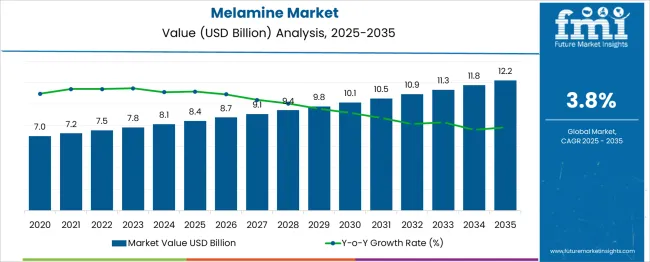

The Melamine Market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 12.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. Over the initial five years, the growth pattern remains stable, with values progressing from USD 8.4 billion to USD 10.1 billion. The annual increment ranges between USD 0.3 and 0.4 billion, with no sign of abrupt acceleration or downturn.

This phase indicates a low-volatility growth path driven by consistent demand in construction, furniture, and coating applications. No inflection point is detected during these years, as the curve maintains uniform upward movement without distortion. From 2030 to 2035, the market grows from USD 10.5 billion to USD 12.2 billion.

Annual gains remain consistent, suggesting the absence of structural shifts, disruptive demand surges, or regulatory disruptions. This section of the curve continues to reflect a stable environment where melamine consumption trends remain aligned with predictable industrial usage.

The growth trajectory confirms the market's maturity with a lack of distinct turning points across the forecast horizon. The inflection mapping exercise validates a gradual, linear evolution in market value, without observable transition from acceleration to deceleration or vice versa.

| Metric | Value |

|---|---|

| Melamine Market Estimated Value in (2025 E) | USD 8.4 billion |

| Melamine Market Forecast Value in (2035 F) | USD 12.2 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The global melamine market is expanding due to increased demand in construction, automotive, and furniture industries. Leading companies include Qatar Melamine Company, Borealis AG, Cornerstone Chemical Company, and Nissan Chemical Industries. These firms focus on producing melamine-formaldehyde resins for laminates, adhesives, and coatings. Key trends involve the development of eco-friendly melamine products and innovations in melamine-based foams for insulation.

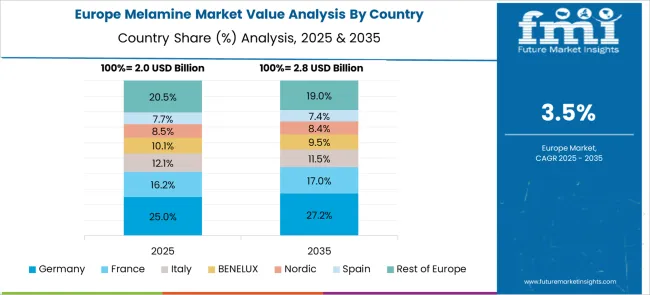

The market is also influenced by fluctuations in feedstock prices and regulatory standards. Asia Pacific leads in production and consumption, while Europe and North America emphasize sustainability and technological advancements in melamine applications.

The melamine market accounts for a small but vital segment of the global chemical industry, with Asia-Pacific dominating consumption at over 60% share due to China's massive construction and furniture sectors, while Europe and North America collectively hold 20-25% share primarily for automotive and coating applications, and emerging markets make up the remaining 15-20%.

Approximately 50% of global melamine demand comes from laminate flooring and furniture production, 30% from adhesives and molding compounds, and the balance from specialty coatings and automotive plastics. The market faces challenges from fluctuating urea feedstock prices and environmental regulations on formaldehyde emissions, but continues to grow at a steady 4-6% annual rate, driven by urbanization trends and increasing demand for durable, lightweight materials across construction and manufacturing sectors.

The Melamine market is witnessing strong momentum, supported by expanding demand across construction, automotive, and furniture manufacturing sectors. The market outlook remains positive as melamine continues to serve as a vital component in the production of thermosetting resins and surface coatings. Growth has been primarily fueled by increasing consumption of melamine-based laminates, adhesives, and molding compounds, driven by infrastructure development and rising interior furnishing standards.

Industrial applications have been further accelerated by the material’s chemical resistance, hardness, and thermal stability, making it a preferred choice in cost-effective, durable surface solutions. Regulatory support for formaldehyde emission reduction and the trend toward lightweight, high-performance materials have led to consistent innovation in melamine resin formulations.

Manufacturers are increasingly investing in modernizing production lines and forming strategic supply alliances to ensure sustainable growth. With emerging economies exhibiting heightened construction activity and industrial expansion, the demand for melamine is expected to remain on a firm upward trajectory over the coming years..

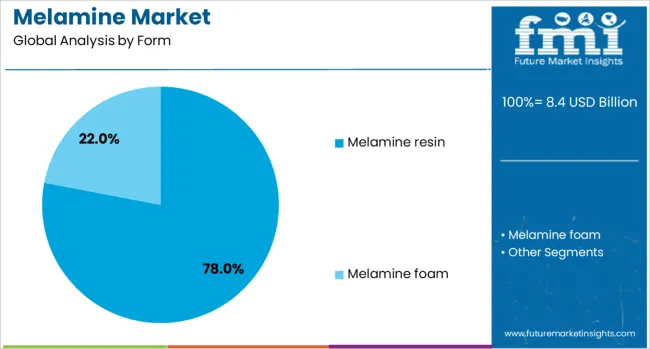

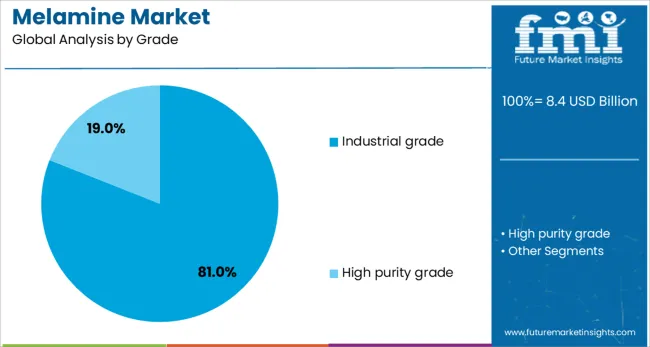

The melamine market is segmented by form, grade, and application and geographic regions. By form of the melamine market is divided into Melamine resin and Melamine foam. In terms of grade of the melamine market is classified into Industrial grade and High purity grade.

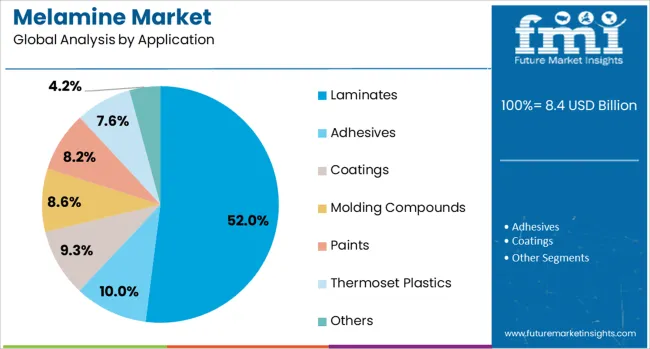

Based on application of the melamine market is segmented into Laminates, Adhesives, Coatings, Molding Compounds, Paints, Thermoset Plastics, and Others. Regionally, the melamine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The melamine resin form segment is projected to contribute 78% of the Melamine market revenue share in 2025, positioning it as the leading segment by form. This dominance has been driven by its widespread use in the manufacture of laminates, adhesives, surface coatings, and molding compounds. The superior bonding strength, thermal resistance, and scratch-resistant surface offered by melamine resin have enabled its adoption across diverse end-use industries.

Industrial manufacturers have increasingly favored melamine resin for its adaptability to high-pressure laminates and decorative surfacing applications. Additionally, the resin’s ability to be chemically modified for enhanced durability and performance has extended its utility in architectural panels and engineered wood products.

The ease of integration with existing manufacturing systems and cost efficiency in bulk production have further strengthened the preference for melamine resin. As demand for engineered interior and industrial materials continues to increase, melamine resin is expected to retain its market leadership through its performance versatility and expanding application base..

The industrial grade segment is expected to hold 81% of the Melamine market revenue share in 2025, making it the leading grade by demand. This growth has been influenced by large-scale consumption of melamine in industrial processes requiring stable chemical structures and mechanical strength. The segment’s expansion has been largely supported by demand in sectors such as construction, automotive parts, electrical applications, and furniture manufacturing.

Industrial-grade melamine has been recognized for its high nitrogen content, flame-retardant properties, and compatibility with formaldehyde-based resins, making it ideal for use in laminate production, insulation materials, and surface coatings. The cost-effectiveness and consistent quality associated with industrial-grade melamine have allowed manufacturers to adopt it widely across high-volume applications.

Increasing focus on environmentally sound and structurally resilient materials in industrial manufacturing has further contributed to the rising consumption of this grade. Its regulatory acceptability and technical suitability in safety-sensitive sectors continue to support its dominant share in the market..

The laminates segment is anticipated to account for 52% of the Melamine market revenue share in 2025, securing its position as the leading application. This leadership has been attributed to the rising demand for melamine-based laminates in flooring, furniture, and interior paneling across residential and commercial spaces. Laminates produced using melamine resins offer exceptional hardness, chemical resistance, and aesthetic versatility, making them well-suited for high-traffic environments.

As consumer preference shifts toward durable, low-maintenance decorative surfaces, melamine laminates have gained popularity for their cost-efficient yet visually appealing properties. Growth in real estate development and modular interior design trends has further driven the adoption of laminates in kitchens, offices, and retail spaces.

Manufacturers have responded by innovating high-pressure laminates with improved texture, color retention, and heat resistance. The long lifecycle and ease of installation associated with melamine laminates have reinforced their position as a material of choice, particularly in emerging economies where affordability and performance are key decision factors..

Growth in the melamine market has been driven by demand for durable resin-based panels, laminates, and molded components across furniture, construction, and consumer goods. In 2024, melamine resin accounted for approximately 28 % of global decorative surface demand. Demand from kitchen cabinetry and retail fixtures contributed roughly 34 % of unit consumption in decorative plywood applications. Growth was concentrated in Asia Pacific and Latin America, followed by Europe. Melamine-formaldehyde adhesives were used in over 46 % of engineered wood production lines.

The melamine market has been propelled by superior resin performance in laminated surfaces, adhesives, and molded components. In more than 42 % of engineered wood applications, melamine-formaldehyde resin provided high hardness, scratch resistance, and heat durability. Decorative paper overlay projects used melamine coatings in over 35 % of furniture back panel designs. Molded plastic utensils, tableware, and kitchenware incorporated melamine resin for improved rigidity. Growth in hospitality and commercial interior fixtures increased demand for melamine-treated surfaces. Consumer preference for low-VOC finishes led to adoption of ultra-low emission resins in 27 % of new furniture launches. Production efficiency gains in melamine panel lamination lines reduced cycle times by about 22 %.

Formaldehyde emissions and high curing energy requirements have constrained initial melamine resin formulations. In regulated markets, resin blends with low-formaldehyde release increased production cost by approximately 24 %. Compliance testing and certification added nearly 18 % to unit onboarding costs in hardwood panel facilities. Slow cure profiles for safer resins delayed line throughput in 9 % of laminate production sites. Formaldehyde tracking requirements and VOC monitoring were newly enforced in 21 % of furniture factories. Consumer sensitivity and labeling standards have limited adoption in certain premium markets. These factors slowed market penetration for high‑end natural-wood aesthetic segments, where alternative adhesives were considered more emission-compliant.

Emerging opportunities have been seen in specialty melamine-modified adhesives and hybrid bio-based resin systems. Melamine-urea blends for cured polymer structures were adopted in 22 % of molded components requiring heat resistance. Research in lignin-based or corn-derived resin substitutes achieved 14 % integration in pilot adhesive lines. Market players developed hybrid melamine resins reinforced with mineral fillers and fire-retardant additives for vertical panel applications. Water-resistant decorative panels using moisture-improved melamine formulations grew by 19 % in bathroom and kitchen use cases. UV-curable melamine coatings were trialed in tabletop finishing systems in 18 % of advanced manufacturing settings. Co-branded clean-label resin lines were launched, targeting sustainable furniture producers.

Trends include the adoption of digitally printed melamine overlays and process automation in resin coating lines. Thin-film melamine layers under 50 microns were applied in over 31 % of decorative plywood surfaces for high-definition visuals. Automated die-cut coating and inline calorimetric resin curing controls reduced thermal exposure and quality variation. Digital pattern registration and resin dispensing automation were implemented in 27 % of new production facilities to support variable décor lines. Sensor-controlled cure profile tracking allowed bond consistency across large-scale runs. Real-time VOC emissions monitoring and resin viscosity stabilization features were embedded in 23 % of modern coating systems. These developments have supported faster turnaround, pattern flexibility, and sustainability compliance in melamine product lines.

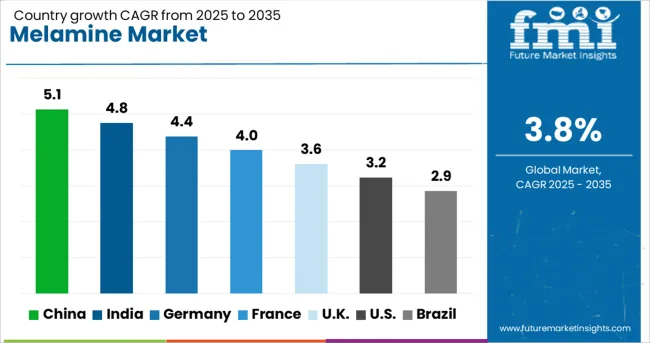

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The melamine market is projected to expand at a global CAGR of 3.8%. China leads the market with a CAGR of 5.1%, surpassing the global average through increased demand in construction and automotive sectors. India follows at 4.8%, supported by its growing manufacturing base and rising industrial applications.

Germany registers a CAGR of 4.4%, driven by technological advancements and sustainable material adoption. The UK and USA trail with 3.6% and 3.2%, respectively, reflecting moderate growth influenced by regulatory frameworks and market maturity. This analysis includes over 40 countries, with the top five nations providing a reference point for regional trends and market drivers in the melamine segment.

China’s melamine market is expected to grow at a CAGR of 5.1% from 2025 to 2035. The expansion is driven by rising demand in the construction and automotive sectors where melamine-based laminates and coatings are used extensively. Growth in furniture manufacturing and packaging industries contributes to increased consumption. The push for improved surface durability and fire resistance in commercial products supports market development.

Local chemical manufacturers are investing in capacity expansions to meet domestic and export demand. Regulatory policies encouraging use of eco-friendly resins influence formulation innovations. The integration of melamine in adhesives and molding compounds is also advancing, providing new application avenues. These factors collectively support China’s higher growth rate compared to the global average.

India’s melamine market is projected to grow at a CAGR of 4.8% during 2025-2035. The rise in residential and commercial construction activities fuels demand for melamine-based laminates and coatings. Packaging sector expansion is supporting the use of melamine in molding and adhesive applications. Indian manufacturers are focusing on developing cost-effective melamine resin formulations to cater to the growing domestic market.

Import dependence is gradually decreasing as local production capacity increases. Environmental regulations encouraging low-emission resins also shape product development. The demand from automotive interiors and consumer electronics sectors is emerging as a growth driver. Infrastructure investments and urban development plans are expected to maintain steady market expansion.

Germany’s melamine market is forecasted to grow at a CAGR of 4.4% from 2025 to 2035. Demand is primarily supported by high standards in the furniture and construction sectors where melamine coatings improve product longevity and resistance. The country’s strong automotive manufacturing base also contributes to steady consumption, particularly for molded melamine components.

Focus on sustainable chemical processes leads to innovation in resin formulations that meet strict regulatory requirements. Import substitution efforts and investments in production technologies aim to improve supply chain resilience. Melamine’s role in enhancing fire retardancy in building materials underpins its adoption. The market is supported by growing consumer preference for durable and eco-friendly materials.

The melamine market in the UK is expected to grow at a CAGR of 3.6% through 2035. The expansion is influenced by demand from the construction and furniture sectors where melamine laminates are favored for durability and aesthetics. Growing interest in eco-compliant and formaldehyde-free melamine resins supports product innovation.

The packaging sector is gradually adopting melamine-based adhesives and molding compounds. Market growth is constrained by limited domestic production capacity, resulting in reliance on imports. Policy emphasis on reducing volatile organic compound emissions impacts formulation strategies. The steady growth of the automotive and consumer goods sectors contributes modestly to melamine demand.

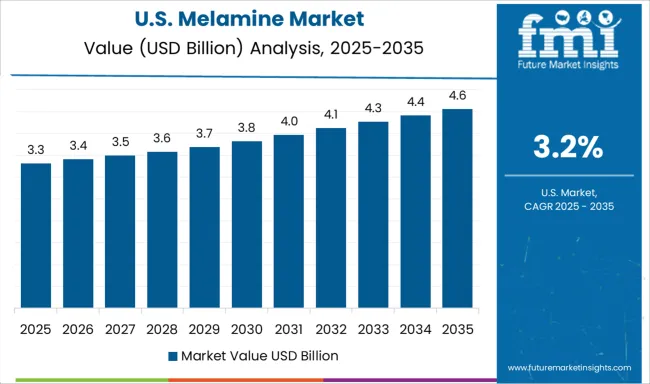

The USA melamine market is projected to grow at a CAGR of 3.2% over the forecast period. Demand is driven by applications in laminate flooring, furniture coatings, and molded plastic components. The growth pace is moderated by market maturity and competition from alternative resin systems. Regulatory pressures related to formaldehyde emissions promote development of low-emission melamine resins.

Expansion of the packaging and automotive sectors supports incremental growth. Supply chain optimization and capacity expansions by key domestic manufacturers are expected to improve availability. The trend towards lightweight, durable materials for consumer electronics is also influencing melamine consumption patterns.

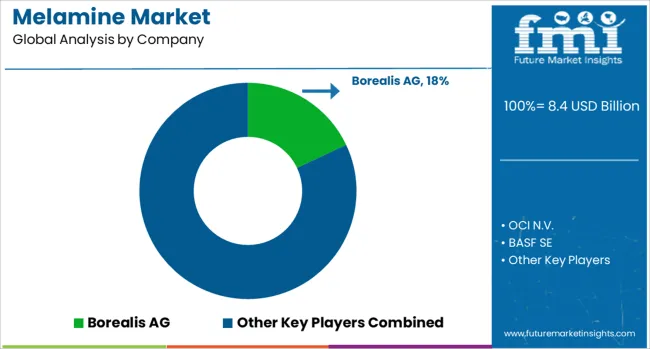

The melamine market includes companies that supply resin-grade and industrial-grade melamine used in laminates, adhesives, coatings, and flame-retardant materials. Borealis AG maintains strong production capacity in Europe, supplying melamine primarily to the wood-based panel and furniture industries.

Its integrated feedstock management and in-house urea chain improve cost control and production consistency. OCI N.V. operates large-scale facilities supporting melamine exports across Asia and the Americas, focusing on efficiency and feedstock integration through vertically aligned ammonia and urea operations.

Borealis AG maintains strong production capacity in Europe, supplying melamine primarily to the wood-based panel and furniture industries. Its integrated feedstock management and in-house urea chain improve cost control and production consistency. OCI N.V. operates large-scale facilities supporting melamine exports across Asia and the Americas, focusing on efficiency and feedstock integration through vertically aligned ammonia and urea operations. BASF SE produces melamine under a diversified portfolio of industrial chemicals, catering to high-volume demand from board and surface industries.

Qatar Melamine Company offers melamine manufactured via urea decomposition, meeting rising demand from regional panel board manufacturers. Methanol Holdings (Trinidad) focuses on melamine production for Latin America and global trading partners, leveraging access to low-cost natural gas feedstock.

Sichuan Golden Elephant Sincerity Chemical supplies melamine for domestic markets in China and exports to Asia-Pacific countries, often bundled with urea-based products. Manufacturers are competing on scale, backward integration, and consistent product quality, especially for thermosetting applications in construction and automotive interior materials. Strategic advantages lie in energy-efficient production processes and diversified supply contracts.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.4 Billion |

| Form | Melamine resin and Melamine foam |

| Grade | Industrial grade and High purity grade |

| Application | Laminates, Adhesives, Coatings, Molding Compounds, Paints, Thermoset Plastics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Borealis AG, OCI N.V., BASF SE, Qatar Melamine Company, Methanol Holdings (Trinidad), and Sichuan Golden Elephant Sincerity Chemical |

| Additional Attributes | Dollar sales by technology (steam methane reforming, partial oxidation, auto-thermal reforming) and application (power generation, transportation, industrial feedstock), demand driven by renewable energy adoption and decarbonization goals, regional trends led by Asia-Pacific with North America catching up, innovation in modular reformers, carbon capture integration, and biogas feedstock optimization. |

The global melamine market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the melamine market is projected to reach USD 12.2 billion by 2035.

The melamine market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in melamine market are melamine resin and melamine foam.

In terms of grade, industrial grade segment to command 81.0% share in the melamine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Melamine Formaldehyde (MF) Market Size and Share Forecast Outlook 2025 to 2035

Global Melamine Beauty Product Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Melamine Pyrophosphate Market Trends – Demand, Innovations & Forecast 2025 to 2035

Melamine Foam Market

Alkylation Melamine-Formaldehyde Resin for Coating Market Size and Share Forecast Outlook 2025 to 2035

Sulfonated Melamine Formaldehyde Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA