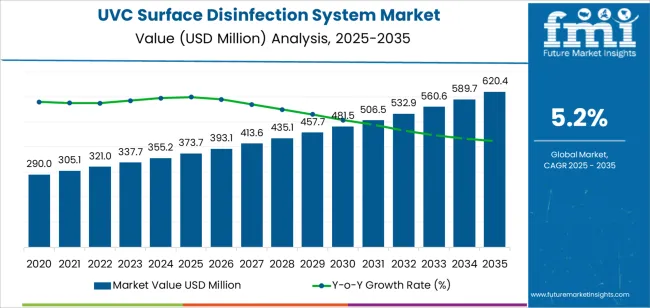

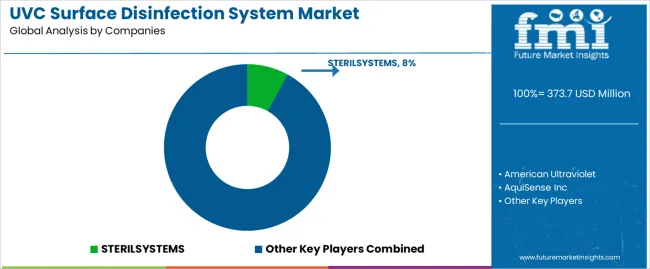

The global UVC surface disinfection system market is valued at USD 373.7 million in 2025 and is projected to reach USD 620.4 million by 2035, marking a CAGR of 5.2%. This growth creates an absolute dollar opportunity of USD 246.7 million over the forecast period. Rolling CAGR analysis indicates a stable upward path shaped by continued demand for surface-level microbial control across laboratories, hospitals, commercial buildings, and high-traffic public settings.

UVC surface disinfection systems are designed to inactivate microorganisms on exposed surfaces through controlled ultraviolet irradiation. Current equipment development focuses on improved lamp efficiency, expanded coverage areas, and tighter control of exposure cycles. Many units now incorporate motion sensors, automated shutoff mechanisms, and monitoring modules that log irradiation time and lamp status. These advancements support consistent performance while reducing operator involvement.

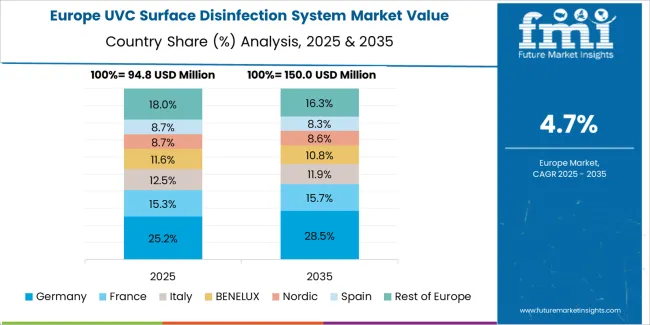

North America and Europe remain major markets due to established hygiene protocols and ongoing upgrading of healthcare and laboratory infrastructure. Asia Pacific continues to grow as adoption of automated disinfection tools expands across medical, education, and transportation sectors. By 2035, improvements in lamp longevity, optical design, and system integration are expected to support continued gains in operational reliability and broader application of UVC surface disinfection technologies.

Between 2025 and 2030, the UVC Surface Disinfection System Market is projected to rise from USD 373.7 million to USD 481.5 million, with global unit deployment increasing from approximately 393.1 thousand units to 481.5 thousand units. The growth volatility index (GVI) for this period is 1.1, indicating a steady acceleration phase driven by increased adoption of automated disinfection platforms across hospitals, laboratories, food-processing plants, logistics hubs, and commercial facilities. Demand is shaped by performance factors including UVC output levels in the 2-6 W/cm² range, system cycle times below 5-10 minutes, wavelength accuracy near 254 nm, and verified log-reduction performance for surface pathogens. Robotic mobile disinfection units, conveyor-based sterilization modules, and fixed-installation high-intensity emitters are gaining traction, particularly in markets prioritizing repeatable and validated decontamination standards. North America, Europe, and East Asia will collectively contribute more than 60 % of incremental demand through expanded facility hygiene modernization.

From 2030 to 2035, the market is expected to advance from USD 481.5 million to USD 620.4 million, with annual installations reaching approximately 589.7-620.4 thousand units. The GVI moderates to 0.9, reflecting mild deceleration as purchasing cycles shift toward replacements and upgrades rather than first-time deployments. Growth during this phase will be driven by improved high-output UVC LED modules with lifetimes above 15,000 hours, enhanced reflector geometries providing higher uniformity of irradiance, and sensor-integrated systems capable of automated dosage verification. Production expansion across South Asia and Eastern Europe is expected to add 10-12 % to global supply capacity by 2035, supporting adoption across healthcare, industrial hygiene, and commercial cleaning segments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 373.7 million |

| Market Forecast Value (2035) | USD 620.4 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

Demand for UVC surface disinfection systems is rising as organizations strengthen protocols to limit pathogen transmission across high-touch areas. These systems use ultraviolet-C irradiation to deactivate viruses, bacteria, and spores on surfaces without chemical residues, supporting rapid turnaround in clinical rooms, laboratories, food-processing areas, and transportation assets. Facilities adopt mobile carts, enclosed chambers, and fixed installations to achieve consistent coverage in settings where manual disinfection can leave gaps. Manufacturers refine lamp stability, optical reflectivity, and safety interlocks to maintain germicidal output while preventing operator exposure. Hospitals integrate UVC systems alongside existing infection-control routines to reduce environmental contamination, support accreditation requirements, and improve cleaning reproducibility during high-occupancy periods.

Market expansion also reflects growth in pharmaceutical production, cleanrooms, and commercial environments seeking verifiable surface-hygiene standards. Companies adopt UVC systems to shorten sanitation cycles, meet regulatory expectations, and maintain product integrity in controlled manufacturing zones. Engineering developments in low-mercury lamps, UVC LEDs, and dose-measurement sensors improve energy efficiency and allow precise validation of exposure levels. Autonomous UVC robots gain traction in large facilities where consistent surface coverage enhances operational efficiency. Although initial capital costs and the need for trained operators remain barriers, broader awareness of environmental hygiene and increased availability of safety-certified equipment support ongoing adoption. These factors reinforce UVC surface disinfection as a dependable, non-chemical component of institutional sanitation programs worldwide.

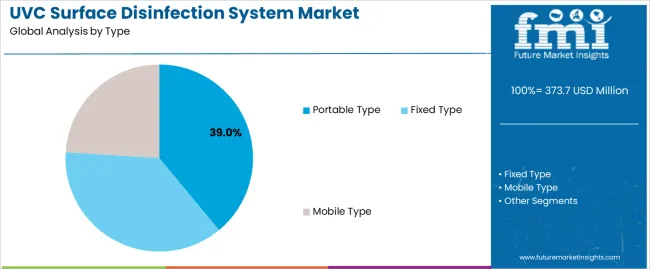

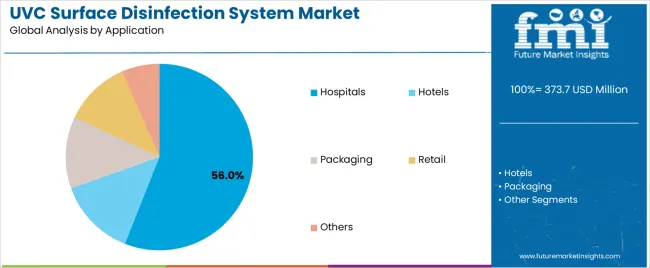

The UVC surface disinfection system market is segmented by type, application, and region. By type, the market is divided into portable, fixed, and mobile systems. Based on application, it is categorized into hospitals, hotels, packaging, retail, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in installation flexibility, disinfection workflows, and regional sanitation practices across healthcare, hospitality, and industrial settings.

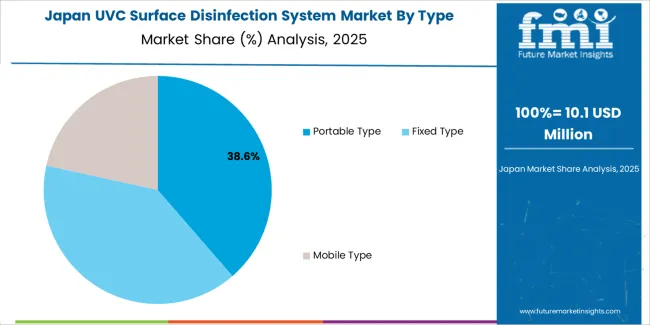

The portable type segment accounts for approximately 39.0% of the global UVC surface disinfection system market in 2025, making it the leading type category. Its prominence stems from the flexibility and ease of deployment offered by handheld and compact portable units, which allow targeted surface treatment in areas with irregular geometry, high-touch surfaces, or limited installation space. Portable systems enable staff to conduct rapid disinfection without structural modification, making them suitable for routine cleaning cycles and supplemental sanitation activity.

Manufacturers focus on improving lamp efficiency, ergonomic gRIP design, and shielding to reduce stray irradiation. Battery-powered models with integrated timers and proximity sensors support safer operation during daily use. Adoption is strongest in healthcare and service industries where facility layouts and varying surface materials require adaptable disinfection tools. Portable units are widely used in small clinical rooms, reception areas, and staff workspaces, and they play a complementary role alongside larger automated systems. Their leadership is reinforced by low initial cost, operational convenience, and suitability for both scheduled disinfection programs and on-demand cleaning tasks across diverse environments.

The hospitals segment represents about 56.0% of the total UVC surface disinfection system market in 2025, making it the dominant application category. This position is driven by the strict hygiene requirements of clinical environments where patient rooms, surgical suites, diagnostic areas, and high-touch equipment surfaces require consistent reduction of microbial loads. Hospitals adopt both portable and mobile UVC systems to supplement chemical disinfection, reduce cross-contamination risks, and support infection-control protocols aligned with regulatory standards.

Demand is strengthened by the need for predictable disinfection cycles that address pathogens resistant to conventional cleaning methods. UVC systems support controlled, repeatable surface treatment without leaving residue, enabling rapid turnover of patient areas. Manufacturers develop models with automated safety interlocks, area-coverage sensors, and programmable cycles suited to hospital workflows. Adoption is highest in North America, Europe, and East Asia, where healthcare facilities have invested in infrastructure upgrades emphasizing air and surface sanitation. Hospitals remain the primary users due to the volume of daily disinfection tasks, the importance of reducing healthcare-associated infections, and the operational advantages provided by UVC systems in achieving consistent, verifiable sanitation outcomes.

The UVC surface disinfection system market is expanding as facilities look for reliable, chemical-free methods to reduce microbial contamination on high-touch surfaces. These systems use controlled Ultraviolet-C light to inactivate pathogens on equipment, worktops and shared spaces in healthcare, food processing, transport and commercial settings. Growth is supported by heightened hygiene expectations, automation in cleaning workflows and interest in repeatable disinfection cycles. Adoption is limited by high device costs, safety considerations and the need for correct exposure times and positioning. Manufacturers are developing mobile units, robotic platforms and compact fixed systems that deliver more consistent performance in varied environments.

Facilities are adopting UVC surface systems to reduce reliance on chemical disinfectants, improve repeatability and support infection-control protocols. Healthcare and laboratory environments use these systems to standardise cleaning between procedures, while food and retail sectors value the ability to disinfect equipment without chemical residue. Increased focus on operational continuity encourages selection of systems that reduce manual cleaning steps and allow fast turnaround of shared areas. As organisations aim for stricter hygiene benchmarks, consistent surface disinfection using UVC is becoming an important complement to routine cleaning practices across multiple industries.

Several practical and financial barriers limit wider use. High initial cost discourages purchase in budget-sensitive environments. Effective disinfection requires correct positioning, surface exposure and shading control, which raises operational complexity. Safety concerns related to direct UVC exposure require training and protective measures. Some facilities lack the floor space or workflow flexibility needed for mobile or robotic units. Lamp replacement, calibration and validation add ongoing expenses. These challenges reduce adoption in smaller sites or settings where conventional methods are deemed adequate for daily disinfection needs.

Manufacturers are advancing systems with better sensor integration, automated dose calculations and programmable cycles that adapt to room layouts. Robotics and mobile units equipped with mapping technology are gaining traction for consistent coverage in large facilities. UVC LEDs with longer service life and lower heat output are being introduced, supporting more compact and energy-efficient devices. Interest is rising in hybrid systems that combine UVC with filtration or monitoring platforms. Adoption is expanding in logistics, hospitality and education as organisations pursue long-term hygiene upgrades supported by reliable, verifiable surface disinfection tools.

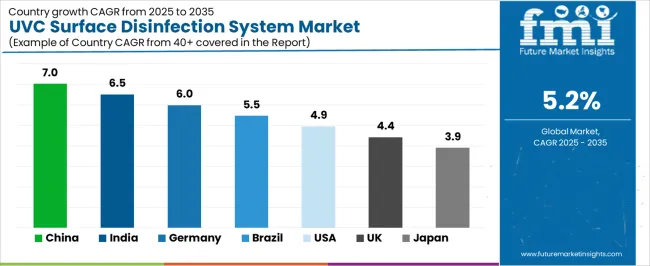

| Country | CAGR (%) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

The UVC Surface Disinfection System Market continues to grow steadily worldwide, with China leading at a 7.0% CAGR through 2035, supported by strong adoption in healthcare, transportation, and commercial facilities, along with advancements in UV-C LED efficiency. India follows at 6.5%, driven by expanding hospital networks, rising infection prevention standards, and increased deployment of automated UV-C cleaning devices. Germany records 6.0%, reflecting strict hygiene regulations, engineering excellence, and widespread integration of UV-C systems in industrial and medical environments. Brazil grows at 5.5%, benefiting from healthcare modernization and rising public sanitation initiatives. The USA, at 4.9%, remains innovation-focused with emphasis on safe, certified disinfection technologies, while the UK (4.4%) and Japan (3.9%) emphasize compact designs, energy-efficient UV-C sources, and high-performance solutions suited for both clinical and commercial settings.

China is observing strong activity in the UVC surface disinfection system market, projected to grow at a CAGR of 7.0% through 2035. Rising use of contact-surface disinfection in hospitals, transport hubs, and logistics centers is reinforcing equipment deployment. Domestic producers refine lamp intensity, coverage uniformity, and housing durability for routine cleaning cycles. Growth in high-traffic retail environments and large industrial sites supports consistent system turnover. Upgrades in public-facility maintenance practices promote broader installation of automated and handheld UVC surface-treatment units.

India is showing steady expansion in the UVC surface disinfection system market, expected to advance at a CAGR of 6.5% through 2035. Greater emphasis on contact-surface hygiene across hospitals, educational facilities, and office buildings encourages ongoing procurement. Local manufacturers improve wavelength control, fixture reliability, and mobility features for diverse operational settings. Increased demand for rapid-cycle disinfection in laboratories and food-handling areas supports regular usage. National infrastructure development programs promote integration of surface-treatment systems across new public buildings.

Across Germany, the UVC surface disinfection system market is advancing at a CAGR of 6.0%, supported by strict hygiene protocols and precise engineering standards. Producers focus on controlled irradiance output, stable fixture geometry, and consistent exposure distribution to ensure repeatable results. Hospitals, laboratories, and industrial facilities rely on UVC platforms to maintain regulated cleanliness levels. Growth in automated cleaning solutions and facility-wide hygiene strategies reinforces continued adoption.

Brazil is registering firm momentum in the UVC surface disinfection system market, projected to grow at a CAGR of 5.5% through 2035. Increased use of UVC cleaning solutions in clinics, airports, and large retail environments contributes to steady installations. Local distributors collaborate with global suppliers to expand access to high-output systems. Growth in standardized facility-cleaning programs promotes routine surface treatment across dense urban regions. Improvements in fixture durability and optical control support broad operational reliability.

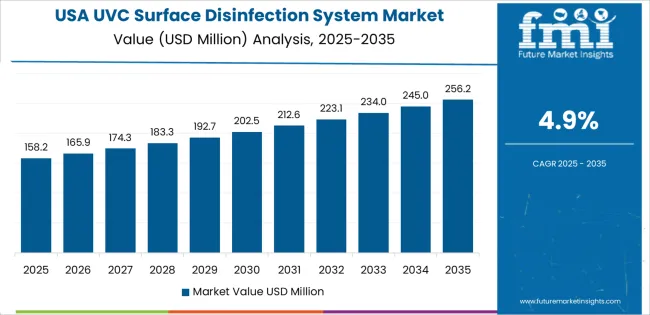

In the United States, the UVC surface disinfection system market is progressing at a CAGR of 4.9% through 2035. Hospitals, laboratories, and logistics facilities increasingly deploy UVC platforms for rapid surface treatment. Producers refine lamp-output efficiency, shielding design, and exposure-distance calibration to improve consistency. Growth in large-scale cleaning protocols across government and private facilities supports regular procurement. Expanded use in food-service operations and emergency-response environments reinforces stable market activity.

Across the United Kingdom, the UVC surface disinfection system market is rising at a CAGR of 4.4% through 2035. High-occupancy facilities such as hospitals, transport stations, and educational buildings adopt UVC systems to support stringent hygiene routines. Manufacturers emphasize compact units, glare-control features, and stable output levels. Growth in structured cleaning practices across public institutions reinforces consistent demand. Integration into maintenance workflows supports recurring installations across regional networks.

Japan is showing gradual progress in the UVC surface disinfection system market, projected to grow at a CAGR of 3.9% through 2035. Hospitals, laboratories, and elder-care centers deploy UVC systems to support routine surface-treatment cycles. Domestic producers focus on compact form factors, precise wavelength output, and quiet operation suitable for small rooms. Growth in clinical research activity and facility sanitation programs supports equipment turnover. Enhanced reflector design and improved lamp coatings reinforce operational reliability.

The global UVC surface disinfection system market is moderately concentrated, shaped by manufacturers supplying germicidal solutions for healthcare, industrial, and commercial sanitation. STERILSYSTEMS holds a strong position through purpose-built UVC modules designed for conveyor systems, food processing, and high-contact surfaces. American Ultraviolet, AquiSense Inc, and XtraLight support the high-performance segment with reliable low-pressure and LED-based UVC systems engineered for rapid disinfection cycles. CureUV, Excelitas, Hitech UV, and Lena Lighting contribute established lamp and fixture technologies suitable for laboratories, hospitals, and public facilities.

LightSources, Lumalier, Osram, and Philips add global manufacturing capacity with standardized UVC lamps and integrated systems that meet international performance guidelines. Competition across these manufacturers is shaped by irradiation uniformity, surface-dose consistency, and fixture durability under frequent operation.

Puro Lighting, Stanley Electric, VGE BV, Tru-D SmartUVC, and UV Technology enhance market diversity with automated mobile units, robotic platforms, and high-intensity fixtures designed for large rooms and hard-to-reach surfaces. These companies focus on validated pathogen-reduction performance, cycle-time efficiency, and safe deployment in sensitive environments such as surgical suites and cleanrooms.

Market competition is influenced by optical design, lamp lifespan, and compliance with occupational exposure standards. Strategic differentiation relies on sensor-guided operation, motion-interruption safety, and integration with facility management systems. As hospitals, transportation hubs, and industrial plants adopt long-term pathogen-control strategies, manufacturers with strong photobiological testing, reliable component sourcing, and energy-efficient UVC platforms are positioned to gain advantage in global surface disinfection applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type / Classification | Portable, Fixed, Mobile |

| Application | Hospitals, Hotels, Packaging, Retail, Logistics hubs, Food-processing, Laboratories, Transportation (airports, stations), Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | STERILSYSTEMS, American Ultraviolet, AquiSense Inc, XtraLight, CureUV, Excelitas, Hitech UV, Lena Lighting, LightSources, Lumalier, Osram, Philips, Puro Lighting, Stanley Electric, VGE BV, Tru-D SmartUVC, UV Technology |

| Additional Attributes | Dollar sales by type & application; unit shipments and ASP; portable vs fixed vs mobile split; cycle time, validated log-reduction metrics (LRV); irradiance (W/cm²) and wavelength accuracy (nm); lamp vs UVC-LED lifetimes and replacement cadence; safety features (motion sensors, interlocks, shielding); exposure/dosage verification & sensor logging; IoT/remote monitoring and maintenance alerts; retrofit vs new-build installations; coverage mapping & positioning guidance; operator training and validation costs; regulatory/certification mapping; case studies and buyer decision drivers. |

The global UVC surface disinfection system market is estimated to be valued at USD 373.7 million in 2025.

The market size for the UVC surface disinfection system market is projected to reach USD 620.4 million by 2035.

The UVC surface disinfection system market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in UVC surface disinfection system market are portable type, fixed type and mobile type.

In terms of application, hospitals segment to command 56.0% share in the UVC surface disinfection system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

UVC Upper Air Disinfection Unit Market Size and Share Forecast Outlook 2025 to 2035

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Measurement Equipment And Tools Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA