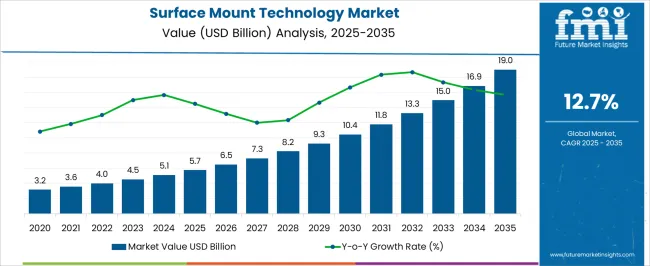

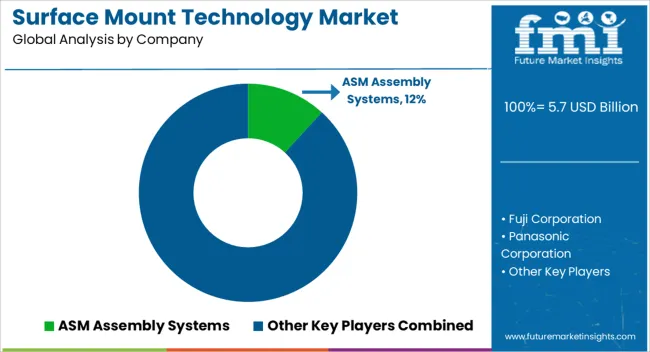

The Surface Mount Technology Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 19.0 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period.

| Metric | Value |

|---|---|

| Surface Mount Technology Market Estimated Value in (2025 E) | USD 5.7 billion |

| Surface Mount Technology Market Forecast Value in (2035 F) | USD 19.0 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The surface mount technology market is witnessing sustained growth, driven by the increasing adoption of miniaturized and high-performance electronic devices across multiple sectors. Rising demand for compact consumer electronics, automotive electronics, telecommunications equipment, and industrial automation systems is creating strong traction for advanced surface mount solutions. The integration of automated equipment and software-controlled production lines is enhancing assembly efficiency, accuracy, and reliability, leading to increased preference for surface mount technologies over traditional through-hole methods.

Industry investments in smart manufacturing, precision placement, and real-time quality control are improving production yields and reducing operational costs. Growing adoption of IoT-enabled devices and high-density printed circuit boards is further expanding the market.

The focus on reducing manufacturing defects, improving operational efficiency, and supporting rapid time-to-market requirements is influencing the strategic choices of electronics manufacturers As consumer demand for compact, high-speed, and multifunctional electronics continues to rise, the surface mount technology market is expected to sustain strong growth, supported by innovations in automated assembly equipment and intelligent process control systems.

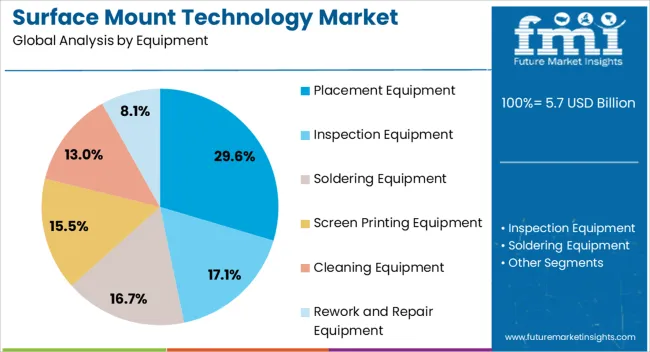

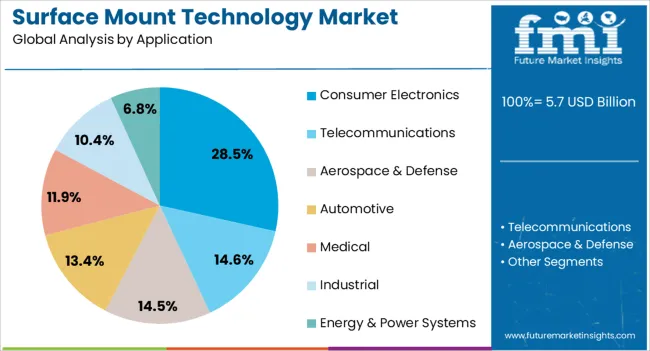

The surface mount technology market is segmented by equipment, application, and geographic regions. By equipment, surface mount technology market is divided into Placement Equipment, Inspection Equipment, Soldering Equipment, Screen Printing Equipment, Cleaning Equipment, and Rework and Repair Equipment. In terms of application, surface mount technology market is classified into Consumer Electronics, Telecommunications, Aerospace & Defense, Automotive, Medical, Industrial, and Energy & Power Systems. Regionally, the surface mount technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The placement equipment segment is projected to hold 29.6% of the surface mount technology market revenue share in 2025, positioning it as the leading equipment type. Its dominance is being driven by the critical role these machines play in accurately positioning components on printed circuit boards with high speed and precision, reducing assembly errors and improving overall production efficiency.

Increasing adoption of high-density board designs and miniaturized components has reinforced the reliance on automated placement equipment, as manual methods are no longer feasible for meeting volume and quality requirements. Technological advancements in vision systems, robotics, and software-controlled process optimization are enabling placement machines to handle a wide variety of components and layouts with minimal downtime.

The segment is also benefiting from strong demand in consumer electronics, automotive electronics, and telecommunications, where rapid assembly cycles and reliability are crucial As manufacturers prioritize productivity, scalability, and high throughput, placement equipment continues to maintain its leadership position in the surface mount technology market.

The consumer electronics application segment is expected to account for 28.5% of the surface mount technology market revenue share in 2025, establishing it as the dominant application area. This is being driven by increasing global demand for smartphones, tablets, wearable devices, laptops, and other compact electronics that require high-precision assembly. The ability of surface mount technology to support high-density boards, miniaturized components, and complex circuits has made it indispensable in the consumer electronics industry.

Rising consumer expectations for performance, reliability, and compact design are further reinforcing the adoption of automated assembly solutions. Manufacturers are leveraging surface mount technologies to achieve faster production cycles, reduce defect rates, and improve product quality, aligning with stringent time-to-market and cost-efficiency objectives.

Additionally, the proliferation of smart devices and IoT-enabled electronics has accelerated the need for scalable and flexible assembly processes that surface mount technology offers As a result, consumer electronics applications are driving significant revenue share and will continue to shape growth in the market over the coming years.

The push for smaller and more powerful electronic devices is a significant driver for the surface mount technology market size and growth. Consumer electronics, such as smartphones, tablets, and wearables, are becoming increasingly compact while offering more features.

This trend is driven by consumer preferences for portability and convenience. SMT technology allows manufacturers to place tiny components very close together on both sides of a printed circuit board (PCB), facilitating the creation of dense, multifunctional, and high-performance devices. Additionally, this miniaturization trend extends to other industries, including aerospace and defense, where space and weight constraints are critical, further boosting demand.

The healthcare sector is rapidly adopting electronic devices for monitoring, diagnostics, and treatment. Wearable health devices, portable monitors, and implantable medical equipment rely on compact, reliable, and high-performance electronics. SMT plays a crucial role in manufacturing these devices, enabling the miniaturization and precise placement of components.

Regulations and standards in surface mount technology are getting stricter to ensure the functionality and reliability required in critical healthcare applications. Additionally, the growing emphasis on telemedicine and remote health monitoring drives demand for sophisticated, miniaturized medical electronics, further boosting the SMT market.

The global rollout of 5G technology is transforming the telecommunications industry, necessitating sophisticated electronic components capable of handling higher data speeds and frequencies. SMT is essential for producing the compact, efficient circuit boards required for 5G infrastructure, including base stations, routers, and switches. These components must meet stringent performance and reliability standards, which SMT can provide.

As 5G networks expand, they drive demand for a wide range of new devices and technologies, all of which require advanced electronic assemblies. This continuous evolution in telecommunications is a significant growth factor for the SMT market.

Modern vehicles are increasingly reliant on advanced electronics for various functionalities, from safety systems like Advanced Driver Assistance Systems (ADAS) to infotainment and connectivity solutions. The shift towards electric and autonomous vehicles further accelerates the need for sophisticated electronic components.

SMT is crucial in manufacturing high-density, reliable electronic assemblies that can withstand the automotive environment's harsh conditions, such as temperature fluctuations and vibrations. As automotive technology evolves, incorporating more electronic systems, the demand for SMT continues to rise, driving significant growth in this market.

Evolution of the Consumer Electronics Industry Fuels Revenues in the Market

The consumer electronics market is continuously evolving, with a focus on more features, better performance, and innovative designs. Consumers expect their devices to be multifunctional, efficient, and stylish. SMT supports this evolution by enabling the integration of complex circuits and multiple components into smaller, more efficient packages.

This capability is crucial for developing advanced devices such as smartphones, smartwatches, and smart home products. As consumer expectations rise, manufacturers rely on SMT to meet the challenge of delivering high-quality, feature-rich devices, driving growth in the SMT market. Risks and challenges facing the SMT market, such as trade wars and component shortages are being addressed, catapulting the market’s growth.

Emergence of Advanced Packaging Technologies is Boosting the Market

Advanced packaging technologies, such as System-in-Package (SiP) and 3D packaging, are becoming more prevalent as they offer significant benefits in terms of size reduction and performance enhancement. These technologies integrate multiple integrated circuits (ICs) and passive components into a single package, optimizing board space and improving electrical performance.

SMT is essential for assembling these advanced packages, which are used in applications ranging from high-performance computing to consumer electronics. The push towards smaller, faster, and more efficient electronic systems is driving the adoption of advanced packaging technologies, thus boosting the SMT market. the potential of 3D printing for advanced SMT applications is likely to amplify in the near future.

Artificial Intelligence and Machine Learning is Transforming the Industry

The integration of artificial intelligence (AI) and machine learning (ML) into SMT manufacturing processes is revolutionizing the industry. The role of Artificial intelligence (AI) in SMT equipment and automation is vast and critical. AI and ML enhance production efficiency by optimizing machine operations, reducing defects, and predicting maintenance needs.

For example, AI-driven inspection systems can identify defects in real-time with higher accuracy than traditional methods, ensuring high-quality output. Machine learning algorithms can optimize placement and soldering processes by analyzing vast amounts of production data. The adoption of these technologies leads to higher yields, lower costs, and improved product quality, driving growth in the SMT market.

The aerospace and defense sectors require robust, reliable, and high-performance electronic assemblies for various applications, including communication systems, navigation, and surveillance. SMT's ability to produce compact and durable components is critical for these industries.

As defense budgets and aerospace innovations grow, there are opportunities for SMT manufacturers to supply advanced electronic solutions for military and aerospace applications. Sustainability initiatives in the SMT supply chain can lead to greater revenues.

The automotive industry's shift towards ADAS and autonomous vehicles creates a substantial demand for sophisticated electronic systems. SMT is crucial for assembling the complex and compact electronic assemblies required for these technologies. As automotive manufacturers invest in self-driving technology and enhanced driver assistance features, there is an opportunity for SMT providers to supply the necessary components and assemblies.

The impact of Industry 4.0 on SMT in significant. The trend towards home automation and smart appliances is driving demand for sophisticated electronic assemblies. SMT plays a key role in manufacturing the compact and reliable components required for smart thermostats, security systems, and connected kitchen appliances. As consumer interest in smart home technologies increases, manufacturers have the opportunity to develop innovative SMT solutions to meet this growing market demand.

Emerging markets, particularly in Asia, Africa, and Latin America, are experiencing rapid industrialization and technological adoption. Investing in SMT companies or establishing SMT manufacturing facilities in these regions can tap into the growing demand for electronics.

These markets offer opportunities for investors to benefit from lower production costs and expanding local consumer bases. The future of SMT in the age of Industry 4.0 is bright in these emerging markets.

As electronic assemblies become more densely packed, managing heat dissipation becomes increasingly challenging. Excessive heat can damage components and reduce the reliability of the product. Developing effective thermal management solutions is critical, but it adds complexity and cost to the manufacturing process.

Integrating advanced technologies such as AI, IoT, and 5G into SMT processes requires significant investment and technical expertise. While these technologies can improve efficiency and open new market opportunities, their integration involves overcoming technical hurdles and ensuring compatibility with existing systems.

The impact of Artificial Intelligence (AI) and Machine Learning (ML) on SMT is significant and businesses need to take proactive measures to overcome technical challenges.

Environmental regulations, such as restrictions on the use of hazardous substances (RoHS) and waste management requirements, pose challenges for SMT manufacturers. Compliance with these regulations requires changes in materials, processes, and waste management practices, which can increase operational costs.

Additionally, regulations vary by region, complicating compliance for companies operating globally. Investment in sustainable SMT practices and lead-free soldering can prove beneficial for manufacturers.

China is known as the "world's factory" due to its vast manufacturing capabilities and well-established infrastructure. The country has a strong base of electronics manufacturing companies, which drives the demand for SMT technology. The presence of numerous contract manufacturers, original equipment manufacturers (OEMs), and original design manufacturers (ODMs) supports the growth of the SMT market. The impact of 3D printing on SMT manufacturing is evident in China.

The Chinese government has implemented various policies and initiatives to boost the electronics and semiconductor industries. Programs such as the "Made in China 2025" plan aim to upgrade the manufacturing sector by promoting advanced technologies, including SMT.

Government incentives, subsidies, and investments in research and development (R&D) further support the growth of the SMT market. Mergers and acquisitions in the surface mount technology industry also shape demand in China.

China's rapid urbanization and industrialization have led to increased demand for consumer electronics, automotive electronics, and industrial automation. The growing middle class and rising disposable incomes drive the consumption of electronic devices, thereby boosting the demand for SMT components and assemblies.

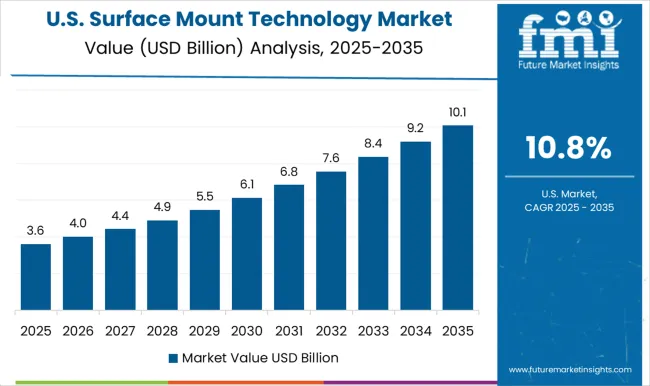

The United States is at the forefront of emerging technologies and industries such as electric vehicles (EVs), renewable energy, IoT, and advanced medical devices. These sectors rely on sophisticated electronic assemblies produced using SMT technology. The growth of these industries fuels the demand for SMT components and drives market expansion. Also, the surface mount technology market mergers and acquisition (M&A) activity boosts revenues in the country.

The increasing demand for high-performance computing (HPC) systems, data centers, and cloud computing infrastructure drives the need for advanced electronic components. SMT technology enables the production of high-density, high-speed electronic assemblies required for HPC applications. The expansion of data centers and cloud computing facilities in the United States contributes to the growth of the SMT market.

The healthcare sector in the United States demands advanced medical electronics, diagnostic devices, and healthcare technologies. SMT plays a crucial role in producing miniaturized, high-performance electronic components used in medical devices and equipment. The growing aging population, advancements in medical technology, and increasing healthcare spending drive demand for SMT solutions in the healthcare sector.

Surface mount technology market financial analysis indicates that India's rapidly growing middle class and increasing disposable incomes drive the demand for consumer electronics products such as smartphones, laptops, and home appliances. SMT technology is essential for producing compact, high-performance electronic assemblies used in these devices. The expansion of the domestic consumer electronics market boosts the demand for SMT components and services.

The Indian government provides various incentives and support measures to promote electronics manufacturing and technology adoption. Initiatives such as the Production Linked Incentive (PLI) scheme for electronics manufacturing attract investments and encourage the expansion of SMT facilities in India. These government efforts shape SMT market investment strategies in India.

India has ambitious goals for renewable energy adoption and sustainability. The emphasis on green technologies drives the demand for electronic components and assemblies used in renewable energy systems such as solar panels and wind turbines. SMT technology enables the production of efficient, reliable electronic assemblies for renewable energy applications, supporting market expansion.

Rework and repair equipment are essential for ensuring the quality and reliability of electronic assemblies. They allow manufacturers to identify and correct defects such as soldering errors, component misplacements, and connectivity issues. By implementing effective rework and repair processes, manufacturers can minimize the risk of product failures and warranty claims, thereby enhancing customer satisfaction.

With the trend towards miniaturization and high-density electronic assemblies, the risk of defects such as solder bridges, tombstoning, and insufficient solder joints increases. Rework and repair equipment are equipped with advanced technologies such as hot-air rework stations, soldering irons, and optical inspection systems to address these challenges effectively.

They enable precise, localized rework and repair of intricate assemblies, supporting the production of compact, high-performance electronics.

The proliferation of smart devices and the Internet of Things (IoT) ecosystem is fueling demand for SMT components and assemblies. Smartphones, smartwatches, smart speakers, home automation systems, and wearable devices rely on SMT technology for their functionality and connectivity. As the IoT market expands and more devices become interconnected, the demand for SMT in consumer electronics continues to grow.

The rise of e-commerce and online retail platforms has made consumer electronics products more accessible to a global audience. Consumers can easily purchase electronic devices online, driving demand for SMT components and assemblies used in these products. The convenience of online shopping, coupled with competitive pricing and fast delivery, contributes to the growth of the consumer electronics segment in the SMT market.

The surface mount technology (SMT) market is highly competitive, featuring global leaders like ASM Assembly Systems and Panasonic alongside regional players and niche providers. These companies offer a range of equipment, components, and services essential for electronic manufacturing.

Additionally, suppliers of materials, software, and emerging technologies contribute to the market's dynamism. Startups and innovators bring new perspectives and disruptive solutions, shaping the industry's future.

Recent Developments

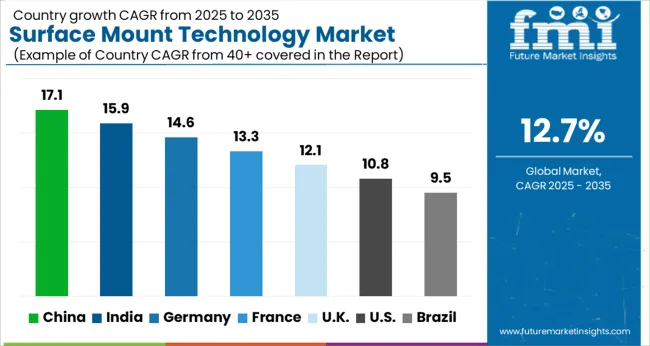

| Country | CAGR |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| France | 13.3% |

| UK | 12.1% |

| USA | 10.8% |

| Brazil | 9.5% |

The Surface Mount Technology Market is expected to register a CAGR of 12.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 17.1%, followed by India at 15.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 9.5%, yet still underscores a broadly positive trajectory for the global Surface Mount Technology Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.6%. The USA Surface Mount Technology Market is estimated to be valued at USD 2.1 billion in 2025 and is anticipated to reach a valuation of USD 5.7 billion by 2035. Sales are projected to rise at a CAGR of 10.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 274.2 million and USD 158.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Equipment | Placement Equipment, Inspection Equipment, Soldering Equipment, Screen Printing Equipment, Cleaning Equipment, and Rework and Repair Equipment |

| Application | Consumer Electronics, Telecommunications, Aerospace & Defense, Automotive, Medical, Industrial, and Energy & Power Systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ASM Assembly Systems, Fuji Corporation, Panasonic Corporation, Mycronic AB, Juki Corporation, TDK Corporation, Murata Manufacturing Co., Ltd., Vishay Intertechnology, Inc., Foxconn Technology Group, Flex Ltd. (formerly Flextronics), Jabil Inc., Celestica Inc., Sanmina Corporation, Europlacer Ltd., Manncorp Inc., Essemtec AG, Nordson Corporation, Siemens Digital Industries Software, Mentor, a Siemens Business, KIC Thermal, Aegis Industrial Software Corporation, Cogiscan Inc., Henkel AG & Co. KGaA, Indium Corporation, Kester (a subsidiary of Illinois Tool Works Inc.), Alpha Assembly Solutions (a part of MacDermid Alpha Electronics Solutions), and AIM Solder |

The global surface mount technology market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the surface mount technology market is projected to reach USD 19.0 billion by 2035.

The surface mount technology market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in surface mount technology market are placement equipment, inspection equipment, soldering equipment, screen printing equipment, cleaning equipment and rework and repair equipment.

In terms of application, consumer electronics segment to command 28.5% share in the surface mount technology market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Measurement Equipment And Tools Market

Surface Drilling Rigs Market

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA