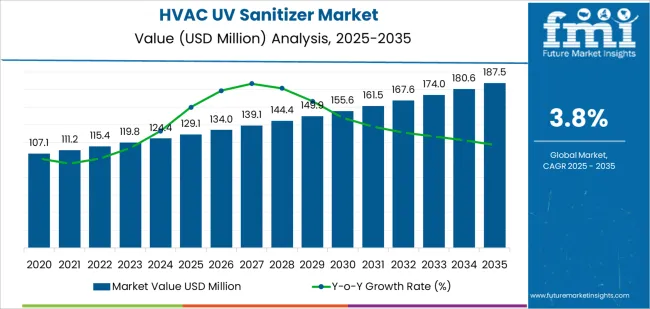

The global HVAC UV sanitizer market, valued at USD 129.1 million in 2025, is projected to reach USD 187.5 million by 2035, growing at a CAGR of 3.8%. This expansion represents a 45.2% increase in market size, supported by heightened awareness of indoor air quality, post-pandemic health consciousness, and regulatory focus on pathogen control in buildings. UV-C germicidal irradiation systems are increasingly adopted across residential, commercial, and healthcare facilities to neutralize airborne microorganisms without relying on chemical agents or filter media.

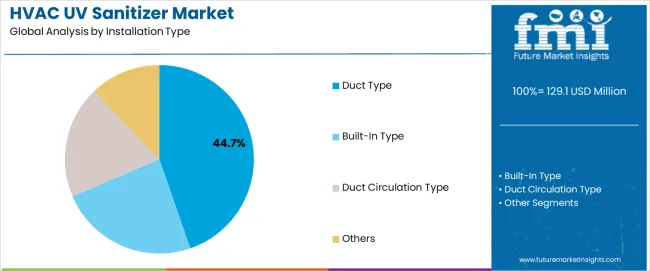

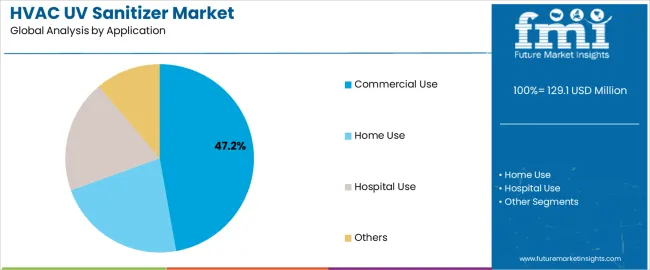

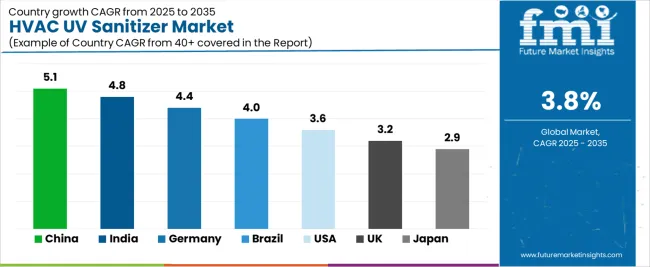

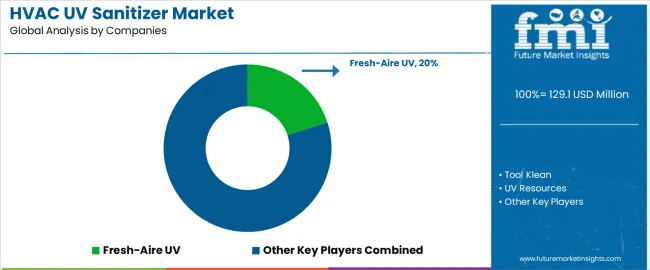

Duct-type installations dominate with 44.7% share due to retrofit flexibility, while commercial use applications lead at 47.2%, driven by adoption in offices, hotels, and educational institutions emphasizing occupant health and safety. Key growth regions include China, India, Germany, Brazil, and the United States, with China leading through policy support for air quality and building modernization. Innovation trends center on energy-efficient UV-C lamp technologies, IoT-enabled monitoring, and integration with HVAC automation systems enhancing operational control and maintenance efficiency. Major players such as Fresh-Aire UV, Tool Klean, and UV Resources maintain leadership through validated performance, installation ease, and contractor partnerships.

Regulatory attention to indoor air quality standards in commercial buildings, healthcare facilities, and educational institutions is creating sustained demand for technologies that reduce disease transmission risks and improve occupant health outcomes. The market is characterized by convergence of HVAC engineering, photobiology, and building automation technologies, with manufacturers developing integrated solutions that combine UV sanitization with real-time air quality monitoring, automated intensity control, and maintenance alerting systems that ensure optimal performance while extending lamp life and reducing operational intervention requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 129.1 million |

| Market Forecast Value (2035) | USD 187.5 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

| HEALTH & AIR QUALITY AWARENESS | TECHNOLOGY & INFRASTRUCTURE EVOLUTION | REGULATORY & BUILDING STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Installation Type | Duct Type, Built-In Type, Duct Circulation Type, Others |

| By Application | Home Use, Commercial Use, Hospital Use, Others |

| By Region | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Duct Type |

|

| Built-In Type |

|

| Duct Circulation Type |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Commercial Use |

|

| Home Use |

|

| Hospital Use |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Region | Market Value 2025 (USD Million) | Market Value 2035 (USD Million) | CAGR (2025-2035) |

|---|---|---|---|

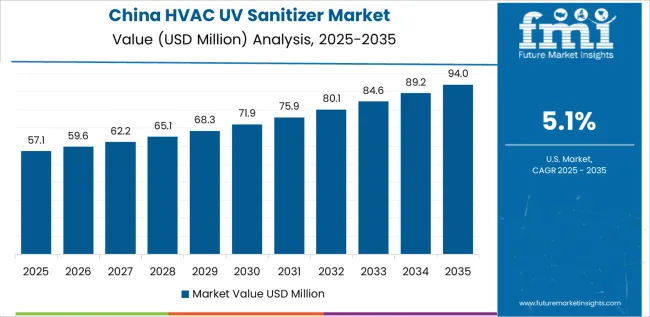

| China | 48.2 | 111.2 | 5.1% |

| India | 3.9 | 7.1 | 4.8% |

| Germany | 107.1 | 149.9 | 4.4% |

| Brazil | 115.4 | 161.5 | 4% |

| United States | 119.8 | 167.6 | 3.6% |

| United Kingdom | 124.4 | 174 | 3.2% |

| Japan | 134 | 180.6 | 2.9% |

Revenue from HVAC UV sanitizers in China is projected to reach USD 111.2 million by 2035, driven by increasing indoor air quality awareness and government initiatives addressing air pollution creating substantial demand for advanced air treatment technologies in residential and commercial buildings. The country's rapid urbanization and growing middle class are generating demand for healthier indoor environments with HVAC UV sanitization positioned as premium upgrade for new construction and existing buildings. National emphasis on public health following pandemic experiences is sustaining interest in technologies that reduce airborne pathogen transmission in schools, offices, and public facilities. Commercial real estate developers are incorporating UV sanitization in premium office buildings and shopping centers as marketing differentiators and tenant amenities. Healthcare facility expansion and modernization programs include UV air treatment as standard infection control measures. Domestic manufacturers are developing cost-competitive UV sanitizer solutions tailored to Chinese HVAC systems and market preferences including integration with local building automation platforms. Technical considerations include adaptation to high-occupancy buildings common in Chinese cities and compatibility with district heating and cooling systems. Growing awareness among building owners and facility managers regarding maintenance cost reductions through mold prevention and HVAC system cleanliness is supporting adoption beyond pandemic-driven health concerns.

Revenue from HVAC UV sanitizers in India is expanding to reach USD 7.1 million by 2035, supported by growing awareness of indoor air quality and increasing adoption in premium commercial buildings creating emerging market opportunities. The country's expanding healthcare infrastructure and construction of modern hospitals are driving adoption in medical facilities where infection control justifies technology investments. Commercial office development in technology parks and business districts includes UV sanitization in premium buildings targeting multinational corporations and quality-conscious tenants. Growing middle class and increasing disposable incomes are creating nascent residential market for whole-house air quality solutions. Market development requires education regarding UV sanitization benefits, proper installation practices, and ongoing maintenance requirements. Price sensitivity remains significant with emphasis on demonstrating cost-effectiveness and measurable health benefits. Climate considerations including high temperatures and humidity affecting mold growth create natural fit for UV technology preventing biological contamination in HVAC systems. Distribution challenges include building contractor awareness, availability of quality products, and technical support infrastructure for installation and service.

Demand for HVAC UV sanitizers in Germany is projected to reach USD 149.9 million by 2035, supported by stringent building standards and comprehensive focus on indoor environmental quality creating sustained demand for validated air treatment technologies. German building regulations emphasize ventilation effectiveness and indoor air quality with growing recognition of UV sanitization as complementary technology to filtration and ventilation strategies. The market is characterized by emphasis on product certification, performance validation, and compliance with VDI guidelines and DIN standards. German facility managers and building engineers prioritize documented effectiveness, energy efficiency, and integration with building automation systems. Healthcare sector maintains established UV sanitization adoption with hospitals and medical facilities implementing comprehensive infection control strategies including air treatment. Commercial building market grows steadily with office buildings, schools, and public facilities implementing UV systems as part of indoor air quality improvement programs. Residential market remains limited but growing with awareness among environmentally conscious homeowners seeking comprehensive indoor environmental solutions. Technical preferences include preference for systems with validated germicidal effectiveness, low energy consumption, and minimal maintenance requirements.

Revenue from HVAC UV sanitizers in Brazil is growing to reach USD 161.5 million by 2035, driven by commercial building development and increasing health awareness creating opportunities for air treatment technologies in metropolitan centers. The country's expanding healthcare infrastructure includes UV sanitization adoption in private hospitals and medical facilities emphasizing infection control and patient safety. Commercial office buildings in São Paulo, Rio de Janeiro, and other major cities are implementing UV systems as tenant amenities and health-focused building features. Growing awareness of mold issues in humid climates creates natural application for UV technology preventing biological growth in HVAC systems. Market development supported by international building consultants and multinational corporations bringing air quality standards from global headquarters to Brazilian facilities. Technical considerations include adaptation to tropical climate conditions, compatibility with local HVAC equipment, and electrical infrastructure. Economic factors influence adoption patterns with emphasis on systems demonstrating clear return on investment through reduced maintenance costs, improved tenant satisfaction, and energy efficiency. Distribution challenges include building contractor education, product availability, and technical support infrastructure.

Revenue from HVAC UV sanitizers in United States is projected to reach USD 167.6 million by 2035, supported by mature HVAC industry and established awareness of UV air treatment creating sustained demand across residential, commercial, and healthcare applications. The country's healthcare sector maintains strong UV sanitization adoption with hospitals, surgery centers, and medical facilities implementing comprehensive air quality strategies including germicidal UV systems. Commercial building market demonstrates steady growth with office buildings, schools, and retail facilities implementing UV systems for occupant health and liability reduction. Residential market expands through contractor sales channels with HVAC service providers offering UV sanitization as system upgrades during maintenance visits and equipment replacements. Industry associations including ASHRAE provide technical guidance and standards supporting proper UV system design and installation. Product availability through distribution networks serving HVAC contractors ensures broad market access. Consumer awareness built through pandemic experiences sustains interest in air quality technologies. Technical innovation includes smart controls, monitoring systems, and integration with building automation platforms. Regulatory environment supports voluntary adoption through building codes recognizing UV as accepted air treatment technology without mandating specific applications.

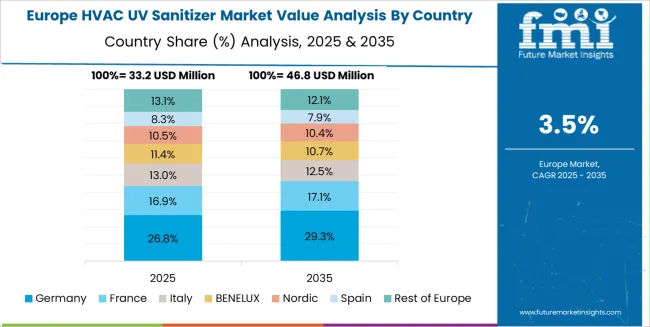

The HVAC UV sanitizer market in Europe is projected to grow from USD 118.4 million in 2025 to USD 162.8 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 36.8% market share in 2025, projected to expand to 37.4% by 2035, supported by stringent building standards and comprehensive indoor air quality focus across commercial and healthcare facilities. The United Kingdom follows with a 28.3% share in 2025, anticipated to reach 28.7% by 2035, driven by healthcare facility investments and commercial building air quality improvements. France holds a 17.9% share, while Netherlands accounts for 11.2% in 2025, reflecting active building performance programs and healthcare facility modernization. The Rest of Europe region is projected to maintain approximately 5.8% collectively through 2035, with Nordic countries, Belgium, and Southern European nations implementing UV sanitization in healthcare facilities and premium commercial buildings as indoor air quality awareness expands.

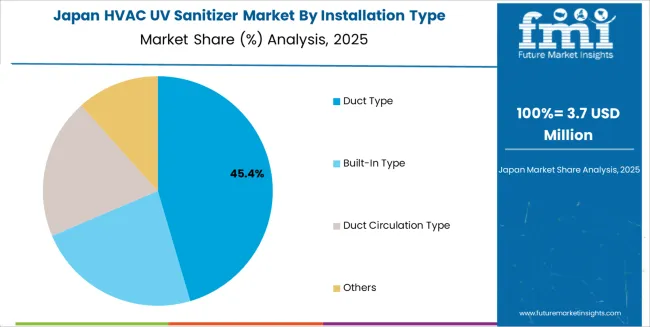

Japanese HVAC UV sanitizer operations reflect the country's emphasis on product reliability and comprehensive validation. Building standards and healthcare regulations establish performance requirements for air treatment technologies with preference for systems demonstrating verified germicidal effectiveness. Japanese consumers and facility managers prioritize long-term reliability, energy efficiency, and minimal maintenance requirements when selecting UV sanitization systems. The market demonstrates unique requirements for compact designs suitable for space-constrained Japanese buildings and integration with sophisticated building automation systems common in commercial facilities. Healthcare sector maintains established UV adoption with hospitals implementing comprehensive infection control measures including air treatment technologies. Commercial building market grows gradually with office buildings in major cities implementing air quality improvements responding to tenant demands and competitive positioning. Technical preferences include preference for silent operation important in noise-sensitive Japanese environments, aesthetic integration with building interiors, and compatibility with local HVAC equipment and electrical standards. Distribution channels emphasize building equipment suppliers, specialized HVAC contractors, and facility management companies providing ongoing service and maintenance. Market maturity creates stable demand patterns with emphasis on proven technologies over experimental approaches.

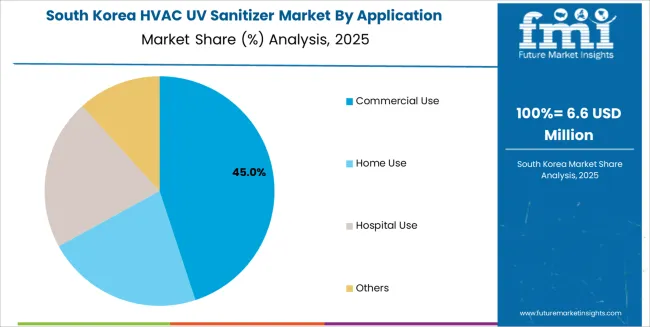

South Korean HVAC UV sanitizer operations reflect the country's technology adoption and government initiatives promoting healthy buildings. Healthcare facility standards require comprehensive infection control measures with UV air treatment recognized as effective supplemental technology. Commercial building market demonstrates strong growth with developers implementing air quality features in premium office buildings and mixed-use developments. Government programs promoting green buildings and indoor environmental quality create favorable environment for UV sanitization adoption. Major building management companies and facility service providers maintain technical expertise in UV system installation and maintenance. Technical preferences emphasize integration with building automation systems, remote monitoring capabilities, and data analytics for performance verification. Market characteristics include preference for systems from established international brands, willingness to invest in validated technologies, and expectations for comprehensive technical support. Residential market remains limited but growing with high-end apartments and single-family homes in affluent areas implementing whole-house air quality solutions. Distribution challenges include building HVAC contractor awareness and availability of trained installation technicians. Research institutions and universities conduct studies on UV effectiveness and optimal system configurations supporting market development through technical validation.

The HVAC UV sanitizer market demonstrates concentration among specialized UV technology companies and HVAC equipment manufacturers. Profit focus centers on systems demonstrating validated germicidal effectiveness, ease of installation, and long-term reliability with sustainable lamp replacement revenue. Value migration favors companies offering comprehensive solutions including installation support, performance monitoring, and documented effectiveness validation. Several competitive archetypes define market dynamics: specialized UV technology companies focusing exclusively on germicidal UV applications with deep photobiology expertise; HVAC equipment manufacturers incorporating UV as accessory products complementing core equipment lines; indoor air quality specialists offering UV as component of comprehensive air treatment portfolios; and regional distributors providing localized installation and service support. Market differentiation centers on germicidal effectiveness validation, lamp longevity and replacement costs, installation flexibility across diverse HVAC configurations, and integration capabilities with building automation systems. Switching costs remain moderate with primary barriers including installation effort for retrofit applications and contractor familiarity with specific product lines.

Competition intensifies around ease of installation and contractor support recognizing that HVAC technician recommendations significantly influence product selection. Distribution strategy proves critical with successful companies maintaining strong relationships with HVAC distributors, mechanical contractors, and facility management companies. Technical credibility established through third-party testing, peer-reviewed research, and case study documentation demonstrating measurable air quality improvements and pathogen reduction. Healthcare market segment emphasizes infection control validation and compliance with facility standards creating opportunities for companies with medical device experience and regulatory expertise. Residential market growth requires consumer education and contractor incentives given limited homeowner awareness of UV sanitization benefits. Innovation focus includes developing more efficient UV-C sources including LED technology offering longer life and lower energy consumption, implementing smart controls optimizing operation based on occupancy and air quality conditions, and creating monitoring systems providing performance verification and maintenance alerts. Market consolidation occurs through acquisitions of specialized UV companies by larger HVAC manufacturers seeking to expand air quality product portfolios and capitalize on sustained indoor air quality emphasis.

| Items | Values |

|---|---|

| Quantitative Units | USD 129.1 million |

| Installation Type | Duct Type, Built-In Type, Duct Circulation Type, Others |

| Application | Home Use, Commercial Use, Hospital Use, Others |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Key Companies Profiled | Fresh-Aire UV, Tool Klean, UV Resources, Lumalier, UVDI, Sanuvox Technologies, Ultravation, BioShield, sterilAir AG, Unike Technology, Reiner Group, American Air & Water, Guangzhou Tofee Electro-Mechanical Equipment |

| Additional Attributes | Dollar sales by installation type and application, regional demand across key markets, competitive landscape, UV technology adoption patterns, HVAC system integration, and building automation development driving indoor air quality improvement, pathogen reduction, and healthy building initiatives |

The global HVAC uv sanitizer market is estimated to be valued at USD 129.1 million in 2025.

The market size for the HVAC uv sanitizer market is projected to reach USD 187.5 million by 2035.

The HVAC uv sanitizer market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in HVAC uv sanitizer market are duct type, built-in type, duct circulation type and others.

In terms of application, commercial use segment to command 47.2% share in the HVAC uv sanitizer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC Coil Coating Market Size and Share Forecast Outlook 2025 to 2035

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Smart HVAC Controls Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Global HVAC Filter Market

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive HVAC Ducts Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

UV-C Sterilizing Conveyors Market Analysis - Size and Share Forecast Outlook 2025 to 2035

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA