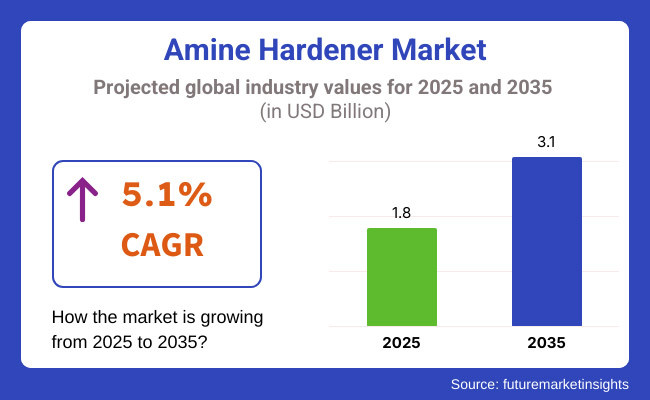

The worldwide Amine Hardener Market is expected to grow to USD 1.8 billion by 2025, projected to reach USD 3.1 billion by 2035, expanding at a CAGR of 5.1% over the forecast period. Amine hardeners, also referred to as amine curing agents are broadly used in epoxy resin systems in several industries.

In 2025, these curing agents are anticipated to hold an approximated 50% of the global epoxy curing agent industry. The advancements in innovative amine-based hardeners for long pot-life applications including resin transfer molding, pultrusion, and filament winding is one of the key developments in the amine hardener sector.

Looking back at the year 2024, the industry of amine hardener applications expanded consistently, driven by the surging demand from several industries such as, construction, automotive, and wind. Due to their remarkable chemical resistance and low viscosity, the adoption of solvent-free aliphatic amines escalated.

Manufacturers also emphasized producing bio-based curing agents that meet environmental requirements, combined with the regulatory support for lightweight and high-strength materials which further propelled the industry landscape.

In 2025, the sector will continue to grow more, with increasing investment in high-performance and sustainable amine curing agents. Faster urbanization and development of infrastructure, especially in developing economies, will spur greater demand for flooring, coating, and adhesives.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing need for light weight and high strength materials in industrial usages. | Increased emphasis on sustainability, with businesses focusing on green and energy-efficient curing agents. |

| Use of solvent-free aliphatic amines because of their excellent chemical resistance and low viscosity. | More R&D in bio-based and high-performance curing agents based on amine to fulfill tough environmental laws. |

| Increased use in flooring, coatings, adhesives, and composite materials for industrial applications. | Increased integration in aerospace, electric cars, and shipping due to the need for lightweight and high strength. |

| Increasing competition from substitutes such as polymercaptan and phenalkamine curing agents. | Innovation in hybrid curing systems and multi-functional hardeners to provide greater durability and efficiency. |

| Industry consolidation through mergers, acquisitions, and regional expansions. | Transition to localized manufacturing, manufacturing automation, and strategic alliances for industry entry. |

The amine hardener industry comes under the group of specialty chemicals and advanced materials, which mainly serves industries such as construction, automotive, aerospace, wind energy, and industrial coatings. These curing agents significantly contribute to improving the performance and longevity of the epoxy-based systems and are thus necessities for high-performance applications.

The course of the world economy has a major influence on the demand for amine hardeners since their major end-use sectors are closely associated with industrial development, infrastructure growth, and technological innovation. Urbanization at a fast pace and rising infrastructure spending, especially in developing countries, are fuelling demand for construction and industrial coatings. Automotive and aerospace industries are experiencing the transition towards high-strength and lightweight materials, further boosting industry growth.

Sustainability patterns and green regulations are transforming the industry, compelling producers to create low-emission and bio-based substitutes. With renewable energy encouraged by government policies, the wind power industry is a prominent driver. Volatile raw material prices and geopolitical tensions can, however, create short-term challenges. Despite this, consistent industrialization, advances in curing technologies, and strategic mergers will be able to maintain long-term growth, making amine hardeners an essential element in several high-growth industries.

The use of aliphatic amine hardeners will increase considerably between 2025 and 2035 because of their superior resistance to chemicals, UV radiation, and moisture. These curing agents provide superior adhesion and flexibility and are well-suited for exterior coatings, adhesives, and industrial applications.

Their application in solvent-free and low-emission formulations fits into sustainability trends and strict environmental regulations. Demand for weather-resistant and durable materials in the building and automotive industries will continue to drive growth. The cycloaliphatic amine segment will lead the industry with an impressive share, growing at a CAGR of 5.4% during 2025 to 2035.

These hardeners possess high mechanical strength, low viscosity, and excellent chemical resistance, thus being the first choice among industrial coatings, composite materials, and automotive usage. VOC-free and high-performance curing systems will be the emphasis driving investment in cycloaliphatic amine technologies.

These hardeners offer superior chemical and thermal stability, and thus are ideal for applications in oil & gas and marine. Yet, increasing regulatory pressure regarding toxicity will compel manufacturers to create safer, modified variants with better environmental compatibility. The modified amine segment will find increased demand as industries seek curing agents with better flexibility, impact resistance, and quicker processing. These products find extensive applications in structural adhesives, protective coatings, and composites.

Metal coatings will experience consistent demand as industries look for tough, corrosion-resistant surfaces. Amine hardeners will improve adhesion and durability in harsh environments, especially in industrial and marine environments. The marine industry will depend on cycloaliphatic amines for saltwater-resistant coatings, with a significant trend toward solvent-free, environmentally friendly formulations.

Oil & gas applications will require high-performance epoxy coatings for harsh conditions, focusing on durability and corrosion resistance. OEM sectors will incorporate amine hardeners for enhanced coatings and adhesives, particularly in automotive and aerospace production.

Industrial and protective coatings will employ amine-based systems for better toughness under severe conditions, with increasing demand for maintenance-free solutions. Civil engineering and flooring will take advantage of amine hardeners for impact-resistance, weather-resistant epoxy systems.

Construction repair and road & bridge construction will utilize fast-curing epoxy solutions for long-lasting structural strengthening. Adhesives and composites, such as windmill blades, automotive adhesives, and fiber composites, will propel demand for high-performance curing agents, especially for applications in renewable energy and light material applications.

The US amine hardener industry is set to witness consistent growth, expanding at a CAGR of 4.4% between 2025 and 2035, supported by increasing use in aerospace, industrial coatings, and adhesives for automotive. The use of high-performance, solvent-free epoxy hardeners will increase owing to tough environmental regulations and the growing adoption of eco-friendly solutions. The sophisticated infrastructure industry will demand long-lasting coatings for bridges, highways, and commercial structures, driving demand for high-strength, chemical-resistant products.

The nation's thriving wind energy industry will also create demand for amine hardeners in the production of wind turbine blades. Cycloaliphatic amines will lead the way, with their superior mechanical strength and resistance to harsh environmental conditions. The persistent transition towards electric vehicles (EVs) and lightweight composites within the automotive industry will continue to drive demand. Growing research and development expenditure on bio-based epoxy curing agents will influence industry developments.

India's amine hardener industry is growing strongly, led by urbanization, increasing construction activities, and infrastructure upgradation. The increasing demand for tough, weather-resistant epoxy coatings in road and bridge construction, industrial flooring, and civil engineering works will lead to strong growth.

The automotive industry, especially EVs, will drive the demand for lightweight, high-performance adhesives and composites. The wind energy segment is experiencing exponential expansion, elevating the demand for amine-based epoxy systems in the production of turbine blades. India's sustainability drive and adoption of environment-friendly building materials will propel the use of low-VOC and solvent-free epoxy hardeners.

Domestic players are making investments in sophisticated manufacturing capacities to cater to growing domestic and export sectors. As the smart cities and high-rise buildings increase, the domain will see a significant boost in demand for cycloaliphatic and modified amines. India's industry will expand at a CAGR of 5.2% during 2025 to 2035.

China's amine hardener industry will achieve a strong CAGR of 6.1% between 2025 and 2035, and it will be among the world's fastest-growing regions. It will be propelled by its enormous manufacturing sector, speedy urbanization, and rising investment in renewable energy.

Its flourishing construction industry with high demand for protective coatings, adhesives, and industrial flooring systems will drive the usage of high-tech amine curing agents. The auto sector, more specifically electric cars, will be a key driver, with more demand for light-weight, high-strength epoxy adhesives.

China's aggressive drive toward wind energy development will also boost demand for amine-based formulating systems in the production of wind turbine blades. The government's stringent norms on low-VOC and environment-friendly materials will spur the use of solvent-free epoxy hardeners. Increasing R&D activities in high-performance and bio-based curing agents will drive the future industry.

Japan's amine hardener industry will experience steady growth, led by its advanced industrial base, high-tech production, and growing use of green materials. The industry will expand steadily at a CAGR of 4.9% between 2025 and 2035. Japan's aerospace and automotive sectors will be dependent on high-performance epoxy adhesives for light, fuel-efficient parts.

The rising penetration of electric vehicles will drive the increasing demand for amine-based adhesives and composites. Japan's strong shipbuilding industry will keep driving the use of cycloaliphatic amines due to their high resistance to saltwater corrosion.

The earthquake-resistant construction focus by the sector will increase the application of tough, high-strength epoxy coatings. Increasing investments in bio-based and low-emission curing agents will have a further impact on industry trends. The demand for high-performance, fast-curing adhesives will rise with the pressure to automate industrial production.

Germany's amine hardener industry will expand at a consistent CAGR of 4.8% during the period 2025 to 2035, owing to technological advancement and sustainability practices. Additionally, its presence in automotive, aerospace, and industrial coatings will drive the industry dynamics.

Sustainability as a priority in the country will fuel the demand for bio-based and solvent-free amine curing agents. Greater investments in the production of electric vehicles will fuel the demand for lightweight, high-strength epoxy adhesives. Energy efficiency in construction and infrastructure longevity will drive the demand for smart epoxy coatings.

Germany's industrial segment will need corrosion-resistant coatings for equipment and protective use, with cycloaliphatic amines being at the forefront in terms of performance gains. Germany's focus on wind energy growth will boost the demand for epoxy formulations used in windmill blade manufacturing. Research and development in high-performance curing agents will be the driving force behind future industry developments.

The UK amine hardener industry will be impacted by rising infrastructure development, rising electric vehicle adoption, and robust demand for high-performing coatings. The construction industry will see a surge in demand for epoxy coatings in flooring, concrete repair, and protective use.

The government's net-zero emission objectives will drive the uptake of solvent-free and bio-based epoxy curing agents. Expansion of the country's offshore wind power will also contribute to demand for amine-based formulations of high-strength, corrosion-resistant materials for manufacture of turbine blades.

The aerospace industry will continue to depend upon advanced adhesives and lightweight composite materials, thus increasing demand for cycloaliphatic and modified amines. High-durability machine coatings, warehouse coatings, and protective coatings will be the focus of industrial manufacturers. Development of next-generation curing agents with enhanced chemical and mechanical resistance will be the future driver of growth.

South Korea's amine hardener industry will see firm growth, supported by its strong electronics, automotive, and shipbuilding industries. The growing trend toward electric vehicles will spur the use of lightweight, high-strength adhesives and composites.

The advanced industrial manufacturing industry in the country will depend on high-performance epoxy coatings to protect machinery and equipment. Shipbuilding will fuel demand for saltwater-resistant amine-based coatings, especially cycloaliphatic formulations.

The building industry will include long-lasting epoxy flooring and protective coatings, improving the lifespan of commercial and industrial buildings. Investments in renewable energy, especially offshore wind farms, will add to the demand for epoxy-based composites. The growing focus on green, low-VOC materials will stimulate the production of solvent-free amine hardeners.

France's amine hardener industry will expand consistently with its robust aerospace, automotive, and construction industries. Growing usage of electric cars will spur the demand for light-weight, high-performance epoxy adhesives.

France's road and bridge building infrastructure projects will demand tough, weather-resistant coatings. France's aerospace sector will continue to use sophisticated epoxy chemistry for composite materials, reducing fuel consumption and strengthening structures.

The transition toward sustainable materials will stimulate the industry for bio-based curing agents and solvent-free epoxies. The marine end-use will remain an important end-use, cycloaliphatic amines being led due to the latter's compatibility in saltwater environments. Expenditure in wind power as well as in industrial coatings will drive demand also.

Italy's amine hardener industry will grow steadily, buoyed by rising demand for high-performance epoxy solutions in construction, automotive, and marine sectors. The nation's emphasis on infrastructure rehabilitation and urban renewal will drive the use of long-lasting epoxy coatings and adhesives for long-term structural integrity.

Italy's high-end automotive sector will incorporate advanced composites to maximize vehicle performance and sustainability, propelling demand for new curing agents. The maritime industry will need durable epoxy coatings for ship repair resistant to corrosion in harsh environments.

The increased push for environmental compliancy will also spur developers to create bio-based, low-emission curing agents. Increasingly strict regulations in the EU will fuel efforts toward greener epoxy solutions as the shift in the direction of sustainable epoxy forms gains pace.

The amine hardener business of Australia and New Zealand will expand as the demand for long-lasting epoxy coatings increases in construction, marine, and renewable energy applications. The level of exposure to harsh weather conditions in the region will speed up the demand for weather-resistant coatings in infrastructure, bridges, and industrial floors. Increasing wind energy ventures will propel the demand for sophisticated composites, especially for turbine blades that need long-lasting high-strength epoxy solutions.

The maritime sector will focus on protective coatings to counter corrosion in offshore environments. Friendly-regulatory frameworks that espouse eco-friendly solutions will motivate companies to innovate with bio-based solutions. Increased investment in aerospace and auto industries will continue to drive the demand for lightweight, high-performance epoxy composites, solidifying the industry's position in the region.

A recent survey by Future Market Insights among stakeholders such as manufacturers, suppliers, and end-users identified key insights that are shaping the amine hardener industry. The demand for high-performance, low-emission epoxy curing agents was emphasized by respondents in light of tight environmental regulations and sustainability objectives.

Most manufacturers are concentrating on formulating bio-based and solvent-free alternatives to adhere to changing industry standards while sustaining durability and mechanical strength. Furthermore, the stakeholders showed a strong interest in high-end amine hardeners that provide stronger adhesion, quicker curing speeds, and better resistance to chemicals and harsh temperatures.

Players in the construction, automotive, and industrial coatings industries reported a greater trend toward specialty formulations designed specifically to meet individual performance needs. The trend toward light-weighting in automotive and aerospace sectors has driven demand even higher for high-strength epoxy adhesives, which accelerated amine hardener formulation innovation further.

The explosive growth of the wind energy industry has presented new opportunities for epoxy-based composites, especially in the manufacturing of turbine blades. Survey respondents also mentioned the growing presence of digitalization and automation in manufacturing processes, enhancing efficiency and consistency in epoxy curing applications.

Despite favourable growth opportunities, the survey identified major challenges such as unstable raw material prices and threats of alternative curing agents. Several players in the industry were worried about the availability of renewable feedstock for bio-based curing agents and the regulatory challenges involved in new product approval. Nevertheless, they are confident that continuous R&D, coupled with strategic partnerships, will assist in offsetting such challenges, leading to long-term business expansion.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | Stringent EPA regulations regarding VOC emissions and toxic chemicals propel demand for low-VOC, environmentally friendly curing agents. Firms should comply with TSCA and receive OSHA safety certifications for on-site security. |

| India | The Bureau of Indian Standards (BIS) regulates quality control for industrial adhesives and coatings. Environmental regulations favor the usage of green and solvent-free curing agents. |

| China | The government's "Made in China 2025" promotes domestic production of cutting-edge materials. Companies should comply with China RoHS for chemical limits and have CCC certification for product safety. |

| Japan | The Chemical Substances Control Law controls the application of harmful substances in coatings and adhesives. Companies are required to obtain JIS certification to fulfill industry standards. |

| Germany | The REACH regulation places strict chemical safety standards, affecting raw material choice. Manufacturers have to adhere to DIN standards for epoxy-based products. |

| United Kingdom | Post-Brexit UK REACH regulations demand adherence to new chemical regulations. BSI standards govern epoxy coatings, maintaining product safety and performance. |

| South Korea | K-REACH demands strict chemical registration and reporting for epoxy curing agents. Companies have to adhere to KS certification for industrial use. |

| France | Strict environmental regulations under the EU's Green Deal are nudging industries towards bio-based products. Product quality and conformity to sustainability is guaranteed through the AFNOR certification. |

| Italy | Regulations under EU REACH and CLP need to be followed. CEN standards specify epoxy hardener performance requirements for industry use. |

| Australia & New Zealand | Stringent chemical safety regulations are imposed by the National Industrial Chemicals Notification and Assessment Scheme (NICNAS). Firms need to conform to AS/NZS standards for adhesives and coatings. |

The industry offers ample opportunities for growth fueled by technological innovations, sustainability practices, and changing end-user requirements. Investors can benefit from the growing trend for low-emission, bio-based curing agents by investing in research and development in eco-friendly formulations. Growth in wind power and infrastructure development across the emerging world continues to build up industry opportunities, requiring formulators to advance high-performance, weather-resistant epoxies formulated to meet severe application conditions.

Strategically, regional customization will be essential for manufacturers to match varied regulatory environments and performance specifications. In the highly regulated economies of the USA and Europe, high-strength amine hardeners compliant with REACH take precedence, whereas in the Asia-Pacific region, low-cost, high-volume production is still key.

Industry leaders in the amine hardener industry, including Huntsman Corporation, Dow Chemical Company, BASF SE, and Evonik Industries AG, are aggressively expanding their industry share through a series of strategic activities. One of the major emphases is on innovation, with major investments in research and development to develop superior, eco-friendly amine hardeners that satisfy changing environmental laws and customer requirements. These technologies usually bring about product differentiation, which enables companies to provide specialized solutions to industries such as construction, automobiles, and electronics.

Strategic alliances and collaborations are also at the core of such growth plans in these companies. By collaborating with raw materials producers and end-users, they seek to establish a secure supply chain and have better insight into industry requirements, which helps them devise customized products. Geographic expansion into developing countries is also a typical strategy, which helps companies leverage areas of rising industrial activity and rising demand for amine hardeners. This growth typically involves creating new production centers or developing distribution networks to increase industry penetration and customer support.

In April 2024, Merichem Technologies, a Black Bay Energy Capital portfolio company, purchased Chemical Products Industries (CPI), which offers new chemistries for sulfur removal as well as for industrial cleaning needs. The takeover is designed to augment the offerings of Merichem and give it more standing in the industry for specialty chemicals.

Market Share Analysis

Aliphatic Amine, Cycloaliphatic Amine, Aromatic Amine, Modified Amine

Metal Coatings-(Marine, Oil & Gas, OEM, Aerospace, Industrial & Protective Coatings), Civil Engineering-(Flooring, Construction repair, Road and Bridge, Others), Composites and Adhesives-(Windmill blades, Automotive Adhesives, Fiber composites, Others)

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, The Middle East & Africa

The industry is expanding due to rising demand for high-performance coatings, adhesives, and composites in construction, automotive, and wind energy applications.

Manufacturers are developing low-VOC, bio-based, and solvent-free amine hardeners to meet stringent environmental standards and customer preferences.

Companies are focusing on advanced formulations with improved durability, chemical resistance, and faster curing times to cater to evolving end-user requirements.

Fluctuations in raw material availability, trade policies, and regional industrial growth are influencing production strategies and investment decisions.

Key players are engaging in mergers, acquisitions, and strategic partnerships to expand their product portfolios and strengthen their global presence.

Table 01: Global Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 02: Global Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Table 03: Global Market Volume (Tons) and Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 04: North America Market Volume (Tons) and Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 05: North America Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Active Ingredient Type, 2018 to 2033

Table 06: North America Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Table 07: Latin America Market Volume (Tons) and Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 08: Latin America Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 09: Latin America Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Table 10: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 12: Western Europe Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 13: Western Europe Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Table 14: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 16: Eastern Europe Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 17: Eastern Europe Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Table 18: East Asia Market Volume (Tons)and Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 19: East Asia Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 16: East Asia Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Table 20: SAP Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: SAP Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 22: SAP Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Table 23: MEA Market Volume (Tons) and Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 24: MEA Market Volume (Kilo Tons) and Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 25: MEA Market Volume (Tons) and Value (US$ Billion) Forecast by End Use, 2018 to 2033

Figure 01: Global Market Historical, Current and Forecast Volume (Tons), 2018 to 2033

Figure 02: Global Market Historical, Current and Forecast Value (US$ Billion), 2018 to 2033

Figure 03: Global Market Incremental $ Opportunity (US$ Billion), 2018 to 2033

Figure 04: Global Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 05: Global Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 06: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity by Aliphatic Amine Segment, 2018 to 2033

Figure 08: Global Market Absolute $ Opportunity by Cycloaliphatic Amine Segment, 2018 to 2033

Figure 09: Global Market Absolute $ Opportunity by Aromatic Amine Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Modified Amine Segment, 2018 to 2033

Figure 11: Global Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 12: Global Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 13: Global Market Attractiveness by End Use, 2023 to 2033

Figure 14: Global Market Absolute $ Opportunity by Metal Coatings Segment, 2018 to 2033

Figure 15: Global Market Absolute $ Opportunity by Civil Engineering Segment, 2018 to 2033

Figure 16: Global Market Absolute $ Opportunity by Composites and Adhesives Segment, 2018 to 2033

Figure 17: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 18: Global Market Share and BPS Analysis by Region to 2023 and 2033

Figure 19: Global Market Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: Global Market Absolute $ Opportunity by North America Region, 2018 to 2033

Figure 22: Global Market Absolute $ Opportunity by Latin America Region, 2018 to 2033

Figure 23: Global Market Absolute $ Opportunity by Western Europe Region, 2018 to 2033

Figure 24: Global Market Absolute $ Opportunity by Eastern Europe Region, 2018 to 2033

Figure 25: Global Market Absolute $ Opportunity by East Asia Region, 2018 to 2033

Figure 26: Global Market Absolute $ Opportunity by SAP Region, 2018 to 2033

Figure 27: Global Market Absolute $ Opportunity by MEA Region, 2018 to 2033

Figure 28: North America Market Share and BPS Analysis by Country to 2023 and 2033

Figure 29: North America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: North America Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 32: North America Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 33: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 34: North America Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 35: North America Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by End Use, 2023 to 2033

Figure 37: Latin America Market Share and BPS Analysis by Country to 2023 and 2033

Figure 38: Latin America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 39: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 40: Latin America Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 41: Latin America Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 42: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 43: Latin America Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 44: Latin America Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 46: Western Europe Market Share and BPS Analysis by Country to 2023 and 2033

Figure 47: Western Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 46: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 47: Western Europe Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 48: Western Europe Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 49: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 50: Western Europe Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 51: Western Europe Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 52: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 53: Eastern Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 54: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 55: Eastern Europe Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 56: Eastern Europe Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 57: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Eastern Europe Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 59: Eastern Europe Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 60: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 61: East Asia Market Share and BPS Analysis by Country to 2023 and 2033

Figure 62: East Asia Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 63: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 64: East Asia Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 65: East Asia Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 66: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 67: East Asia Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 68: East Asia Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 69: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 70: SAP Market Share and BPS Analysis by Country to 2023 and 2033

Figure 71: SAP Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 72: SAP Market Attractiveness by Country, 2023 to 2033

Figure 73: SAP Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 74: SAP Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 75: SAP Market Attractiveness by Product Type, 2023 to 2033

Figure 76: SAP Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 77: SAP Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 78: SAP Market Attractiveness by End Use, 2023 to 2033

Figure 79: MEA Market Share and BPS Analysis by Country to 2023 and 2033

Figure 80: MEA Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 81: MEA Market Attractiveness by Country, 2023 to 2033

Figure 82: MEA Market Share and BPS Analysis by Product Type to 2023 and 2033

Figure 83: MEA Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 84: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 85: MEA Market Share and BPS Analysis by End Use to 2023 and 2033

Figure 86: MEA Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 87: MEA Market Attractiveness by End Use, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Amine Market Size and Share Forecast Outlook 2025 to 2035

Amine Based Carbon Capture Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Amine Additives in Paints and Coatings Market

Diamine Oxidase Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Thiamine Market Size and Share Forecast Outlook 2025 to 2035

Melamine Formaldehyde (MF) Market Size and Share Forecast Outlook 2025 to 2035

Melamine Market Size and Share Forecast Outlook 2025 to 2035

Global Melamine Beauty Product Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Melamine Pyrophosphate Market Trends – Demand, Innovations & Forecast 2025 to 2035

Dopamine and Norepinephrine Reuptake Inhibitor Market

Melamine Foam Market

Glutamine Market – Growth, Demand & Functional Health Benefits

Histamine Toxicity Market

Ethylamine Market Analysis - Size, Share & Forecast 2025 to 2035

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Benzylamine Market Size and Share Forecast Outlook 2025 to 2035

Glucosamine Supplement Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Methylamine Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA