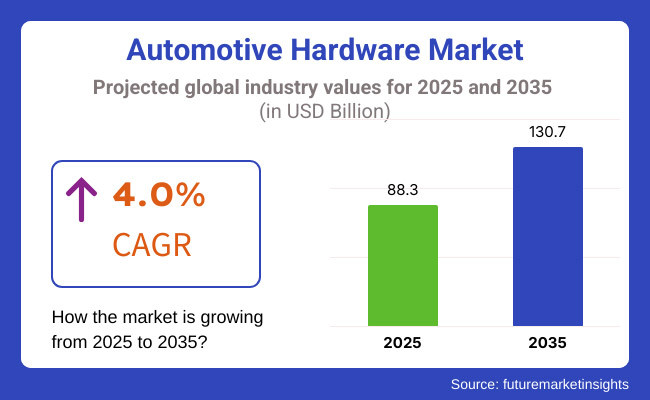

The global Automotive Hardware Market was valued at USD 74.3 billion in 2020 and is projected to reach USD 88.3 billion by 2025. During the 2025 to 2035 period, a compound annual growth rate (CAGR) of 4.0% is anticipated, resulting in a market size of approximately USD 130.7 billion by 2035. This expansion is being fueled by the adoption of modular vehicle architectures and periodic platform refresh cycles that have been widely implemented across OEM product strategies.

Modularized hardware components are increasingly being utilized to enable flexible vehicle design. Lightweight hinge modules incorporating multi-link mechanisms and precision latching systems are being deployed across electric and hybrid platforms. Among the latest innovations, Magna International’s mechatronic hinge assemblies have been engineered for seamless integration within EV body structures.

These assemblies are being applied in applications such as flap-based hood openings and hands-free tailgate operations. As stated in Magna’s 2024 product brief, these modules are “supporting automated and body-structure applications with seamless integration.”

Security hardware is being transformed through embedded sensing. Shiroki Corporation has introduced in-vehicle door locks with integrated sensor elements. These components are designed to detect latch engagement and initiate ECU-level authentication, allowing enhanced compatibility with digital key systems and improved compliance with evolving vehicle access standards.

Centralized vehicle platforms are prompting OEMs to standardize hardware across multiple vehicle classes. As a result, recurring demand is being observed for latches, door modules, hinges, and seat mechanisms. With component commonality contributing to cost efficiency and streamlined assembly processes, suppliers are being encouraged to invest in scalable and reconfigurable manufacturing lines capable of rapid kit changeovers.

The increasing electrification of vehicles is adding complexity to the hardware ecosystem. Active mechanical components, such as power tailgates, electronically actuated mirror assemblies, and motorized seat adjustments, are being integrated into ECU-controlled systems. To meet these demands, hardware systems are now being designed with enhanced precision, durability, and diagnostics-readiness—including torque sensing and fault detection capabilities.

Repairability standards are shaping trends in the aftermarket. A rise in door latch-related recalls has been reported, highlighting failure points in body closure mechanisms. This is driving renewed demand for replacement hardware across both authorized OEM service networks and independent repair channels.

Looking forward, the Automotive Hardware Market is expected to be influenced by the evolution of electrified body components, digitized vehicle access systems, and standardized modular platforms. As vehicle architectures continue to be reimagined, sustained investment in mechanical hardware will be required to support future-ready automotive design.

Door latches are projected to dominate the global automotive body components market, accounting for approximately 21% of total revenue in 2025. The segment is forecast to grow at a CAGR of 4.2% through 2035, slightly above the global average growth rate of 4.0%. Door latches are critical safety and functionality components, essential for ensuring secure door closure, passenger protection, and seamless integration with electronic locking systems.

With the rising adoption of advanced driver assistance systems (ADAS) and smart entry technologies, OEMs are transitioning from mechanical to electronically actuated latches in both premium and mass-market vehicle segments.

This shift is also being driven by electrification trends, where electric latches are required to align with frameless door designs and EV architecture. Furthermore, the growing demand for lightweight yet high-strength latching systems to improve crash performance and reduce vehicle weight is spurring material innovation and modular latch designs.

OEMs are expected to continue dominating the automotive body components market, contributing approximately 69% of total revenue in 2025, with the segment projected to grow at a CAGR of 4.1% between 2025 and 2035. This dominance is attributed to the critical role body components play in safety compliance, fit-and-finish quality, and brand-specific design customization during vehicle assembly.

Automakers and Tier-1 suppliers are closely collaborating on the development of component systems-including gas springs, hinges, bonnet support rods, and mounting brackets—that meet exact vehicle specifications. OEM integration ensures optimal alignment, crashworthiness, and aesthetic compatibility, which are key to both consumer satisfaction and regulatory certification.

As EV manufacturers emphasize flush surfaces and aerodynamic designs, body components like door seals, fuel flaps, and exterior handles are increasingly being engineered with high-precision tooling and low-tolerance assembly standards. The rise of modular vehicle platforms is also enabling OEMs to streamline body component production and maintain design consistency across multiple models, reinforcing their lead in the sales channel landscape.

Challenge

High Costs and Regulatory Complexities

Factors like high production costs, quality control, and safety regulation compliance become essential for the automotive hardware industry. Automakers are required to comply with FMVSS and UNECE guidelines, raising costs and demanding more complex testing protocols pre-deployment.

Supply Chain Disruptions and Material Shortages

Fluctuations in raw material availability, be it with steel, aluminum, or composites, affect both production times and cost efficiency. Global supply chain interruption, trade restrictions, and the shortage of semiconductors create further challenges to market stability.

Opportunity

Growing Demand for Lightweight and High-Performance Components

The move toward fuel-efficient and electric vehicles (EVs) is boosting demand for lightweight, high-durability automotive hardware like aluminum and carbon-fiber components. Competency in advanced materials engineering and weight reduction can give manufacturers a competitive advantage.

Integration of Smart and Connected Hardware

The automotive hardware landscape is evolving with innovations such as smart mobility, IoT-enabled components, and even AI-based diagnostics. Next-gen vehicles will have electronic locking systems, advanced braking mechanisms, sensor-integrated chassis and others as their essentials.

American automotive hardware companies are still a significant market within the sector, finding their niche as major automakers increasingly turn out electric and autonomous vehicles and as vehicle safety and performance technologies progress. The increasing need for weight reduction with high-durability material is paving the road toward innovation in automobile hardware components, namely locks, latches, hinges, and fasteners.

Furthermore, stringent government regulations promoting the deployment of safe hardware features in the vehicles are likely to further bolster the growth of advanced hardware solutions. Increasing adoption of aftermarkets and the rising trend of customization of vehicles also fuels the growth of the market.

The rising efficient loads in the vehicle and increasing penetration of smart & connected vehicles is also pulling the demand for high-performance mechanical hardware incorporated with electronic systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The Hardware Market in the automotive sector across the UK is witnessing steady growth owing to the transition towards electric mobility in the country coupled with investment in the manufacturing of high-performance vehicles. To improve vehicle efficiency and recover safety, automakers are concentrating on lighter and more corrosion-resistant hardware material.

Growing demand for premium and luxury vehicles is also fuelling innovation in advanced automotive hardware solutions such as high-strength fasteners, precision-engineered latches, and aerodynamic hinges. Further, the expanding e-commerce industry is making aftermarket automotive hardware easily accessible to end-users, which in turn will propel replacement and upgrade sales.

Another factor driving the shift towards recyclable and eco-friendly materials in automotive hardware manufacturing in the UK is the country's focus on sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

Key EU member states contributing to the automotive hardware market include Germany, France, and Italy, bolstered by their strong automotive manufacturing capabilities and growing investments in lightweight and high-strength materials. At E, we are increasingly seeing these types of features incorporated into vehicles as a result of the EU's strict safety regulations and emissions laws, as manufacturers wish to improve durability and fuel economy.

The increase in electric and hybrid vehicle production is also amplifying the demand for hardware solutions that facilitate lightweight construction and improved aerodynamics. Moreover, the growth of the luxury vehicle class in Europe is spurring advancement in premium, precision-designed auto hardware. The drive towards circular economy practices in the region is also impacting the development of sustainable and recyclable automotive hardware materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.9% |

Due to Japan's strong emphasis on precision engineering, the manufacturing of high-quality vehicles, and the adoption of advanced materials in automotive components, Japan's automotive hardware market has been bolstered. An electric and autonomous vehicle run in Japan is shaping demand for lightweight, corrosion-resistant and high-performance hardware solutions.

Moreover, automakers in the country are also incorporating AI-powered design and manufacturing processes to improve the efficiency and safety of vehicles. Market dynamics are increasingly influenced by the integration of smart locking mechanisms and electronic latches in next-generation vehicles. The market with consumers seeking high-quality replacement and upgrade components is also expanded by Japan’s growing after-market industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

The country is also benefitting from the rapidly growing production of automotive hardware, with its deep automotive manufacturing roots to rising investments in electric and connected vehicle technologies. The nation's automakers have made vehicle safety and efficiency more important by adopting higher-strength, lighter-weight beast hardware materials.

Furthermore, the increasing adoption of autonomous and intelligent vehicles is leading to demand for integrated electronic and mechanical hardware solutions. Expanding e-commerce platforms in South Korea and its growing aftermarket industry have made automotive hardware more readily available to consumers, leading to a bump in sales of replacement and performance-enhancing components.

The future of automotive hardware development and manufacturing is also being shaped by government initiatives encouraging greener automotive manufacturing practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Rising vehicle production, increased focus on lightweight and durable components, and advancements in vehicle safety and performance are the key factors driving the growth of the automotive hardware market. As electric vehicles (EVs) and autonomous-driving technologies continue to develop, so does the need for quality automotive hardware parts. Some key trends to watch for include material innovation, automation in production, and hardware solutions in the smart space.

Robert Bosch GmbH (12-16%)

Bosch dominates the automotive hardware market with its extensive portfolio of braking, powertrain, and safety components, contributing to advanced vehicle systems.

Denso Corporation (10-14%)

Denso leads in thermal and powertrain hardware, with a strong presence in both traditional and electrified vehicle markets.

Magna International Inc. (8-12%)

Magna is a key supplier of lightweight automotive hardware solutions, enhancing fuel efficiency and vehicle durability.

ZF Friedrichshafen AG (6-10%)

ZF focuses on intelligent transmission and chassis hardware, supporting next-generation mobility and safety solutions.

Aisin Seiki Co., Ltd. (4-8%)

Aisin Seiki advances drivetrain and braking systems, emphasizing eco-friendly and high-performance automotive hardware.

Other Key Players (45-55% Combined)

Numerous global and regional suppliers contribute to the competitive landscape of the automotive hardware market. These include:

The overall market size for the Automotive Hardware market was USD 88.3 Billion in 2025.

The Automotive Hardware market is expected to reach USD 130.7 Billion in 2035.

The demand for automotive hardware will be driven by the increasing production of vehicles, rising demand for lightweight and durable materials, advancements in vehicle safety components, and growing adoption of electric and autonomous vehicles.

The top 5 countries driving the development of the Automotive Hardware market are the USA, China, Germany, Japan, and India.

The Door Latches is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Vehicle, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Vehicle, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Vehicle, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Vehicle, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Vehicle, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Vehicle, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Vehicle, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Appearance Chemical Market Size and Share Forecast Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA