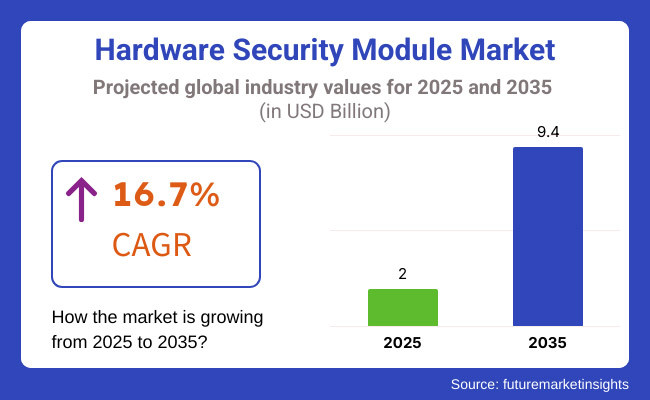

The hardware security market is expected to grow from USD 2.0 billion in 2025 to USD 9.4 billion by 2035, which means a compound annual growth rate (CAGR) of 16.7% for the predicted period. The outbreak of cyber threats, an increase in digital transactions, and the popularity of cloud-based security services are three main precipitating factors for this development. Following North America as a leader in cyber security investments, Europe strengthening its data protection regulations, and Asia Pacific quickly adopting digital transformation, the HSM market has every capability for substantial growth in the next decade.

Identified as a strong growth prospect, the hardware security module industry is expected to change significantly from 2025 to 2035 as more and more companies around the globe will utilize HSMs to keep sensitive information safe and comply with government regulations.

The year 2024 marked a number of the hardware security module market's significant breakthroughs, bringing about the transformation of the sector. IBM Corporation got a deal to replace HSMs with post-quantum cryptography PKI systems; thus, safeguarding data, the company ushered in the first move to fight off future quantum computing threats.

On the other hand, Thales TCT's termination of some HSM products has stressed the technical innovators' need to pursue security solutions, underlining the market's need for the steady creation of ideas. The launch of the KeyperPLUS network HSM, the most prominent HSM of Ultra Electronics, a next-generation solution aimed at boosting cryptographic security for critical infrastructure, has been another major advancement. The HSM innovations speak of a decisively evolving market reshaped by the digital world where the protection of confidential information becomes an explicit necessity.

Although the environment is generally seen as positive, hardware security modules still have to face some challenges, especially the high cost of implementation and complexity of integration. HSM solutions demand heavy initial investment in terms of hardware, software, and IT infrastructure; thus, they are quite difficult for SMEs to adopt. Those companies that are tactically on a path to capitalize on the promotion of flexible and easy-to-implement security solutions will definitely gain an edge over others as the market keeps changing.

The extensive cloud-to-HSM migration not only depicts a breakthrough in the development of cloud services in the future but also will increasingly help to secure the transparency of business operations. HSMs deployed in the cloud deliver the advantages of scale, remote manageability, and economic data loss protection, thereby making them a preferred choice for every organization.

Banks and Healthcare facilities are already utilizing these solutions for secure transactions, digital identity verification, and data encryption. Not only that, but the synergy of AI and Machine Learning with Cloud Cost HSM SaaS offerings also allows for predictive threat detection and provides real-time security monitoring, which strengthens their usage even further. As more and more companies go for the cloud, the demand for cloud HSMs is projected to boom, which, in turn, will create new markets and broader data security applications.

The market is segmented based on type, industry, application, and region. By type, the market is divided into LAN-based HSMs/network-attached HSMs, PCIe-based/embedded plugin HSMs, and USB-based/portable HSMs. In terms of industry, it is segmented into BFSI, healthcare & life sciences, manufacturing, retail & CPG, government & defense, energy & utilities, and others (telecommunications, transportation & logistics, education, media & entertainment). Based on application, the market is categorized into payment processing, code and document signing, SSL and TLS, authentication, database encryption, and others (PKI & Certificate management, blockchain & cryptocurrency, digital rights management (DRM), IoT device security). Regionally, the market is classified into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The LAN-based HSMs/network-attached HSMs segment is projected to hold a 41% share by 2035. This strong growth is driven by rapid enterprise migration toward hybrid and multi-cloud environments, where network-attached HSMs offer scalable, centralized encryption key management with high availability and flexible integration across modern IT ecosystems. Organizations across BFSI, government, healthcare, and cloud services are significantly increasing investments in LAN-based HSMs to meet evolving compliance mandates and combat rising cyber threats.

PCIe-based/embedded plugin HSMs maintain strong demand for ultra-low latency, high-performance use cases, particularly in high-frequency payment and telecom networks where on-premises security is critical. These HSMs continue to serve key roles in ensuring ultra-secure cryptographic processing in controlled environments. Meanwhile, USB-based/portable HSMs address niche requirements for portable, secure key storage in field-based or remote operations. However, the market is clearly shifting toward centralized, software-integrated security models that support the scalability and agility demanded by digital business transformation. LAN-based HSMs, with their ease of management and cloud compatibility, are poised to dominate next-generation cryptographic infrastructure strategies.

| Type Segment | Market Share (2035) |

|---|---|

| LAN-based HSMs | 41% |

The BFSI segment leads the HSM market, projected to expand at a CAGR of 8.5% from 2025 to 2035. The sector’s need for robust encryption is deep-rooted, driven by compliance with stringent regulations such as PCI-DSS, GDPR, PSD2, and SWIFT mandates. The accelerating growth of digital banking, contactless payments, mobile wallets, and cross-border financial transactions is fueling strong demand for scalable HSM solutions that can securely manage cryptographic keys and enable real-time secure payment processing. Healthcare & life sciences are emerging as a highly dynamic growth area.

Rapid digitization of electronic health records, clinical research data, and genomic databases is driving adoption of advanced HSM solutions for secure data storage and regulatory compliance with standards such as HIPAA. Increasing reliance on cloud-based platforms and telemedicine is also contributing to greater encryption requirements across healthcare ecosystems.

Government & defense maintains steady demand for military-grade encryption to protect classified and sensitive national data. Manufacturing and energy & utilities are securing industrial IoT networks and critical infrastructure systems, while retail & CPG is enhancing payment security and consumer data protection. Other industries including telecommunications, transportation & logistics, education, and media & entertainment are progressively investing in HSM solutions to support secure digital transformation.

| Industry Segment | CAGR (2025 to 2035) |

|---|---|

| BFSI | 8.5% |

The payment processing segment is projected to grow at the fastest CAGR of 8.8% between 2025 and 2035. This growth is being driven by the rapid expansion of contactless payments, real-time payment networks, mobile wallets, and cross-border e-commerce, all of which require FIPS 140-3 compliant HSMs to secure cryptographic keys used in transaction authorization. Major payment processors, fintechs, and financial institutions are expanding their HSM investments to support critical capabilities such as tokenization, EMV key management, and mobile wallet integration.

Additionally, regulatory mandates on payment security are reinforcing market momentum. Code and document signing remains a critical application, particularly as software-driven businesses seek to guarantee authenticity and integrity in increasingly automated digital workflows. SSL/TLS certificates and authentication use cases continue to witness sustained demand as organizations strengthen trust in online interactions.

Database encryption is gaining traction, especially in cloud-first environments where secure encryption key management is vital. Meanwhile, new application areas including blockchain & cryptocurrency, PKI & certificate management, digital rights management (DRM), and IoT device security are expanding the market’s boundaries. This ongoing diversification of applications is set to drive continued innovation and investment in advanced HSM capabilities.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Payment Processing | 8.8% |

The expansion of the Hardware Security Module (HSM) market is mainly attributed to the surge in data protection needs, a need for compliance with certain regulations, and a high level of modalities in encryption security across different sectors. HSM vendors are centered on making progress in the highly secure, scalable, and regulatory-compliant solutions that will satisfy the increasing requests from banks оn cloud service providers and firms. For financial institutions prioritizing encryption security, regulatory compliance, and performance, the preservation of sensitive financial transactions and personal data is a must.

High-performance HSMs that provide modular security for the cloud are service providers' priorities, fulfilling cloud apps with HSMs and thus flanking potential infiltrations in data. Cost-effective and secure solutions for securing digital assets sought by end users, inclusive of businesses and organizations, are not to be left out. The HSM market is definitely seeing an upward trend due to the increase in cyberattacks, the tightening of data protection regulations, and the emergence of more efficient cryptographic mechanisms. The combination of high technology with the exclusive service of cloud-based security and blockchain application connection is bringing dynamics to this market, making it one of the pillars of modern cybersecurity infrastructure.

Contract & Deals Analysis

| Company | Contract Value (USA USD Million) |

|---|---|

| IBM Corporation | Approximately USD 50 - USD 70 |

| Ultra Electronics | Approximately USD 20 - USD 30 |

Cyber threats are constantly evolving, which poses a significant risk to the hardware security module (HSM) market. Cybercriminals are becoming continually more specific and innovative with their attack methods, and HSM suppliers need to constantly build new security strategies to prevent vulnerabilities from being a risk. Since HSM is used to protect sensitive secrets, any security breaches in the HSM system could result in the loss of cryptographic keys, data leaks, and loss of reputation for the company.

Industry regulatory compliance is another primary concern, as banks, health care, and governmental entities are required to abide by some strict data security protocols. FIPS 140-2/3, PCI DSS, GDPR, and HIPAA require organizations to use cryptographic solutions that are secure without risk. In such events, non-compliance may lead to adverse consequences such as financial loss, penalties, and even risk of business shutdown.

Supply chain risks can affect the HSM production capabilities as well as its pricing strategies. The semiconductor shortages and the geopolitical tensions affecting the major manufacturing regions can result in the postponement of hardware production. The companies should take the steps necessary to develop resilient supply chains and modulate these risks through diverse sourcing strategies.

The exorbitant cost of HSM installation and upkeep is a constraint for the smaller companies. While the bigger businesses can manage the expense of encryption hardware, small and medium-sized enterprises (SMEs) encounter the challenge of the initial investment as well as the integration expenses, hampering their market capabilities.

Market rivalry is growing, with cloud-based HSM solutions taking the lead. The classical on-premise HSMs are indeed on the highest protection level, recyclers, but the cloud-based alternatives, instead of cost and size, offer a possibility of scaling. Companies that do not manage to adapt to new market needs will most likely partner with their customers to swift, adaptable competitors who are offering hybrid or cloud-native security solutions.

| Country | CAGR (%) |

|---|---|

| India | 17.9% |

| China | 17.8% |

| The USA | 17.5% |

| Australia | 16.6% |

| Germany | 16.5% |

| Japan | 16.4% |

America dominates the share for HSM, spearheaded mostly by stringent data protection regulations, cloud computing, and growing cyber-attacks. HSMs are extensively used by healthcare organizations, governments, and banks to safeguard data and support regulatory compliance. According to PCI DSS and FIPS, the payment and transaction business depends upon HSMs for safe electronic payment and transactions.

For companies in the healthcare industry, patient data is protected, and they are HIPAA-compliant through HSMs. HSMs are also used by cloud providers to protect encryption and cryptographic key management to allow secure data in the cloud.

FMI forecasts the USA market to grow at 17.5% CAGR over the research period.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| Tight Data Protection Regulations | HIPAA, PCI DSS, and FIPS compliance require advanced security products like HSMs. |

| High Cybersecurity Awareness | Increasing cyber-attacks and data breaches compel organizations to utilize HSMs for improved security. |

| Cloud Computing Growth | HSMs contribute significantly towards secure key management and encryption within cloud offerings. |

China's HSM market is seeing fast growth driven by accelerating digitalization, rigorous cybersecurity requirements, and growing online payment and e-commerce usage. Banks use HSMs in some payment transaction processing and transaction encryption, especially with the ELV digital wallets they provide as online banking continues to grow.

Compliance with cybersecurity law forces companies to implement high-grade data protection, which in turn forces them to implement HSMs for encryption and authentication. Additionally, the prevalent use of cloud computing and IoT technologies triggers the need for HSMs to store and share data securely.

Growth Drivers in China

| Key Drivers | Description |

|---|---|

| Cybersecurity Regulations | The Cybersecurity Law requires strong data protection, forcing HSM uptake. |

| Digital Payment Security | Mobile payment and e-commerce growth calls for reliable cryptography solutions. |

| Cloud and IoT Development | HSMs provide robust authentication and data protection for cloud computing and IoT environments. |

The HSM market in Germany prospers due to stringent data privacy regulations, significantly developed industrial platforms, and Industry 4.0 use of technologies. Organizations use HSMs to have secure data encryption, key handling for crypto, and digital signatures for GDPR compliance.

The banking industry depends upon HSM for security in e-banking and e-payment, and business enterprises engaged in industrial manufacturing business use HSM in Industrial Internet of Things (IIoT) applications for end-to-end secure communication and integrity of data. The high sense of urgency towards security, even when there is cybersecurity, is turning German business enterprises into a high-end demand generator for high-level HSM solutions.

Market analysis by FMI indicates the growth in the German market would be at 16.5% CAGR in the forecast period.

Growth Drivers in Germany

| Key Drivers | Description |

|---|---|

| GDPR Compliance | Stringent rules necessitate strong security solutions such as the use of HSMs. |

| Industrial IoT Security | Industrial-oriented IIoT platforms leverage HSMs to provide safe communication and data integrity. |

| Digital Banking Security | Banks employ HSMs for safe online banking and anti-fraud security. |

The Australian HSM market continues to grow steadily due to the strength of data privacy regulation, heightened cybersecurity awareness, and faster digitization of banking operations. HSMs are utilized in companies to facilitate encrypted security, digital signatures, and authentication for Privacy Act and Consumer Data Right (CDR) compliance mandates.

Growth Drivers in Australia

| Key Drivers | Facts |

|---|---|

| Severe Data Privacy Regulations | Demand for HSMs is fueled by the Privacy Act and adhering to CDR. |

| Digital Banking Protection | HSMs are utilized by banks to facilitate secure online banking and prevention against fraud. |

| Initiatives of National Cybersecurity | Efforts from the government towards more cyber awareness propel HSM adoption. |

Thales Group (Gemalto) (18-23%)

Thales is the market leader in hardware security modules, leveraging its expertise in cryptographic key management and compliance. The company focuses on cloud integration, providing scalable HSM solutions compatible with multi-cloud environments. Thales continues to enhance its HSMs with quantum-safe encryption, ensuring data security against future cyber threats. Its strategic direction includes expanding partnerships with cloud service providers and investing in AI-driven cryptographic solutions.

Utimaco GmbH (15-20%)

Utimaco is known for its modular HSM solutions catering to enterprise security and regulatory compliance. The company is expanding its product portfolio into IoT and cloud security, leveraging AI-driven encryption and identity management. Utimaco focuses on delivering flexible, scalable HSMs for diverse industries, including financial services, healthcare, and government. Its strategic direction includes enhancing key management automation and collaborating with cybersecurity firms for integrated solutions.

Futurex (10-15%)

Futurex specializes in high-performance HSMs for payment security and data encryption. The company focuses on cloud-based key management, tokenization, and data protection solutions for financial institutions and enterprises. Futurex is investing in next-generation encryption algorithms and AI-based security analytics to enhance threat detection and data integrity. Its strategic outlook includes expanding its global reach through partnerships with payment processors and cloud service providers.

Yubico (8-12%)

Yubico is a leading provider of hardware authentication keys and HSMs for identity and access management. The company emphasizes multi-factor authentication, zero-trust security, and compliance with industry standards. Yubico is enhancing its hardware security devices with biometric authentication and passwordless login solutions. Its strategic focus includes expanding its product ecosystem to support hybrid and multi-cloud security architectures.

IBM Corporation (7-11%)

IBM integrates its HSMs with cloud security and quantum-safe cryptography, focusing on secure data processing and regulatory compliance. The company is investing in advanced cryptographic technologies, including lattice-based encryption, to safeguard sensitive data against quantum computing threats. IBM’s strategic direction includes enhancing its hybrid cloud security platform with AI-driven threat intelligence and expanding its partnerships for secure digital transformation.

Other Key Players (30-42% Combined)

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.0 billion |

| Projected Market Size (2035) | USD 9.4 billion |

| CAGR (2025 to 2035) | 16.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/ Volume in units |

| Types Analyzed | LAN-based HSMs (Network-attached), PCIe-based (Embedded Plugin), USB-based (Portable) |

| Applications Analyzed | Payment Processing, Code & Document Signing, SSL & TLS, Authentication, Database Encryption, PKI/Credential Management, Application-Level Encryption |

| By Sales Channels | Direct Sales Channel, Distribution Channel (Integrators, Distributors, VARs) |

| By Industries Analyzed | BFSI, Healthcare & Life Sciences, Manufacturing, Retail & CPG, Government & Defense, Energy & Utilities, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East, and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia |

| Key Players | Thales Group (Gemalto), Utimaco, Futurex, Yubico, IBM, Ultra Electronics, SPYRUS, Securosys, Entrust, Nitrokey |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

| Customization and Pricing | Available on request |

The global hardware security module (HSM) market is projected to witness a CAGR of 16.7% between 2025 and 2035.

The global hardware security module (HSM) market stood at USD 2 billion in 2025.

The global hardware security module (HSM) market is anticipated to reach USD 9.4 billion by 2035 end.

North America is expected to record the highest CAGR, driven by increasing data security regulations and the adoption of cloud-based HSMs.

The leading companies in the market include Thales Group (Gemalto), Utimaco GmbH, Futurex, Adweb Technologies, Yubico, Atos, Ultra Electronics, SPYRUS, Inc., Securosys, Entrust Corporation, Nitrokey, Kryptoagile, and IBM Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 26: Global Market Attractiveness by Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by Industry, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 56: North America Market Attractiveness by Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by Industry, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Industry, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Industry, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Industry, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Industry, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Hardware-Assisted Verification Market Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hardware Encryption Market

Door Hardware Market

Gaming Hardware Market Analysis by Gaming Platform, Product Type, End-user, and Region Through 2035

Automotive Hardware Market Growth - Trends & Forecast 2025 to 2035

Bitcoin Mining Hardware Market

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA