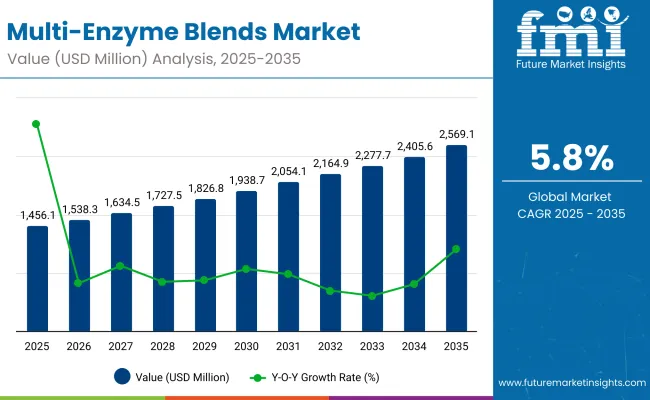

The Multi-Enzyme Blends Market is expected to record a valuation of USD 1.46 billion in 2025 and USD 2.57 billion in 2035, reflecting an increase of USD 1.11 billion, which equals a growth of 76.4% over the decade. The overall expansion represents a CAGR of 5.8%, nearly doubling the market size during the forecast period.

Multi Enzyme Blend Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1.46 billion |

| Market Forecast Value in (2035F) | USD 2.57 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

During the first five-year period from 2025 to 2030, the market expands from USD 1.46 billion to USD 1.94 billion, adding nearly USD 0.48 billion, which contributes 43% of the total decade growth. This phase witnesses steady adoption in poultry and swine feed, driven by rising demand for nutrient release, phytate-phosphorus utilization, and feed cost optimization. Carbohydrase-dominant blends remain in the lead, catering to over one-fifth of formulations due to their proven role in non-starch polysaccharide (NSP) breakdown.

The second half, from 2030 to 2035, contributes around USD 0.63 billion, equivalent to 57% of total growth, as the market rises from USD 1.94 billion to USD 2.57 billion. This acceleration is supported by advances in thermostable enzyme coatings, integration of probiotics and organic acids in blends, and widespread application in aquaculture and ruminants. Specialty blends and NSP enzyme combinations gain traction, while regional demand is led by North America (30%) and Europe (28%), supported by regulatory pressure on sustainable phosphorus management.

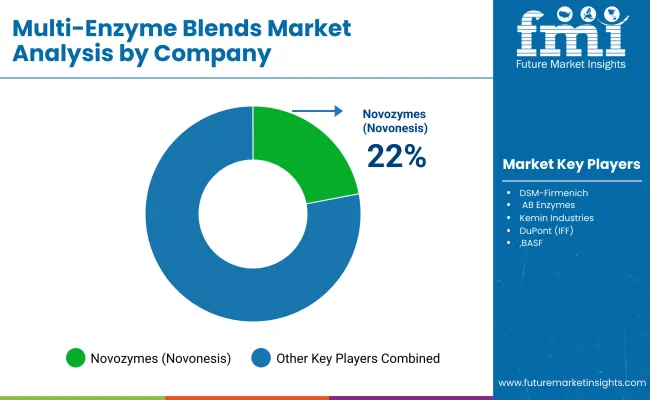

From 2020 to 2024, the Multi-Enzyme Blends Market expanded steadily, supported by microbial-derived enzyme adoption across poultry and swine feed. During this period, the competitive landscape was dominated by global ingredient suppliers controlling nearly 70-75% of revenues, with leaders such as Novozymes, DSM-Firmenich, and DuPont (IFF) focusing on broad-spectrum blends targeting feed digestibility and phytate-phosphorus release. Competitive differentiation relied on thermostability, multi-enzyme synergies, and inclusion cost efficiency, while probiotics and organic acid integrations were often marketed as complementary rather than core solutions. Direct-to-farm service penetration remained limited, contributing less than 10% of the overall value.

Demand for multi-enzyme blends will expand to USD 1.46 billion in 2025, and the revenue mix will gradually shift as specialty blends and enzyme-probiotic combinations rise to over 20% share by 2035. Traditional leaders face growing competition from regional innovators focusing on thermostable coatings, fermentation efficiency, and tailored livestock-specific blends. Major incumbents are pivoting toward hybrid offerings, integrating probiotics, organic acids, and digital on-farm dosing advisory to retain market leadership. Emerging players specializing in aquaculture blends, coated phytases, and gut-health-driven formulations are gaining share. The competitive advantage is moving away from single-function enzyme innovation toward ecosystem strength, livestock-specific solutions, and recurring integration into compound feed formulations.

Advances in enzyme formulation and coating technologies have enhanced thermostability and activity, enabling more efficient nutrient release across diverse livestock feed applications. Carbohydrase-dominant blends are gaining popularity due to their proven ability to break down non-starch polysaccharides (NSPs), improving digestibility and energy utilization in poultry and swine diets. The integration of phytase into blends has significantly contributed to phosphorus release, reducing feed costs and meeting sustainability regulations tied to phosphorus management.

The expansion of precision livestock nutrition and feed optimization programs has fueled market growth. Innovations in multi-enzyme combinations, such as carbohydrases with proteases and lipases, are opening new opportunities in aquaculture and ruminant feed. Segment growth is expected to be led by carbohydrase-dominant blends, poultry feed applications, and microbial-derived enzymes, given their precision, adaptability, and high return on investment for feed formulators.

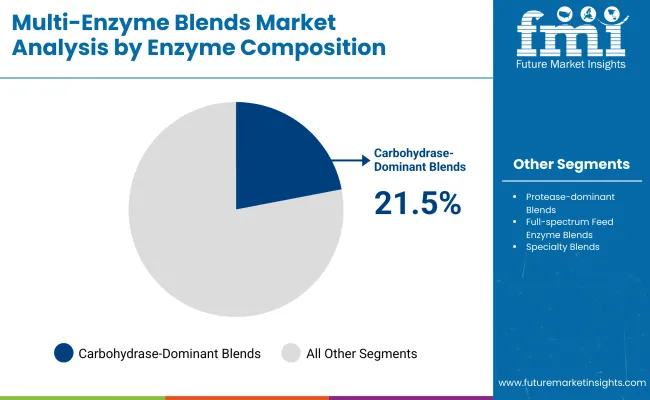

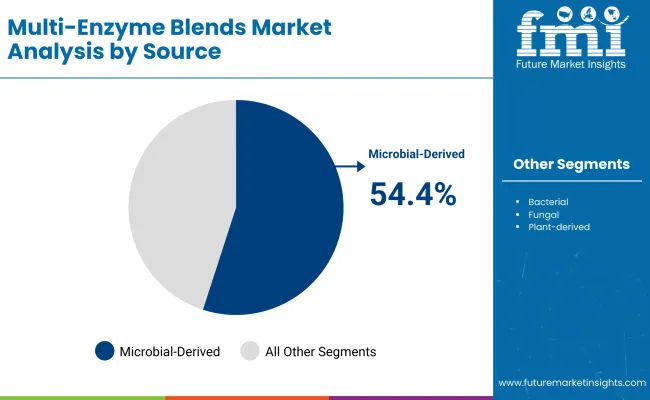

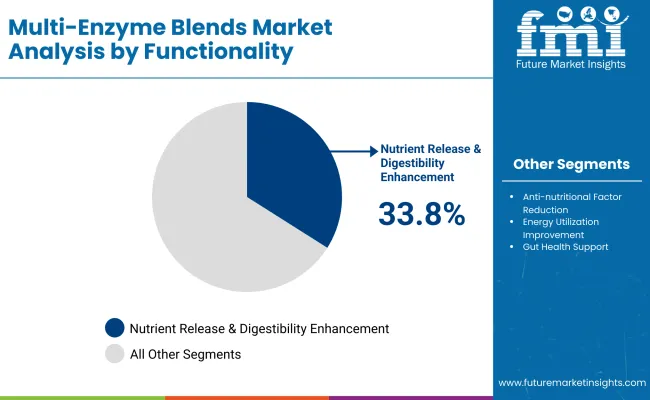

The Multi-Enzyme Blends Market is segmented by enzyme composition, source, functionality, livestock type, delivery format, application method, sales channel, and region. Carbohydrase-dominant blends lead enzyme composition due to their role in breaking down non-starch polysaccharides. Microbial-derived enzymes dominate sources, supported by efficient fermentation. Nutrient release and digestibility enhancement remain the top functionality, driving adoption in poultry and swine feed.

By livestock type, poultry accounts for the largest share, followed by swine and ruminants, while aquaculture is emerging. Delivery formats include powder/granules, liquids, and encapsulated forms, with encapsulated enzymes gaining traction for stability. Feed mill inclusion is the primary application method, while direct-to-integrator sales are expanding in distribution.

Regionally, North America and Europe lead in adoption, while Asia-Pacific is the fastest-growing region driven by rising livestock production and feed efficiency needs.

| Enzyme Composition Segment | Value Share (%) |

|---|---|

| Carbohydrase -dominant Blends | 21.50% |

| Xylanase + β- Glucanase + Cellulase | 8.40% |

| Amylase + Cellulase + Hemicellulase | 7.60% |

| Protease-dominant Blends | 18.90% |

| Protease + Amylase + Lipase | 7.80% |

| Protease + Cellulase + Pectinase | 6.50% |

| Full-spectrum Feed Enzyme Blends | 16.20% |

| With added Phytase | 5.90% |

| Specialty Blends | 15.10% |

| NSP Enzymes + Phytase | 5.80% |

| Enzymes + Probiotics | 5.10% |

| Enzymes + Organic Acids | 4.20% |

Carbohydrase-dominant blends lead the enzyme composition segment by 21.5% in 2025, driven by strong demand for NSP-degrading enzymes such as xylanase, β-glucanase, and cellulase. These blends improve nutrient digestibility, enhance feed conversion ratios, and reduce anti-nutritional effects, making them the most widely adopted across poultry and swine feed.

The segment’s growth is also supported by continuous advancements in thermostable enzyme coatings and fermentation efficiency, which ensure stability during feed pelleting. As multi-enzyme combinations gain traction, carbohydrase blends remain the backbone of enzyme supplementation strategies, with integration into broader feed efficiency and cost-optimization programs. The segment is expected to retain its leadership as the primary driver of performance-based enzyme formulations throughout the forecast period.

| Source Segment | Value Share (%) |

|---|---|

| Microbial-derived | 54.40% |

| Bacterial (Bacillus spp.) | 31.20% |

| Fungal (Aspergillus spp., Trichoderma spp.) | 23.20% |

| Plant-derived | 28.50% |

| Animal-derived | 17.10% |

Microbial-derived enzymes dominate the source segment by 54.4% in 2025, holding over half the market share due to their scalability, cost efficiency, and proven fermentation platforms. Bacillus-based enzymes lead the microbial group, offering robustness and thermostability, while fungal sources remain critical for cellulase and hemicellulase production.

The strength of microbial enzymes lies in their adaptability across livestock species and feed types, ensuring consistent activity under diverse gastrointestinal conditions. Plant-derived enzymes, though smaller in share, are gaining attention for clean-label positioning, while animal-derived enzymes remain limited to niche applications. Microbial sources are expected to retain dominance as the backbone of multi-enzyme blends, supported by continued innovation in strain engineering and large-scale fermentation.

| Segment | Value Share (%) |

|---|---|

| Nutrient Release & Digestibility Enhancement | 33.80% |

| Anti-nutritional Factor Reduction | 21.40% |

| Energy Utilization Improvement | 17.90% |

| Gut Health Support | 14.60% |

| Feed Cost Optimization | 12.30% |

Nutrient release and digestibility enhancement lead the functionality segment by 33.8% in 2025, commanding over one-third of the market. This dominance is attributed to the effectiveness of multi-enzyme blends in improving feed conversion ratios, unlocking bound nutrients, and enhancing overall livestock performance. The demand is particularly strong in poultry and swine production, where efficiency gains directly translate into cost savings.

Anti-nutritional factor reduction and energy utilization improvement follow as key functionalities, reflecting industry focus on neutralizing inhibitors and maximizing feed energy yield. Gut health support and feed cost optimization are growing priorities, driven by the phasing down of antibiotic growth promoters and volatility in feed ingredient prices. Collectively, these functionalities reinforce the role of multi-enzyme blends as essential tools in sustainable livestock production.

Cost Constraints and Complexity in Formulation

Despite their benefits, adoption of multi-enzyme blends is limited by cost and operational challenges. High-performance blends with multiple coated enzymes carry significant investment costs, which can limit accessibility for small-scale farmers. Beyond procurement, formulating diets with precise enzyme inclusion rates requires technical expertise and feed mill infrastructure. Variability in raw material composition and enzyme-substrate interactions adds complexity, making standardized outcomes difficult. Furthermore, maintaining enzyme activity during feed pelleting and storage requires careful handling. These constraints create barriers for wider adoption, particularly in developing markets with limited technical capacity.

Sustainability, Gut Health, and Specialty Blends as Emerging Priorities

The market is experiencing a shift toward specialty blends that combine enzymes with probiotics, organic acids, or phytase for multifunctional benefits. Sustainability drivers, including phosphorus management regulations and rising feed costs, are accelerating adoption of enzyme solutions that reduce environmental impact while enhancing efficiency. At the same time, gut health has become a key focus, with enzyme blends positioned as alternatives to antibiotic growth promoters. Advances in encapsulation and fermentation technologies are enabling tailored solutions for species-specific diets. These trends highlight a growing emphasis on integrated, value-added enzyme formulations rather than single-function additives.

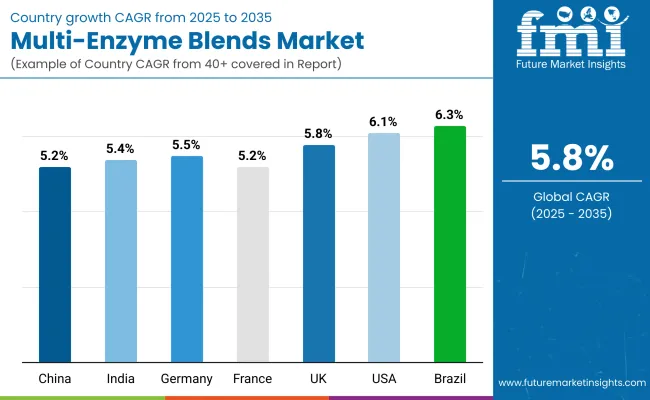

| Countries | CAGR |

|---|---|

| China | 5.28% |

| India | 5.44% |

| Germany | 5.50% |

| France | 5.24% |

| UK | 5.81% |

| USA | 6.29% |

| Brazil | 6.39% |

The global Multi-Enzyme Blends Market shows distinct regional variations in adoption, influenced by livestock intensity, feed cost pressures, and regulatory mandates on sustainability.

Asia-Pacific emerges as the fastest-growing region, anchored by China (5.3% CAGR) and India (5.4% CAGR). Growth is driven by large-scale poultry and swine production systems, rising compound feed output, and regulatory encouragement to reduce phosphate emissions. China’s emphasis on sustainable phosphorus management and feed efficiency accelerates adoption of phytase-rich blends, while India’s expansion reflects growing poultry integration and rising demand for cost-optimized feed formulations. Europe maintains a strong growth profile, led by Germany (5.5% CAGR), France (5.2% CAGR), and the UK (5.8% CAGR), supported by stringent regulations on environmental impact and the ban on antibiotic growth promoters.

Investments in advanced feed milling technologies and emphasis on gut health solutions keep Europe slightly ahead of North America in terms of functional blend innovation. North America accounts for the largest regional share at 30%, with the USA (6.3% CAGR) driving adoption. Growth reflects maturity in poultry and swine industries, coupled with rising integration of enzyme-probiotic blends and cloud-enabled feed optimization platforms. Expansion here is service-driven, with greater emphasis on tailored nutrition programs and digital advisory support rather than commoditized enzyme sales. Latin America shows moderate expansion, led by Brazil (6.4% CAGR), where large-scale poultry and pork exports drive adoption of multi-enzyme blends to enhance feed efficiency and competitiveness in global trade. Middle East & Africa, though smaller at 3% share, is gradually expanding with poultry integration and aquaculture projects fueling enzyme demand.

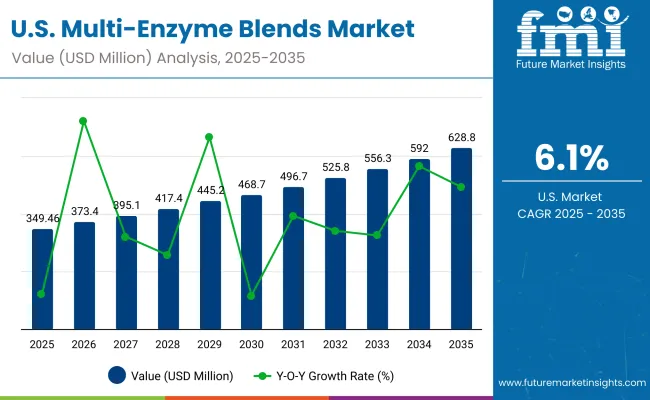

| Year | USA Multi-Enzyme Blend Market (USD Million) |

|---|---|

| 2025 | 349.46 |

| 2026 | 373.4 |

| 2027 | 395.1 |

| 2028 | 417.4 |

| 2029 | 445.2 |

| 2030 | 468.7 |

| 2031 | 496.7 |

| 2032 | 525.8 |

| 2033 | 556.3 |

| 2034 | 592.0 |

| 2035 | 628.8 |

The Multi-Enzyme Blends Market in the United States is projected to grow at a CAGR of 6.3%, driven by strong adoption across poultry and swine feed industries. Demand is reinforced by the need to optimize feed conversion ratios and reduce phosphorus excretion in line with sustainability regulations. Feed integrators are investing in enzyme-probiotic blends to improve gut health, while ruminant nutrition programs are gradually integrating multi-enzyme solutions. Academic and commercial collaborations are fostering innovations in thermostable coatings and precision feed technologies, creating opportunities for bundled enzyme-nutrition advisory services.

The Multi-Enzyme Blends Market in the United Kingdom is expected to grow at a CAGR of 5.8%, supported by sustainability-driven feed regulations and the phase-out of antibiotic growth promoters. Poultry and dairy sectors are accelerating usage of enzyme blends to enhance digestibility and gut health. Universities and government-backed research bodies are running trials on enzyme-probiotic combinations to align with One Health initiatives. Rising demand for specialty feed in aquaculture is also emerging as a growth driver.

India is witnessing rapid growth in the Multi-Enzyme Blends Market, forecast to expand at a CAGR of 5.4% through 2035. Rising poultry integration and feed mill expansions in tier-2 and tier-3 cities are key drivers. Feed manufacturers are using carbohydrase and phytase blends to improve digestibility and offset high maize and soybean meal prices. Educational institutions and industry associations are promoting enzyme supplementation awareness, while aquaculture players are increasingly turning to enzyme-rich formulations to enhance feed utilization and export competitiveness.

The Multi-Enzyme Blends Market in China is expected to grow at a CAGR of 5.3%, the highest among leading economies. Growth is anchored by the world’s largest swine and poultry feed industries, where phytase and carbohydrase blends are becoming standard. Government-backed sustainability policies encourage phosphorus reduction and improved nitrogen utilization, boosting enzyme inclusion in feed formulations. Local companies are developing competitively priced microbial-derived blends, expanding access for mid-scale farmers. Aquaculture and pet nutrition are emerging as new high-growth application areas.

| Countries | 2025 |

|---|---|

| UK | 20.33% |

| Germany | 20.27% |

| Italy | 10.83% |

| France | 14.41% |

| Spain | 10.76% |

| BNELUX | 6.65% |

| Nordic | 5.63% |

| Rest of Europe | 11% |

| Countries | 2035 |

|---|---|

| UK | 20.51% |

| Germany | 21.23% |

| Italy | 9.80% |

| France | 14.91% |

| Spain | 11.57% |

| BNELUX | 5.15% |

| Nordic | 5.81% |

| Rest of Europe | 11% |

The Multi-Enzyme Blends Market in Germany is projected to grow at a CAGR of 5.5%, underpinned by the country’s leadership in precision livestock nutrition and advanced feed milling technologies. German feed producers are integrating carbohydrase and phytase blends into compound feeds to meet EU sustainability mandates and optimize phosphorus utilization. Dairy and ruminant farms are increasingly adopting fiber-degrading enzymes to improve feed efficiency and reduce methane emissions. Poultry producers remain major users, supported by strict compliance with EU feed standards and the need to enhance gut health without antibiotics. Specialty feed mills are also experimenting with enzyme-probiotic combinations to align with consumer demand for sustainable animal protein.

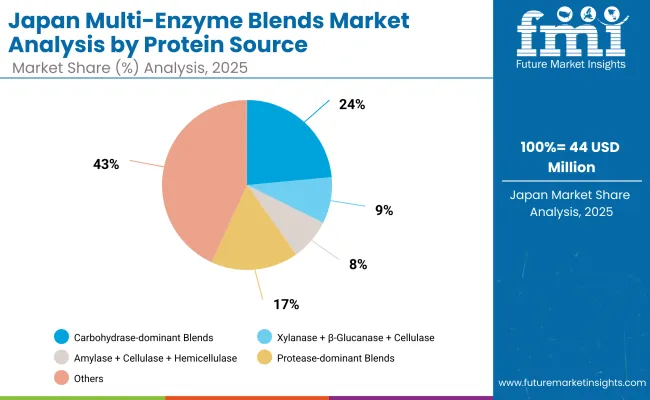

| Enzyme Composition Segment | Value Share (%) |

|---|---|

| Carbohydrase -dominant Blends | 24.20% |

| Xylanase + β- Glucanase + Cellulase | 9.10% |

| Amylase + Cellulase + Hemicellulase | 8.30% |

| Protease-dominant Blends | 17.40% |

| Protease + Amylase + Lipase | 7.20% |

| Protease + Cellulase + Pectinase | 6.10% |

| Full-spectrum Feed Enzyme Blends | 14.50% |

| With added Phytase | 5.40% |

| Specialty Blends | 12.80% |

| NSP Enzymes + Phytase | 4.80% |

| Enzymes + Probiotics | 4.20% |

| Enzymes + Organic Acids | 3.70% |

The Multi-Enzyme Blends Market in Japan is projected to grow from USD 0.044 billion in 2025 to USD 0.078 billion by 2035, expanding at a CAGR of 5.9%. Carbohydrase-dominant blends lead the market with a 24.2% share, followed by protease-dominant blends at 17.4%, reflecting Japan’s focus on efficient feed conversion and nutrient digestibility. Poultry and swine producers remain the primary adopters, while aquaculture is gaining momentum due to rising seafood demand.

Specialty blends combining enzymes with probiotics and organic acids are expanding rapidly, with growth rates above 6.5%, as Japan emphasizes gut health and antibiotic-free feed. Full-spectrum feed enzyme blends hold a strong 14.5% share, highlighting the market’s preference for multi-functional formulations that address multiple nutritional challenges simultaneously. Supported by stringent food safety regulations and consumer demand for sustainable livestock production, Japan represents a stable but innovation-driven enzyme market in East Asia.

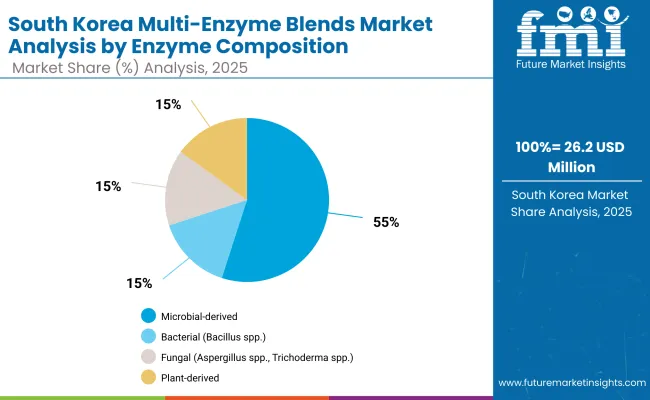

| Segment | Value Share (%) |

|---|---|

| Microbial-derived | 55.10% |

| Bacterial (Bacillus spp.) | 31.60% |

| Fungal (Aspergillus spp., Trichoderma spp.) | 23.50% |

| Plant-derived | 28.20% |

| Animal-derived | 16.70% |

The Multi-Enzyme Blends Market in South Korea is valued at approximately USD 26.2 million in 2025, accounting for nearly 1.8% of the global market. Microbial-derived enzymes dominate with a 55.1% share, led by Bacillus-based and Aspergillus/Trichoderma-derived strains that are widely used in poultry and swine feed. This dominance reflects South Korea’s advanced feed industry, where precision nutrition, gut health, and sustainability drive demand for high-efficiency enzyme solutions.

Plant-derived enzymes hold a significant 28.2% share, supported by consumer-driven preference for natural and clean-label feed additives. Animal-derived enzymes remain niche at 16.7%, serving specialty applications. The market’s expansion is strongly linked to South Korea’s intensive poultry and swine production systems, coupled with its focus on reducing dependence on antibiotic growth promoters. As Industry 4.0 frameworks extend into livestock management, demand for advanced enzyme blends combined with probiotics and organic acids is expected to accelerate.

The Multi-Enzyme Blends Market is moderately fragmented, with global leaders, regional innovators, and specialized formulators competing across diverse livestock feed applications. Global ingredient leaders such as Novozymes (Novonesis), DSM-Firmenich, and DuPont (IFF) hold significant market share, driven by extensive multi-enzyme portfolios, fermentation expertise, and integration with large feed manufacturers. Their strategies increasingly emphasize thermostable coatings, enzyme-probiotic combinations, and full-spectrum blends designed for efficiency and sustainability in poultry and swine feed.

Established mid-sized players, including Kemin Industries, AB Enzymes, and Adisseo, cater to demand for targeted enzyme solutions and species-specific blends. These companies are accelerating adoption through partnerships with feed integrators and innovations in coated phytase and NSP-degrading enzyme platforms, making them highly relevant for ruminant, aquaculture, and gut-health-focused feed segments.

Specialized providers such as BioResource International (BRI) and Advanced Enzyme Technologies focus on niche formulations and cost-effective enzyme blends tailored to regional feed requirements. Their strength lies in customization, regional adaptability, and integration of organic acids or probiotics for multifunctional performance.

Competitive differentiation is shifting away from single-enzyme activity toward integrated ecosystems, where suppliers combine microbial-derived enzymes with probiotics, offer precision nutrition services, and develop subscription-based advisory platforms for feed optimization.

Key Developments in Multi Enzyme Blends Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.46 Billion |

| Enzyme Composition | Carbohydrase -dominant, Protease-dominant, Full-Spectrum Blends, Specialty Blends, NSP + Phytase, Enzyme + Probiotics, Enzyme + Organic Acids |

| Source | Microbial-derived (Bacterial, Fungal), Plant-derived, Animal-derived |

| Functionality | Nutrient Release & Digestibility, Anti-nutritional Factor Reduction, Energy Utilization, Gut Health Support, Feed Cost Optimization |

| Livestock Type | Poultry, Swine, Ruminants, Aquaculture, Pets |

| Delivery Format | Powder/Granules, Liquid, Encapsulated |

| Application Method | Feed Mill Inclusion (Premix, Compound Feed), On-Farm Inclusion |

| Sales Channel | Direct to Integrators/Farms, Through Feed Manufacturers, Distributors & Agents |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novozymes (Novonesis), DSM- Firmenich, AB Enzymes, Kemin Industries, DuPont (IFF), Adisseo, BASF, BioResource International (BRI), Advanced Enzyme Technologies, Bluestar Adisseo |

| Additional Attributes | Dollar sales by enzyme composition and livestock type, adoption trends in poultry/swine/aquaculture feed, specialty blends with probiotics and acids, regulatory impact on phosphorus and antibiotic reduction, microbial fermentation advancements, encapsulation and coating innovations, regional adoption patterns, sustainability-driven demand, and integration of enzymes into precision livestock nutrition programs. |

The global Multi-Enzyme Blends Market is estimated to be valued at USD 1.46 billion in 2025.

The market size for the Multi-Enzyme Blends Market is projected to reach USD 2.57 billion by 2035.

The market is expected to grow at a CAGR of 5.8%, representing a value increase of USD 1.11 billion over the decade.

The key product types include carbohydrase-dominant blends, protease-dominant blends, full-spectrum blends, specialty blends, NSP + phytase formulations, enzyme-probiotic blends, and enzyme-organic acid combinations.

In terms of livestock, poultry feed commands the largest share in 2025, accounting for over 20% of the market, supported by high efficiency gains and cost savings.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Leaders & Share in the Dairy Blends Industry

UK Dairy Blends Market Growth – Trends, Demand & Innovations 2025–2035

USA Dairy Blends Market Insights – Demand, Size & Industry Trends 2025–2035

Emulsifier Blends / Self-Emulsifying Bases Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Blends Market

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Cultured Dairy Blends Market

Meat Stabilizers Blends Market Trends - Source & Function Analysis

Lactic Acid Cosmic Blends Market Size and Share Forecast Outlook 2025 to 2035

Custom Dry Ingredients Blends Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Demand for Hybrid Protein Blends in Private Label Formulations in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA