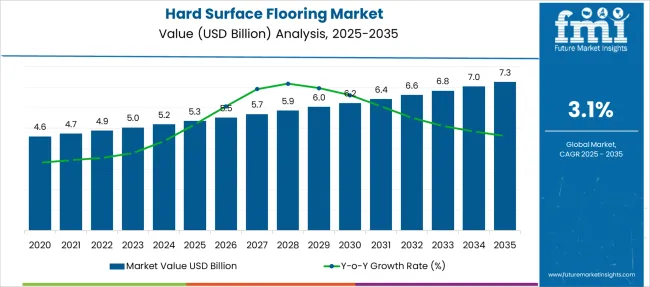

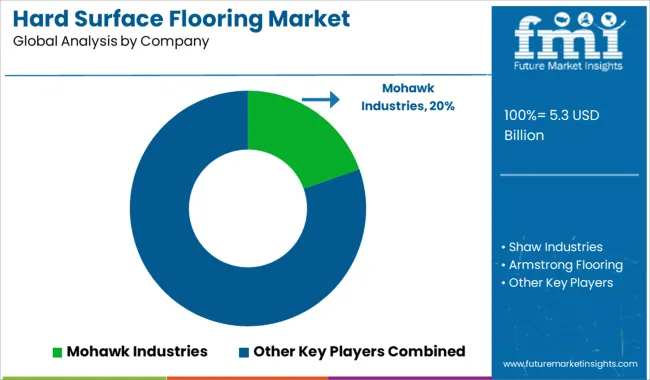

The Hard Surface Flooring Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 7.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

| Metric | Value |

|---|---|

| Hard Surface Flooring Market Estimated Value in (2025 E) | USD 5.3 billion |

| Hard Surface Flooring Market Forecast Value in (2035 F) | USD 7.3 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The hard surface flooring market is experiencing consistent growth driven by evolving consumer preferences toward durable, low-maintenance, and aesthetically versatile flooring solutions. Advancements in material technology, design innovation, and manufacturing efficiency have expanded the appeal of hard surface flooring across residential, commercial, and industrial spaces.

Rising urbanization, real estate development, and remodeling activities are further supporting the market, particularly in emerging economies. Sustainability is becoming a core driver, with increasing demand for recyclable, eco-friendly, and low-VOC flooring options.

Additionally, consumer inclination toward allergen-resistant and easy-to-clean surfaces has accelerated the shift from traditional carpeting to hard surface alternatives. As architectural and interior design trends favor modern finishes and wood-look textures, the hard surface flooring market is well-positioned to continue its upward trajectory with both volume and value gains expected in the near to mid-term.

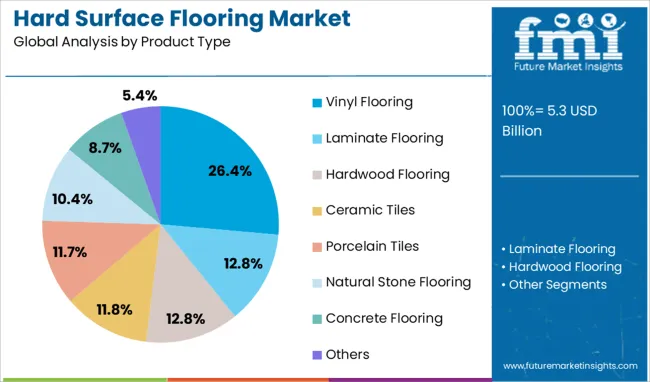

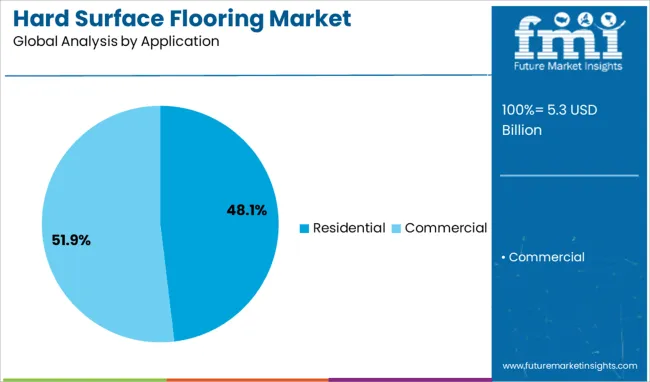

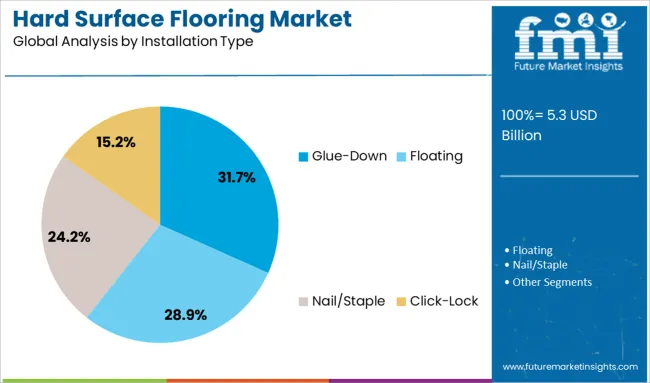

The hard surface flooring market is segmented by product type, application, installation type, and distribution channel and geographic regions. By product type of the hard surface flooring market is divided into Vinyl Flooring, Laminate Flooring, Hardwood Flooring, Ceramic Tiles, Porcelain Tiles, Natural Stone Flooring, Concrete Flooring, and Others. In terms of application of the hard surface flooring market is classified into Residential and Commercial. Based on installation type of the hard surface flooring market is segmented into Glue-Down, Floating, Nail/Staple, and Click-Lock. By distribution channel of the hard surface flooring market is segmented into Online Retail and Offline Retail. Regionally, the hard surface flooring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vinyl flooring leads the product type category with a 26.4% market share, supported by its resilience, affordability, and aesthetic adaptability across various interiors. The material's resistance to moisture, stains, and heavy foot traffic makes it a preferred option for both residential and commercial settings.

Recent technological advancements have enhanced the realism of vinyl surfaces, replicating wood, stone, and ceramic finishes while offering easier installation and lower maintenance. The segment's growth is also bolstered by its compatibility with underfloor heating and superior sound absorption properties.

Vinyl flooring appeals to cost-conscious consumers seeking high-performance flooring without sacrificing design flexibility. As manufacturers introduce eco-friendly, phthalate-free, and fully recyclable vinyl options, its adoption is expected to remain strong, particularly in renovation and multi-family housing markets.

The residential segment commands a leading 48.1% share in the application category, driven by robust home renovation trends and increased investment in personal living spaces. Homeowners are increasingly prioritizing flooring solutions that combine durability with design versatility, making hard surface options like vinyl, laminate, and engineered wood highly attractive.

This segment has benefitted from rising disposable incomes, favorable mortgage rates, and a growing do-it-yourself culture that supports product adoption. Furthermore, hard surface flooring is being favored in kitchens, bathrooms, and basements due to its moisture resistance and low maintenance needs.

Aesthetic preferences for sleek, modern interiors have also contributed to segment dominance. The residential segment is expected to maintain its lead as consumers continue to invest in home improvement projects that enhance property value and comfort.

The glue-down installation method holds a 31.7% share in the hard surface flooring market, favored for its superior stability and long-term performance in both residential and commercial settings. This method ensures a firm bond between the flooring and subfloor, reducing movement, sound transmission, and wear over time.

It is particularly suited for high-traffic areas and environments requiring moisture resistance and precision. The segment benefits from increasing demand in multi-family housing, office spaces, and retail outlets where longevity and structural reliability are paramount.

Though installation requires more time and professional expertise compared to floating methods, its durability and seamless appearance justify continued preference among developers and contractors. As manufacturers innovate with pre-applied adhesives and low-VOC glues, the glue-down segment is expected to see sustained adoption in projects prioritizing long-term flooring solutions.

The hard surface flooring market is expanding due to rising renovation demand, versatile product offerings, and a strong shift toward low-maintenance options like vinyl and laminate. Competitive strategies focused on innovation, e-commerce growth, and quality compliance further strengthen global adoption.

The hard surface flooring market is seeing strong momentum from increasing residential remodeling and commercial renovation projects. Homeowners prefer hard surface options like vinyl, laminate, and hardwood for their durability and aesthetic appeal, which adds value to properties. In the commercial segment, spaces such as offices, retail stores, and hospitality venues are opting for hard flooring solutions to withstand heavy traffic while maintaining a modern look. This trend is supported by rising disposable incomes and an inclination toward upgrading interiors for long-term functionality. The need for stylish yet practical flooring choices continues to push demand in developed economies while creating growth opportunities in emerging regions where construction activity is increasing.

One of the key dynamics shaping this market is the evolution of versatile product lines that cater to diverse consumer preferences. Vinyl flooring is gaining traction due to its water resistance and ease of installation, while engineered wood appeals to those seeking premium aesthetics with better stability than traditional hardwood. Ceramic and stone tiles dominate spaces requiring durability and moisture protection, such as kitchens and bathrooms. Manufacturers are focusing on delivering varied textures, finishes, and color palettes that replicate natural materials, enabling homeowners and businesses to achieve desired design themes without compromising on cost or performance.

Demand for flooring that requires minimal upkeep is influencing product selection across residential and commercial spaces. Hard surface flooring options like luxury vinyl tiles and laminate have become popular due to their stain resistance, durability, and easy cleaning requirements. These attributes are particularly important in urban households with busy lifestyles and commercial environments that experience heavy foot traffic. The growing emphasis on practicality and convenience is steering consumers away from carpets and rugs toward hard surface alternatives. Manufacturers are responding by integrating enhanced protective coatings and finishes, further improving performance and extending product life cycles, ensuring broader adoption globally.

Competition in the hard surface flooring market is driven by strategic initiatives focused on product differentiation, regional expansion, and branding. Leading players are investing in advanced manufacturing technologies to improve product quality and maintain competitive pricing. Partnerships with distributors and expansion into e-commerce platforms have amplified reach, catering to both large-scale projects and direct-to-consumer demand. Brands are also emphasizing certifications and quality compliance to build trust among architects, designers, and end-users. Promotional campaigns highlighting durability, design variety, and installation ease are further influencing purchase decisions, consolidating the market’s position in both developed and emerging economies.

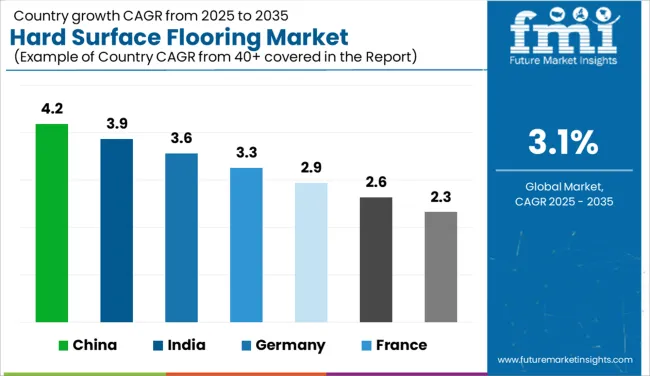

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The hard surface flooring market, projected to grow at a global CAGR of 3.1% from 2025 to 2035, shows distinct patterns across major countries. China leads with a 4.2% CAGR, supported by strong demand in residential and commercial construction, while India follows at 3.9%, driven by growing urban housing projects and increased renovation activities. Germany maintains steady progress at 3.6%, benefiting from sustainable building trends and premium flooring adoption. France exhibits 3.3%, propelled by a preference for high-quality, design-oriented solutions within modern architecture. The United Kingdom and the United States show relatively slower growth, with CAGRs of 2.9% and 2.6%, respectively, primarily due to market maturity and slower construction expansion compared to emerging economies. However, opportunities persist through upgrades in luxury and low-maintenance flooring categories, as consumer preferences shift toward functional, aesthetically appealing options. The report evaluates 40+ markets, highlighting these top five for their strategic role in shaping the industry’s direction.

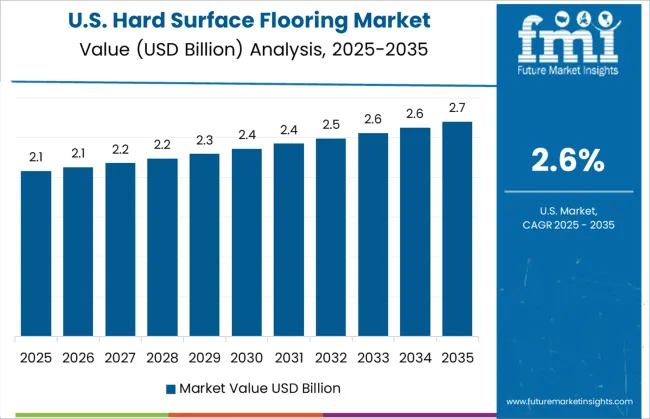

The CAGR for the hard surface flooring market in the United States advanced from 2.2% during 2020–2024 to approximately 2.6% between 2025–2035. This growth has been attributed to increasing investments in large-scale renovation projects across residential and commercial sectors. The trend of replacing carpets with hard flooring materials has accelerated as consumers seek durable, easy-to-clean alternatives that enhance property aesthetics. Commercial real estate developers in office and hospitality sectors have emphasized flooring solutions like LVT (luxury vinyl tile) and engineered wood to withstand heavy traffic and maintain design appeal. Additionally, the rise of e-commerce platforms has increased accessibility to premium flooring options, allowing suppliers to reach a broader customer base. Renovation programs supported by federal energy-efficiency incentives also indirectly boost demand for floor materials that improve thermal compatibility.

The CAGR of the UK hard surface flooring market expanded from an estimated 2.3% during 2020–2024 to about 2.9% for 2025–2035, primarily supported by growth in housing refurbishments and the commercial fit-out sector. Demand for vinyl and laminate products surged as homeowners sought budget-friendly options for kitchen and bathroom upgrades. Luxury vinyl tiles gained popularity due to their aesthetic similarity to hardwood while maintaining lower installation costs. The rise of online retail platforms and home-improvement chains further boosted accessibility, encouraging DIY adoption. Market penetration in premium housing developments has been limited but is expected to rise as construction activity rebounds post-economic slowdowns. E-commerce strategies and digital design tools have been leveraged by manufacturers to support consumer decision-making.

China experienced a CAGR increase from approximately 3.7% during 2020–2024 to 4.2% for 2025–2035, driven by rapid infrastructure development and urban housing upgrades. Demand for hard surface flooring in metropolitan regions has been rising, especially for premium ceramic tiles and engineered wood floors. Builders favor these materials for high-rise residential complexes due to their durability and aesthetic appeal. The hospitality and retail sectors also witnessed heightened demand for commercial-grade vinyl and stone flooring. Growth in online marketplaces such as JD.com and Alibaba enabled widespread availability of diverse flooring options, boosting consumer adoption across Tier 2 and Tier 3 cities. Domestic manufacturers are scaling up production to meet design customization trends, including matte finishes and large-format tiles.

India saw a rise in CAGR from 3.4% during 2020–2024 to around 3.9% in 2025–2035, fueled by increasing construction in residential apartments and commercial spaces. Rapid expansion in mid-tier housing and government housing initiatives supported broader demand for cost-effective hard flooring options like vitrified tiles and laminates. Ceramic tiles are highly favored for kitchen and bathroom applications due to their affordability and moisture resistance. The hospitality and retail segments are adopting designer stone and engineered wood solutions to align with contemporary aesthetics. Growth of organized retail and digital buying platforms is further enhancing product accessibility for urban and semi-urban households. Manufacturers in India are prioritizing local sourcing and quick-delivery logistics to strengthen supply chains and maintain competitive pricing.

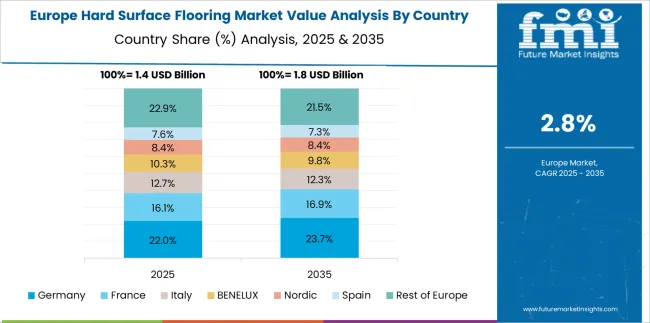

France recorded a CAGR improvement from about 2.7% during 2020–2024 to 3.3% in the 2025–2035 period, supported by robust demand from residential renovation and commercial infrastructure upgrades. The French housing sector has seen growing interest in ceramic tiles and engineered wood due to their durability and aesthetic versatility. Kitchen and bathroom remodeling projects account for a significant portion of sales, with waterproof vinyl flooring emerging as a popular choice. Additionally, the hospitality industry is investing heavily in premium flooring solutions to enhance customer experience and interior appeal. Government-driven energy-efficiency initiatives have also indirectly contributed to flooring replacement activity, boosting demand for thermally compatible materials. The shift toward DIY and e-commerce platforms has further simplified access to a wide range of products, making mid- to high-end flooring options more attainable for consumers seeking modern designs and functionality.

In the hard surface flooring market, leading manufacturers are focusing on performance-driven materials, aesthetic appeal, and product durability to cater to growing demand in residential and commercial spaces. Companies like Mohawk Industries and Shaw Industries dominate with broad product portfolios, including vinyl planks, ceramic tiles, and engineered wood, aimed at renovation and new construction projects. Armstrong Flooring and Tarkett have strengthened their positions by integrating eco-friendly production practices and launching innovative modular flooring systems for easy installation and maintenance.

Mannington Mills and Congoleum emphasize resilient flooring solutions like luxury vinyl tiles that deliver both water resistance and design versatility. Beaulieu International Group leverages its extensive global network to supply cost-competitive and design-rich offerings, particularly in emerging markets. Interface focuses on premium, modular, and sustainable flooring systems targeted at high-end commercial projects, while Karndean Designflooring differentiates with luxury vinyl tiles replicating natural wood and stone aesthetics.

These companies are investing in advanced manufacturing technologies, digital platforms for direct consumer engagement, and strategic partnerships to expand distribution channels. Their efforts toward customization, quick installation formats, and premium finishes are shaping competitive differentiation in a market where product performance and design innovation remain primary purchasing drivers.

Key strategies for 2024 and 2025 in the hard surface flooring market include expanding digital sales channels, introducing water-resistant and scratch-resistant materials, and targeting premium residential renovations. Manufacturers are focusing on sustainable sourcing, innovative textures, and quick-installation solutions to meet consumer preferences for convenience and aesthetics. Partnerships with builders and commercial contractors are being strengthened to capture large-scale projects, while localized production hubs are being developed to reduce logistics costs and improve delivery timelines.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.3 Billion |

| Product Type | Vinyl Flooring, Laminate Flooring, Hardwood Flooring, Ceramic Tiles, Porcelain Tiles, Natural Stone Flooring, Concrete Flooring, and Others |

| Application | Residential and Commercial |

| Installation Type | Glue-Down, Floating, Nail/Staple, and Click-Lock |

| Distribution Channel | Online Retail and Offline Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mohawk Industries, Shaw Industries, Armstrong Flooring, Tarkett, Mannington Mills, Congoleum, Beaulieu International Group, Interface, and Karndean Designflooring |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive brand positioning, product mix performance, pricing dynamics, distribution channel share, emerging material preferences, and growth opportunities in residential and commercial segments. |

The global hard surface flooring market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the hard surface flooring market is projected to reach USD 7.3 billion by 2035.

The hard surface flooring market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in hard surface flooring market are vinyl flooring, laminate flooring, hardwood flooring, ceramic tiles, porcelain tiles, natural stone flooring, concrete flooring and others.

In terms of application, residential segment to command 48.1% share in the hard surface flooring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hard Ground Tent Stake Hammer Market Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Hardwood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Hardness Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Hard-Wired Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Hard Disk Drive Market - Size, Share, and Forecast 2025-2035

Hardware-Assisted Verification Market Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hard Gelatin Capsules Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hardware Security Module Market Analysis - Size, Share & Forecast 2025 to 2035

Hard Seltzer Market Analysis by ABV Content, Packaging and Distribution Channel Through 2035

Industry Share Analysis for Hardwood Pulp Companies

Hard Tea Market

Hardgel Liquid Capsule Filling Machines Market

Hardware Encryption Market

Chardonnay Market Trends - Growth & Industry Forecast 2025 to 2035

Orchard Tractors Market Size and Share Forecast Outlook 2025 to 2035

Microhardness Testing System Market Size and Share Forecast Outlook 2025 to 2035

Soil Hardening Agent Market Size and Share Forecast Outlook 2025 to 2035

Door Hardware Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA