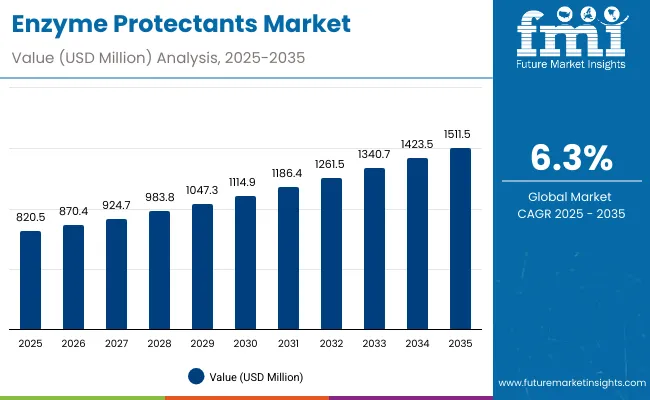

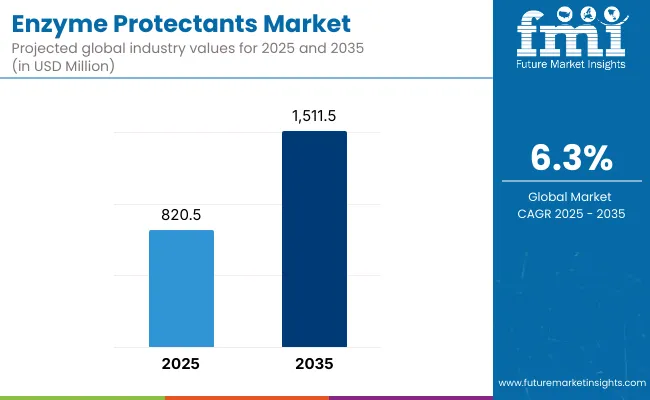

The enzyme protectants market is expected to record a valuation of USD 820.5 million in 2025 and reach USD 1,511.5 million by 2035, reflecting an increase of nearly USD 691 million over the decade. This expansion represents a 6.3% CAGR and signals a significant rise in the demand for solutions that safeguard enzyme stability and extend performance in industrial, pharmaceutical, and research-driven environments.

Enzyme Protectants Market Key Takeaways

| Metric | Value |

|---|---|

| Enzyme Protectants Estimated Value in (2025E) | USD 820.0 million |

| Enzyme Protectants Forecast Value in (2035F) | USD 1,511.5 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

During the first five-year phase from 2025 to 2030, the market is projected to grow from USD 820.5 million to approximately USD 1,114.9 million, adding close to USD 294 million, which accounts for around 43% of total decade growth. This steady progression will be underpinned by broader adoption of enzymes in biologics, food biotechnology, and diagnostic formulations, where stability requirements remain critical for commercial success. Strategic investments in encapsulation and protective coatings are anticipated to strengthen market positioning in this period.

The second phase from 2030 to 2035 is forecast to contribute an additional USD 397 million, accounting for nearly 57% of total growth, as the market accelerates from USD 1,114.9 million to 1,511.5 million. This momentum is likely to be reinforced by the integration of enzymes into precision fermentation, synthetic biology, and advanced bioprocessing, where optimized protectants will be indispensable for functionality. As adoption deepens across emerging economies, competitive advantage is expected to hinge on application-specific innovation and sustainable sourcing frameworks.

From 2020 to 2024, the Enzyme Protectants Market expanded steadily, driven by demand from pharmaceuticals, food and beverage, and industrial biotechnology. During this period, leading global chemical and life science companies consolidated their positions, with stabilizers and polymers holding dominant shares. Competitive differentiation was based on performance reliability, formulation flexibility, and regulatory compliance. Service-led models had minimal traction, as most revenue was concentrated in product categories.

By 2025, the market is expected to expand to USD 820.5 million, with adoption reinforced by biologics, diagnostics, and functional food innovation. Over the decade, the revenue mix is projected to shift toward bio-based and encapsulated protectants, creating opportunities for innovators offering sustainable, application-specific solutions. Competitive advantage will increasingly be defined by integrated innovation ecosystems, sustainability credentials, and end-use partnerships across pharmaceuticals and biotechnology.

Growth in the enzyme protectants market is being driven by the rising reliance on enzymes as critical biocatalysts across pharmaceuticals, food systems, diagnostics, and industrial biotechnology. Increasing demand for stability under variable storage and processing conditions has created the need for advanced protectants that can safeguard enzymatic activity and extend functional lifespan. As biologics and precision fermentation technologies gain momentum, higher sensitivity of enzyme formulations has reinforced the necessity for specialized protective agents.

Advances in encapsulation, coating systems, and stabilization techniques are being adopted to enhance enzyme resilience in harsh processing environments. Regulatory emphasis on product consistency and quality in pharmaceuticals and food sectors has further supported adoption. Sustainability goals are also being addressed through natural and bio-based protectants, which are projected to gain wider acceptance as industries reduce reliance on synthetic inputs.

Industrial biotechnology and agricultural formulations are expected to expand demand, as enzymes increasingly replace traditional chemical catalysts in bio-based processes. Research institutions and diagnostic laboratories are also reinforcing uptake, as enzyme protectants enable reproducibility and accuracy in sensitive assays. The market is thus expected to grow on the back of technological innovation, regulatory alignment, and cross-sector integration of enzymes into high-value applications.

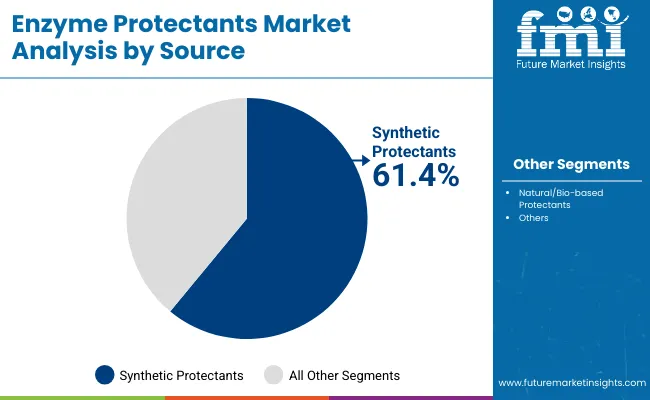

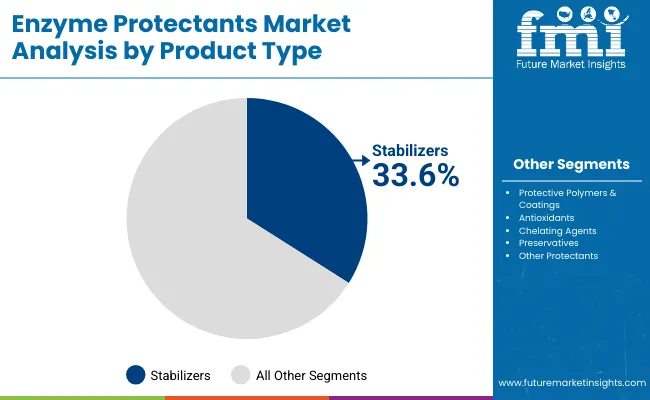

The enzyme protectants market has been segmented across product type, source, formulation, end-use application, and region to provide a comprehensive understanding of future growth opportunities. Product type segmentation highlights the diversity of stabilizers, protective polymers, antioxidants, chelating agents, preservatives, and other novel protectants designed to enhance enzyme stability. By source, the market is differentiated between synthetic protectants and natural or bio-based protectants, reflecting a balance between performance-driven innovation and sustainability-focused adoption. In terms of end-use applications, pharmaceuticals and biologics, food and beverage, industrial biotechnology, diagnostics and research, and agricultural formulations represent the primary demand centers, each with unique drivers of adoption. Regional segmentation spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, where differing innovation ecosystems, regulatory frameworks, and industrial strengths shape distinct growth pathways. The combination of these segmental perspectives highlights the multi-dimensional expansion trajectory of enzyme protectants over the coming decade.

| Source Segment | Market Value Share, 2025 |

|---|---|

| Synthetic Protectants | 61.4% |

| Natural/Bio-based Protectants | 38.6% |

Stabilizers are projected to lead the enzyme protectants market with a 33.6% share in 2025, supported by their critical role in preserving enzyme activity under storage and processing stress. Their adoption is being reinforced by widespread use across pharmaceuticals, food, and diagnostics, where maintaining enzymatic integrity is essential. Growth will be steady, with increasing focus on amino acid and sugar-based systems that offer cost-effectiveness and scalability. While stabilizers dominate, rapid advancements are expected in smaller categories such as other protectants and preservatives, which are recording higher CAGRs and addressing niche applications. Over the decade, a shift toward more specialized protectants is anticipated, but stabilizers are expected to retain their dominant role as a backbone solution across industries.

| Product Type | 2025 Share% |

|---|---|

| Stabilizers | 33.6% |

| Protective Polymers & Coatings | 22.7% |

| Antioxidants | 16.8% |

Synthetic protectants are projected to command 61.4% of the enzyme protectants market in 2025, supported by their proven reliability, scalability, and compatibility with diverse industrial and pharmaceutical applications. Their ability to deliver consistent performance under rigorous conditions has positioned them as the preferred choice for large-scale production environments. Over the forecast period, innovation in chemical formulations is expected to extend their utility in biopharma and industrial biotechnology. However, demand for natural and bio-based protectants is rising steadily, driven by sustainability imperatives, consumer preference for clean-label solutions, and regulatory incentives. This segment, while smaller, is poised to expand as plant-derived and fermentation-based protectants gain credibility through improved performance. Although synthetic protectants will remain dominant, the decade ahead is expected to see a gradual rebalancing as bio-based alternatives strengthen their role in environmentally aligned innovation strategies.

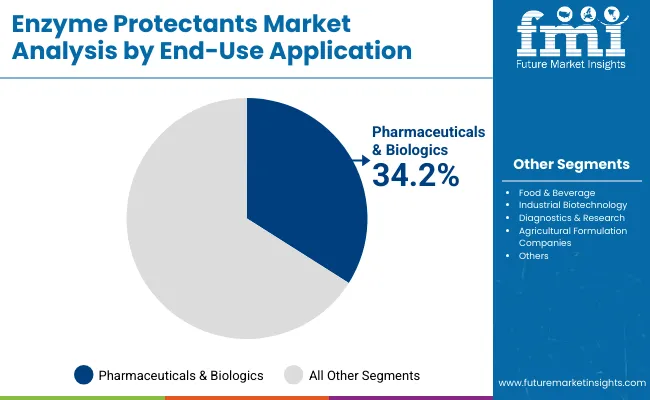

| End-Use Application | 2025 Share% |

|---|---|

| Pharmaceuticals & Biologics | 34.2% |

| Food & Beverage | 26.2% |

| Industrial Biotechnology | 18.9% |

Pharmaceuticals and biologics are expected to remain the largest end-use application, holding 34.2% of market share in 2025. Growth will be reinforced by rising adoption of biologics, precision fermentation, and advanced drug formulations where enzymes are increasingly embedded. Protectants are being relied upon to ensure structural stability and functional consistency of enzymes in highly sensitive therapeutic and diagnostic contexts. The pharmaceutical sector’s stringent quality and regulatory requirements have positioned protectants as indispensable. Meanwhile, diagnostics and research applications are projected to record faster growth, supported by demand for reproducibility in assays and next-generation molecular tools. Food and beverage applications will also see robust uptake as consumers demand enhanced nutritional value and clean-label processing. Collectively, end-use adoption is being shaped by both clinical imperatives and consumer-driven innovation.

Adoption of enzyme protectants is being accelerated by the need for stability in biologics, diagnostics, and industrial bioprocesses, even as cost challenges and performance variability persist. The market is being shaped by scientific innovation and sustainability imperatives, with drivers rooted in expanding enzyme applications and trends defined by the integration of advanced protective technologies into biomanufacturing systems.

Rising Dependence on Biologics and Precision Fermentation

Market growth is being driven by the rapid expansion of biologics and precision fermentation, which demand consistent enzyme activity across sensitive production environments. Enzyme protectants are increasingly being relied upon to preserve structural integrity during manufacturing and storage, particularly for therapeutic proteins and specialty ingredients. Pharmaceutical and food sectors are accelerating adoption as stability directly impacts efficacy and shelf life. With the biopharma pipeline expanding and fermentation-derived products gaining scale, protectants are expected to transition from optional additives to critical enablers of product reliability. This shift is projected to solidify protectants as indispensable components in future biomanufacturing strategies.

Shift toward Natural and Bio-Based Protectants

A key trend shaping the market is the transition toward natural and bio-based protectants, driven by sustainability commitments and regulatory encouragement. Plant-derived stabilizers and fermentation-based systems are increasingly being explored to replace synthetic formulations while maintaining comparable performance. Consumer preference for clean-label solutions in food and healthcare products is reinforcing this trend. Companies are investing in R&D partnerships to optimize bio-based protectants that align with both environmental and functional criteria. While synthetic options will continue to dominate due to scalability, the decade ahead is expected to witness a progressive rebalancing, with natural solutions carving a stronger foothold in high-value applications.

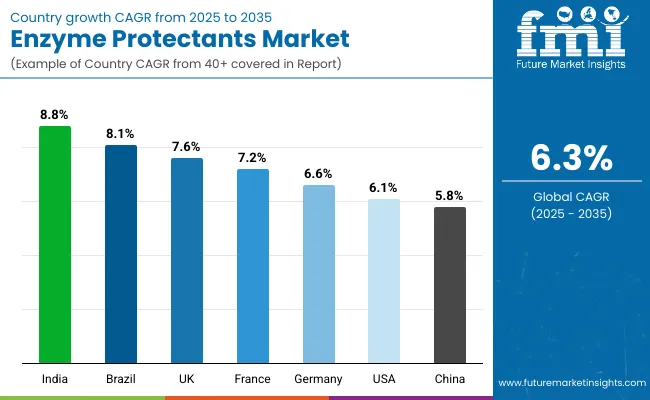

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.8% |

| India | 8.8% |

| Germany | 6.6% |

| France | 7.2% |

| UK | 7.6% |

| USA | 6.1% |

| Brazil | 8.1% |

The global enzyme protectants market is projected to display varied growth trajectories across leading countries, reflecting differences in biopharmaceutical strength, industrial biotechnology maturity, and regulatory frameworks. In Asia-Pacific, China is anticipated to expand at a CAGR of 5.8%, supported by large-scale biologics manufacturing and government-backed investment in synthetic biology. India, with the fastest growth at 8.8%, is expected to advance rapidly as enzyme applications gain traction in pharmaceuticals, food processing, and agricultural formulations, reinforced by expanding domestic biotech capacity and export-oriented production models.

In Europe, the United Kingdom (7.6%) and France (7.2%) are predicted to outpace Germany (6.6%), benefiting from supportive R&D ecosystems and regulatory clarity around biologics and enzyme-enabled food technologies. Germany will remain a pivotal hub for industrial biotechnology, but growth will be moderated by a more mature adoption base.

North America is expected to record steady expansion, with the United States growing at 6.1%, driven by advanced biologics pipelines, rising adoption of diagnostics, and strong research investment, although market maturity tempers acceleration.

Latin America, led by Brazil at 8.1%, is forecast to deliver robust momentum, as agricultural biotechnology and enzyme-stabilized formulations gain wider acceptance. This distribution highlights a decade in which emerging markets drive acceleration while established hubs consolidate leadership through innovation and compliance alignment.

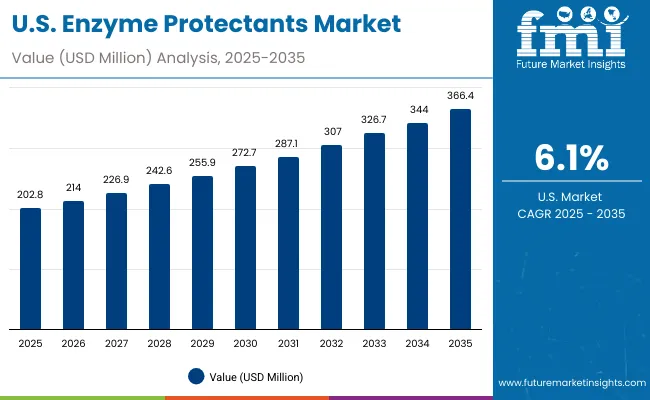

| Year | USA Enzyme Protectants Market (USD Million) |

|---|---|

| 2025 | 202.8 |

| 2026 | 214.0 |

| 2027 | 226.9 |

| 2028 | 242.6 |

| 2029 | 255.9 |

| 2030 | 272.7 |

| 2031 | 287.1 |

| 2032 | 307.0 |

| 2033 | 326.7 |

| 2034 | 344.0 |

| 2035 | 366.4 |

The enzyme protectants market in the United States is projected to expand from USD 202.8 million in 2025 to USD 366.4 million in 2035, advancing at a CAGR of approximately 6.1%. Growth is expected to be supported by the deepening penetration of biologics, where enzyme stability is critical for therapeutic reliability. Adoption is being reinforced by diagnostics and research institutions, which rely on consistent enzyme performance in high-sensitivity assays.

Food and beverage applications are anticipated to strengthen demand, particularly as clean-label formulations gain traction and stability-enhancing protectants are integrated into functional product development. Industrial biotechnology is also being positioned as a growth engine, where enzyme protectants will play a key role in scaling bio-based production.

Collaborative research partnerships between academic institutes and biopharma players are predicted to accelerate innovation, while sustainability mandates are likely to encourage gradual adoption of bio-based protectants alongside synthetic solutions.

The enzyme protectants market in the United Kingdom is projected to expand steadily, supported by the country’s strong pharmaceutical and biotechnology ecosystem. With growth expected at a CAGR of 7.6%, demand will be reinforced by biologics development hubs clustered around Cambridge and Oxford, where advanced protein engineering and precision fermentation are being integrated into pipelines. Food and beverage adoption is also predicted to rise, as UK manufacturers align with clean-label standards and functional formulations.

Diagnostic and research institutions are projected to create incremental demand, with increased reliance on enzyme-stabilized assays. As sustainability frameworks intensify, gradual integration of bio-based protectants is anticipated alongside established synthetic solutions.

The enzyme protectants market in China is projected to expand at a CAGR of 5.8%, reflecting both its vast biopharma base and rapid industrial biotechnology adoption. Government-backed investments in synthetic biology and large-scale fermentation are expected to reinforce demand for enzyme stability solutions. Food and beverage sectors will continue to integrate protectants into functional and fortified products to serve domestic and export markets. Diagnostics and research institutions are projected to increase uptake, supported by regulatory emphasis on quality and reproducibility in biotechnology. While synthetic protectants will dominate, gradual interest in bio-based alternatives is likely as sustainability mandates strengthen.

The enzyme protectants market in India is forecast to record the fastest growth among key countries, expanding at a CAGR of 8.8% from 2025 to 2035. This trajectory is being supported by the rapid expansion of pharmaceutical manufacturing, where stability of enzyme formulations is vital for biologics and generic drug development. The food processing sector is also contributing, with adoption being encouraged by the rising consumer demand for fortified and functional products.

Agricultural biotechnology is expected to emerge as a growth frontier, as protectants are increasingly utilized to ensure enzyme performance in bio-based agro formulations. India’s cost-competitive manufacturing base and export orientation are reinforcing its role as a future hub for global enzyme protectant demand.

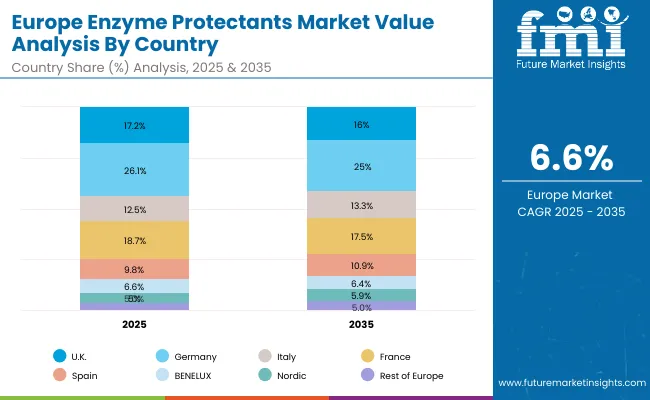

| Countries | 2025 |

|---|---|

| UK | 17.2% |

| Germany | 26.1% |

| Italy | 12.5% |

| France | 18.7% |

| Spain | 9.8% |

| BENELUX | 6.6% |

| Nordic | 5.0% |

| Rest of Europe | 4.1% |

| Countries | 2035 |

|---|---|

| UK | 16.0% |

| Germany | 25.0% |

| Italy | 13.3% |

| France | 17.5% |

| Spain | 10.9% |

| BENELUX | 6.4% |

| Nordic | 5.9% |

| Rest of Europe | 5.0% |

The enzyme protectants market in Germany is projected to expand at a CAGR of 6.6%, anchored by its leadership in industrial biotechnology and pharmaceutical innovation. Demand is being reinforced by the country’s strong biologics pipeline and precision manufacturing standards, where enzyme stability is critical for compliance and performance. The food and beverage sector is also contributing, with adoption focused on functional foods and high-quality ingredients.

Diagnostic laboratories and research institutions are anticipated to sustain demand growth, as reproducibility in enzymatic assays remains central to Germany’s advanced R&D ecosystem. Sustainability policies are expected to accelerate interest in bio-based protectants, though synthetic solutions will remain dominant.Pharma and biotech sectors are strengthening biologics integration.

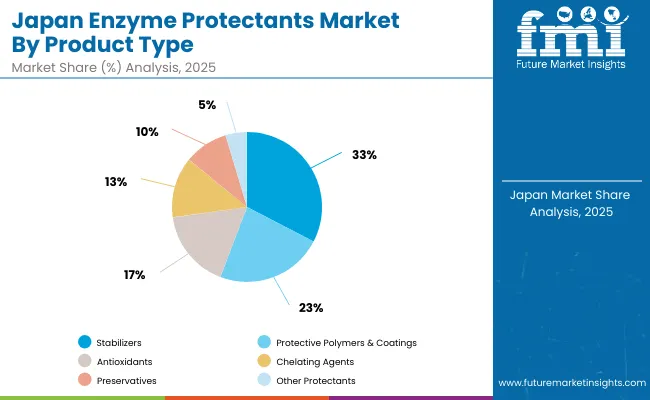

| Product Type | Market Value Share, 2025 |

|---|---|

| Stabilizers (polyols, sugars, amino acids, trehalose, glycerol) | 32.6% |

| Protective Polymers & Coatings (PEGylation agents, encapsulation materials, biopolymers) | 23.2% |

| Antioxidants (ascorbic acid, tocopherols, glutathione) | 17.0% |

| Chelating Agents (EDTA, citrates, phosphates) | 13.1% |

| Preservatives (sodium benzoate, potassium sorbate, parabens) | 9.5% |

| Other Protectants (protease inhibitors, surfactants, novel excipients) | 4.6% |

The enzyme protectants market in Japan is projected to record steady expansion, led by strong biopharmaceutical development, advanced food innovation, and cutting-edge diagnostic applications. Stabilizers are anticipated to maintain leadership at 32.6%, though emerging demand for chelating agents, preservatives, and novel protectants is forecast to deliver faster growth due to rising sensitivity in biologics and functional foods. The increasing adoption of protective polymers and coatings is also being reinforced by Japan’s emphasis on precision manufacturing, where enzyme formulations require high resilience during processing.

A gradual transition is expected toward antioxidants and bio-based alternatives, aligned with regulatory emphasis on safety and sustainability. Advanced encapsulation and coating technologies are predicted to shape competitive differentiation, while academic-industry collaboration will continue to drive innovation in performance-specific protectants.

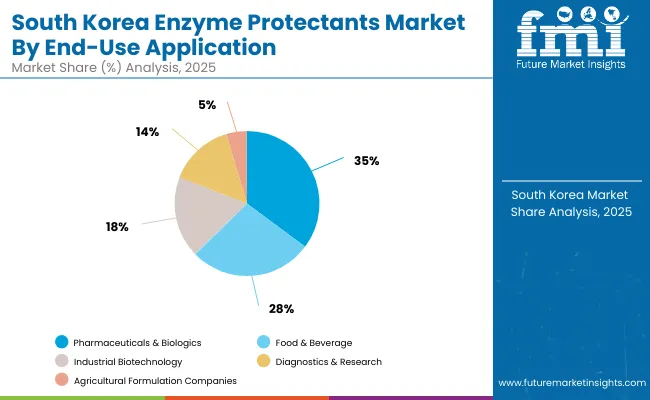

| End-Use Application | Market Value Share, 2025 |

|---|---|

| Pharmaceuticals & Biologics | 35.2% |

| Food & Beverage | 27.5% |

| Industrial Biotechnology | 18.2% |

| Diagnostics & Research | 14.5% |

| Agricultural Formulation Companies | 4.6% |

The enzyme protectants market in South Korea is expected to expand steadily, driven by its strong biopharmaceutical sector, advanced food technology base, and rising diagnostic adoption. Pharmaceuticals and biologics will dominate with a 35.2% share in 2025, underpinned by the country’s robust biologics manufacturing and investment in precision fermentation. Food and beverage applications are also projected to expand, aligned with South Korea’s leadership in functional foods and nutraceutical innovation.

Industrial biotechnology and agricultural formulations are forecast to grow at faster rates, supported by sustainability policies and bio-based manufacturing strategies. Diagnostics and research applications are expected to accelerate, with advanced assays requiring enhanced enzyme stability for reproducibility.

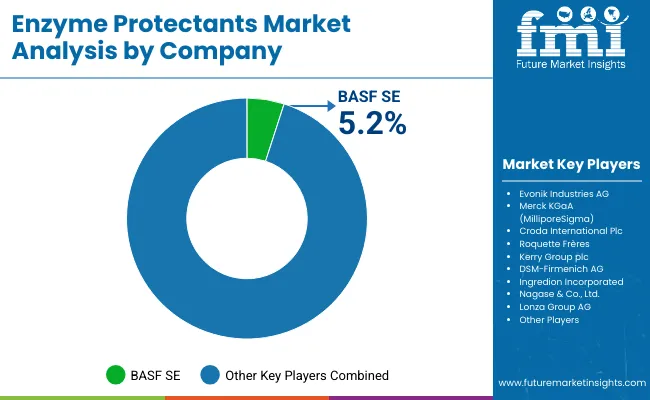

| Company | Global Value Share 2025 |

|---|---|

| BASF SE | 5.2% |

| Others | 94.8% |

The enzyme protectants market is moderately fragmented, with global leaders, diversified life sciences companies, and specialized ingredient suppliers competing across pharmaceutical, food, and industrial applications. Multinational giants such as BASF SE, Evonik Industries AG, and Merck KGaA (Millipore Sigma) hold strong positions, supported by advanced formulation capabilities, robust research pipelines, and global distribution networks. Their strategies are increasingly focused on sustainability, regulatory compliance, and high-performance protectant technologies designed for biopharmaceuticals and diagnostics.

Established ingredient suppliers, including Roquette Frères, Kerry Group plc, and Ingredion Incorporated, are driving adoption in the food and beverage segment through clean-label formulations, functional stability solutions, and customer-centric innovation models. These companies are leveraging partnerships and application-specific R&D to strengthen their footprint in nutraceutical and functional food markets.

Specialized players such as Croda International Plc, DSM-Firmenich AG, Nagase & Co., Ltd., and Lonza Group AG are focusing on customized, high-value protectants, particularly in biologics, industrial biotechnology, and agricultural formulations. Their strength lies in innovation-driven pipelines and adaptability to niche applications.

Competitive differentiation is shifting toward integrated offerings that combine sustainability credentials, application-specific performance, and digital R&D platforms. As demand grows across sectors, collaboration with biopharma, food manufacturers, and research institutions is expected to define future positioning.

Key Developments in Enzyme Protectants Market

| Item | Value |

|---|---|

| Quantitative Units | USD 820.0 million |

| Product Type | Stabilizers, Antioxidants, Chelating Agents, Preservatives, Protective Polymers & Coatings, Other Protectants |

| Source | Synthetic Protectants, Natural/Bio-based Protectants |

| Form ulation | Powder (freeze-dried, spray-dried), Liquid Solutions, Encapsulated/Coated Systems |

| End-Use Application | Pharmaceuticals & Biologics, Food & Beverage, Industrial Biotechnology, Diagnostics & Research, Agricultural Formulations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Evonik Industries AG, Merck KGaA (MilliporeSigma), Croda International Plc, Roquette Frères, Kerry Group plc, DSM-Firmenich AG, Ingredion Incorporated, Nagase & Co., Ltd., Lonza Group AG |

| Additional Attributes | Segment-level dollar sales by type, source, and application; adoption trends in biologics, functional foods, and industrial biotechnology; rising demand for bio-based protectants alongside synthetic solutions; sector-specific growth in pharmaceuticals, diagnostics, and food industries; role of encapsulation, PEGylation, and stabilization technologies; sustainability-driven R&D pipelines; regional trends shaped by regulatory compliance and biomanufacturing hubs. |

The global Enzyme Protectants is estimated to be valued at USD 820.0 million in 2025.

The market size for the Enzyme Protectants is projected to reach USD 1,511.5 million by 2035.

The Enzyme Protectants is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in the enzyme protectants market are stabilizers, antioxidants, chelating agents, preservatives, protective polymers & coatings, and other protectants.

In terms of product type, the stabilizers segment is projected to command the largest share at 33.6% of the enzyme protectants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme-Enabled Cold-Brew Concentrates Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzyme Replacement Therapy Market Insights - Size & Forecast 2025 to 2035

Enzyme Substrates Market – Growth & Forecast 2025 to 2035

Enzyme Inhibitors Market

Coenzyme Q10 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioenzyme Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Sea Enzyme Products Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cake Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Food Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multi-Enzyme Blends Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Enzymes Market Analysis by Product Type, End User and Region through 2035

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA