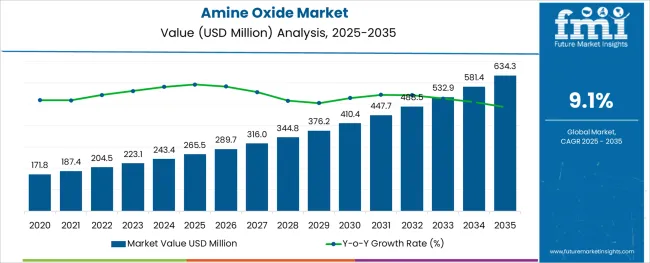

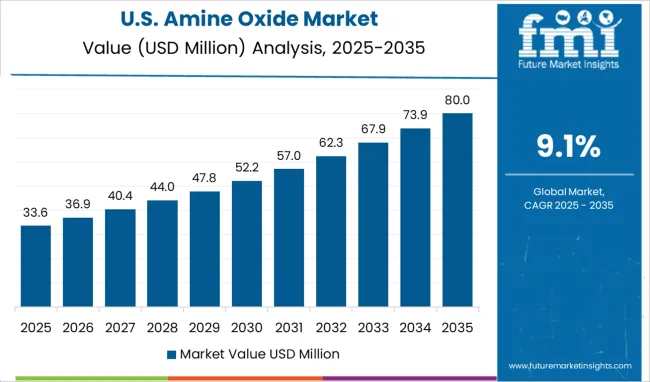

The Amine Oxide Market is estimated to be valued at USD 265.5 million in 2025 and is projected to reach USD 634.3 million by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

The amine oxide market is expanding as consumer demand rises for mild surfactants in personal care and household cleaning products. Industry updates have highlighted a shift toward environmentally friendly ingredients that provide effective cleansing without harsh chemical impact. Formulation scientists have increasingly incorporated amine oxides into product lines due to their foam-boosting and conditioning properties.

Growing urban populations and changing hygiene habits have also supported the widespread use of liquid detergents and shampoos where amine oxides are key components. Market expansion has been further driven by regulatory support for biodegradable and low-irritation surfactants that align with green chemistry initiatives.

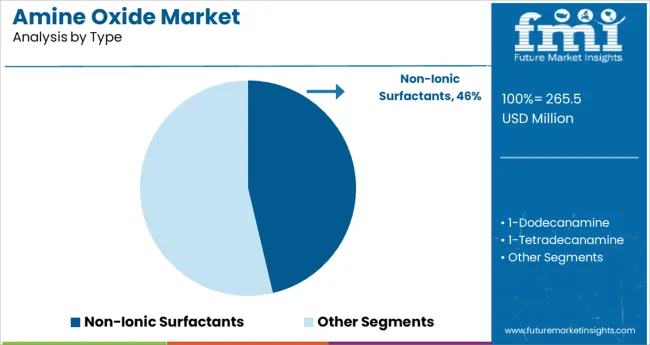

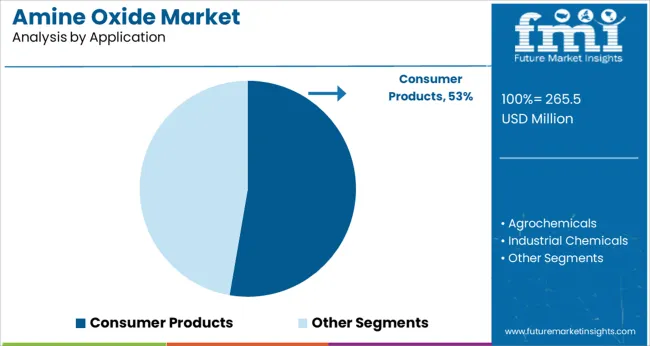

Looking ahead, demand is expected to rise with new product launches in the consumer goods segment and expanding usage in industrial cleaning formulations. Segmental growth is led by Non-Ionic Surfactants in the type category and Consumer Products as the leading application, reflecting product performance needs and strong market penetration.

The market is segmented by Type and Application and region. By Type, the market is divided into Non-Ionic Surfactants, 1-Dodecanamine, 1-Tetradecanamine, Decanamine, Hexadecanamine, Octodecanamine, and Others. In terms of Application, the market is classified into Consumer Products, Agrochemicals, Industrial Chemicals, Coatings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type and Application and region. By Type, the market is divided into Non-Ionic Surfactants, 1-Dodecanamine, 1-Tetradecanamine, Decanamine, Hexadecanamine, Octodecanamine, and Others. In terms of Application, the market is classified into Consumer Products, Agrochemicals, Industrial Chemicals, Coatings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Non-Ionic Surfactants segment is projected to contribute 46.3% of the amine oxide market revenue in 2025, sustaining its leadership in type classification. This segment has seen growth because of the versatile role of non-ionic surfactants in stabilizing formulations and enhancing the mildness of cleaning and personal care products. Chemists have favored these surfactants for their ability to maintain foam quality while reducing skin irritation.

Additionally, the compatibility of non-ionic surfactants with various other ingredients allows for flexible formulation across a wide range of end-use products. Demand from personal care and household sectors has remained strong as these products continue to prioritize user safety and environmental responsibility.

The Non-Ionic Surfactants segment is expected to hold its lead as new formulations further leverage their gentle cleansing and effective emulsification characteristics.

The Consumer Products segment is forecasted to account for 52.7% of the amine oxide market revenue in 2025, holding its position as the largest application area. This segment’s growth is supported by the rising consumption of personal care and household cleaning products across global markets. Consumers have shown increasing interest in skin-friendly and eco-conscious products where amine oxides play a key role in enhancing product texture and cleansing efficiency.

The convenience of liquid and foaming formulations in daily hygiene routines has also fueled demand in this application. Additionally, product development efforts have focused on improving surfactant performance while meeting environmental and safety standards, which has strengthened market acceptance.

As consumer awareness of ingredient safety continues to grow and lifestyle trends favor premium home and personal care products, the Consumer Products segment is expected to maintain its dominance in the amine oxide market.

The increase in the demand for mild surfactants especially from the personal care industry is expected to drive the global amine oxide market. The personal care products containing amine oxide offer improved performance even at high temperatures in hard water. Amine oxides are also widely used in home cleaning products.

Amine oxides are used as thickeners, emollients, emulsifiers, stabilizers, and conditioners. Amine oxide is a surface-active agent which is used to change the surface tension of water that helps in increasing the wetting surfaces, emulsifying, foaming, and also assists in cleansing.

Thus, the growing demand for home cleaning products is expected to augment the overall growth of the amine oxide market.

Amine oxides are slowly finding their foothold in agricultural adjuvants and oil field chemicals. Owing to the versatility of the amine oxides to work under varying temperature and pressure there is an increase in the use of this chemical in other applications as well.

Destructive effects of chlorine bleach and snowballing use of green alternatives are expected to create obstruction in the way of Amine Oxide industry growth. The irritating mist produced when the cleaners are delivered from trigger sprayers is one of the foremost downsides of 'chlorine bleach' cleaners.

Moreover, chlorine bleach tends to have a harmful impact mostly on the skin, lungs, and eyes. As per the scientific research, it was summarized that human tissue is internally or externally burnt. Therefore, green bleach alternatives such as baking soda are extremely preferred instead of chlorine bleach.

Henceforth, rendering to the increasingly harmful effects of chlorine bleach and the growing use of green bleach alternatives, the market demand for amino oxide is projected to witness major downtime in the forthcoming years.

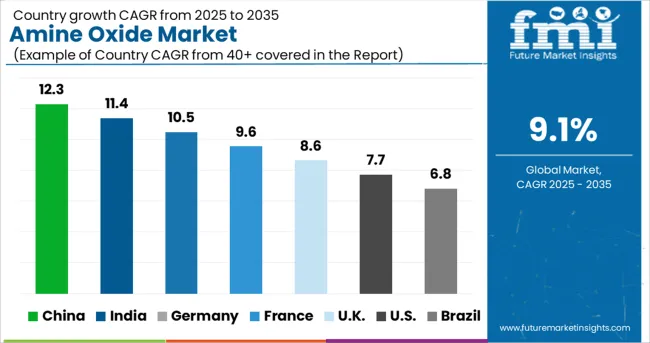

The growing population especially in the Asia Pacific is expected to drive the demand for the personal care and home care industry which in turn is expected to boost the overall growth of the amine oxide market.

The growing demand for the use of sulfur-free as well as milder personal care products is expected to boost the overall growth of the amine oxide market. Amine oxide is considered a high production volume class of compounds in many member countries of the Organization for Economic Co-operation and Development (OECD).

Japan is one of the major manufacturers of amine oxide in the Asia Pacific. China is expected to emerge as the major producer as well as consumer in the coming few years.

Amine oxides are surfactants commonly used in consumer products such a shampoos, conditioners, detergents, and hard surface cleaners. The personal care industry is witnessing a strong growth rate in Europe with the largest revenue collection from Germany.

The ECHA has permitted the usage of Amine Oxide oxide in the production of household products, abiding by strict rules and regulations. The consumer behavior towards maintaining a quality life makes Europe a potential market for novel innovations and launches in the beauty and personal care market. Thus, in turn, the demand for Amine Oxide Oxide is increasing significantly in the region.

North America is expected to be one of the major consumers of amine oxide as it is one of the essential chemicals used in most of the widely used home cleaning products. The USA is one of the largest manufacturers of amine oxide followed by Europe.

Besides, the increase in the usage of amine oxides in the pharmaceutical industry is advancing the market. The regional market is led by the USA which is a chief producer of amine oxides. The amine oxides market in Latin America is projected to prosper at a stable pace over the forecast period.

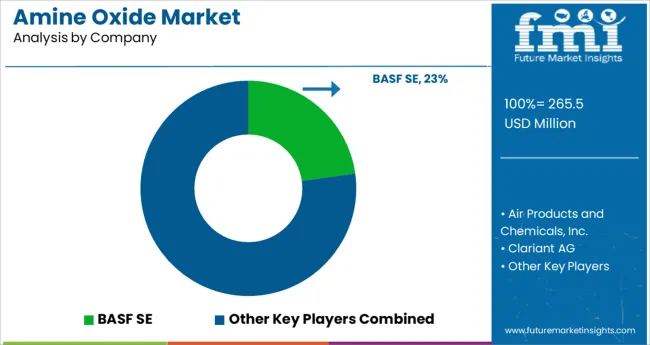

Some of the key BASF SE participants present in the global demand of the Amine Oxide market include Air Products and Chemicals, Inc., BASF, AkzoNobel N.V., Stepan Company, Pilot Chemical, Solvay, The Lubrizol Corporation, Lonza Company, Huntsman Corporation, and Clariant Corporation, among others.

In April 2024, Air Products has completed the acquisition of the remaining 50 percent equity stake in its gasification technology joint venture (JV) with China Shenhua Coal to Liquid and Chemical Co. Ltd., a subsidiary of China Energy Group.

| Attributes | Details |

|---|---|

| Growth Rate | CAGR of 4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

End-use industries, Application, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan; Japan; Middle East and Africa |

| Key Countries Profiled | USA,Canada,Brazil,Argentina,Germany,UK,France,Spain,Italy,Nordics,BENELUX,Australia & New Zealand,China,India,ASEAN,GCC Countries,South Africa |

| Key Companies Profiled |

Omya UK Chemicals; Innovo Chemicals; American Elements,; PrathamStarchem Pvt. Ltd.; GFS Chemicals; The Dow Chemical Company; HangzhouWenjian Calcium Industry Co., Ltd; CAO Industries |

| Customization | Available Upon Request |

The global amine oxide market is estimated to be valued at USD 265.5 million in 2025.

It is projected to reach USD 634.3 million by 2035.

The market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types are non-ionic surfactants, 1-dodecanamine, 1-tetradecanamine, decanamine, hexadecanamine, octodecanamine and others.

consumer products segment is expected to dominate with a 52.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lauryl Dimethyl Amine Oxide Market Growth – Trends & Forecast 2025 to 2035

Amine Market Size and Share Forecast Outlook 2025 to 2035

Amine Based Carbon Capture Market Size and Share Forecast Outlook 2025 to 2035

Amine Hardener Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amine Additives in Paints and Coatings Market

Diamine Oxidase Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Thiamine Market Size and Share Forecast Outlook 2025 to 2035

Melamine Formaldehyde (MF) Market Size and Share Forecast Outlook 2025 to 2035

Melamine Market Size and Share Forecast Outlook 2025 to 2035

Global Melamine Beauty Product Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Melamine Pyrophosphate Market Trends – Demand, Innovations & Forecast 2025 to 2035

Dopamine and Norepinephrine Reuptake Inhibitor Market

Melamine Foam Market

Glutamine Market – Growth, Demand & Functional Health Benefits

Histamine Toxicity Market

Ethylamine Market Analysis - Size, Share & Forecast 2025 to 2035

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Benzylamine Market Size and Share Forecast Outlook 2025 to 2035

Glucosamine Supplement Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA