while Asia-Pacific is expanding rapidly due to increased industrialization and urbanization. |

The global HVAC centrifugal compressors market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the HVAC centrifugal compressors market is projected to reach USD 1.3 billion by 2035.

The HVAC centrifugal compressors market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in HVAC centrifugal compressors market are chillers, industrial, commercial and heat pumps.

In terms of , segment to command 0.0% share in the HVAC centrifugal compressors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC UV Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Centrifugal Casting Alloy Powder Market Size and Share Forecast Outlook 2025 to 2035

HVAC Coil Coating Market Size and Share Forecast Outlook 2025 to 2035

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

Centrifugal Pumps Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Centrifugal Blood Pump Market – Trends & Forecast 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

Centrifugal Separator Market Segmentation based on Product Type, End Use and Region: A Forecast for 2025 and 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Compressors and Vacuum Pumps Market Growth - Trends & Forecast 2025 to 2035

African Centrifugal Pump Market Growth 2024-2034

UK Centrifugal Pumps Market Analysis – Size, Share & Trends 2025-2035

USA Centrifugal Pumps Market Insights – Size, Trends & Forecast 2025-2035

Smart HVAC Controls Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA