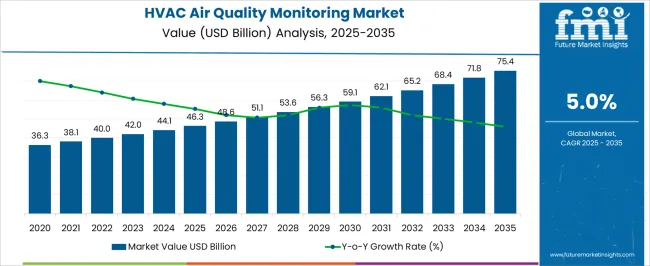

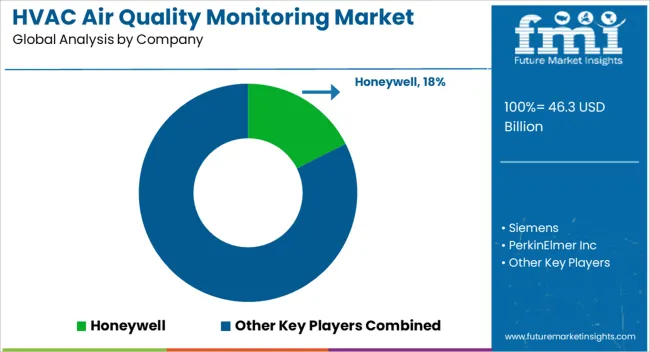

The HVAC air quality monitoring market is estimated to be valued at USD 46.3 billion in 2025 and is projected to reach USD 75.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The year-on-year (YoY) growth analysis of the HVAC air quality monitoring market indicates a steady and consistent upward trend, with market value projected to rise from USD 46.3 billion in 2025 to USD 75.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5%. Early-stage growth is expected to move from USD 46.3 billion in 2025 to USD 48.6 billion in 2026, reaching USD 51.1 billion by 2027.

This progression reflects the increasing adoption of HVAC monitoring systems across commercial, residential, and industrial spaces, where accurate air quality control, regulatory compliance, and operational efficiency are becoming critical considerations for building managers and facility operators. By 2035, the market is projected to reach USD 75.4 billion, highlighting the expanding reliance on advanced air quality monitoring solutions to ensure healthy, safe, and optimized indoor environments. The YoY growth pattern underscores the rising demand for precise, reliable, and durable monitoring systems capable of detecting pollutants, managing airflow, and improving energy utilization.

Market participants providing high-performance sensors, analytics platforms, and integrated solutions are likely to benefit from this steady expansion. The trend suggests that HVAC air quality monitoring will continue to be a critical factor in operational management, offering strong opportunities for suppliers who address the evolving needs of building operators and industrial users.

| Metric | Value |

|---|---|

| HVAC Air Quality Monitoring Market Estimated Value in (2025 E) | USD 46.3 billion |

| HVAC Air Quality Monitoring Market Forecast Value in (2035 F) | USD 75.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The HVAC air quality monitoring market is a specialized segment within the broader HVAC systems market, where it holds approximately 4-5% share, driven by the need for healthier indoor environments and regulatory compliance in commercial and residential spaces. Within the building automation and smart building market, air quality monitoring accounts for about 3-4% share, as these systems integrate sensors, controls, and analytics to optimize ventilation, energy efficiency, and occupant comfort. In the indoor air quality solutions market, HVAC air quality monitoring represents roughly 5-6% share, reflecting its critical role in detecting pollutants, controlling particulate matter, and maintaining optimal humidity and CO₂ levels.

The commercial and residential construction market contributes around 2-3% share, where incorporation of air quality monitoring solutions is increasingly being mandated in new buildings to ensure compliance with green building standards and improve occupant well-being. In the environmental monitoring equipment market, the share of HVAC air quality monitoring is close to 3%, as it forms a specialized application within broader environmental sensing technologies for commercial, industrial, and public spaces.

The HVAC air quality monitoring market is advancing rapidly, driven by increasing awareness of indoor air quality, stringent regulations on pollutant control, and demand for healthier work and living environments. Building automation systems and integration of IoT-enabled sensors have enhanced real-time monitoring and maintenance efficiency.

The push toward sustainable buildings, combined with heightened concern over airborne chemical exposure in enclosed spaces, is propelling investment in advanced air quality solutions. With commercial, residential, and industrial facilities prioritizing safety and energy efficiency, HVAC air quality monitoring systems are becoming a central part of building infrastructure.

Growing health-consciousness post-COVID and smart city initiatives globally continue to stimulate adoption.

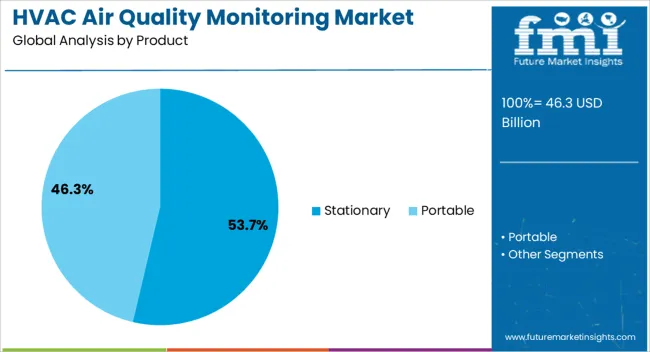

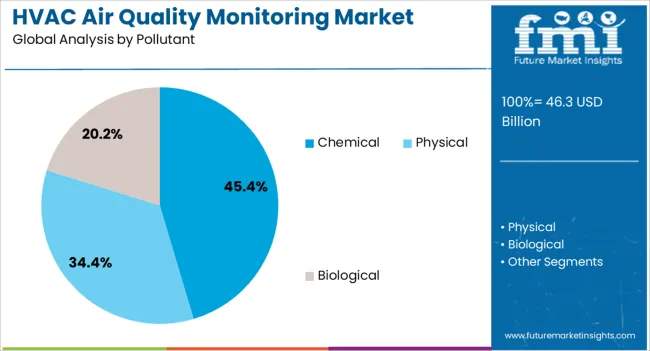

The HVAC air quality monitoring market is segmented by product, pollutant, application, and geographic regions. By product, the HVAC air quality monitoring market is divided into Stationary and Portable. In terms of pollutants, the HVAC air quality monitoring market is classified into Chemical, Physical, and Biological.

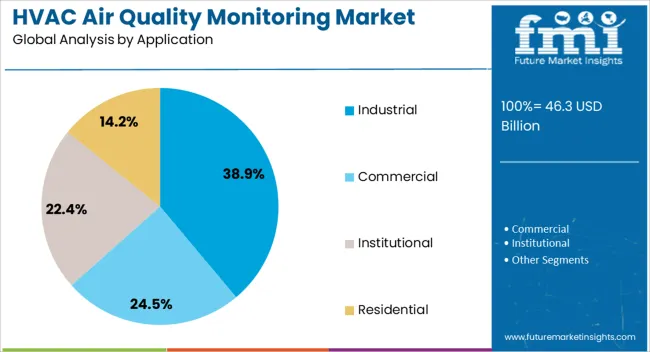

Based on application, the HVAC air quality monitoring market is segmented into Industrial, Commercial, Institutional, and Residential. Regionally, the HVAC air quality monitoring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stationary segment leads the product category with a 53.70% share in 2025, owing to its precision, reliability, and suitability for fixed installations across commercial and industrial spaces. Stationary monitors enable continuous air quality assessment and seamless integration with HVAC systems, allowing for automated ventilation adjustments and improved energy management.

Their deployment in high-occupancy buildings and industrial facilities supports regulatory compliance and occupational health.

Additionally, technological advancements in sensor miniaturization and multi-pollutant detection have enhanced the functionality and cost-efficiency of stationary systems, ensuring consistent market demand across both new construction and retrofitting projects.

Chemical pollutants are expected to dominate with a 45.40% market share in 2025, primarily due to growing concerns over volatile organic compounds (VOCs), formaldehyde, and other harmful gases. As regulatory authorities tighten permissible exposure limits in industrial and indoor environments, demand for specialized HVAC monitoring targeting chemical pollutants is increasing.

Building managers and industrial operators are prioritizing chemical detection to ensure occupant safety, product integrity, and compliance with air quality mandates.

Enhanced sensor technologies that can accurately detect low concentrations of complex chemicals are further propelling adoption in sensitive applications like laboratories, cleanrooms, and manufacturing plants.

The industrial application segment accounts for 38.90% of the market in 2025, making it the leading application area for HVAC air quality monitoring. Industrial environments often face high pollutant concentrations from chemical processes, combustion activities, and particulate emissions, necessitating robust monitoring and ventilation solutions.

HVAC-integrated air quality systems ensure compliance with workplace safety norms while maintaining operational efficiency and reducing downtime.

The growth of sectors such as pharmaceuticals, food processing, and electronics manufacturing, all of which demand controlled environments, is contributing significantly to the uptake of advanced HVAC monitoring solutions across industrial sites.

The HVAC air quality monitoring market is expanding due to growing health awareness and regulatory compliance requirements. Opportunities exist in smart, connected, and IoT-enabled solutions, while trends highlight data-driven predictive air management. High costs and integration complexities remain challenges. Overall, the market outlook is positive, driven by demand for healthier indoor environments, real-time monitoring, and energy-efficient HVAC systems across residential, commercial, and industrial facilities worldwide.

The HVAC air quality monitoring market is experiencing growth due to increasing awareness of indoor air quality in commercial, residential, and healthcare environments. Businesses, schools, hospitals, and office complexes are prioritizing air quality to enhance occupant health, productivity, and comfort. Regulatory requirements and workplace safety standards are compelling the integration of monitoring systems into heating, ventilation, and air conditioning infrastructure. Additionally, concerns about airborne pollutants, allergens, and pathogen transmission have accelerated the adoption of advanced air quality sensors and continuous monitoring solutions.

Significant opportunities are emerging from the development of smart, IoT-enabled air quality monitoring systems. Integration with building management systems allows real-time data collection, predictive maintenance, and automated ventilation adjustments. Advanced sensors capable of detecting VOCs, particulate matter, CO₂, and humidity levels provide actionable insights to optimize energy consumption and indoor comfort. Commercial buildings, smart homes, and industrial facilities increasingly demand scalable, connected solutions, creating avenues for manufacturers to provide value-added services, analytics platforms, and subscription-based monitoring offerings.

A key trend in the market is the shift toward data-driven, predictive HVAC air quality management. Analytics platforms aggregate sensor data to forecast potential issues, optimize filter replacement schedules, and detect contaminant spikes. AI and machine learning are being applied to improve system efficiency and reduce operational costs. Regulatory pushes for energy efficiency and indoor environmental quality standards also influence the trend toward smart, integrated solutions. Demand is growing for solutions that combine real-time monitoring with actionable insights, creating a holistic approach to air quality management.

Despite market growth, high upfront costs for advanced monitoring systems pose adoption challenges, particularly in small and medium-sized enterprises. Integration with existing HVAC infrastructure can be complex, requiring technical expertise and customization. Variability in sensor accuracy, maintenance requirements, and compatibility with diverse building systems also complicates deployment. Additionally, stringent data security requirements for connected systems necessitate secure communication protocols. Manufacturers must focus on cost-effective, plug-and-play solutions and reliable support services to address these challenges and ensure wider market adoption.

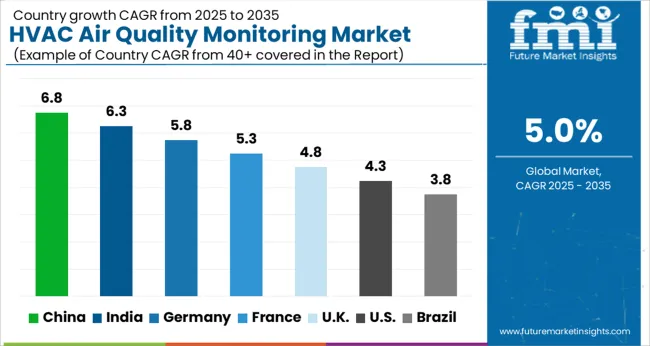

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global HVAC air quality monitoring market is projected to grow at a CAGR of 5% from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3% and Germany at 5.8%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. Expansion is supported by increasing demand for indoor air quality management, rising adoption of smart HVAC systems, and regulatory emphasis on workplace and residential air safety. Emerging markets like China and India are experiencing rapid urban infrastructure growth, driving monitoring system adoption, while developed markets like the USA, UK, and Germany focus on upgrading legacy systems and integrating advanced sensor technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The HVAC air quality monitoring market in China is growing at 6.8% CAGR, the highest among leading nations. Growth is driven by urbanization, large-scale commercial and residential projects, and increasing awareness of indoor air safety. Adoption of smart HVAC systems integrated with air quality sensors is accelerating. Manufacturers are introducing high-accuracy, real-time monitoring solutions for CO2, VOCs, PM2.5, and temperature control. Government incentives supporting healthy buildings and energy-efficient infrastructure further boost adoption.

The HVAC air quality monitoring market in India is advancing at 6.3% CAGR, supported by increasing commercial and residential developments. Rising awareness of indoor air pollution and its impact on health is accelerating adoption. Manufacturers are supplying cost-effective, real-time monitoring systems suitable for offices, hospitals, and industrial facilities. Integration with smart building management systems enhances efficiency and control. Rapid industrial growth and urban population expansion further contribute to market growth.

The HVAC air quality monitoring market in Germany is growing at 5.8% CAGR, supported by regulatory standards for energy-efficient and safe indoor environments. Adoption of real-time sensors and IoT-enabled HVAC systems is increasing across commercial, healthcare, and industrial sectors. Retrofit projects and modernization of legacy HVAC systems contribute to steady growth. Manufacturers are focusing on high-precision, low-maintenance solutions that comply with European safety and environmental standards.

The HVAC air quality monitoring market in the United Kingdom is expanding at 4.8% CAGR, influenced by commercial, healthcare, and residential requirements for safe indoor environments. Adoption of high-accuracy sensors for VOCs, CO2, and particulate matter is increasing. Energy-efficient HVAC systems integrated with monitoring solutions are gaining traction. Retrofit and infrastructure upgrade projects further drive demand. Market growth is supported by government regulations on indoor air quality and workplace safety.

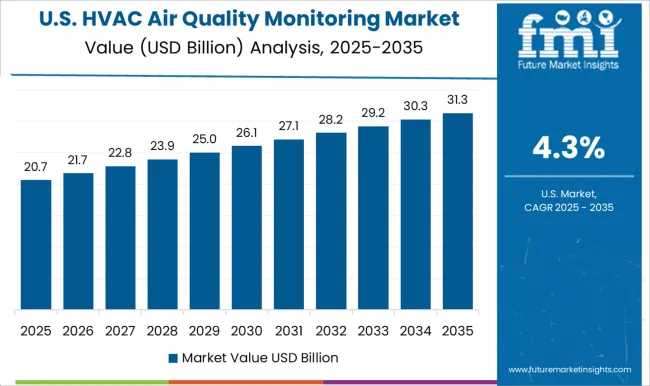

The HVAC air quality monitoring market in the United States is growing at 4.3% CAGR, the slowest among leading nations. Growth is supported by increasing adoption of smart HVAC systems in commercial and residential buildings. Retrofit projects, particularly in older offices and industrial facilities, contribute to steady demand. High-precision, low-maintenance sensors for CO2, VOCs, and particulate matter are widely adopted. Federal and state initiatives for energy efficiency and workplace safety reinforce the market.

Leading suppliers in the HVAC air quality monitoring market, such as Honeywell, Siemens, and Emerson Electric Co., are competing by offering systems that ensure accurate detection of pollutants, temperature, and humidity in commercial and industrial buildings. Honeywell emphasizes integrated monitoring solutions with real-time alerts and remote management, presenting brochures that highlight improved indoor air quality and energy efficiency. Siemens focuses on smart sensing and building automation compatibility, promoting scalable systems that optimize ventilation and reduce operational costs. Emerson Electric Co. targets industrial and large-scale commercial facilities, marketing robust air quality sensors that maintain compliance with safety standards and regulatory requirements.

Other notable players, including PerkinElmer Inc., Teledyne Technologies, Thermo Fisher, and Agilent, differentiate through high-precision analytical instruments and data-driven monitoring solutions. PerkinElmer and Thermo Fisher highlight advanced particulate and gas detection technologies suitable for laboratories and high-risk environments. Teledyne Technologies emphasizes compact, durable sensors for continuous monitoring, while Agilent markets user-friendly systems that integrate easily with existing HVAC networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 46.3 Billion |

| Product | Stationary and Portable |

| Pollutant | Chemical, Physical, and Biological |

| Application | Industrial, Commercial, Institutional, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell, Siemens, PerkinElmer Inc, Teledyne Technologies, Thermo Fisher, Emerson Electric Co., and Agilent |

| Additional Attributes | Dollar sales by device type (sensors, controllers, monitors) and application (residential, commercial, industrial) are key metrics. Trends include increasing demand for smart, real-time air quality monitoring, integration with HVAC systems, and focus on indoor environmental health. Regional adoption, technological advancements, and regulatory standards are driving market growth. |

The global HVAC air quality monitoring market is estimated to be valued at USD 46.3 billion in 2025.

The market size for the HVAC air quality monitoring market is projected to reach USD 75.4 billion by 2035.

The HVAC air quality monitoring market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in HVAC air quality monitoring market are stationary, portable, pm sensor and other.

In terms of pollutant, chemical segment to command 45.4% share in the HVAC air quality monitoring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Smart HVAC Controls Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Global HVAC Filter Market

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive HVAC Ducts Market Growth - Trends & Forecast 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA