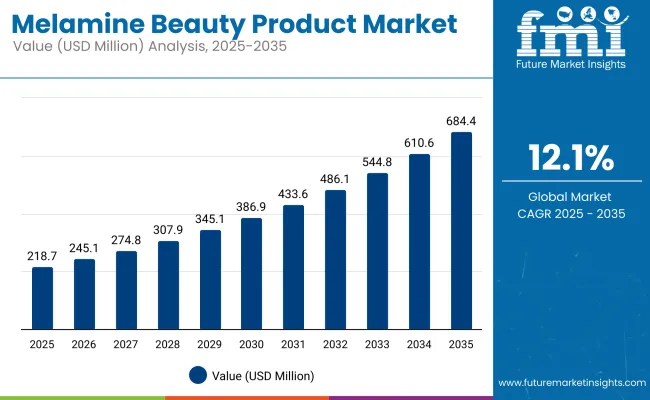

The Melamine Beauty Product Market is forecast to reach a valuation of USD 218.7 million in 2025 and USD 684.5 million in 2035, marking an increase of approximately USD 465.8 million, or a 3.1X growth across the decade. This expansion reflects a CAGR of 12.1%, driven by innovation in skin microbiome repair and functional beauty formulations.

Global Melamine Beauty Product Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 218.7 million |

| Market Forecast Value in (2035F) | USD 684.5 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

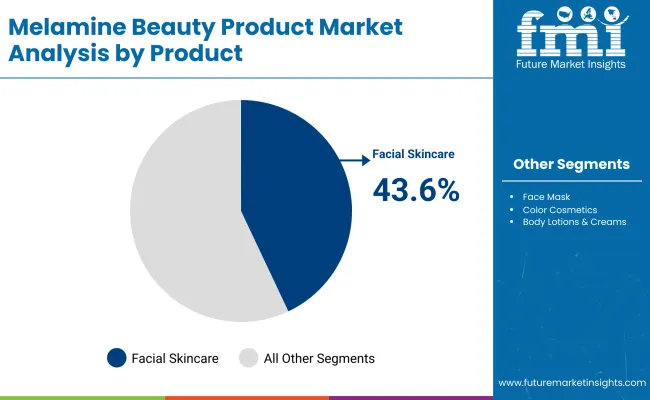

During the first half of the forecast period (2025-2030), the market grows from USD 218.7 million to USD 386.9 million, contributing USD 168.2 million, which represents 36.1% of the total decade growth. This growth phase is led by rising demand for facial skincare and body lotions, with multifunctional attributes like hydration and anti-inflammatory properties gaining prominence. Facial skincare continues to dominate this phase with a projected 43.6% segmental share.

From 2030 to 2035, the market expands further from USD 386.9 million to USD 684.5 million, generating USD 297.6 million, which accounts for 63.9% of total growth. The latter half benefits from the adoption of melamine-derived compounds in more sophisticated formulations, including bio-fermented actives and marine extracts. Together, color cosmetics and body lotions are expected to capture a larger cumulative share, crossing the 55% mark by 2035, as demand for soft-finish, sensorial products accelerates.

From 2020 to 2024, the Melamine Beauty Product Market gained momentum, growing steadily on the back of rising demand for multifunctional and sensorial beauty solutions. During this period, leading beauty brands such as L’Oréal and Estée Lauder captured a dominant share of the market revenue.

Their focus on innovative formulations with melamine derivatives created products that combined efficacy with enhanced consumer experience. Consumer preference has shifted toward performance-led texturesvelvety, soft-focus, second-skin finishesdelivered through melamine-integrated product chemistry.

This evolution is challenging traditional beauty formats and paving the way for sensorial cosmetics. The market now witnesses rising competition from digital-first beauty players offering personalized and sustainable solutions. To remain competitive, top-tier brands are increasingly moving toward hybrid innovation models, merging sustainability, biotechnology, and digital engagement.

Formulation technology developments have enhanced the performance and sensory characteristics of melamine-based beauty products to enable more effective and efficient solutions in varied applications. Increased interest in multifunctionality has promoted consumer satisfaction and loyalty. Skincare and color cosmetics, among other industries, are creating demand for melamine solutions that fit easily into existing beauty regimens.

Growth in clean-label and dermatologist-recommended products has driven market expansion. Advances in product formula and packaging improvements are anticipated to create new areas of application. Segment growth is anticipated to be spearheaded by skincare products, especially those with melamine for enhanced benefits.

The Global Melamine Beauty Product Market is segmented by product type, functional claims, ingredient type, end-user, sales channel, and region. Product types include facial skincare (moisturizers, serums & essences, face masks, toners), color cosmetics (lipsticks & lip tints, foundations & BB/CC creams, eye makeup, blushers & highlighters), body lotions & creams, and fragranceseach representing core categories driving consumer adoption.

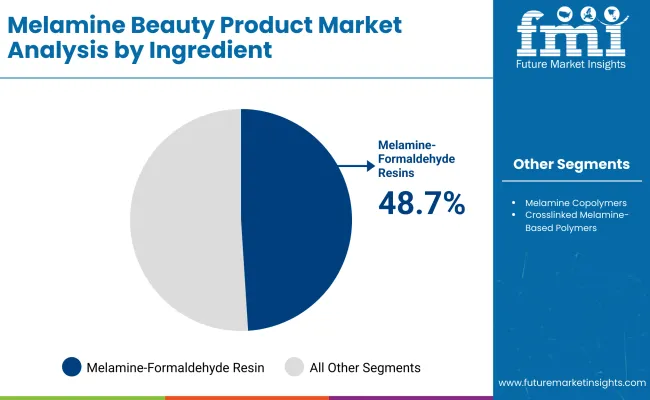

Functional claims cover key performance attributes such as film forming & long-lasting wear, gloss & shine enhancement, texture improvement, durability & water resistance, and matte/oil control effects, which shape product innovation and brand positioning. Ingredient types include melamine formaldehyde resins, melamine copolymers (e.g., melamine-tosylamide resins), and crosslinked melamine-based polymers that serve as film formers and texture enhancers in advanced cosmetic formulations.

End-user segments comprise professional users, general consumers, and sensitive skin consumers, reflecting varied application needs and skin tolerability preferences. Sales channels are bifurcated into online channels (e-commerce websites, brand websites) and offline channels (department stores, drugstores/pharmacies, beauty specialty stores, hypermarkets, and pop-up stores), highlighting the omnichannel nature of modern beauty retail. Regionally, the market scope spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa, with varying adoption patterns, regulatory environments, and innovation intensity across geographies.

| Product Segment | Market Value Share, 2025 |

|---|---|

| Facial Skincare | 43.6% |

| Others | 56.4% |

The facial skincare segment is projected to contribute 43.6% of the Melamine Beauty Product Market revenue in 2025, establishing itself as the leading product category. This dominance is fueled by persistent demand for multifunctional skincare solutions, including deep hydration, oil regulation, and improved wear performance. The segment’s momentum is further sustained by continuous innovation in formulations that enhance skin texture, appearance, and user satisfaction, particularly among consumers seeking high-performance yet sensorial beauty products.

| Ingredient Segment | Market Value Share, 2025 |

|---|---|

| Melamine-Formaldehyde Resins | 48.7% |

| Others | 51.3% |

Melamine-formaldehyde resins are expected to account for 48.7% of the market share in 2025, generating approximately USD 106.51 million in sales. These resins are widely used for their film-forming and durability-enhancing properties, especially in beauty products designed for long wear, resistance to humidity, and uniform finish.

Their unique ability to deliver lightweight yet high-performance textures positions them as an essential active in hybrid skincare-makeup formulations. As consumers increasingly seek out resilient, sweat-proof, and mattifying products, demand for melamine-formaldehyde-based compounds is anticipated to remain strong.

| End Use Segment | Market Value Share, 2025 |

|---|---|

| professional users | 59.2% |

| Others | 40.8% |

The professional users segment is projected to dominate the melamine beauty product market in 2025, accounting for 59.2% of the market share and generating approximately USD 129.47 million in revenue. This leadership is attributed to growing demand from dermatologists, aestheticians, spa therapists, and salon professionals for high-performance skincare and cosmetic products. These users often rely on melamine-based solutions for their durability, skin-safe formulation integrity, and long-wear finish, especially for clinical applications, event prep, and post-treatment care.

Their preference for performance-driven products that offer film-forming properties, hydration, and second-skin texture ensures consistent demand for melamine-infused formulations. Additionally, professionals often set product benchmarks that influence retail adoption by general consumers, further amplifying their role in shaping product development and brand reputation. The other consumer segment, although smaller at 40.8%, still represents a significant portion of the market, particularly through e-commerce, drugstores, and beauty retail chains, where users seek salon-like results at home.

Drivers

Superior Film-Forming Capabilities for Long-Wear and Transfer-Resistance

Melamine-based polymers, particularly crosslinked melamine-formaldehyde resins, are increasingly preferred for their film-forming efficiency, which enables transfer-resistance, humidity tolerance, and extended wearespecially in facial products like foundations, BB creams, and lip tints.

These properties are highly valued in warm and humid climates (e.g., Southeast Asia, Latin America), driving adoption among brands targeting performance-driven and active-wear beauty consumers. This chemical advantage differentiates melamine-integrated products from those using more traditional acrylate or silicone-based film formers.

Growing Demand for Texture-Enhancing Hybrid Polymers in Color Cosmetics

Melamine copolymers, such as melamine-tosylamide resins, are being leveraged in hybrid polymer blends to create silk-matte, soft-touch finishes without sacrificing pigment dispersion or application feel. In premium and indie color cosmetic lines, these resins offer high compatibility with anhydrous and low-oil content bases, enabling minimalist but sensorial product formats. As brands compete on sensorial finish and lightweight textures, especially in eye and lip makeup, melamine derivatives are gaining traction as a texture innovation enabler.

Restraints

Regulatory Scrutiny and Residual Formaldehyde Concerns

Despite being widely used in durable coatings and industrial resins, melamine-formaldehyde systems face scrutiny in cosmetic applications due to concerns about formaldehyde release, even in trace amounts. Regulatory bodies in the EU, California (Prop 65), and South Korea are intensifying safety assessments of chemical additives in personal care products. This has forced several beauty brands to delay launches or reformulate productsespecially where "clean beauty" or allergen-free labels are prioritized.

Formulation Complexity and Stability Challenges with Natural Actives

Melamine-based polymers are often incompatible with naturally derived emulsifiers, enzymes, and probiotic extracts. Brands seeking to integrate both bio-active ingredients and performance polymers in one formulation face complex formulation hurdles, including pH instability, separation, and texture breakdown. This limits the penetration of melamine polymers into fast-growing categories like bio-fermented skincare, reef-safe sunscreens, or edible-grade lip care, where consumers demand both natural ingredients and advanced performance.

Key Trends

Rise of Heat-Activated and Sensorial Melamine Polymers for Smart Makeup

A new wave of heat-activated melamine crosspolymers is emerging, especially in self-setting foundations, skin-adaptive blushers, and thermo-responsive lip stains. These polymers harden slightly upon contact with body heat, creating a natural-looking finish with strong adhesion and minimal pilling. Brands are marketing these attributes as "second-skin technology" or "touch-sensor wear," aligning with growing demand for smart makeup that adapts to movement, skin temperature, and sebum levels.

Strategic Integration into Sustainable and Long-Wear Hybrid Form

While melamine resins are synthetic, there is a trend to combine them with biodegradable bases or packaging innovations to maintain sustainability credentials. For example, color sticks and refillable pressed powders now integrate melamine-tosylamide film formers in water-free formats to offer both long-wear and reduced packaging waste. This "performance + planet-safe" hybrid approach is being adopted by mid-tier and luxury brands seeking to meet ESG benchmarks without compromising on wear time or texture.

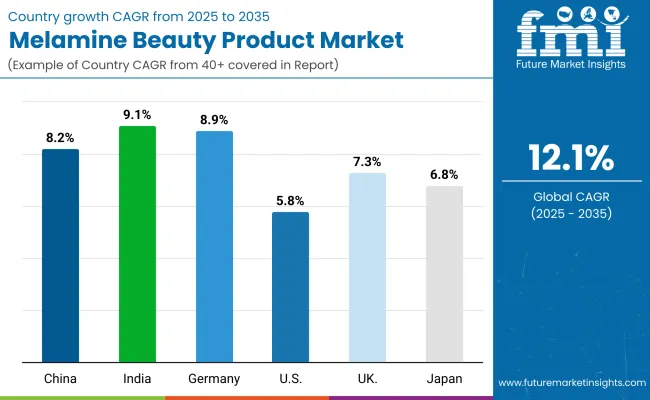

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

| India | 9.1% |

| Germany | 8.9% |

| USA | 5.8% |

| UK | 7.3% |

| Japan | 6.8% |

The global Melamine Beauty Product Market shows a pronounced regional disparity in adoption speed, strongly influenced by consumer trends and regulatory environments. Asia-Pacific emerges as the fastest-growing region, anchored by China at 8.2% CAGR and India at 9.1%. This acceleration is driven by rising disposable incomes, urbanization, and the mass adoption of digital beauty retail.

| Year | USA Melamine Beauty Product Market (USD Million) |

|---|---|

| 2025 | 49.21 |

| 2026 | 54.54 |

| 2027 | 60.44 |

| 2028 | 66.99 |

| 2029 | 74.24 |

| 2030 | 82.28 |

| 2031 | 91.19 |

| 2032 | 101.07 |

| 2033 | 112.01 |

| 2034 | 124.14 |

| 2035 | 137.58 |

The Melamine Beauty Product Market in the USA is projected to grow at a CAGR of 5.8% from 2025 to 2035, reaching USD 137.58 million by 2035, up from USD 49.21 million in 2025. This expansion is driven by heightened consumer preference for sensorial skincare, long-wear cosmetics, and high-performance hybrid formulations.

Increased demand is coming from both general consumers and professional users such as dermatologists and estheticians, who favor melamine-infused products for their film-forming and texture-enhancing properties. Growth is particularly visible in facial skincare, which commands a 44.5% share of the market value in 2025. Adoption is rising through premium beauty retail, dermatology clinics, and clean-label cosmetic startups integrating bio-fermented melamine derivatives.

The Melamine Beauty Product Market in China is forecast to grow at a CAGR of 8.2% between 2025 and 2035. The market is valued at USD 39.80 million in 2025, with facial skincare accounting for 42.8% of sales. China's expansion is being fueled by a surge in domestic beauty brands, fermented skincare innovations, and an emerging preference for lightweight, pore-blurring formulations.

Government support for biocosmetics R&D and digital-first brand growth is accelerating demand for melamine-derived actives in hydrating creams, sun care, and hybrid skin-makeup products. City-tier expansion is introducing melamine-based products to emerging urban clusters. Local brands are promoting affordable, sensorial skincare with strong consumer loyalty. E-commerce integration and influencer-led marketing are propelling mass-market demand.

India's Melamine Beauty Product Market is projected to grow at a CAGR of 9.1% through 2035. Though currently smaller in size compared to leading markets, rising middle-class income, urban grooming consciousness, and beauty influencer ecosystems are expanding the scope of skincare and body care adoption. The country is experiencing increased usage of melamine-based ingredients in dermatologically tested products and hydration-focused formulations tailored to tropical climates.

Growth is especially visible in tier-2 and tier-3 cities, aided by D2C brands and regional distribution networks. Mass-market and affordable beauty ranges are adopting melamine films for product performance. Dermatology chains are recommending barrier-enhancing and anti-inflammatory applications. Ayurveda + actives hybrid brands are integrating melamine for sensory enhancement.

Germany’s Melamine Beauty Product Market is expected to register a CAGR of 8.9% during 2025–2035. The market is supported by strong cosmeceutical demand, clean-label product development, and cross-segment collaborations between beauty and pharma players. Premium skincare brands in Germany are using melamine-based polymers and copolymers to develop velvet-touch serums, barrier creams, and texture-enhancing BB creams.

The rise of eco-certification and demand for performance with compliance is further driving innovation. Apothecary channels are integrating high-performance actives in prescriptive skincare. Sustainability-oriented brands use melamine’s durability to reduce product wastage. Functional beauty tech startups are leveraging film-forming agents in dermatological trials.

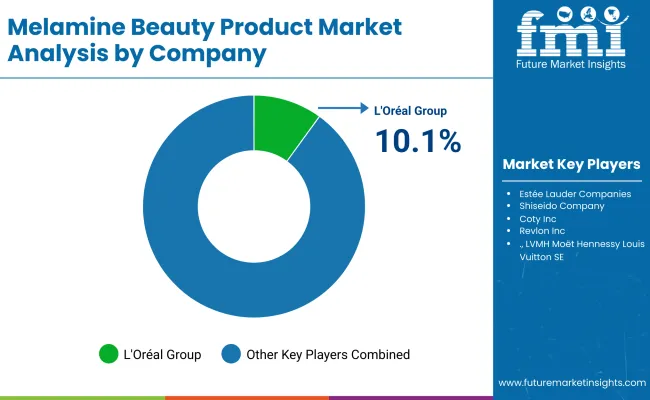

The Melamine Beauty Product Market is moderately fragmented, featuring a mix of global leaders, mid-sized innovators, and niche-focused specialists. Major brands like L'Oréal and Estée Lauder dominate the market, leveraging their extensive resources to develop advanced formulations that incorporate melamine-derived ingredients. These companies maintain significant market share through strong brand recognition and effective distribution networks, allowing them to cater to a wide range of consumer preferences.

To stay competitive, these leading brands increasingly emphasize clean-label trends, and digital innovation. They are adopting eco-friendly practices in sourcing and packaging while formulating products that prioritize transparency and safety. Additionally, digital engagement strategies, such as personalized marketing and interactive platforms, are becoming essential for building consumer loyalty and enhancing the overall shopping experience in the beauty sector.

Key Developments in Global Melamine Beauty Product Market

| Item | Value |

|---|---|

| Quantitative Units | USD 245.1 million |

| Product Types | Facial Skincare (Moisturizers, Serums & Essences, Face Masks, Toners), Color Cosmetics (Lipsticks & Lip Tints, Foundations & BB/CC Creams, Eye Makeup, Blushers & Highlighters), Body Lotions & Cr eams, Fragrances |

| Ingredient Types | Melamine Formaldehyde Resins, Melamine Copolymers (e.g., Melamine- Tosylamide Resins), Crosslinked Melamine-Based Polymers (film formers, texture enhancers) |

| End-use Industry | Professional Users, General Consumers, Sensitive Skin Consumers |

| Functional Claims | Film Forming & Long-Lasting Wear, Gloss & Shine Enhancement, Texture Improvement, Durability & Water Resistance, Matte / Oil Control Effects |

| Sales Channel | Online Channels (E-Commerce Website, Brand Website), Offline Channels (Department Stores, Drugstores / Pharmacies, Beauty Specialty Stores, Hypermarkets, Pop-up Stores) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Companies Profiled | L'Oréal Group, Estée Lauder Companies, Shiseido Company, Coty Inc., Revlon Inc., LVMH Moët Hennessy Louis Vuitton SE, Chanel S.A., Unilever PLC, Procter & Gamble Co., Johnson & Johnson, Amorepacific Corporation, Beiersdorf AG, Avon Products, Kao Corporation, Elizabeth Arden |

| Additional Attributes | Dollar sales by product type and ingredient category, adoption trends in multifunctional beauty products, rising demand for melamine-enhanced formulations, sector-specific growth in skincare, color cosmetics, and body care, revenue segmentation by online and offline sales channels, integration with digital marketing and personalized beauty solutions, consumer engagement through functional claims like durability and gloss enhancement, regional trends shaped by digital-first buying behavior and pop-up store activations, and innovations in melamine-based polymers supporting long-lasting, oil-controlling, and shine-enhancing effects. |

The global Melamine Beauty Product Market is estimated to be valued at USD 218.7 million in 2025.

The market size for the Melamine Beauty Product Market is projected to reach USD $684.5 million by 2035.

The Melamine Beauty Product Market is expected to grow at a CAGR of 12.1% between 2025 and 2035.

The key product types in the Melamine Beauty Product Market are facial skincare, color cosmetics, body lotions, and fragrances.

In terms of product type, skincare is expected to command 43.6% share in the Melamine Beauty Product Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Snail Beauty Products Market

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

Europe & Asia Pacific Herbal Beauty Products Market Trends – Growth & Forecast 2016-2026

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Melamine Formaldehyde (MF) Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA