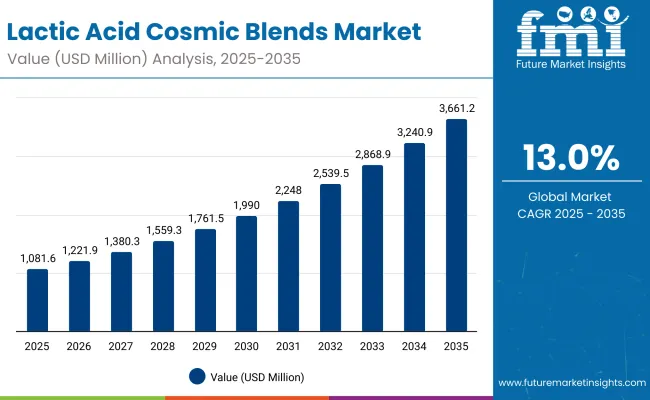

The Lactic Acid Cosmic Blends Market is projected to grow from USD 1,081.6 million in 2025 to USD 3,661.2 million by 2035, expanding at a CAGR of 13.0%. Growth is primarily supported by rising demand for multifunctional skincare solutions combining exfoliation, brightening, and anti-acne benefits.

Lactic Acid Cosmic Blends Market Key Takeaways

| Metric | Value |

|---|---|

| Lactic Acid Cosmic Blends Market Estimated Value in (2025E) | USD 1,081.6 million |

| Lactic Acid Cosmic Blends Market Forecast Value in (2035F) | USD 3,661.2 million |

| Forecast CAGR (2025 to 2035) | 13.0% |

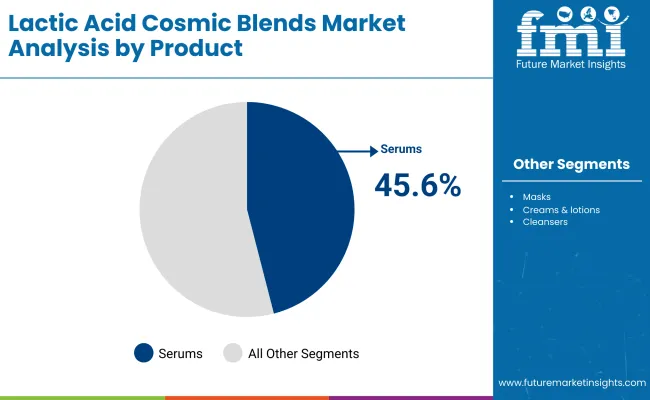

Among product types, serums hold a 45.6% share in 2025, making them the most preferred format due to high concentration and efficacy.

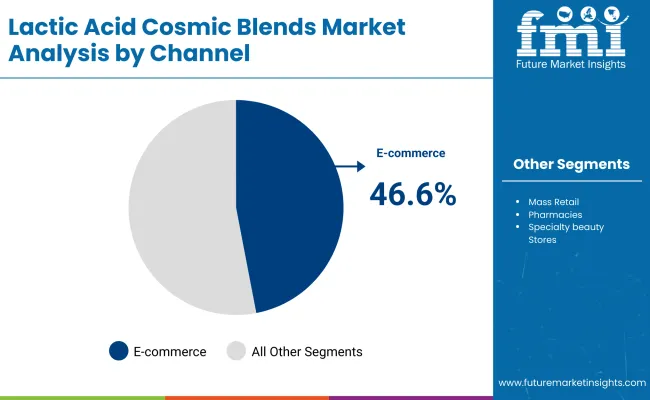

Regionally, Asia-Pacific leads with China and India driving double-digit growth, while the USA and Europe remain strong mature markets with steady adoption. E-commerce accounts for the largest distribution share, capturing 46.6% of value in 2025, underlining the digital-first beauty consumption trend.

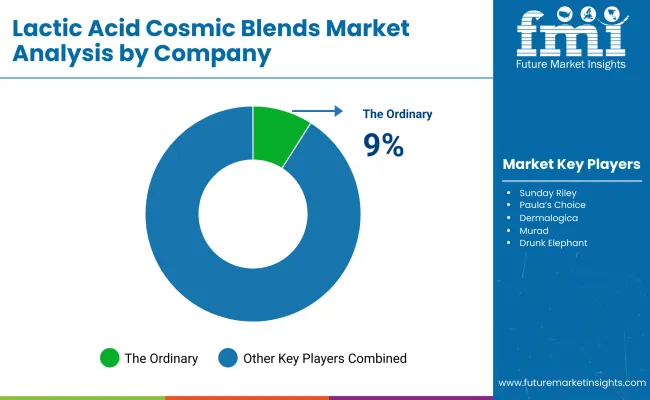

Competitive dynamics highlight The Ordinary with a global value share of 9.0% in 2025, while other players including Sunday Riley, Paula’s Choice, Dermalogica, and Murad intensify competition with product innovation, clean-label formulations, and dermatologist-tested claims.

From 2020 to 2024, the Lactic Acid Cosmic Blends Market grew steadily, laying the foundation for strong adoption across skin care categories. In 2025, the market is projected to reach USD 1,081.6 million, with serums leading product sales and e-commerce emerging as the largest channel. By 2035, the market is forecast to surpass USD 3,661.2 million, with revenue diversification across creams/lotions, masks, and mass retail. Competitive differentiation is increasingly driven by innovation in clean-label formulations, dermatologically tested claims, and brand strength in direct-to-consumer platforms.

Consumers are increasingly shifting toward skincare products that combine exfoliation, brightening, and renewal benefits in one formulation. Lactic acid blends meet this demand by offering gentle exfoliation while simultaneously improving hydration and skin tone, making them suitable for sensitive skin types. This multifunctionality reduces the need for multiple-step routines, fueling stronger adoption across serums, toners, and creams.

The market is benefitting from heightened consumer awareness of ingredient transparency and ethical sourcing. Lactic acid blends are gaining traction due to their compatibility with vegan, natural/organic, and clean-label positioning, allowing brands to target eco-conscious and ingredient-savvy consumers. This attribute not only supports premium pricing strategies but also drives retail penetration in specialty beauty and e-commerce platforms.

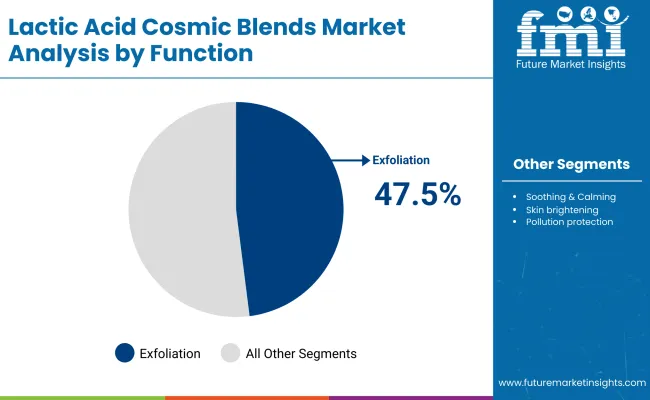

The Lactic Acid Cosmic Blends Market is segmented by function, product type, channel, claim, and geography, reflecting its broad consumer adoption. By function, exfoliation, brightening, skin renewal, and acne treatment are key categories, with exfoliation leading at 47.5% share in 2025 due to demand for gentle yet effective exfoliants. Product types include serums, toners, creams/lotions, and masks, with serums holding strong appeal for concentrated, fast-acting results. Distribution spans e-commerce, pharmacies, specialty beauty stores, and mass retail, with e-commerce commanding 46.6% share in 2025 as digital-first skincare brands expand globally. Claims such as vegan, natural/organic, clean-label, and clinical-grade continue to shape consumer preferences, reinforcing trust and premiumization. Regionally, the market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific emerging as the fastest-growing region

| Function | Value Share % 2025 |

|---|---|

| Exfoliation | 47.5% |

| Others | 52.5% |

The exfoliation function is projected to contribute 47.5% of the Lactic Acid Cosmic Blends Market revenue in 2025, positioning it as one of the most dominant categories. This leadership stems from the growing consumer preference for gentle yet effective chemical exfoliants that improve skin texture and promote renewal without the irritation often linked to harsher actives. Rising popularity of exfoliating serums and toners, supported by dermatologists and beauty influencers, further accelerates this demand. With multifunctional blends offering hydration and brightening benefits alongside exfoliation, this segment is expected to sustain its strong market position throughout the forecast period.

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 45.6% |

| Others | 54.4% |

The serums segment is forecasted to command 45.6% of the Lactic Acid Cosmic Blends Market share in 2025, driven by their concentrated formulations and faster visible results. Serums enriched with lactic acid blends are increasingly favored for targeting exfoliation, brightening, and skin renewal, offering lightweight textures suitable for layering in modern skincare routines. Their versatility across both daily-use and treatment-based products has facilitated stronger adoption in premium and mass-market categories. With rising demand for multifunctional and high-efficacy products, serums are expected to remain a central growth driver for lactic acid blends.

| Channel | Value Share % 2025 |

|---|---|

| E-commerce | 46.6% |

| Others | 53.4% |

The e-commerce channel is projected to contribute 46.6% of the Lactic Acid Cosmic Blends Market revenue in 2025, highlighting its growing importance in the beauty and skincare industry. Online platforms have become the preferred medium for consumers seeking product variety, ingredient transparency, and competitive pricing. The rise of D2C brands and subscription-based models has further strengthened e-commerce penetration. Additionally, digital marketing, influencer partnerships, and personalized shopping experiences are driving adoption. As consumer buying habits increasingly shift online, e-commerce is set to remain a critical distribution channel for lactic acid blends.

Rising Demand for Exfoliation-Based Skincare

Consumer preference for chemical exfoliation over physical scrubs is boosting the adoption of lactic acid blends. These formulations offer gentle yet effective resurfacing, catering to sensitive skin types while addressing acne, dullness, and uneven texture. The multifunctionality of lactic acidcombining exfoliation with hydrationmakes it a preferred ingredient in serums, creams, and masks. As consumers demand clinically validated yet mild solutions, product launches featuring lactic acid blends are accelerating, driving consistent growth in both premium and mass-market skincare categories.

E-commerce and Direct-to-Consumer Growth

E-commerce platforms have transformed consumer access to lactic acid blends, offering ingredient transparency, reviews, and affordable trial sizes. Direct-to-consumer (D2C) brands leverage digital marketing and influencer partnerships to popularize lactic acid-based products across geographies. Subscription boxes and bundled offers further enhance product adoption. Rising digital literacy in Asia-Pacific and increasing online penetration in emerging markets have amplified availability. This strong e-commerce-driven distribution strategy significantly supports market expansion, ensuring consistent exposure and brand engagement for both established and niche players.

Skin Sensitivity and Regulatory Constraints

Despite benefits, lactic acid blends pose challenges due to potential irritation, redness, and increased photosensitivity when overused. These side effects raise caution among dermatologists and hesitant consumers, particularly in markets with limited education on chemical exfoliation. Additionally, concentration thresholds for alpha-hydroxy acids (AHAs) vary across regulatory frameworks in the EU, USA, and Asia, restricting formulation flexibility for brands. Compliance costs and reformulation needs often delay product launches, creating barriers for smaller players to compete with global giants in this evolving segment.

Shift Toward Clean-Label and Vegan Formulations

Consumers are increasingly demanding sustainable, vegan, and clean-label lactic acid blends, pushing brands to reformulate with eco-friendly and ethically sourced ingredients. Biotechnology-derived lactic acid is gaining prominence, aligning with sustainability goals and reducing dependence on petrochemical-based raw materials. Packaging innovations, recyclable formats, and cruelty-free certifications are now key purchase drivers. Brands that communicate transparency in sourcing and efficacy data are seeing stronger resonance, particularly with Gen Z and millennial consumers. This shift is shaping the market into a values-driven and innovation-led segment.

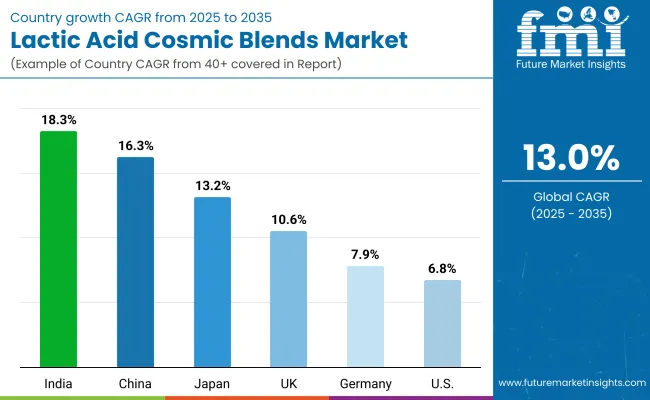

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.3% |

| USA | 6.8% |

| India | 18.3% |

| UK | 10.6% |

| Germany | 7.9% |

| Japan | 13.2% |

The global Lactic Acid Cosmic Blends Market reveals notable regional disparities in growth momentum, largely influenced by consumer awareness, retail modernization, and demand for premium skincare formulations. Asia-Pacific emerges as the fastest-growing region, anchored by China at 16.3% CAGR and India at 18.3% CAGR. China’s expansion is supported by rapid urbanization, rising middle-class income, and widespread adoption of acid-based exfoliation products in both mass and premium skincare lines. India’s strong growth reflects increasing dermatology-focused launches, surging MSME participation in local manufacturing, and rising awareness of lactic acid blends through digital-first beauty brands.

Europe maintains a steady growth profile, led by Germany at 7.9% CAGR and the UK at 10.6% CAGR, fueled by stringent EU standards on cosmetic safety and a strong consumer shift toward clean-label and vegan skincare. The region benefits from high penetration of premium skincare brands and a regulatory framework that supports innovation in bio-based formulations.

Japan is projected to grow at 13.2% CAGR, reflecting consumer preferences for multifunctional skincare, particularly brightening and anti-aging products. North America, with the USA at 6.8% CAGR, shows moderate growth, influenced by market maturity and strong competition from established chemical exfoliation alternatives. However, demand for dermatologist-tested and clinical-grade blends remains strong, with e-commerce and D2C platforms driving incremental growth.

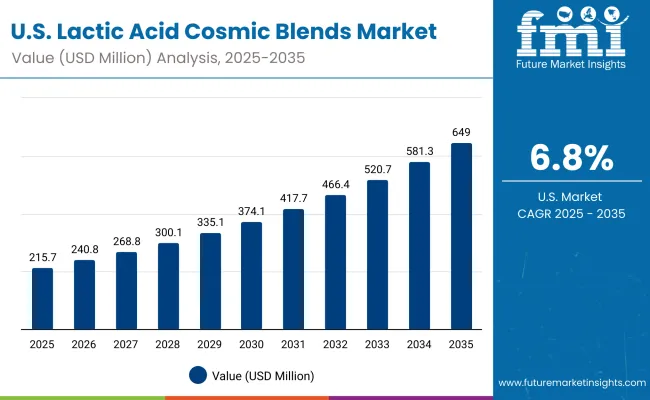

| Year | USA Lactic Acid Cosmic Blends Market (USD Million) |

|---|---|

| 2025 | 215.71 |

| 2026 | 240.83 |

| 2027 | 268.88 |

| 2028 | 300.19 |

| 2029 | 335.15 |

| 2030 | 374.17 |

| 2031 | 417.75 |

| 2032 | 466.40 |

| 2033 | 520.71 |

| 2034 | 581.35 |

| 2035 | 649.05 |

The USA Lactic Acid Cosmic Blends Market is projected to expand from USD 215.71 million in 2025 to USD 649.05 million in 2035, reflecting steady adoption at a CAGR of 11.6%. Growth is being fueled by rising consumer preference for dermatologist-tested and clinical-grade exfoliation products, coupled with increasing demand for multifunctional skincare that combines exfoliation with brightening and hydration.

E-commerce platforms are playing a transformative role in distribution, enabling broader access to niche and premium lactic acid formulations. Major domestic and international brands are investing in R&D to enhance product safety and reduce irritation, appealing to sensitive-skin consumers. The clinical skincare segment, particularly formulations recommended by dermatologists, is gaining traction due to rising awareness of safe acid-based exfoliation practices.

Innovation in delivery formats such as serums, masks, and multi-active blends is further boosting market value. Additionally, strong uptake of clean-label and vegan products supports brand differentiation in a competitive market. With consumer education on acid blends rising, the USA market is positioned for consistent growth, though competition from glycolic and salicylic acid products remains a moderating factor.

The UK Lactic Acid Cosmic Blends Market is projected to expand at a CAGR of 10.6% between 2025 and 2035, supported by demand for exfoliation-driven and brightening skincare products. Consumer interest in clean-label, dermatologist-tested formulations is strengthening, as sensitivity-friendly acids gain traction. Premium brands are pushing growth through specialty beauty stores and pharmacies, while mass retail remains essential for mainstream adoption.

Cultural heritage and sustainability trends influence the market, as brands emphasize safe formulations and recyclable packaging. Retail innovations, including AR-driven product trials in beauty outlets, further enhance consumer engagement. The UK’s combination of government-backed health awareness campaigns, public-private R&D collaborations, and strong online retail adoption ensures consistent expansion.

India’s Lactic Acid Cosmic Blends Market is set for rapid growth, with a forecast CAGR of 18.3%, driven by expanding middle-class skincare consumption and strong MSME participation. Tier-2 and tier-3 cities are experiencing sharp adoption, as affordable product launches and rising awareness drive penetration. Exfoliation and acne-treatment functions dominate demand, aligning with the country’s climate-driven skincare concerns.

Educational institutions and training centers are shaping consumer awareness by emphasizing dermatologist-recommended and clinical-grade blends. Retail expansion through e-commerce platforms and pharmacies is creating a dual growth channel that caters to both premium and affordable categories. India’s youthful population, combined with growing male grooming trends, further strengthens long-term adoption.

China is expected to lead global growth in the Lactic Acid Cosmic Blends Market, expanding at a CAGR of 16.3% through 2035. Growth is underpinned by robust demand for multifunctional skincare, particularly blends targeting brightening and anti-aging. Domestic firms are offering competitively priced formulations, accelerating adoption among younger consumers. City-level digitization programs and wellness campaigns are further amplifying consumer awareness of safe exfoliation routines.

High adoption through e-commerce platforms supports nationwide reach, while pharmacies and specialty beauty stores cater to premium demand. Municipal campaigns promoting skincare safety and innovation, alongside smart manufacturing rollouts, provide favorable conditions for global and local brands. By 2035, China will remain a hub for affordable innovation and a testing ground for clean-label and vegan acid blends.

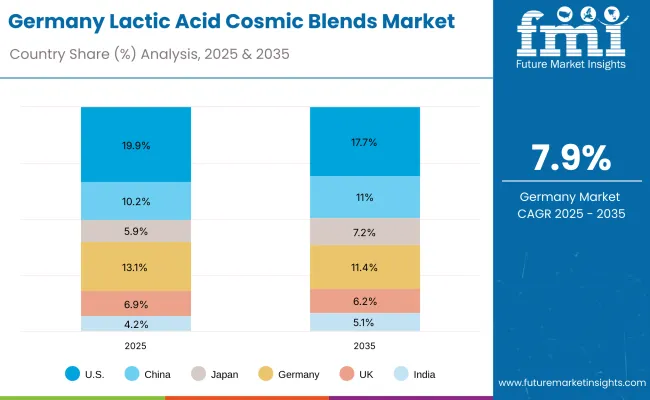

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

Germany’s Lactic Acid Cosmic Blends Market is projected to grow at a CAGR of 7.9% from 2025 to 2035, accounting for 13.1% of global share in 2025 but moderating to 11.4% by 2035. This gradual decline in share reflects faster growth in Asia, though Germany remains a central hub in Europe. The country’s strong reputation in dermatology-driven skincare and premium cosmetic manufacturing supports consistent demand, especially for exfoliation and brightening blends.

Pharmacies and specialty beauty stores dominate distribution, supported by high consumer trust in clinical-grade and dermatologist-tested products. Clean-label and vegan claims are gaining traction, reflecting broader EU regulatory alignment and Germany’s sustainability-conscious consumers. Domestic and international players are investing in advanced formulations that combine lactic acid with other actives for multifunctional benefits, a trend particularly visible in anti-aging and skin-renewal products.

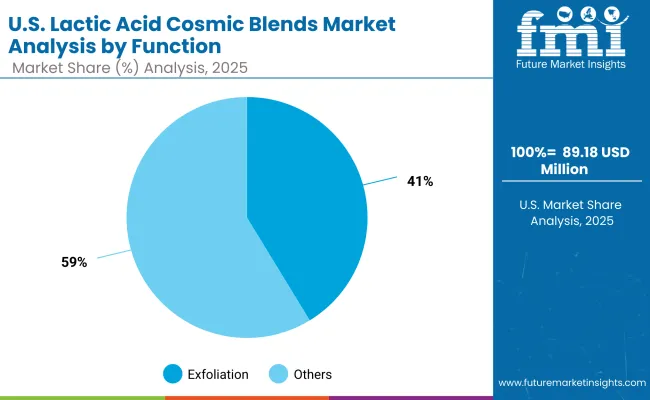

| USA By Function | Value Share % 2025 |

|---|---|

| Exfoliation | 41.3% |

| Others | 58.7% |

The Lactic Acid Cosmic Blends Market in the United States is projected to grow steadily at a CAGR of 6.8% from 2025 to 2035, with exfoliation accounting for 41.3% of the functional share in 2025. The USA remains a mature yet innovation-driven market, where demand is anchored in dermatologist-tested and clinical-grade formulations. Exfoliating serums and lotions dominate the product landscape, supported by strong adoption in both pharmacies and specialty beauty stores.

Consumer preference for clean-label and multifunctional skincare is driving product launches, with lactic acid blends increasingly paired with hyaluronic acid and niacinamide for synergistic effects. The USA also benefits from a strong digital commerce ecosystem, where e-commerce and direct-to-consumer (D2C) channels are boosting accessibility of premium blends. High investments in dermatology research, combined with the rising popularity of vegan and sustainable formulations, are expected to reinforce market growth.

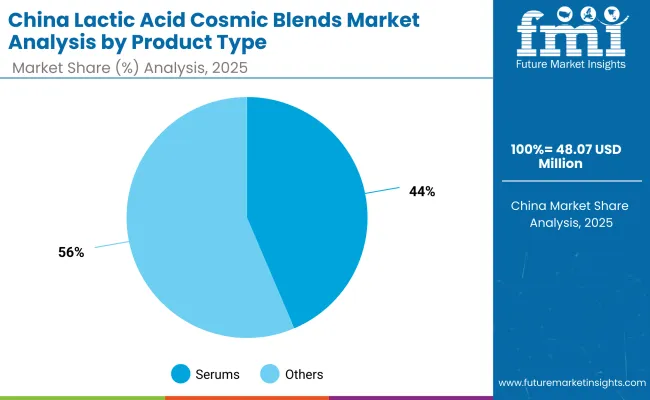

| China By Product Type | Value Share % 2025 |

|---|---|

| Serums | 43.6% |

| Others | 56.4% |

The Lactic Acid Cosmic Blends Market in China is expected to grow at a robust CAGR of 16.3%, supported by strong consumer demand for multifunctional skincare. In 2025, serums account for 43.6% of the product share, driven by their ability to deliver high concentration formulations for exfoliation, brightening, and acne treatment. This dominance is reinforced by rising consumer preference for lightweight, easily absorbed products in both mass and premium beauty categories.

China’s skincare industry is being reshaped by e-commerce platforms, which provide a powerful distribution network for local and international lactic acid brands. Clinical-grade and clean-label claims are gaining traction as consumers increasingly link efficacy with safety, creating opportunities for innovation in dermatologist-tested formulations. Moreover, the influence of K-beauty and J-beauty trends is spurring product diversification, especially in serums and toners that combine lactic acid with natural botanicals.

| Company | Global Value Share 2025 |

|---|---|

| The Ordinary | 9.0% |

| Others | 91.0% |

The Lactic Acid Cosmic Blends Market is moderately fragmented, with global skincare leaders, mid-sized innovators, and niche-focused beauty brands competing for consumer loyalty. Leading players such as The Ordinary, Paula’s Choice, and Murad maintain a strong foothold by offering clinically backed lactic acid formulations with proven exfoliation and skin renewal benefits. Their focus on affordability and efficacy has helped capture a significant share in both mass and premium segments.

Mid-sized companies, including Pixi Beauty, Sunday Riley, and REN Clean Skincare, are innovating with clean-label and vegan claims, targeting health-conscious and eco-aware consumers. These brands leverage e-commerce channels and influencer-led marketing to expand reach, particularly among millennials and Gen Z.

Niche and specialized brands, such as Dermalogica and Glow Recipe, emphasize dermatologist-tested and multi-functional blends that integrate lactic acid with natural actives, appealing to sensitive-skin users. Their strength lies in customization, localized formulations, and premium positioning. Overall, competitive differentiation is shifting from concentration-based formulations alone toward holistic value propositions, including sustainability, ingredient transparency, and multifunctionality. Subscription models, DTC platforms, and cross-category launches (serums, masks, and toners) are also shaping brand strategies to build recurring revenue streams.

Key Developments in Lactic Acid Cosmic Blends Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,081.6 Million |

| Function | Exfoliation, Brightening, Skin renewal, Acne treatment |

| Product Type | Serums, Toners, Creams/lotions, Masks |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, Mass retail |

| Claim | Vegan, Natural/organic, Clean-label, Clinical-grade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary, Sunday Riley, Paula’s Choice, Dermalogica , Murad, Drunk Elephant, Pixi Beauty, SkinCeuticals , REN Clean Skincare, Glow Recipe |

| Additional Attributes | Dollar sales by product type and distribution channel, adoption trends in multifunctional formulations (exfoliation, brightening, and skin renewal), rising demand for serums and creams/lotions, sector-specific growth in dermatology, premium skincare, and mass beauty retail, clean-label and vegan claims driving consumer preferences, regional growth influenced by digital marketing and e-commerce penetration, and innovations in encapsulation technologies, water-soluble delivery systems, and natural/organic ingredient blends. |

The global Lactic Acid Cosmic Blends Market is estimated to be valued at USD 1,081.6 million in 2025.

The market size for the Lactic Acid Cosmic Blends Market is projected to reach USD 3,661.2 million by 2035.

The Lactic Acid Cosmic Blends Market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in the Lactic Acid Cosmic Blends Market are serums, toners, creams/lotions, and masks.

In terms of product type, serums are expected to contribute a significant share of 45.6% in 2025, making them the leading category in the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lactic Butter Market Analysis - Size, Share & Forecast 2025 to 2035

Lactic Acid Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lactic Acid Bacteria Market Analysis by End-use Application, Functionality and Other Strains Type Through 2035

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Lactic Acid Esters Market Trends & Demand 2022 to 2032

Lactic Acid Blends Market

UK Lactic Acid Market Outlook – Size, Share & Forecast 2025-2035

USA Lactic Acid Market Analysis – Trends, Growth & Industry Insights 2025-2035

Polylactic Acid Market Expansion - Biodegradable Materials & Industry Trends 2024 to 2034

Prophylactic HIV Drugs Market Growth - Industry Trends & Forecast 2025 to 2035

Europe Lactic Acid Market Trends – Demand, Growth & Forecast 2025-2035

Natural L-Lactic Acid Market

Gypsum-Free Lactic Acid Market Growth – Trends & Forecast 2022-2032

Thromboprophylactic Drugs Market Insights – Trends, Demand & Growth 2025-2035

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA