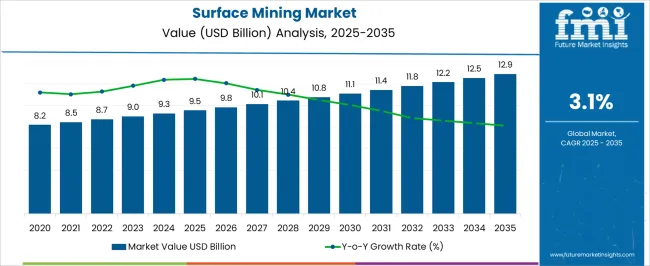

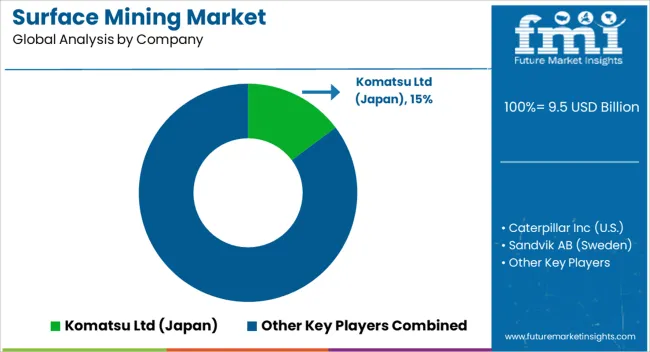

The Surface Mining Market is estimated to be valued at USD 9.5 billion in 2025 and is projected to reach USD 12.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

| Metric | Value |

|---|---|

| Surface Mining Market Estimated Value in (2025 E) | USD 9.5 billion |

| Surface Mining Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The surface mining market is witnessing strong growth momentum, supported by the rising global demand for energy resources, construction materials, and industrial minerals. Increasing investments in large-scale mining projects and the growing need for cost-efficient extraction methods are driving adoption of surface mining techniques over underground alternatives. Advancements in equipment automation, real-time monitoring, and data-driven decision-making are improving productivity, safety, and operational efficiency across mining sites.

Rising emphasis on sustainability and resource optimization is encouraging the deployment of digital solutions that minimize waste and environmental impact. The ability of surface mining to provide higher recovery rates, lower operating costs, and faster project timelines is influencing its continued preference by mining operators.

As global energy demand increases and infrastructure development accelerates, the market is poised for sustained growth Manufacturers and service providers are also focusing on integrating software-based systems to optimize planning and execution, ensuring that surface mining remains a vital part of the global resource supply chain.

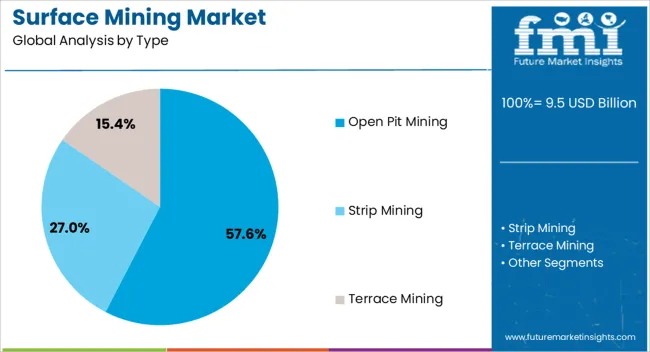

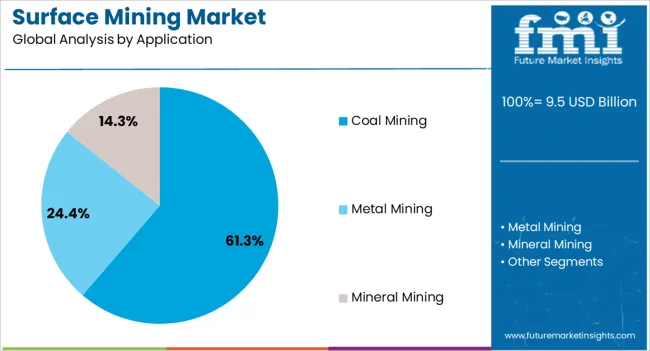

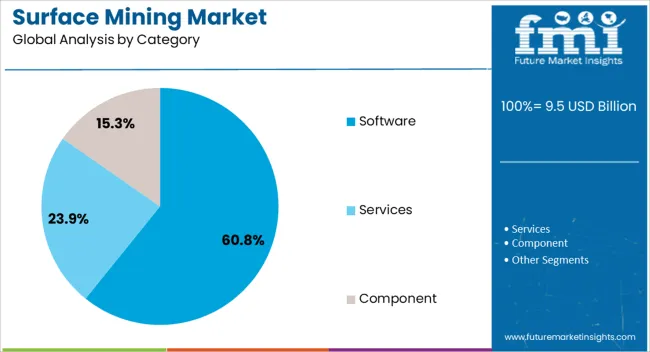

The surface mining market is segmented by type, application, category, and geographic regions. By type, surface mining market is divided into Open Pit Mining, Strip Mining, and Terrace Mining. In terms of application, surface mining market is classified into Coal Mining, Metal Mining, and Mineral Mining. Based on category, surface mining market is segmented into Software, Services, and Component. Regionally, the surface mining industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The open pit mining segment is projected to hold 57.6% of the surface mining market revenue share in 2025, making it the leading type of mining method. Its dominance is being supported by the ability to extract large volumes of minerals efficiently and economically, especially in deposits located near the earth’s surface. The technique allows for continuous operations with advanced machinery, resulting in lower production costs and higher material recovery compared to underground mining methods.

Growing demand for bulk commodities such as coal, iron ore, and copper is reinforcing the adoption of open pit mining, as it enables large-scale production to meet global requirements. Enhanced safety standards and the integration of autonomous haulage systems are further improving operational reliability, reducing risks for workers while maximizing output.

Additionally, open pit mining provides flexibility in design and scalability, enabling operators to adapt quickly to changing production needs The combination of cost-effectiveness, efficiency, and scalability is driving its leadership position within the surface mining industry.

The coal mining segment is anticipated to account for 61.3% of the surface mining market revenue share in 2025, making it the dominant application area. This leadership is being driven by the continued reliance on coal for electricity generation in many regions, particularly in Asia-Pacific, where energy demand is growing rapidly. Surface mining techniques, especially open pit methods, are widely adopted in coal extraction due to their ability to access large reserves quickly and cost-effectively.

The increasing requirement for thermal coal in power plants and metallurgical coal in steel production is supporting segment growth. Technological innovations, including high-capacity draglines and continuous mining equipment, are further improving efficiency and reducing operational downtime.

Environmental regulations are pushing operators to adopt cleaner mining technologies, but coal remains a critical component of the global energy mix, ensuring its continued prominence As developing economies expand their energy infrastructure, the coal mining segment will maintain its leading role, reinforced by both economic necessity and large-scale resource availability.

The software category segment is expected to represent 60.8% of the surface mining market revenue share in 2025, establishing itself as the leading category. Its leadership is being fueled by the rapid digital transformation of mining operations, where software solutions are being used to optimize exploration, planning, fleet management, and predictive maintenance. Mining companies are increasingly leveraging data analytics, simulation tools, and AI-driven platforms to improve decision-making and reduce operational costs.

Software integration is enabling real-time monitoring of equipment performance, production rates, and environmental compliance, which enhances efficiency and reduces downtime. The widespread adoption of automation and remote operation technologies in surface mining has elevated the importance of software as a central enabler of productivity.

In addition, sustainability goals are encouraging operators to implement digital platforms that minimize environmental impacts and improve resource utilization With growing emphasis on safety, efficiency, and cost reduction, software solutions are expected to remain the backbone of innovation in surface mining, consolidating their leading position in the market.

Surface mining refers to the mining technique where the overlying layer of soil and rock is removed, followed by the recovery or excavation of the underlying minerals. This method of mining provides considerably better recovery, safety, flexibility, environmental conditions and grade control as compared to other mining methods such as underground mining. The technique of surface mining gained momentum in the 16th century and has been widely prevalent at a global level, especially in North America.

Factors such as lower injury rates, better recovery, flexibility and grade control serve as drivers for the global surface mining industry. However, from an environmental perspective, surface mining tends to have an extensive and more prominent impact on the surrounding environment as compared to underground mining. This is a disadvantage for the global surface mining industry. Hence, to counter this environmental impact associated with the surface mining operations, a safety zone needs to be placed around the mining area. Another disadvantage associated with the global surface mining industry is the relatively higher transport cost involved during the mining operation. For instance, the transportation cost of rock in open pit mining method accounts for about 50% of the total operating cost. Supporting regulations for surface mining such as the Surface Mining Control and Reclamation Act, 1977 in the US, and proper economic planning alongwith the establishment of safety zone near the mine surface have been introduced in recent times. These developments, the vast horizontal and low lying reserves and the surging demand of iron-ore, diamond, chromium and coal, will act as opportunistic factors for the global surface mining market.

Market segmentation of surface mining can be done on the basis of mining methods, the type of mineral deposits and regions. On the basis of mining methods, the global surface mining can be categorised into 3 groups: strip mining, terrace mining and open-pit mining. Among these, strip mining is applied where both the surface of the ground and the ore body are relatively horizontal with a minimal depth under the surface. An example of strip mining is the coal mining operation at Mpumalanga. Terrace mining is opted for where the overlying layer is relatively thicker or the ore incline is too steep. Terrace mining is a multi-step method in which the entire mine moves over the ore reserve from one end to another. This type of mining is prevalent in Germany-based lignite mines, and in some of the coal mines in the UK and South Africa. Open-pit mining refers to the traditional cone-shaped excavation with a typical vein structure, and steeply dipping and stratified ores. This mining method is primarily used for the excavation of metals such as Sishen iron-ore and Palabora copper ore. However, at some places open-pit mining can also be used for the excavation of other types of deposits such as diamond ore at Finsch.

On the basis of the type of mineral deposits, surface mining can be categorised as stratified and non-stratified. Stratified surface mining can be further sub-divided into horizontal and inclined. Non-stratified is divided into vertical vein, and massive stockwork or pipe.

On the basis of region, the global surface mining market includes North America, Latin America, Asia Pacific, Japan, Western Europe, Eastern Europe, and Middle East & Africa. Among these, surface mining is mostly prevalent in North America, followed by Latin America, Asia Pacific, and Middle East & Africa. Surface mining accounts for about 85% of the overall mineral exploitation in the US. The major countries using surface mining include the US, Canada, Mexico, Peru, India, China, Chile, Brazil, Indonesia, Ukraine, Angola and Australia.

Some of the prominent players of the global surface mining market include: Goldcorp, Teck, Rio Tinto, BHP Billiton, Vale S A, Freeport-McMoran, Barrick Gold and others. With the adoption of safety measures, economical techniques and support from governmental legislations, the mining companies are expected to witness further positive growth, thereby contributing to a sustainable positive future for the global surface mining market.The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.It also contains projections usinga suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

On the basis of the type of mineral deposits, surface mining can be categorised as

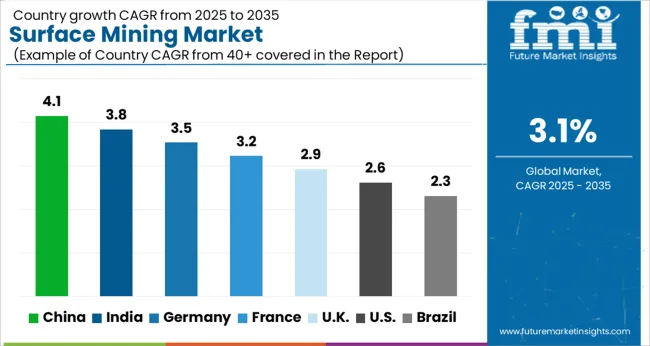

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The Surface Mining Market is expected to register a CAGR of 3.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.1%, followed by India at 3.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.3%, yet still underscores a broadly positive trajectory for the global Surface Mining Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.5%. The USA Surface Mining Market is estimated to be valued at USD 3.4 billion in 2025 and is anticipated to reach a valuation of USD 4.4 billion by 2035. Sales are projected to rise at a CAGR of 2.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 466.1 million and USD 282.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.5 Billion |

| Type | Open Pit Mining, Strip Mining, and Terrace Mining |

| Application | Coal Mining, Metal Mining, and Mineral Mining |

| Category | Software, Services, and Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Komatsu Ltd (Japan), Caterpillar Inc (USA), Sandvik AB (Sweden), Atlas Copco AB (Sweden), ABB Ltd. (Switzerland), Hitachi Construction Machinery Co. Ltd (Japan), BHP Billiton (Australia), Vale S.A (Brazil), Cisco Systems Inc.(USA), Anglo American Plc. (UK), Freeport-McMoRan Inc. (USA), and Barrick Gold Corporation (Canada) |

The global surface mining market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the surface mining market is projected to reach USD 12.9 billion by 2035.

The surface mining market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in surface mining market are open pit mining, strip mining and terrace mining.

In terms of application, coal mining segment to command 61.3% share in the surface mining market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA