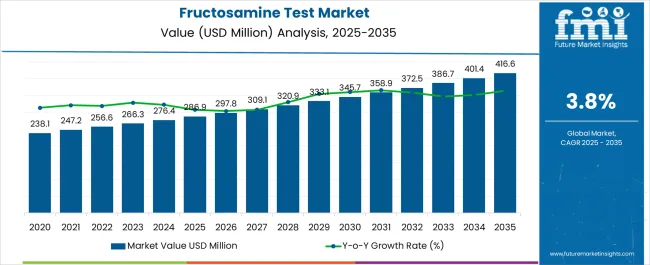

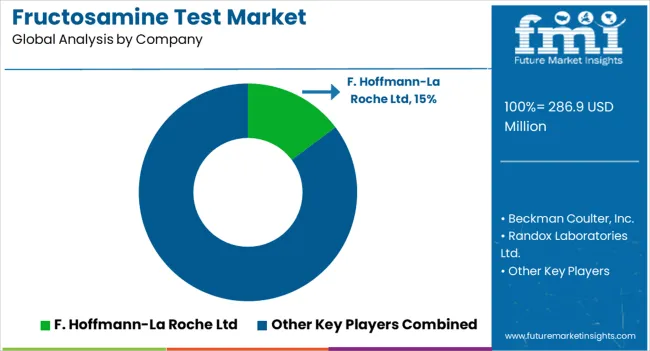

The Fructosamine Test Market is estimated to be valued at USD 286.9 million in 2025 and is projected to reach USD 416.6 million by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Fructosamine Test Market Estimated Value in (2025 E) | USD 286.9 million |

| Fructosamine Test Market Forecast Value in (2035 F) | USD 416.6 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

The fructosamine test market is witnessing stable growth, primarily fueled by rising diabetes prevalence and the need for effective monitoring of intermediate-term glycemic control. Unlike long-term assessments, this test provides a two to three-week snapshot of blood glucose levels, making it valuable for treatment adjustments and therapy monitoring.

The current market landscape is shaped by increasing adoption in clinical laboratories, heightened awareness among healthcare providers, and the rising burden of lifestyle-related metabolic disorders. Technological improvements in diagnostic platforms have enhanced accuracy and efficiency, supporting broader application in both developed and emerging healthcare systems.

As healthcare infrastructure continues to modernize, demand for accessible and cost-effective testing methods is projected to rise. With diabetes management gaining prominence globally, the fructosamine test market is expected to expand steadily, supported by early detection initiatives and growing integration into routine diagnostic protocols.

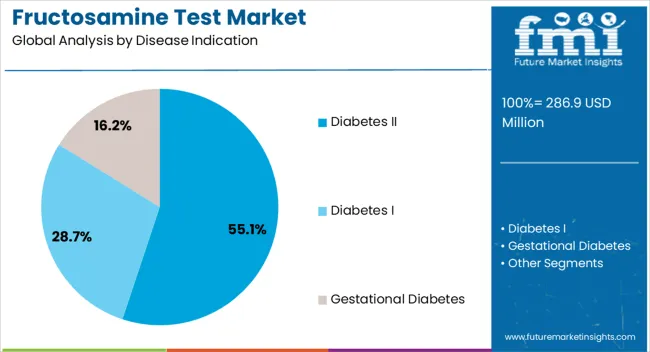

The Diabetes II segment dominates the disease indication category, accounting for approximately 55.10% share of the fructosamine test market. Its leadership is attributed to the global surge in Type II diabetes cases, linked to sedentary lifestyles, obesity, and aging populations.

Fructosamine testing is particularly valuable in monitoring glycemic control among patients requiring frequent therapy adjustments. The test’s ability to provide short-term glucose assessments complements HbA1c testing, making it highly relevant for this patient group.

Clinical guidelines increasingly recognize its role in managing complex diabetes cases, further reinforcing adoption. With healthcare systems prioritizing early intervention and cost-effective monitoring strategies, the Diabetes II segment is expected to sustain its leading share throughout the forecast period.

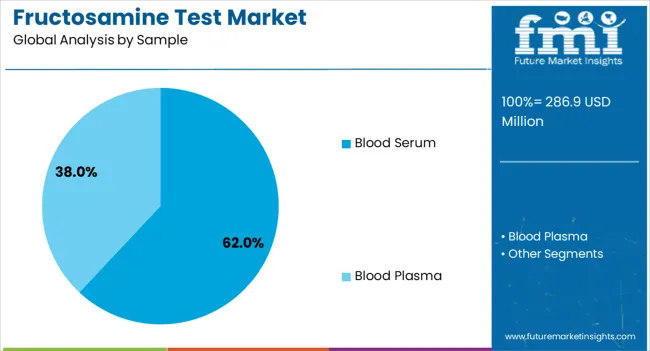

The blood serum segment leads the sample category with approximately 62.00% share, owing to its established role in clinical diagnostics and reliability in detecting glycated proteins. Blood serum provides accurate and reproducible results, making it the preferred medium for fructosamine testing in laboratories and hospitals.

Its dominance is supported by well-established sample collection and processing protocols, ensuring compatibility with automated analyzers and standardized diagnostic systems. The segment’s growth is further reinforced by continuous improvements in assay sensitivity and efficiency.

As demand for reliable diagnostic outcomes rises globally, blood serum testing is expected to maintain its stronghold in the fructosamine test market.

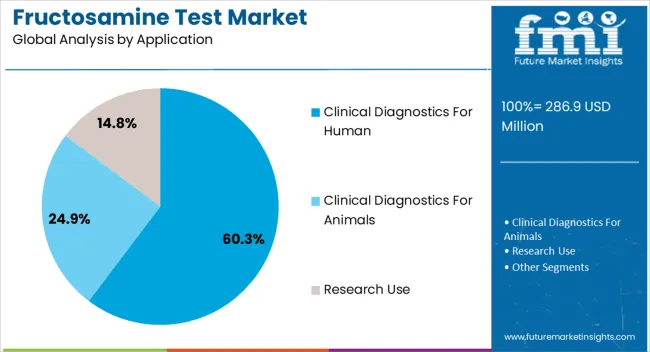

The clinical diagnostics for human segment holds approximately 60.30% share in the application category, underscoring its central role in driving market demand. Widespread adoption across hospital laboratories, diagnostic centers, and endocrinology clinics has cemented its position.

The segment benefits from increasing physician preference for short-term monitoring tools to evaluate treatment efficacy and adjust medication plans. Its integration into routine diagnostic workflows has enhanced accessibility and patient reach, particularly in developed healthcare markets.

With continued focus on improving diabetes management outcomes and reducing complications through timely interventions, this segment is expected to sustain its leading role in the coming years.

Due to its effectiveness in monitoring immediate glucose control in diabetes, the demand for fructosamine testing is growing. It is widely used for diagnosing prediabetes and monitoring diabetes as it does not require fasting and reflects average blood sugar over a more extended period.

As an alternative to typical HbA1c testing, fructosamine provides an overview of blood glucose levels over 2-3 weeks. This is important for people who suffer from changing glucose levels or are undergoing quick treatment changes.

Fructosamine testing can be helpful during pregnancy and in conditions that impact hemoglobin. This makes it an effective instrument for accurate diabetes treatment.

There has been a spike in cases of diabetes during the last few years, and the trend is expected to further escalate in the upcoming years. According to the International Diabetes Federation, around 783 million adults will be living with diabetes in 2045. This will uplift the demand for glucose monitoring tests like fructosamine tests.

The global market for fructosamine tests experienced a CAGR of 3.3% between 2020 and 2025. Total market valuation at the end of 2025 reached USD 266.3 million. In the forecast period, the worldwide fructosamine test industry is set to expand at a CAGR of 3.8%.

| Historical CAGR (2020 to 2025) | 3.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 3.8% |

Multiple factors are expected to fuel the growth of the fructosamine test market during the assessment period. These include the rising incidence of diabetes and the growing need for quick diagnostic testing.

Diabetes, a condition marked by high blood glucose levels, carries a high risk of consequences, including renal problems, nerve damage, and heart disease. Its prevalence has sharply increased during the last few decades. For instance,

Fructosamine tests are essential in addressing the growing demand for efficient monitoring tools to treat diabetes. As the number of persons with this chronic condition keeps increasing globally, so will the demand for fructosamine tests.

Fructosamine tests are valuable tools for diabetes treatment and monitoring because they provide a dynamic, immediate evaluation of glycemic control.

Since diabetes is an ongoing condition that requires constant monitoring, being able to recognize small variations in blood glucose levels is essential for rapid treatments and modifications to treatment plans.

The hemoglobin A1c test, considered the gold standard, gives a more extended average of blood glucose levels over many months. Fructosamine tests, on the other hand, provide a more rapid evaluation of glycemic control by reflecting changes over a shorter period of time, usually two to three weeks.

The increasing awareness of the importance of routine diabetes check-ups is a primary factor driving the need for diagnostic instruments, including fructosamine testing. People and healthcare professionals are becoming more aware of the need for a proactive approach to curing diabetes as information is shared successfully.

Since fructosamine tests provide a more immediate measure of glycemic control, they are ideally suited to support the focus on early identification and treatment. Given the understanding that blood glucose levels are dynamic, patients look for convenient and effective monitoring devices.

Healthcare practitioners are also aware of the importance of fructosamine testing in providing real-time information that allows immediate changes to treatment plans. Hence, they often recommend these tests for patients with diabetic symptoms.

Increasing awareness about regular diabetes monitoring is expected to create lucrative opportunities for the fructosamine test market. Subsequently, supportive healthcare policies and government initiatives will benefit the market.

Regulatory agencies, including the Food and Drug Administration (FDA), have set strict guidelines ensuring diagnostic tests' security, effectiveness, and reliability. Because fructosamine testing involves evaluating short-term glycemic management, it is a difficult procedure requiring stringent validation.

Complying with regulatory requirements requires carrying out thorough clinical trials, demonstrating the precision and accuracy of test results, and ensuring quality assurance standards are met.

The requirement for strong clinical evidence to demonstrate the clinical utility of fructosamine tests, especially when compared to current standards such as HbA1c testing, complicated the approval process.

The approval timeline may also be affected by modifications to regulations or the addition of additional requirements due to the changing nature of the regulatory environment. Manufacturers and developers have to spend time and money on thorough documentation and compliance methods to get through this complex regulatory system.

Although these regulations protect public health, they also make it more difficult for businesses to develop novel fructosamine tests.

They may also cause a delay in the release of these essential diagnostic instruments. Hence, such stringent regulatory processes and compliance requirements could be a barrier to the growth of the fructosamine test market.

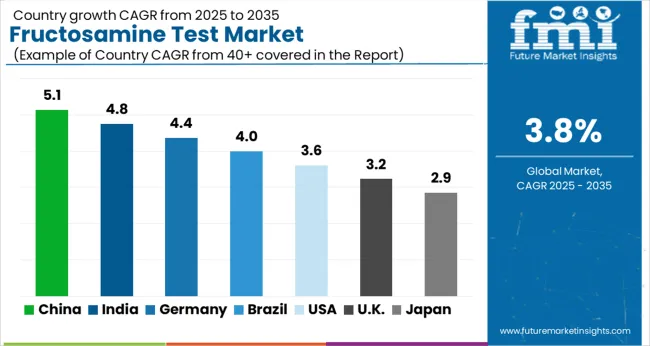

The table below gives an insight into how top nations are going to respond to the growing demand for fructosamine testing. China and India are expected to thrive rapidly due to the increasing number of diabetes patients and growing health awareness.

The United States remains the most dominant market for fructosamine test products, holding a global market share of around 28.0% in 2025. Over the forecast period, the United States fructosamine test market is expected to register a CAGR of 1.1%. This is due to the growing adoption of fructosamine testing over traditional monitoring techniques.

Several reasons are contributing to the greater adoption of fructosamine testing in the United States. For instance, its ability to provide a more accurate overview of glycemic control than traditional approaches such as HbA1c meets the growing demand for more frequent and precise monitoring in diabetes therapy.

Secondly, the adaptability of fructosamine testing is useful in cases of quick medication changes as well as for people with fluctuating glucose levels. Thus, the growing popularity of fructosamine testing will continue to play a key role in boosting the growth of the fructosamine test industry in the United States.

The rising incidence of diabetes is another key factor expected to boost sales of fructosamine testing solutions. Similarly, innovation in fructosamine assay tests and the growing need for diabetic patient monitoring will improve the United States fructosamine test industry share.

In 2025, China's fructosamine test market size reached USD 16.7 million. Over the assessment period, demand for fructosamine tests in China is projected to grow with a robust CAGR of 7.5%. This is attributable to the rising incidence of diabetes among the exploding geriatric population.

Diabetes prevalence risks are increasing due to China's aging population. This shift in the population is expected to create a need for advanced glucose monitoring methods, particularly fructosamine testing.

Diabetes is becoming more common as the aged population grows; thus, accurate and regular monitoring is required. The combination of an increasing elderly population and the diabetes pandemic drives the uptake of novel diagnostic techniques, signaling a necessary reaction to the changing healthcare environment in China.

The below section highlights the estimated market shares of key segments, including disease indication, sample, application, and end-user. This information can be vital for companies to frame their strategies accordingly.

Market Growth Outlook by Disease Indication

| Disease Indication | Value CAGR |

|---|---|

| Diabetes I | 4.9% |

| Diabetes II | 2.4% |

| Gestational Diabetes | 7.5% |

The diabetes II segment accounted for a dominant market share of 59.4% in 2025. Over the forecast period, it is poised to advance at 2.4% CAGR. This is due to the rising prevalence of diabetes II globally, creating frequent monitoring needs.

According to the World Health Organization (WHO), more than 95% of people with diabetes have type 2 diabetes. The fructosamine test's effectiveness in assessing short-term glycemic control aligns with the chronic nature of Type II diabetes management. As a result, its demand is expected to rise with increasing cases of diabetes II.

Market Growth Outlook by Key Sample

| Sample | Value CAGR |

|---|---|

| Blood Serum | 3.5% |

| Blood Plasma | 5.9% |

The blood serum segment leads the fructosamine test market with a market value share of 81.4% in 2025. For the projection period, a CAGR of 3.5% has been predicted for the target segment. This can be attributed to the rising usage of blood samples in fructosamine testing.

Since serum doesn't include anticoagulants, it interacts with enzymatic assays less and produces consistent and accurate results. On the other hand, anticoagulants found in plasma may have an impact on the enzymatic processes used in fructosamine assays.

Serum also improves the accuracy of test results by providing a clearer background for colorimetric measurements.

In fructosamine testing, serum is highly preferred over plasma with the aim of collecting the most accurate and pure sample possible, which is essential for managing diabetes and monitoring short-term glycemic control.

Market Growth Outlook by Key Application

| Application | Value CAGR |

|---|---|

| Clinical Diagnostics for Human | 2.8% |

| Clinical Diagnostics for Animals | 5.9% |

| Research Use | 4.8% |

As per the latest analysis, clinical diagnostics for humans will remain a key application of fructosamine tests during the assessment period. In 2025, the target segment accounted for a market share of 56.4% in 2025, and it is expected to progress at 2.8% CAGR through 2035.

The main reason fructosamine testing is employed so often in human clinical diagnostics is because of its special significance in diabetes control. It provides a more immediate view of glycemic control, which is essential for modifying treatment when conditions shift swiftly.

Diabetes is a dynamic disease that requires regular monitoring, which is consistent with fructosamine’s capacity to reflect glucose levels over a period of two to three weeks. This accuracy is instrumental in clinical settings because it helps medical practitioners provide customized patient treatment.

Market Growth Outlook by Key End User

| End-user | Value CAGR |

|---|---|

| Hospitals | 2.8% |

| Ambulatory Surgical Centers | 3.9% |

| Long-Term Care Facilities | 6.2% |

| Specialty Clinics | 5.2% |

| Others | 7.6% |

The hospital segment acts as a leading end user of the fructosamine tests with a 29.8% value share in 2025. Compared to other end users, hospitals are having a higher need for fructosamine testing kits due to their large patient numbers.

Due to the high patient volume, especially for individuals with diabetes, accurate and regular monitoring of short-term glycemic control is necessary. Fructosamine testing meets the volume and urgency of hospital settings by providing quick insights into glucose levels over a few weeks.

In order to strengthen their positions, key companies are strategically making acquisitions and working on partnership agreements. Through acquisitions, businesses can grow their skills, penetrate new markets, and diversify their portfolios.

The dynamic market for fructosamine tests is promoting growth and sustainability through the ability of key players to meet consumer expectations, adjust to evolving industry trends, and maintain a competitive edge through strategic actions. Expanding into emerging regions and untapped markets can enhance a company's growth in terms of revenue.

Recent Developments in the Fructosamine Test Market

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 275.9 million |

| Projected Market Size (2035) | USD 399.9 million |

| Expected Growth Rate (2025 to 2035) | 3.8% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; South Asia & Pacific; East Asia; Western Europe; Eastern Europe; Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, China, Japan, South Korea, India, Association of Southeast Asian Nations, Australia & New Zealand, Rest of South Asia and Pacific, Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordic Countries, Rest of Western Europe, Russia, Hungary, Poland, Rest of Eastern Europe, Saudi Arabia, Türkiye, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Segments Covered | Disease Indication, Sample, Application, End-user, and Region |

| Key Companies Profiled | Beckman Coulter, Inc.; Randox Laboratories Ltd.; Fortress Diagnostics; KAMIYA BIOMEDICAL COMPANY; Abbexa; Weldon Biotech, Inc.; Eurolyser Diagnostica GmbH; F. Hoffmann-La Roche Ltd; Asahi Kasei Pharma Corporation (EKF DIAGNOSTICS); LifeSpan BioSciences, Inc; Zhejiang Kangte Biotechnology Co., Ltd.; Diazyme; Abcam plc.; Weldon Biotech, Inc.; Bio Vision; Mybiosource |

| Report Coverage | Market Forecast, Competition Intelligence, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global fructosamine test market is estimated to be valued at USD 286.9 million in 2025.

The market size for the fructosamine test market is projected to reach USD 416.6 million by 2035.

The fructosamine test market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in fructosamine test market are diabetes ii, diabetes i and gestational diabetes.

In terms of sample, blood serum segment to command 62.0% share in the fructosamine test market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fructosamine Reagents Market

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Testosterone Test Market Size and Share Forecast Outlook 2025 to 2035

Test rig Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Sensors Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Testosterone Booster Industry Analysis by Component, Source, Distribution Channels and Regions 2025 to 2035

Testosterone Injectable Market

Test Tube Market

Testliner Market

Testicular Cancer Treatment Market

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Intestinal Pseudo-Obstruction Treatment Market - Trends, Growth & Forecast 2025 to 2035

Intestinal Fistula Treatment Market Growth - Demand & Innovations 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA