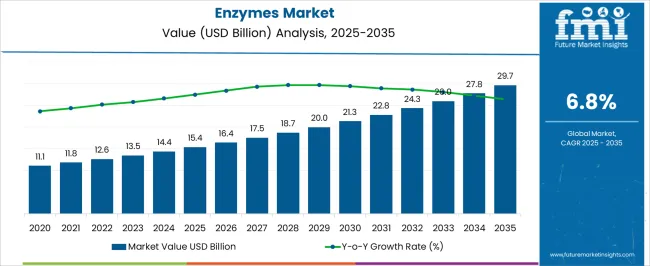

The enzymes market is estimated at USD 15.4 billion in 2025 and is projected to reach USD 29.7 billion by 2035, registering a CAGR of 6.8% over the forecast period. Growth is being shaped by rising applications of enzymes across food processing, pharmaceuticals, biofuels, and industrial sectors. Enzymes are widely adopted for their catalytic efficiency, enabling faster reactions under mild conditions while reducing energy requirements. The food and beverage industry remains the largest consumer, driven by demand for bakery enzymes, dairy enzymes, and those used in brewing. In healthcare, enzyme-based therapies and diagnostic applications are expanding, reflecting growing precision in medical treatments. Biofuel production also benefits from enzymatic solutions, improving the efficiency of starch and cellulose conversion. The market is supported by ongoing R&D in enzyme engineering, with companies developing stable, high-activity variants. Environmental benefits, coupled with the move toward cleaner industrial processes, further strengthen the long-term adoption outlook.

Quick Stats for Enzymes Market

| Metric | Value |

|---|---|

| Enzymes Market Estimated Value in (2025 E) | USD 15.4 billion |

| Enzymes Market Forecast Value in (2035 F) | USD 29.7 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The enzymes market is experiencing stable growth, supported by increasing demand across food processing, pharmaceuticals, biofuels, and industrial applications. Industry publications and corporate disclosures have highlighted significant investment in enzyme innovation, focusing on enhanced stability, specificity, and environmental sustainability. Growing consumer preference for natural and clean-label products has further fueled the use of enzymes as processing aids and functional ingredients.

In the food and beverage industry, enzymes are playing a critical role in improving product quality, extending shelf life, and optimizing production efficiency. Pharmaceutical applications are also expanding, driven by enzyme-based therapeutics and diagnostic uses. Additionally, environmental concerns and regulatory encouragement for green technologies have accelerated enzyme adoption in industries such as detergents and bioenergy. The market is expected to benefit from advancements in protein engineering, biocatalysis, and fermentation processes, enabling tailored solutions for diverse industrial needs.

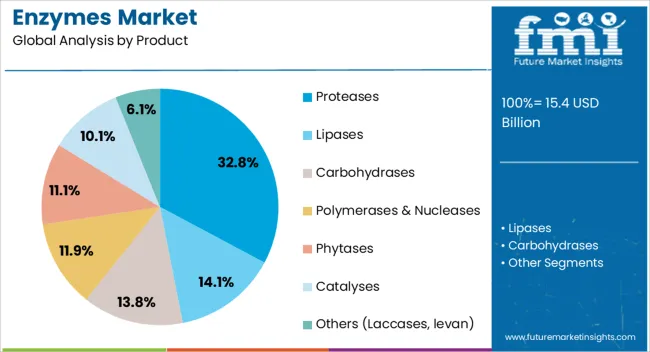

The enzymes market is segmented by product, application, and geographic regions. By product, enzymes market is divided into Proteases, Lipases, Carbohydrases, Polymerases & Nucleases, Phytases, Catalyses, and Others (Laccases, levan). In terms of application, enzymes market is classified into Food & beverage, Detergents, Animal feed, Biofuels, Textile, Pulp & paper, Personal care & cosmetics, Nutraceutical, and Wastewater. Regionally, the enzymes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Proteases segment is projected to contribute 32.8% of the enzymes market revenue in 2025, positioning it as the leading product category. Growth in this segment has been driven by proteases’ broad application range, particularly in food processing, detergents, and pharmaceuticals.

In the food industry, proteases are extensively used for protein hydrolysis, flavor development, and texture improvement, while in detergents, they enhance cleaning efficiency by breaking down protein-based stains. Pharmaceutical applications include therapeutic enzyme formulations and peptide synthesis.

Advances in enzyme engineering have improved protease stability and activity under varying temperature and pH conditions, increasing their industrial utility. The ability to produce proteases through cost-effective microbial fermentation has further strengthened their market position. With consistent demand from multiple high-volume industries, the Proteases segment is expected to maintain steady growth.

The Food & Beverage segment is projected to account for 27.4% of the enzymes market revenue in 2025, making it the largest application area. Demand in this segment has been driven by enzymes’ role in improving processing efficiency, enhancing product quality, and enabling cleaner-label formulations.

Enzymes are utilized in baking for dough conditioning, in brewing for fermentation optimization, and in dairy for lactose hydrolysis and flavor development. Consumer trends toward natural, minimally processed products have encouraged manufacturers to replace synthetic additives with enzyme-based solutions.

Additionally, food safety regulations and sustainability initiatives have encouraged wider enzyme adoption, as they allow for reduced chemical usage and energy savings. The continuous innovation of specialized food-grade enzymes tailored to niche product requirements is expected to further boost the Food & Beverage segment’s share in the market.

The enzymes market is being driven by diverse applications across food processing, pharmaceuticals, biofuels, textiles, and detergents. Food and beverage companies are using enzymes to enhance flavor, texture, and shelf life in bakery, dairy, and brewing segments. In healthcare, enzymes are applied in diagnostics, drug development, and enzyme replacement therapies. Biofuel producers rely on enzymes for efficient starch and cellulose conversion, reducing energy costs. Industrial users value enzymatic processes for lowering chemical use and enabling cleaner production. Increasing consumer demand for natural and efficient solutions supports ongoing adoption across multiple end-user industries.

One of the key restraints is the high cost of production, particularly for specialized enzymes requiring advanced fermentation and purification processes. Maintaining enzyme stability under varying temperature and pH conditions is another challenge, limiting broader industrial use. Intellectual property concerns and complex regulatory pathways for therapeutic enzymes slow innovation and commercialization. Price sensitivity in developing markets restricts adoption, especially in cost-driven industries like textiles and detergents. These factors create barriers for small and mid-tier companies looking to scale enzyme production.

Advances in biotechnology and protein engineering are enabling the development of enzymes with higher specificity, stability, and activity under extreme conditions. Tailored enzyme formulations are being introduced for niche applications such as nutraceuticals, precision medicine, and biodegradable plastics. Demand is also growing for eco-friendly enzymatic alternatives that replace harsh chemicals in detergents, pulp processing, and leather treatment. Partnerships between biotech firms and industrial users are expanding, leading to co-developed solutions for energy efficiency and waste reduction. Digital tools like AI-driven protein modeling are accelerating enzyme discovery and optimization, setting the stage for continued innovation.

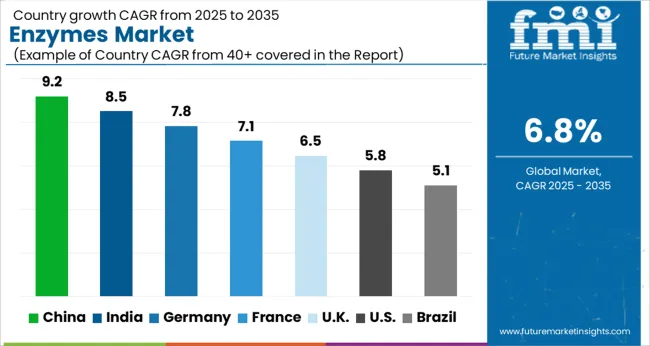

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The global enzymes market is projected to grow at a CAGR of 6.8% between 2025 and 2035, supported by rising applications across food processing, pharmaceuticals, biofuels, and industrial manufacturing. Among BRICS nations, China leads with a CAGR of 9.2%, fueled by large-scale industrial production and investments in biotech research. India follows at 8.5%, driven by expanding pharmaceutical manufacturing and growing food processing demand. In the OECD region, Germany posts 7.8%, backed by strong R&D capabilities and adoption of high-quality enzyme solutions across healthcare and bioenergy. France records 7.1%, supported by steady uptake in dairy, bakery, and nutraceutical industries. The United Kingdom, at 6.5%, reflects stable adoption in clinical diagnostics and specialty food sectors. The United States, at 5.8%, shows maturity but consistent demand in biofuel and pharma applications. Brazil, growing at 5.1%, benefits from agro-processing and bioethanol production.

China’s enzymes market is projected to grow at a CAGR of 9.2%, the highest globally, supported by strong industrial adoption and government-backed biotechnology programs. Food processing companies are expanding enzyme usage in bakery, dairy, and brewing applications to enhance efficiency and quality. Pharmaceutical firms are integrating enzymes in diagnostics and drug development, particularly in precision medicine. Biofuel producers are also scaling enzyme use for ethanol and biodiesel, aligning with energy diversification strategies. Domestic manufacturers benefit from low-cost production bases, while multinational firms invest in R&D centers to cater to local demand. With expanding industrial clusters, China is becoming a global hub for enzyme production and application innovation.

Food, dairy, and brewing industries driving demand

Expanding use of enzymes in pharmaceuticals and diagnostics

Growing biofuel production supports large-scale enzyme adoption

India’s enzymes market is expected to grow at a CAGR of 8.5%, driven by expanding pharmaceutical manufacturing, food processing, and bioenergy sectors. Enzymes are being adopted in nutraceuticals and functional foods, reflecting the rise in health-conscious consumption. Local producers are expanding fermentation capacity, while global companies are forming partnerships with Indian firms to serve domestic and export markets. Enzymes are increasingly applied in textile processing, detergents, and paper manufacturing, supporting industrial growth. Healthcare adoption is also rising, with enzyme-based therapies being explored in chronic disease management. Government initiatives supporting biotech startups and biofuel production are creating favorable conditions for market expansion.

Pharmaceutical and nutraceutical industries expanding enzyme use

Biofuel sector adoption rising under government initiatives

Industrial applications in textiles, paper, and detergents growing steadily

Germany’s enzymes market is forecast to grow at a CAGR of 7.8%, supported by advanced R&D capabilities and strong industrial biotechnology infrastructure. German manufacturers emphasize high-quality enzyme formulations tailored for pharmaceuticals, food, and specialty chemicals. Healthcare applications are particularly important, with enzymes integrated into diagnostics and therapeutic solutions. The food industry leverages enzymes in bakery, dairy, and brewing to maintain product consistency and efficiency. Bioenergy producers are adopting enzyme solutions for efficient biomass conversion. German companies also lead in sustainability, engineering enzymes that enable greener industrial processes. A strong regulatory environment ensures product safety and quality, reinforcing trust in enzyme-based solutions across end-user sectors.

Advanced R&D drives pharmaceutical and biotech applications

Food and beverage industry widely adopts enzyme solutions

Enzymes enable greener processes in bioenergy and chemicals

France’s enzymes market is expected to grow at a CAGR of 7.1%, supported by its established food and beverage sector and rising nutraceutical demand. Dairy and bakery companies are leading adopters, using enzymes to improve product texture, flavor, and nutritional value. Healthcare adoption is growing, with diagnostic labs utilizing enzymes for molecular testing and disease detection. France’s focus on sustainability has driven enzyme use in bio-based materials and eco-friendly detergents. Domestic producers collaborate with research institutes to innovate enzyme formulations suited for pharmaceuticals and industrial applications. Government support for biotech clusters has enhanced capacity for enzyme development. These factors position France as a steady-growth market with emphasis on both traditional and emerging uses.

Dairy and bakery industries heavily reliant on enzyme technologies

Healthcare adoption expands through diagnostics and molecular testing

Bio-based applications promoted under sustainability initiatives

The United Kingdom’s enzymes market is projected to expand at a CAGR of 6.5%, supported by strong demand in pharmaceuticals, diagnostics, and specialty food processing. Enzymes are widely used in clinical diagnostics for rapid testing, with adoption reinforced during public health initiatives. Food manufacturers utilize enzymes in bakery, beverages, and plant-based products to meet evolving consumer preferences. Universities and biotech startups are actively involved in enzyme engineering, creating tailored variants for industrial and healthcare applications. Biofuel projects also incorporate enzymatic solutions to improve efficiency in biomass conversion. Market expansion is influenced by growing demand for specialty healthcare solutions and premium food formulations, though competition is concentrated among established players.

Widespread enzyme use in diagnostics and healthcare

Food processing sector focuses on bakery and plant-based products

Research-driven innovation fosters tailored enzyme development

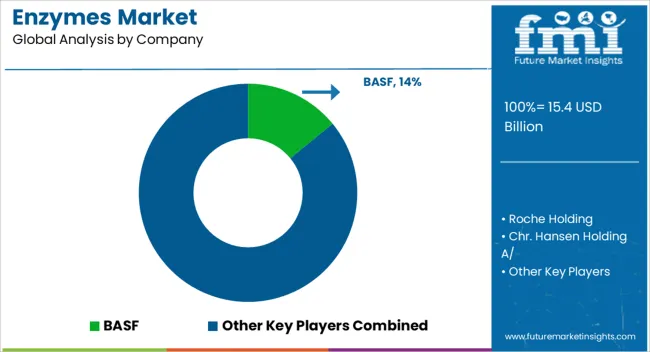

The enzymes market is moderately consolidated, with competition shaped by a handful of global leaders and a wide base of regional and niche players. Large companies such as Novozymes, DuPont/DSM, BASF, Chr. Hansen and AB Enzymes dominate through extensive product portfolios, global distribution networks, and strong investment in research and development. Their focus lies in developing high-performance enzyme formulations for food processing, pharmaceuticals, biofuels, and industrial applications, where scale and regulatory expertise provide a competitive edge.

Mid-tier players, including Advanced Enzyme Technologies, Amano Enzyme, and Codexis, strengthen their position by targeting specialized applications such as nutraceuticals, diagnostics, and custom biocatalysts. Competitive strategies revolve around innovation in enzyme engineering, partnerships with biotech firms, and expansion into emerging markets in Asia and Latin America. Differentiation increasingly comes from sustainability credentials, enzyme stability under extreme conditions, and value-added services, with innovation and customization emerging as the primary tools to secure long-term advantage.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.4 Billion |

| Product | Proteases, Lipases, Carbohydrases, Polymerases & Nucleases, Phytases, Catalyses, and Others (Laccases, levan) |

| Application | Food & beverage, Detergents, Animal feed, Biofuels, Textile, Pulp & paper, Personal care & cosmetics, Nutraceutical, and Wastewater |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Roche Holding, Chr. Hansen Holding A/, Ab Enzymes, Amano Enzymes, Royal DSM, Kerry Group, Codexis, Novozymes, Sanofi, and Danisco |

| Additional Attributes | Dollar sales vary by enzyme type, including proteases, amylases, lipases, and cellulases; by application, such as food & beverages, detergents, pharmaceuticals, animal feed, and biofuels; by end-use industry, spanning food processing, healthcare, agriculture, and industrial manufacturing; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for biocatalysts, clean-label products, and sustainable industrial processes. |

The global enzymes market is estimated to be valued at USD 15.4 billion in 2025.

The market size for the enzymes market is projected to reach USD 29.7 billion by 2035.

The enzymes market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in enzymes market are proteases, lipases, carbohydrases, amylases, xylanases, cellulases, pectinases, lactases, polymerases & nucleases, phytases, catalyses and others (laccases, levan).

In terms of application, food & beverage segment to command 27.4% share in the enzymes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Enzymes Market Analysis by Product Type, End User and Region through 2035

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Biofuel Enzymes Market

Aquafeed Enzyme Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Industrial Enzymes Market Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Tropical Fruit Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Clinical Chemistry Enzymes Market Report – Trends & Forecast 2023-2033

Bio-Based Detergent Enzymes Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA