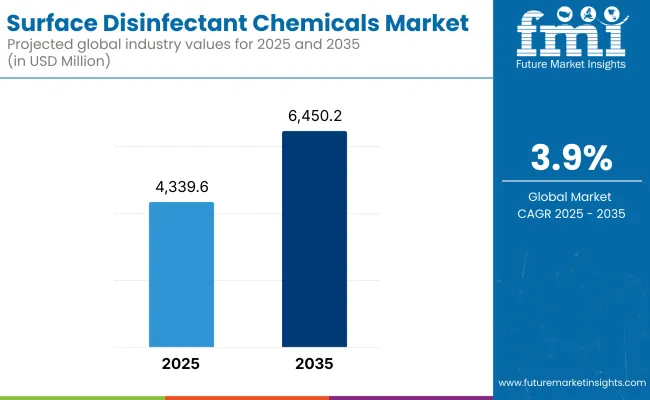

The global surface disinfectant chemicals market is projected to be valued at USD 4,339.6 million in 2025 and is expected to reach USD 6,450.2 million by 2035, expanding at a CAGR of 3.9% during the forecast period. This steady growth is driven by increasing investments in infection control, particularly following recent global health crises, as well as a growing focus on hospital-acquired infection (HAI) prevention strategies. Demand is further supported by strict hygiene regulations across healthcare, commercial, and residential settings.

Surface disinfectants, including quaternary ammonium compounds, hydrogen peroxide, chlorine compounds, alcohols, and phenolics, play a crucial role in ensuring microbial safety by deactivating harmful pathogens on surfaces. These chemicals are extensively used in healthcare and food processing sectors, and their application is expanding in hospitality, industrial sanitation, and household hygiene. Additionally, the shift toward green and non-toxic formulations is reshaping industry innovation, driving demand for sustainable and eco-friendly disinfectant solutions.

Market Metrics

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 4,339.6 million |

| Industry Value (2035F) | USD 6,450.2 million |

| CAGR (2025 to 2035) | 3.9% |

Key trends include the formulation of bio-based and non-corrosive disinfectants, increasing preference for ready-to-use sprays and wipes, and the growing prevalence of electrochemically activated solutions (ECAS) in health centers as well as laboratories. The use of AI-based cleaning validation systems and automated disinfection robots is also revolutionizing disinfectant application in high-risk areas.

Consumption in North America is the highest in the world, mostly attributed to infection control policies in hospitals, elder care facilities and public infrastructure. The United States has been particularly aggressive in adopting EPA-registered disinfectants for use in medical and commercial cleaning services. The demand for eco-labeled products is also increasing at an unprecedented rate in the region.

Driven by regulatory compliance with REACH and the Biocidal Products Regulation (BPR), coupled with an increasing demand for sustainable, fragrance-free, and non-irritating disinfectants, Europe is expected to represent a lucrative market. Countries such as Germany, the UK and the Netherlands are paying particular attention to healthcare and food safety, with spending on high-efficacy surface disinfectants rising sharply for schools and public transit systems.

The Asia-Pacific region exhibits the most rapid development, driven by high-density populations, expanding urban infrastructure, and increasing investments in the healthcare sector and food safety. Surface disinfectants are being embraced by China, India, Japan, and Southeast Asian countries alike in corporate and residential settings, as hygiene and sanitation awareness approaches the levels of Europe post-COVID-19.

Challenges

Health Hazards, Resistance, and Regulatory Complexity

Despite being effective, many surface disinfectant chemicals are linked with skin and respiratory irritation with prolonged exposure. The overuse of specific chemical agents can induce resistance in microbes, prompting regulatory agencies to impose restrictions on their use. Bizarre levels of different regional standards make it also primitive to cover global products for the entire world.

Opportunities

Green Disinfectants, Healthcare Expansion, and Smart Cleaning Systems

As the world moves toward safer, greener alternatives, plant-based, biodegradable disinfectants are gaining popularity. Key Opportunities The growth of healthcare infrastructure in emerging economies and the proliferation of smart cleaning systems in airports, offices, and retail chains. Demand is also increasing for touchless disinfection technologies, like UV-integrated spraying units and IoT-linked fogging units, which will extend the market scope.

The years 2020 to 2024 marked a significant growth period for the surface disinfectant chemicals market, primarily driven by the COVID-19 pandemic. Public health concerns saw skyrocketing demand through residential, commercial and industrial environments. Chlorine-based disinfectants, hydrogen peroxide, and alcohol-based formulations, quaternary ammonium compounds became staples of infection control in hospitals, offices, transport hubs, and homes.

However, the post-pandemic normalization phase and its accompanying changes soon arrived. Concerns about overuse, chemical resistance and increasing focus on health and environmental safety prompted a re-evaluation of disinfectant formulations. End users and governments began to prefer safer, low-residue and biodegradable alternatives. Another factor is the emergence of green cleaning initiatives and consumer demand for transparency in chemical ingredients, which has prompted companies to make the transition to eco-friendly alternatives more quickly.

Between 2025 and 2035, the market is expected to undergo a transformation driven by the convergence of sustainability, automation, and smart hygiene protocols. Bio-based disinfectants, AI-enabled sanitation systems, and surface technologies with antimicrobial properties will become standard. Sectors will have to redesign products, and the way they are used with clean smart systems, data-verified disinfection compliance, and nanotechnology-based surface protectants.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emergency authorizations and fast-track approvals during the pandemic; varying national guidelines. |

| Technological Innovation | Alcohol, chlorine, and peroxide-based disinfectants dominated standard spray-and-wipe formats. |

| Industry Adoption | Mass use in healthcare, hospitality, transport, and food services; driven by hygiene urgency. |

| Smart & AI-Enabled Solutions | Limited automation; reliance on manual application and visual inspections. |

| Market Competition | Led by Reckitt, Ecolab, Diversey, Procter & Gamble, and 3M; largely formula-focused differentiation. |

| Market Growth Drivers | COVID-19 pandemic, hospital-acquired infection prevention, and commercial hygiene pressure. |

| Sustainability and Environmental Impact | Concerns over chemical residues, respiratory risks, and packaging waste emerged post-pandemic. |

| Integration of AI & Digitalization | Basic tracking via inventory systems and scheduling tools. |

| Advancements in Product Design | Single-use wipes, sprays, and mists with ethanol/chlorine blends; high evaporation and flammability. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Harmonized global disinfection standards, ingredient transparency mandates, eco-certification protocols, and residue safety regulations. |

| Technological Innovation | Advanced bio-disinfectants, probiotic surface cleaners, electrostatic spray compatibility, and self-disinfecting coatings with nano-silver or copper ions. |

| Industry Adoption | Institutionalized protocols in smart buildings, food production, healthcare robotics, and public infrastructure; demand for continuous disinfection systems. |

| Smart & AI-Enabled Solutions | AI-powered surface mapping for disinfection, sensor-triggered robotic cleaners, UV-C integrated disinfectant hybrids, and real-time coverage validation. |

| Market Competition | Entry of biotech firms, green chemistry innovators, and sanitation-as-a-service platforms offering data-driven disinfection analytics. |

| Market Growth Drivers | Smart facility design, antimicrobial material integration, green regulatory frameworks, and demand for digital disinfection compliance. |

| Sustainability and Environmental Impact | Shift toward biodegradable formulations, zero-VOC chemicals, refillable dispensers, and circular packaging practices. |

| Integration of AI & Digitalization | Cloud-linked sanitation dashboards, IoT-enabled dispensers, automated dosage control, and blockchain-backed hygiene traceability. |

| Advancements in Product Design | Reusable surface protectants, foam-based no-rinse formulas, long-acting antimicrobial films, and non-flammable, hypoallergenic variants. |

North America and Europe collectively dominate the global market for surface disinfectant chemicals. Infection control measures in hospitals, nursing homes and public facilities continue to spur demand for the quaternary ammonium compounds, hydrogen peroxide and chlorine-based disinfectants.

Regulatory standards imposed by organizations such as the EPA and CDC ensure uniform use of products inside both public and private sectors. Growing applications in transportation and education, in addition to the commercial cleaning sector, further foster the market trail.

| Country | CAGR (2025 to 2035) |

|---|---|

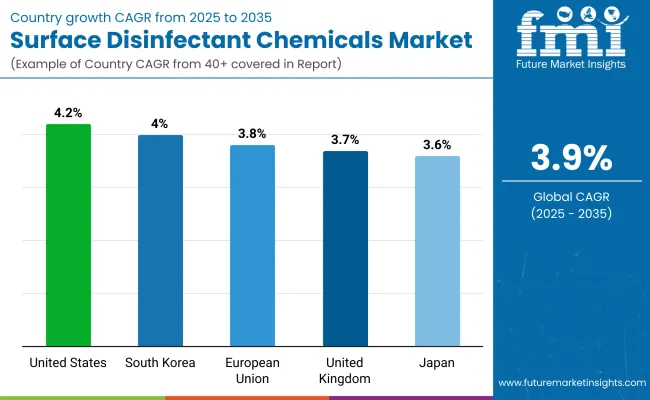

| USA | 4.2% |

The United Kingdom surface disinfectant chemicals market is projected to grow at a CAGR of 3.7% during the forecast period (2020 to 2025). Hospitals, restaurants, retail stores, and offices still follow heightened disinfection protocols. Consumer preferences and environmental regulations, in particular, are driving the demand for eco-friendly and low-toxicity formulations. However, manufacturers are pressured by the Biocidal Product Regulations (BPR) to develop compliant and non-toxic disinfectant mixtures.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The Surface Disinfectant Market in the EU is approximating a growth in terms with a CAGR of 3.8% from 2025 to 2035. Germany, France and the Netherlands, among others, are focusing more on cleaner public infrastructure and more stringent hygiene enforcement.

The impact of EU-wide regulations on ECHA and the so-called Biocidal Products Regulation, will foster replacement with safer, non-corrosive and biodegradable disinfectant products. The increasing interest in both alcohol-based disinfectants and hydrogen peroxide solutions also suggests that consumer confidence in quick-acting formulations is rising.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 3.8% |

Japan’s surface disinfectant chemicals market is growing moderately, driven by its culture of cleanliness and strong hygiene practices in both public and private spaces. Healthcare is still its top customer, followed by hospitality and retail. Japanese preferences are for quick drying, no residue, and low-odour disinfectants, especially alcohol and oxidizing agents. To respond to this emerging need, local manufacturers are concentrating on compact packing and multipurpose formulations that can serve both institutional and household needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

There is strong demand for surface disinfectant chemicals across the medical, educational and commercial sectors in South Korea. The public’s increased consciousness of cleanliness, especially in urban settings, drives the use of disinfectant sprays, wipes and fogging solutions.

Demand is also increasing in the electronics and food manufacturing sectors, where surface hygiene is paramount. The domestic production base is robust, and the MFDS ensures strict regulatory compliance, which guarantees both quality and innovation in product offerings.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

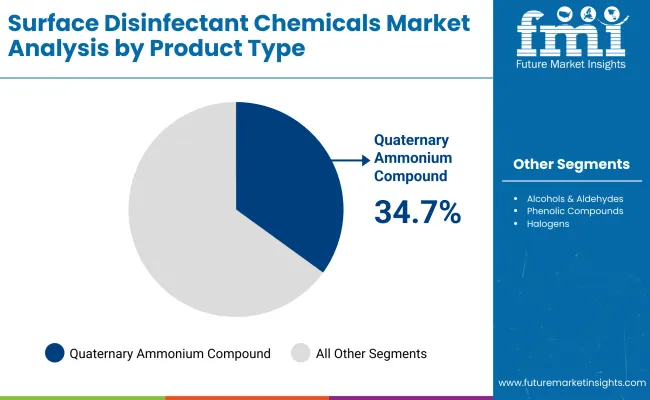

Product Type Market Share (2025)

| Product Type | Value Share (%) |

|---|---|

| Quaternary Ammonium Compound | 34.7% |

Quaternary ammonium compounds estimated to hold 34.7% of the global market value of surface disinfectant chemicals during 2025. These compounds are well known for their broad-spectrum antimicrobial activity, stability, and low toxicity to users, making them a common tool in hospitals, food preparation areas, and domestic cleaning applications.

QACs are effective against bacteria, viruses, and fungi and are used in disinfectant sprays, wipes, and floor cleaners. They are suitable for use on many kinds of surfaces, porous and non-porous, which makes them perfect for use in everyday disinfectant solutions.

Quaternary ammonium compounds will remain at the forefront of the Surface disinfectant product class as demand for high-efficacy, ready-to-use disinfectants continues to grow in healthcare and commercial environments.

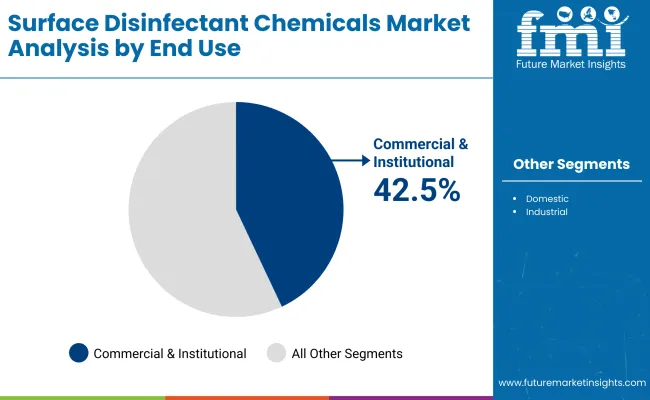

End Use Market Share (2025)

| End Use Sector | Value Share (%) |

|---|---|

| Commercial & Institutional | 42.5% |

By end use, the commercial and institutional ended up being the biggest segment, accounting for 42.5% of the value of surface disinfectant chemicals within the market in 2025. This application was then followed by others in hospitals, educational institutions, retail stores, hospitality, and transportation facilities, such as areas for which strict hygiene protocols and repeat disinfection are required.

Surface disinfectants that provide demonstrated antimicrobial efficacy and long-lasting protection are necessary for high foot traffic and public health demands. The categories of products commonly used in this space include floor disinfectants, hard-surface sprays, and restroom sanitizers.

The rising global health conscious along with better public hygiene awareness due to the post pandemic environment is likely to accelerate further this trend, where the commercial and institutional segment is expected to dominate towards the business end, backed by regulatory mandates and increasing consumer expectations based on safety.

Mirroring this trend, the global surface disinfectant chemicals market continues to grow steadily, driven by increasing hygiene awareness, enhanced infection control in healthcare and public infrastructure, and heightened regulatory scrutiny on cleanliness and safety across various industries.

These include quaternary ammonium compounds, hydrogen peroxide, sodium hypochlorite, alcohols, and phenolic disinfectants widely used in hospitals, commercial areas, food processing industries, and residential spaces. The post-COVID environment remains a key driver of demand for broad-spectrum, fast-acting, and residue-free disinfectants, while innovation focuses on formulations that incorporate eco-friendly, non-toxic, and long-lasting antimicrobials.

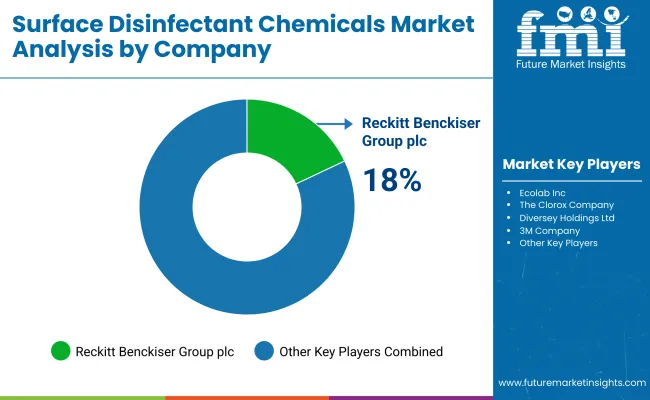

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Reckitt Benckiser Group plc | 18 - 22% |

| Ecolab Inc. | 15 - 19% |

| The Clorox Company | 11 - 14% |

| Diversey Holdings Ltd. | 8 - 11% |

| 3M Company | 6 - 9% |

| Others | 26 - 34% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Reckitt Benckiser Group plc | In 2024, Reckitt expanded its Dettol and Lysol lines with plant-based surface disinfectants, addressing the rising demand for non-toxic household and institutional cleaners. |

| Ecolab Inc. | Launched a new range of healthcare-grade surface disinfectants in 2023, offering rapid kill times and compatibility with sensitive equipment and surfaces. |

| The Clorox Company | In 2025, Clorox introduced AI-enhanced dosing systems for commercial cleaning setups, ensuring optimal chemical usage and consistent disinfection results. |

| Diversey Holdings Ltd. | Expanded its Oxivir line of hydrogen peroxide-based disinfectants in 2024, targeting hospitals, airports, and foodservice chains with residue-free, no-rinse formulas. |

| 3M Company | Upgraded its disinfectant wipes and sprays in 2023 with dual-action cleaning and virucidal efficacy, suitable for high-touch surfaces in healthcare and hospitality. |

Key Market Insights

Reckitt Benckiser Group plc (18-22%)

A global leader in hygiene solutions, Reckitt continues to dominate consumer and institutional segments with trusted brands like Lysol and Dettol, combining broad-spectrum efficacy with green chemistry trends.

Ecolab Inc. (15-19%)

A frontrunner in infection prevention, Ecolab delivers EPA-registered and hospital-grade disinfectants tailored for critical environments, with an emphasis on surface compatibility and automation-readiness.

The Clorox Company (11-14%)

Clorox’s institutional cleaning portfolio supports disinfection protocols in schools, workplaces, and transportation hubs, offering scalable solutions with sustainability certifications and smart dispensing tools.

Diversey Holdings Ltd. (8-11%)

Renowned for its Oxivir and Virex product families, Diversey leads in high-efficacy, low-residue surface disinfection chemicals for healthcare, food processing, and public facility applications.

3M Company (6-9%)

Leveraging its innovation in materials and infection control, 3M supplies surface disinfectants optimized for fast turnover environments and critical zones, with built-in cleaning and disinfection properties.

Other Key Players (Combined Share: 26-34%)

Numerous regional manufacturers and specialized chemical firms contribute to market innovation, cost competitiveness, and application diversity through eco-friendly formulations and customized packaging:

The overall market size for the surface disinfectant chemicals market was USD 4,339.6 million in 2025.

The surface disinfectant chemicals market is expected to reach USD 6,450.2 million in 2035.

Demand will be driven by growing awareness of hygiene and sanitation, rising healthcare-associated infection (HAI) prevention efforts, expanding use in residential and commercial cleaning, and stringent regulatory mandates for infection control.

The top 5 countries driving the market are the United States, China, Germany, India, and the United Kingdom.

The quaternary ammonium compounds segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ million) Forecast by End Use, 2017 to 2033

Table 6: Global Market Volume (Tons) Forecast by End Use, 2017 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 9: North America Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2017 to 2033

Table 11: North America Market Value (US$ million) Forecast by End Use, 2017 to 2033

Table 12: North America Market Volume (Tons) Forecast by End Use, 2017 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2017 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by End Use, 2017 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End Use, 2017 to 2033

Table 19: Europe Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 21: Europe Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Product Type, 2017 to 2033

Table 23: Europe Market Value (US$ million) Forecast by End Use, 2017 to 2033

Table 24: Europe Market Volume (Tons) Forecast by End Use, 2017 to 2033

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 26: East Asia Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 27: East Asia Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 28: East Asia Market Volume (Tons) Forecast by Product Type, 2017 to 2033

Table 29: East Asia Market Value (US$ million) Forecast by End Use, 2017 to 2033

Table 30: East Asia Market Volume (Tons) Forecast by End Use, 2017 to 2033

Table 31: South Asia & Pacific Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 32: South Asia & Pacific Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 33: South Asia & Pacific Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 34: South Asia & Pacific Market Volume (Tons) Forecast by Product Type, 2017 to 2033

Table 35: South Asia & Pacific Market Value (US$ million) Forecast by End Use, 2017 to 2033

Table 36: South Asia & Pacific Market Volume (Tons) Forecast by End Use, 2017 to 2033

Table 37: MEA Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 38: MEA Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 39: MEA Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 40: MEA Market Volume (Tons) Forecast by Product Type, 2017 to 2033

Table 41: MEA Market Value (US$ million) Forecast by End Use, 2017 to 2033

Table 42: MEA Market Volume (Tons) Forecast by End Use, 2017 to 2033

Figure 1: Global Market Value (US$ million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by End Use, 2017 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End Use, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2017 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by End Use, 2017 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End Use, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by End Use, 2017 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End Use, 2017 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ million) by End Use, 2023 to 2033

Figure 57: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Product Type, 2017 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ million) Analysis by End Use, 2017 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by End Use, 2017 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ million) by Product Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ million) by End Use, 2023 to 2033

Figure 75: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 77: East Asia Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 81: East Asia Market Volume (Tons) Analysis by Product Type, 2017 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ million) Analysis by End Use, 2017 to 2033

Figure 85: East Asia Market Volume (Tons) Analysis by End Use, 2017 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia & Pacific Market Value (US$ million) by Product Type, 2023 to 2033

Figure 92: South Asia & Pacific Market Value (US$ million) by End Use, 2023 to 2033

Figure 93: South Asia & Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia & Pacific Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 95: South Asia & Pacific Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 96: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia & Pacific Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 99: South Asia & Pacific Market Volume (Tons) Analysis by Product Type, 2017 to 2033

Figure 100: South Asia & Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia & Pacific Market Value (US$ million) Analysis by End Use, 2017 to 2033

Figure 103: South Asia & Pacific Market Volume (Tons) Analysis by End Use, 2017 to 2033

Figure 104: South Asia & Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia & Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia & Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia & Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia & Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ million) by Product Type, 2023 to 2033

Figure 110: MEA Market Value (US$ million) by End Use, 2023 to 2033

Figure 111: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 113: MEA Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 114: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: MEA Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 117: MEA Market Volume (Tons) Analysis by Product Type, 2017 to 2033

Figure 118: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: MEA Market Value (US$ million) Analysis by End Use, 2017 to 2033

Figure 121: MEA Market Volume (Tons) Analysis by End Use, 2017 to 2033

Figure 122: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 125: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 126: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Trends, Growth, and Share Analysis from 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Water Sports Equipment Market Growth – Size, Trends & Forecast 2024-2034

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Protection Services Market Growth – Trends & Forecast 2024-2034

Surface Measurement Equipment And Tools Market

Surface Drilling Rigs Market

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA