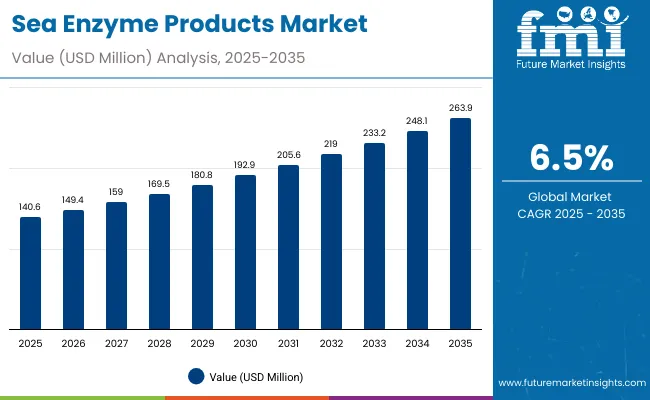

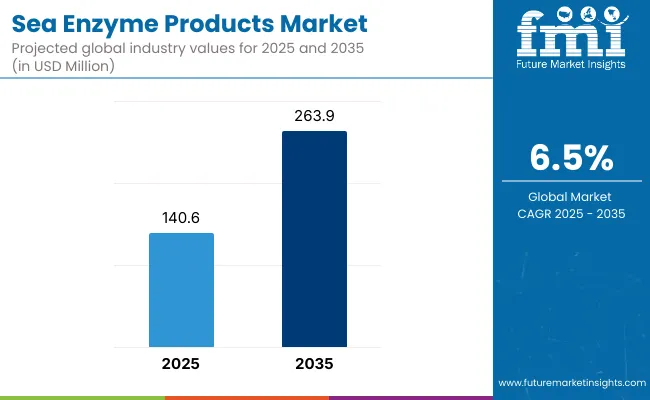

The Sea Enzyme Products Market has been projected to reach a valuation of USD 140.6 million by 2025 and is expected to expand to USD 263.9 million by 2035, reflecting an absolute increase of USD 123.3 million over the decade. This translates into a compound annual growth rate (CAGR) of 6.5%, effectively resulting in a 1.9X market expansion during the forecast period.

Sea Enzyme Products Market Key Takeaways

| Metric | Value |

|---|---|

| Sea Enzyme Products Estimated Value in (2025E) | USD 140.6 million |

| Sea Enzyme Products Forecast Value in (2035F) | USD 263.9 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

In the first half of the decade (2025 to 2030), the market is expected to grow from USD 140.6 million to approximately USD 188.5 million, accounting for nearly 39% of the total decade’s growth. This initial growth phase is likely to be driven by heightened demand for marine-derived enzymes in biotherapeutics, nutraceuticals, and functional foods, where sea-based enzymes such as proteases, lipases, and amylases have been increasingly recognized for their eco-origin, bioactivity, and specificity. Marine microorganisms and seaweed sources are expected to dominate this stage due to scalable cultivation methods.

From 2030 to 2035, the market is projected to add USD 75.4 million, contributing 61% of the total decade’s gains. This phase is expected to witness accelerated growth due to rising interest in enzyme-enabled industrial biocatalysis, bio-cleaning, and sustainable marine waste utilization. Distribution through online nutraceutical platforms and B2B bio-ingredient supply chains is expected to mature further. Emerging enzyme classes like laccases and chitinases are also anticipated to gain market share, supported by synthetic biology integration and marine biotechnology R&D investments.

From 2020 to 2024, the Sea Enzyme Products Market expanded from USD 108 million to USD 140.6 million, driven primarily by rising demand for marine-derived enzymes in clean-label food systems, functional nutrition, and biopharmaceutical processing. During this period, value capture remained concentrated among vertically integrated enzyme manufacturers controlling over 65% of total market revenues. Global leaders such as Novonesis, DuPont Nutrition & Biosciences (IFF), and Biocon Limited sustained dominance through proprietary marine enzyme libraries, scalable fermentation platforms, and regulatory alignment across food, pharma, and cosmetics. High substrate specificity, enzymatic stability under extreme conditions, and certified marine sourcing were key differentiators.

By 2025, the market is projected to exceed USD 140.6 million, with synthetic biology, marine microbial bioprospecting, and strain engineering expected to reshape the value chain. An increasing share of revenue will be attributed to application-specific enzymes, multi-enzyme formulations, and co-development platforms collectively forecasted to represent over 40% of market value by 2030. Traditional enzyme manufacturers are now being challenged by emerging players offering AI-optimized strain design, on-demand fermentation, and precision bio-manufacturing. As a result, innovation ecosystems, recombinant platform flexibility, and downstream customization capabilities are expected to define competitive advantage throughout the next decade.

The growth of the Sea Enzyme Products Market has been primarily driven by rising demand for bio-based and sustainable alternatives across food, pharma, and industrial segments. Sea-derived enzymes have increasingly been recognized for their superior functionality, high substrate specificity, and eco-friendly sourcing, particularly as regulatory frameworks continue to tighten around synthetic additives and chemical processing aids. A growing preference for clean-label formulations and marine-origin nutraceuticals has been observed across consumer-centric sectors, reinforcing the market’s upward trajectory.

Value-added applications in pharmaceuticals and biotherapeutics have been significantly enabled through marine-sourced enzymes, especially proteases and chitinases, given their immunomodulatory and anti-inflammatory properties. Additionally, their utility in enzyme-assisted extraction, bio-catalysis, and targeted drug delivery systems has been expanding. Waste valorization from marine fish and shellfish by-products has also gained traction, creating a circular economic incentive that aligns with zero-waste production goals.

The industrial enzyme segment is being reshaped by innovations in marine microbial fermentation, offering scalable, high-yield enzyme production under saline and extreme pH conditions. Distribution dynamics are evolving through direct B2B supply and digital health platforms, improving accessibility. As synthetic biology advances are integrated with marine biotechnology, a pipeline of novel enzyme classes is expected to be introduced, ensuring sustained growth momentum across regions and applications.

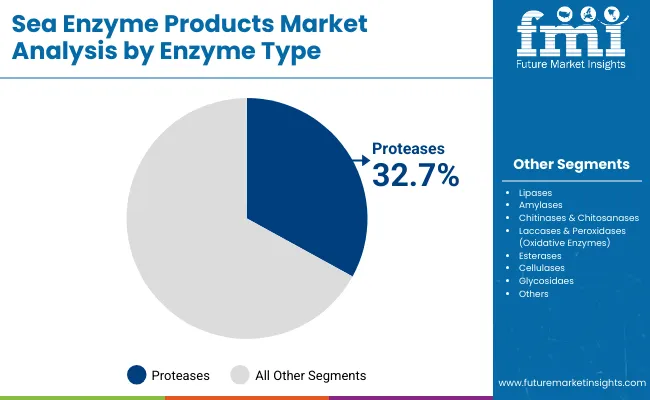

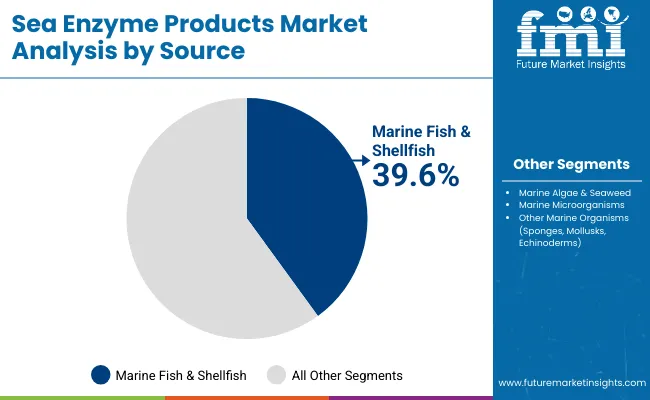

The Sea Enzyme Products Market has been segmented based on enzyme type, source, and application to provide a structured understanding of value drivers and growth differentials. Enzyme types encompass diverse biological catalysts such as proteases, lipases, amylases, and oxidative enzymes, each tailored to distinct biochemical processes and end-use functionalities. Sources are categorized by marine origin ranging from algae and seaweed to fish waste and microorganisms each contributing to product novelty, sustainability, and scalability. Application-wise, sea enzymes have been integrated into food processing, biopharmaceuticals, and industrial workflows, reflecting the broadening scope of demand. The segmental framework allows key stakeholders to align R&D priorities, sourcing strategies, and go-to-market approaches with the most lucrative growth clusters. Going forward, high-growth enzyme types and novel marine sources are expected to reshape industry boundaries, while emerging applications in bio-catalysis and environmental remediation are likely to expand downstream market penetration across diverse geographies and use cases.

| Enzyme Type Segment | Market Value Share, 2025 |

|---|---|

| Proteases (collagenase, trypsin-like enzymes, peptidases) | 32.7% |

| Lipases | 17.9% |

Proteases have been projected to contribute 32.7% of the total market value in 2025, maintaining their lead across enzyme categories. Their dominance has been attributed to their wide applicability in protein hydrolysis, tenderization, and enzymatic digestion across food, pharmaceutical, and biomedical industries. Proteases derived from marine organisms are increasingly preferred for their high activity under saline and temperature-variable conditions, enabling their use in industrial settings. The growth of proteases is being further supported by expanding use in wound care, enzymatic debridement, and targeted therapy formulations. Innovations in recombinant enzyme engineering and selective proteolysis are also expected to sustain protease segment expansion. With rising R&D into novel marine proteases with superior specificity and reduced allergey, this segment is likely to remain at the forefront of commercial and therapeutic applications in the coming decade.

| Source | 2025 Share% |

|---|---|

| Marine Fish & Shellfish (viscera, digestive glands, waste by-products) | 39.6% |

| Marine Algae & Seaweed | 28.7% |

| Marine Microorganisms (bacteria, fungi, actinomycetes) | 23.2% |

Marine fish and shellfish have been estimated to represent 39.6% of the market share by 2025, driven by their widespread availability and enzyme-rich waste streams such as viscera and digestive glands. These by-products, once underutilized, are now being valorized through advanced extraction and purification technologies to yield high-quality enzymes suitable for industrial and pharmaceutical use. Regulatory support for marine waste minimization and zero-discharge initiatives has further strengthened the case for fish-derived enzymes. Enzymes sourced from crustaceans and mollusks have shown strong performance in chitin degradation and bioconversion processes, opening new avenues in waste recycling and bio-refining. As traceability and sustainability become market differentiators, supply chains built around certified marine resources are expected to further enhance the commercial viability of fish- and shellfish-based enzyme production.

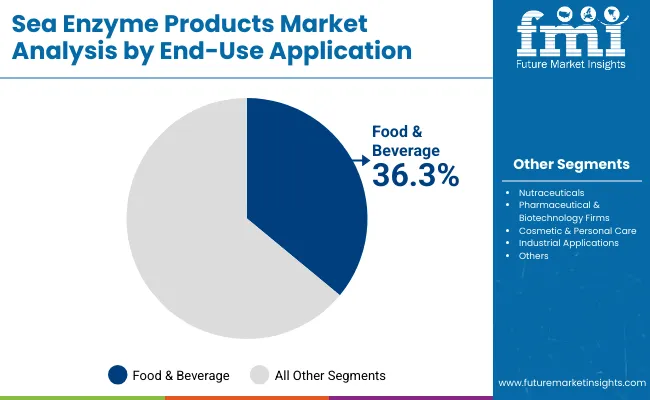

| End-Use Application | 2025 Share% |

|---|---|

| Food & Beverage | 36.3% |

| Nutraceuticals | 25.6% |

| Pharmaceutical & Biotechnology Firms | 18.0% |

Food & beverage processing has been projected to account for 46.3% of total market revenue in 2025, reflecting the significant utility of sea enzymes in improving product texture, flavor, digestibility, and shelf-life. Marine-derived enzymes have been increasingly adopted in processes like protein hydrolysis, starch breakdown, and lipid emulsification due to their high catalytic efficiency and natural origin. The trend toward clean-label, minimally processed, and functional foods has driven food manufacturers to adopt marine enzyme solutions. Consumer demand for enzyme-enhanced plant-based and seafood-alternative products has also supported this application growth. As food industries globally shift toward bio-processing and natural ingredient sourcing, enzyme customization tailored to specific food matrices is expected to unlock further innovation. Given their GRAS status and high functional adaptability, sea enzymes are expected to maintain a dominant role within this application segment through the forecast period.

Rising environmental scrutiny and bioeconomy adoption are reshaping demand for marine-derived biocatalysts. While cost structures and regulatory clarity continue to evolve, the Sea Enzyme Products Market is being steadily shaped by innovation-driven use cases across sustainable food, health, and industrial applications. The interplay of eco-innovation, waste valorization, and marine sourcing defines both the growth potential and emerging challenges.

Marine Waste Valorization and Circular Economy Integration

Strong momentum has been observed around the use of marine waste such as fish viscera, shells, and processing residues-as enzymatic feedstock, in line with global zero-waste objectives. Through biorefinery approaches, these low-value by-products have been upcycled into high-performance enzymes, enabling dual benefits of waste mitigation and product innovation. Policies supporting sustainable marine waste utilization are expected to further stimulate investment and cross-sector collaboration. Such integration of circular bioeconomy principles is forecasted to remain a cornerstone growth driver.

Synthetic Biology and Designer Enzymes from Marine Microorganisms

A pronounced shift toward synthetic biology tools for engineering custom marine enzymes has been accelerating. Enzymes are being tailored at the genomic level for enhanced thermal stability, catalytic efficiency, and targeted application specificity. Marine microorganisms, especially extremophiles, are being genetically modified to produce next-generation enzymes under scalable, fermentation-based systems. This trend is poised to redefine product pipelines and intellectual property creation across marine biotechnology sectors.

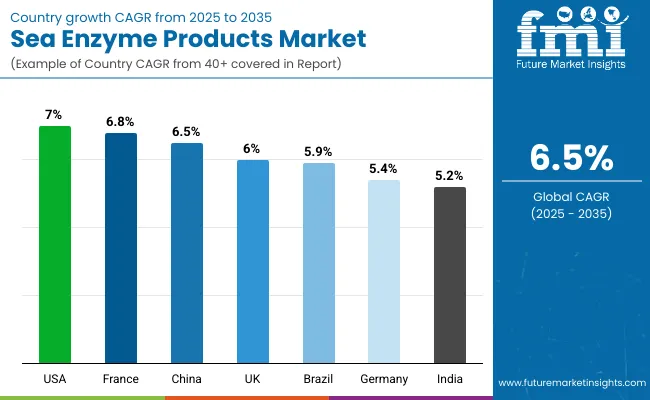

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.5% |

| India | 5.2% |

| Germany | 5.4% |

| France | 6.8% |

| UK | 6.0% |

| USA | 7.0% |

| Brazil | 5.9% |

The global Sea Enzyme Products Market has been witnessing varied growth momentum across key countries, shaped by differential access to marine biomass, biotechnology infrastructure, and regulatory frameworks supporting blue bioeconomy innovations. The most dynamic growth has been observed in the United States, where a CAGR of 7.0% is projected through 2035, fueled by the expansion of marine nutraceuticals, bio-industrial fermentation, and FDA-aligned enzyme therapeutics. Government funding for sustainable marine biotechnology has further catalyzed adoption.

In France (6.8% CAGR) and the United Kingdom (6.0% CAGR), EU-wide circular economy initiatives and functional ingredient trends have been reflected in increased utilization of sea-derived enzymes in food and pharmaceutical formulations. China (6.5% CAGR) is being positioned as a volume leader, supported by large-scale marine aquaculture waste valorization programs and aggressive investment in marine microbial fermentation facilities.

Meanwhile, India (5.2% CAGR) is gaining traction due to a rising nutraceutical industry and coastal biomass harvesting expansion, although infrastructure constraints have moderated growth speed. Germany (5.4% CAGR) continues to focus on enzyme applications in sustainable manufacturing and process engineering. Brazil (5.9% CAGR) shows promise with emerging interest in algae-based enzyme solutions for local food and bio-cleaning sectors. Regional strategies are increasingly being aligned to support R&D collaboration, resource traceability, and enzymatic innovation at scale.

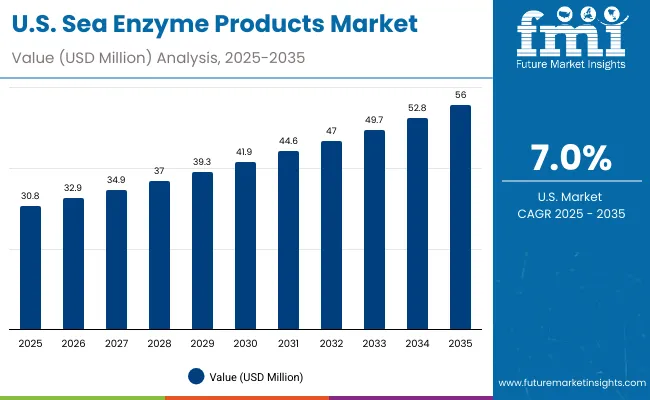

| Year | USA Sea Enzyme Products Market (USD Million) |

|---|---|

| 2025 | 30.8 |

| 2026 | 32.9 |

| 2027 | 34.9 |

| 2028 | 37.0 |

| 2029 | 39.3 |

| 2030 | 41.9 |

| 2031 | 44.6 |

| 2032 | 47.0 |

| 2033 | 49.7 |

| 2034 | 52.8 |

| 2035 | 56.0 |

The Sea Enzyme Products Market in the United States is projected to expand from USD 30.8 million in 2025 to USD 56.0 million in 2035, reflecting a CAGR of approximately 6.1%. This growth has been shaped by increasing adoption of marine-derived enzymes in food innovation, nutraceutical development, and biopharmaceutical applications. Demand has been particularly reinforced by consumer preference for clean-label and functional ingredients, where sea enzymes are viewed as sustainable, natural, and high-performing solutions.

Industrial uptake has been encouraged by biocatalysis applications in waste processing, detergents, and bio-cleaning, where marine enzymes outperform conventional chemical catalysts under variable environmental conditions. Biotherapeutic research has been prioritized by pharmaceutical firms, integrating marine proteases and chitinases into novel drug delivery and wound-healing solutions. Nutraceutical players have been actively incorporating sea enzymes into digestive aids and performance supplements, driving retail and online sales growth.

The Sea Enzyme Products Market in the United Kingdom is expected to record steady growth at a CAGR of 6.0% between 2025 and 2035. Adoption has been influenced by strong regulatory emphasis on sustainability and the rising demand for clean-label food and nutraceutical products. Enzyme integration in pharmaceutical R&D has been prioritized under the country’s biopharma innovation agenda. Cosmetics and personal care sectors have also been driving demand for marine-derived enzymes, particularly oxidative and lipolytic enzymes, to enhance bioactive product lines. Industrial use is being reinforced through waste valorization and eco-friendly bio-cleaning solutions. With trade ties across Europe and biotech advancements, UK sales are anticipated to expand consistently.

China’s Sea Enzyme Products Market is forecasted to grow at a CAGR of 6.5% during 2025-2035, positioning the country as a regional leader. Expansion has been strongly driven by large-scale valorization of aquaculture and seafood processing waste, which provides abundant raw material for enzyme extraction. Government-backed marine biotechnology initiatives have been prioritized, enabling investment in microbial fermentation and recombinant enzyme production. The food and beverage sector has increasingly embraced sea enzymes for protein hydrolysis, starch breakdown, and functional ingredient innovation. Pharmaceutical interest has been heightened by the potential of marine proteases and chitinases in targeted therapies and wound healing. Export-oriented strategies are also being reinforced, with China emerging as a supply hub for marine-derived bio-ingredients.

India’s Sea Enzyme Products Market is projected to expand at a CAGR of 5.2% through 2035, reflecting gradual but consistent adoption. Growth has been supported by the rapid rise of the nutraceutical sector, where digestive health and immunity-boosting enzyme supplements are gaining traction. Food and beverage manufacturers have increasingly turned to marine-derived enzymes to improve texture, flavor, and shelf-life in both traditional and modern product categories. Pharmaceutical R&D in India has also been integrating marine enzymes into drug development and bioprocessing, albeit at a slower pace compared to developed markets. Infrastructure challenges and cost-sensitive manufacturing have moderated growth rates, but rising coastal biomass utilization and partnerships with global biotech firms are expected to expand capacity.

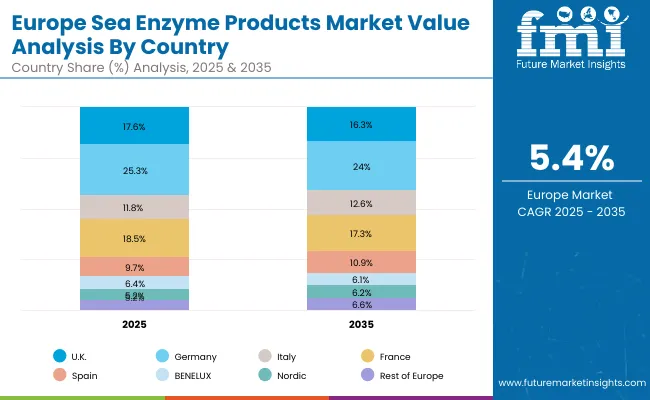

| Country | 2025 |

|---|---|

| UK | 17.6% |

| Germany | 25.3% |

| Italy | 11.8% |

| France | 18.5% |

| Spain | 9.7% |

| BENELUX | 6.4% |

| Nordic | 5.2% |

| Rest of Europe | 5.5% |

| Country | 2035 |

|---|---|

| UK | 16.3% |

| Germany | 24.0% |

| Italy | 12.6% |

| France | 17.3% |

| Spain | 10.9% |

| BENELUX | 6.1% |

| Nordic | 6.2% |

| Rest of Europe | 6.6% |

The Sea Enzyme Products Market in Germany is anticipated to expand at a CAGR of 5.4% from 2025 to 2035. Growth has been closely tied to the country’s strong emphasis on sustainable manufacturing, where marine enzymes are being adopted for eco-friendly bio-catalysis and industrial applications. Food and beverage companies have increasingly adopted enzyme-based solutions to align with consumer preferences for natural and clean-label products. Pharmaceutical and biotechnology firms are expanding R&D pipelines that integrate marine enzymes for innovative therapies and bioprocessing methods. Industrial applications, including waste management and bio-cleaning, are also being advanced in line with Germany’s green industrial strategy. Collaboration with EU marine research networks is expected to further support innovation and scale.

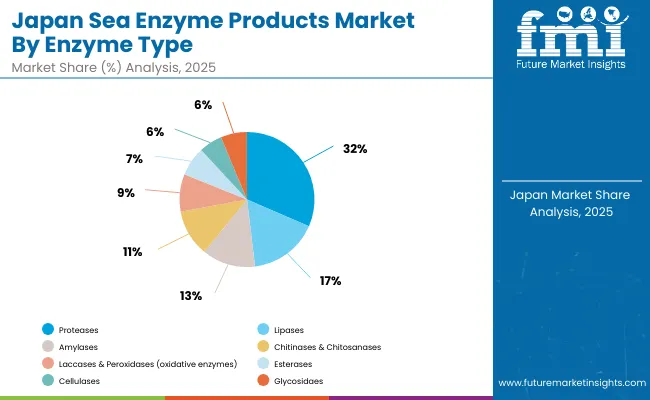

| Enzyme Type | Market Value Share, 2025 |

|---|---|

| Proteases (collagenase, trypsin-like enzymes, peptidases) | 31.5% |

| Lipases | 16.6% |

| Amylases | 12.8% |

| Chitinases & Chitosanases | 11.2% |

| Laccases & Peroxidases (oxidative enzymes) | 9.0% |

| Esterases | 7.0% |

| Cellulases | 5.6% |

| Glycosidaes | 6.3% |

The Sea Enzyme Products Market in Japan is projected to witness robust growth, anchored by proteases at 31.5% share in 2025, followed by lipases (16.6%) and amylases (12.8%). A clear transition is expected toward glycosidases and cellulases, which, despite smaller bases, are forecasted to expand at 6.5% CAGR, reflecting their emerging role in industrial and pharmaceutical applications.

The strong emphasis on biopharmaceutical innovation in Japan has been reinforcing adoption of chitinases, proteases, and oxidative enzymes, particularly for wound healing, targeted therapies, and bioactive ingredient formulations. In food and beverage sectors, marine enzymes have been increasingly integrated into functional products aligned with Japan’s advanced health-conscious consumer base. Rising investment in marine microbial R&D and enzyme engineering is also positioning Japan as a leader in enzyme customization.

As industrial automation deepens, enzyme-enabled biocatalysis in bio-cleaning, textiles, and green chemistry is expected to rise, further diversifying the application base.

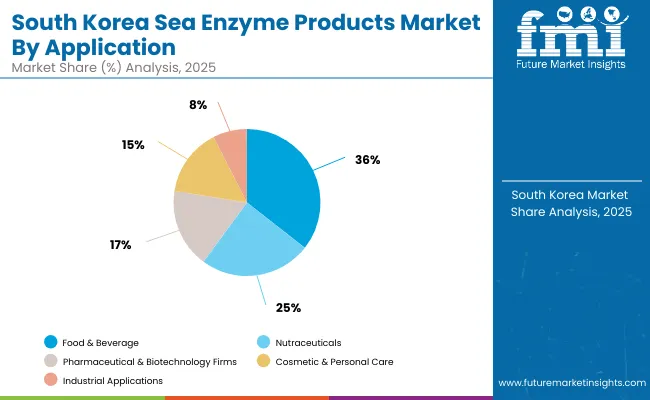

| End-Use Application | Market Value Share, 2025 |

|---|---|

| Food & Beverage | 35.6% |

| Nutraceuticals | 24.5% |

| Pharmaceutical & Biotechnology Firms | 17.4% |

The Sea Enzyme Products Market in South Korea is expected to display a highly innovation-centric trajectory, with food & beverage applications maintaining a dominant share of 35.6% in 2025. Growth has been reinforced by South Korea’s advanced functional food sector, where marine enzymes are increasingly utilized to improve digestibility, texture, and nutritional value in premium and health-oriented product lines.

The pharmaceuticals & biotherapeutics segment, representing 17.4%, is being rapidly transformed through the integration of marine enzymes in topical formulations, enzyme therapies, and targeted drug delivery. Strong national biotech initiatives and university-industry collaborations have enabled significant investment in marine biotechnology, making therapeutic enzyme research a high-priority focus.

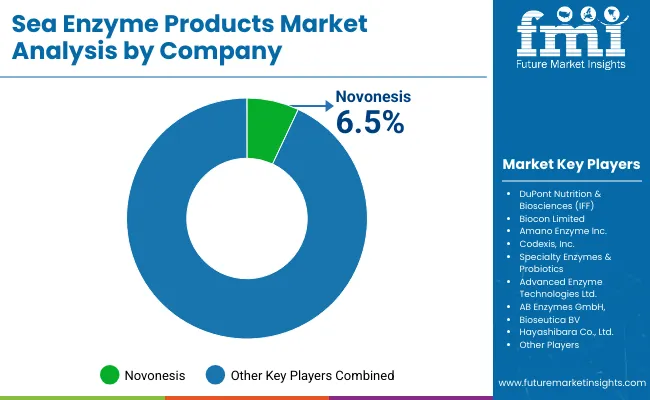

| Company | Global Value Share 2025 |

|---|---|

| Novonesis | 6 .5% |

| Others | 93 .5% |

The Sea Enzyme Products Market is moderately fragmented, with a balanced mix of multinational leaders, mid-sized biotechnological innovators, and niche marine enzyme specialists operating across diverse end-use sectors. Global enzyme giants such as Novonesis, DuPont Nutrition & Biosciences (IFF), and Biocon Limited have been observed to command significant market presence, primarily driven by their scale, proprietary enzyme platforms, and vertically integrated marine biotechnology capabilities. These companies have been actively investing in enzyme customization, fermentation optimization, and regulatory compliance alignment, particularly for pharmaceutical and food-grade applications.

Mid-sized players such as Amano Enzyme Inc., Advanced Enzyme Technologies Ltd., and AB Enzymes GmbH have been catering to the growing demand for application-specific formulations in functional foods, nutraceuticals, and biotherapeutics. Their strength has been reflected in regional adaptability, fermentation agility, and targeted innovation pipelines.

Niche-focused players like Codexis, Specialty Enzymes & Probiotics, Bioseutica BV, and Hayashibara Co., Ltd. have been differentiating through marine enzyme R&D, recombinant strain engineering, and co-development models with end-users. Competitive edge is shifting from generic enzyme catalogues to value-added services, such as co-formulation support, regulatory documentation, and end-to-end application integration.

The future of competition is expected to be defined not solely by enzyme efficacy, but by platform-based solutions, synthetic biology integration, and marine sustainability certifications.

Key Developments in Sea Enzyme ProductsMarket

| Item | Value |

|---|---|

| Quantitative Units | USD 140.6 million |

| Enzyme Type | Proteases (collagenase, trypsin-like enzymes, peptidases), Lipases, Amylases, Chitinases & Chitosanases, Laccases & Peroxidases (oxidative enzymes), Esterases, Cellulases, Glycosidases |

| Source | Marine Algae & Seaweed, Marine Fish & Shellfish (viscera, digestive glands, waste by-products), Marine Microorganisms (bacteria, fungi, actinomycetes), Other Marine Organisms (sponges, mollusks, echinoderms) |

| Formulation | Liquid Concentrates, Powdered & Encapsulated, Immo bilized / Carrier-Bound Enzymes, Crude Extracts / Fermentation Broths |

| End-Use Application | Food & Beverage, Nutraceuticals, Pharmaceutical & Biotechnology Firms, Cosmetic & Personal Care, Industrial Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novonesis, DuPont Nutrition & Biosciences (IFF), Biocon Limited, Amano Enzyme Inc., Codexis, Inc., Specialty Enzymes & Probiotics, Advanced Enzyme Technologies Ltd., AB Enzymes GmbH, Bioseutica BV, Hayashibara Co., Ltd. |

| Additional Attributes | Revenue analysis by enzyme type, source, and end-use application; innovations in marine microbial fermentation; integration with synthetic biology and recombinant strains; expansion of enzyme use in clean-label foods, biopharmaceuticals, and eco-industrial processing; trends in marine waste valorization; and regulatory push for sustainable marine biotechnology platforms. |

The global Sea Enzyme Products is estimated to be valued at USD 140.6 million in 2025.

The market size for the Sea Enzyme Products is projected to reach USD 263.9 million by 2035.

The Sea Enzyme Products is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key enzymes in the Sea Enzyme Products Market are Proteases, Lipases, Amylases, Chitinases & Chitosanases, Laccases & Peroxidases, Esterases, Cellulases, and Glycosidase.

In terms of end-use application, the Food & Beverage segment is expected to command the largest share at 36.3% in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seasoning Filling System Market Size and Share Forecast Outlook 2025 to 2035

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Sealing & Strapping Packaging Tape Market Size and Share Forecast Outlook 2025 to 2035

Search and Rescue Equipment (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Seaport Security Management Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Sealing Agent for Gold Market Size and Share Forecast Outlook 2025 to 2035

Sealant Web Film Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Allergy Market Size and Share Forecast Outlook 2025 to 2035

Seaweed-Based Anti-Aging Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sea Buckthorn Actives Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Derived Minerals Market Size and Share Forecast Outlook 2025 to 2035

Seasoning Market Size and Share Forecast Outlook 2025 to 2035

Seating And Positioning Belts Market Size and Share Forecast Outlook 2025 to 2035

Sea Air Logistics Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Sealed Wax Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Influenza Vaccines Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA