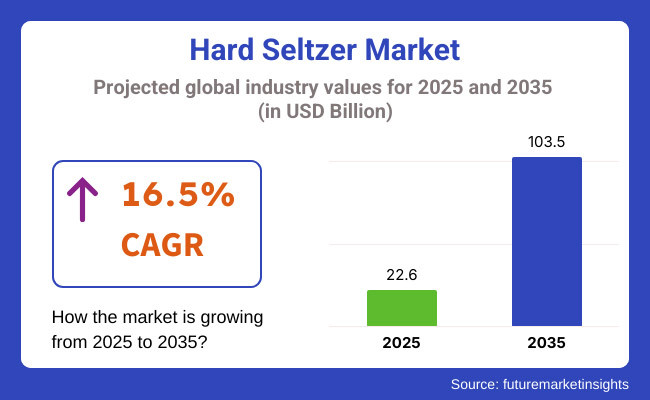

The global market for hard seltzers in 2023 was USD 16.8 billion. Demand for hard seltzers grew at a rate of 34.5% annually between 2024 and therefore made the estimate that the global market would be USD 22.6 billion in 2025. The global sales will grow at a CAGR of 16.5% between forecast period years 2025 to 2035, and subsequently become a value of USD 103.5 billion by fourth quarter of year 2035.

Hard seltzer is propelled by increasing consumer demands for reduced-calorie, healthier, and refreshing alcoholic beverages. Hard seltzer has been marketed as a healthy alternative beverage in relation to conventional alcoholic beverages such as cocktails, wine, and beer on the basis of reduced sugar and calorie intake. Consumers, particularly young consumers, have been extremely demanding of hard seltzer because of its low-alcohol and healthy character.

Also, the growth of the market is attributed to the fact that there are more hard seltzers as a result of more diversity since they come in varied flavors such as fruit and flower, herbs, etc. Diversification of the flavor will attract more consumers with special drinking experiences such as social consumers and consumers who will adopt a better and more craft experience drink. Apart from this, higher numbers of outdoor party, social party, and bash cases are driving the hard seltzer business.

Health drink culture has been one of the strongest drivers of the unprecedented frenzy of hard seltzers. The beverages are being positioned as gluten-free, low-carb, and reduced-alcohol proportion, which is being bolstered by people who require a fit lifestyle but are unable to refuse drinking something alcoholic. Why hard seltzers are specifically best suited to capture the desires of the drinkers for lighter and cold beverages is powering the firm's beat to grow at spectacularly rapid speeds.

Product innovation is also required in the hard seltzer category, where manufacturers introduce new flavor, formula, and pack to remain in the market. Craft and artisanal hard seltzers are also new product types because consumers are looking for newer and better experiences. Low-sugar, organic, and functional types, with types that have extra vitamins or probiotics, also set the stage for hard seltzers to be opened to consumers other than core consumers.

Following is comparative analysis of variation in six-month CAGR of base year (2024) and current year (2025) for hard seltzer market globally. This speaks volumes about variation in performance and is an indicator of trends towards realization of revenue, thereby making it easier for stakeholders to have better vision in terms of direction of growth in the year. January to June is first half or H1. July to December is second half or H2.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 16.0% |

| H2 (2024 to 2034) | 16.1% |

| H1 (2025 to 2035) | 16.2% |

| H2 (2025 to 2035) | 16.5% |

In the first half (H1) of the years 2025 to 2035, the company will be expanding at a level of 16.2%, and in the second half (H2) of the same years, even faster at a level of 16.5%. Ascending to the second half, i.e., H1 2025 to H2 2035, the CAGR will hold itself at 16.2% for the first half and comparatively higher by 16.5% for the second half.

The overall industry has experienced an addition of 20 BPS in the first half (H1) and the firm an addition of another 30 BPS in the second half (H2). The hard seltzer industry is growing aggressively as a result of the consumer trend of low-calorie, gluten-free, and low-strength products.

The company is fighting the threat by innovation, but the company itself has threats but mainly so as a result of the heritage alcohol company business, but its future is positive. the hard seltzer segment would remain a market leader in the alcoholic beverages industry globally, with strong growth in Europe and further innovation to respond to changing consumer preferences.

Hard Seltzer Market has expanded with a meteoric growth rate as there is a growing demand from the consumers for low-calorie, gluten-free, and flavored alcoholic beverages. The market is segmented into Organized and Unorganized Segments, classified based on the existence in the market, the distribution channel, and the size of operations.

Organized Segment - Leading the Market with an Energy-Enriched Brand Presence, The structured segment includes behemoth multinationals with good distribution networks, international presence, and sufficient market coverage. They over-spend on advertising, distribution, and R&D, positioning them in the market for hard seltzers. White Claw (USA), White Claw is Mark Anthony Brands-owned and highest-rated hard seltzer in the world with a strong brand name, fashionable flavors, and aggressive global expansion.

Truly Hard Seltzer (USA), Boston Beer Company's truly brand has been repositioned as a higher-end brand focusing on new and emerging flavors, variety packs, and sponsored promotion campaigns. Bud Light Seltzer (USA), Anheuser-Busch InBev subsidiary Bud Light Seltzer is banking on beer brand heritage to spur sales in North America and spread out into Europe and Latin America.

Topo Chico Hard Seltzer, Jointly owned by Coca-Cola and Molson Coors, Topo Chico Hard Seltzer is differentiated on the back of its premium mineral water brand and is growing rapidly in Europe and Latin America.

Unorganized Segment - Emerging Players and Craft Innovators, The unorganized segment consists of small, autonomous, local players of low volume with focus on local geography, organic product basket, and specialty branding. They disrupt the market with innovation, sustainability, and direct-to-consumer programs. NUTRL Vodka Seltzer (USA/Canada), Rather than malt, NUTRL is vodka-seltzer, cleaner and sugar-free, that the consumer enjoys.

Willie's Superbrew (USA), Embracing real fruit ingredients and sustainability as an inherent value, Willie's Superbrew is popular with health-aware and earth-sensitive consumers. SunnyD Vodka Seltzer (USA) Heritage connection positioning, SunnyD Vodka Seltzer targets millennials and Gen Z consumers who know the heritage orange drink brand.

Craft & Premiumization Hard Seltzers under the Limelight

Shift: Mass-market, generic hard seltzers are being avoided by American consumers in favor of at-spirit-based, craft, and premium hard seltzers by growing numbers. While hard seltzers rode the selling high for a couple of years being light and clean, 31% of USA shoppers now demand premium ingredients, authentic spirits, and small-batch processing.

All of this particularly in Europe, where authentic vodka and tequila-based hard seltzers capture malt-based hard seltzer market share. Hard liquor premiumization and cocktail culture are driving Australian and Japanese craft-based, artisanal hard seltzer demand.

Strategic Response: As the shift occurred, High Noon (USA) employed its authentic vodka-based formula to differentiate against malt-based competitors and became the leading spirits-based RTD brand in the country. Lone River Ranch Water (UK) brought a tequila-flavored hard seltzer to Europe that became a hit among cocktail drinkers as a premium alternative to mass brands.

Barrel House Hard Seltzer in Australia created small-batch craft seltzers infused with locally inspired botanicals such as finger lime and lemon myrtle to meet consumers who craved a premium drinking experience. Suntory launched in Japan a series of premium hard seltzers with whisky and umeshu-flavored variants on the back of the nation's affinity for refined and sophisticated alcoholic drinks.

Shift away from Fruit Flavors towards Botanical & Cocktail-Inspired Flavors

Shift: Fruit cocktail dominated the original hard seltzer segment, but now consumers are demanding stronger, herbal, and cocktail-style flavor. In Europe, 19% year-on-year value growth of herb and botanical hard seltzer in 2024 was observed, with consumers being drawn to a gin cocktail and aperitif-style taste. In Asia-Pacific, yuzu, matcha, and umami flavor is 22% higher, with consumers being drawn to less sweet, more sophisticated flavors.

Strategic Response: White Claw Botanicals in Germany & the UK led the way with a juniper, sage, and hibiscus flavor portfolio as a gin-inspired portfolio within the hard seltzer segment. Topo Chico Hard Seltzer in America added to its portfolio with a margarita-flavored portfolio of products like smoky agave, spicy chili, and floral lavender, whose premium sales grew 14%.

At the same time, Japanese Suntory launched -196°C Strong Zero yuzu and shiso-tasting seltzers that gained popularity as they were marketed against whiskey and sake consumers looking for a low-calorie beverage to satisfy their thirst.

Health & Wellness Impact: Low Alcohol & Functional Seltzers Go Mainstream

Shift: With less imbibing, the consumer is going for lower-ABV and functional hard seltzer. In North America, 37% of Gen Z consumers are consuming sessionable lower-ABV drinks, while electrolyte-enriched alcohol products have blown up in Europe with 21% rise in demand in 2024. Functional drinks-those that contain vitamins, adaptogens, and probiotics-are also trending upward because consumers are choosing hangover-proof, health-focused drinks.

Strategic Response: Markets are pushing back with hard seltzers with a plus. In the US, Vizzy Hard Seltzer launched a vitamin C-infused variant of the brand as a healthier alcoholic drink and recorded a 17% sales increase among health-conscious millennials.

In Europe, Trip CBD Seltzer launched an adaptogen-infused hard seltzer to attract customers looking for relaxation and stress relief. In Australia, Fellr launched an electrolyte-infused seltzer for health-conscious consumers looking for hydration-friendly alcoholic drinks.

Ethical Sourcing & Sustainability As Differentiators

Shift: customers today are adding sustainability to the consumption of drinks. 42% of consumers in North America are opting for sustainable ingredients and sustainable packaging on their hard seltzers. 24% more consumers in Europe are opting for carbon-neutral alcohol brands, whereas Asian-Pacific customers are increasingly purchasing more thanks to sustainability, especially in South Korea and Japan, where consumers are extremely environment-conscious.

Strategic Response: The brands are changing towards the sustainability drive path. USA's Truly Hard Seltzer rolled out 100% recyclable aluminum can with 18% reduced carbon footprint per unit. UK's Kopparberg Hard Seltzer was designed to be carbon-neutral to produce and saw a 12% boost in market share from environmentally conscious customers. Japan's Asahi rolled out a biodegradable volume bottle that fits the country's harsh climate condition and promotes brand loyalty.

On-Premise & Ready-to-Serve Hard Seltzer Migration

Shift: Hard seltzers first went wild off-premise in retail, but on-premise hard seltzer consumption (restaurants, bars, festivals, and stadiums) is currently driving growth.North American on-premise hard seltzer sales increased by 27% in 2024 as restaurants and bars began replacing traditional cocktails with premium hard seltzers.

Even in Europe, no exception there, hard seltzer kegs are observed to be on the increase in pubs and beer gardens. Sports event sales of canned hard seltzer drinks in Australia increased 21% as consumer demand is fueled by portable, easy-to-drink beverages.

Strategic Response: To ride the wave, White Claw (USA) launched on-tap hard seltzer in mass music festivals and reached 19% brand trial rate. Aperol Spritz Hard Seltzer partnered with beer gardens and cocktail bars in Germany and reached on-prem sales through 15% lifts. Brookvale Union also launched event-style hard seltzer pouches in Australia, offering pre-mixed, bar-grade hard seltzers served in sports stadia, to reach upper segments of millennial drinkers.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of hard seltzer through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 12.2% |

| Germany | 17.9% |

| China | 19.5% |

| Japan | 8.8% |

| India | 10.3% |

Demand for low-calorie, gluten-free, and flavored alcoholic drinks is driving growth in the USA hard seltzer market. With its lower sugar and higher awareness of health conscious drinking habits, hard seltzer is consumed as a refreshing, lighter substitute for beer and cocktails.

Furthermore, the demand for natural fruit-flavored, sugar-free, and organic hard seltzers is driven by the increasing development of craft hard seltzers and premium RTD (ready-to-drink) alcoholic beverages. USA consumers are also spending more on premium and innovative flavor varieties, such as spin-off and spiked sparkling water blends infused with botanicals.

Legislative measures encouraging clear labeling and lower ABV options are these lines encouraging, these easy-drinking, low-ABV beverages; and hard seltzers that are sessionable and high-ABV for the more experienced consumers.

Germany's hard seltzer segment is showing growth, thanks to consumer interest in low-alcohol, sugar-free and naturally-ingredient-based drinks. Craft alcoholic drinks, carbonated beverage trends and functional alcohol blends are fueling demand for premium and clean-label hard seltzers.

With increased interest in wellness-oriented alcoholic alternatives, German producers are pouring money into low-calorie, organic based and naturally flavored seltzers to catch young consumers and health-minded drinkers.

The hard seltzer market is growing rapidly in China, fueled by higher disposable income, rising demand for low-alcohol alternatives and a shift in drinking culture toward lighter beverages. The expansion of flavored ready-to-drink (RTD) alcoholic beverages and hard seltzers, particularly with Asian fruit flavors, is creating demand for new, premium quality alcoholic beverages.

With government policy encouraging responsible drinking, Chinese manufacturers are concentrated on sugar-free and fortified drinks as well as unique regional flavours like lychee, green tea and dragon fruit hard seltzers.

Japan’s hard seltzer marketplace is helped by the countries’ focus on functional alcoholic beverages, premium quality and low calorie beverage trends. Japanese consumers prefer low-sugar, mild-favored carbonated alcoholic beverages that reflect their low-alcohol content drinking culture.

Japan’s luxury fermented alcohol technology, combined with its experience in botanical-infused carbonated drinks, is behind the demand for zero-sugar, low-alcohol and collagen-infused hard seltzers.

Its hard seltzer market is growing thanks to rising interest in low-calorie alcohol, premium RTD drinks and fruit-flavored spiked sparkling water. Hard seltzer is also becoming more popular in social drinking, premium bars and home consumption.

In addition to government-backed guidelines for moderate alcohol consumption, Indian producers are playing an active role by creating low-cost, conveniently flavored, fruit-inspired hard seltzers targeting these urban millennials and Gen Z consumers.

| Segment | Value Share (2025) |

|---|---|

| Flavored Hard Seltzers (By Application) | 73.1% |

Based on this continues consumer demand for fruit-flavored, botanical, and exotic-flavored alcoholic sparkling beverages, the flavored hard seltzer segment accounts for the stronger share of the market. Fruits that taste natural like citrus, berry and tropical fruit combinations are very appealing for consumers as they give a light refreshing touch. Health-driven demand has also helped boost sales of clean-label, low-calorie alcoholic drinks.

With demand in progress for low-carb and sugar-free alternatives to boozy drinks, producers have set their sights on fermentation-past, naturally sweetened and vegetable spruce-up hard seltzers. The innovations also cater to consumers who want guilt-free pleasure without sacrificing flavor and drinkability.

Accounting for a forecast value share of 73.1% in 2025, this category will see robust growth, especially in Asia-Pacific and North America. These are expected to grow even more as they have caught on with wellness-driven lifestyles and higher-end, better-for-you alcohol products have become more mainstream in these areas.

| Segment | Value Share (2025) |

|---|---|

| High-ABV & Low-Calorie Hard Seltzers (By Application) | 26.9% |

With consumers increasingly clamoring for variety in their ABV, he notes that the trend is rapidly shifting toward more potent, cocktaillike seltzers and lighter, zero-sugar options. Consumers are gravitating toward hard seltzers with a mix of heavy flavors, sessionability and health-minded ingredients, compelling brands to roll out creative formulations that respond to shifting palates.

Adding to the growing demand among consumers searching for flavor alternatives to spirits and traditional beer, higher-ABV products have become more widely available in restaurants, bars and retailers. As beverage alcohol brands are competing on differentiation and premiumization, there is growing demand for infused, barrel-aged and craft hard seltzers with unique taste profiles. These innovations appeal to both casual imbibers and cocktail enthusiasts who crave easy-to-sip, ready-to-chug offerings.

Demand for this segment is strongest in North America and Europe expected value share of 26.9% in 2025. Hard seltzer innovation is in its highest gear in these markets, boosted by a rich beverage ecosystem placing craft-quality ingredients, sustainability and consumer-led product development at the forefront.

The hard seltzer category is crowded, with players delivering unique flavors and differentiating their brands while pushing themselves into new markets. Companies are doubling down on organic ingredients, sugar-free formulations and marketing efforts targeting health-inclined drinkers.

Industry leaders like White Claw, Truly Hard Seltzer, Bud Light Seltzer, Corona Hard Seltzer, and High Noon rule the space through their know-how with hard seltzer creating, electrifying beverage marketing, and large retail widespread distribution channels. Several companies are increasing their Asia-Pacific and European operations to meet growing demand for low-calorie alcoholic drinks.

Some of the key strategies include partnerships with premium beverage distributors, investment to introduce high-ABV hard seltzer varieties, and development of botanical-infused hard seltzers that specifically appeal to functional alcohol consumption. Manufacturers are focusing on sustainable packaging and carbon-neutral production.

For instance

The market is categorized based on alcohol by volume (ABV) content, including beverages with 1.0% to 4.9% ABV, 5.0% to 6.9% ABV, and other variations.

Products are available in different packaging formats, primarily metal cans and bottles, catering to consumer preferences and convenience.

The market is segmented into off-trade channels, such as retail stores and supermarkets, and on-trade channels, including bars, restaurants, and pubs.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global hard seltzer industry is projected to reach USD 22.6 billion in 2025.

Key players include The Coca-Cola Company, Mark Anthony Brands International, Heineken N.V.

North America is expected to dominate due to high demand for flavored, low-calorie alcoholic beverages.

The industry is forecasted to grow at a CAGR of 16.5% from 2025 to 2035.

Key drivers include rising demand for low-calorie alcohol, increased RTD beverage consumption, and innovative flavor expansions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by ABV Content, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by ABV Content, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by ABV Content, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by ABV Content, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 14: North America Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by ABV Content, 2018 to 2033

Table 20: Latin America Market Volume (Litre) Forecast by ABV Content, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 22: Latin America Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by ABV Content, 2018 to 2033

Table 28: Europe Market Volume (Litre) Forecast by ABV Content, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 30: Europe Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by ABV Content, 2018 to 2033

Table 36: Asia Pacific Market Volume (Litre) Forecast by ABV Content, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 38: Asia Pacific Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by ABV Content, 2018 to 2033

Table 44: MEA Market Volume (Litre) Forecast by ABV Content, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 46: MEA Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: MEA Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by ABV Content, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by ABV Content, 2018 to 2033

Figure 10: Global Market Volume (Litre) Analysis by ABV Content, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by ABV Content, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by ABV Content, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 14: Global Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by ABV Content, 2023 to 2033

Figure 22: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by ABV Content, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by ABV Content, 2018 to 2033

Figure 34: North America Market Volume (Litre) Analysis by ABV Content, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by ABV Content, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by ABV Content, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 38: North America Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by ABV Content, 2023 to 2033

Figure 46: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by ABV Content, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by ABV Content, 2018 to 2033

Figure 58: Latin America Market Volume (Litre) Analysis by ABV Content, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by ABV Content, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by ABV Content, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 62: Latin America Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by ABV Content, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by ABV Content, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by ABV Content, 2018 to 2033

Figure 82: Europe Market Volume (Litre) Analysis by ABV Content, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by ABV Content, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by ABV Content, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 86: Europe Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by ABV Content, 2023 to 2033

Figure 94: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by ABV Content, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by ABV Content, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Litre) Analysis by ABV Content, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by ABV Content, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by ABV Content, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by ABV Content, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by ABV Content, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by ABV Content, 2018 to 2033

Figure 130: MEA Market Volume (Litre) Analysis by ABV Content, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by ABV Content, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by ABV Content, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 134: MEA Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: MEA Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by ABV Content, 2023 to 2033

Figure 142: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hard Ground Tent Stake Hammer Market Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Hardwood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Hardness Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Hard-Wired Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Hard Disk Drive Market - Size, Share, and Forecast 2025-2035

Hardware-Assisted Verification Market Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hard Gelatin Capsules Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hardware Security Module Market Analysis - Size, Share & Forecast 2025 to 2035

Industry Share Analysis for Hardwood Pulp Companies

Hard Tea Market

Hardgel Liquid Capsule Filling Machines Market

Hardware Encryption Market

Chardonnay Market Trends - Growth & Industry Forecast 2025 to 2035

Orchard Tractors Market Size and Share Forecast Outlook 2025 to 2035

Microhardness Testing System Market Size and Share Forecast Outlook 2025 to 2035

Soil Hardening Agent Market Size and Share Forecast Outlook 2025 to 2035

Door Hardware Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA