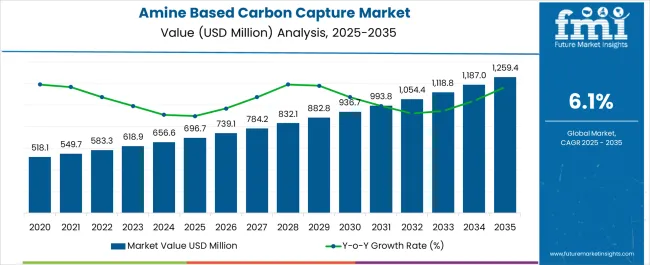

The amine based carbon capture market, valued at USD 696.7 million in 2025 and projected to reach USD 1,259.4 million by 2035, is growing at a CAGR of 6.1%, with growth unfolding in distinct five-year blocks. Between 2021 and 2025, the market rises from USD 518.1 million to USD 696.7 million, adding USD 178.6 million, driven by initial deployment in coal and gas-fired power plants, where post-combustion capture is prioritized to meet emission reduction targets.

The next block, from 2026 to 2030, sees the market expand further from USD 739.1 million to USD 882.8 million, generating USD 143.7 million in opportunity as industries such as cement, steel, and chemicals accelerate adoption, supported by government-backed incentives and pilot-to-commercial project transitions.

Between 2031 and 2035, the market advances sharply from USD 936.7 million to USD 1,259.4 million, adding USD 322.7 million and representing the most significant growth contribution. This phase is marked by large-scale integration of amine-based systems across both developed and emerging economies, with innovation in solvent regeneration reducing energy penalties and costs.

Expansion into hydrogen production and bioenergy facilities further enhances uptake. The five-year block analysis shows consistent acceleration, with the final years delivering the strongest gains, positioning the amine based carbon capture market for sustained long-term expansion through efficiency gains, regulatory pressure, and diversification of industrial applications.

| Metric | Value |

|---|---|

| Amine Based Carbon Capture Market Estimated Value in (2025 E) | USD 696.7 million |

| Amine Based Carbon Capture Market Forecast Value in (2035 F) | USD 1259.4 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The amine-based carbon capture market holds a pivotal position within the global carbon capture, utilization, and storage (CCUS) ecosystem, accounting for nearly 42–45% share due to its established use in post-combustion CO₂ separation across coal-fired and natural gas power plants. Within the broader industrial decarbonization solutions segment, it represents about 28–30% share, supported by its ability to integrate with existing facilities and deliver high capture efficiency. In the solvent-based carbon capture technologies domain, amine-based solutions dominate with an estimated 65–68% share, reflecting their maturity, scalability, and widespread deployment across refineries, petrochemicals, and steel plants. Their influence extends into the environmental compliance sector, where they hold roughly 18–20% share, reinforced by policy-driven adoption in Europe, North America, and emerging Asia-Pacific markets aiming to reduce carbon footprints.

Growth momentum is being fueled by government subsidies, tax credits, and carbon pricing schemes that encourage investment in capture infrastructure. R&D initiatives are also advancing new amine formulations with lower energy requirements and reduced degradation, addressing operational cost challenges. Despite issues such as high regeneration energy demand and amine waste management, these technologies remain central to near-term decarbonization pathways. Partnerships between energy companies, technology providers, and governments are sustaining deployment, positioning the amine-based carbon capture market as the backbone of scalable emissions reduction strategies worldwide.

The market is being driven by increasing adoption of carbon capture, utilization, and storage solutions in sectors such as power generation, cement, steel, and chemicals. Amine-based technologies are preferred due to their high efficiency in capturing carbon dioxide from flue gases and their adaptability across various industrial processes. Rising investments in decarbonization projects and the integration of advanced solvent formulations are enhancing the operational efficiency and cost-effectiveness of these systems.

The demand is also being supported by government incentives, carbon pricing mechanisms, and corporate sustainability targets, all of which are accelerating the deployment of carbon capture infrastructure. Ongoing advancements in amine regeneration processes and energy optimization are expected to strengthen the market’s long-term outlook further, positioning amine-based solutions as a critical enabler in the transition to low-carbon industrial operations.

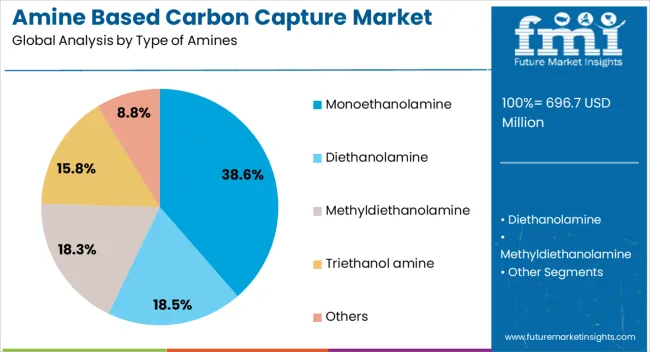

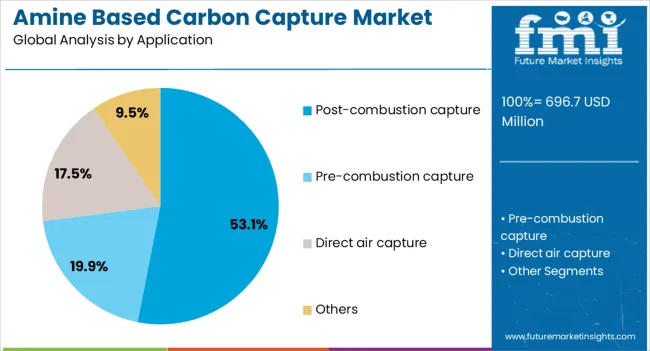

The amine based carbon capture market is segmented by type of amines, application, and geographic regions. By type of amines, the amine-based carbon capture market is divided into Monoethanolamine, Diethanolamine, Methyldiethanolamine, Triethanolamine, and Others. In terms of application, amine based carbon capture market is classified into Post-combustion capture, Pre-combustion capture, Direct air capture, and Others. Regionally, the amine based carbon capture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The monoethanolamine subsegment within the type of amines segment is projected to hold 38.60% of the amine based carbon capture market revenue share in 2025, making it the leading choice among amine types. Growth in this subsegment has been driven by its proven efficiency in selectively capturing carbon dioxide, supported by its established use in large-scale industrial applications. The chemical stability and relatively low cost of monoethanolamine have made it a preferred solvent for both retrofitted and newly constructed carbon capture facilities.

Its high reactivity with carbon dioxide enables effective removal from post-combustion flue gas streams, contributing to operational reliability. Additionally, process familiarity among operators and widespread availability of technical expertise for monoethanolamine-based systems have reinforced its dominance. Research advancements aimed at reducing energy consumption during regeneration have further enhanced its commercial viability. With industrial stakeholders seeking dependable and scalable solutions to meet emission reduction goals, monoethanolamine continues to be positioned as the primary solvent in amine-based carbon capture systems.

The post-combustion capture subsegment within the application segment is anticipated to account for 53.10% of the amine based carbon capture market revenue share in 2025, establishing itself as the dominant application. This leadership position is supported by the suitability of post-combustion systems for integration with existing industrial and power generation infrastructure, allowing facilities to reduce emissions without major redesigns. The ability to apply amine-based solutions directly to flue gases from coal, gas, and biomass plants has driven widespread adoption.

Technological improvements in solvent formulations and process integration have reduced energy penalties and improved capture efficiency, making post-combustion capture more cost-competitive. Regulatory mandates for emission control and carbon pricing frameworks are accelerating investments in these systems across multiple regions. The scalability of post-combustion solutions, combined with their compatibility with both large and small facilities, has ensured strong market demand As industries work to achieve net-zero targets, post-combustion capture remains central to the decarbonization strategies of major emitters worldwide.

Amine-based carbon capture growth is shaped by power sector retrofits, industrial adoption, efficiency improvements, and strong policy-backed partnerships. These factors ensure its central role in near-term emission reduction strategies.

Amine-based carbon capture systems are increasingly deployed in coal-fired and natural gas power plants as governments and utilities seek proven technologies for emission reduction. These solvents are widely recognized for their strong ability to capture CO₂ even from flue gas streams with low concentrations. Policy frameworks, carbon pricing, and emission reduction mandates in Europe and North America are pushing plant operators to retrofit facilities with these solutions. Asia-Pacific is following with large-scale demonstration projects supported by state-backed utilities. The growing adoption reflects a reliance on established chemical processes to achieve immediate emission reduction targets, despite ongoing concerns over high energy consumption during solvent regeneration.

The industrial sector has emerged as a key adopter of amine-based carbon capture. Refineries, cement plants, petrochemical complexes, and steel mills are integrating these systems to lower their emission intensity while complying with global climate commitments. The flexibility of amine solvents makes them suitable for high-capacity industrial processes that emit significant amounts of CO₂. The sector is under pressure from regulatory compliance, corporate climate goals, and public demand for cleaner production. Amine-based systems are serving as a transitional bridge for industries to maintain operational continuity while preparing for long-term shifts toward alternative decarbonization methods.

Economic viability remains one of the strongest dynamics shaping the outlook of amine-based carbon capture. The technology’s high operational cost, largely tied to the energy required for solvent regeneration, has slowed broader adoption. However, research-driven improvements in solvent stability and regeneration efficiency are beginning to reduce overall costs.

Pilot projects around the world are demonstrating how advanced amine blends can minimize degradation and extend operational lifespans. Industry collaborations are also introducing hybrid systems combining amine capture with waste-heat recovery. Although costs remain a barrier, the steady progress toward efficiency is ensuring that amine-based solutions retain a leading role in the near-term carbon capture market.

Partnerships between energy producers, chemical companies, and governments are accelerating deployment of amine-based carbon capture projects. Policy incentives such as tax credits, carbon pricing, and emission-trading mechanisms are strengthening the economic case for investment. Public-private collaboration is particularly evident in North America and Europe, where demonstration plants are scaling into commercial facilities. Joint ventures with engineering firms and technology providers are also ensuring rapid deployment in heavy industries. These collaborations reduce financial risks while creating standardized solutions suitable for global replication. Strong policy backing, when combined with industry partnerships, has transformed amine-based capture from a demonstration phase into a commercially viable pathway for near-term emissions reduction.

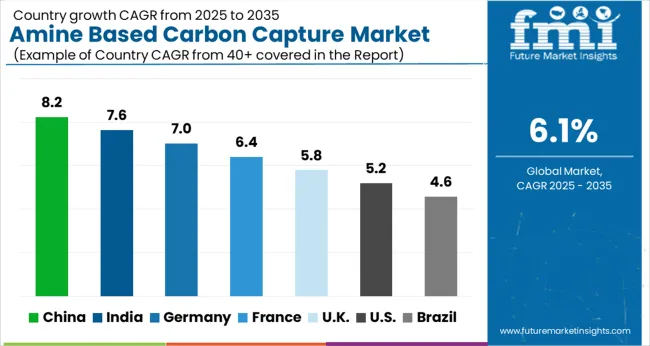

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

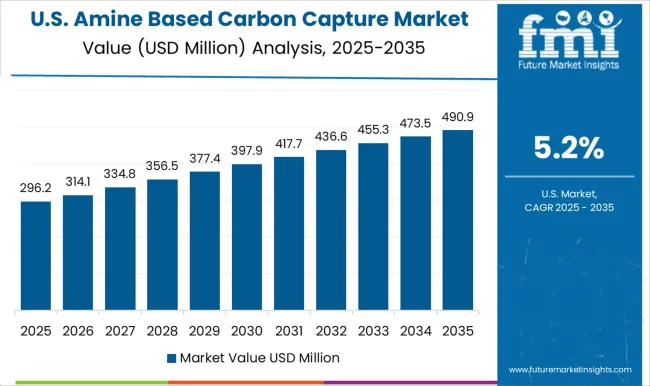

| USA | 5.2% |

| Brazil | 4.6% |

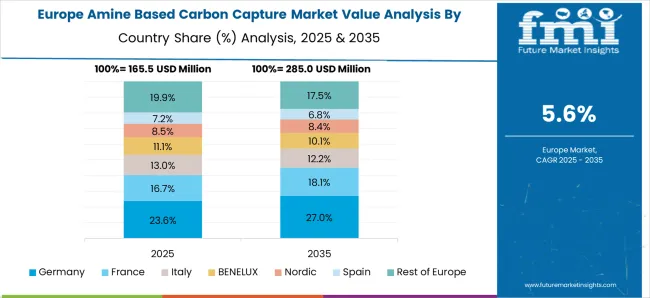

The amine-based carbon capture market is projected to grow globally at a CAGR of 6.1% from 2025 to 2035, supported by rising emission reduction targets, industrial retrofits, and large-scale deployment in energy and manufacturing hubs. China leads with a CAGR of 8.2%, driven by heavy coal dependency, large-scale power plant retrofits, and significant government-backed investment in industrial decarbonization programs. India follows at 7.6%, supported by rising industrialization, demand for emission control in cement and steel sectors, and favorable regulatory incentives. France stands at 6.4%, reflecting adoption in industrial clusters and government-supported demonstration projects. The United Kingdom posts 5.8%, with progress shaped by North Sea carbon storage projects and partnerships in power and industrial capture. The United States records 5.2%, reflecting slower adoption tied to cost challenges and regulatory complexities, but remains relevant through tax credits, pilot projects, and advanced R&D initiatives. The analysis demonstrates how Asia-Pacific dominates growth through large-scale adoption, Europe benefits from compliance-driven expansion, and North America prioritizes technology innovation with incremental deployment.

China is projected to register a CAGR of 8.2% for 2025–2035, well above the global 6.1% benchmark. During 2020–2024, growth was gauged near 7.1% as utility retrofits and pilot clusters built early momentum. The step up to 8.2% is explained by large post-combustion projects in coal and gas power, integration in refinery and chemicals corridors, and policy traction for transport and storage hubs. Provincial procurement, standardized EPC packages, and solvent performance upgrades have strengthened bankability. Industrial clusters around coastal provinces are expected to anchor capture volumes, while storage readiness in offshore basins improves project certainty. In my view, China will remain the volume leader as repeatable designs compress costs and shorten schedules.

The United States is anticipated to deliver a CAGR of 5.2% across 2025–2035, under the global 6.1% reference. During 2020–2024, estimated CAGR stood near 4.6% as incentives and Class VI permitting advanced. The movement toward 5.2% is shaped by tax credit utilization, mid-scale solvent retrofits at gas processing and ethanol plants, and growing pipeline of power projects using heat-integration to curb regeneration energy. Developer-operator partnerships and O&M warranties are improving bankability. My perspective is that steady policy execution and solvent performance gains will expand adoption, even as siting and permitting keep growth measured.

India is expected to post a CAGR of 7.6% during 2025–2035, outpacing the global 6.1% trajectory. During 2020–2024, CAGR was estimated near 6.6% as cement, steel, and fertilizer pilots validated capture economics. The rise toward 7.6% is linked to clinker hubs adopting common capture units, urea plants trialing low-energy amines, and early pipeline studies near coastal storage. Public sector undertakings are prioritizing brownfield integration where steam availability lowers regeneration costs. Vendor partnerships offering performance guarantees and service contracts are improving risk appetite. My assessment is that India moves from pilots to early commercial phases, with industrial clusters and shared utilities driving faster throughput.

France is forecast to record a CAGR of 6.4% for 2025–2035, modestly above the global 6.1% guidepost. During 2020–2024, growth was around 5.6% as demonstration units built operational confidence. The transition to 6.4% is supported by chemicals and refining complexes adopting solvent revamps, coordinated cluster initiatives, and firming storage access through European networks. Funding calls and carbon price signals have improved return profiles, while standardized solvent management lowers degradation and waste costs. Aviation fuels and petrochemicals provide steady flue gas sources, making capture units easier to load. My view is that France will scale through integrated cluster planning and disciplined OPEX control.

The United Kingdom is projected to achieve a CAGR of 5.8% for 2025–2035, just below the global 6.1% baseline. For 2020–2024, CAGR is assessed near 5.1% given staggered final investment decisions and front-end engineering focus. The increase from about 5.1% to 5.8% is driven by North Sea transport and storage maturation, Track-supported clusters progressing toward commercial operations, and rising use of amine units in gas-fired power and blue hydrogen schemes. Supply chains around Teesside and the Humber are expected to tighten execution. In my judgment, predictable storage access and revenue support will lift deployment pace and narrow the gap to the global rate.

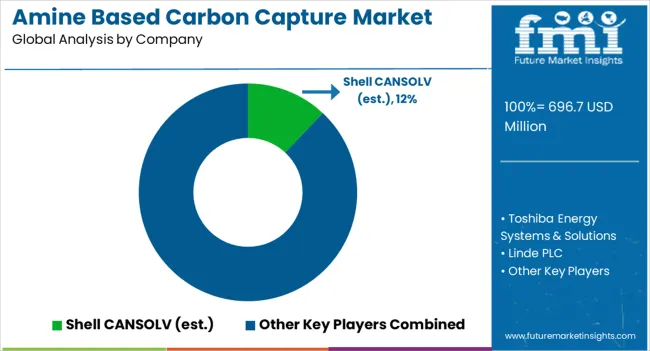

The amine-based carbon capture market is shaped by global technology leaders and specialized solution providers, including Shell CANSOLV, Toshiba Energy Systems & Solutions, Linde PLC, Mitsubishi Heavy Industries (MHI), Fluor Corporation, Koch-Glitsch, BASF SE, Pentair, Carbon Clean, GEA Group, and Aker Carbon Capture / SLB (ACC joint offers). These companies compete on efficiency of solvent formulations, energy optimization, integration with industrial processes, and large-scale deployment readiness. Shell CANSOLV is recognized for its extensive track record in post-combustion capture projects, leveraging proven amine solvent chemistry for coal and gas-fired power plants. Toshiba Energy Systems & Solutions emphasizes advanced amine blends and integration within Asian industrial hubs, while Linde PLC combines gas processing expertise with solvent-based capture units tailored to refineries and petrochemical plants.

Mitsubishi Heavy Industries (MHI) leads with its KM CDR Process, known for large-scale deployments in Asia and the Middle East. Fluor Corporation focuses on its Econamine FG Plus technology, delivering energy-efficient solvent regeneration solutions. Koch-Glitsch strengthens the ecosystem by offering process equipment and mass transfer solutions critical for absorption and regeneration stages. BASF SE continues to innovate with proprietary solvent formulations that lower energy penalties and extend operational lifespans. Pentair specializes in gas separation and modular solutions for smaller-scale facilities. Carbon Clean is a fast-growing player, offering compact, low-cost systems designed for distributed industrial applications, while GEA Group emphasizes process integration and energy recovery. Aker Carbon Capture / SLB (ACC joint offers) have combined expertise in EPC delivery and modular capture units, positioning themselves for accelerated commercial rollouts. A balance between established chemical giants and emerging technology providers marks the competitive landscape. Strategic priorities include improving solvent performance, scaling modular units, expanding partnerships with industrial emitters, and aligning with government-backed decarbonization programs. Growth is expected to be driven by stricter emission mandates, the availability of carbon incentives, and industry collaborations targeting cost reductions and faster commercial deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 696.7 Million |

| Type of Amines | Monoethanolamine, Diethanolamine, Methyldiethanolamine, Triethanol amine, and Others |

| Application | Post-combustion capture, Pre-combustion capture, Direct air capture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shell CANSOLV (est.), Toshiba Energy Systems & Solutions, Linde PLC, Mitsubishi Heavy Industries (MHI), Fluor Corporation, Koch-Glitsch, BASF SE, Pentair, Carbon Clean, GEA Group, and Aker Carbon Capture / SLB (ACC joint offers) |

| Additional Attributes | Dollar sales, share, adoption in power and industrial sectors, regional policy incentives, cost efficiency trends, competitive benchmarking, technology upgrades, and partnership opportunities. |

The global amine based carbon capture market is estimated to be valued at USD 696.7 million in 2025.

The market size for the amine based carbon capture market is projected to reach USD 1,259.4 million by 2035.

The amine based carbon capture market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in amine based carbon capture market are monoethanolamine, diethanolamine, methyldiethanolamine, triethanol amine and others.

In terms of application, post-combustion capture segment to command 53.1% share in the amine based carbon capture market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Amine Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Amine Hardener Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amine Additives in Paints and Coatings Market

Diamine Oxidase Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Thiamine Market Size and Share Forecast Outlook 2025 to 2035

Melamine Formaldehyde (MF) Market Size and Share Forecast Outlook 2025 to 2035

Melamine Market Size and Share Forecast Outlook 2025 to 2035

Global Melamine Beauty Product Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Melamine Pyrophosphate Market Trends – Demand, Innovations & Forecast 2025 to 2035

Dopamine and Norepinephrine Reuptake Inhibitor Market

Melamine Foam Market

Glutamine Market – Growth, Demand & Functional Health Benefits

Histamine Toxicity Market

Ethylamine Market Analysis - Size, Share & Forecast 2025 to 2035

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Benzylamine Market Size and Share Forecast Outlook 2025 to 2035

Glucosamine Supplement Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Methylamine Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA