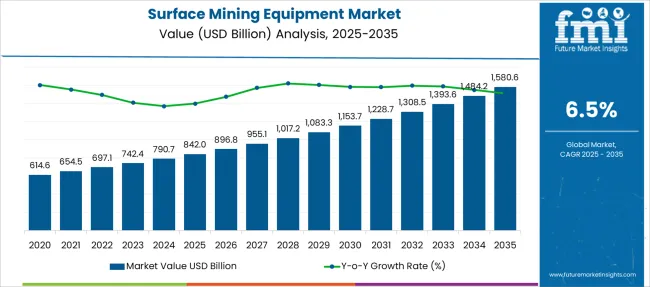

The Surface Mining Equipment Market is estimated to be valued at USD 842.0 billion in 2025 and is projected to reach USD 1580.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Surface Mining Equipment Market Estimated Value in (2025E) | USD 842.0 billion |

| Surface Mining Equipment Market Forecast Value in (2035F) | USD 1580.6 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The growth of open-pit mining, which allows for economical extraction of surface mineral deposits, has driven investments in advanced machinery. Improvements in equipment automation and durability have enhanced operational efficiency and safety in mining projects.

Rising demand for coal as an energy source in several regions has further fueled the need for robust surface mining solutions. Industry focus on cost optimization and environmental compliance has encouraged the adoption of equipment that delivers high productivity while reducing emissions and downtime.

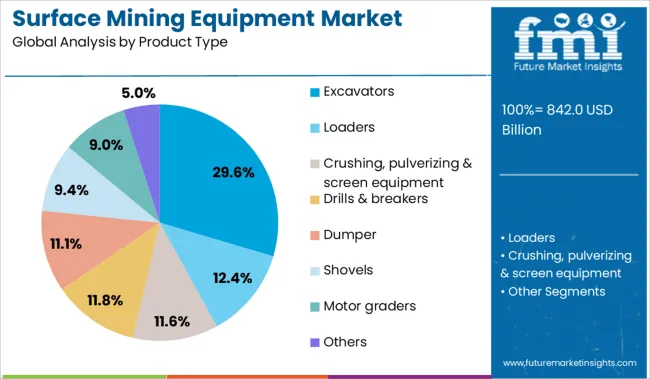

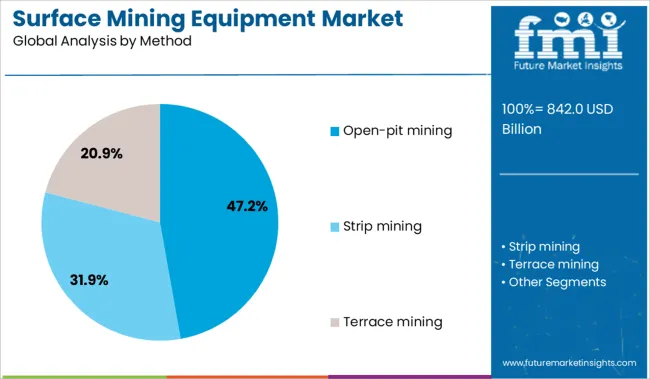

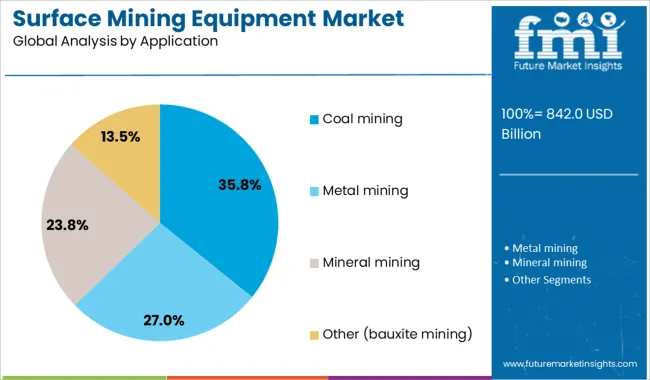

Future market growth is expected to be supported by technological advancements and expanding mining activities in emerging economies. Segmental growth is likely to be led by Excavators in product type, Open-pit mining as the predominant method, and Coal mining as the leading application.

The market is segmented by Product Type, Method, and Application and region. By Product Type, the market is divided into Excavators, Loaders, Crushing, pulverizing & screen equipment, Drills & breakers, Dumper, Shovels, Motor graders, and Others.

In terms of Method, the market is classified into Open-pit mining, Strip mining, and Terrace mining. Based on Application, the market is segmented into Coal mining, Metal mining, Mineral mining, and Other (bauxite mining). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Excavators segment is projected to represent 29.6% of the surface mining equipment market revenue in 2025, establishing its leadership in product types. This growth has been driven by the versatility and efficiency of excavators in material handling, overburden removal, and loading operations. Excavators are preferred for their adaptability to various terrains and ability to perform multiple functions with specialized attachments.

Their increased use in large-scale mining projects is supported by advancements in hydraulic technology and operator control systems, which improve precision and productivity.

As mining operations continue to scale up and focus on operational efficiency, the demand for excavators is expected to remain strong.

The Open-pit mining segment is expected to account for 47.2% of the market revenue in 2025, maintaining its dominance as the primary mining method. This method’s popularity stems from its cost-effectiveness and suitability for extracting near-surface mineral deposits. Open-pit mining facilitates the use of large machinery, enabling high volume extraction with relatively lower operational risks compared to underground mining.

The method also allows for continuous extraction, improving overall project timelines. Regulatory approvals and environmental considerations have also favored open-pit approaches where feasible.

As mineral demand grows, open-pit mining is poised to retain its leading role in mining operations.

The Coal mining segment is projected to contribute 35.8% of the surface mining equipment market revenue in 2025, making it the largest application segment. This growth reflects the ongoing reliance on coal for energy production in many countries despite the rise of alternative energy sources. Surface mining equipment is essential for efficient coal extraction, especially in large open-pit mines.

The segment benefits from government infrastructure projects and energy policies supporting coal production in various regions. Additionally, modernization efforts in coal mining operations have led to increased demand for reliable and high-capacity equipment.

The Coal mining segment is expected to maintain its market dominance as coal continues to be a significant energy source in developing and developed markets.

Rising demand for mineral resources, infrastructure development, and efficiency needs boost surface mining equipment adoption. Opportunities lie in fuel-efficient machinery, tele-operated systems, and partnerships with mining firms and OEM financing schemes.

The surface mining equipment market is expanding as global demand for metals, coal, and aggregates rises alongside infrastructure and construction projects. Mining firms need heavy-duty machinery-such as excavators, haul trucks, dozers, and drills-that deliver high uptime, load capacity, and cost-per-ton efficiency. Equipment reliability reduces downtime and supports tight project schedules. Governments' push for new roads, ports, and energy projects reinforces demand for extracted materials. Mining operators focus on lowering operational costs through higher fuel efficiency, extended service intervals, and improved parts availability. In high-demand regions such as Australia, Latin America, and parts of Africa, companies are investing in larger fleets and modern equipment to boost productivity in large open-pit operations.

Opportunities in the surface mining equipment market center on introducing machinery with higher fuel efficiency, lower emissions, and remote-control or semi-autonomous features. Manufacturers developing tele-operated or assisted-control machines can help mining companies reduce operator fatigue and enhance safety in hazardous zones. Additionally, offering pay-per-use models, equipment rental agreements, and OEM-sponsored financing packages helps smaller mining firms access high-end machinery without heavy upfront costs. Expansion into emerging markets with new resource developments offers potential, especially when bundled with on-site training and maintenance services. Collaborations between equipment makers, mining operators, and government-supported programs for mine modernization can unlock broader adoption and support sustainable operations over long-term project cycles.

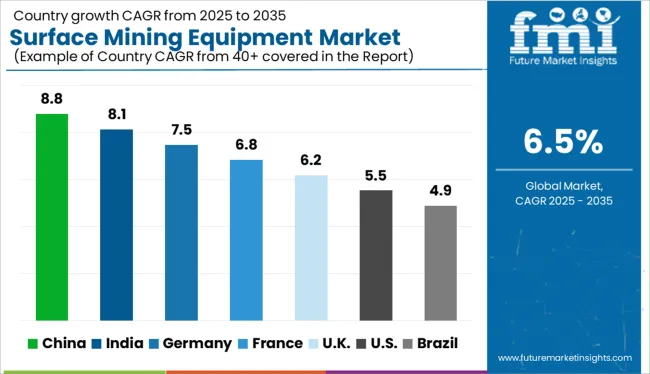

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| U.K. | 6.2% |

| U.S. | 5.5% |

| Brazil | 4.9% |

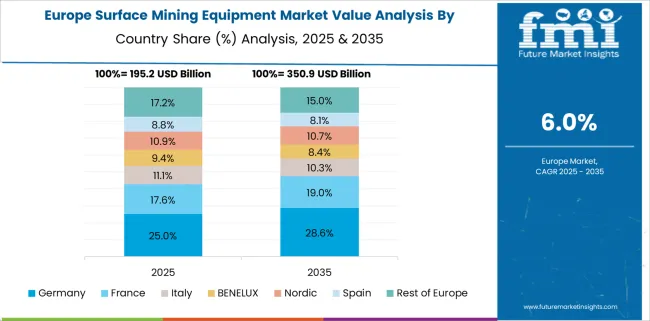

The global surface mining equipment market is projected to grow at a CAGR of 6.5% from 2025 to 2035, driven by rising demand for metals, minerals, and construction materials amid infrastructure and energy transitions. Among BRICS economies, China leads with an 8.8% CAGR, supported by vast coal and rare earth extraction, coupled with heavy investment in autonomous and electric mining fleets. India follows at 8.1%, propelled by domestic mineral exploration, government-backed mining reforms, and capacity expansion in coal production. Within the OECD group, Germany shows notable growth at 7.5% due to automation in quarry operations and sustainability mandates. The United Kingdom (6.2%) and the United States (5.5%) reflect steady replacement demand, with a focus on electrification, operator safety, and fleet digitization. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

Between 2025 and 2035, China surface mining equipment market is projected to grow at a CAGR of 8.8%, with annual gains fluctuating from 8.4% to 9.2%. Expansion in coal, iron ore, and rare earth mining is generating robust demand for large-scale equipment including hydraulic excavators, surface miners, and haul trucks. Domestic manufacturers are enhancing their capabilities by integrating automation, remote diagnostics, and fuel-efficient designs. Environmental concerns are also driving upgrades to cleaner and more efficient machinery across key provinces. With steady infrastructure growth and resource security strategies, investments in surface mining machinery continue to rise.

From 2025 to 2035, India is expected to record a CAGR of 8.1% in its surface mining equipment market, with yearly growth ranging between 7.7% and 8.5%. Growing energy needs and construction activity are prompting a resurgence in coal and bauxite surface mining. Public sector undertakings and private firms alike are expanding fleets with modernized dozers, drills, and draglines. Government reforms on mineral exploration, along with digitized mine planning, are promoting greater equipment adoption in both greenfield and brownfield operations. Local production is also expanding under "Make in India" efforts.

A CAGR of 6.2% is projected for the surface mining equipment market across the United Kingdom between 2025 and 2035, with annual growth hovering between 5.9% and 6.5%. Demand is being led by quarrying, limestone, and aggregates extraction for infrastructure and commercial real estate development. Equipment suppliers are shifting toward compact, high-efficiency loaders and wheel excavators that suit mid-sized mining operations. Regulatory guidelines on emissions and land rehabilitation are pushing fleets to modernize with eco-friendly units. Data-centric equipment with telematics and GPS guidance is seeing strong uptake.

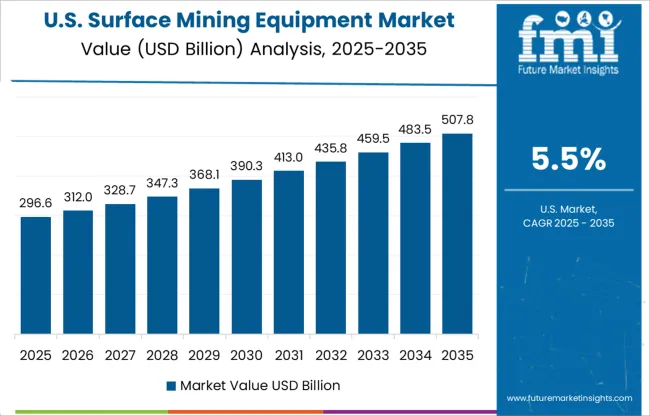

Between 2025 and 2035, the U.S. surface mining equipment market is projected to grow at a CAGR of 5.5%, with year-to-year increases ranging from 5.1% to 5.8%. Demand is being driven by expansion in aggregates, phosphate, and metal mining sectors. Federal investments in infrastructure and energy independence are influencing equipment modernization cycles, especially for haul trucks, blast drills, and crushing plants. Environmental compliance is encouraging the use of low-noise, fuel-efficient machinery. Tech upgrades like predictive maintenance and fleet optimization software are becoming standard.

Germany’s surface mining equipment market is forecast to grow at a CAGR of 7.5% during the period of 2025 to 2035, with year-on-year growth fluctuating between 7.1% and 7.9%. A shift toward environmentally conscious open-pit mining is fueling demand for electric and hybrid equipment, particularly in lignite and industrial minerals sectors. High emphasis on precision, noise reduction, and low-emission operations is driving the need for smarter, sensor-integrated equipment. Research institutions and OEMs are collaborating to create next-generation drills, loaders, and crushing systems compatible with European mining standards.

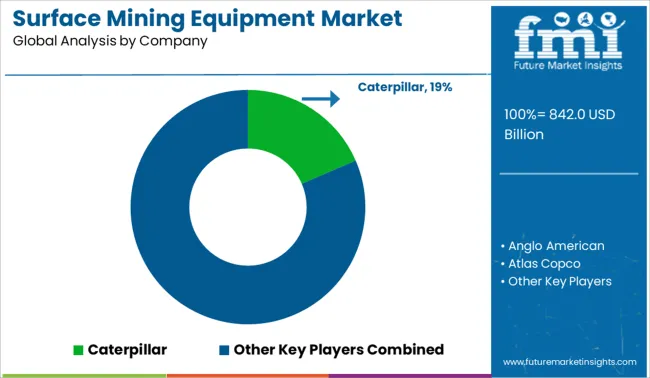

The surface mining equipment market is moderately consolidated, dominated by a few global OEMs that offer high-capacity, durable machinery tailored for large-scale mining operations. Tier 1 manufacturers like Caterpillar, Komatsu, and Hitachi Construction Machinery lead with integrated equipment portfolios-including haul trucks, excavators, and drills-backed by automation, telematics, and fuel-efficient technologies. Caterpillar holds the top position with an 18.5% share, driven by global reach and long-term supply agreements with major mining firms like BHP and Rio Tinto.

Tier 2 companies such as Liebherr, Volvo, and J.C. Bamford Excavators provide versatile and regionally optimized machines. Tier 3 players, including Boart Longyear and Atlas Copco, specialize in drilling and auxiliary systems. End users like Anglo American, Barrick Gold, and Vale significantly influence market trends through procurement strategies, digitalization goals.

| Item | Value |

|---|---|

| Quantitative Units | USD 842.0 Billion |

| Product Type | Excavators, Loaders, Crushing, pulverizing & screen equipment, Drills & breakers, Dumper, Shovels, Motor graders, and Others |

| Method | Open-pit mining, Strip mining, and Terrace mining |

| Application | Coal mining, Metal mining, Mineral mining, and Other (bauxite mining) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Anglo American, Atlas Copco, Barrick Gold, BHP Billiton, Boart Longyear, Freeport-McMoRan, Hitachi Construction Machinery, J.C. Bamford Excavators, Komatsu, Liebherr, Metso, Rio Tinto, Sandvik, Vale, and Volvo |

| Additional Attributes | Dollar sales by equipment type (draglines, excavators, loaders, trucks, shovels, dozers), mineral type (coal, copper, iron, limestone, gold), and end-user (mining contractors, quarry operators, government-owned entities); regional demand driven by commodity prices, infrastructure investment, and regulatory environments; technological innovations in automation, electrification, and remote operation; total cost of ownership including fuel, maintenance, and operator training; environmental impact of emissions, dust, and land disruption; and emerging use cases in rare earth and battery metal extraction. |

The global surface mining equipment market is estimated to be valued at USD 842.0 billion in 2025.

The market size for the surface mining equipment market is projected to reach USD 1,580.6 billion by 2035.

The surface mining equipment market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in surface mining equipment market are excavators, loaders, crushing, pulverizing & screen equipment, drills & breakers, dumper, shovels, motor graders and others.

In terms of method, open-pit mining segment to command 47.2% share in the surface mining equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Drilling Rigs Market

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Measurement Equipment And Tools Market

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA