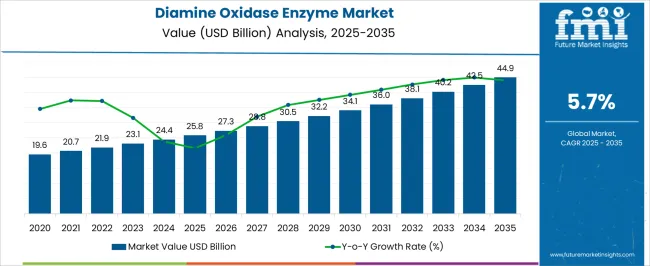

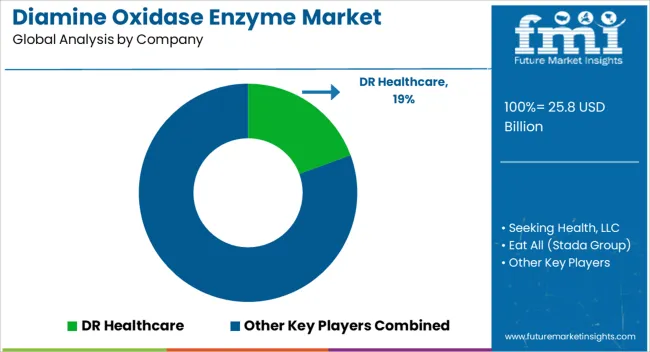

The diamine oxidase enzyme market is estimated to be valued at USD 25.8 billion in 2025 and is projected to reach USD 44.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The diamine oxidase enzyme market is projected to grow from USD 25.8 billion in 2025 to USD 44.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.7%. The market expansion is being driven by rising demand for enzyme-based dietary supplements, gastrointestinal health products, and clinical formulations where diamine oxidase plays a crucial role in histamine regulation. Absolute dollar opportunity indicates that significant revenue potential is being captured through increasing adoption of enzyme therapies across nutraceutical and pharmaceutical sectors.

Market performance is being influenced by product efficacy, regulatory approvals, and consumer awareness about digestive health management. Year-on-year growth demonstrates a steady accumulation of market value as demand for diamine oxidase enzyme applications strengthens across global regions. Market participants offering high-quality, reliable enzyme formulations are being positioned to gain notable market share, as end-use industries increasingly integrate enzyme solutions to improve health outcomes and product differentiation.

The diamine oxidase enzyme market is being shaped by clinical research findings, formulation standardization, and evolving consumer preferences, reflecting consistent value creation over the forecast period. Incremental gains in revenue highlight the potential for strategic investments and partnerships to enhance market presence and capitalize on growing enzyme utilization.

| Metric | Value |

|---|---|

| Diamine Oxidase Enzyme Market Estimated Value in (2025 E) | USD 25.8 billion |

| Diamine Oxidase Enzyme Market Forecast Value in (2035 F) | USD 44.9 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The diamine oxidase enzyme market is estimated to hold a notable proportion within its parent markets, representing approximately 10-12% of the enzyme supplements market, around 6-7% of the nutraceuticals market, close to 5-6% of the digestive health products market, about 3-4% of the functional foods and beverages market, and roughly 2-3% of the biopharmaceuticals market. Collectively, the cumulative share across these parent segments is observed in the range of 26-32%, reflecting a focused yet significant presence of diamine oxidase-based solutions across multiple health and biochemical applications. The market has been influenced by the growing awareness of histamine intolerance, digestive health concerns, and the need for targeted enzyme supplementation, which have driven adoption across both consumer and clinical segments.

Procurement is often guided by efficacy, safety profiles, and regulatory compliance, while formulations are increasingly designed for enhanced bioavailability and integration into dietary supplements or functional food products. Market players have emphasized specialized production processes, quality control, and stability to maintain reliability in applications ranging from gastrointestinal support to complementary health therapies. As a result, the diamine oxidase enzyme market has not only captured a strong share within its core enzyme supplement segment but has also impacted broader nutraceutical, digestive health, and functional food categories, highlighting its strategic role in supporting health-focused biochemical solutions.

The diamine oxidase enzyme market is experiencing steady growth driven by increasing consumer awareness of histamine intolerance management, rising prevalence of related gastrointestinal disorders, and expanding use in functional food formulations. The enzyme’s ability to aid histamine degradation has positioned it as a valuable supplement in both clinical and preventive health applications.

Technological advancements in enzyme extraction and stabilization have improved product efficacy and shelf life, thereby expanding market acceptance. Regulatory support for dietary supplements and the growing trend toward self directed health management are also influencing adoption rates.

As consumer preferences shift toward natural solutions for digestive wellness, the market is expected to witness continued growth, with innovation in delivery formats and distribution strategies further enhancing accessibility and consumer reach.

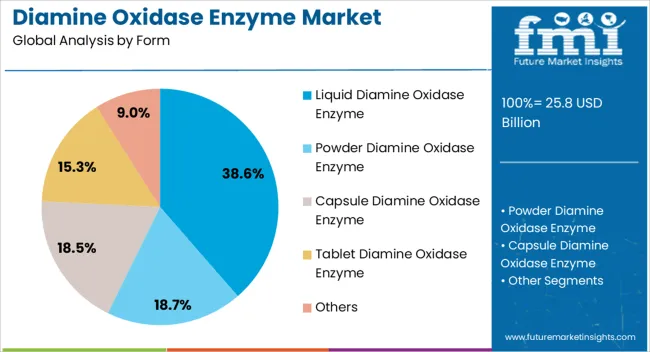

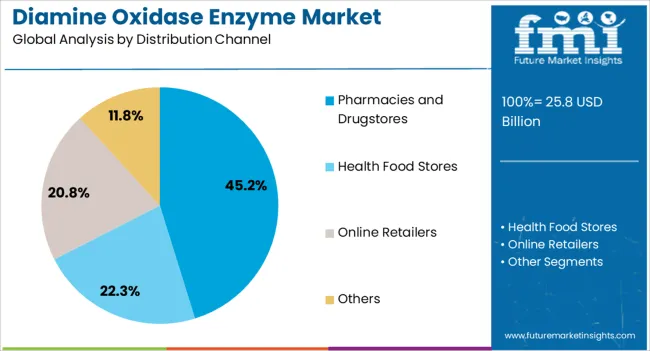

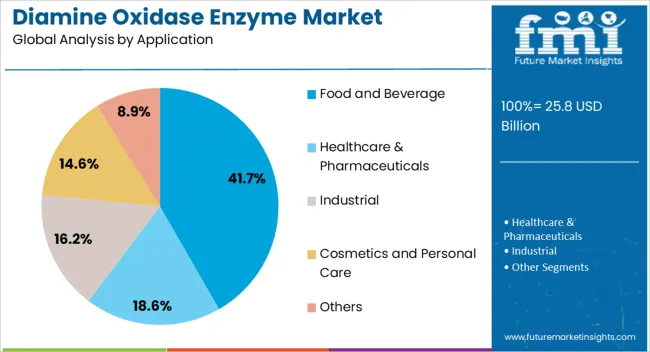

The diamine oxidase enzyme market is segmented by form, distribution channel, application, and geographic regions. By form, diamine oxidase enzyme market is divided into liquid diamine oxidase enzyme, powder diamine oxidase enzyme, capsule diamine oxidase enzyme, tablet diamine oxidase enzyme, and others. In terms of distribution channel, diamine oxidase enzyme market is classified into pharmacies and drugstores, health food stores, online retailers, and others. Based on application, diamine oxidase enzyme market is segmented into food and beverage, healthcare & pharmaceuticals, industrial, cosmetics and personal care, and others. Regionally, the diamine oxidase enzyme industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid diamine oxidase enzyme form segment is projected to account for 38.6% of total market revenue by 2025, positioning it as a key segment in the form category. Its dominance is supported by faster absorption rates, ease of consumption, and suitability for individuals with swallowing difficulties.

The liquid form also allows for precise dosing flexibility, making it attractive for personalized supplementation needs. Improved stability in liquid formulations and the potential for blending with other functional ingredients in beverages and liquid supplements have further driven adoption.

As demand for convenient and bioavailable supplement formats increases, the liquid form continues to maintain a strong position in the market.

The pharmacies and drugstores segment is anticipated to hold 45.2% of market revenue by 2025, making it the leading distribution channel. This is attributed to the trust and credibility associated with professional healthcare retail environments, where consumers often seek expert advice on supplementation.

Pharmacies and drugstores offer convenient access, product authenticity assurance, and in some cases, pharmacist guided dosage recommendations. Their established supply chain networks ensure consistent product availability, while the integration of dietary supplements alongside prescription medications strengthens consumer purchasing confidence.

These advantages have cemented the dominance of this channel in the distribution landscape.

The food and beverage segment is expected to represent 41.7% of total market revenue by 2025, making it the most significant application area. This growth is being driven by the incorporation of diamine oxidase enzyme into functional food and drink products aimed at managing histamine sensitivity.

Increasing consumer demand for health enhancing foods and beverages, coupled with the convenience of integrating supplementation into daily diets, has spurred innovation in this segment. Manufacturers are developing fortified drinks, snack bars, and dairy alternatives enriched with the enzyme to target health conscious consumers.

This synergy between functional nutrition and digestive health solutions is solidifying the food and beverage sector’s leadership in the application category.

The diamine oxidase enzyme market is being driven by rising awareness of digestive health and histamine intolerance. Opportunities are emerging in functional foods, supplements, and personalized nutrition, while trends emphasize enzyme fortification and tailored solutions. Challenges include regulatory restrictions, production complexities, and stability concerns affecting shelf life. Despite these constraints, DAO enzymes are increasingly adopted across nutraceutical and pharmaceutical segments, providing targeted digestive support and opening new avenues for product innovation, distribution expansion, and consumer-focused health solutions worldwide.

The demand for diamine oxidase (DAO) enzymes has been reinforced by growing consumer awareness regarding digestive health and histamine intolerance. Dietary supplements containing DAO are increasingly being used to alleviate symptoms such as headaches, gastrointestinal discomfort, and allergic reactions associated with histamine accumulation. Nutraceutical and functional food manufacturers are integrating DAO enzymes into capsules, tablets, and fortified foods to cater to a health-conscious consumer base. This rising adoption is further supported by increased online distribution channels and proactive health campaigns, driving the market expansion across Europe, North America, and Asia-Pacific, where digestive health management is gaining prominence among adults and elderly populations.

Significant opportunities exist in functional foods, nutraceuticals, and specialized dietary supplements containing diamine oxidase enzymes. Manufacturers are leveraging these enzymes to develop products aimed at managing histamine-related disorders, offering premium formulations with standardized enzyme activity levels. Retailers and e-commerce platforms are witnessing growing consumer acceptance, creating space for product differentiation and brand expansion. Pharmaceutical companies are also exploring co-formulations with probiotics and other digestive aids, widening the application range. These developments provide manufacturers with avenues to capture untapped consumer segments while strengthening market positioning in the fast-growing digestive health domain.

A key trend shaping the DAO enzyme market is the focus on personalized nutrition and enzyme fortification in dietary regimens. Consumers are increasingly seeking tailored solutions based on digestive health profiles, histamine tolerance, and lifestyle preferences. Supplement providers are introducing formulations with precise enzyme dosages, optimized delivery mechanisms, and combined bioactive ingredients to maximize efficacy. Functional foods such as fortified dairy, beverages, and snack items are being enriched with DAO enzymes to offer convenience and improve adherence. This trend is influencing product innovation strategies, creating a competitive environment centered on efficacy, bioavailability, and consumer-specific health outcomes.

The market faces challenges arising from stringent regulatory approvals and complexities in enzyme production. Diamine oxidase enzymes require controlled fermentation processes or extraction from biological sources, making large-scale manufacturing costly and technically demanding. Regulatory scrutiny in Europe, North America, and Asia restricts certain health claims and necessitates rigorous quality testing, delaying product launches. Furthermore, storage and stability concerns for enzyme formulations affect shelf life and consumer acceptance. These factors compel manufacturers to focus on high-quality production, secure supply chains, and compliance with local regulatory frameworks to maintain competitiveness and market credibility.

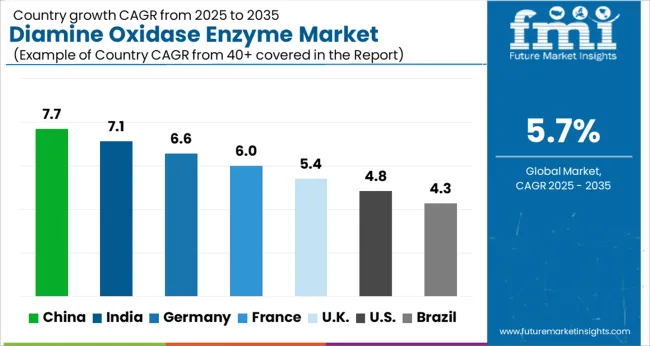

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global diamine oxidase enzyme market is projected to grow at a CAGR of 5.7% from 2025 to 2035. China leads with a growth rate of 7.7%, followed by India at 7.1%, and Germany at 6.6%. The United Kingdom records a growth rate of 5.4%, while the United States shows the slowest growth at 4.8%. Rising awareness of digestive health, increasing prevalence of histamine intolerance, and growing dietary supplement consumption are driving global demand. Emerging economies such as China and India experience higher growth due to expanding health-conscious populations, rising supplement adoption, and growing pharmaceutical manufacturing. Developed markets like the USA, UK, and Germany see steady growth supported by strong healthcare infrastructure, research investment, and regulatory compliance. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The diamine oxidase enzyme market in China is projected to grow at a CAGR of 7.7%. Rising awareness of histamine intolerance, digestive health, and gastrointestinal disorders is driving demand for enzyme supplements. The increasing popularity of functional foods, nutraceuticals, and dietary supplements further supports growth. Pharmaceutical companies and nutraceutical manufacturers are investing in enzyme-based formulations, while research into improved enzyme stability and efficacy strengthens the market. Large-scale production capabilities, expanding distribution networks, and rising consumer interest in gut health accelerate adoption. Government policies promoting healthcare and nutrition awareness, along with growing e-commerce penetration, enhance accessibility and support market expansion in China.

The diamine oxidase enzyme market in India is projected to grow at a CAGR of 7.1%. Expanding awareness about digestive health, growing prevalence of histamine intolerance, and increased adoption of nutraceuticals contribute to market growth. Pharmaceutical and dietary supplement manufacturers are focusing on enzyme-based products to meet rising consumer demand. Urban and semi-urban populations are increasingly inclined toward functional foods and gut health solutions, accelerating adoption rates. Investments in R&D, high-quality enzyme production, and improved distribution channels enhance accessibility and product availability. Regulatory support for nutraceuticals and dietary supplements further contributes to steady market expansion, while India’s growing e-commerce infrastructure ensures broader reach for enzyme products.

The diamine oxidase enzyme market in Germany is projected to grow at a CAGR of 6.6%. Germany’s well-established healthcare and pharmaceutical sectors drive demand for enzyme supplements targeting digestive health. High consumer awareness regarding gut health, histamine intolerance, and nutritional supplementation supports steady market adoption. Investment in R&D, product innovation, and formulation efficiency ensures quality and consistency of enzyme-based products. The market benefits from advanced manufacturing facilities, stringent quality control standards, and strong distribution networks. Regulatory compliance and emphasis on evidence-based dietary supplements reinforce steady growth. The German market also sees increasing interest in functional foods enriched with diamine oxidase enzymes, supporting industrial and consumer demand.

The diamine oxidase enzyme market in the United Kingdom is projected to grow at a CAGR of 5.4%. Rising awareness of histamine intolerance and digestive disorders drives demand for enzyme supplements. Functional foods, nutraceuticals, and dietary supplements incorporating diamine oxidase enzymes are increasingly preferred by consumers. Investments in product formulation, research, and distribution networks support higher adoption rates. Regulatory standards ensuring safety and efficacy contribute to consumer confidence and market stability. The UK market benefits from a growing focus on preventative healthcare and personalized nutrition solutions, as well as increasing online sales channels that facilitate access to enzyme-based products.

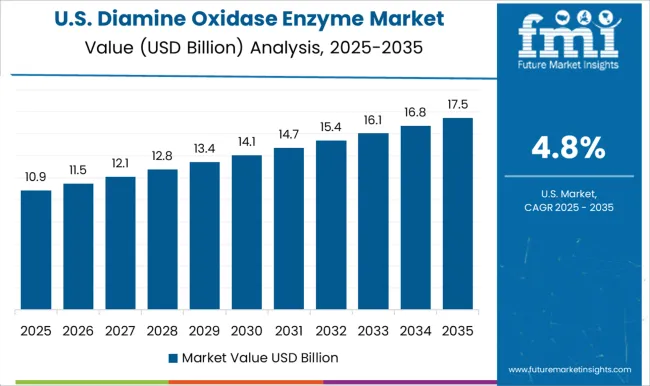

The diamine oxidase enzyme market in the United States is projected to grow at a CAGR of 4.8%. Growing prevalence of digestive disorders and histamine intolerance supports steady adoption of enzyme supplements. The dietary supplement and nutraceutical sectors are investing in high-quality formulations to meet consumer demand. Research initiatives focusing on enzyme efficacy, stability, and bioavailability enhance product performance. Distribution through retail, pharmacy chains, and e-commerce channels ensures broad accessibility. The USA market benefits from strong healthcare infrastructure, regulatory compliance, and increasing consumer preference for functional foods and nutritional supplements. Emphasis on preventive health solutions continues to drive steady growth in the diamine oxidase enzyme segment.

The diamine oxidase enzyme market is defined by a mix of nutraceutical leaders and specialized supplement producers competing to offer digestive health solutions. DR Healthcare, Seeking Health, LLC, and Eat All (Stada Group) dominate with high-purity DAO enzyme formulations, emphasizing efficacy, bioavailability, and allergen-friendly profiles. Brochures highlight targeted support for histamine metabolism, promoting gut comfort and overall well-being. Pure Encapsulations, LLC, Enzymedica, Inc., and Swanson differentiate through product certifications, clean-label claims, and ingredient transparency, appealing to health-conscious consumers seeking reliable enzyme supplements.

XYMOGEN and Klaire Labs emphasize clinical-grade formulations and research-backed dosages, ensuring credibility among healthcare practitioners and specialty retailers. Regional and emerging players such as NOW Foods, Nature's Way, Jarrow Formulas, Inc., Himalaya Herbal Healthcare, and Thompson's (Integria Healthcare) compete through broad distribution networks, competitive pricing, and diversified wellness portfolios. Their marketing materials stress ease of integration into daily health routines, consistency, and digestive support. Competition is driven by enzyme potency, product stability, allergen management, and consumer trust. Brochures often highlight laboratory testing, standardized activity levels, and adherence to regulatory standards, positioning diamine oxidase supplements as reliable and effective solutions for individuals managing histamine sensitivity or digestive discomfort.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.8 billion |

| Form | Liquid Diamine Oxidase Enzyme, Powder Diamine Oxidase Enzyme, Capsule Diamine Oxidase Enzyme, Tablet Diamine Oxidase Enzyme, and Others |

| Distribution Channel | Pharmacies and Drugstores, Health Food Stores, Online Retailers, and Others |

| Application | Food and Beverage, Healthcare & Pharmaceuticals, Industrial, Cosmetics and Personal Care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DR Healthcare, Seeking Health, LLC, Eat All (Stada Group), Pure Encapsulations, LLC, Enzymedica, Inc., Swanson, XYMOGEN, Klaire Labs, NOW Foods, Nature's Way, Jarrow Formulas, Inc., Himalaya Herbal Healthcare, and Thompson's (Integria Healthcare) |

| Additional Attributes | Dollar sales by product type (capsules, tablets, powders, liquids) and application (dietary supplements, pharmaceuticals, functional foods) are key metrics. Trends include rising demand for digestive health and histamine intolerance solutions, growth in nutraceutical formulations, and increasing consumer awareness of enzyme supplementation. Regional adoption, regulatory approvals, and product innovations are driving market growth. |

The global diamine oxidase enzyme market is estimated to be valued at USD 25.8 billion in 2025.

The market size for the diamine oxidase enzyme market is projected to reach USD 44.9 billion by 2035.

The diamine oxidase enzyme market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in diamine oxidase enzyme market are liquid diamine oxidase enzyme, powder diamine oxidase enzyme, capsule diamine oxidase enzyme, tablet diamine oxidase enzyme and others.

In terms of distribution channel, pharmacies and drugstores segment to command 45.2% share in the diamine oxidase enzyme market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Triethylenediamine Market Growth - Trends & Forecast 2025 to 2035

Hexamethylenediamine Market

Tetraacetylethylenediamine (TAED) Market Size and Share Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Glucose Oxidase Market Analysis – Trends & Forecast 2025-2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Protectants Market Size and Share Forecast Outlook 2025 to 2035

Enzyme-Enabled Cold-Brew Concentrates Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzyme Replacement Therapy Market Insights - Size & Forecast 2025 to 2035

Enzyme Substrates Market – Growth & Forecast 2025 to 2035

Enzyme Inhibitors Market

Coenzyme Q10 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioenzyme Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Sea Enzyme Products Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cake Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA