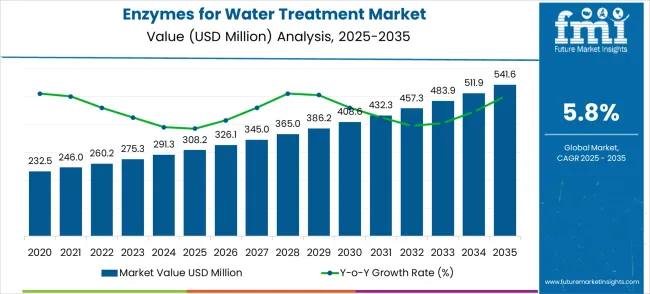

The enzymes for water treatment market is expected to grow from USD 363.7 million in 2025 to USD 670.0 million by 2035, with a CAGR of 6.3%. Between 2021 and 2025, the market grows steadily, from USD 268.0 million in 2021 to USD 363.7 million in 2025. The annual increases from USD 284.8 million in 2022, USD 302.8 million in 2023, and USD 321.9 million in 2024 indicate consistent progress. This steady growth reflects increasing adoption of enzyme-based water treatment solutions, driven by industries seeking more efficient and effective methods for wastewater treatment and purification across various sectors.

From 2021 to 2025, the market experiences a stable growth rate of 6.3% YoY, reflecting a steady demand for enzyme-based solutions in water treatment. The rise in demand is supported by industries like municipal water systems and industrial wastewater treatment, which increasingly rely on enzymes for their efficient, eco-friendly properties. This phase of growth highlights the market's gradual expansion as businesses and governments prioritize more advanced water treatment methods. The consistency in growth rate during this period suggests that the market is gaining momentum, with increasing acceptance of enzyme-based technologies as a reliable and effective solution.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 308.2 million |

| Forecast Value in (2035F) | USD 541.6 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

From 2026 to 2030, the market experiences a more pronounced acceleration, rising from USD 386.6 million in 2026 to USD 493.6 million in 2030. This phase sees stronger YoY growth rates due to enhanced regulatory requirements for water treatment and the growing preference for advanced water management solutions. The market benefits from greater investments in water treatment technologies as industries look for more cost-effective and efficient ways to meet stringent regulations. However, there is a slight deceleration in 2029, primarily due to market saturation in developed regions and slower adoption in emerging economies.

The average YoY growth rate for the 10-year period remains consistent at 6.3%, which highlights the stable and predictable growth trajectory of the enzymes for water treatment market. Although some fluctuations occur in specific years, the overall trend shows steady market expansion driven by advancements in water treatment technologies, regulatory support, and a rising global demand for efficient water purification solutions. The market’s resilience, combined with its steady growth, positions it for long-term development, with minimal volatility expected over the next decade.

Market expansion is being supported by the rapid increase in industrial wastewater generation worldwide and the corresponding need for specialized enzyme treatments that ensure effective pollutant removal and water quality improvement. Modern water treatment facilities rely on precise enzyme dosing and biological process control to ensure proper functioning of treatment systems including biological nutrient removal, organic matter degradation, and contaminant transformation processes. Even minor process adjustments or system upgrades can require comprehensive enzyme optimization to maintain optimal treatment performance and discharge compliance.

The growing complexity of water treatment technologies and increasing regulatory pressures are driving demand for professional enzyme solutions from certified biotechnology companies with appropriate expertise and regulatory approvals. Environmental agencies are increasingly requiring proper treatment documentation following discharge activities to maintain permits and ensure environmental protection standards. Treatment specifications and compliance requirements are establishing standardized enzyme application procedures that require specialized products and trained technical personnel.

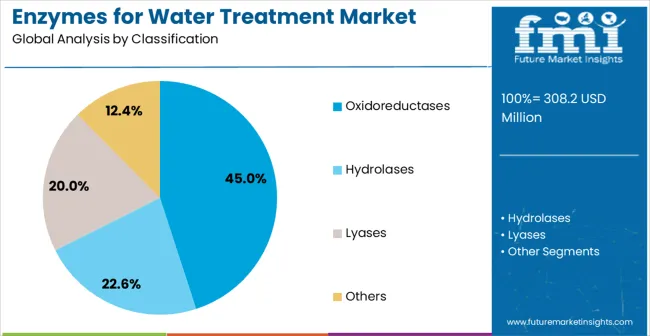

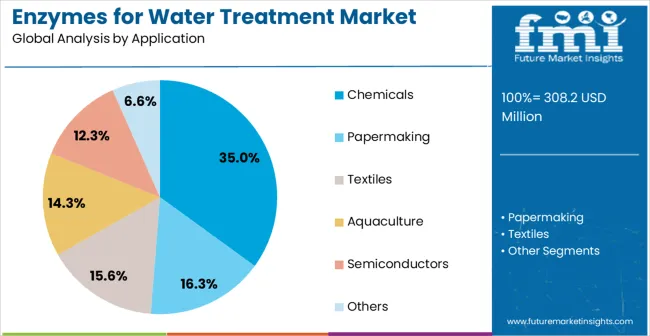

The market is segmented by enzyme type, application, and region. By enzyme type, the market is divided into oxidoreductases, hydrolases, lyases, and other enzyme categories. Based on application, the market is categorized into chemicals processing, papermaking, textiles treatment, aquaculture applications, semiconductor manufacturing, and others Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

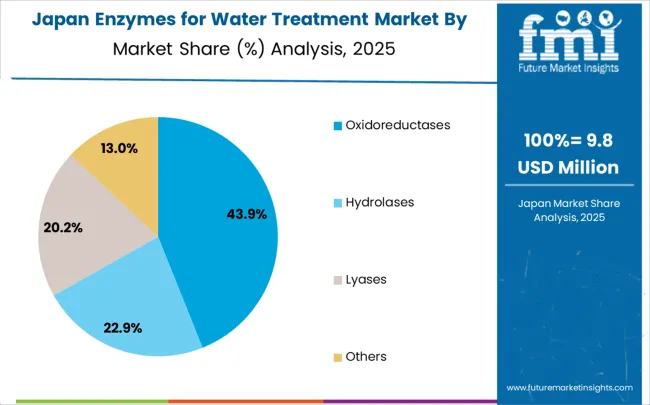

Oxidoreductases are projected to account for 45% of the enzymes for water treatment market in 2025. This leading share is driven by their critical role in oxidative treatment processes, widely used across industrial water treatment applications. Oxidoreductases effectively degrade organic pollutants through controlled oxidation and electron transfer reactions, making them indispensable in industrial wastewater and process water conditioning. Their ability to break down complex organic compounds, such as phenolic substances, aromatic hydrocarbons, and synthetic dyes, positions them as the enzyme of choice in many industrial sectors. The segment's growth is also supported by well-established application procedures and the broad availability of oxidoreductase products from leading biotechnology suppliers. Their versatility and adaptability to various operating conditions ensure their dominance in the market.

The chemicals processing application segment is projected to account for 35% of the enzymes for water treatment market in 2025, underscoring its pivotal role in water treatment solutions. Enzymes are increasingly utilized in chemical plants to enhance water treatment processes, such as the removal of organic compounds, contaminants, and pollutants from wastewater. The ability of enzymes to catalyze specific reactions ensures more efficient and eco-friendly water treatment, reducing the need for harsh chemicals. With growing regulatory pressure to minimize chemical use and reduce environmental impact, the demand for enzyme-based solutions in chemical processing continues to rise. Manufacturers are investing in enzyme technologies to optimize treatment processes, ensuring improved water quality, operational efficiency in the chemical processing industry.

The enzymes for water treatment market is advancing steadily due to increasing environmental regulation enforcement and growing recognition of enzyme technology. The market faces challenges including high product development costs, need for continuous research on new enzyme applications, and varying treatment requirements across different industrial sectors. Regulatory harmonization efforts and certification programs continue to influence product quality and market development patterns.

The growing deployment of specialty enzyme formulations is enabling targeted treatment solutions at industrial facilities, municipal treatment plants, and specialized processing operations. Custom-formulated enzyme products equipped with enhanced stability characteristics provide improved performance and extended operational life for customers while expanding biotechnology company capabilities. These formulations are particularly valuable for challenging treatment applications and complex wastewater compositions that require specialized enzyme solutions without process disruption.

Modern enzyme manufacturers are incorporating advanced biotechnology platforms and automated monitoring systems that improve treatment effectiveness and reduce operational complexity. Integration of bioprocess control systems and real-time performance monitoring enables more precise enzyme application procedures and comprehensive treatment documentation. Advanced biotechnology also supports development of next-generation enzyme solutions including thermostable formulations and pH-resistant enzyme variants.

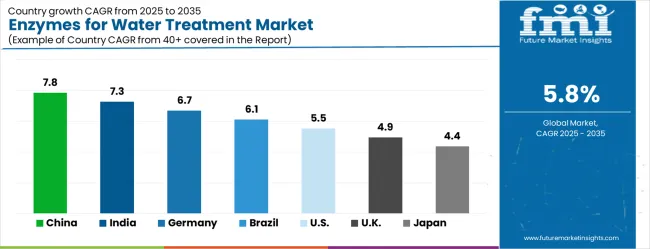

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| United States | 5.5% |

| United Kingdom | 4.9% |

| Japan | 4.4% |

The enzymes for water treatment market is growing rapidly, with China leading at a 7.8% CAGR through 2035, driven by strong industrial expansion, environmental regulation enforcement, and expanding biotechnology networks. India follows at 7.3%, supported by rising industrial water treatment requirements and increasing certified enzyme product availability. Germany grows steadily at 6.7%, emphasizing biotechnology innovation, quality standards, and advanced manufacturing expertise. Brazil records 6.1%, integrating enzyme technology into its established industrial sector. The United States shows growth at 5.5%, focusing on technology advancement, regulatory compliance.. The United Kingdom demonstrates growth at 4.9%, supported by pharmaceutical and chemical manufacturing modernization. Japan maintains expansion at 4.4%, driven by precision manufacturing and environmental stewardship requirements. Overall, China and India emerge as the leading drivers of global Enzymes for Water Treatment market expansion. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The enzymes for water treatment market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035. The rapid industrialization and urbanization in China have led to significant water treatment challenges, driving demand for enzymatic solutions that are both effective and eco-friendly. The growing focus on improving water quality in both industrial and municipal sectors is boosting the market for water treatment enzymes. China’s commitment to environmental reforms and the adoption of green technologies is also contributing to the increasing use of enzymatic treatments in water purification processes. The growing awareness of water scarcity and pollution management further underscores the need for efficient, renewable water treatment solutions.

The enzymes for water treatment market in India is expected to grow at a CAGR of 7.3% from 2025 to 2035. The increasing industrial activity and urbanization are leading to higher levels of water contamination, resulting in a growing demand for water treatment solutions. Enzymes are gaining popularity in sectors like textiles, pharmaceuticals, and food processing, where large volumes of wastewater are produced. India’s government initiatives aimed at improving water management and wastewater treatment systems are expected to further accelerate market growth. The rise in population and increasing water demand in urban areas are key factors driving the adoption of enzymatic solutions.

Demand for enzymes for water treatment is expected to expand at a CAGR of 6.7% from 2025 to 2035. As a leader in environmental technologies, Germany is experiencing a shift towards enzyme-based solutions for wastewater treatment in both industrial and municipal applications. The country’s stringent environmental regulations have prompted industries to adopt more effective treatments for waste. Enzymatic methods are particularly beneficial in sectors like chemicals and food processing, where the wastewater often contains complex organic pollutants. With its strong focus on water management and pollution control, Germany’s demand for enzymatic treatments continues to rise.

The enzymes for water treatment market in Brazil is forecasted to grow at a CAGR of 6.1% from 2025 to 2035. The country’s significant industrial growth, particularly in agriculture, mining, and manufacturing, has led to a rise in water pollution, creating a strong demand for treatment solutions. Enzymes are increasingly being used to treat wastewater due to their efficiency in breaking down organic pollutants. Brazil’s large agricultural sector, which generates a substantial amount of wastewater, is adopting enzyme-based treatments for irrigation and water recycling. The growing industrial base and urbanization in Brazil present significant opportunities for market expansion.

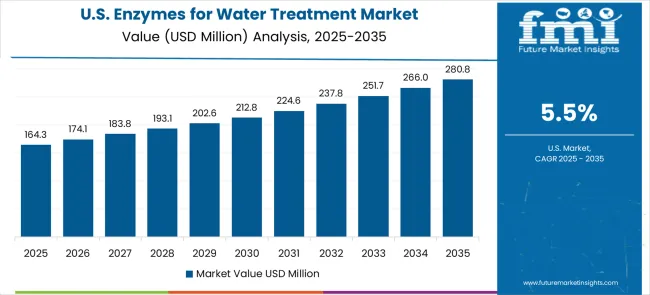

The enzymes for water treatment market in the United States is expected to grow at a CAGR of 5.5% from 2025 to 2035. The USA has a well-developed water treatment infrastructure, and industries such as food processing, chemicals, and pharmaceuticals are adopting enzyme-based methods to address wastewater challenges. Enzymatic solutions are favored for their ability to treat organic pollutants in wastewater, particularly in sectors with high contamination levels. With ongoing urbanization and the continued focus on efficient water management, the demand for enzymes in the water treatment sector is expected to rise steadily.

The enzymes for water treatment market in the United Kingdom is expected to grow at a CAGR of 4.9% from 2025 to 2035. The UK is seeing increasing demand for enzyme-based solutions in municipal and industrial wastewater treatment due to the rising concerns about water quality and resource management. Enzymatic treatments are particularly popular in the food and beverage industry, where wastewater is often rich in organic matter. The growth of e-commerce and the retail sector, along with increasing awareness of water treatment methods, is expected to further drive the demand for enzymes in the UK.

The enzymes for water treatment market in Japan is expected to grow at a CAGR of 4.4% from 2025 to 2035. The advanced industrial infrastructure, particularly in sectors like electronics and automotive, is driving the demand for effective wastewater treatment solutions. Enzyme-based treatments are increasingly used to address water pollution challenges, especially in industries generating high volumes of wastewater. The growing focus on water quality, coupled with the need for efficient, eco-friendly technologies, is further contributing to market growth. As industries expand and urbanization continues, the adoption of enzymatic solutions for municipal and industrial water treatment will rise, providing a more eco-conscious and cost-effective approach to water purification.

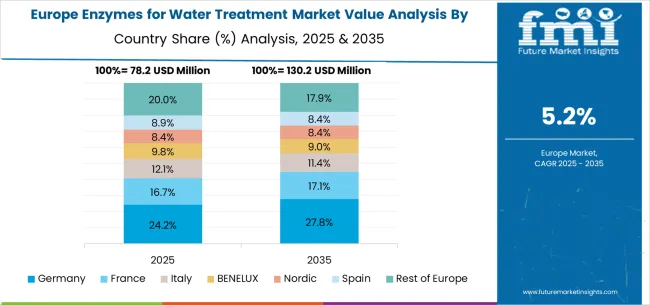

The enzymes for water treatment market in Europe is projected to grow from USD 78.2 million in 2025 to USD 130.2 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany will remain the leader, increasing from 24.2% in 2025 to 27.8% by 2035, supported by its strong chemical manufacturing base, advanced biotechnology sector, and stringent water quality standards.

France will account for 16.7% in 2025, rising to 17.1% by 2035, reflecting demand from industrial water treatment and wastewater management. Italy is projected to hold 12.1% in 2025, declining slightly to 11.4% by 2035, reflecting steady but maturing applications across municipal and industrial water sectors.

The BENELUX region will represent 9.8% in 2025, easing to 9.0% by 2035, due to concentrated adoption in industrial hubs. The Nordic countries will hold 8.4% in 2025, remaining stable at 8.4% by 2035, reflecting consistent investments in sustainable water management solutions.

Spain will capture 8.9% in 2025, remaining nearly flat at 8.4% by 2035, reflecting moderate demand growth. Meanwhile, the Rest of Europe will decline from 20.0% in 2025 to 17.9% by 2035, reflecting slower adoption in Eastern Europe compared to Western leaders.

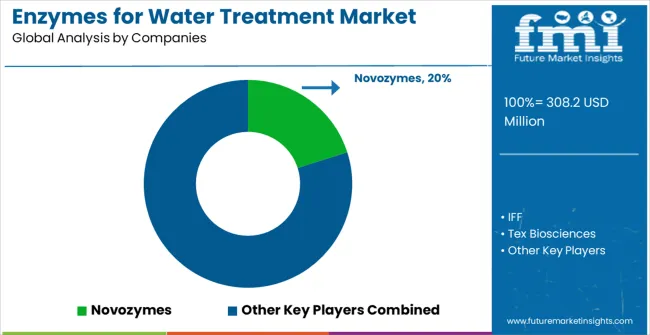

The enzymes for water treatment market is defined by competition among specialized biotechnology companies, enzyme manufacturers, and environmental technology providers. Companies are investing in advanced enzyme development, custom formulation capabilities, regulatory approvals, and technical support services to deliver effective, reliable, and cost-efficient enzyme solutions. Strategic partnerships, biotechnological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Tex Biosciences, India-based, offers comprehensive enzyme solutions with a focus on industrial applications and technical expertise. American Biosystems, operating in North America, provides specialized enzyme products integrated with water treatment technologies. Antozyme Biotech emphasizes biotechnology innovation and custom formulation services. Novozymes, Denmark, delivers globally recognized enzyme solutions with extensive research capabilities and regulatory approvals.

Nature Bioscience offers enzyme products focused on environmental applications and ecological treatment solutions. Realzyme provides specialized enzyme formulations for challenging treatment applications. IFF delivers enzyme solutions integrated into comprehensive biotechnology portfolios. Afrizymes, and Guangdong VTR Bio-tech offer regional expertise and specialized product development. Longda Bio-products, Advanced Enzyme Technologies, Infinita Biotech, and Aumenzymes provide diverse enzyme solutions, technical support, and application expertise across global and regional markets.

Enzymes for water treatment represent advanced biological catalysts enabling eco-friendly and efficient water purification processes across industrial and municipal applications, with the global market valued at USD 308.2 million in 2025 and projected to reach USD 541.6 million by 2035, growing at a 5.8% CAGR. These specialized biocatalysts, including oxidoreductases, hydrolases, and lyases, break down complex organic pollutants, reduce chemical oxygen demand, and eliminate toxic compounds from wastewater streams in chemicals, papermaking, textiles, aquaculture, and semiconductor industries. Market expansion is driven by stringent environmental regulations, increasing water scarcity, demand for eco-conscious treatment alternatives, and technological advances in enzyme engineering. However, scaling requires coordinated efforts across enzyme optimization, process integration, regulatory compliance, and cost-effective production systems.

Environmental Regulation and Incentives: Implement strict discharge standards for industrial wastewater while providing tax credits for companies adopting enzyme-based treatment systems. Create fast-track permitting for facilities incorporating biological water treatment technologies and offer grants for enzyme treatment pilot projects.

Research Infrastructure Investment: Fund national biotechnology centers focusing on enzyme engineering for water treatment applications, including directed evolution laboratories and pilot-scale testing facilities. Support research programs developing next-generation enzymes for emerging contaminants including pharmaceuticals, microplastics, and per- and polyfluoroalkyl substances (PFAS).

Technology Transfer Programs: Facilitate partnerships between academic research institutions and enzyme manufacturers to commercialize breakthrough water treatment enzymes. Provide funding for proof-of-concept studies validating enzyme efficacy against specific industrial pollutants and scaling challenges.

Water Security Initiatives: Include enzyme-based treatment technologies in national water security strategies, particularly for water-stressed regions requiring advanced wastewater reuse capabilities. Support development of decentralized treatment systems using stable, easy-to-deploy enzyme formulations.

International Cooperation Programs: Establish technology sharing agreements promoting enzyme-based water treatment in developing countries facing severe water pollution challenges. Fund capacity building programs training local technicians on enzyme application and process optimization.

Performance Standards Development: Create standardized testing protocols for enzyme activity, stability, and effectiveness across different wastewater compositions and treatment conditions. Establish benchmarking systems comparing enzyme-based treatment performance with conventional chemical and physical treatment methods.

Application Guidelines and Best Practices: Develop comprehensive technical guides for enzyme selection, dosing optimization, and process integration across different industrial applications. Create troubleshooting databases documenting common challenges and solutions in enzyme-based water treatment implementation.

Safety and Environmental Assessment: Establish comprehensive safety protocols for enzyme handling, storage, and disposal in water treatment applications. Develop environmental impact assessment frameworks comparing enzyme-based treatment with alternative technologies across lifecycle parameters.

Technology Validation Networks: Create multi-industry testing consortiums validating enzyme performance across different wastewater types and treatment scenarios. Establish pilot testing facilities enabling companies to evaluate enzyme effectiveness before full-scale implementation.

Market Intelligence and Forecasting: Provide regular analysis of regulatory trends, emerging contaminants, and technology adoption patterns influencing enzyme demand in water treatment applications. Track innovation trends in enzyme engineering and competitive landscape developments.

Advanced Enzyme Engineering: Invest in directed evolution platforms and computational design tools developing enzymes with enhanced stability, broader pH tolerance, and resistance to inhibitory compounds commonly found in industrial wastewater. Create enzyme variants optimized for specific temperature and salinity conditions.

Formulation and Delivery Systems: Develop immobilized enzyme systems enabling enzyme recovery and reuse, reducing treatment costs and improving process economics. Create stabilized liquid formulations extending enzyme shelf-life and simplifying handling and dosing procedures.

Multi-Enzyme Systems: Design synergistic enzyme cocktails targeting complex pollutant mixtures and providing comprehensive treatment solutions. Develop sequential enzyme treatment systems optimized for specific industrial waste streams and treatment objectives.

Process Integration Technologies: Create enzyme monitoring and control systems enabling real-time optimization of dosing rates and treatment conditions. Develop automated enzyme feeding systems responding to variations in wastewater composition and flow rates.

Application-Specific Solutions: Develop specialized enzyme products for emerging applications including pharmaceutical wastewater treatment, microplastic degradation, and endocrine disruptor removal. Create industry-specific enzyme packages addressing unique challenges in textiles, food processing, and chemical manufacturing.

Treatment System Integration: Implement enzyme-based treatment as part of comprehensive water management strategies combining pretreatment, biological treatment, and polishing steps. Develop hybrid systems integrating enzymes with membrane filtration, activated carbon, and advanced oxidation processes.

Process Optimization Programs: Establish systematic approaches for enzyme selection, dosing optimization, and performance monitoring tailored to specific wastewater characteristics and discharge requirements. Implement data-driven optimization using continuous monitoring and feedback control systems.

Operator Training and Competency: Develop comprehensive training programs for plant operators covering enzyme handling, safety procedures, troubleshooting techniques, and performance optimization. Create competency certification systems ensuring consistent operation and maintenance practices.

Environmental Impact Metrics and Reporting: Implement measurement systems tracking enzyme treatment performance, including pollutant removal efficiency, energy consumption, and chemical usage reduction. Develop reporting frameworks demonstrating environmental benefits and regulatory compliance.

Collaborative Research Programs: Partner with enzyme manufacturers and research institutions on application-specific enzyme development and optimization studies. Participate in industry consortiums sharing best practices and validating new enzyme technologies.

Technology Development Investment: Finance enzyme engineering companies developing breakthrough catalysts for water treatment applications, including funding for laboratory infrastructure, pilot testing facilities, and regulatory approval processes. Support joint ventures between established enzyme manufacturers and specialized biotechnology startups.

Manufacturing Scale-Up Financing: Provide capital for constructing large-scale enzyme production facilities incorporating advanced fermentation systems, downstream processing equipment, and quality control laboratories. Structure investments with milestones tied to production capacity, product quality, and regulatory approvals.

Market Expansion and Infrastructure: Fund deployment of enzyme-based treatment systems in emerging markets facing severe water pollution challenges. Support development of regional service networks providing technical support, training, and supply chain management for enzyme-based treatment systems.

Circular Economy Initiatives: Invest in companies developing enzyme recycling and recovery technologies enabling eco-concious treatment economics. Support development of integrated waste-to-resource systems using enzymes to convert wastewater contaminants into valuable byproducts.

Digital Technology Integration: Finance development of smart water treatment platforms integrating enzyme-based treatment with IoT sensors, predictive analytics, and automated control systems. Support companies developing digital twins and machine learning algorithms optimizing enzyme treatment performance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 308.2 million |

| Enzyme Type | Oxidoreductases, Hydrolases, Lyases, and Other Enzyme Categories |

| Application | Chemicals Processing, Papermaking, Textiles Treatment, Aquaculture Applications, Semiconductor Manufacturing, and Other Industrial Uses |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Tex Biosciences, American Biosystems, Antozyme Biotech, Novozymes, Nature Bioscience, Realzyme, IFF, Afrizymes, Guangdong VTR Bio-tech, Longda Bio-products, Advanced Enzyme Technologies, Infinita Biotech, Aumenzymes |

| Additional Attributes | Dollar sales by enzyme type, application, and technology platform, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established biotechnology companies and emerging enzyme developers, buyer preferences for conventional versus engineered enzyme systems, integration with digital treatment monitoring platforms and process control systems |

The global enzymes for water treatment market is estimated to be valued at USD 308.2 million in 2025.

The market size for the enzymes for water treatment market is projected to reach USD 541.6 million by 2035.

The enzymes for water treatment market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in enzymes for water treatment market are oxidoreductases, hydrolases, lyases and others.

In terms of application, chemicals segment to command 35.0% share in the enzymes for water treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Enzymes Market Analysis by Product Type, End User and Region through 2035

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Biofuel Enzymes Market

Aquafeed Enzyme Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Industrial Enzymes Market Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Tropical Fruit Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Clinical Chemistry Enzymes Market Report – Trends & Forecast 2023-2033

Bio-Based Detergent Enzymes Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA