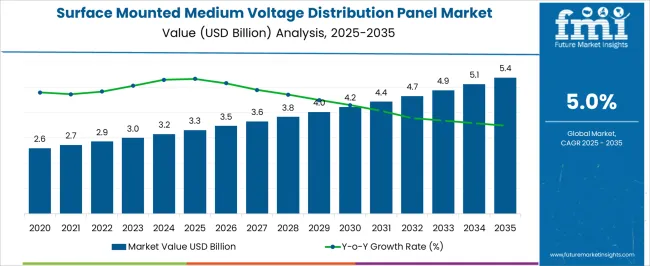

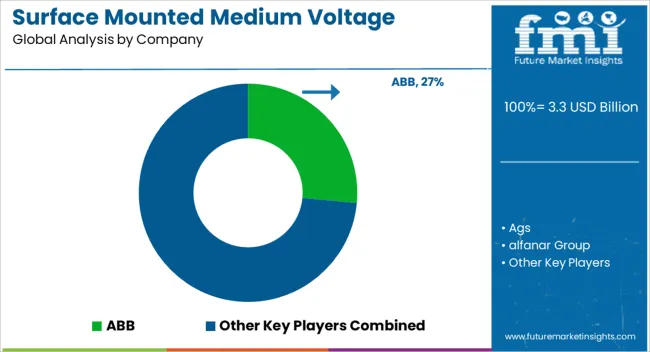

The surface-mounted medium voltage distribution panel market is anticipated to be USD 3.3 billion in 2025 and projected to reach USD 5.4 billion by 2035, creating an absolute dollar opportunity of USD 2.1 billion during the forecast period at a CAGR of 5.0%. Growth momentum is shaped by the increasing demand for reliable power distribution in industrial facilities, commercial buildings, and expanding urban infrastructure.

From USD 2.6 billion in 2020, the market grew to USD 2.7 billion in 2021 and USD 2.9 billion in 2022, highlighting consistent investment in electrical safety and distribution reliability. By 2023, the market touched USD 3.0 billion and rose further to USD 3.2 billion in 2024, with utility operators emphasizing advanced distribution networks. Projections beyond 2026 show values moving to USD 3.5 billion, USD 3.8 billion in 2028, and USD 4.0 billion in 2029 as industrial upgrades, smart grids, and renewable energy integration strengthen the role of distribution panels.

By 2030, the market will reach USD 4.2 billion, supported by ongoing electrification in manufacturing and data centers. The trend continues with USD 4.7 billion in 2032 and USD 5.1 billion in 2034, culminating at USD 5.4 billion in 2035, with stronger replacement demand and wider compliance with grid modernization programs.

| Metric | Value |

|---|---|

| Surface Mounted Medium Voltage Distribution Panel Market Estimated Value in (2025 E) | USD 3.3 billion |

| Surface Mounted Medium Voltage Distribution Panel Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The surface mounted medium voltage distribution panel market is influenced by five interconnected parent markets that together shape its long-term demand and growth path. The electrical equipment and switchgear market holds the largest share at 36%, as distribution panels serve as a core component for managing medium voltage loads across factories, utilities, and commercial spaces.

The power generation and transmission market contributes around 24%, driven by investments in renewable integration, smart grids, and substation upgrades, where medium voltage panels ensure stability and safety. The industrial automation market represents 18%, with rising deployment of automated production facilities, data centers, and processing plants requiring reliable power distribution panels. The construction and infrastructure market accounts for a 12% share, reflecting demand from residential complexes, commercial towers, and public infrastructure that depend on robust distribution systems for continuous supply.

The remaining 10% comes from the energy storage and distributed energy resources market, where panels are used for connecting solar, wind, and backup systems into medium voltage networks.

The surface mounted medium voltage distribution panel market is witnessing robust growth due to increasing urbanization, infrastructure expansion, and growing demand for reliable and space efficient power distribution solutions. Advancements in building automation, energy management systems, and safety standards are encouraging commercial establishments to adopt modern electrical infrastructure.

Surface-mounted panels are gaining traction as they offer simplified installation, easy maintenance, and reduced floor space requirements in high-density urban environments. Additionally, regulatory emphasis on energy efficiency and building safety is reinforcing the integration of advanced distribution technologies across new and retrofit projects.

The market outlook remains positive as smart grid developments and modular construction practices continue to align with the adoption of compact and scalable panel solutions.

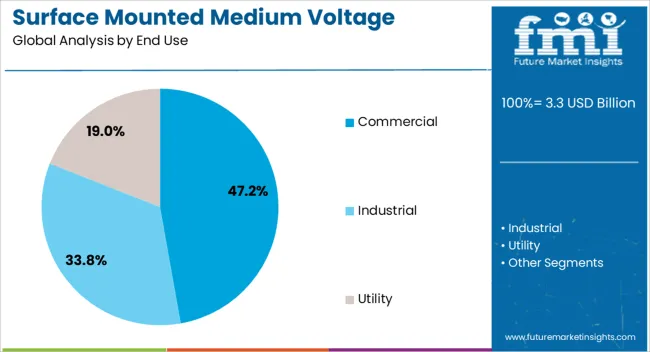

The surface mounted medium voltage distribution panel market is segmented by end use, and geographic regions. By end use, surface mounted medium voltage distribution panel market is divided into Commercial, Industrial, and Utility. Regionally, the surface mounted medium voltage distribution panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commercial segment is expected to hold 47.20% of the total market revenue by 2025 under the end use category, positioning it as the leading segment. This dominance is driven by increased deployment of surface mounted panels in office complexes, retail centers, educational institutions, and healthcare facilities where efficient space utilization and safety compliance are critical.

The ease of retrofitting these panels into existing infrastructures without extensive structural modifications makes them highly suitable for commercial applications. Additionally, the growing focus on smart energy management and building electrification is supporting the use of advanced distribution systems across commercial buildings.

As the demand for reliable and compact power distribution solutions continues to rise in urban commercial zones, this segment is projected to maintain its leadership in the market.

The market for surface mounted medium voltage distribution panels is driven by industrial applications, grid modernization, and infrastructure development, while high costs and compliance requirements remain notable challenges.

The surface mounted medium voltage distribution panel market is expanding as industries demand reliable electrical infrastructure to manage growing power loads. Factories, processing units, and logistics hubs depend on these panels for uninterrupted distribution, making them a crucial part of operational safety and efficiency. Medium voltage networks are becoming more common in industrial estates, requiring panels that balance compact installation with high capacity. Expansion in data centers and electronics manufacturing has strengthened demand further, as these facilities rely heavily on secure distribution networks. The ability of surface mounted units to fit in constrained spaces while offering high-performance safety features ensures consistent adoption across industrial and commercial environments worldwide.

Government-backed grid modernization programs and private sector upgrades are reinforcing the adoption of medium voltage distribution panels. Utility providers are investing in panel replacements to enhance reliability, reduce power losses, and comply with electrical safety standards. These modernization efforts include smart grid deployments, renewable energy integration, and digital monitoring systems where distribution panels act as key enablers. Surface-mounted configurations are preferred for their adaptability in both retrofits and new installations, minimizing construction downtime. Expansion of renewable energy sources such as solar and wind is creating additional demand, as panels are used to regulate power flows and secure transmission. This alignment of policy, investment, and technology drives steady uptake of distribution panels.

Infrastructure development across residential complexes, commercial towers, and public facilities has emerged as an important growth factor for the market. The need for efficient power management in airports, metro projects, and healthcare facilities has resulted in higher adoption of surface-mounted panels. Builders and contractors are prioritizing panels that can be installed quickly without heavy civil work, reducing project delays. Urban expansion in Asia and industrial growth in Europe are pushing utilities and contractors to incorporate medium voltage systems for large-scale projects. These panels serve as the backbone of safe and dependable electricity distribution in modern buildings, highlighting their crucial role in construction-led growth worldwide.

Despite consistent growth, the market faces challenges related to upfront costs and compliance with diverse regional standards. Medium voltage distribution panels require high-grade materials, circuit protection systems, and skilled installation, which increases capital expenditure. Smaller enterprises and projects in developing regions often delay adoption due to financial constraints. Standardization across geographies remains another challenge, as varying electrical codes and certification requirements create barriers for global suppliers. Competition among manufacturers also puts pressure on pricing, affecting profitability. While demand remains strong, resolving these cost and compliance hurdles is essential for accelerating adoption across all regions, especially in cost-sensitive and emerging economies.

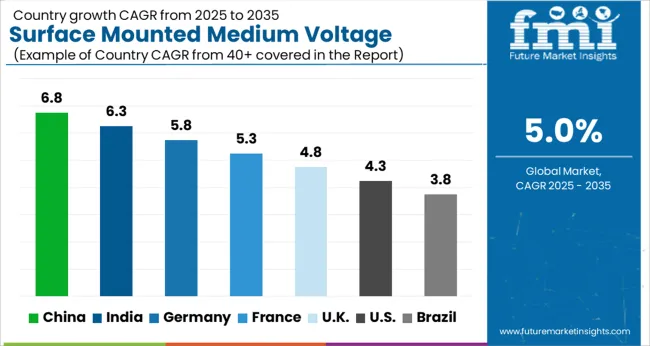

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

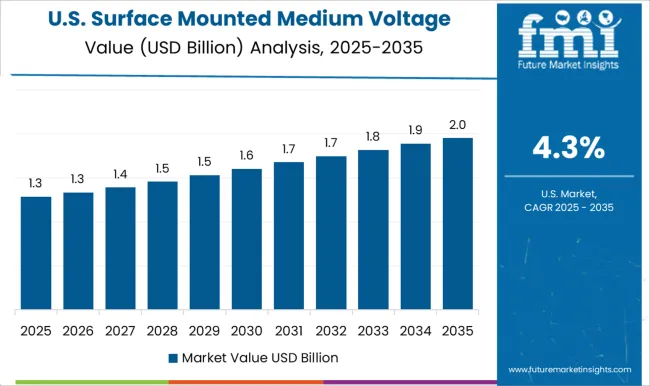

| USA | 4.3% |

| Brazil | 3.8% |

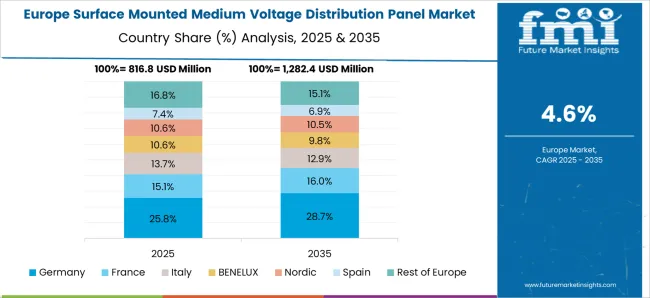

The global surface mounted medium voltage distribution panel market is projected to grow at a CAGR of 5.0% between 2025 and 2035. China leads expansion at 6.8%, followed by India at 6.3% and Germany at 5.8%, while France posts 5.3%, the United Kingdom 4.8%, and the United States 4.3%. Growth is supported by rising industrial electricity demand, grid modernization programs, and the integration of renewable energy with distribution networks. China and India are accelerating adoption through infrastructure development and large-scale industrialization, supported by government-backed electrification projects. Germany, France, and the UK focus on grid reliability, safety standards, and equipment upgrades in advanced industrial and utility sectors. The USA shows steady growth as data centers, manufacturing hubs, and utilities drive incremental adoption, though cost sensitivity and regional compliance remain key considerations. The analysis includes over 40+ countries, with the leading markets detailed below.

The surface mounted medium voltage distribution panel market in China is projected to grow at a CAGR of 6.8% during 2025 to 2035. Expansion in refining, chemicals, electronics, and data center clusters has favored panels that deliver compact footprints with strong safety features. Provincial grid reinforcement and industrial park electrification have encouraged upgrades from legacy gear to standardized medium voltage assemblies with higher interrupting ratings. Procurement teams prioritize short installation windows and proven after sales service, which benefits suppliers with local factories and field engineering depth. Ports, metro systems, and large campuses continue to add feeders and backup lines, pushing demand for surface mounted configurations in retrofit corridors. China is positioned to outpace the global average as replacement cycles and new capacity both contribute through 2035.

The surface mounted medium voltage distribution panel market in India is anticipated to advance at a CAGR of 6.3% between 2025 and 2035. Transmission and distribution upgrades under national programs have created steady panel demand for substations serving manufacturing zones, logistics parks, and commercial towers. Rail corridors, airports, and metro depots require space efficient switchgear with fast commissioning, which suits surface mounted layouts. Developers and EPC firms favor standardised, type tested assemblies with clear documentation, driving vendor selection toward players with certified labs and long term service contracts. Growth in cement, metals, and food processing adds feeders and motor control sections, increasing panel count per site. Given expanding captive power and renewable tie ins, India is considered a high potential adopter through the forecast horizon.

The surface mounted medium voltage distribution panel market in Germany is expected to rise at a CAGR of 5.8% from 2025 to 2035. Industrial automation intensity and stringent electrical safety codes have favored high reliability switchgear with advanced protection relays and arc mitigation features. Automotive plants, specialty chemicals, and precision engineering sites continue to refresh feeder sections and ring main units to enhance uptime. Utilities pursue loss reduction and selective coordination, which elevates demand for standardized medium voltage panels paired with digital monitoring. Brownfield retrofits in tight technical rooms often choose surface mounted assemblies to avoid civil works. Vendors with strong documentation, cyber secure interfaces, and responsive service networks are likely to gain share as end users prioritize lifecycle performance across the forecast window.

The surface mounted medium voltage distribution panel market in the United Kingdom is projected to grow at a CAGR of 4.8% during 2025 to 2035. Replacement of aging gear across hospitals, universities, and commercial estates has supported steady panel orders. Data center expansion around London and regional hubs calls for reliable medium voltage distribution with clear segregation, arc containment, and rapid maintenance access. Distribution network operators focus on resilience during weather events, which pushes upgrades in substations feeding industrial parks and housing developments. EPCs value products with transparent certification and supplier backed commissioning. While budgets remain guarded, multi year frameworks and service agreements help smooth procurement. With measured investment across public and private portfolios, adoption is expected to track a stable upward path through 2035.

The surface mounted medium voltage distribution panel market in the United States is anticipated to expand at a CAGR of 4.3% between 2025 and 2035. Petrochemical complexes, semiconductor fabs, and cold storage facilities require dependable medium voltage distribution paired with rigorous protection coordination. Utilities and cooperatives target substation modernization with clear preferences for tested assemblies and domestic service capability. Data center campuses across multiple states add feeders and standby lines, which lifts panel counts per project. Cost sensitivity and varied state codes require vendors to offer configurable designs with strong documentation and quick replacement part access. Given the mix of replacement and greenfield projects, the market is expected to post steady growth, though purchasing decisions remain highly specification driven.

The surface mounted medium voltage distribution panel market is shaped by a mix of global electrical equipment manufacturers, regional panel producers, and specialized power distribution solution providers. Leading players such as Siemens, Schneider Electric, ABB, and Eaton maintain strong positions by offering diversified portfolios of medium voltage (MV) panels, including air-insulated and gas-insulated options, suitable for commercial, industrial, and utility applications. Competitive differentiation is largely driven by panel reliability, safety features, compact and modular designs, ease of installation, and compliance with international standards such as IEC and ANSI.

Regional manufacturers, particularly in Asia-Pacific and Europe, compete by providing cost-effective, customized solutions and local technical support for utilities, industrial facilities, and renewable energy projects. Strategic partnerships with system integrators, EPC contractors, and power utilities enhance market reach and facilitate turnkey project implementation. Innovation in digital monitoring, smart metering integration, and high-performance insulation technology strengthens competitive positioning. Companies prioritizing regulatory compliance, product quality, and robust after-sales service networks are well-positioned to capture significant market share. Overall, firms combining technological expertise, scalable manufacturing, and strong distribution networks are expected to benefit from the growing demand for reliable MV power distribution solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| End Use | Commercial, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Ags, alfanar Group, Arranger Electric Co., Ltd, CSE Solutions Pvt. Ltd., Eaton, EAMFCO, ESL POWER SYSTEMS, INC., General Electric, Hager Group, INDUSTRIAL ELECTRIC MFG, Larsen & Toubro Limited, Legrand, Meba Electric Co., Ltd, NHP, Norelco, Paneltronics, RBaker, Schneider Electric, Siemens, and Symbiotic Systems |

| Additional Attributes | Dollar sales, share, regional demand hotspots, regulatory standards, utility upgrade trends, competitive positioning, cost challenges, and growth opportunities across industrial and infrastructure projects. |

The global surface mounted medium voltage distribution panel market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the surface mounted medium voltage distribution panel market is projected to reach USD 5.4 billion by 2035.

The surface mounted medium voltage distribution panel market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in surface mounted medium voltage distribution panel market are commercial, industrial and utility.

In terms of , segment to command 0.0% share in the surface mounted medium voltage distribution panel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Measurement Equipment And Tools Market

Surface Drilling Rigs Market

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA